How Artificial Intelligence Can Impact the Finance Industry: Key Changes and Benefits

Artificial intelligence is transforming the finance industry by enhancing customer service, streamlining operations, optimizing investment strategies, and improving risk management. This article explores how artificial intelligence can impact the finance industry, reshaping various aspects of finance and offering both significant benefits and new challenges.

Key Takeaways

- AI is reshaping the finance industry by enhancing customer satisfaction, streamlining back office operations, and optimizing investment strategies through advanced data analytics.

- The integration of AI in finance improves risk management and fraud prevention by enabling real-time transaction monitoring and more accurate risk assessments.

- Despite the benefits of AI, ethical considerations such as data privacy, bias in AI models, and workforce transformation pose significant challenges that require careful management.

Revolutionizing Financial Services with AI

The financial services industry is undergoing a seismic shift, thanks to the integration of AI technologies. AI enables financial institutions to better understand market dynamics and customer behaviors through advanced data analytics, leading to significant operational cost savings. This transformation spans across various facets of the industry, from customer satisfaction to back office operations and investment strategies.

Enhancing Customer Satisfaction with AI-Powered Tools

AI-powered tools are transforming customer satisfaction in the finance industry. AI chatbots, for instance, provide 24/7 customer service, handling up to 80% of inquiries and significantly reducing the workload on human agents. These tools lead to faster response times and increased customer engagement, ultimately enhancing customer satisfaction.

Moreover, AI-driven personalized services offer tailored financial advice and products, enhancing the overall customer experience.

Streamlining Back Office Operations

AI is optimizing back office operations by automating routine tasks, resulting in considerable cost savings and efficiency gains. Robotic Process Automation (RPA) and AI minimize manual tasks, improving workflow efficiency and reducing operational costs. Financial institutions using AI can allocate resources more strategically, boosting overall productivity and customer engagement.

AI in Investment Strategies

AI is revolutionizing investment strategies by analyzing large datasets and predicting market trends. AI-enhanced predictive analytics help financial firms execute trades more effectively and refine trading strategies. This results in more informed investment decisions and optimized portfolio management, highlighting AI’s impact on the financial industry.

Leveraging AI for Risk Management and Fraud Prevention

AI is transforming risk management and fraud prevention. By analyzing extensive data sets, AI tools can identify unusual patterns in financial transactions, enhancing fraud detection and prevention strategies. Integrating AI technologies in risk management is changing how financial institutions operate, offering advanced techniques and ensuring compliance with regulatory standards.

Advanced Fraud Detection Techniques

AI-driven fraud detection systems monitor real-time transactions, swiftly flagging potential fraudulent activities. Using behavioral analytics, these systems detect anomalies in transaction patterns, significantly enhancing fraud detection and prevention.

Machine learning models also adapt over time, enhancing their accuracy in detecting fraud and money laundering.

Improving Risk Assessments with AI Algorithms

AI algorithms enhance risk assessments by evaluating diverse financial data and predicting potential risks. These algorithms can process vast amounts of data quickly, offering more accurate and timely risk assessments.

Advanced analytics offered by AI identify risks that may not be visible through traditional methods, allowing financial institutions to proactively manage investment risks.

Ensuring Regulatory Compliance

AI significantly aids in ensuring regulatory compliance in the finance industry. AI applications help organizations adhere to regulations by automating the monitoring of transactions and facilitating accurate reporting. Streamlining compliance processes ensures that financial institutions can navigate complex regulations more efficiently.

AI’s Role in Decision Making Processes

AI is transforming decision-making processes in the finance industry. By leveraging vast data sets, AI enhances decision-making through real-time analysis, reducing human error and increasing efficiency. This change is particularly evident in areas like credit decisions and market analysis, where AI’s impact is profound.

Credit Decisions and Loan Processing

AI improves credit decisions and loan processing by considering alternative data sources and assessing real-time data. This results in more comprehensive evaluations of creditworthiness and increased efficiency in credit approvals.

AI automation minimizes human errors and accelerates the decision-making timeline, enabling financial institutions to focus on more strategic activities involving artificial intelligence.

Market Analysis and Predictive Analytics

AI-driven predictive analytics enable financial firms to forecast market trends and adapt their strategies accordingly. By analyzing real-time data, AI technologies facilitate more accurate market predictions and allow finance teams to respond swiftly to market changes.

This enhances decision-making processes, making them more data-driven and responsive.

Enhancing Operational Efficiency and Cost Savings

AI greatly enhances operational efficiency and cost savings in the finance industry. Automation in back office functions improves accuracy and compliance while reducing operational costs. By processing large datasets, AI generates actionable insights that lead to smarter financial management and better decision-making. This ultimately results in substantial cost savings for financial institutions.

Automating Routine Tasks

AI tools automate routine tasks, streamlining compliance processes and reducing the likelihood of human error. This reduces costs associated with repetitive tasks and enhances operational efficiency in the finance sector. Overall, AI-powered automation leads to significant cost savings and improved productivity for financial institutions.

Optimizing Transactional Data Management

AI optimizes transactional data management by identifying patterns and anomalies, improving overall analysis and efficiency. By quickly analyzing transaction histories, AI enhances data management workflows, allowing financial institutions to make better-informed decisions.

This optimization is crucial for improving operational workflows and efficiency within the financial industry.

Ethical Considerations and Challenges of AI in Finance

While AI offers numerous benefits, it also raises significant ethical concerns and challenges in the finance industry. Issues related to bias, consumer privacy, and regulatory compliance must be tackled to ensure ethical AI implementation.

This section delves into these challenges and their implications for the finance industry.

Data Privacy and Protection

The reliance on AI in finance necessitates access to sensitive personal data, raising concerns about how this information is managed and protected. AI systems often use personal data without clear consent, leading to significant privacy violations.

Robust data privacy and protection measures are crucial for maintaining consumer trust and regulatory compliance.

Biases and Fairness in AI Models

AI models can perpetuate existing biases present in historical data, impacting fairness in crucial areas such as lending and investment decisions. These biases can lead to discriminatory outcomes against underrepresented groups, emphasizing the need for ethical oversight in AI implementation.

Diversity in training data and human oversight are essential steps to mitigate these biases.

Job Displacement and Workforce Transformation

AI’s integration into the finance industry is reshaping job roles and creating new opportunities that require expertise in AI technologies. Emerging career opportunities in finance increasingly demand proficiency in AI, with substantial demand for AI talent reported by major financial firms.

This shift necessitates workforce training and adaptation to new skill sets.

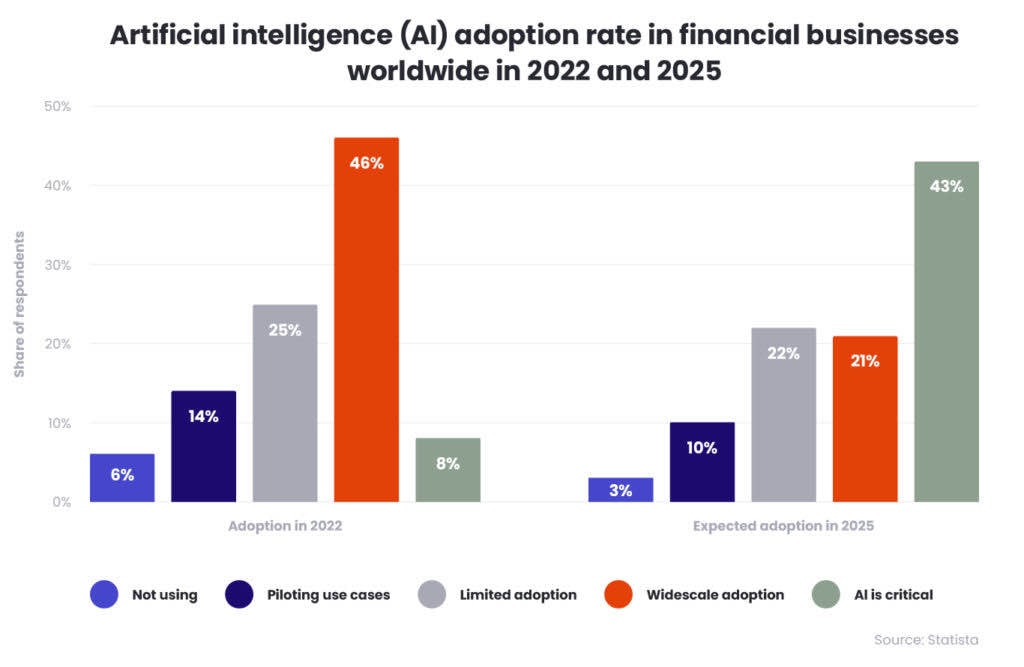

Future Prospects of AI in the Finance Industry

The future of AI in the finance industry looks promising, with financial institutions projected to nearly triple their AI spending by 2027. Increased investment in AI technologies will enhance operational strategies, customer engagement, and innovation in the financial sector.

However, central banks are struggling to keep pace with rapid advancements in AI, emphasizing the need for effective regulatory responses.

AI Integration and Scalability

Scalable AI solutions are crucial for effectively integrating AI into existing financial systems and processes. These solutions accommodate the evolving technological landscape in financial services, improving productivity and positioning institutions to leverage emerging technologies.

AI co-pilots that assist employees are expected to significantly boost productivity, enhancing the financial sector’s efficiency.

Emerging Trends in AI Technologies

Emerging AI technologies are shaping the future of the finance industry, enabling more efficient coding and testing processes. The exploration of large language AI models and natural language processing by entities like the European Central Bank highlights innovative applications in software development.

These advancements streamline operations, reduce errors, and enhance the agility of financial institutions in adapting to market changes.

Summary

AI is revolutionizing the finance industry by enhancing customer satisfaction, streamlining operations, improving risk management, and facilitating better decision-making. However, ethical considerations such as data privacy, biases, and job displacement must be addressed. As AI continues to evolve, financial institutions must navigate these challenges while embracing the opportunities AI presents. The future of AI in finance is bright, promising a more efficient, secure, and personalized financial landscape.

Frequently Asked Questions

How does AI improve customer satisfaction in the finance industry?** **?

AI enhances customer satisfaction in the finance industry by delivering 24/7 service via chatbots, offering tailored financial advice, and ensuring faster response times, ultimately fostering greater customer engagement. These capabilities lead to a more responsive and personalized banking experience.

What role does AI play in risk management and fraud prevention?** **?

AI plays a crucial role in risk management and fraud prevention by analyzing large data sets to detect unusual patterns and employing behavioral analytics for real-time fraud detection. This proactive approach significantly enhances risk assessments and mitigation strategies.

How is AI used in investment strategies?** **?

AI enhances investment strategies by analyzing extensive datasets to predict market trends and optimize portfolio management. This allows for more informed decision-making and refined trading strategies.

What ethical concerns does AI raise in the finance industry?** **?

AI raises significant ethical concerns in the finance industry, particularly regarding data privacy, biases in algorithms that may result in discrimination, and the potential for job displacement which requires workforce adaptation. Addressing these issues is essential to ensure responsible AI integration in finance.

What are the future prospects of AI in the finance industry?** **?

The future of AI in the finance industry looks promising, with expected increases in AI spending, improved operational strategies, and enhanced customer engagement. As organizations integrate scalable AI solutions, they will be better equipped to navigate evolving technologies.