Why Are RWA Crypto Projects Fading Away After the Initial Hype?

Why are RWA crypto projects fading away after the initial hype? Despite their promise of bridging traditional finance with blockchain, these projects face significant hurdles. In this article, we’ll explore the key issues such as regulatory challenges, liquidity concerns, and investor confidence that contribute to their decline.

Key Takeaways

- RWA crypto projects initially gained traction due to investment from established financial institutions, creating credibility and attracting new investors.

- Challenges such as regulatory complexities, liquidity issues, and network security concerns hinder the growth and adoption of RWA projects.

- Successful integration of RWAs into DeFi platforms and demonstrating real-world utility are essential for long-term sustainability and attracting a stable investor base.

Initial Hype and Market Expectations

The initial excitement for RWA crypto projects was significantly influenced by investment management giants like BlackRock entering the space, which changed the competitive dynamics. As these established players stepped into the cryptocurrency market, they brought with them a wave of credibility and trust, which in turn attracted a plethora of new investors and developers eager to capitalize on this emerging opportunity. Such reputable institutions suggested a promising future where traditional financial assets could seamlessly transition into the digital realm.

Tokenized RWAs were seen as the next evolution within Web3, facilitating the representation of traditional physical assets like real estate and art on the blockchain.

This approach promised to unlock liquidity in otherwise illiquid markets, facilitating fractional ownership and easier trade of previously cumbersome assets.

The landscape of RWAs was diverse, encompassing:

- Treasuries

- Securities

- Private credit

- Tangible items like real estate

Each of these digital assets brought a new dimension to the cryptocurrency market, offering a range of investment opportunities that were previously out of reach for the average investor.

User activity in the RWA market showed signs of growth, indicating renewed interest and potential for expansion despite past stagnation. The total value locked (TVL) in the RWA sector reached a record high of $6.57 billion, indicating increased adoption despite broader market downturns. This surge in activity was a testament to the market’s initial optimism, driven by the belief that RWAs could bridge the gap between traditional finance and the burgeoning world of blockchain technology.

Challenges in Tokenization of Real-World Assets

However, the path to integrating real-world assets into the blockchain ecosystem is fraught with challenges. The regulatory landscape for tokenized assets varies by jurisdiction, complicating compliance with securities, property, and tax laws. While Switzerland permits direct on-chain issuance of tokenized assets, many other regions lack clear legal frameworks for such operations. This inconsistency makes it difficult for projects to navigate the global regulatory environment effectively.

Tokenization of real-world assets often necessitates costly and complex Special Purpose Vehicles (SPVs) to manage and tokenize assets. These SPVs add layers of legal and financial complexity, which can be prohibitive for smaller projects and deter investors. Proving ownership of tokenized assets in court can be complicated without established recognition of NFTs as valid ownership certificates. The lack of legal clarity undermines the trust and reliability crucial for widespread adoption of RWA projects.

Automated compliance features in smart contracts can reduce legal barriers, fostering institutional participation in asset tokenization. Establishing methods for authenticating NFTs and enabling court-ordered transfers is crucial for the widespread acceptance of RWA tokenization.

Various protocols for compliance and auditing will be essential for the successful implementation of RWAs as they gain traction. Addressing these challenges is crucial for the long-term viability and success of RWA projects.

Liquidity Issues and Investor Confidence

Liquidity issues pose a significant challenge for RWA projects. In niche markets where the number of potential buyers and sellers is limited, liquidity risks are heightened, potentially leading to price volatility. This volatility can deter investors, particularly retail investors sensitive to market fluctuations. Liquidity fragmentation occurs due to varying blockchain preferences among institutional investors, creating isolated pools of liquidity that impede asset movement.

Cross-chain interoperability protocols are essential for seamless asset transfer between different blockchains, reducing liquidity fragmentation. Standardizing token protocols across blockchains can enhance compatibility, improving liquidity and cross-chain operations for tokenized assets. Decentralized exchanges facilitating multi-chain trading can unify liquidity from various blockchains, addressing liquidity islands. Dedicated liquidity pools for tokenized RWAs and incentives can attract liquidity providers and enhance market liquidity.

Tokenization increases liquidity for previously illiquid assets, enabling fractional ownership, which can attract a broader range of investors. Ensuring transparency and maintaining investor confidence is crucial. Investors need to feel assured that the markets they are trading in are stable and that their investments are secure. Balancing liquidity and confidence is vital for the long-term success of RWA projects.

Overcoming Network Security Concerns

Network security is a major concern for RWA projects. Technological vulnerabilities, such as coding flaws in smart contracts, pose significant risks, including the potential loss of tokens or assets. Vulnerabilities in smart contracts can lead to financial losses, emphasizing the need for robust security measures. The risk of hacks in smart contracts creates uncertainty around tokenized asset ownership.

RWA projects emphasize investor security and transparency through blockchain to mitigate these risks. This approach can be a significant attraction compared to more speculative assets, as it promises a higher degree of safety and reliability. Thoroughly auditing and continuously monitoring smart contracts is essential to maintain trust and encourage wider adoption.

Real-World Utility vs. Speculative Gains

Investing in real-world asset projects offers a grounded opportunity, contrasting with the often speculative nature of meme coins. RWA projects may struggle to maintain investor interest if immediate financial returns are not apparent, leading to a potential shift back to speculative crypto assets. This challenge highlights the importance of demonstrating tangible real-world utility and long-term value.

Applications like using RWAs as collateral for loans or including them in index funds highlight their potential to provide real value. These applications can attract investors seeking stability and long-term growth rather than quick, speculative gains.

Balancing real-world utility with the allure of high returns is a delicate act that RWA projects must master to succeed.

Integration with Decentralized Finance (DeFi)

Integrating RWAs into DeFi platforms is anticipated to enhance the accessibility and efficiency of financial services. RWAs can be used as collateral for loans, included in index funds, and managed through autonomous protocols. For instance, Paribus aims to facilitate DeFi loans by employing RWA tokens as collateral. Such integration can create new financial products and services that leverage real-world assets, expanding the utility and appeal of both RWAs and DeFi.

Bridging the gap between traditional finance and the crypto ecosystem, RWAs can significantly enhance the DeFi space. This synergy can lead to increased cryptocurrency adoption and the development of innovative financial solutions, including rexas finance.

Integrating RWAs into the DeFi ecosystem creates new financial products and services that leverage real-world assets.

Long-Term Value and Sustainable Growth

Sustainable growth for RWA projects depends on several key factors. The entry of established financial institutions like BlackRock into the RWA tokenization space boosts credibility and attracts more investors. This involvement lends legitimacy and brings in much-needed capital and expertise. The projected growth of RWAs reflects their ability to bridge traditional finance with the blockchain ecosystem.

A strong community around a crypto project can significantly enhance its chances of achieving long-term stability and growth. Transparency and effective communication from a project’s team foster trust and investor confidence, essential for long-term growth. Projects that clearly define their value proposition and address market demands are better positioned for sustainable success.

Focusing on real value and long-term growth, RWA projects can differentiate themselves from more speculative ventures. This approach attracts a stable investor base and ensures the project’s viability and sustainability in the long run. Building and maintaining a strong community, coupled with transparent operations, are crucial for achieving these goals.

Case Studies: Successes and Failures

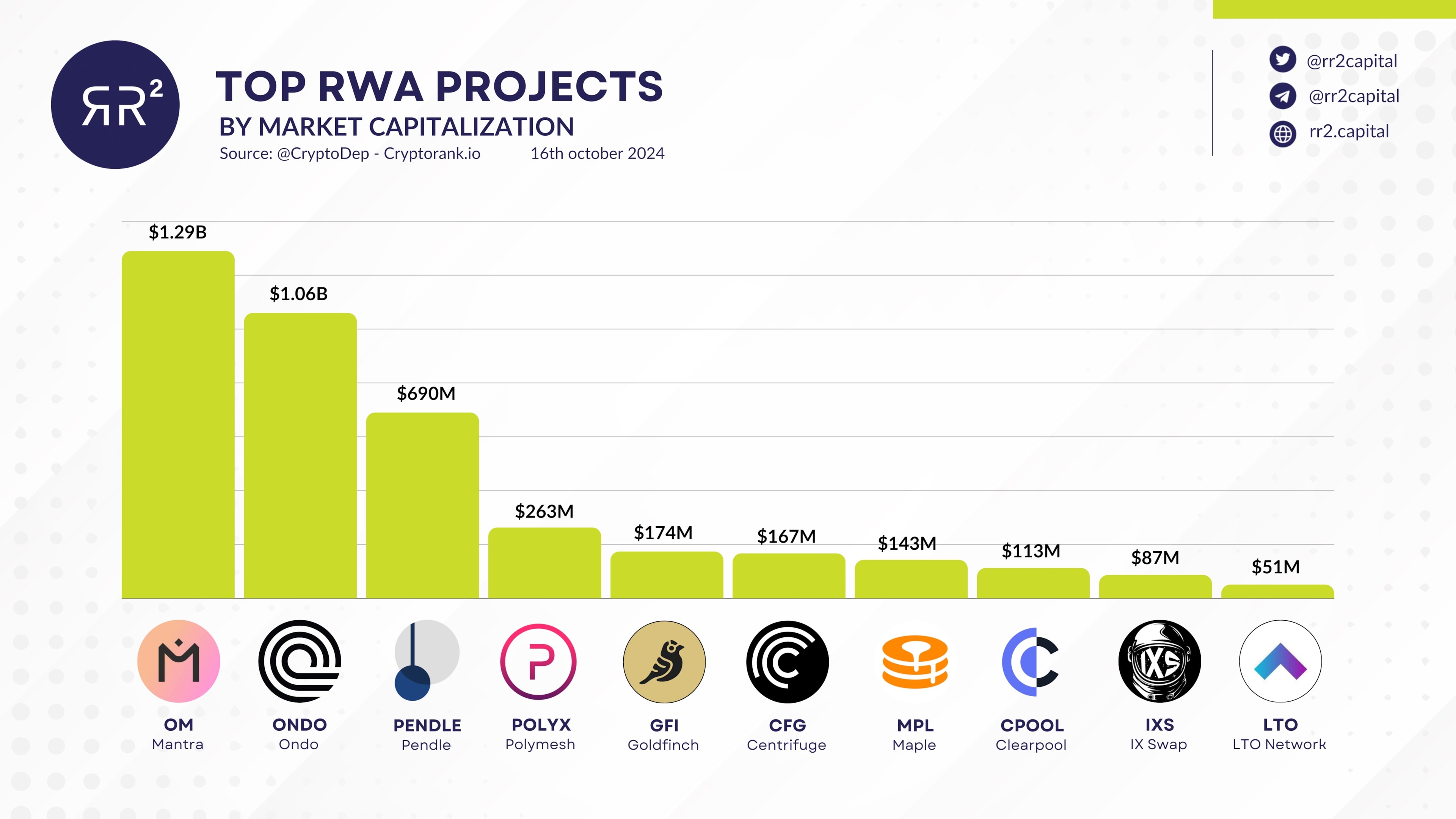

Examining case studies of both successful and failed RWA projects provides valuable insights into the factors contributing to their outcomes. SwissAssetDAO has been a key player in the securitization of real-world assets within the crypto space, operating as a Decentralized Autonomous Organization. Other notable projects like MakerDAO, Ondo Finance, and GoldFinch have made significant contributions to the development of the tokenized RWA landscape.

Not all projects have been successful. Lykke, for instance, was the first company to issue digital shares on the blockchain in 2015, but it faced regulatory challenges leading to its discontinuation.

These case studies reveal key lessons on regulatory navigation, market demand, and technological readiness. Analyzing these factors helps understand what drives success and what pitfalls to avoid.

Future Prospects for RWA Projects

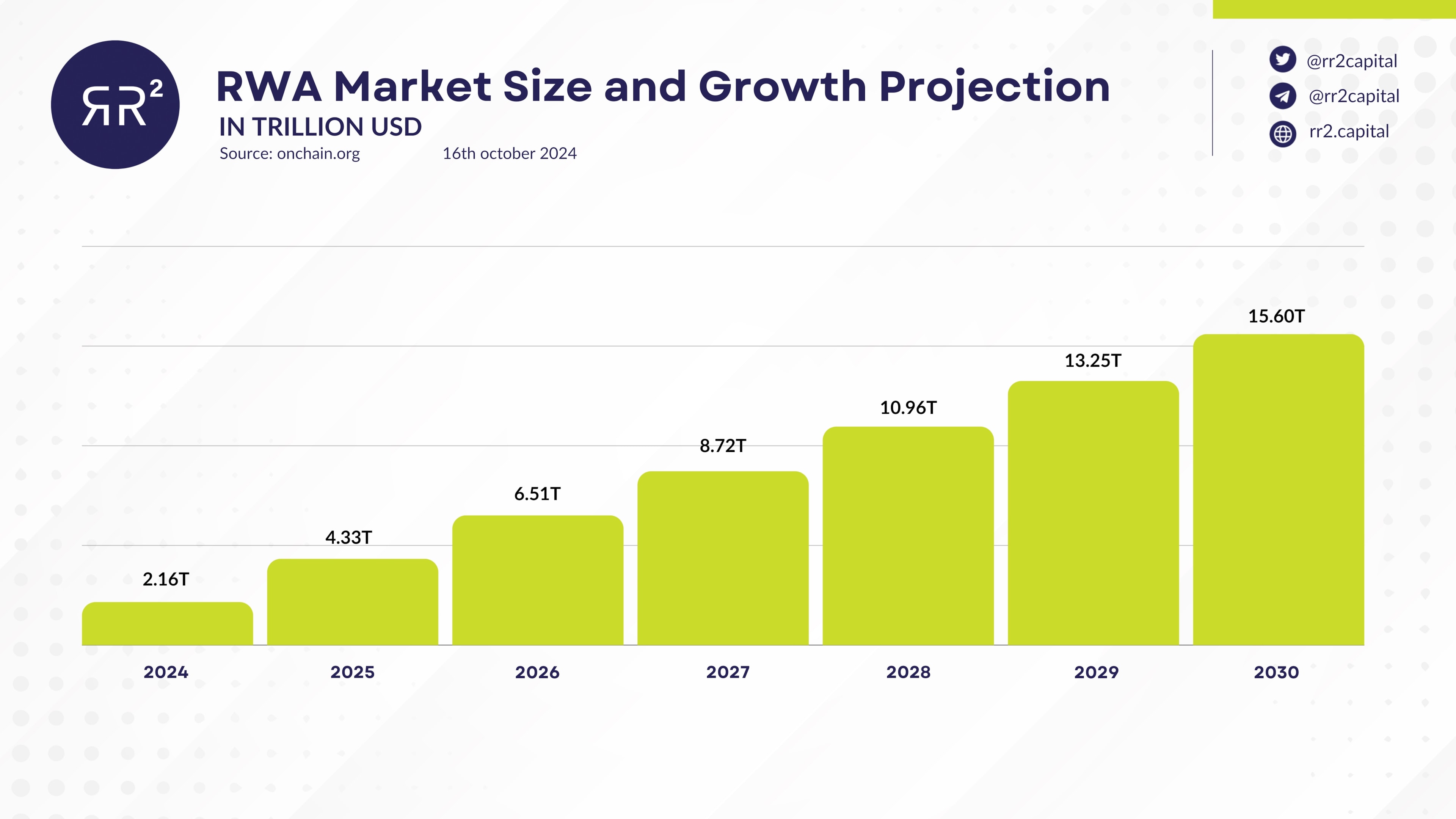

The future of RWA projects looks promising, with the tokenization market expected to reach between $3.5 trillion in a prolonged bearish scenario and up to $9 trillion in a bullish market. Boston Consulting Group estimates that tokenizing illiquid assets could represent a business opportunity worth $16 trillion. These projections underscore the immense potential of RWA projects to transform the financial landscape.

Real-World Assets and Artificial Intelligence have been identified as optimal drivers for future growth in the crypto market. Sectors expected to lead the next crypto bull run are characterized by tangible value, real-world utility, and potential for long-term growth. Focusing on real-world applications ensures that RWA projects remain relevant and valuable in the evolving cryptocurrency landscape.

Innovative projects and their potential for significant integration make the future of cryptocurrency promising. The continuous development and adoption of RWAs can drive substantial growth and create new opportunities within the crypto market. Staying ahead of technological advancements and market trends, RWA projects can position themselves at the forefront of this growth.

Summary

In summary, the initial hype surrounding RWA projects was driven by the promise of bridging traditional finance with blockchain technology. However, various challenges, including regulatory hurdles, liquidity issues, and network security concerns, have tempered this enthusiasm. Despite these obstacles, the potential for long-term value and sustainable growth remains strong, especially with the integration of RWAs into the DeFi ecosystem.

The future of RWA projects looks bright, with significant market potential and opportunities for innovation. By focusing on real-world utility and addressing the challenges head-on, RWA projects can achieve lasting success. As the crypto market evolves, staying informed and engaged with these developments is crucial for investors and enthusiasts alike.

Frequently Asked Questions

What initially drove the hype around RWA crypto projects?

The hype around RWA crypto projects was primarily driven by the participation of notable financial institutions such as BlackRock, highlighting a potential merger of traditional finance with blockchain technology. This intersection sparked significant interest and optimism in the market.

What are the main challenges in tokenizing real-world assets?

Tokenizing real-world assets faces significant challenges due to regulatory complexities, legal hurdles, and technological issues surrounding ownership verification and compliance. Addressing these factors is crucial for successful implementation.

How do liquidity issues impact RWA projects?

Liquidity issues can significantly hinder RWA projects by causing price volatility and eroding investor confidence, making it challenging to attract and maintain investments. Implementing solutions like cross-chain interoperability and decentralized exchanges can help mitigate these effects.

What role does network security play in the success of RWA projects?

Network security is essential for safeguarding investor assets and fostering trust in RWA projects, as vulnerabilities can lead to substantial financial losses and compromise the integrity of tokenized assets. Prioritizing network security ensures the project’s long-term success and reliability.

What are the future prospects for RWA projects?

The prospects for RWA projects are quite promising, as the tokenization market is projected to experience significant growth, driven by RWAs and AI. This sector presents potential opportunities valued in the trillions.