Can I Buy a House with Bitcoin? Understand the Process & Options

Yes, you can buy a house with Bitcoin. This guide will explain the options, the process, and what you need to know about using Bitcoin for real estate purchases, including the question: “Can I buy a house with Bitcoin?”

Key Takeaways

- Real estate purchases with Bitcoin are becoming more common, with options for direct transactions and cash conversions.

- Navigating legal and tax implications is crucial when using Bitcoin for real estate, necessitating guidance from professionals.

- The acceptance of cryptocurrency in real estate is growing, with smart contracts improving transaction security and efficiency.

Understanding Real Estate Purchases with Bitcoin

Real estate purchases using Bitcoin are a reality now. You can buy various types of real estate properties, including houses, land, condos, and even commercial spaces, with Bitcoin or other cryptocurrencies. Whether you’re seeking a cozy home or a lucrative commercial investment, your digital currency can facilitate the real estate purchase of real estate property.

Using Bitcoin in real estate transactions allows you to cover various payments and costs, such as closing costs and down payments, making the process more streamlined for those familiar with virtual money. However, both buyers and sellers need to understand the intricacies of Bitcoin transfers and their application in real estate transactions.

High-profile transactions, like a $22 million penthouse sale in Miami, highlight the growing acceptance of digital money in magnum real estate. Though rare, these transactions demonstrate the potential and feasibility of using Bitcoin for significant real estate purchases. The rising number of successful transactions suggests that this trend is gaining traction.

You can either convert Bitcoin to cash or use it directly, each option having its own considerations. If the seller doesn’t accept cryptocurrency, converting Bitcoin might be necessary. Direct transactions can simplify the process by reducing intermediary fees. Understanding these options will aid in making an informed decision.

Direct Bitcoin Transactions with Private Sellers

Finding a seller willing to accept Bitcoin for their property can feel like discovering a hidden gem in real estate. Direct Bitcoin transactions with private sellers are exciting but finding crypto-friendly sellers can be challenging. Platforms like BitPay can facilitate these transactions, making it easier for sellers to accept Bitcoin.

Private sellers may choose to accept full crypto payments or a mix of crypto and cash, depending on their comfort level and financial needs. This flexibility can be beneficial for both parties, but it’s important to remember that Bitcoin transactions do not leave a traditional paper trail.

This lack of documentation can complicate the transaction process, so ensuring clear communication and proper legal guidance is crucial.

Legal Considerations

Navigating the legal landscape when dealing with private sellers is essential. A real estate attorney can address all legal concerns, help you understand contract specifics, local laws, and compliance issues related to Bitcoin transactions, ensuring peace of mind throughout the process.

The evolving legal framework surrounding cryptocurrencies can affect real estate transactions. As regulations change, having a knowledgeable attorney ensures compliance with current laws, preventing potential legal issues and ensuring a smooth transaction process.

Transaction Process

Buying a house with Bitcoin involves several key steps. Initially, the buyer transfers Bitcoin from their wallet to the seller’s wallet, simplifying the payment method. Services like BitPay allow buyers to receive an email invoice and pay directly from their crypto wallet, ensuring both parties are comfortable with the process.

A challenge in these transactions is that traditional real estate agents may not be set up for crypto commissions. While the main transaction can be in Bitcoin, certain payments to government agencies or intermediaries might still need to be made in cash. To mitigate risks, using an escrow process through an accredited bank and title company is recommended.

The closing process for a real estate transaction using Bitcoin can be completed in as little as seven days, significantly reducing risk compared to traditional methods. This speed and efficiency make Bitcoin a viable option for streamlining the home buying process.

Converting Bitcoin to Cash for Home Purchases

For those preferring or needing to convert Bitcoin to cash for home purchases, the process can be straightforward but involves several considerations. Services like RealOpen allow buyers to purchase any property as cash buyers by converting crypto to cash during escrow, essential when dealing with sellers who do not accept Bitcoin directly.

Converting Bitcoin to traditional cash comes with tax implications. Understanding and navigating these is crucial. Working with financial advisors and tax professionals ensures compliance with regulations and helps you make the most of your cryptocurrency in the home buying process.

Capital Gains Taxes

Converting Bitcoin to cash for a home purchase may trigger pay capital gains taxes. The tax rate depends on the duration of ownership, with different rates for short-term and long-term transactions. Working with a tax professional ensures accurate reporting of Bitcoin gains to the IRS.

Taxes on profits made from cryptocurrency conversions are calculated based on your income bracket. Understanding these tax rules and reporting them correctly is crucial to avoid any legal complications.

More details about virtual currency tax rules can be found on the IRS FAQ page.

Working with Financial Advisors

Engaging a financial professional familiar with cryptocurrency is invaluable for navigating transaction complexities and tax liabilities. Financial advisors offer insights on transaction strategies and provide guidance on tax implications when converting Bitcoin to fiat currency, ensuring compliance with regulations.

Consulting financial professionals can lead to a smoother and more informed real estate transaction process involving Bitcoin. Their expertise helps you make the most of your digital assets while avoiding potential pitfalls.

Using Crypto Assets as Collateral for a Mortgage

Using crypto assets as collateral for a mortgage is another innovative way to leverage cryptocurrency in real estate. Crypto-backed mortgages let homeowners use their cryptocurrency holdings instead of cash for mortgage applications, allowing them to keep their digital assets while securing a mortgage.

Most lenders accept major cryptocurrencies, such as Bitcoin and Ethereum, as collateral due to their liquidity. These mortgages are often over-collateralized, requiring the collateral’s value to exceed the loan amount, protecting the lender against crypto price volatility and providing security to both parties.

Finding Crypto-Friendly Lenders

Finding lenders who accept cryptocurrency as collateral can be daunting but is crucial for securing a crypto-backed mortgage. Research and identify lenders specializing in crypto-backed mortgages. A mortgage broker specializing in cryptocurrency is recommended for buyers using cryptocurrency for deposits.

To find lenders accepting cryptocurrency, compare interest rates, fees, and terms among various crypto mortgage providers. Required documentation may include identity verification, income proof, cryptocurrency holdings, and credit history. Understanding these requirements will streamline the mortgage application process.

Collateralization Process

The collateralization process involves several steps to protect both the borrower and lender. A significant benefit of using cryptocurrency as collateral is avoiding a taxable event by staying in crypto until closing day, allowing buyers to leverage their cryptocurrency without selling it and providing asset management flexibility.

The collateralized cryptocurrency is often held in an escrow account managed by the lender until the mortgage is fully repaid. If the collateral’s value falls significantly, borrowers may need to provide additional cryptocurrency to maintain the loan-to-value ratio. As the mortgage is repaid, the collateralized cryptocurrency is gradually released back to the borrower, ensuring protection for both parties throughout the mortgage term.

Advantages and Disadvantages of Buying Real Estate with Bitcoin

Buying real estate with Bitcoin offers a unique blend of advantages and disadvantages. A significant advantage is the speed and cost-effectiveness of transactions, especially beneficial for international dealings. This can streamline the home buying process by reducing the need for paperwork and bank approvals.

Using cryptocurrency can lower costs associated with traditional real estate dealings by minimizing intermediary fees. The speed of transaction and investment diversification are notable advantages of buying a home with Bitcoin.

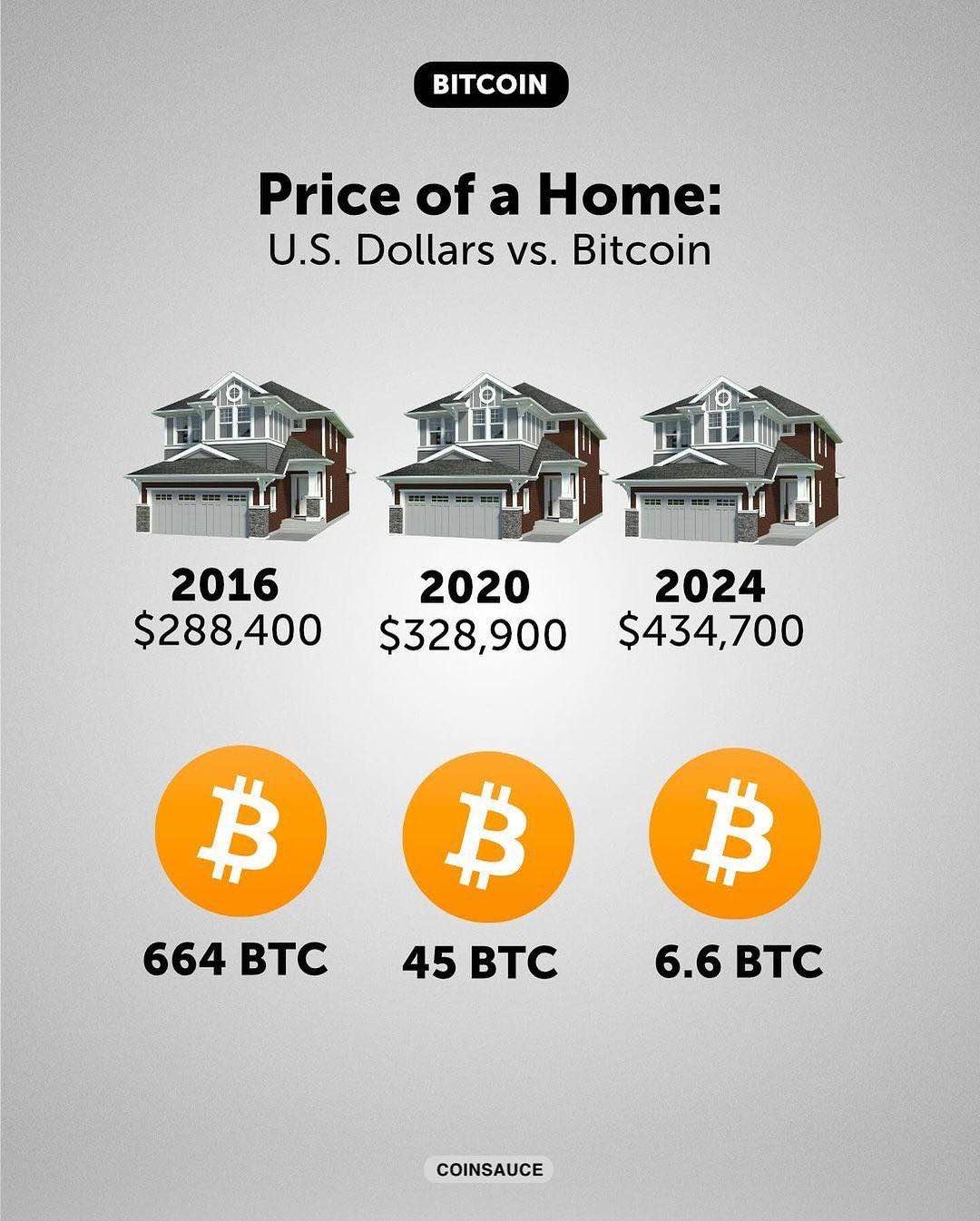

However, the market volatility of cryptocurrencies can pose challenges in stabilizing property purchase prices and crypto prices, as they are considered a volatile asset. This volatility can impact home-buying budgets, making it important to carefully consider the timing of your down payment.

Some sellers may be unwilling to accept cryptocurrency for real estate transactions, limiting your purchasing options. Additionally, the speculative nature of cryptocurrencies means significant value volatility can affect your home-buying budget.

The lack of regulation surrounding cryptocurrency transactions can result in fewer legal protections for buyers. These factors underscore the importance of thoroughly researching and understanding the implications before buying property with Bitcoin.

Exploring Alternative Cryptocurrencies for Real Estate Investment

While Bitcoin is the most commonly used cryptocurrency in real estate transactions, others are also gaining traction. Ethereum is widely accepted due to its robust platform for smart contracts. BitPay can facilitate real estate purchases using various cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Dogecoin, and several others. This variety allows buyers to diversify their crypto portfolio and choose the digital currency that best suits their needs.

Stablecoins like USD Coin and Tether are particularly favorable for real estate transactions as they minimize volatility. These cryptocurrencies provide a stable value, making them an attractive option for both buyers and sellers in the real estate industry.

Exploring alternative cryptocurrencies can create new opportunities and provide greater flexibility in your real estate investments.

The Role of Smart Contracts in Crypto Real Estate Transactions

Smart contracts are revolutionizing real estate transactions. Ethereum’s decentralized platform allows smart contracts and decentralized applications to operate without third-party interference. These contracts automate the buying and selling process, eliminating intermediaries and speeding up transactions.

Smart contracts enhance security by providing tamper-proof records of transactions on the blockchain. This transparency ensures all parties have access to the same immutable transaction history, reducing the risk of fraud and enhancing trust.

Blockchain technology ensures secure and transparent recording of all cryptocurrency transactions, making it a valuable tool in the real estate industry.

Increasing Acceptance of Cryptocurrency in the Real Estate Industry

The real estate industry is experiencing a growing acceptance of cryptocurrency payments. Currently, 38% of real estate agents are comfortable accepting cryptocurrency as a payment method. This growing comfort level reflects the broader integration of cryptocurrencies into real estate transactions, broadening business opportunities and making crypto real estate more accessible.

Luxury properties are increasingly being offered for sale in Bitcoin, reflecting a growing acceptance of digital currencies in high-end markets. This trend indicates that the real estate industry is evolving to accommodate the preferences of tech-savvy buyers, making it easier for potential buyers to use their digital assets in real estate purchases.

Summary

In summary, the idea of buying a house with Bitcoin is no longer just a futuristic concept—it’s a reality. From understanding the basics of real estate purchases with Bitcoin to exploring different transaction methods, this guide has covered the essential aspects of navigating the real estate market with digital currency. Whether you choose to engage in direct Bitcoin transactions with private sellers, convert your Bitcoin to cash, or use your crypto assets as collateral for a mortgage, each option comes with its own set of advantages and challenges.

The growing acceptance of cryptocurrency in the real estate industry, along with the innovative use of smart contracts and alternative cryptocurrencies, highlights the evolving landscape of real estate investments. By staying informed and working with knowledgeable professionals, you can successfully leverage your cryptocurrency holdings to achieve your real estate goals. Embrace this exciting new frontier and explore the possibilities that Bitcoin and other digital currencies offer in the world of real estate.

Frequently Asked Questions

Can I buy any type of real estate property with Bitcoin?

Yes, you can purchase various types of real estate, such as houses, land, condos, and commercial properties, using Bitcoin. However, the availability may vary by seller and location.

What are the legal considerations when buying real estate with Bitcoin?

When buying real estate with Bitcoin, it is essential to engage a real estate attorney to ensure compliance with evolving laws and to address specific contract details. This helps to mitigate legal risks and navigate the complexities of cryptocurrency transactions.

How do I convert Bitcoin to cash for a home purchase?

To convert Bitcoin to cash for a home purchase, consider using services like RealOpen during the escrow process. It’s crucial to consult with tax professionals to handle any tax implications and accurately report your Bitcoin gains.

What are the advantages and disadvantages of buying real estate with Bitcoin?

Buying real estate with Bitcoin offers quick transactions, lower fees, and diversification, but comes with risks such as market volatility, limited acceptance by sellers, and reduced legal protections. It’s essential to weigh these factors before proceeding.

Can I use cryptocurrencies other than Bitcoin for real estate purchases?

Yes, you can use cryptocurrencies other than Bitcoin, such as Ethereum, Bitcoin Cash, Dogecoin, and stablecoins like USD Coin, for real estate purchases. This offers flexibility and a diverse range of options for your transactions.