From Meme Coins to Real Utility: Where is Crypto Actually Heading in 2025?

Where is crypto actually heading in 2025? This article examines the shift from meme coins to real utility: where is crypto actually heading in 2025? It explores what this transition means for the future of the market.

Key Takeaways

- Meme coins, initially created for humor, are evolving into practical cryptocurrencies with real-world applications, driven by community support and market dynamics.

- Technological advancements, such as AI integration, Layer 2 solutions, and cross-chain interoperability, are shaping the growth and functionality of utility-focused cryptocurrencies in 2025.

- Institutional adoption and clearer regulations are contributing to a more legitimate cryptocurrency market, attracting traditional investors and bolstering market confidence.

The Evolution of Meme Coins

Meme coins often start as humorous projects, often reminiscent of internet jokes and memes, but can evolve into significant players in the crypto market by offering real-world applications. These coins are characterized by their ability to skyrocket overnight and crash just as fast, presenting a fun, chaotic, and surprising dynamic. Despite their volatility, the power of the community plays a crucial role in their success.

In 2025, significant opportunities might arise as retail investors spot signs of an impending bull run, which could lead to increased interest in meme coins. However, investors should expect volatility with trending meme coins as market speculative dynamics continue.

Here are the stories of three top meme coins that have made their mark as among the top best meme coin in the crypto world.

Dogecoin: From Joke to Juggernaut

Dogecoin was created by Billy Markus and Jackson Palmer as the first official meme coin. What started as a joke quickly gained traction, thanks to viral social media adoption and a strong community, leading Dogecoin to boast a market cap of over $61 billion and an all-time high price of $0.7376. Notable events like Trump’s election win and Elon Musk’s involvement have further solidified Dogecoin’s market positioning.

The Dogecoin Foundation is now working on significant improvements such as faster and cheaper transactions and enhanced tipping functionalities. These advancements demonstrate how Dogecoin has transitioned from a meme to a coin with practical applications, making it one of the most influential players in the meme coin market.

Shiba Inu: Beyond the Meme

Launched in 2020, Shiba Inu quickly made a name for itself as a meme token. Key facts include:

- In May 2025, it reached a market cap of over $8 billion.

- One of its key strategies for increasing value is the token burn mechanism.

- Over 1 billion SHIB were burned in 2024 alone.

The Shiba ecosystem includes components like:

- LEASH

- BONE

- ShibaSwap

- Shibarium

Each contributes to its growing functionality. The development of Shibarium, a Layer-2 chain, and continuous token burns are part of Shiba Inu’s strategy to enhance its value and utility within the crypto market.

Pepe Coin: Nostalgia Meets Market Cap

Pepe Coin was launched in April 2023 and quickly gained popularity through meme culture and a dedicated community. Its deflationary nature, supported by a burning mechanism, increases its scarcity and market value. Active trading and community engagement have been significant drivers of its popularity.

Built on the Ethereum blockchain, Pepe Coin benefits from the robust functionality and market engagement that Ethereum provides. This meme coin’s journey from a nostalgic internet meme to a significant player in the crypto market highlights the potential for meme coins to evolve and gain substantial market caps.

Real Utility in Crypto: Key Trends of 2025

The crypto market of 2025 is characterized by technological maturation, regulatory clarity, and institutional adoption, which are key drivers for the explosive growth of altcoins. Innovations like AI integration, Layer 2 scaling, and cross-chain infrastructure are reshaping the landscape. Technology that solves real-world problems is increasingly driving sustained value growth in the crypto market.

Projects like SpacePay and Best Wallet Token exemplify the emphasis on low-cost transactions and robust security features. Additionally, pro-crypto initiatives from governments are stimulating technological advancements and fostering a more robust market environment.

These key trends are defining the real utility in crypto in 2025.

AI Integration in Cryptocurrencies

AI tools are becoming essential for functions such as trading optimization and smart contract audits in the crypto world. These tools enhance efficiency and accuracy, making cryptocurrencies more robust and attractive to investors.

Layer 2 Solutions

Layer 2 networks are significantly improving transaction speeds and reducing fees for cryptocurrencies, leading to faster transactions. Ethereum’s gas fees, for instance, have dramatically decreased to below 50 cents thanks to Layer 2 solutions. Shiba Inu’s Layer-2 chain also reduces gas fees and boosts speed, showcasing the practical benefits of these solutions.

DeFi protocols have captured value by recreating traditional financial services on-chain, and ongoing improvements in Layer 2 technologies promise to further enhance blockchain transaction efficiencies. These protocol upgrades are crucial for the future scalability and usability of blockchain networks.

Cross-Chain Interoperability

Cross-chain solutions are facilitating seamless asset transfers across different blockchains without security risks. These interoperability tools are advancing, allowing for integrated multi-blockchain user experiences and enhancing the overall user experience by providing access to a diverse range of blockchain functionalities.

Emerging Crypto Projects with Real Utility

Several cryptocurrencies have successfully evolved from meme tokens into platforms offering real-world applications, demonstrating their potential for utility. For instance, Floki Inu’s FlokiFi suite includes DeFi tools that enhance financial services for its users, marking its transition into the DeFi landscape. Social media serves as a major catalyst for the growth and visibility of cryptocurrencies.

Monitoring major exchanges in cryptocurrency helps spot new and credible tokens that may have garnered investor interest. Endorsements from influential figures can significantly sway market sentiment and enhance the visibility of a cryptocurrency on top exchanges.

Here are three emerging projects that are revolutionizing areas from payments to influencer marketing.

SpacePay ($SPY): Revolutionizing Payments

SpacePay supports merchants in accepting cryptocurrency by providing:

- A payment infrastructure that integrates with existing point-of-sale systems

- A transaction fee of just 0.5%, significantly lower than traditional payment processors

- The ability to convert cryptocurrency payments to fiat instantly

SpacePay is revolutionizing low-cost cryptocurrency payments and addressing merchant volatility concerns.

Best Wallet Token ($BEST): Next-Gen Wallet Ecosystem

Best Wallet Token ($BEST) is designed to enhance the Best Wallet ecosystem. Token holders have governance rights, allowing them to influence the development and direction of the ecosystem.

The wallet ecosystem accommodates a wide variety of blockchain networks, enhancing user experience and making it a versatile tool in the crypto world.

SUBBD ($SUBBD): AI-Powered Creator Economy

SUBBD focuses on transforming influencer marketing through advanced AI capabilities. This project leverages AI to facilitate more effective content monetization and allows influencers to engage their audience dynamically, revolutionizing the creator economy.

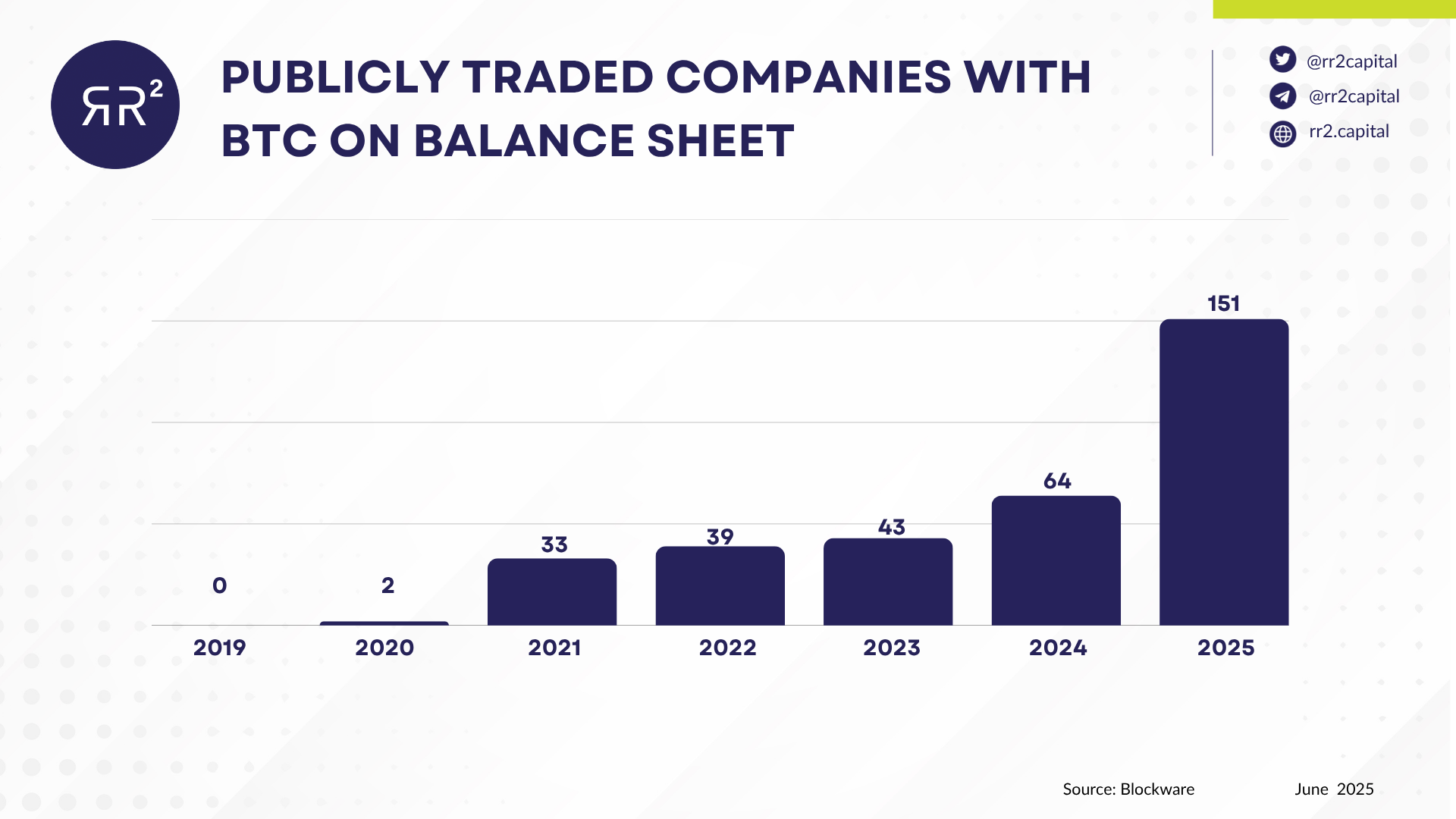

Institutional Adoption and Regulatory Clarity

The cryptocurrency market is witnessing a revival due to several factors:

- Increasing adoption and investor confidence.

- Entry of traditional financial institutions into cryptocurrency, enhancing market legitimacy and attracting more investors.

- Introduction of clearer regulations in various countries, enhancing stability and attracting institutional interest.

Clearer regulations are encouraging institutional investors to engage more with cryptocurrencies. The impact of Bitcoin ETFs, pro-crypto policies, and regulatory developments in 2025 on the crypto market will be explored.

Bitcoin ETFs and Institutional Capital

The emergence of Bitcoin ETFs has created diverse investment products, facilitating easier access for institutional investors. The launch of ETFs has significantly boosted institutional interest by providing a regulated and accessible entry point into Bitcoin. These ETFs simplify the investment process, allowing traditional investors to acquire Bitcoin without directly managing it.

Bitcoin ETFs have significantly attracted institutional capital by providing a regulated investment vehicle, thereby increasing Bitcoin’s market capitalization and enhancing its legitimacy.

Pro-Crypto Policies and Their Impact

Pro-crypto policies and clear guidelines have reduced regulatory risk and encouraged innovation. Supportive regulatory changes have encouraged more companies to innovate and engage with cryptocurrencies, fostering a more robust and dynamic crypto market.

Regulatory Developments in 2025

The ongoing regulatory changes are expected to shape the future of cryptocurrency markets by establishing clearer operational new rules. Regulatory clarity can enhance operational standards, facilitating growth and trust in the crypto industry.

Security audits from companies such as CertiK and ConsenSys provide insights into project legitimacy. They also help in mitigating technical risks.

Community Building and Social Momentum

A robust crypto community often drives the success and sustainability of cryptocurrency projects. Strong communities help coins survive and maintain interest, especially during market downturns. Investing in meme coins requires an understanding of community engagement and its impact on value.

Communities provide organic marketing and development support, which sustains momentum. For example, Floki Inu’s marketing strategy includes partnerships with sports teams, which has helped build its brand and community engagement.

Let’s explore the role of social media, community proposals, and influencer endorsements in building strong crypto communities.

The Role of Social Media

Social media platforms serve as foundational tools for engagement and promotion within the cryptocurrency ecosystem. Effective community building on social media enhances user loyalty and fosters a sense of belonging among crypto enthusiasts. Influencer endorsements on social media can significantly sway public opinion, driving interest and investment in particular tokens.

Community Proposals and Governance

Community-driven governance mechanisms allow members to participate in critical decision-making processes that affect project direction. Decentralized governance often involves community proposals that enable members to influence project directions and improvements, fostering community growth.

Projects with strong community engagement can enhance the sustainability of meme coins, ensuring they adapt and grow according to the collective vision of their passionate community.

Influencer Endorsements

Influencer endorsements play a pivotal role in shaping market sentiment and enhancing token visibility in the cryptocurrency arena. Platforms like SUBBD utilize AI to revolutionize influencer marketing, facilitating more effective content monetization and allowing influencers to engage their audience dynamically.

The combined effect of influencer marketing and AI-driven strategies creates a robust environment that can amplify market sentiment and significantly affect token valuations.

Risks and Rewards of Investing in Utility-Focused Cryptos

Investing in utility-focused cryptos involves navigating a landscape of high risk and high reward opportunities. The strong investor demand for crypto projects can be indicated by consistently oversubscribed presale rounds, suggesting significant upsides for well-positioned tokens. However, this comes with the caveat of extreme volatility, where market sentiment can shift rapidly, impacting token values and investment returns.

Financial institutions are increasingly integrating cryptocurrencies into their investment strategies to diversify portfolios and manage inflation risks. This trend underscores the long-term viability of well-designed utility tokens. Sustainable tokenomics, such as preventing excessive dilution and incentivizing long-term holding, are crucial for ensuring the stability and growth of these projects.

Analyzing market trends and community activity is crucial before investing in any meme coin. Investors must conduct their own research to understand the potential risks and rewards associated with their investments. This due diligence helps mitigate risks and enhances the likelihood of making informed, profitable decisions.

High Risk, High Reward Opportunities

Strong investor demand for crypto projects can be indicated by consistently oversubscribed presale projects. Future meme coin presales are anticipated to have rosy futures with significant upsides, provided they navigate the inherent high risks, hype, and extreme volatility. Remember, the presale ends soon!

Partnerships provide credibility and distribution channels that are crucial for the growth of crypto projects.

Long-Term Viability and Stability

Sustainable tokenomics is crucial. It helps prevent excessive dilution and encourages long-term holding. Projects with well-designed token economics are ranked higher based on factors like:

- Token distribution

- Vesting schedules

- Staking mechanisms

- Utility drivers.

These strong incentive structures encourage holding over speculation, contributing to the long-term viability of the project.

The Importance of Own Research

Analyzing market trends and community activity is crucial before investing in any meme coin. This due diligence helps investors understand the potential risks and rewards associated with their investments, ensuring they make informed, profitable decisions.

How to Identify Promising Utility Tokens

Identifying promising utility tokens involves analyzing their practical applications and the problems they aim to solve. Key factors contributing to the success of promising tokens include:

- Aligning with market trends

- Solving genuine problems

- Building passionate communities

- Exchange accessibility

- Active development teams

- Bull market launches

- Being early movers

Here are some tips on how to spot the next big utility token.

Technology Innovation Assessment

The assessment of technical innovation involves considering factors such as:

- Technical audits

- Development activities

- Consistent code commits and frequent updates, which indicate serious project development

- A rise in developer contributions, which is also a key indicator

Evaluating a project’s team involves assessing their background, previous successes, and strategic partnerships, which significantly affect evaluations.

Community and Social Metrics

Active engagement and genuine follower growth on social media platforms indicate a project’s potential investor interest. Projects with strong community support, including early adopters, are more likely to succeed, as they benefit from organic marketing, active development support from their passionate community, and a solid social presence.

Market Timing and Narrative Alignment

Aligning investment strategies with prevailing market narratives can significantly affect the success of a cryptocurrency investment. Market timing involves analyzing and predicting optimal entry and exit points for investments in cryptocurrencies based on market cycles. A well-timed investment that resonates with current market narratives can lead to higher returns and a lower risk of adverse outcomes.

Success Stories: Cryptos That Transitioned from Meme to Utility

This year’s breakout star in the meme coin market is Dogwifhat, showcasing the potential for meme tokens to gain traction and utility. The transition of meme coins to utility signifies a shift in investor perception, emphasizing the importance of community engagement and real-world applications.

As more meme coins like Dogwifhat move towards offering utility, the landscape of other cryptocurrencies may benefit from increased legitimacy and innovation.

Dogecoin and Its Payment Use Cases

Dogecoin, originally created as a joke, has evolved to become a widely recognized crypto asset with practical applications, especially in the realm of payments. Various merchants and platforms are increasingly adopting Dogecoin as a legitimate payment method, reflecting its growing acceptance in the mainstream economy.

The successful integration of Dogecoin for payments not only enhances its utility but also promotes broader acceptance of cryptocurrency in everyday transactions.

Shiba Inu’s Ecosystem Expansion

Shiba Inu has launched ShibaSwap and is developing SHIB: The Metaverse to enhance its utility within the crypto ecosystem. The development of ShibaSwap, a decentralized exchange, and SHIB: The Metaverse are crucial for positioning Shiba Inu as a significant player in the crypto market beyond its meme origins.

Floki Inu’s DeFi and Metaverse Ventures

Floki Inu has developed a suite of DeFi tools called FlokiFi and an NFT-based metaverse game named Valhalla. The features of Floki Inu include an NFT marketplace and various DeFi tools aimed at enhancing user engagement.

These ventures have contributed to its significant increase in value and positioned it as a key player in the crypto world.

Summary

The evolution from meme coins to real utility is reshaping the crypto landscape in 2025. From Dogecoin’s practical payment applications to Shiba Inu’s expansive ecosystem and Floki Inu’s DeFi and metaverse ventures, these projects illustrate the potential for meme coins to evolve and gain real-world utility. As technological advancements, regulatory clarity, and community engagement continue to drive this transformation, the future of cryptocurrency looks promising and full of opportunities. Stay tuned and keep exploring the dynamic world of crypto.

Frequently Asked Questions

What are meme coins?

Meme coins are cryptocurrencies that initially begin as lighthearted or humorous projects, yet they can develop into notable assets in the crypto market by providing tangible use cases.

How has Dogecoin evolved over the years?

Dogecoin has transformed from a humorous meme-based cryptocurrency into a significant digital asset, gaining recognition for its practical use in payments and growing community support. This evolution showcases its resilience and adaptability in the ever-changing cryptocurrency landscape.

What is Shiba Inu’s strategy for increasing its value?

Shiba Inu is focused on enhancing its value through token burn mechanisms, the development of Shibarium, and expanding its ecosystem with components like LEASH, BONE, ShibaSwap, and SHIB: The Metaverse. This multifaceted approach aims to increase demand and utility for its tokens.

What role does AI play in the crypto market?

AI plays a crucial role in the crypto market by optimizing trading strategies and conducting smart contract audits, significantly improving operational efficiency and accuracy.

How can investors identify promising utility tokens?

To identify promising utility tokens, focus on their practical applications, community engagement, and technological innovation while ensuring alignment with current market trends. This approach will help you make informed investment decisions.