5 Key Reasons Why Stablecoins Growth Thrives Globally

Stablecoins are thriving globally because they offer a stable alternative to volatile cryptocurrencies, enhance financial inclusion, and make cross-border transactions more efficient. As their market capitalization rises and regulatory frameworks evolve, we explore the key reasons why stablecoins growth thrives globally.

Key Takeaways

- Stablecoins provide a vital hedge against currency devaluation, particularly in high-inflation economies, by offering access to a stable store of value like the US dollar.

- They are enhancing financial inclusion in emerging markets by providing accessible alternatives to traditional banking, enabling smoother transactions and cross-border trade.

- The market capitalization and adoption of stablecoins are rapidly growing, reflecting their increasing trust and utility across various sectors, while evolving regulatory frameworks will further integrate them into global finance.

Stablecoins as a Hedge Against Currency Devaluation

Stablecoins serve as a bridge between the volatile world of cryptocurrencies and the relative stability of traditional fiat currencies. For those of us in countries plagued by high inflation, like Argentina, stablecoins are not just a financial tool but a lifeline. Imagine watching your hard-earned savings dwindle in value because your local currency is depreciating daily. Stablecoins provide a much-needed refuge against such currency devaluation.

One of the most compelling aspects of stablecoins is their ability to offer access to the US dollar, a global store of value. This is particularly crucial in emerging markets where local currencies are unstable. Holding stablecoins allows individuals to protect their assets from inflation and economic instability. It’s like having a dollar-pegged refuge that shields you from the storm of depreciating local currencies.

Moreover, stablecoins enable transactions without the limitations imposed by traditional banking systems. This is a game-changer in modern digital commerce, where the speed and efficiency of transactions can make or break businesses. Imagine running a business in an inflation-ridden economy and being able to transact seamlessly without worrying about the fluctuating value of your local currency. That’s the power stablecoins offer.

Stablecoins also contribute significantly to the broader crypto industry by maintaining a stable value, thereby increasing the overall stablecoin supply and activity. Most stablecoins are pegged to the US dollar, providing a stable and predictable asset for everyday transactions. This stability is essential for fostering trust and encouraging more crypto users to participate in the stablecoin sector.

In summary, stablecoins offer a dollar-pegged refuge for individuals in inflation-ridden economies, enabling them to conduct crypto transactions seamlessly and safeguard their assets from currency devaluation. As stablecoin adoption continues to grow, it is clear that these digital assets are not just a financial novelty but a vital tool for economic stability and growth.

Enhancing Financial Inclusion in Emerging Markets

In many emerging markets, financial inclusion remains a significant challenge. Traditional banking systems often fail to reach the unbanked populations, leaving millions without access to essential financial services. Basic banking infrastructure has emerged as a powerful tool to bridge this gap.

Consider the impact of stablecoins in regions with high inflation and economic instability. Offering protection against local currency fluctuations, stablecoins increase confidence in transactions, making them a more accessible alternative to traditional banking. This is particularly important in underdeveloped financial systems where trust in local currencies is often eroded.

Stablecoins present a reliable alternative to traditional banking, providing a stable and predictable asset for storing value and facilitating transactions. In regions like Africa, stablecoins have experienced explosive growth, with real-world use cases expanding rapidly. From facilitating remittances to enabling trade, stablecoins are transforming the financial landscape in these areas.

Moreover, stablecoins are increasingly viewed as a viable option for executing cross-border B2B transactions. This is particularly beneficial for businesses in emerging markets, where access to traditional finance is limited and expensive. Providing a decentralized finance solution, stablecoins empower these businesses to engage more actively in the global market.

Stablecoins offer a cost-effective means to enhance financial inclusion in emerging markets. They provide an accessible alternative to traditional banking, protect against local currency fluctuations, and ease cross-border transactions. As stablecoin adoption soars in these regions, it is evident that they play a crucial role in bridging financial inclusion gaps and fostering economic growth.

Cross-Border Transactions and Remittances

Cross-border transactions and remittances are essential lifelines for many families and businesses in emerging markets. However, traditional payment networks are often slow and expensive. This is where stablecoins come into play, revolutionizing the way we transfer money across borders.

Integrating stablecoins into financial applications has significantly improved the speed and cost-effectiveness of cross-border payments. Sending money to a relative in another country instantly and at a fraction of the cost of traditional remittance systems is now possible with stablecoins.

Stablecoins reduce the fees and processing times associated with international money transfers. In countries like Brazil, India, and Nigeria, stablecoins have facilitated billions in transactions, supporting local economies and enhancing financial stability. This is particularly important in regions where traditional USD banking and payment systems are either unavailable or prohibitively expensive.

Stablecoins also offer a more efficient and cost-effective solution for cross-border trade. Businesses can now conduct transactions without the delays and high costs of traditional banking systems, significantly benefiting regions like Central America and Africa.

In summary, stablecoins are transforming cross-border payments and remittances by providing faster, cheaper, and more efficient solutions. They support local economies, enhance financial stability, and open up new opportunities for cross-border trade. With growing stablecoin adoption, their role in enhancing global finance integration becomes increasingly evident.

Growing Market Capitalization and Adoption

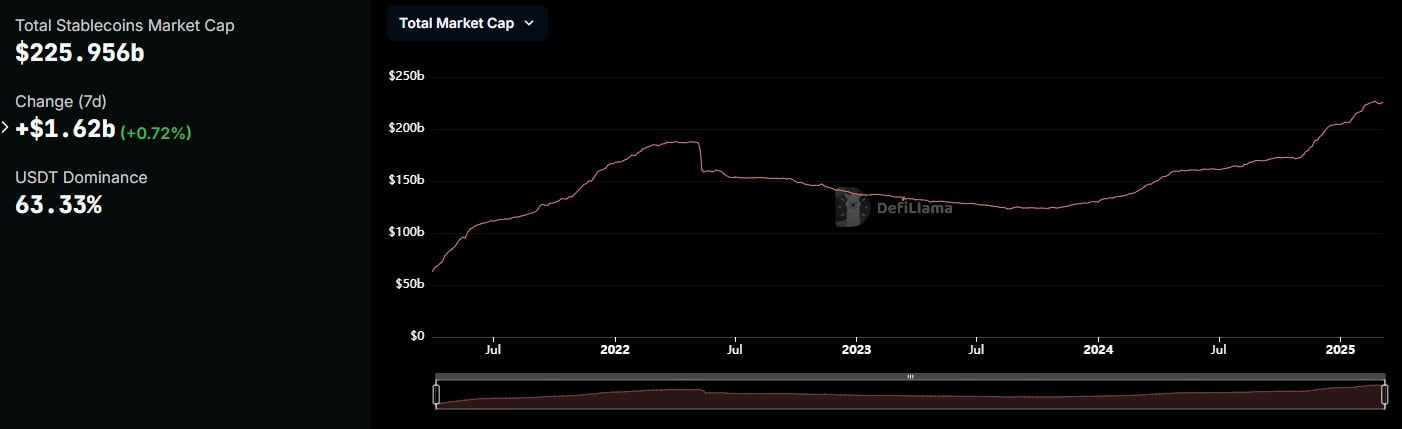

The market capitalization of stablecoins has seen unprecedented growth in recent years. As of now, the estimated market value of stablecoins stands at $200 billion. This growth reflects the rising trust and adoption of stablecoins across various sectors.

A key driver of this growth is Tether (USDT), with its market capitalization expected to reach $138 billion by January 2025. Tether’s market traction has significantly boosted overall stablecoin supply and activity. This growth has also had a positive impact on blockchains like Arbitrum, Base, and Optimism, which have seen their market caps rise.

In 2024 alone, the stablecoin transaction volume reached an impressive $15.6 trillion. This data underscores the widespread adoption and utility of stablecoins in various financial transactions. Retail adoption, driven by factors such as cost and convenience, has also contributed significantly to this growth.

Stablecoins also represent a substantial portion of transaction value in Central, Northern, and Western Europe, with average monthly inflows of $10-$15 billion. This access is expanding rapidly in emerging markets too, alongside the use of fiat currency.

The growing market capitalization and adoption of stablecoin growth underscore their transformative potential in the global financial landscape. Expanding stablecoin adoption creates new opportunities for smaller networks and enhances financial accessibility for individuals and businesses globally.

Regulatory Frameworks and Global Finance Integration

The regulatory landscape for stablecoins is still evolving, characterized by a lack of established frameworks and shifting regional policies. This presents both challenges and opportunities for the stablecoin sector. Governments worldwide are moving towards creating stablecoin regulations to ensure stability and consumer protection.

The development of a cohesive regulatory framework is crucial for the broader acceptance of stablecoins. However, this process is complex and requires careful consideration of various factors, including financial inclusion, consumer protection, and the integration of decentralized finance into the traditional financial system.

Despite these challenges, stablecoin integration into global finance is expected to improve as regulatory frameworks develop. This will enhance stability, security, and foster greater trust and adoption among users.

In summary, the regulatory landscape for stablecoins is a work in progress. While there are challenges to overcome, the potential for stablecoins to bridge the gap between traditional finance and decentralized finance is immense. As regulatory frameworks evolve, stablecoins are poised to play a crucial role in the future of global finance.

Summary

In summary, stablecoins are thriving globally for several key reasons. They provide a hedge against currency devaluation, enhance financial inclusion in emerging markets, revolutionize cross-border transactions and remittances, and boast growing market capitalization and adoption. Despite the evolving regulatory landscape, stablecoins are poised to play a crucial role in the future of global finance.

As we look ahead, the potential for stablecoins to transform the financial landscape is immense. By bridging the gap between traditional finance and decentralized finance, stablecoins offer a more inclusive, efficient, and stable financial system for everyone. The future of stablecoins is bright, and their impact on global finance is only just beginning.

Frequently Asked Questions

What are stablecoins?

Stablecoins are digital assets that aim to maintain a stable value by being pegged to traditional fiat currencies or other stable assets. They offer a reliable means of transaction in the cryptocurrency space.

How do stablecoins provide a hedge against currency devaluation?

Stablecoins act as a protective measure against currency devaluation by providing a stable, dollar-pegged alternative that helps individuals preserve their assets in inflation-affected economies. This mechanism ensures that users can maintain value despite fluctuations in their local currency.

How do stablecoins enhance financial inclusion in emerging markets?

Stablecoins enhance financial inclusion in emerging markets by offering unbanked individuals access to crucial financial services, protecting them from local currency instability, and simplifying cross-border transactions. This fosters greater economic participation and security for underserved populations.

What impact do stablecoins have on cross-border transactions and remittances?

Stablecoins significantly enhance cross-border transactions and remittances by offering faster processing times, lower fees, and improved efficiency compared to traditional methods. This shift can make sending money internationally more accessible and cost-effective for users.

What are the regulatory challenges for stablecoins?

Regulatory challenges for stablecoins include the need for evolving frameworks that address stability and consumer protection concerns. As governments work to create these regulations, uncertainties in compliance and operational requirements remain a significant hurdle.