What’s the Best Way to Diversify into Crypto Assets? Your Essential Guide

Wondering what’s the best way to diversify into crypto assets? This guide will show you how to spread your investments across different cryptocurrencies, platforms, and sectors to manage risk and boost returns. Get ready to explore practical strategies and tips for building a balanced and resilient crypto portfolio.

Key Takeaways

- Diversifying a crypto portfolio across various assets, blockchain platforms, and sectors mitigates risk and enhances long-term returns.

- Key strategies for diversification include investing in a mix of cryptocurrencies, balancing market capitalization, and maintaining geographic diversity.

- Regular portfolio rebalancing is essential for aligning investments with risk tolerance and market conditions while avoiding excessive trading costs.

Understanding Crypto Portfolio Diversification

Diversification in crypto investments is a risk management technique aimed at reducing the impact of market volatility by spreading investments across multiple cryptocurrency projects. Imagine the crypto market as a wild roller coaster ride. If all your investments are tied to just a few cryptocurrencies, you’re in for a bumpy experience when the market takes a downturn. However, by diversifying your crypto portfolio, you can smooth out the ride and reduce the risk of significant losses.

A diversified portfolio can potentially enhance the chances of achieving stable, long-term returns by balancing risk. This means including a mix of established and emerging cryptocurrencies to hedge against market volatility.

Investing in a broad array of digital assets allows you to capitalize on varied market trends and mitigate the negative impact of any single underperforming asset. Creating a balanced crypto portfolio requires understanding market dynamics and analyzing factors like investment horizon and risk tolerance.

Key Strategies for Diversifying Your Crypto Investments

Understanding the importance of diversification, we can now delve into key diversification strategies for achieving a well-diversified crypto portfolio. These strategies include investing in various cryptocurrencies, exploring different blockchain platforms, and sector-based diversification.

Each approach plays a crucial role in spreading your investment risks and tapping into various growth opportunities within the crypto market.

Invest in Various Cryptocurrencies

One of the most effective ways to diversify your crypto portfolio is by investing in a variety of cryptocurrencies. This means not limiting yourself to just Bitcoin or Ethereum but also exploring other types of crypto assets such as utility tokens, security tokens, and governance tokens. For instance, including privacy coins, stablecoins, and blockchain protocols in your portfolio can offer a balanced mix of stability and growth potential.

Consider the unique use cases of different cryptocurrencies. Ripple, for example, is designed for real-time money transfers, while Ethereum supports decentralized finance (DeFi) protocols and smart contracts. Stablecoins like USDC and USDT provide a hedge against volatility by maintaining a stable value.

Investing in cryptocurrencies with various use cases helps create a robust digital asset portfolio that mitigates risks and maximizes returns.

Explore Different Blockchain Platforms

Another strategy for diversifying your crypto investments is exploring different blockchain platforms. Each blockchain technology offers unique features and benefits, helping to spread investment risk. For example, Ethereum is well-known for its smart contract capabilities, enabling decentralized applications without the need for intermediaries. Cardano, on the other hand, focuses on scalability and security, making it an attractive option for long-term investors.

EOS provides efficient web services like cloud storage and decentralized applications (dApps), highlighting the importance of diversifying across various blockchain technologies to capture different market opportunities and innovations. Investing in multiple blockchain platforms mitigates the risks associated with any single technology and enhances the overall stability of your crypto portfolio.

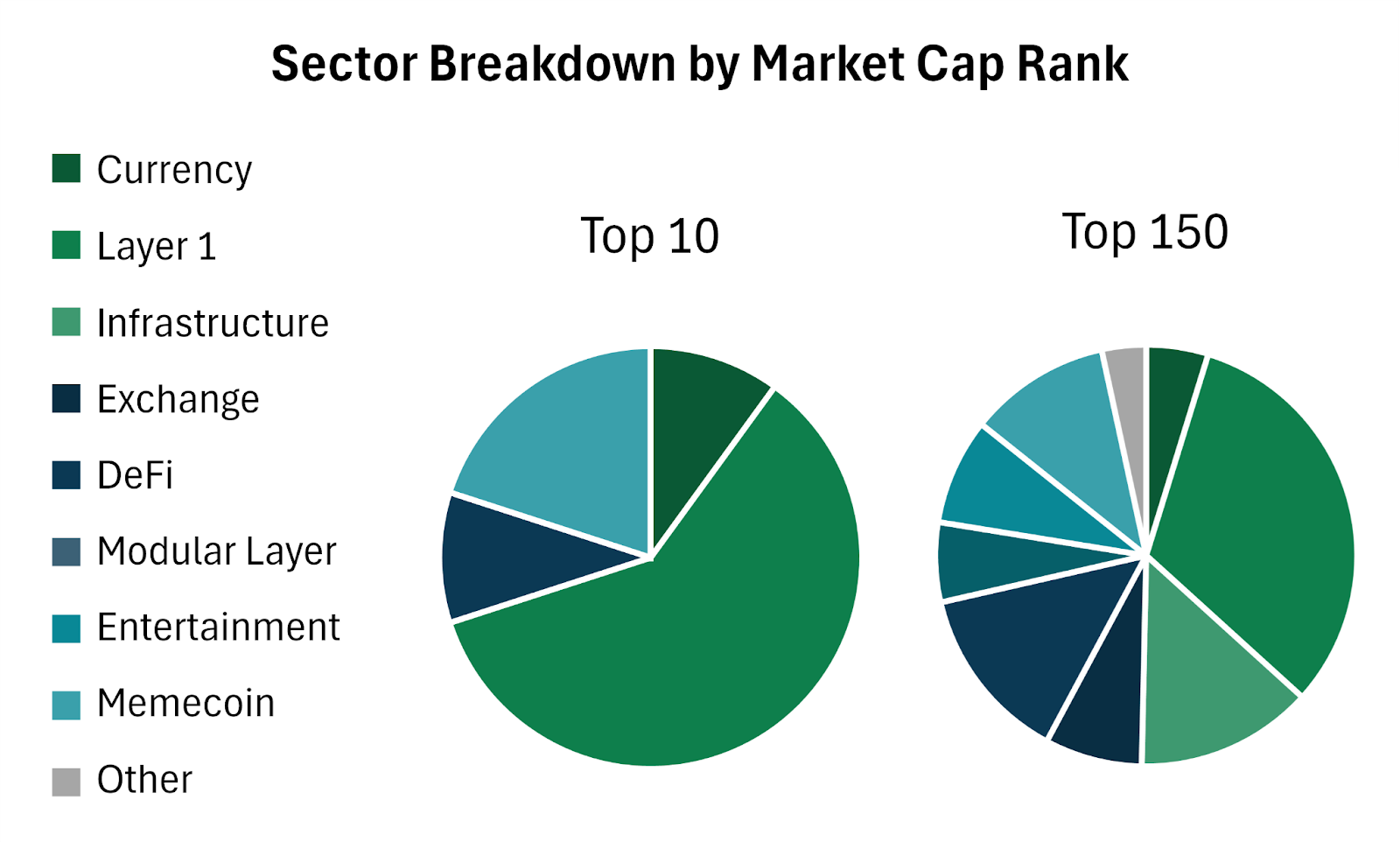

Sector-Based Diversification

Sector-based diversification involves spreading your investments across various sectors within the crypto industry. This strategy helps mitigate potential market risks and capitalizes on growth opportunities in different areas. For instance, you could invest in cryptocurrencies focused on decentralized finance (DeFi), gaming, or supply chain management.

Diversifying across sectors reduces the impact of sector-specific downturns and increases the likelihood of achieving stable returns.

Balancing Market Capitalization in Your Portfolio

Balancing market capitalization in your crypto portfolio is crucial for achieving a well-diversified portfolio. Market capitalization, or ‘market cap’, measures a cryptocurrency’s total market value and influences investment strategies. Including a mix of large-cap and small-cap cryptocurrencies can help balance stability and growth potential. Large-cap cryptocurrencies, like Bitcoin and Ethereum, usually offer more stability, while smaller, less established cryptocurrencies present higher growth opportunities but come with increased risks.

A market cap-weighted portfolio often leads to overexposure to a few dominant cryptocurrencies, which can limit diversification benefits. Instead, consider a balanced approach that includes both high-cap and low-cap cryptocurrencies to manage risk effectively.

Regularly reviewing and adjusting your portfolio based on market capitalization changes helps maintain a balanced crypto portfolio aligned with your investment goals.

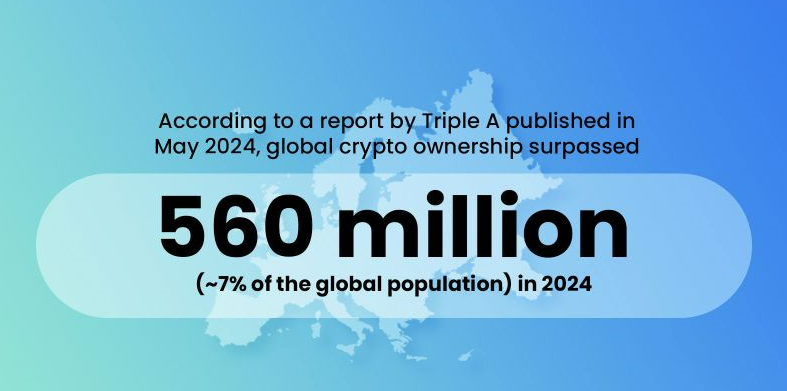

Geographic Diversification in Crypto Investments

Geographic diversification involves spreading your crypto investments across different global regions, which can mitigate overexposure to specific market risks and regulatory environments. Investing in projects from regions like the US, Europe, and Asia allows you to capitalize on diverse technological innovations and market trends. For instance, Portugal has become a crypto powerhouse and tax haven, attracting numerous crypto investors, while El Salvador made headlines as the first country to accept Bitcoin as legal tender.

However, it’s essential to avoid investing in crypto projects that are banned or limited in certain jurisdictions to prevent regulatory risks. Countries like Switzerland and Malta are known for their favorable regulatory environments, making them attractive destinations for cryptocurrency businesses.

Geographic diversification can enhance the resilience of your crypto portfolio by reducing the impact of regional economic and regulatory changes.

Timing Your Investments for Optimal Diversification

Timing your investments is another critical aspect of achieving optimal diversification. Dollar-cost averaging (DCA) is a popular strategy that involves investing a total sum in small increments over time, helping to reduce the impact of market volatility. Adhering to a planned investment schedule with DCA promotes emotional discipline and consistent investing, regardless of market conditions.

Regular investments through DCA enable you to accumulate more cryptocurrency during price dips and less during price peaks, lowering the average cost of purchasing an asset and leading to a more favorable average price per unit. This systematic approach can be automated, allowing for consistent investments without the need for constant market monitoring.

DCA effectively manages investment timing and helps achieve a well-diversified crypto portfolio.

Benefits of a Well Diversified Crypto Portfolio

A well-diversified crypto portfolio offers numerous benefits, primarily by reducing overall investment risk. By spreading your investments across various digital assets, you can mitigate the negative impact of poorly performing assets with gains from others. This balanced approach enhances potential returns and increases the likelihood of long-term success.

Stablecoins in your portfolio help preserve value during market slumps and provide liquidity, reducing overall volatility. A mix of high-cap and low-cap cryptocurrencies offers a blend of stability and growth potential, ensuring a resilient investment strategy.

Geographic diversification reduces exposure to specific market fluctuations and regulatory changes, making your crypto portfolio more robust.

Risks and Challenges of Diversifying Crypto Assets

While diversification is a powerful strategy, it comes with its own set of challenges. Diversifying a crypto portfolio can lead to lower absolute investment returns, as it may dilute the potential gains from high-risk investments. Additionally, selling or trading crypto assets to diversify your portfolio can incur tax liabilities, adding to the complexity of managing your investments.

Creating and maintaining a diversified crypto portfolio requires significant research and time investment. The need to stay updated on various cryptocurrencies, blockchain platforms, and market trends can be overwhelming. Moreover, diversification may not always protect against losses during market downturns, especially when the markets are highly correlated.

Despite these challenges, a well-diversified portfolio often offers more benefits than risks.

Practical Examples of Diversified Crypto Portfolios

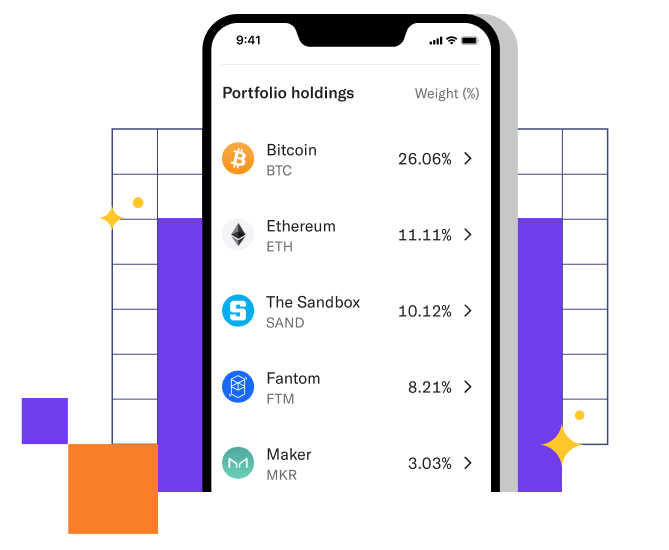

Examples of diversified crypto portfolios help illustrate how diversification works in practice. An aggressive portfolio, known as the ‘20/40/40 Mix’, allocates 20% to large-cap cryptocurrencies, 40% to mid-cap, and 40% to small-cap cryptocurrencies, balancing high growth potential with significant risk.

A conservative portfolio, the ‘80/20 Mix’, consists of 80% in stablecoins and large-cap cryptocurrencies and 20% in mid-cap and small-cap cryptocurrencies, prioritizing stability over growth.

A balanced portfolio, the ‘40/30/30 Mix’, allocates 40% to large-cap, 30% to mid-cap, and 30% to small-cap cryptocurrencies, providing a mix of stability and growth.

An all-rounder investor’s portfolio typically includes substantial holdings in Bitcoin and Ethereum, with smaller allocations to other large-cap cryptos. These examples demonstrate how different allocation strategies can achieve a diversified crypto portfolio tailored to various risk appetites and investment goals.

How Often to Rebalance Your Crypto Portfolio

Regularly rebalancing your crypto portfolio maintains alignment with your risk tolerance and investment strategy. Optimal rebalancing intervals may range from weekly to every three months, depending on individual risk tolerance and market conditions. Regular rebalancing helps ensure that your asset allocation stays in line with your investment goals, even as market conditions change.

However, avoid excessively frequent rebalancing due to potential high trading fees that can erode profits. High volatility in asset prices creates opportunities for more effective rebalancing across various asset classes, enhancing overall portfolio performance.

Balancing rebalancing frequency and trading costs helps maintain a well-diversified crypto portfolio that adapts to market movements.

Summary

Diversifying your crypto portfolio is not just a strategy; it’s a necessity in the volatile world of cryptocurrency investments. By spreading your investments across various cryptocurrencies, blockchain platforms, and sectors, you can reduce risks and enhance potential returns. Geographic diversification and timing your investments through strategies like dollar-cost averaging add further layers of stability to your portfolio.

Remember, a well-diversified crypto portfolio is your best defense against market volatility and your key to achieving long-term success. Stay informed, stay diversified, and you’ll be well on your way to navigating the crypto market with confidence. Embrace the journey, and may your crypto investments flourish.

Frequently Asked Questions

Why is diversification important in crypto investing?

Diversification is crucial in crypto investing as it mitigates market volatility by spreading risk across various assets, ultimately enhancing potential returns while protecting your portfolio from adverse fluctuations.

What are some key strategies for diversifying a crypto portfolio?

Investing in multiple cryptocurrencies, exploring various blockchain platforms, and diversifying across different sectors within the crypto industry are essential strategies for a robust crypto portfolio. This approach can help mitigate risks and capitalize on market opportunities.

How does dollar-cost averaging help in diversification?

Dollar-cost averaging enhances diversification by spreading investments over time, allowing you to buy more shares when prices are low and fewer when prices are high, ultimately mitigating risk. This disciplined approach can help balance your portfolio through varying market conditions.

What are the benefits of geographic diversification in crypto investments?

Geographic diversification strengthens your investment portfolio by reducing exposure to regional risks and varying regulatory environments. This approach enhances resilience and stability in your overall crypto investments.

How often should I rebalance my crypto portfolio?

To maintain alignment with your investment strategy, consider rebalancing your crypto portfolio every few months, though intervals can vary from weekly to quarterly based on your risk tolerance and market conditions.