Decoding the Bitcoin Halving: Your Essential Guide

Curious about what’s the Bitcoin halving? Fundamentally, it’s a built-in feature of Bitcoin that halves miner rewards roughly every four years to ensure the cryptocurrency’s controlled circulation. This significant event affects Bitcoin’s supply and introduces an intriguing dynamic to its economy. Stay with us as we unpack what this means for miners and investors alike.

Key Takeaways

- Bitcoin halving is a predetermined event that cuts the block reward by 50% every 210,000 blocks, resulting in decreased rate of new Bitcoin entering the market, with implications for supply and inflation control akin to scarce resources.

- Halving has significant impact on miners by reducing profitability and potentially leading to decreased network hashrate, necessitating efficiency improvements and strategic adaptations in mining operations to mitigate the reward reduction.

- Bitcoin halving events historically influence market sentiment and Bitcoin’s price, often leading to substantial increases, but future market responses are uncertain and dependent on various factors, including investor demand and broader market dynamics.

Understanding the Bitcoin Halving Phenomenon

Bitcoin halving, a captivating event, holds a significant position in the cryptocurrency world. It is a scheduled phenomenon that reduces the block reward for Bitcoin miners by 50%, occurring every 210,000 blocks, or approximately four years. This ingenious mechanism is scripted into the Bitcoin protocol to limit inflation, similar to how scarce resources like gold have limited supplies. The first bitcoin halving occurred serves as a reminder of the importance of this event in the world of cryptocurrency.

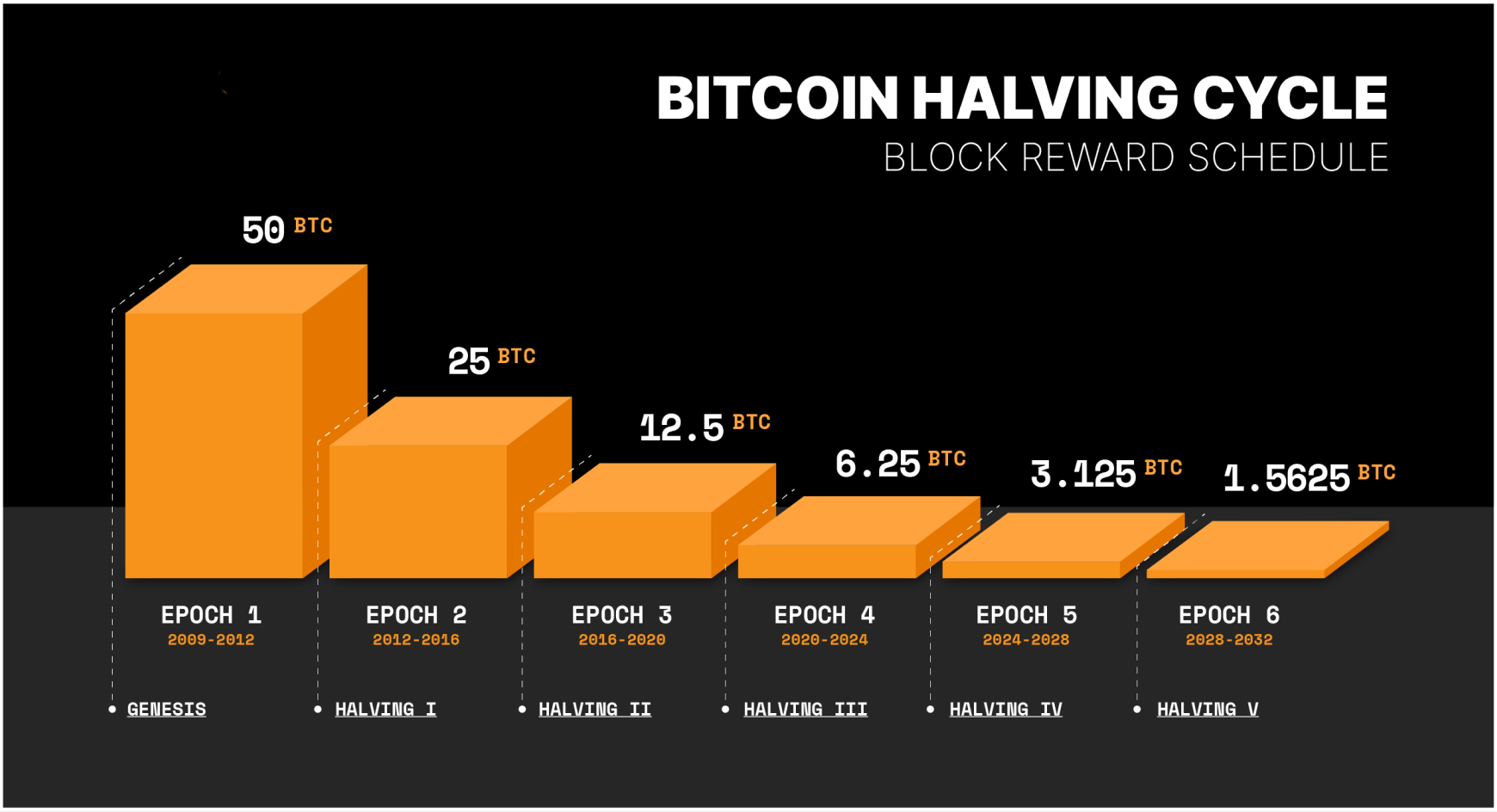

This periodic decrease began with the first halving in 2012, reducing the mining reward from 50 BTC to 25 BTC, and this trend continued with subsequent halvings. The recent halving in 2020 left miners with a reward of just 6.25 BTC per block, demonstrating the impact of these events on the rate of new bitcoins entering the market.

The Mechanics Behind Bitcoin Halving

Bitcoin’s operational mechanics heavily rely on the halving process. It works by meticulously reducing the reward for mining Bitcoin transactions, effectively decreasing the rate at which new coins are created. This mechanism ensures a controlled increase in Bitcoin supply, adding an enticing layer of intrigue to the cryptocurrency’s ecosystem.

The Role of Miners

In the Bitcoin network, miners serve as meticulous transaction validators and processors, thereby establishing their pivotal role. Using powerful computers or specialized hardware, they solve complex cryptographic puzzles that validate transactions and add new blocks to the blockchain. In return for their computational contributions, miners are rewarded with newly created bitcoins, reinforcing the security of the blockchain network.

However, the Bitcoin halving event presents a challenging hurdle for miners. As the mining reward decreases, it can make mining operations unprofitable for some, potentially causing them to cease operations if the Bitcoin price doesn’t compensate for the reduced reward. Consequently, miners might have to enhance their operational efficiencies or upgrade their equipment to stay competitive.

Proof of Work and Network Security

The proof-of-work system serves as the backbone of Bitcoin’s network security. It’s a competitive arena where miners strive to solve cryptographic puzzles, enabling them to add a new block to the blockchain. This mechanism requires miners to devote considerable time and energy to solve encrypted hashes, demonstrating that computational work was executed to maintain the network’s consensus and security,.

Following a halving event, the Bitcoin network continues to uphold its security through difficulty adjustments. These adjustments keep block production at consistent intervals, ensuring the network’s stability. Over time, the network becomes more resilient as it relies less on new currency generation and more on the robust network of nodes running the Bitcoin code,.

Tracking the Halving Timeline

Occurring at regular intervals, Bitcoin halvings denote major landmarks in the history of the cryptocurrency, with specific bitcoin halving dates marking these events. The first halving took place on November 28, 2012, followed by the second on July 9, 2016, and the third on May 11, 2020. With each halving, the block reward was cut in half, highlighting the predictable pattern of Bitcoin’s halving events.

Looking forward, the next halving is estimated to occur around April 18, 2024. This upcoming event will reduce the reward to 3.125 BTC per block, continuing the planned decrease in mining rewards. This pattern is expected to continue every four years until the final bitcoin is mined, around the year 2140,.

Impact on the Bitcoin Ecosystem

The Bitcoin ecosystem experiences significant effects due to halving events. They influence supply dynamics, miner profitability, and market sentiment, creating a ripple effect that could potentially influence the cryptocurrency’s price when bitcoin decreases.

Market Sentiment and BTC Price

Historically, market sentiment has been noticeably swayed by Bitcoin halving events, often resulting in substantial price increases. For instance, Bitcoin’s price surged to nearly $1,000 after the first halving and reached $2,550 by July 2017 after the second halving. Similarly, the bitcoin’s price surged from $8,787 during the most recent halving in May 2020 to reach $49,504 on 11 May 2021.

This price surge can be attributed to the psychological impact of halving events, which can spur demand due to the reduced new supply. However, it’s important to remember that while past halvings have been followed by price increases, the impact of the next halving is uncertain and highly dependent on evolving market dynamics and investor demand.

Miner Response to Reward Reductions

Miners face a considerable challenge with the halving of their rewards. With the immediate halving of miner rewards, profitability declines, potentially leading to a decrease in the overall hashrate. This scenario affects both large and small mining operations, forcing them to adapt their strategies to stay afloat.

To maintain profitability post-halving, miners prioritize energy-efficient practices, invest in cost-effective hardware, and build up excess capital during profitable periods. This strategic planning creates a buffer against the impact of reduced rewards, allowing miners to continue their operations even as the rewards decrease.

The Bitcoin White Paper’s Vision

Envisioned by its enigmatic creator, Satoshi Nakamoto, Bitcoin was intended to be a novel form of peer-to-peer electronic payment system that eradicates the need for a trusted third party. Nakamoto also suggested the potential evolution of Bitcoin into a store of value, highlighting its unique characteristics.

The Bitcoin white paper advocated for a controlled expansion of Bitcoin supply, introducing new coins gradually via block rewards along with a fixed supply cap. This vision established Bitcoin’s deflationary nature, setting it apart from traditional fiat currencies. While the term ‘halving’ is not explicitly used in the white paper, the concept of halving is implicit in the programmed reduction of block rewards every 210,000 blocks, aligning with Nakamoto’s aim for a predictable and controlled supply increase.

Preparing for the Next Bitcoin Halving

Strategic preparation is necessary for investors aiming to leverage the next Bitcoin halving. Accumulating Bitcoin at favorable rates before the halving event can help avoid market volatility and increase the chance of high returns. The period between the market bottom and the next halving, typically around 500 days, is considered the optimal accumulation period for Bitcoin.

However, investors should also be aware of the risks associated with such a strategy. While “buy low and HODL” has been a preferred investment approach for long-term Bitcoin investors, it’s crucial to have a balanced investment portfolio that includes Bitcoin and potentially traditional assets. Additionally, careful consideration should be given to Bitcoin mining companies, as their performance may be affected post-halving.

The Future Beyond Bitcoin Mining Rewards

Upon reaching the maximum supply of 21 million bitcoins, the future of Bitcoin presents captivating prospects. At this point, the bitcoin mining reward, or block reward, for miners is expected to be zero, transitioning transaction fees to become the primary incentive for mining activities on the bitcoin blockchain. Miners will continue to play a crucial role in the network by verifying transactions and adding new blocks, with their compensation coming solely from potentially increased mining fees.

The future role of Bitcoin, whether predominantly as a daily currency or as a store of value, will have a significant impact on miners and the broader Bitcoin ecosystem. High-value transactions or large batches may result in higher profits for miners from transaction fees, especially if Bitcoin’s primary use case evolves to be a store of value rather than a daily currency.

Trade Bitcoin Smartly During Halving

A robust risk management plan is a prerequisite for trading Bitcoin during halving events. There’s potential to profit from the halving event by speculating on price movements both before and after the halving occurs. Buying Bitcoin in advance and planning to hold for at least a year post-halving could capitalize on the anticipated increase in demand and subsequent price rise,.

Utilizing tools like the Stock-to-Flow model, observing hash rates, and monitoring active addresses can help in predicting price changes and determining the right time to trade. Other metrics such as:

- Bitcoin Days Destroyed

- Hash Ribbons

- Bitcoin rainbow chart

- Fear and Greed index

can provide insights on market activity, making trading decisions more informed and calculated.

Summary

In summary, understanding the Bitcoin halving phenomenon and its implications is crucial for investors and traders in the cryptocurrency space. From the miners’ response to reward reductions to the psychological impact on market sentiment, the halving events play a significant role in Bitcoin’s ecosystem. While the future beyond Bitcoin mining rewards presents intriguing possibilities, it’s crucial to prepare strategically for the next halving and trade smartly during such events.

Frequently Asked Questions

What happens during Bitcoin halving?

During Bitcoin halving, the mining reward is reduced by half to limit the number of new coins entering the network, which is considered a crucial event in the crypto calendar.

Will Bitcoin go up or down after halving?

Bitcoin’s price is expected to rise after the halving due to the decrease in supply, assuming demand stays constant or increases.

What does halving Bitcoin 2024 mean?

The halving of Bitcoin in 2024 means that the rewards for miners on the Bitcoin blockchain will be reduced by half, decreasing the number of new coins entering the network. This event is designed to control the supply of Bitcoin.

Should I buy Bitcoin before or after halving?

It is recommended to buy Bitcoin before halving as the six months prior to the halving has historically been a good buying opportunity. Additionally, dollar-cost averaging is a smart strategy for investing in Bitcoin.

How does the halving affect Bitcoin’s price?

The halving can exert upward pressure on Bitcoin’s price due to the reduced new supply, especially if demand remains strong or grows.