Top Restaking Crypto Projects for Optimal Earnings in 2024

Maximizing returns in the crypto world often leads investors to restaking. This curated selection delivers the best restaking crypto projects for 2024, designed to elevate your portfolio’s performance. Expect to find not only a list but also essential insights to inform your strategy and capture the full earnings potential of restaking.

Key Takeaways

- Restaking involves reinvesting staking rewards into the same crypto project, offering compound returns and the potential to enhance network security.

- Choosing a restaking project requires evaluating the project’s reputation, understanding tokenomics, and considering the staking rewards and risks, ensuring a well-researched investment.

- Our top restaking crypto projects for 2024 include EigenLayer, Renzo & Karak & cater to various investor needs with diverse staking options and potential returns.

Understanding Restaking Crypto Projects

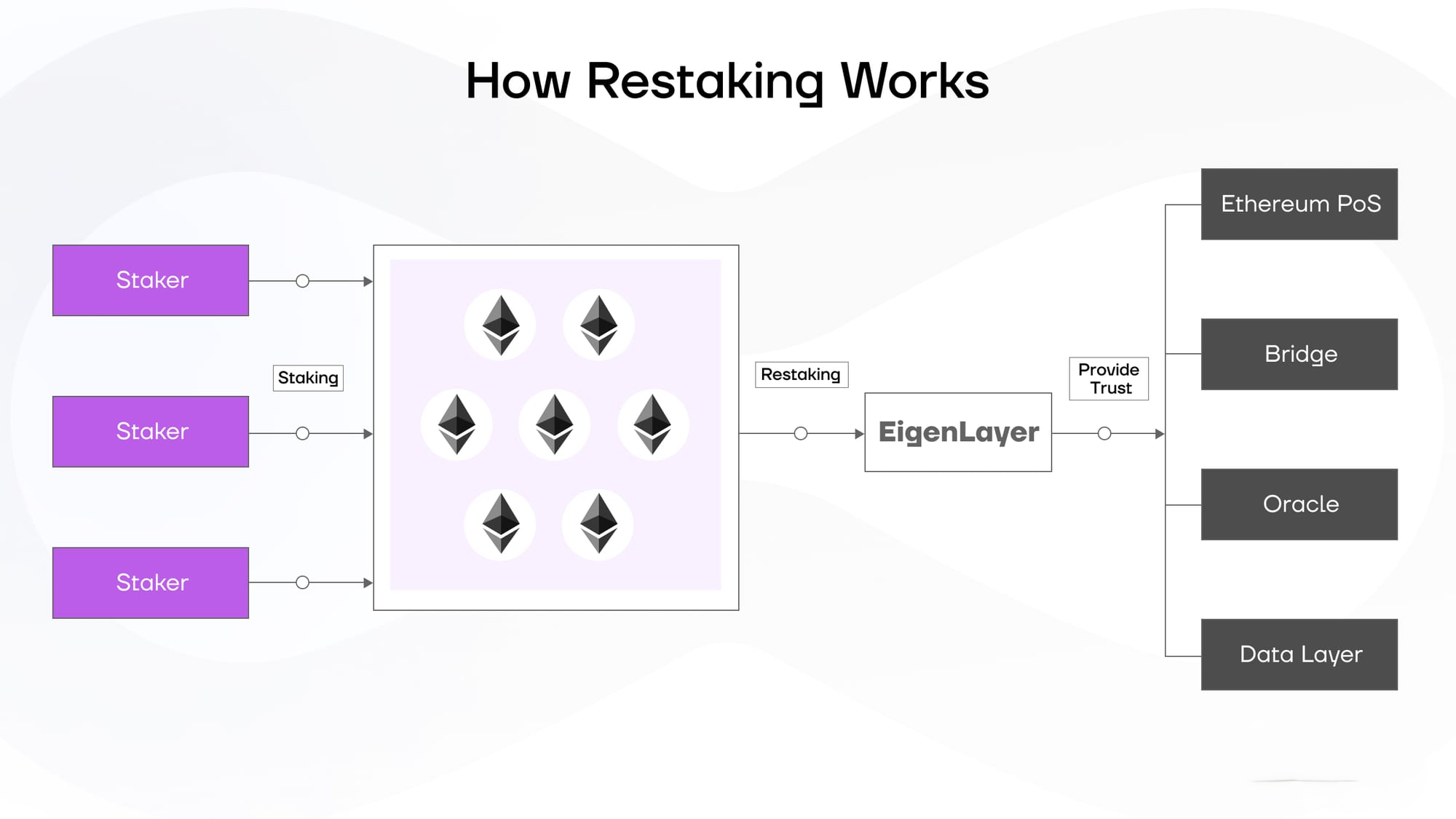

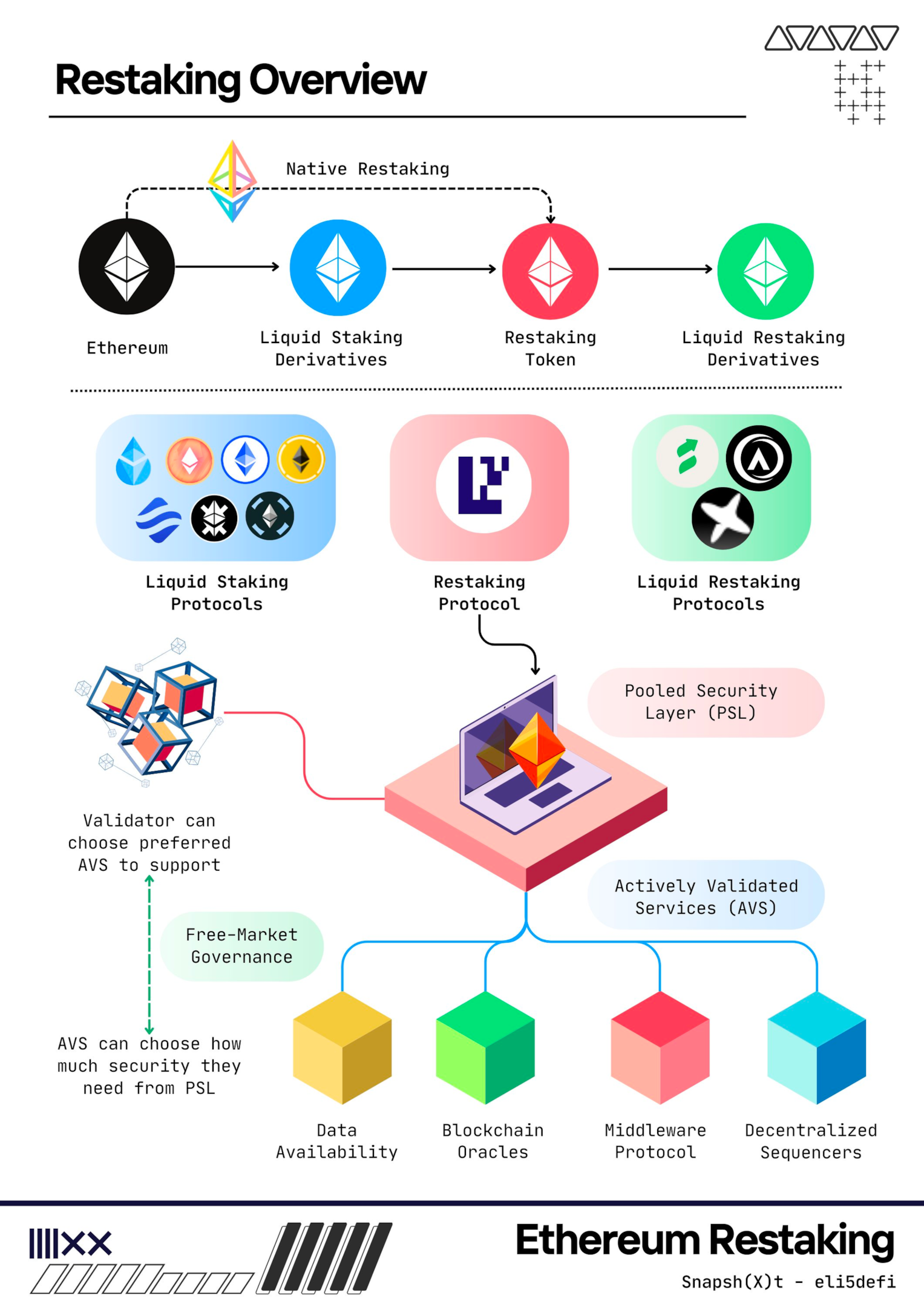

Restaking revolutionizes the crypto-verse, allowing reinvestment of staking rewards into the same project, yielding compounded returns over time. Imagine a marketplace where validators choose which modules to secure through restaking. The choice is influenced by factors like reward rates and associated risks, bringing an all-new dynamic to the crypto investment realm. But, it’s not just about compounding your earnings. Platforms like EigenLayer support restaking across multiple protocols, opening up a world of possibilities for your staked assets.

However, with greater rewards come greater responsibilities. Those partaking in restaking must be aware of additional slashing conditions, enforced by each actively validated service, to ensure network integrity is maintained. As you venture into this realm, ensure careful steps and well-informed decisions.

What is Restaking?

Restaking can be likened to reinvesting earnings into a business to bolster future profits. It involves more than just depositing tokens to underpin network operations and earning rewards, it also includes reinvesting those rewards for potentially enhanced future earnings. Sounds exciting, right?

What benefits does restaking offer? Let’s explore!

Advantages of Restaking

Restaking is not just about growing your earnings, it’s about enhancing the entire crypto investment experience. It opens up opportunities for compounding returns, akin to the effect of compounding interest in traditional finance. Moreover, restaking also augments the security of blockchain networks by aggregating resources among validators, providing a pooled security posture across various platforms.

So, restaking not only fattens your wallet but also contributes to a more secure network.

Factors to Consider When Choosing Restaking Projects

Selecting a suitable restaking project requires comprehensive analysis. High returns are crucial, but so are the project’s utility, clear roadmap, and prospects for long-term growth. The expertise of the development team and the level of community engagement are critical in reflecting the project’s capacity to overcome challenges and maintain a supportive investor base.

There’s more to consider! Let’s delve into the essential factors of choosing restaking projects.

Project Reputation

Reputation is everything when it comes to crypto projects. It’s the first thing you should evaluate before jumping on board. The expertise of the team, the quality of the whitepaper, and even the project’s social media presence can be indicators of the project’s credibility and potential for success.

Hence, thorough research is key to ensure your investment goes into a credible project.

Tokenomics

Understanding the tokenomics of a project is crucial. It involves evaluating token distribution, allocation, and staking options. But it’s not just about the numbers. It’s also about the potential for scarcity, the demand for tokens, and how these factors can affect market dynamics and potential manipulation.

Therefore, explore the tokenomics and staking coin opportunities thoroughly before committing your assets to staking coins.

Staking Rewards

Staking rewards are a major attraction for investors, but they’re influenced by a variety of factors. These include:

- The size of the network

- Total value locked within it

- Fees charged by validators

- The roles of validators and delegates

Cryptocurrencies, including crypto staking coins, offer varying annual returns for staking, showcasing the diversity in earnings potential. Crypto staking involves locking up a portion of these staking coins to support the network and earn rewards.

Restaking protocols further enhance staking flexibility, allowing validators to restake staked assets across multiple platforms. Therefore, pay close attention to the actual reward rates offered for maximizing your earnings and to earn passive income.

Top 3 Restaking Crypto Projects

Having covered the fundamentals, let’s reveal what we believe will be the top 3 restaking crypto projects for 2024. These projects will not only offer promising returns but also provide a robust platform for restaking. So, let’s get started!

1. EigenLayer

EigenLayer is a decentralized protocol that allows Ethereum validators and stakers to leverage their staked ETH for securing additional networks or services, a process known as restaking. This innovative approach extends the utility of staked ETH beyond just securing the Ethereum network, thereby increasing the potential rewards for stakers.

Restaking on EigenLayer involves redeploying staked ETH to provide security for various other blockchain projects or decentralized applications. This means that stakers can opt to support multiple networks simultaneously, earning rewards from each while still maintaining their primary stake in Ethereum.

EigenLayer’s restaking mechanism enhances network security and efficiency by distributing trust across multiple platforms, encouraging a more resilient and interconnected blockchain ecosystem. This setup benefits both stakers, through increased earning opportunities, and emerging networks, which gain access to a robust security layer without needing to establish a large independent validator base. EigenLayer thus represents a significant step forward in optimizing resource utilization within the blockchain space.

2. Renzo

Renzo is a decentralized finance (DeFi) protocol designed to maximize the utility of staked assets through a process known as restaking. It allows users to redeploy their staked assets across multiple blockchain platforms, increasing the potential yield and enhancing the security of various networks simultaneously.

Renzo’s restaking options enable users to take their initially staked tokens and use them as collateral to stake in additional DeFi projects or blockchain networks. This mechanism provides stakers with the opportunity to earn multiple streams of rewards without needing to unstake their assets from their primary staking positions.

By participating in Renzo’s restaking, users can diversify their investment portfolio, mitigate risk, and optimize returns. Moreover, the protocol benefits emerging networks by providing them with enhanced security and liquidity, which are crucial for their growth and stability. Renzo’s innovative approach to restaking thus creates a more interconnected and resilient blockchain ecosystem, leveraging the value of staked assets across multiple platforms.

3. Karak

Karak is an advanced DeFi protocol that enables users to maximize the value of their staked assets through restaking options. It allows users to take assets they have already staked in one blockchain network and redeploy them to secure and support additional networks or decentralized applications.

Through Karak’s restaking mechanism, users can earn rewards from multiple sources without needing to unstake or move their primary assets. This is achieved by locking the staked tokens as collateral and using derivative tokens or other mechanisms to participate in additional staking opportunities.

Karak’s restaking options offer several advantages. Firstly, they provide users with the potential to increase their overall returns by tapping into multiple reward streams. Secondly, they enhance the security and reliability of newer or smaller blockchain networks, which benefit from the additional security provided by these restaked assets. Lastly, Karak promotes a more interconnected and efficient DeFi ecosystem, where resources are utilized more effectively, and stakers can maximize their earnings potential while contributing to the growth and stability of the broader blockchain landscape.

Strategies for Maximizing Restaking Rewards

Choosing an appropriate project is vital, but implementing effective strategies can also amplify your restaking rewards. From diversification to regular monitoring and risk management, these strategies can help you get the most out of your restaking investments.

Diversification

Diversification is a powerful strategy in the world of investments, and it’s no different in crypto staking. By including a variety of cryptocurrencies and assets in your portfolio, you can withstand market volatility and potentially lower the overall risk profile of your investment strategy. So, don’t put all your eggs in one basket.

Diversify your financial portfolio by exploring passive income opportunities!

Regular Monitoring

Regular monitoring is essential to ensure that staking rewards are claimed within the optimal timeframe to maximize earnings. For instance, in the case of staking XNL, rewards can be claimed every three days, requiring constant vigilance to avoid missing the claim period.

Stay vigilant about your investments and ensure timely reward claims!

Risk Management

Risk management plays a vital role in crypto staking. It involves:

- Evaluating potential profitability

- Tax reporting

- Restrictions when selecting a cryptocurrency for staking

- Identifying patterns of volatility

- Understanding market value fluctuations

- Considering staking-specific risks such as slashing mechanisms and smart contract vulnerabilities

These factors are vital for a successful staking strategy on staking platforms, ensuring an efficient staking process.

Summary

In conclusion, restaking in cryptocurrencies offers a viable path to optimize your digital assets’ earnings. By choosing the right projects, understanding the tokenomics, and adopting strategies like diversification, regular monitoring, and risk management, you can maximize your restaking rewards. The future of restaking looks promising, and the top 10 restaking crypto projects for 2024 offer exciting opportunities for investors. So, go ahead and take the plunge into the world of restaking!

Frequently Asked Questions

What is restaking in cryptocurrencies?

Restaking in cryptocurrencies means reinvesting staking rewards into the same project to potentially earn compounded returns. It’s a strategy to maximize earnings from staking.

What are the benefits of restaking?

Restaking can help you grow your returns and strengthen the security of the blockchain network.

How to choose a restaking project?

Consider factors such as project reputation, tokenomics, and staking rewards when choosing a restaking project. These will help you make an informed decision.

What are some of the top restaking crypto projects for 2024?

Consider restaking in EigenLayer, Karak, Renzo, Etherfi, Pendle, Restake Finance, Puffer Finance for 2024. These projects have strong potential for restaking.

How can I maximize restaking rewards?

You can maximize restaking rewards by diversifying your investments, regularly monitoring your staking rewards, and effectively managing risks. This will help you optimize your earnings.