Complete Guide to EU MiCA Regulations for Crypto Investors

The EU MiCA (Markets in Crypto-Assets) regulations for crypto represent a crucial framework aimed at harmonizing the legal landscape for crypto-assets across Europe. These EU MiCA regulations for crypto, set to be fully implemented by 2025, introduce comprehensive rules for issuing, trading, and safeguarding crypto-assets. They’re designed to enhance investor protection, ensure market integrity, and foster innovation in the crypto market. In this guide, we’ll break down what MiCA means for you as an investor or a crypto service provider and its long-term impact on the market.

Key Takeaways

- MiCA regulations create a unified framework for crypto-assets across the EU, enhancing investor protection and market integrity.

- Crypto asset service providers must obtain authorization under MiCA by December 30, 2024, introducing stricter compliance requirements.

- MiCA balances regulatory oversight with the promotion of innovation, fostering a stable environment for the growth of digital finance in Europe.

Overview of MiCA Regulations

The MiCA regulation represents a pivotal step towards harmonizing the legal landscape for crypto-assets across the European Union. MiCA addresses the fragmented regulatory environment that has hindered the growth and stability of the crypto market by introducing a standardized framework. This unification of legal standards is not just about creating consistency; it’s about fostering a more secure and predictable market where investors can operate with greater confidence.

At its core, MiCA establishes a comprehensive regulatory framework for the crypto market, setting clear rules and guidelines for the issuance, trading, and custody of crypto-assets. This framework is designed to cover all types of crypto-assets that are not currently regulated under existing financial legislation, ensuring that no aspect of the market remains in a legal grey area.

MiCA enhances investor protection, promotes market integrity, and supports the development of innovative financial products by providing a clear and consistent regulatory regime, including the mica framework. This regulation is a testament to the EU’s commitment to creating a robust and dynamic digital finance ecosystem, paving the way for a new era of growth and innovation in the crypto market.

Key Provisions of MiCA

One of the most significant aspects of the MiCA regulation is the establishment of a unified regulatory framework for crypto assets regulation that are not currently covered by existing financial legislation. This ensures that all crypto-assets, regardless of their nature or function, are subject to clear and consistent rules across the EU.

Under MiCA, crypto-assets are defined as digital representations of value that can be transferred and stored electronically. This broad definition encompasses a wide range of digital assets, from cryptocurrencies to tokenized assets, ensuring that all forms of digital representation value are regulated under a single framework.

Crypto-assets are further categorized into three main types: electronic money tokens, asset-referenced tokens, and other types of crypto-assets. Each category is subject to specific regulatory requirements designed to address their unique characteristics and risks. For instance, electronic money tokens are treated similarly to traditional e-money, while asset-referenced tokens highlight the difference in how they are regulated to ensure they maintain their value stability. Examples of these categories can help clarify their distinctions, as they are often associated with commonly confused words.

Title II and Title III of MiCA lay out detailed provisions for the issuance and trading of these crypto-assets, including requirements for transparency, disclosure, and consumer protection. These clear rules are intended to mitigate the risks associated with digital assets and foster a more secure and trustworthy market environment.

Implementation Timeline and Measures

The journey of MiCA from proposal to implementation has been a meticulously planned process, aimed at ensuring a smooth transition for all stakeholders involved. MiCA was proposed in 2020 and is set to come into effect on January 1, 2025, marking a significant milestone in the regulatory landscape for crypto-assets.

The regulation officially began on June 30, 2023, with various measures scheduled to be developed over the subsequent 12 to 18 months. The first consultation package was released in July 2023, followed by a second package in October 2023, and the final consultation package is anticipated to be released in the first quarter of 2024. These consultation phases are crucial for refining the regulatory framework and addressing any potential issues that may arise during implementation, as outlined in the official journal.

Starting on June 30, 2024, MiCA introduces a unified regulatory framework for crypto asset service providers across the EU, replacing existing national regimes. This transition is designed to ensure that service providers are adequately prepared to comply with the new regulations while minimizing disruptions to their operations.

Transitional measures vary by EU member state, allowing current crypto-asset service providers to continue operating until they receive MiCA authorization. This transitional period, which extends until mid-2026, provides a buffer for entities already compliant with national laws to adapt to the new regulatory environment.

Role of European Supervisory Authorities

The successful implementation and enforcement of MiCA regulations rely heavily on the roles and responsibilities of various European supervisory authorities. The European Securities and Markets Authority (ESMA) plays a pivotal role in this ecosystem, emphasizing the ongoing vulnerabilities in the crypto market despite the implementation of MiCA regulations. ESMA has the authority to enforce actions against non-complying crypto service providers, ensuring that the market operates within the parameters set by MiCA.

To ensure consistent application and enforcement of MiCA regulations across EU member states, ESMA and the European Banking Authority (EBA) collaborate closely with national competent authorities in almost every case. This collaboration makes sense for maintaining a unified approach to regulation and preventing regulatory arbitrage.

The EBA is specifically tasked with developing regulatory and supervisory frameworks tailored for crypto-asset service providers under MiCA. These authorities collaborate to create a coherent and effective regulatory environment that supports the growth and stability of the crypto market across the European Union.

Impact on Crypto Asset Service Providers

The introduction of MiCA regulations brings significant changes for crypto asset service providers, fundamentally altering how they operate within the EU. As of December 30, 2024, all crypto asset service providers must obtain authorization from their national authorities under MiCA to operate legally. This requirement marks a shift from the previous virtual asset service provider regime, necessitating compliance with new and more stringent requirements by July 1, 2026.

One of the key benefits of MiCA is the simplification of the licensing process for crypto projects in the EU, creating a unified regulatory environment that encourages innovation while ensuring compliance. This streamlined process allows for the cross-border provision of crypto-asset services across EU member states, fostering a more integrated and efficient market.

MiCA also places a strong emphasis on consumer protection, compelling crypto firms to provide clear and truthful information about the risks associated with investing in crypto assets. This requirement ensures that customers are well-informed and can make educated investment decisions. Additionally, companies must ensure that customers are aware of the risks involved in crypto investments.

Operational resilience is another critical aspect of MiCA, as it allows Web3 businesses to benefit from a stable legal framework that supports the deployment of distributed ledger technology. For certain service providers already under prudential supervision, such as banks, MiCA may only require notification to the relevant authority instead of undergoing the full authorization process, ensuring they have the right word for compliance.

Ultimately, MiCA has a huge effect on the crypto market, driving a shift towards greater transparency, accountability, and consumer protection. By setting clear rules and guidelines, MiCA creates a more secure and predictable environment for both service providers and investors.

Enhancing Market Integrity and Consumer Protection

Market integrity and consumer protection are at the heart of MiCA’s regulatory framework. The regulation seeks to prevent market manipulation and promote transparency in the crypto market, thereby enhancing investor confidence and market stability. Measures against market manipulation and insider trading are central to MiCA’s aims, ensuring that the market operates fairly and without undue influence.

Businesses are required to enforce internal controls to avoid conflicts of interest and report any suspicious activities to regulators. These requirements are designed to create a more transparent and accountable market environment. Additionally, MiCA introduces stringent anti-money laundering (AML) and know-your-customer (KYC) requirements to tackle illicit activities in the crypto market.

Transparency and disclosure are also key components of MiCA. The regulation mandates that entities issuing and trading crypto assets, including asset-referenced and e-money tokens, must provide clear and comprehensive disclosures to consumers. This ensures that consumers are well-informed about the risks involved and can make educated investment decisions.

The European Securities and Markets Authority (ESMA) plays a crucial role in establishing supervisory practices that address market integrity and investor protection within the crypto ecosystem. By regulating significant crypto players and stablecoins, MiCA aims to enhance financial stability and reduce the risk of market disruptions. For stablecoin issuers, MiCA requires maintaining full reserves to ensure that users can redeem their tokens for fiat currency at any time.

In essence, MiCA’s comprehensive regulatory framework has a positive effect on market integrity and consumer protection, creating a safer and more transparent crypto market for all participants.

Supporting Innovation in Digital Finance

While MiCA places a strong emphasis on regulation and consumer protection, it also recognizes the importance of supporting innovation in the digital finance sector. By establishing clear rules for token issuance, MiCA aims to mitigate risks and foster technological advancement in the digital finance sector. This regulatory clarity provides a structured environment that encourages responsible innovation while addressing the risks associated with digital assets.

The regulatory framework set by MiCA has the potential to influence global standards, encouraging other jurisdictions to adopt similar measures that affect someone’s mood and innovation. This global influence can create a more cohesive and integrated international crypto market, benefiting investors and service providers alike.

Additionally, the clear regulatory framework of MiCA aims to attract institutional investors to the crypto market, creating opportunities for growth and development. MiCA supports the development of a dynamic and forward-looking digital finance ecosystem by balancing regulation with innovation.

National Competent Authorities’ Role

National Competent Authorities (NCAs) play a pivotal role during the transitional period of the MiCA regulation. Existing entities can continue their operations under national laws until they obtain relevant national competent authorities authorization, ensuring that there is no disruption in service provision during the regulatory transition. This arrangement provides a buffer period for entities to adjust to the new regulatory requirements while maintaining operational continuity.

Collaboration between NCAs and the European Securities and Markets Authority (ESMA) is crucial to ensure consistent supervisory practices across the EU. ESMA works diligently to ensure that NCAs adopt a convergent approach to authorizations of crypto-asset service providers, promoting uniformity in the application of MiCA provisions across different jurisdictions. This collaborative effort aims to prevent regulatory arbitrage and ensure a level playing field for all market participants.

NCAs are also responsible for notifying ESMA and the European Banking Authority (EBA) about the designated authorities responsible for implementing MiCA provisions within their respective jurisdictions. This notification process is essential for maintaining transparency and accountability in the regulatory framework, ensuring that all stakeholders are aware of the relevant authorities overseeing the implementation and enforcement of MiCA.

Legal Framework and Technical Standards

The legal framework outlined in MiCA includes comprehensive measures for the authorization and supervision of transactions relating to crypto assets. This framework is designed to provide legal certainty and clarity for all market participants, ensuring that they operate within well-defined regulatory boundaries. The regulatory framework includes about 35 mandates for delegated acts, which are essential for the detailed implementation of MiCA.

The implementation process of MiCA is supported by Delegated Regulations and Technical Standards developed by EU authorities. These technical standards provide the detailed rules and guidelines necessary for the practical application of the regulation, ensuring that all aspects of the crypto market are adequately covered. For instance, the German parliament passed an Act on the Digitalisation of Financial Markets to facilitate MiCA’s implementation, highlighting the proactive measures taken by member states to support this regulatory transition.

The establishment of a robust legal framework and technical standards under MiCA aims to create a stable and predictable environment for the crypto market. This regulatory clarity not only enhances investor confidence but also supports the growth and development of the digital finance sector, paving the way for a more secure and innovative financial ecosystem.

Challenges and Opportunities

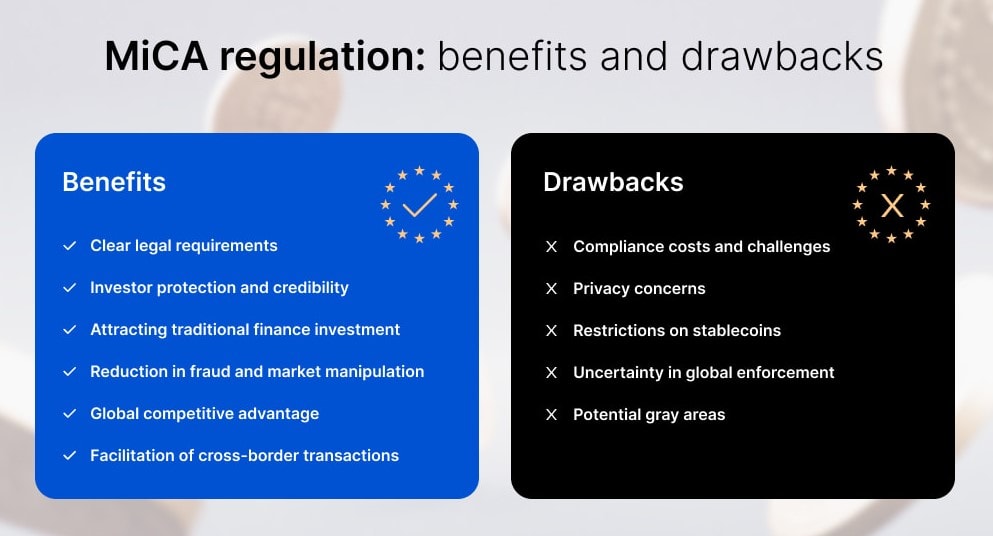

The MiCA regulation presents both challenges and opportunities for the crypto market. One of the primary challenges is the potential increase in operational and legal expenses for crypto businesses as they strive to comply with the new regulations. These increased costs can impact profitability and may be particularly burdensome for smaller firms that lack the resources of larger, established players.

Global crypto firms also face complexities due to differing regulations in non-EU countries, complicating international compliance efforts. Navigating these regulatory differences requires significant effort and resources, posing an additional challenge for firms looking to operate on a global scale. Moreover, the ESMA has raised concerns about potential systemic risks associated with stablecoins, highlighting the need for robust oversight and risk management in the crypto ecosystem.

Despite these challenges, MiCA offers significant opportunities for the crypto market. The regulation aims to mitigate financial risks associated with significant crypto-assets like stablecoins, enhancing financial stability and reducing the risk of market disruptions. By providing a clear regulatory framework, MiCA supports innovation and encourages the development of new financial products and services.

While MiCA does not currently cover decentralized finance (DeFi) and non-fungible tokens (NFTs), future amendments could introduce regulations for these sectors. This potential expansion of the regulatory framework presents opportunities for further innovation and growth in the digital finance sector. By creating a stable and predictable regulatory environment, MiCA fosters an ecosystem that supports responsible innovation and attracts institutional investors.

Ultimately, MiCA’s new regime has the potential to effect change in the crypto market, producing change by balancing the need for regulation with the support for innovation. By addressing the associated risks and providing a clear regulatory framework, MiCA creates a more secure and dynamic environment for all market participants, in light of the new rules.

Summary

The MiCA regulation represents a significant milestone in the journey towards a unified and comprehensive regulatory framework for the crypto market in the European Union. By establishing clear rules and guidelines, MiCA aims to enhance investor protection, market integrity, and financial stability. The regulation addresses key areas such as market manipulation, consumer protection, and operational resilience, creating a more secure and transparent market environment.

As the crypto market continues to evolve, MiCA’s balanced approach to regulation and innovation provides a solid foundation for future growth and development. By supporting responsible innovation and attracting institutional investors, MiCA fosters a dynamic and forward-looking digital finance ecosystem. With the implementation of MiCA, the European Union is well-positioned to lead the way in creating a robust and innovative regulatory framework for the crypto market.

Frequently Asked Questions

What is the main goal of the MiCA regulation?

The primary objective of the MiCA regulation is to establish uniform legal standards for crypto-assets throughout the EU, thereby addressing regulatory inconsistencies and creating a cohesive framework for the crypto market.

How does MiCA impact crypto asset service providers?

MiCA impacts crypto asset service providers by mandating that they obtain authorization from national authorities, which simplifies the licensing process and enhances consumer protection through clearer risk disclosures. This regulatory framework promotes a safer and more transparent environment for both providers and consumers in the crypto space.

What measures does MiCA introduce to enhance market integrity?

MiCA enhances market integrity by implementing robust measures against market manipulation, enforcing internal controls, and mandating transparency and disclosure for crypto asset entities. Additionally, it enforces stringent AML and KYC requirements to combat illicit activities within the crypto market.

When will MiCA come into effect?

MiCA is scheduled to come into effect on January 1, 2025. This follows its official initiation on June 30, 2023, with ongoing developments expected in the interim.

How does MiCA support innovation in the digital finance sector?

MiCA fosters innovation in the digital finance sector by providing a clear regulatory framework for token issuance, which promotes a structured environment for responsible innovation and attracts institutional investors. This clarity ultimately encourages the development of new financial products and services.