Why Does the Volume on Crypto DEX’s Keeps Growing Against CEX’s?

Why does the volume on crypto DEXs keep growing against CEXs? This trend is fueled by factors like enhanced security, lower trading fees, regulatory pressures on centralized exchanges, and rising institutional interest in decentralized finance (DeFi). As traders seek more control and transparency, decentralized exchanges are becoming their go-to choice over traditional CEXs. This article delves into each of these factors to explain why does the volume on crypto DEX’s keeps growing against CEX’s and how DEXs are gaining ground.

Key Takeaways

- Decentralized exchanges (DEXs) are gaining popularity due to their enhanced security, self-custody, and lower trading fees compared to centralized exchanges (CEXs).

- Regulatory pressures on CEXs and the fallout from exchanges like FTX are driving traders towards decentralized platforms, which offer more flexibility and control.

- Technological advancements and innovative trading mechanisms in DEXs, including automated market makers and liquidity pools, are attracting a broader user base and improving trading experiences.

Rise of Decentralized Trading

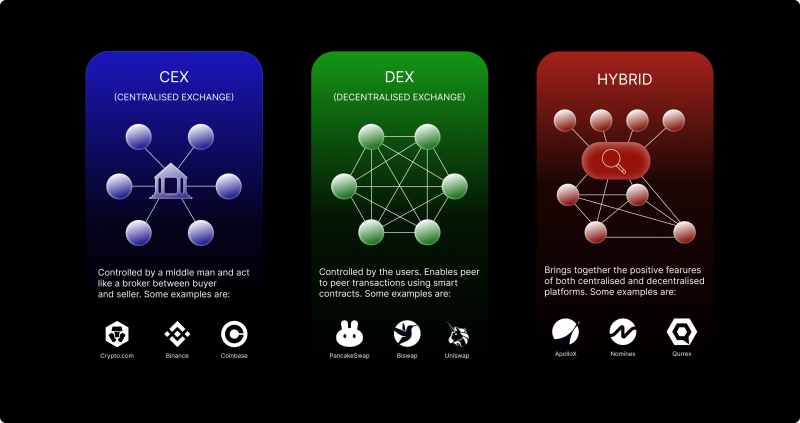

The rise of decentralized trading is a testament to the evolving preferences of crypto traders. Unlike centralized exchanges (CEXs), decentralized exchanges operate without a central authority, allowing users to trade directly with each other. This peer-to-peer trading model not only enhances security but also embodies the principles of transparency and inclusivity that decentralized finance (DeFi) stands for.

One of the standout features of decentralized exchanges is their ability to eliminate intermediary costs, significantly lowering trading fees for users. This cost efficiency, coupled with the enhanced security and self-custody offered by DEXs, is driving traders to move away from centralized exchanges. Additionally, DEXs provide access to a wider range of crypto assets, appealing to users looking for diverse trading opportunities.

Decentralized swap DEXs are attracting more traders due to their simplicity and ease of use. The ratio of DEX to CEX trading volume is at an all-time high. This trend indicates changing user habits and preferences. This shift is more than just a trend; it signifies a fundamental change in how traders view and interact with digital assets.

Enhanced Security and Self-Custody

Security is a paramount concern in the crypto space, and decentralized exchanges offer a compelling solution. Users retain full control over their private keys on DEXs, significantly reducing risks associated with centralized platforms. Self-custody gives individuals complete ownership of their assets, minimizing the risks of hacks and security breaches.

The decentralized nature of DEXs eliminates the single point of failure that is inherent in centralized exchanges. Without a central authority holding private keys, the risk of losing funds due to mishandling is drastically reduced. Using secure hardware wallets can further enhance the self-custody and security of digital assets.

However, decentralized exchanges are not without risks. Smart contract vulnerabilities and bugs can pose significant threats and potential losses. Future advancements like multi-signature wallets and zero-knowledge proofs are expected to bolster the security of DEXs, making them more attractive to security-conscious traders.

Regulatory Pressures on Centralized Exchanges

Regulatory pressures on centralized exchanges are becoming increasingly stringent. The upcoming MiCA regulation in the EU, for instance, will enforce stricter compliance for virtual asset exchanges, holding them fully accountable for tokens not issued by a legal entity. These regulatory requirements necessitate customer verification processes like Know Your Customer (KYC) and Anti-Money Laundering (AML), which can be cumbersome for users.

Recent OECD frameworks may require crypto exchanges to report taxpayer crypto transactions, further increasing regulatory obligations. These pressures are pushing traders towards decentralized exchanges, which operate more flexibly and with less regulation in the realm of cryptocurrency trading.

The recent collapse of notable centralized exchanges like FTX has only amplified this trend, as traders seek safer and more autonomous trading platforms.

Cost Efficiency and Fee Structures

Decentralized exchanges (DEXs) are renowned for their cost efficiency. By utilizing smart contracts to enable trades directly on the blockchain, DEXs minimize the need for intermediaries, thereby reducing transaction costs. This is a significant advantage over centralized exchanges (CEXs), which typically charge higher withdrawal and trading fees.

While users of DEXs might face higher gas fees on blockchain networks, the overall cost effectiveness remains a key attraction, especially for high-volume traders. Some DEXs also offer incentives like governance tokens or liquidity mining rewards to further attract traders.

Lower fees and additional incentives make DEXs more appealing to cost-conscious users.

Innovation in Trading Mechanisms

Automated market makers (AMMs) are at the heart of innovation in decentralized exchanges. AMMs utilize liquidity pools to facilitate constant trading without the need for traditional buyers and sellers, ensuring consistent liquidity and efficient price determination. This revolutionary approach eliminates the conventional order book system, streamlining the trading process and enhancing the overall trading experience.

Smart contracts play a crucial role in automating trades on DEXs, minimizing human error and enhancing the trustworthiness of transactions. Blockchain technology in DEXs enables direct peer-to-peer trading, eliminating intermediaries and increasing transparency and efficiency.

These innovative trading mechanisms not only improve the efficiency of decentralized exchanges but also attract a diverse range of traders. Whether you’re a seasoned trader or a newcomer to the crypto space, the advanced trading tools and mechanisms offered by DEXs provide a compelling alternative to traditional centralized platforms.

Growing Institutional Interest

Institutional interest in decentralized exchanges is on the rise, signaling a significant shift in the market. In 2022 alone, DEXs attracted at least 20 funding rounds, indicating strong confidence from institutional investors. Despite market fluctuations, DEX revenue has remained stable and is showing gradual growth, further solidifying their appeal.

Firms like BlackRock creating funds on the Ethereum network show increasing confidence in decentralized financial systems. Blockchain advancements have made it easier for institutional investors to integrate DeFi solutions, drawn by the transparency, security, and efficiency of DEXs.

This institutional interest is a testament to the robust and evolving nature of the decentralized trading ecosystem.

User Control and Transparency

Decentralized exchanges empower users by allowing direct trading, enhancing control over digital assets and reducing reliance on intermediaries. The non-custodial nature of a decentralized exchange ensures users maintain full control over their private keys and funds, a primary advantage of these platforms. Decentralized exchanges require users to be proactive in managing their security.

Transactions on DEXs are recorded on public blockchains, making them transparent and verifiable for users. This transparency, combined with real-time trading activity and liquidity levels, keeps users informed and engaged with their trades.

The financial independence offered by self-custody and the transparency of the trading process are significant draws for users seeking greater control over user funds and security in their trading activities.

Impact of Recent Exchange Collapses

The recent collapse of major centralized exchanges, most notably FTX in 2022, has had a profound impact on the crypto trading community. The FTX collapse highlighted the inherent risks associated with centralized exchanges and increased the vulnerability among cryptocurrency users. This incident has made traders wary of centralized platforms and has significantly increased the demand for decentralization in trading.

As trust in centralized exchanges wanes, traders turn increasingly to decentralized exchanges for their trading needs. The shift towards DEXs is not just about seeking safer platforms but also about embracing the autonomy and security that decentralized trading offers.

Privacy and Anonymity

Privacy and anonymity are critical factors driving the popularity of decentralized exchanges. Unlike centralized exchanges, DEXs do not require personal information for trading, allowing users to trade without revealing their identity. This anonymous nature provides a secure trading environment, which is particularly appealing to privacy-conscious users.

Without storing personal data in a central database, DEXs eliminate the risk of data breaches and enhance overall security. As concerns about data privacy grow, more traders are opting for DEXs due to their enhanced security features and the reduced risk of account freezes.

Privacy and anonymity have become crucial in the trading landscape, making DEXs a preferred choice for many.

Liquidity and Market Access

Liquidity is a vital aspect of any trading platform, and decentralized exchanges are no exception. Liquidity pools on DEXs rely on user contributions, which can cause fluctuations in available liquidity based on participation. Despite these challenges, DEXs have managed to maintain high liquidity levels, with major platforms like Uniswap commanding over half of the total DEX trading volume.

The access to a diverse range of tokens is another key advantage of decentralized exchanges. Unlike centralized platforms, DEXs do not require token vetting, resulting in a broader array of assets available for trading. This diverse market access, combined with the substantial trading volume on DEXs, makes them an attractive option for traders seeking both liquidity and variety.

Technological Advancements

Technological advancements in blockchain are crucial for enhancing the efficiency and scalability of DEXs. Layer 2 scaling solutions like Optimistic Rollups and zk-Rollups are being integrated into DEXs to increase transaction throughput and reduce costs by processing transactions off-chain. These solutions significantly improve the user experience by making transactions faster and cheaper.

Cross-chain interoperability, supported by platforms like Polkadot and Cosmos, is another critical advancement for DEXs. This technology enhances liquidity across different blockchain networks for DEXs, making it easier for users to trade a wide range of assets. These technological advancements strengthen the DEX ecosystem, making it more robust and scalable.

Community Governance and Decentralization

Community governance is a cornerstone of decentralized exchanges, allowing users to participate actively in decision-making processes. Governance tokens allow community members to propose and vote on project changes, enhancing user engagement and ensuring beneficial platform evolution. Voting rights granted by these tokens allow holders to influence protocol upgrades and new feature implementations.

Various governance models, such as token locking and time-weighted voting, are designed to prevent manipulation and encourage broader participation. Quadratic voting and delegative democracy aim to address limitations of existing governance structures, ensuring a more democratic and inclusive decision-making process.

The evolving governance models in DeFi are a testament to the commitment to decentralization and community involvement.

Summary

The rise of decentralized exchanges is reshaping the crypto trading landscape, offering numerous advantages over traditional centralized platforms. Enhanced security, cost efficiency, innovative trading mechanisms, and growing institutional interest are just a few factors driving this shift. Regulatory pressures on centralized exchanges and the impact of recent exchange collapses have further fueled the demand for decentralized trading.

As we look ahead, the future of cryptocurrency trading seems increasingly decentralized. The ongoing technological advancements and the emphasis on user control and transparency are likely to make DEXs even more appealing. Embracing decentralized exchanges means embracing a more secure, transparent, and inclusive trading environment. The evolution of DEXs is not just a trend; it’s a revolution in the making.

Frequently Asked Questions

Why are decentralized exchanges becoming more popular compared to centralized exchanges?

Decentralized exchanges are gaining popularity due to their enhanced security, lower costs, and greater autonomy for users, which appeal to a growing number of traders. This shift highlights a preference for increased asset diversity and control in the trading experience.

How do decentralized exchanges ensure the security of user funds?

Decentralized exchanges ensure the security of user funds by allowing users to retain control over their private keys and utilize secure hardware wallets, significantly reducing the risk of hacks and security breaches. This approach empowers users to manage their own assets safely.

What are the regulatory pressures faced by centralized exchanges?

Centralized exchanges face significant regulatory pressures, including strict compliance with KYC, AML, and transaction reporting requirements. These regulations can be burdensome for users, often prompting a shift toward decentralized exchanges.

How do decentralized exchanges maintain liquidity?

Decentralized exchanges maintain liquidity by utilizing liquidity pools created by users, which provide consistent access to a variety of tokens for trading. This model fosters a more resilient and dynamic trading environment.

What technological advancements are enhancing decentralized exchanges?

Layer 2 scaling solutions and cross-chain interoperability are key technological advancements enhancing the efficiency, scalability, and liquidity of decentralized exchanges, thus improving user experience significantly.