Decrypting China’s Role in the Crypto Ecosystem: Influence and Impact

When it comes to China’s role in the crypto ecosystem, the country presents a study in contrasts. Despite its ban on cryptocurrency trading and mining, China is boldly innovating with the e-CNY and significant investments in blockchain technology. How these actions influence the global crypto landscape is central to understanding the evolving digital economy. This article unpacks the nuances of China’s approach and its ripple effects on global finance.

Key Takeaways

- China has enacted a severe ban on cryptocurrencies and ICOs to control risks to its fiat currency and financial stability, resulting in regulatory measures that forced crypto businesses and miners to move operations abroad.

- The development of China’s digital yuan or e-CNY is advancing China’s entry into the digital currency space, with potential benefits like improved payment efficiency and challenges including considerations around user privacy and state surveillance.

- While restricting cryptocurrencies, China is actively pursuing blockchain technology leadership and international collaboration, using it to strengthen its financial systems and global economic influence, despite regulatory complexities within its own jurisdiction.

China’s Stance on Cryptocurrencies

Fueled by concerns that digital assets could undermine the Yuan, China’s national fiat currency, the Chinese government enacted a severe ban on non-approved cryptocurrencies in September 2021. Despite this, Chinese citizens have continued their involvement with cryptocurrencies, illustrating the resilient interest in these digital assets.

Simultaneously, due to the risks of financial scams and criminal activities, the Chinese government declared Initial Coin Offerings (ICOs) illegal in 2017. To fortify this ban, measures such as removing cryptocurrency influencers from social media platforms were undertaken, demonstrating the lengths to which the government will go to control the cryptocurrency market within its borders.

Crypto Regulation in China

Culminating in a complete prohibition of all cryptocurrency transactions, the Chinese government progressively instituted bans on various cryptocurrency activities. In response to these regulations, major players in the crypto realm, like Binance, moved operations outside China to continue their business activities.

Owing to its low electricity costs, China was previously a hub for cryptocurrency mining. However, the industry witnessed a sharp downturn as crackdowns were enforced to curb these activities. This shift underscores China’s approach to crypto regulation, which allows room for growth in digital finance while maintaining stringent control over its impact on the Chinese economy.

Initial Coin Offerings (ICOs)

China’s 2017 ban on Initial Coin Offerings (ICOs) was intended to prevent potential risks associated with cryptocurrencies replacing its fiat currency and to address their use for criminal activities. The effect of this ban echoed globally, causing a significant drop in Ethereum’s market capitalization and the price of Bitcoin.

In response to the ICO ban, measures were taken to protect investors. Directives were issued for blockchain projects to refund raised funds, like Bitcoin and Ethereum, to contributors. This action highlights China’s commitment to maintaining financial stability while grappling with the complexities of the emerging digital economy.

The Rise of the Digital Yuan

Despite a complete ban on cryptocurrency, China has persistently moved forward into the digital currency space. The country is in the process of developing an official digital yuan, also known as e-CNY, which can be considered as China’s cryptocurrency. This digital yuan has been under development for over eight years, indicating a long-term strategic initiative.

By potentially reducing China’s dependence on the US dollar, the digital yuan can lessen the geopolitical leverage held by the US via sanctions. Through collaborative efforts like mBridge, the digital yuan positions China to potentially bypass established financial transaction systems, like SWIFT, increasing its foothold in international trade finance.

People’s Bank of China and CBDCs

A special task force was set up by the People’s Bank of China (PBOC) in 2014 to research digital currencies and consider issuing its own Central Bank Digital Currency (CBDC). The PBOC aims to:

- Improve financial system capabilities

- Replace some of the cash in circulation with the digital yuan

- Enhance payment system efficiency

- Promote financial inclusion.

The e-CNY will feature managed anonymity—with users able to create accounts using just a mobile number within certain transaction limits—while also adhering to anti-money laundering and anti-terrorism financing measures. The PBOC is exploring the digital yuan’s application in international finance, as evidenced by Project mBridge, which aims to improve efficiency in cross-border bank transfers.

Advantages and Challenges

By aiming to enhance cross-border payment efficiency, the digital yuan strengthens China’s position in the global financial system. As it challenges the US dollar’s dominance as a reserve currency, the digital yuan holds the potential to alter global economic relations. Furthermore, digital yuan transactions offer instant processing and lower costs compared to conventional payment systems that involve financial intermediaries.

However, implementing the digital yuan presents its own unique set of challenges. While it provides the government with advanced traceability of financial transactions, aiding in the prevention of illegal activities, it also raises concerns about user privacy and the potential for increased state surveillance. Additionally, robust security is crucial to prevent cyber threats, and the transaction irreversibility could pose risks in the event of errors or fraudulent activity.

Blockchain Technology in China

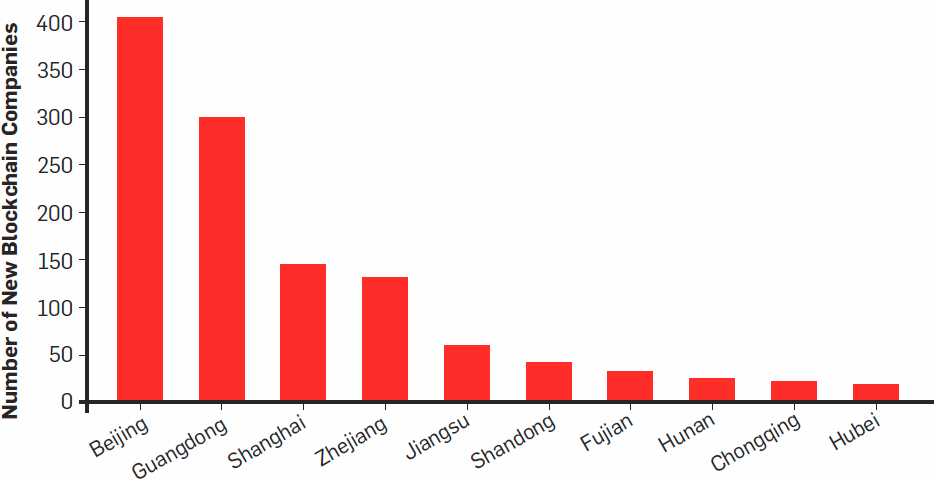

Although the Chinese government maintains a strict stance on cryptocurrencies, it has demonstrated a strong inclination to be a leader in the field of blockchain technology. The government’s support for blockchain technology is indicative of its ambition to be at the forefront of setting global standards for this revolutionary technology, which reflects the Chinese government views cryptocurrency as an important aspect of the digital economy.

The integration of blockchain technology with Artificial Intelligence (AI) in China is increasingly leveraged across various industries, from facial recognition to smart city applications. This integration showcases China’s commitment to harnessing the potential of cutting-edge technologies to drive economic growth and societal improvement.

Blockchain Network Development

China’s blockchain strategy is anchored by the Blockchain Service Network (BSN). It aims to provide a global infrastructure for the deployment and operation of a wide range of blockchain applications, simplifying the process for developers and companies.

BSN boasts specialized cloud environments and tools that facilitate interoperability among diverse decentralized applications (DApps), minimizing the traditionally high costs associated with their development and upkeep. China is actively developing BSN’s public infrastructure by integrating Public City Nodes built on major cloud services, forming a comprehensive and secure blockchain operating environment.

Blockchain Technologies and Artificial Intelligence

As part of its strategy to assert global technological leadership, China actively invests in state-of-the-art technologies like artificial intelligence (AI) and blockchain, both in the private sector and government initiatives. President Xi Jinping has endorsed blockchain technology, suggesting that it has the potential to benefit multiple industries, including finance, education, and health care.

This endorsement underscores China’s commitment to harnessing the potential of emerging technologies to drive economic growth and societal improvement. By integrating AI and blockchain, China is creating an enabling environment for technological advancement that will undoubtedly shape the future of numerous industries.

Cryptocurrency Trading and Exchanges

In 2017, China imposed a ban on cryptocurrency trading platforms and initial coin offerings (ICOs). Despite these restrictions, it is not illegal for individuals in China to hold cryptocurrencies, creating an intriguing dichotomy in China’s relationship with the crypto ecosystem.

Diverging from mainland China’s stringent regulations, Hong Kong has surfaced as a key player in the cryptocurrency sphere, offering a more relaxed regulatory environment for cryptocurrency trading and exchanges. This divergence highlights the complexities of regulating cryptocurrencies within a country that is simultaneously wary of and fascinated by the potential of digital currencies.

Trading Activities and Restrictions

By December 2021, cryptocurrency exchanges like Huobi Global had stopped operations for users in mainland China. The Beijing Arbitration Commission clarified in 2020 that China recognizes cryptocurrencies as virtual commodities, but prohibits token funding and trading platforms from exchanging virtual currency/tokens for legal tender.

Chinese law does not recognize cryptocurrencies as legal tender. The regulatory framework includes the Provisions on the Administration of Blockchain Information Services and the Encryption Law. Chinese judicial rulings involving virtual currency fall into categories such as:

- Disputes over Bitcoin investment

- Bitcoin transfer

- Returned profits

- Bitcoin mining machine purchases

Hong Kong’s Role

As a separate administrative region, Hong Kong enjoys more relaxed cryptocurrency regulations compared to mainland China. Catering to a wide range of users, cryptocurrency exchanges such as BitMEX, OKCoin, BTCC, and platforms like Crypto.com and Binance, are based in Hong Kong.

Hong Kong-based exchanges offer varied services like bitcoin mining, wallet provision, and liquidity services along with advanced security protocols for safe trading. To accommodate international traders, Hong Kong’s crypto platforms have integrated multi-language support and adhere to AML/KYC regulations.

International Collaboration and Competition

Even though cryptocurrencies are prohibited within its borders, China actively engages in global discussions concerning crypto-asset regulation. China is proactively developing the e-CNY for major cross-border bank payments to forge an international payment system independent of United States influence.

China’s active involvement in these discussions and its endeavors to establish the e-CNY as a major player in cross-border payments underscore its intentions to play a significant role in shaping the future of the global cryptocurrency ecosystem, as China aims to make an impact in this domain.

Collaboration with the European Union and Other Countries

Through Project mBridge, China cooperates with international partners, including the central banks of Hong Kong, the United Arab Emirates, and Thailand, to test the infrastructure for wholesale central bank digital currencies (CBDCs). The e-CNY pilot within Project mBridge represents a critical development, as it is the first case where multiple jurisdictions have successfully executed interbank CBDC transactions, positioning China’s digital currency for potential global use.

Amid growing collaboration, China and the European Union stand to mutually benefit from developing ‘green’ blockchain technologies that promise to be more energy-efficient than the conventional proof-of-work models.

Competition with the United States and Russia

The introduction of the digital yuan could pose a significant threat to the predominance of the US dollar in international finance. China is expected to become a dominant power in key technologies such as artificial intelligence and blockchain, which are essential components of modern financial networks and the overall financial ecosystem.

Russia has turned to the Chinese yuan amidst Western sanctions, increasing its economic dependence on China and potentially giving China leverage in bilateral trade. However, this move exposes Russia to significant financial risks, such as:

- China’s control over the yuan-ruble exchange rate

- Limited access to reserves due to potential Chinese restrictions

- The Russian Central Bank’s holdings in yuan-denominated assets

Summary

As we’ve explored, China’s relationship with the cryptocurrency ecosystem is intricate, characterized by a strict stance on cryptocurrencies and a parallel drive towards developing its digital currency. The nation’s ambitious blockchain strategies and collaborations with international partners highlight its desire to be at the forefront of global digital finance. However, the path to this leadership position is fraught with challenges, including maintaining user privacy, ensuring robust security, and navigating international competition. As the landscape evolves, the world will closely watch China’s maneuvers in this fascinating realm.

Frequently Asked Questions

Why did China ban cryptocurrencies?

China banned cryptocurrencies due to concerns that these digital assets could undermine the national fiat currency, the Yuan. This decision was made to protect the country’s financial system.

What is China’s stance on blockchain technology?

China supports blockchain technology and aims to set global standards in this field.

What is the role of the People’s Bank of China in the development of the digital yuan?

The People’s Bank of China played a central role in the development of the digital yuan by establishing a task force in 2014 to study digital currencies and explore the possibility of issuing its own CBDC.

Despite the ban, can individuals in China hold cryptocurrencies?

Individuals in China can hold cryptocurrencies despite the ban.

How is China collaborating with other countries in the realm of digital currencies and blockchain technology?

China is collaborating with central banks from Hong Kong, the United Arab Emirates, and Thailand through Project mBridge to test infrastructure for wholesale CBDCs. This collaboration showcases China’s efforts in digital currency and blockchain technology.