Top 5 Upcoming Crypto ETF’s for 2025 You Need to Watch

Curious about the top upcoming crypto ETF’s for 2025? Here, we spotlight five ETFs set to launch or make waves in 2025, offering fresh opportunities in the crypto market. Get ready to explore options that could fit your investment goals.

Key Takeaways

- The Grayscale Ethereum Trust ETF (ETHE) offers a straightforward way for investors to gain exposure to Ethereum, with approximately $2.52 billion in assets under management as of March 2025.

- Fidelity’s Crypto Industry and Digital Payments ETF targets innovative firms within the digital finance sector, presenting a diversified investment opportunity for long-term growth.

- The VanEck Bitcoin Strategy ETF features physical Bitcoin backing and a low management fee of 0.20%, making it an attractive option for investors seeking to minimize costs while tracking Bitcoin’s performance.

Grayscale Ethereum Trust ETF (ETHE)

The Grayscale Ethereum Trust ETF, known by its ticker ETHE, has been making waves since its uplisting to NYSE Arca as a spot Ether exchange-traded product in July 2024. As of March 2025, ETHE boasts assets under management totaling approximately $2.52 billion, signaling strong investor interest and confidence.

ETHE is designed to reflect the price value of Ether, minus expenses and other liabilities, making it an attractive option for those looking to gain exposure to Ethereum without the complexities of directly holding the cryptocurrency. This structure provides a straightforward way for investors to participate in the Ethereum market through a regulated and familiar investment vehicle.

For investors seeking to diversify their portfolios with a focus on Ethereum, ETHE offers a compelling opportunity. Its significant assets under management and clear objective to mirror the price of Ether make it a notable ETF to watch in 2025. Holding ETHE allows investors to benefit from Ethereum’s growth while reducing some of the risks of direct cryptocurrency investments.

Fidelity Crypto Industry and Digital Payments ETF

Fidelity’s Crypto Industry and Digital Payments ETF is poised to capitalize on the immense growth opportunities within the digital payments sector and the broader cryptocurrency market. This ETF is designed for investors who believe in the long-term potential of digital finance and want to invest in companies that are at the forefront of this transformation.

Fidelity’s strategy focuses on long-term capital appreciation by targeting innovative firms leading the digital finance revolution. These companies are not just involved in cryptocurrencies but are also pioneering advancements in digital payment solutions, blockchain technology, and related services. Investing in this ETF provides exposure to a diversified portfolio of innovative companies leading the future of finance.

This ETF represents a blend of growth and innovation, making it an exciting option for investors looking to tap into the digital finance sector’s potential. With Fidelity’s reputation and strategic approach, this ETF is set to be a significant player in the crypto investment landscape in 2025.

VanEck Bitcoin Strategy ETF

The VanEck Bitcoin Strategy ETF stands out with its objective to mirror the performance of Bitcoin prices while minimizing operational costs. Designed as a passive investment vehicle, this ETF does not aim to outperform Bitcoin but rather to track its price movements closely. This approach provides investors with a straightforward way to gain exposure to Bitcoin’s market performance.

One of the unique aspects of this ETF is that it will have physical Bitcoin backing, with shares stored securely in cold storage. This ensures that the ETF’s value is directly tied to the actual Bitcoin held, providing a level of security and transparency that investors find reassuring.

VanEck also plans to set the ETF’s management fee at a competitive 0.20% following a temporary fee waiver period. This low fee structure makes it an attractive option for cost-conscious investors looking to benefit from Bitcoin’s price movements without incurring high management costs.

However, it’s important to note that this fund is not categorized as an investment company under the Investment Company Act of 1940, meaning it lacks certain regulatory protections. Investors should be aware of this aspect and consider it when evaluating the ETF’s risk profile. Despite this, the VanEck Bitcoin Strategy ETF offers a promising way to invest in Bitcoin through a regulated financial product.

Invesco Blockchain Economy ETF

The Invesco Blockchain Economy ETF is another exciting option for 2025, focusing on companies involved in blockchain technology, digital payments, and cryptocurrency services. This ETF aims to provide exposure to key companies that are directly engaged in blockchain technology, which could lead to significant growth opportunities as the technology continues to evolve and gain adoption.

With an expense ratio of 0.60%, the Invesco Blockchain Economy ETF offers a competitive cost structure, making it an attractive option for investors looking for a balance between growth potential and cost efficiency. This ETF is designed to capture the growth of the blockchain sector by investing in a diversified range of companies, reducing the risk associated with investing in individual stocks.

For investors interested in the broader blockchain economy, this ETF represents a compelling way to gain exposure to this rapidly growing sector. Its focus on innovation and competitive expense ratio position it as a hot pick for the upcoming year.

ARK Next Generation Internet ETF (ARKW) Expansion

The ARK Next Generation Internet ETF (ARKW) is set to expand its portfolio by introducing additional cryptocurrency assets, enhancing its appeal to investors looking for exposure to the digital finance sector. This ETF is already known for its focus on the next generation of internet technologies, and the inclusion of more cryptocurrency assets aligns with this vision.

Investors can expect potential returns as ARKW diversifies into emerging cryptocurrencies, capitalizing on trends in digital finance and the growing adoption of blockchain technologies. This strategy aims to leverage the increasing integration of digital assets into everyday financial systems to maximize growth objectives.

ARKW connects blockchain technology, digital assets, and the broader internet economy, positioning itself for future growth. This ETF’s expansion into cryptocurrencies is a timely move that positions it well for success in the rapidly evolving digital finance landscape.

Understanding Crypto ETF Strategies

Crypto ETFs come in various forms, each designed to cater to different investor goals. Whether you’re looking for income generation, hedging against volatility, or capital appreciation, there’s likely a crypto ETF strategy that fits your needs. Understanding these strategies is crucial for making informed investment decisions.

Spot ETFs provide direct exposure to the current market price of cryptocurrencies by holding the actual assets. This is ideal for investors who want to benefit from the price movements of cryptocurrencies without the complexities of managing digital wallets.

On the other hand, futures ETFs track derivatives that reflect the expected future price of cryptocurrencies, allowing investors to speculate on future price movements without owning the underlying assets.

Some ETFs employ a covered call strategy, where they hold a long position in an asset while selling call options on the same asset to generate income. This strategy can provide a steady income stream while also offering some downside protection.

However, futures-based crypto ETFs can experience tracking errors, which can affect their performance relative to the actual cryptocurrency market. Understanding these nuances can help you choose the right ETF strategy for your investment goals.

How to Choose the Right Crypto ETF for Your Portfolio

Selecting the right crypto ETF for your portfolio involves careful consideration of several factors. One of the primary considerations should be the fees associated with the ETF. Lower fees can enhance your overall returns, so it’s essential to prioritize options with competitive expense ratios. For example, ETHE has a total expense ratio of 2.50%, which covers the management and administrative costs associated with the fund.

Another crucial factor is liquidity. Choosing ETFs that are easily tradable ensures that you can quickly buy or sell shares as needed. This is particularly important in the volatile world of cryptocurrencies, where market conditions can change rapidly. Additionally, assessing the track record and reliability of the ETF provider can provide added peace of mind.

Investing in crypto ETFs offers a convenient way to gain exposure to digital assets without the complexities of managing digital wallets. However, it’s essential to be aware of the potential risks, such as tracking errors and higher fees compared to direct cryptocurrency investments. Considering these factors helps in selecting a crypto ETF that aligns with your investment goals and risk tolerance.

Risks and Rewards of Investing in Crypto ETFs

Investing in crypto ETFs comes with its own set of risks and rewards. One of the most significant risks is market volatility, as the underlying assets can fluctuate dramatically. This volatility can lead to substantial gains but also significant losses, making it essential for investors to be prepared for price swings.

Regulatory changes also pose a risk to crypto ETFs. Changes in regulations can impact the availability and performance of these investment vehicles, creating uncertainty for investors. Staying informed about regulatory developments is crucial for managing this risk.

On the flip side, the growing acceptance of crypto ETFs is democratizing sophisticated investment opportunities for average investors to achieve. These ETFs provide a regulated and familiar way to invest in digital assets, making it easier for more people to happen in the cryptocurrency market.

The potential rewards of investing in crypto ETFs include diversification, growth opportunities, and the convenience of accessing digital assets through traditional financial products.

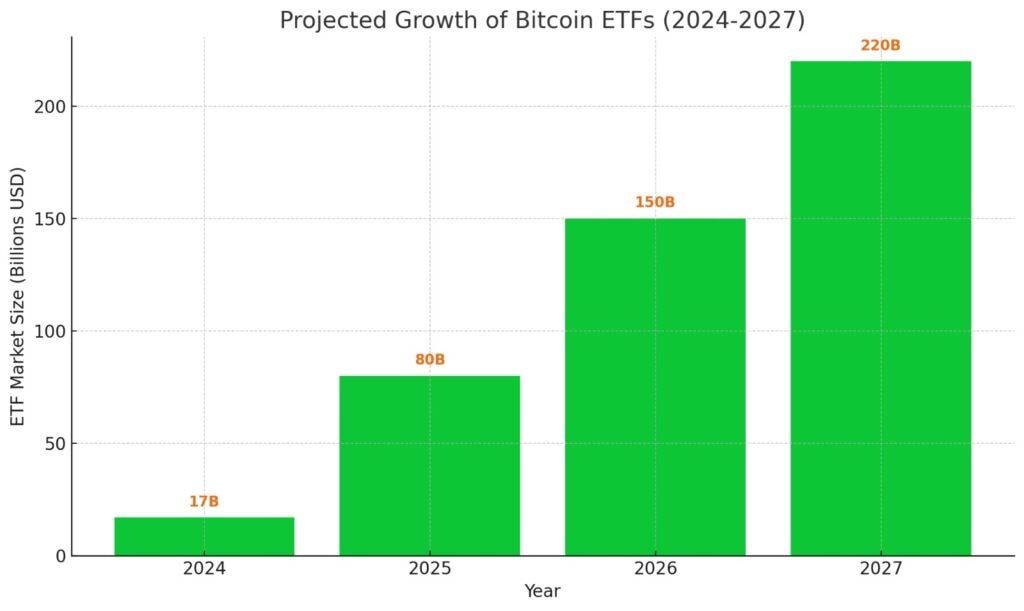

The Future of Crypto ETFs Beyond 2025

Looking beyond 2025, the future of crypto ETFs appears promising. One of the most significant trends is the potential for Asia to become a leading region in the ETF market, possibly exceeding European assets in the next five years. This shift could open up new investment opportunities and drive further growth in the crypto ETF space.

Another area of exploration is the integration of private assets into ETFs. Although current regulations limit such developments, ongoing exploration and innovation could eventually lead to new and exciting investment products. This could further enhance the diversity and appeal of crypto ETFs.

As the market continues to evolve, staying informed about these trends and developments will be crucial for investors. The future of crypto ETFs is bright, and those who stay ahead of the curve will be well-positioned to capitalize on the opportunities that lie ahead.

Summary

In summary, the top five upcoming crypto ETFs for 2025 offer exciting opportunities for investors looking to diversify their portfolios and tap into the booming digital economy. From the Grayscale Ethereum Trust ETF to the ARK Next Generation Internet ETF, each of these ETFs brings something unique to the table, catering to different investment goals and strategies.

Staying informed about the latest trends and developments in the crypto ETF market is essential for making informed investment decisions. By understanding the risks and rewards, choosing the right ETF for your portfolio, and keeping an eye on future trends, you can position yourself for success in the evolving world of digital assets. The future of crypto ETFs is bright, and now is the time to start exploring these promising investment opportunities.

Frequently Asked Questions

What are the main factors to consider when choosing a crypto ETF?

When selecting a crypto ETF, prioritize fees, liquidity, and the ETF provider’s track record. This ensures cost-effectiveness, ease of trading, and trust in the management of your investment.

What are the risks associated with investing in crypto ETFs?

Investing in crypto ETFs carries risks such as significant market volatility and potential regulatory changes that could affect their performance. It’s essential to stay informed to navigate these challenges effectively.