Efficient Strategies for Mining Bitcoin at Home in 2024

Mining bitcoin at home might seem daunting, but it’s entirely possible with the right information. This guide delivers the essentials and demystifies the process, leading you confidently into home mining. Explore practical solutions for hardware acquisition, electricity cost management, and system optimization that makes sense for everyday enthusiasts.

Key Takeaways

- Home Bitcoin mining requires specialized hardware (GPUs or ASICs), a stable power source, and robust internet connectivity, with profitability heavily influenced by electricity costs, hardware efficiency, and mining difficulty.

- Setting up a home mining rig involves selecting compatible hardware, assembling the rig, installing a mining-friendly operating system, configuring mining software, and joining a mining pool for more consistent payouts.

- Optimizing Bitcoin mining performance entails adjusting rig settings for efficiency, regularly maintaining hardware, balancing operational costs against mining profits, and considering renewable energy and Time-of-Use electricity pricing to reduce expenses.

The Essentials of Home Bitcoin Mining

Before we dive into the specifics, it’s essential to understand the requirements and challenges of home Bitcoin mining. At the core, mining requires:

- Specialized hardware known as mining rigs—powerful computers designed to crunch numbers at high speed

- A reliable power source to keep your rig running

- A robust internet connection to keep it connected to the Bitcoin network

But it’s not just about having the right gear. You’ll also need to consider other factors such as cooling, noise, and electricity costs.

Beyond the hardware, mining Bitcoin profitably hinges on factors like electricity costs, the type of mining hardware, and the current mining difficulty levels.

Choosing the Right Mining Hardware

Selecting the right mining hardware is crucial in your mining journey. The two main types of hardware for Bitcoin mining are top graphics processing units (GPUs) and application-specific integrated circuits (ASICs). ASIC miners, such as the Bitmain Antminer S19 XP Hydro and the MicroBT WhatsMiner M56S, are specialized devices that offer high hash rates and efficient power consumption.

When choosing your hardware, consider factors like:

- price

- hash rate

- energy efficiency

- noise levels

And don’t forget about your local electricity costs, as these can significantly impact your mining profitability.

Securing a Reliable Power Source

The importance of a reliable power source cannot be overstated in Bitcoin mining. The operational cost of a mining rig can be substantial, especially in areas with high electricity rates. By understanding your electricity rate and selecting an efficient power supply unit (PSU), you can significantly impact your mining venture’s profitability and optimize its computing power.

It’s also important to consider the compatibility between your mining location’s voltage configuration and the PSU manufacturer’s rating, as higher voltages typically lead to improved efficiency. For home mining setups, a three-phase power system is more efficient and can be split into manageable phases for different equipment, making it the recommended choice.

Establishing a Robust Internet Connection

Alongside a reliable power source, a stable internet connection is crucial for successful Bitcoin mining. This is because your mining rig needs to maintain constant communication with the Bitcoin network for transaction verification. Low latency is crucial in mining to quickly communicate with the mining pool. The ideal latency is below 70ms to prevent delays that could lead to rejected shares.

Surprisingly, Bitcoin mining doesn’t require high bandwidth – bandwidths as low as 2 or 5 Mbps are sufficient to support mining activities.

Constructing Your Home Mining Setup

Now that we’ve covered the essentials, let’s dive into the construction of your home mining setup. This mining process involves:

- Selecting compatible hardware components

- Assembling them into a mining rig

- Installing an operating system that supports mining

- Configuring the necessary mining software.

Finally, you’ll connect your rig to a private network, either through an Ethernet cable or a wireless connection, and start mining.

Assembling the Mining Rig

Assembling your mining rig is a bit like building a PC, but with a few crucial differences. A typical mining rig is a customized PC configuration that differs from conventional PCs by having multiple GPUs, as opposed to just one. These GPUs are connected via risers to the motherboard, allowing you to harness their combined processing power for mining.

Essential components include GPUs such as NVIDIA GeForce RTX 3090 or RTX 3080, a motherboard capable of supporting multiple GPUs, along with a CPU, adequate RAM, and a power supply unit (PSU).

Installation and Configuration of Mining Software

With your rig assembled, the next step is to install and configure your bitcoin mining software. Applications like CGMiner, BFGMiner, or EasyMiner are popular choices for Bitcoin mining. Once installed, you’ll need to configure the software to match your mining goals and hardware capabilities. This typically involves setting parameters like the number of threads and mining intensity. And remember, keeping your software up to date is crucial for optimizing performance and maintaining security.

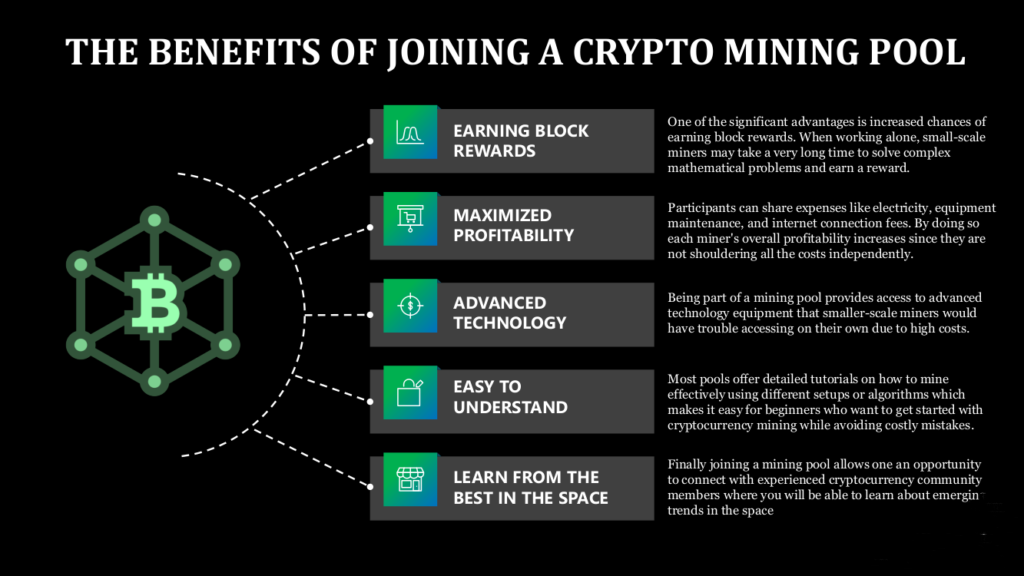

Joining a Competitive Mining Pool

Joining a mining pool can greatly enhance your mining capabilities. In a mining pool, you combine your resources with other miners to solve blocks more quickly, leading to more consistent payouts. When choosing a mining pool, consider factors like pool fees, transparency, and payout methods.

Once you’ve selected a pool, you’ll need to register, add the pool’s stratum address to your mining software, connect your wallet, configure your client, and start mining.

Optimizing Mining Performance and Efficiency

Once you’ve got your mining rig up and running, it’s time to focus on optimization. This involves fine-tuning your rig settings, regularly monitoring and maintaining your hardware, and balancing your mining costs with profitability.

By carefully managing these factors, you can improve your mining performance and increase your Bitcoin earnings.

Adjusting Mining Rig Settings

Adjusting your mining rig settings can significantly boost your mining efficiency. Overclocking your GPUs, for instance, can improve mining performance while reducing power usage. But be careful – running your hardware at higher speeds can also increase the risk of overheating.

To avoid this, you’ll need to manage your GPU temperatures, ensuring they remain within safe operating ranges.

Monitoring and Maintenance Best Practices

Regular monitoring and maintenance are crucial for maintaining mining efficiency. This involves:

- Cleaning your components

- Adjusting fan speeds

- Regularly checking for hardware issues

- In case of hardware failures, consider warranty repairs if applicable, and have spare parts at hand for quick repairs to minimize downtime

- Install an energy meter to track real-time electricity usage and identify inefficiencies

Balancing Cost and Profitability

Finally, balancing cost and profitability is a crucial aspect of Bitcoin mining. This involves selecting efficient hardware, optimizing software settings, and considering factors like electricity costs and mining difficulty. Utilizing renewable energy sources like solar or wind power can significantly cut down on electricity expenses, and Time-of-Use pricing can lead to cost savings by mining during off-peak hours when electricity rates are lower.

Understanding the Bitcoin Mining Ecosystem

To fully grasp the potential and challenges of home Bitcoin mining, it’s important to understand the broader Bitcoin mining ecosystem. This involves:

- Recognizing the role of miners in transaction verification

- Understanding the impact of mining difficulty on small miners

- Appreciating the significance of block rewards and transaction fees.

By understanding these factors, you’ll be better equipped to navigate the world of Bitcoin mining and make informed decisions about your mining operations.

The Role of Miners in Transaction Verification

Miners play a crucial role in the Bitcoin network. They act as auditors, verifying the legitimacy of Bitcoin transactions and maintaining the integrity of the blockchain. By confirming new transactions and adding them to the blockchain, miners prevent double-spending – a potential issue where the same Bitcoin is spent twice.

This role not only makes miners integral to the Bitcoin network but also provides them with the opportunity to earn Bitcoin rewards through bitcoin mining work.

The Impact of Mining Difficulty on Small Miners

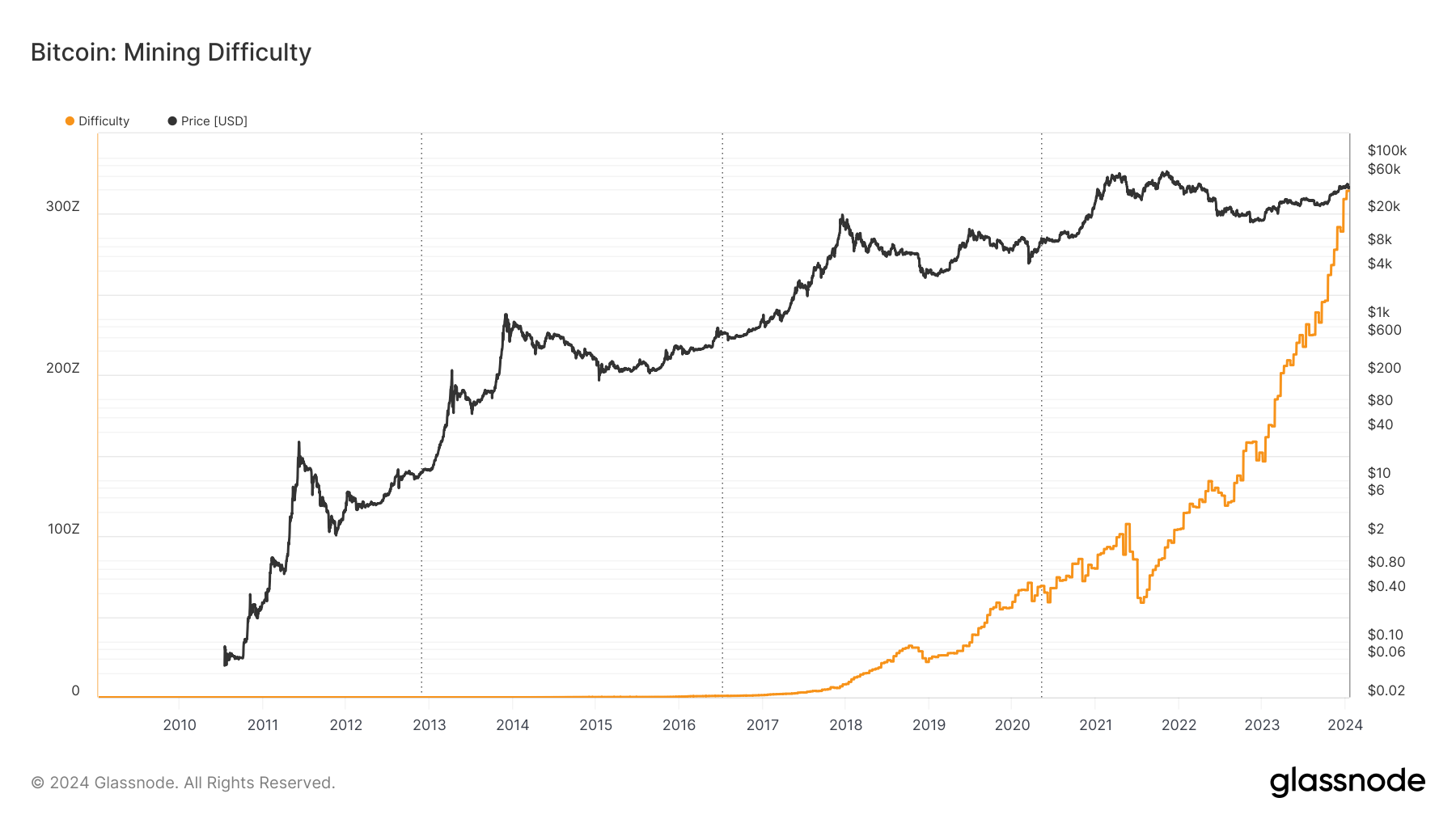

The difficulty of mining Bitcoin has a significant impact on small miners. As more miners join the Bitcoin network, the mining difficulty increases, making it harder for small miners to compete. High mining difficulty can make it impossible for small-scale miners to mine Bitcoin profitably, leading to consolidation in the mining industry.

However, small miners can still find opportunities in mining alternative cryptocurrencies that have lower mining difficulty.

The Significance of Block Rewards and Transaction Fees

Block rewards and transaction fees are two key financial incentives for Bitcoin miners. Block rewards, which halve approximately every four years, provide the primary financial incentive for miners. However, as block rewards diminish, transaction fees become increasingly significant.

In the future, as Bitcoin nears its maximum supply limit, miners will rely more on transaction fees. This will necessitate a shift in mining strategies and the need to adapt to the evolving fee-to-reward ratio.

Navigating Legal and Regulatory Considerations

As with any financial activity, it’s crucial to navigate the legal and regulatory landscape when embarking on a Bitcoin mining venture. The legality of Bitcoin mining varies greatly around the world, with some countries having explicit regulations, operating under legal gray areas, or establishing outright bans.

Beyond the legal status of Bitcoin mining, miners must also be mindful of potential financial risks and ensure that their bitcoin mining operations comply with any relevant regulations.

Assessing the Legality of Bitcoin Mining

Understanding the legal status of Bitcoin mining is crucial for any prospective miner. The legality of Bitcoin mining is influenced by various factors, including financial regulations, anti-money laundering laws, and whether a country considers digital currencies as legal tender or taxable assets. Therefore, compliance with legal standards is crucial to mitigate the risks of regulatory penalties and to ensure the legality of mining activities and taxation.

Potential Financial Risks and Regulations

Navigating the financial risks and regulations associated with Bitcoin mining is a critical aspect of running a successful mining operation. From a regulation standpoint, it’s important to understand that Bitcoin is classified as a commodity by the Commodity Futures Trading Commission and is taxed as property by the Internal Revenue Service in the United States. Miners, therefore, need to ensure they are compliant with tax obligations and are aware of the potential financial risks associated with cryptocurrency transactions.

Alternative Cryptocurrencies to Mine at Home

Given the challenges of Bitcoin mining, especially for small miners, it’s worth considering alternative cryptocurrencies to mine at home. Several cryptocurrencies that are specifically designed to be ASIC-resistant and more accessible for home miners include:

- Ethereum

- Litecoin

- Monero

- Zcash

These cryptocurrencies offer opportunities to mine bitcoin at home as well as for cloud mining enthusiasts to participate in mining and potentially earn profits.

In this section, we’ll cover a few such alternatives, including Vertcoin, Monero, and Bytecoin.

Identifying ASIC-Resistant Cryptocurrencies

ASIC-resistant cryptocurrencies are designed to resist the dominance of ASICs, providing opportunities for those with less powerful hardware to participate in mining. Popular ASIC-resistant cryptocurrencies include Monero and Vertcoin. These cryptocurrencies can be mined using a CPU or a GPU, making them more accessible for home miners.

Their ASIC-resistance helps level the playing field, allowing for more competitive mining without the need for specialized hardware.

Evaluating Profitability of Altcoin Mining

When considering alternative cryptocurrencies for mining, profitability is a key factor. Just like with Bitcoin, the profitability of mining altcoins varies based on factors like mining difficulty, hardware efficiency, and market conditions. While Bitcoin mining is considered very profitable, some altcoins may offer higher profitability for small-scale home miners, making bitcoin mining profitable in comparison.

When evaluating profitability, it’s crucial to consider your electricity costs, the efficiency of your mining hardware, and the current market prices of the cryptocurrency you’re mining.

Summary

In conclusion, mining Bitcoin at home is a fascinating venture that offers both financial rewards and a deep understanding of blockchain technology. While it requires careful planning, investment in specialized hardware, and understanding of factors like electricity costs and mining difficulty, the potential rewards can be significant. Moreover, by considering alternative ASIC-resistant cryptocurrencies, even small-scale home miners can participate in the exciting world of cryptocurrency mining. So, are you ready to dive into the world of home Bitcoin mining?

Frequently Asked Questions

Is it still profitable to mine Bitcoin at home?

Yes, mining for Bitcoin can still be profitable, but it depends on factors like location, energy costs, and equipment used in the process. Joining a mining pool can also increase your chances of earning consistent rewards.

How long does it take to mine 1 BTC?

It can take anywhere from 10 minutes to 30 days to mine 1 BTC, depending on your hardware and software setup.

Can a beginner mine Bitcoin?

Yes, a beginner can still mine Bitcoin with relative ease by setting up a dedicated Bitcoin miner, although it is no longer as simple as it once was. It does, however, remain attainable for newcomers.

Can a normal PC mine Bitcoin?

Yes, you can build a computer capable of mining cryptocurrency with specific hardware, such as certain Nvidia graphics cards, but it may not be worth it for most home users due to the speed limitations of common hardware.

What is the role of miners in Bitcoin transaction verification?

Miners play a crucial role in verifying the legitimacy of Bitcoin transactions and maintaining the integrity of the blockchain by acting as auditors and preventing double-spending. This helps ensure the security and reliability of the cryptocurrency system.