Future Policies for Bitcoin in the United States: What to Expect

Bitcoin regulations in the United States are in flux, with policymakers actively discussing future policies that could reshape the landscape. As 2024 approaches, what changes can we expect in federal laws, regulatory oversight, and taxation? This article dives into the potential future policies for Bitcoin in the United States and what they could mean for investors, businesses, and everyday users.

Key Takeaways

- US cryptocurrency regulation involves multiple federal bodies such as the SEC, CFTC, and Department of the Treasury, creating a complex regulatory landscape that currently allows legal use but hesitates on bank acceptance due to lack of a comprehensive framework.

- Potential changes to federal securities laws and their application to cryptocurrencies may redefine the regulatory environment, particularly through the Howey Test which identifies investment contracts, thus impacting how Initial Coin Offerings (ICOs) and other crypto activities are regulated.

- The SEC continues to exert significant influence over the crypto market with increased enforcement actions and calls for major exchanges to register, aiming to stabilize markets and uphold investor protections, reflecting its commitment through cases like those against Coinbase.

Current Regulatory Landscape for Bitcoin in the US

In the United States, the tapestry of cryptocurrency regulations is a patchwork quilt, crafted by the hands of multiple federal bodies. The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Department of the Treasury, among others, weave their threads into this complex fabric. Within this landscape, it’s perfectly legal to use, buy, and possess cryptocurrencies, yet the embrace of these digital currencies by US banks remains tentative, hindered by the absence of a comprehensive regulatory framework.

For those yearning to dive into the crypto market, US-based cryptocurrency exchanges demand a ritual of identification, from revealing your name and address to providing a photograph of your ID and a selfie. This rite of passage ensures that only those who are willing to share their personal details may access the platform. This is a testament to the stringent requirements faced by centralized exchanges, while the decentralized finance (DeFi) sector navigates murkier waters.

Cryptocurrency transactions, particularly sales considered securities or money transmission, are regulated at both the state and federal levels, adding layers of complexity for cryptocurrency companies. And yet, in the early months of 2024, the SEC cast a ray of hope by approving the first 11 spot bitcoin ETFs, signaling a potential shift towards greater acceptance within the existing securities laws.

But as we stand at the cusp of 2024, the winds of change are whispering of upcoming cryptocurrency regulations, with policymakers engaged in fervent discussions. The existing framework, while providing legal clarity, struggles to fully mitigate the unique risks blockchain technology brings to the table. The juxtaposition of legal use and limited bank acceptance paints a picture of a sector poised for transformation, as the cryptocurrency sector eagerly anticipates the regulatory road ahead.

Potential Changes in Federal Securities Laws

The federal securities laws in the United States have long served as the guardians of investor interests, with a mandate to regulate investments regardless of their form or nomenclature. As cryptocurrencies continue their meteoric rise, one can’t help but wonder how these laws might evolve to encompass the burgeoning asset class. The heart of the matter lies in the ‘investment contract’ – a concept that, thanks to the U.S. Supreme Court’s interpretation, includes even the most novel and uncommon devices if they bear the hallmarks of what commerce recognizes as securities.

The ‘Howey Test’ – a litmus test crafted by the Supreme Court – determines if an asset is an ‘investment contract’ and thus, a security. It considers whether there’s an investment of money in a common enterprise, with a reasonable expectation of profits derived predominantly from the efforts of others. This three-pronged criteria has become the cornerstone in the SEC’s assessment of various financial arrangements, including those in the crypto space.

Financial institutions and innovators tread carefully, knowing that the SEC wields a diverse toolkit to regulate the crypto market. Companies pondering Initial Coin Offerings (ICOs) or Security Token Offerings (STOs) must navigate these waters with legal and regulatory acumen to sidestep the whirlpools of fines and criminal charges. The potential for change in securities laws hangs over the cryptocurrency market like a sword of Damocles, promising to redefine the regulatory landscape for digital currencies.

Role of the Securities and Exchange Commission (SEC)

The SEC, as a regulatory authority, casts a long shadow over the digital asset terrain, asserting its dominion over any token or digital asset that stands as a security. In a landmark case in 2023, a New York federal court sided with most of the SEC’s charges against Coinbase, bolstering the agency’s stance that crypto transactions on its platform are, indeed, ‘investment contracts’ under the Howey test. This has set a precedent, as the SEC continues to navigate the uncharted waters of the crypto sector.

The Howey test remains the SEC’s compass, guiding its determination of whether a cryptocurrency is a security. The test’s criteria – investment of money, common enterprise, expectation of profit, and the reliance on the efforts of a third party – are meticulously scrutinized by the SEC. With recent enforcement actions, the SEC aims to uphold market integrity by clamping down on price manipulation and monitoring for unusual activities. The year 2023 witnessed the SEC wielding its gavel in 26 cryptocurrency enforcement actions, following the tumultuous bankruptcies that rattled the crypto world.

The SEC’s reach extends beyond the corporate veil, with charges laid against high-profile individuals, including celebrities, for improperly promoting cryptocurrencies. Chair Gary Gensler’s clarion call for major crypto exchanges to register as securities trading platforms echoes throughout the halls of the financial sector. The charges against Coinbase, for operating as an unregistered national securities exchange, serve as a stark reminder of the SEC’s vigilant watch over the marketplace.

Expanding its gaze, the SEC has fortified its Cyber Unit, now known as the Crypto Assets and Cyber Unit, increasing its size by two-thirds in 2022. This move underscores the SEC’s intent to extend investor protections to crypto, ensuring that the same standards that have underpinned the success of U.S. securities markets are upheld in the digital realm. The SEC’s enforcement is motivated by a desire to bolster investor protections, stabilize markets, and shine a light on the digital landscape’s intricacies. When a cryptocurrency is deemed a security, the issuer must navigate the labyrinth of SEC regulations, with extensive reporting and transparency requirements. The SEC’s increased scrutiny on stablecoins and other tokens is a testament to its commitment to bringing greater regulatory oversight to the table.

Commodity Futures Trading Commission (CFTC) Oversight

The Commodity Futures Trading Commission (CFTC) stands as a sentinel, overseeing the futures and derivatives trading of cryptocurrencies, with a keen eye on curbing market manipulation and fraud. Its jurisdiction encompasses virtual currency futures markets, presiding over the self-certification processes for new contracts. The CFTC’s approach is surgical, primarily targeting market manipulators whose actions sully the integrity of Bitcoin and other digital currencies. This focus on mitigation is crucial, for cryptocurrency regulation must address the irreversible nature of digital contracts that are immune to disputes or reversal.

CFTC Commissioner Caroline Pham has championed a leading role for the CFTC in digital asset regulation, signaling a proactive stance towards the crypto industry. The agency has issued a primer, laying out its regulatory role and the inherent risks of digital assets, serving as a guide for the uninitiated and a warning for the reckless. As the guardian of market integrity, the CFTC’s vigilance is a bulwark against the dark tides of manipulation that threaten the cryptocurrency market.

Internal Revenue Service (IRS) Taxation Policies

When it comes to the Internal Revenue Service (IRS), cryptocurrencies enter the realm of ‘digital assets,’ subject to the same scrutiny as other forms of value recorded on cryptographically secure ledgers. Brokers dealing in digital assets must report transactions exceeding $10,000 to the IRS, ensuring transparency in the flow of digital wealth. The IRS requires taxpayers to maintain meticulous records, levying taxes on gains from sales and the fair market value of mined cryptocurrencies. It’s a mandate that extends to everyone filing certain tax forms, with a pointed question about digital assets that cannot be ignored.

In 2023, the IRS demonstrated its commitment to digital asset compliance by:

- Proposing regulations for broker reporting

- Bolstering its team with two private-sector experts to sharpen its focus on the taxation and compliance of digital assets

- The Inflation Reduction Act’s funding is fueling the IRS’s endeavors, enhancing taxpayer service, modernizing technology, and reinforcing enforcement efforts

Like the detail-oriented accountant, the IRS’s policies on cryptocurrency taxation are meticulous and comprehensive, ensuring that every digital penny is accounted for.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

The Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations serve as the watchtowers guarding against the misuse of cryptocurrencies. The AMLA 2020 fortifies these defenses, aligning virtual asset providers with the stringent requirements of the Bank Secrecy Act. Exchanges and wallets must adopt Know Your Customer (KYC) protocols and AML measures, or face the stark reality of denied licenses or burdensome remediation work.

The Financial Action Task Force (FATF) has exposed nefarious schemes involving cryptocurrencies, where phishing and complex transfer networks obscure the ill-gotten gains. The Department of Justice’s National Cryptocurrency Enforcement Team (NCET) is dedicated to disrupting illicit activities funded through cryptocurrencies, targeting everything from cyber crimes to terrorist financing. In collaboration with the Financial Crimes Enforcement Network, the commitment to AML and CTF laws is unwavering, as regulatory authorities demand businesses implement robust safeguards to prevent cryptocurrencies from becoming conduits for cross border crypto crimes and other financial transgressions.

Impact of Central Bank Digital Currency (CBDC) Development

As dawn breaks on the horizon of the digital economy, the development of Central Bank Digital Currencies (CBDCs) casts a long shadow over the cryptocurrency market. Announcements regarding CBDCs have been known to send ripples through the crypto markets, impacting Bitcoin prices with effects that can vary over time. The introduction of CBDCs during the tumultuous times of the COVID-19 pandemic has illuminated their potential to significantly influence financial markets.

The emergence of CBDCs is more than a new chapter in the annals of virtual currency; they are a harbinger of transformation, challenging the established norms of the global financial system. As central banks around the world flirt with the idea of issuing their own digital currencies, the crypto sector watches with bated breath, anticipating the potential reverberations on the blockchain landscape.

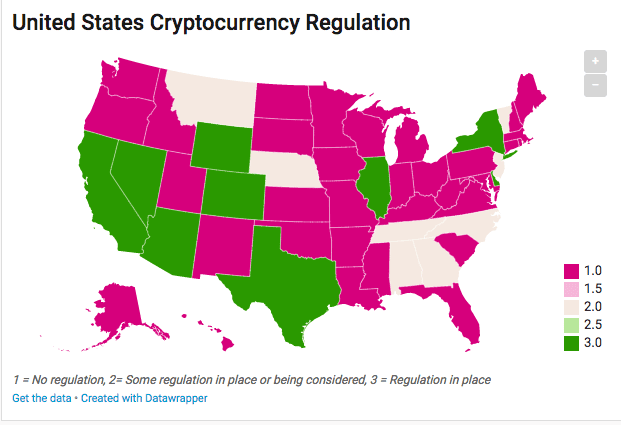

State-Level Bitcoin Regulations

Venturing into state-level dynamics, we encounter additional layers of cryptocurrency regulations, such as New York’s BitLicense. Since its inception in June 2015, the BitLicense has set the pace, requiring virtual currency enterprises to secure a license from the Department of Financial Services (DFS). The DFS oversees the BitLicense applications through the Nationwide Multistate Licensing System and Registry (NMLS), ensuring a structured process for applicants.

Entities seeking approval must present a complete checklist for a substantive review of their BitLicense application. Additionally, licensees are mandated to obtain surety bonds or fund accounts dedicated to customer protection. New York presents a choice: to apply for a BitLicense or to seek a charter under the New York Banking Law for conducting virtual currency business activities. The latter, a limited purpose trust company charter, may offer added benefits such as fiduciary powers.

In the Empire State, businesses can offer a selection of coins – those approved by DFS, self-certified coins, or coins on the DFS Greenlist. These state-level regulations, while perhaps seen as an added hoop to jump through, symbolize a commitment to consumer protection and financial regulations that serve as a blueprint for other states considering their own digital currency oversight mechanisms.

Future of Bitcoin in Decentralized Finance (DeFi)

Decentralized Finance (DeFi) stands as a testament to the transformative power of blockchain technology, challenging traditional financial entities with a model that eliminates the need for centralized intermediaries. Platforms like Aave, Compound, and MakerDAO are at the forefront, offering users the ability to:

- lend and borrow assets via smart contracts, a cornerstone of the DeFi revolution

- earn interest on their holdings

- participate in liquidity pools

- trade assets directly from their wallets

Stablecoins such as USDT, USDC, and DAI act as pillars of stability within this volatile market, providing a buffer against the unpredictable tides of cryptocurrency values.

Incentives like yield farming and liquidity mining beckon participants to DeFi protocols, rewarding them for their liquidity contributions with lucrative returns. Synthetics create a bridge to the world of traditional assets, allowing investors to partake in the performance of stocks and commodities through blockchain-based representations. The CFTC acknowledges the potential of these financial innovations to reshape regulated markets, hinting at a future where digital assets play a pivotal role in the financial ecosystem.

The DeFi landscape is both a frontier of opportunity and a minefield of regulatory challenges. The future of Bitcoin in DeFi hinges on the ability to navigate these challenges, striking a balance that fosters innovation while ensuring the stability and integrity of financial services.

Financial Stability and Consumer Protection

Financial stability and consumer protection are twin pillars that uphold the integrity of the cryptocurrency market. Regulators are tasked with the delicate balancing act of fostering innovation while erecting safeguards to protect investors and maintain market integrity. The SEC, in its pursuit of investor protection, justifies its tightened enforcement as a shield against fraud, market manipulation, and a beacon for greater transparency.

The collapses of platforms like FTX and Terra Luna have exposed the vulnerabilities within the crypto space, amplifying the calls for clear and robust policies to shield investors from harm. Legislative initiatives are in the works, with proposals that could introduce stringent compliance requirements for crypto exchanges and enhance consumer protections. Collaborative efforts between the government and the crypto industry are essential to establish effective regulations that strike the right balance between innovation and fraud prevention.

Yet, there’s a cautionary note: Over-regulation could suffocate the very innovation that has made the crypto space a hub of financial creativity. As policymakers grapple with these issues, the future of the cryptocurrency market hangs in the balance, with the potential for either a flourishing ecosystem or a stifled environment where innovation is curtailed in the name of consumer protection.

Global Regulatory Cooperation

The world of cryptocurrencies knows no borders, and as such, global regulatory cooperation is the compass that guides us towards a harmonious regulatory framework. A symphony of international collaboration and information sharing is paramount for effective monitoring of crypto asset service providers. The cross-border nature of the markets necessitates a consistent and comprehensive approach to regulation and oversight to:

- Protect investors from significant risks

- Ensure transparency and accountability in the industry

- Prevent money laundering and terrorist financing

- Promote market integrity and fair competition

The Financial Stability Board (FSB) underscores the importance of a thorough analysis of the crypto economy to craft suitable regulatory frameworks that can withstand the intricacies of this evolving space. As the G20 Presidency sheds light on the macro implications of crypto assets, it becomes evident that a coordinated and consistent policy approach is critical for the stability of the global financial system. Authorities are called upon to synchronize their regulatory frameworks with the emerging guidelines and standards developed by international bodies to ensure a uniform treatment of crypto assets across the globe.

Navigating the patchwork of international regulations is akin to sailing the high seas – it requires vigilance, cooperation, and the willingness to adapt to the ever-changing conditions. The journey towards global regulatory clarity is ongoing, with each nation contributing its piece to the puzzle in the quest for a balanced and effective oversight of the cryptocurrency market.

Upcoming Legislative Proposals

On the horizon, a new era of cryptocurrency regulation is taking shape with upcoming legislative proposals in the U.S. Congress. These proposals seek to cement a more lucid regulatory framework for cryptocurrencies, potentially ushering in a new epoch for the crypto sector. The proposed Financial Innovation and Technology (FIT) for the 21st Century Act and the Blockchain Regulatory Certainty Act are but two of the bills that signal a shift toward a more structured approach to cryptocurrency regulation. One bill in particular aims to bring cryptocurrencies under the same regulatory umbrella as traditional financial assets, potentially transforming the way the crypto market operates.

Another intriguing proposal suggests the creation of a new regulatory body dedicated to the oversight of cryptocurrency markets, a move that could redefine the landscape for crypto firms and investors alike. As federal agencies clamor for Congressional action to address gaps in cryptocurrency regulation, the future of crypto regulatory frameworks seems poised for significant change. These legislative winds could carry the crypto market toward safer shores or possibly into uncharted waters, depending on how the balance between innovation and regulation is struck.

How to Stay Compliant

In the shifting sands of cryptocurrency regulation, staying compliant is the beacon that keeps businesses and investors from running aground. Here are some key points to remember:

- Centralized cryptocurrency exchanges are required to issue Form 1099-B to their customers and report transactions to the IRS, ensuring compliance with tax regulations.

- Whether trading crypto assets or accepting them as payment, one must remain cognizant of the specific regional regulations that govern these activities.

- The CFTC, in its role as a regulatory authority, offers a plethora of customer advisories aimed at steering market participants away from scams related to digital assets and trading.

To navigate the complexities of the crypto market, staying abreast of the latest regulatory developments is crucial. Seeking professional guidance can be the difference between floundering in regulatory quagmires and sailing smoothly through the compliance channels. Embracing transparency and clear communication about compliance efforts not only builds trust in the crypto space but also fortifies the foundation upon which the market can grow and innovate. Staying compliant is not just about adhering to the rules; it’s about understanding the spirit of the regulations and contributing to a healthy, trustworthy market that benefits all.

Summary

As we conclude our exploration of the future policies for Bitcoin in the United States, we are reminded that the cryptocurrency market is a dynamic and ever-evolving landscape. From the current regulatory framework to the role of federal agencies like the SEC and CFTC, and from the state-level regulations to the potential impacts of CBDCs and DeFi, the intricacies of navigating this space are manifold. While upcoming legislative proposals promise to bring clarity and structure, the importance of global regulatory cooperation and staying compliant cannot be overstated.

Let this journey be a reminder that the future of Bitcoin and cryptocurrencies in the US is a tapestry being woven by the collective efforts of regulators, legislators, and market participants. As the threads of innovation intertwine with the strands of regulation, a new picture emerges – one that holds the promise of financial inclusion, responsible innovation, and stability. May this inspire you to engage proactively with the evolving regulatory landscape, ensuring that you, too, can contribute to the responsible growth of this transformative sector.

Frequently Asked Questions

Are cryptocurrencies legal to use in the US?

Yes, cryptocurrencies are legal to use, buy, and possess in the US, despite limited acceptance by banks due to regulatory limitations.

What is the Howey test, and why is it important for cryptocurrencies?

The Howey test is used by the SEC to determine if a cryptocurrency is considered a security by evaluating specific criteria related to investment and profit expectations. This is important for cryptocurrencies as it helps to determine whether they fall under regulatory frameworks for securities.

What does the CFTC regulate in terms of cryptocurrencies?

The CFTC regulates futures and derivatives trading of cryptocurrencies to prevent market manipulation and fraud.

How are cryptocurrency transactions taxed by the IRS?

Cryptocurrency transactions are taxed by the IRS as digital assets. Detailed records and reporting of transactions over $10,000 are required, and taxpayers must pay taxes on gains from sales and fair market value of mined cryptocurrency.

What new regulations may be coming for cryptocurrency markets?

New legislative proposals in Congress aim to establish clearer regulatory frameworks for cryptocurrencies, potentially bringing them under the same regulatory umbrella as traditional financial assets and creating a new regulatory body for the crypto market. These changes could significantly impact the way cryptocurrencies are classified and regulated.