Senator Lummis and the Bitcoin Strategic Reserve: A Bold New Proposal

Senator Cynthia Lummis proposes a Bitcoin Strategic Reserve to buy 1 million Bitcoins in five years. This initiative, known as Senator Lummis and the Bitcoin Strategic Reserve, includes selling U.S. gold holdings to fund the purchase. Discover the details and potential impacts of this bold move.

Key Takeaways

- Senator Lummis proposes a national Bitcoin reserve aimed at purchasing up to 1 million Bitcoins by selling a portion of U.S. Treasury gold holdings, positioning Bitcoin alongside traditional assets like gold.

- The proposal is designed to mitigate inflation risks and decrease national debt through Bitcoin’s fixed supply, while acknowledging the volatility and associated risks of digital currencies.

- Wyoming’s innovative legislation and Senator Lummis’ advocacy highlight the state’s role in advancing digital asset management, setting a precedent for integrating Bitcoin into federal financial portfolios.

The Vision Behind the Bitcoin Strategic Reserve

Senator Cynthia Lummis has proposed a national Bitcoin reserve that aims to purchase up to 1 million Bitcoins over the next five years. This ambitious plan is part of a broader global trend where countries are increasingly considering Bitcoin as a viable reserve asset. The proposal involves accumulating approximately 5% of the total Bitcoin supply, positioning it similarly to existing gold reserves.

Lummis’ initiative is not just about hoarding digital currency; it’s about integrating Bitcoin into the federal financial system responsibly. The legislation emphasizes the protection of individual Bitcoin holders’ rights while ensuring that the federal government manages its Bitcoin assets prudently. This balance aims to foster trust and stability within the burgeoning digital economy.

This vision of a Bitcoin strategic reserve also reflects a significant shift in how financial assets are perceived and managed. As nations worldwide grapple with economic uncertainties, Bitcoin’s fixed supply and decentralized nature offer a new form of financial security and innovation. This approach could position the U.S. as a global leader in financial innovation and digital asset management.

Selling Gold Holdings for Bitcoin

To fund the Bitcoin Strategic Reserve, Senator Lummis proposes converting a portion of the U.S. Treasury’s gold holdings into Bitcoin. This move involves selling some of the government’s gold reserves, estimated at around $675 billion based on current prices, to accumulate the targeted Bitcoin stockpile. The estimated cost to purchase the additional Bitcoins is upwards of $90 billion.

The integration of Bitcoin into the federal financial system, however, is not without its challenges. The sale of gold holdings to buy Bitcoin would need to navigate complex regulatory and tax implications. Nevertheless, Lummis argues that utilizing gold certificates to purchase Bitcoin would not disrupt the U.S. balance sheet. This strategic maneuver aims to ensure that the transition is financially neutral, avoiding any significant impact on the national deficit.

Using a portion of the gold reserve to purchase Bitcoin would diversify the U.S.’s asset holdings and enhance financial resilience. This shift from traditional precious metals to digital currency underscores a broader transformation in how we perceive and manage wealth in the digital age. The potential benefits of this strategy include improved financial security and a more robust economic foundation amidst global uncertainties.

Addressing Soaring Inflation Rates

As inflation rates soar to new and unprecedented heights, the need for effective hedges against inflation becomes paramount. Supporters of Senator Lummis’ proposal argue that Bitcoin’s fixed supply offers a more reliable hedge against inflation than traditional assets like gold. Over the past 16 years, Bitcoin has demonstrated consistent value appreciation, reinforcing its potential as a strong inflation hedge.

The establishment of a Bitcoin reserve aims to provide a financial cushion amid rising inflation and escalating national debt. Incorporating Bitcoin into national reserves would bolster economic resilience and offer protection against inflationary pressures and economic uncertainties. This strategic move is designed to bolster the U.S. economy’s stability and provide a new avenue for financial security.

However, critics caution that Bitcoin’s volatility poses risks that gold does not. While Bitcoin’s fixed supply and historical appreciation make it an attractive option, its price fluctuations could threaten financial stability. Balancing these risks and rewards will be crucial as policymakers navigate this innovative proposal. The potential for Bitcoin to act as a safeguard against inflation could significantly impact the nation’s economic strategy and financial policies.

Impact on National Debt and Government Deficit

Senator Lummis introduced the BITCOIN Act as a strategic measure to enhance the U.S. dollar and reduce national debt through a Bitcoin reserve. The proposal suggests that holding Bitcoin for two decades could help reduce national debt as its value appreciates over time. Investor opinions indicate that establishing a Bitcoin reserve could be a prudent investment relative to the nation’s significant national debt.

Lummis’ plan to convert gold reserves into Bitcoin aims to avoid increasing the national deficit. Utilizing existing gold reserves, valued at approximately $675 billion, allows the U.S. to acquire Bitcoin without increasing the national debt. This approach reflects a significant shift in U.S. political attitudes towards Bitcoin, with potential implications for national fiscal policies as the national debt reaches new heights.

The strategic Bitcoin reserve could act as a valuable asset, offering long-term benefits and potentially reducing the national debt. Exploring innovative financial strategies aims to strengthen the U.S. economic position and ensure fiscal responsibility. This forward-thinking approach underscores the potential for Bitcoin to play a pivotal role in shaping the future of national financial policies.

Innovation Technology and Competitiveness

Senator Lummis believes that adopting Bitcoin as a savings technology could position the U.S. as a leader in global financial innovation. This proposal has ignited discussions about the Federal Reserve’s adaptation to the rapidly changing financial landscape. By integrating Bitcoin into federal asset portfolios, state treasuries and pension funds could protect against inflation and enhance financial stability.

The increasing market demand and technological advancements are driving banks to adopt cryptocurrencies and integrate blockchain technology into their services. Regulatory frameworks are evolving, allowing banks to safely incorporate these innovations. The integration of digital currencies into mainstream banking is expected to significantly enhance transaction efficiency and boost competitiveness through optimized investment.

Leading banks’ transition to blockchain technology signifies a transformative shift towards digitalization in the financial sector. This increased acceptance of blockchain technologies is prompting regulatory bodies to adapt their frameworks, further boosting innovation technology and competitiveness. Embracing these advancements could position the U.S. at the forefront of global financial innovation and digital asset management.

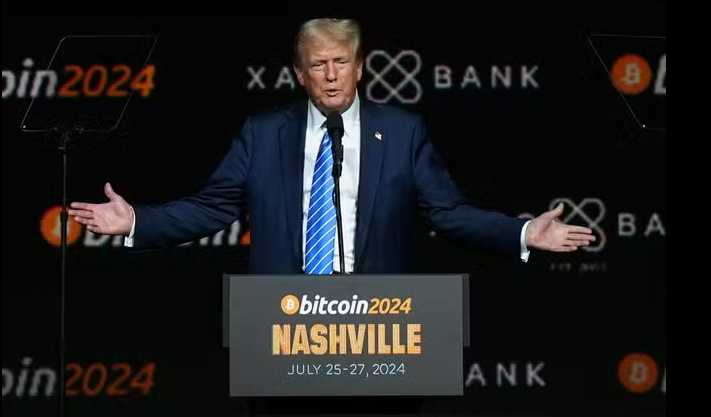

Trump’s Influence on Crypto Policies

Former President Donald Trump’s approach to cryptocurrencies has shifted dramatically from skepticism to support. He now believes that the U.S. should dominate crypto production and has actively accepted cryptocurrency donations for his campaign. This proactive stance towards the crypto market reflects his evolving views on the potential of digital currencies.

Trump’s new venture, World Liberty Financial, aims to support decentralized finance, indicating his commitment to the crypto industry. Additionally, Trump has criticized the current SEC Chairman, Gary Gensler, for his aggressive stance on crypto regulation, and has vowed to remove him from his position. This shift in policy and leadership could significantly impact the regulatory environment for cryptocurrencies in the U.S.

Trump’s influence on crypto policies underscores the political dynamics shaping the future of digital currencies. As policymakers and industry leaders navigate these changes, the potential for Bitcoin and other cryptocurrencies to play a pivotal role in the economy continues to grow. This evolving landscape presents both opportunities and challenges for the crypto industry in the U.S.

Securing a Decentralized Network

In decentralized networks, only the data owner retains the encryption key, ensuring that storage providers cannot access the stored data. Many decentralized storage solutions utilize blockchain technology to verify transactions and maintain data integrity. This combination of encryption, data fragmentation, and decentralized management significantly bolsters the security posture of a Bitcoin reserve.

Data stored in decentralized networks can be fragmented and encrypted, providing additional layers of security. This approach ensures that even if one piece of data is compromised, the integrity of the entire system remains intact. Secure storage solutions are essential for maintaining the integrity and security of the Bitcoin reserve.

These advanced security measures ensure the safe and efficient management of U.S. Bitcoin assets. This emphasis on security not only protects the reserve but also builds trust in the broader adoption of decentralized networks and blockchain technology.

Wyoming’s Role in the Digital Asset Revolution

Wyoming has positioned itself at the forefront of the digital asset revolution with its innovative legislation. The state has introduced a digital asset registration act, allowing individuals and entities to register digital assets with the Secretary of State. This law enhances ownership rights and regulatory clarity, making Wyoming a pioneer in digital asset management.

Senator Cynthia Lummis, a key advocate for the Bitcoin Strategic Reserve, hails from Wyoming. Her proposal aims for an initial acquisition of 200,000 Bitcoins, with plans to expand to 1 million Bitcoins over five years. This ambitious plan reflects Wyoming’s commitment to fostering a robust digital asset ecosystem and leading the way in financial innovation.

The comprehensive framework Wyoming is establishing includes initiatives aimed at enhancing ownership rights and increasing regulatory clarity for digital assets. Leveraging cryptographic techniques and promoting transparency through decentralization, Wyoming sets a global standard for digital asset management and innovation.

Financial Assets and the Federal Government Balance Sheet

The proposed strategic Bitcoin reserve aims to act as a supplementary store of value, strengthening America’s financial standing. Lummis suggests that investing in Bitcoin could create a balance without completely discarding traditional assets like gold. This dual-asset approach offers a diversified strategy for national financial security.

However, incorporating Bitcoin into the federal balance sheet presents challenges due to its classification as an ‘indefinite-lived intangible asset’ under current accounting guidelines. This classification means Bitcoin’s value can only be written down if impaired but cannot be increased even if its market value rises. These complexities in accounting treatment require careful navigation to accurately reflect Bitcoin’s value on financial statements.

Recent proposals for fair value accounting for crypto assets could allow federal entities to reflect Bitcoin’s market value more accurately in their financial reports. Adopting flexible accounting standards for Bitcoin could encourage federal adoption as a treasury reserve asset, aligning with trends seen in the corporate sector. This strategic move could enhance the U.S. financial position and strengthen its economic resilience.

The Future of the Crypto Industry in the U.S.

The transition to include Bitcoin in national reserves could signify a shift towards a digital economy for the U.S. Senator Cynthia Lummis views Bitcoin as an evolving alternative to gold, potentially becoming the new safe-haven asset. Support for Bitcoin as a strategic reserve asset reflects growing public trust in its ability to act as a stable store of value amid inflationary pressures.

Lummis’ initiative envisions the U.S. holding 1 million BTC over a period of 20 years. This long-term strategy could act as a catalyst for significant appreciation in Bitcoin’s value, offering substantial benefits to the national economy. Early adopters of blockchain in banking are gaining competitive advantages by offering innovative services and attracting new clients.

Embracing these advancements could position the U.S. at the forefront of the global crypto industry. This forward-thinking approach underscores the potential for Bitcoin and other digital assets to play a crucial role in shaping the future of the U.S. economy.

Summary

Senator Lummis’ proposal for a Bitcoin Strategic Reserve represents a bold new vision for the U.S. financial landscape. By diversifying national reserves with Bitcoin, the U.S. aims to enhance its economic resilience, address soaring inflation rates, and reduce national debt. This innovative approach reflects a significant shift in how financial assets are perceived and managed.

As we navigate the complexities of integrating Bitcoin into the federal financial system, the potential benefits of this strategy become increasingly clear. By embracing digital assets and pioneering regulatory frameworks, the U.S. can position itself as a leader in global financial innovation. The future of the crypto industry in the U.S. holds immense promise, and Senator Lummis’ vision is a crucial step towards realizing that potential.

Frequently Asked Questions

What is Senator Lummis’ Bitcoin Strategic Reserve proposal?

Senator Lummis’ Bitcoin Strategic Reserve proposal advocates for the U.S. Treasury to acquire up to 1 million Bitcoins over five years, establishing a national Bitcoin reserve. This initiative aims to bolster the nation’s cryptocurrency holdings and enhance its economic strategy.

How will the U.S. fund the Bitcoin Strategic Reserve?

The U.S. plans to fund the Bitcoin Strategic Reserve by selling a portion of its gold reserves. This approach offers a way to leverage existing assets for digital currency investment.

How does Bitcoin act as a hedge against inflation?

Bitcoin serves as a hedge against inflation due to its fixed supply and historical value appreciation, offering a reliable store of value over time. This characteristic helps protect purchasing power in inflationary environments.

What impact could the Bitcoin reserve have on the national debt?

Holding Bitcoin could positively impact the national debt by appreciating in value, which may provide a means to reduce the debt without increasing the deficit.

How is Wyoming leading the digital asset revolution?

Wyoming is leading the digital asset revolution by enacting forward-thinking legislation for digital asset registration and management, establishing itself as a forerunner in the digital asset space.