Is the Crypto Industry Ready to Tackle the Insurance Business?

Is the crypto industry ready to tackle the insurance business? Increasingly, it seems prepared to do so. The sector confronts unique challenges: volatility, theft, and regulatory ambiguity. Yet, new insurance solutions and evolving regulations are paving the way. This article delves into the necessity of insurance in the crypto space, current industry efforts, challenges, regulatory impacts, and groundbreaking innovations shaping the future of crypto insurance.

Key Takeaways

- The crypto industry faces unique risks, necessitating tailored insurance solutions to mitigate theft, fraud, and extreme market volatility.

- Current cryptocurrency insurance coverage is minimal, with less than 1% of crypto assets insured, highlighting a significant growth opportunity for insurers.

- The evolving regulatory landscape and the use of blockchain technology, including smart contracts, are critical in shaping the future of crypto insurance and enhancing risk management.

The Necessity of Insurance in the Crypto Industry

The crypto market is notorious for its unpredictability. Unlike traditional assets, crypto assets can experience extreme volatility within short periods, making insurance an essential tool for managing these risks. Insurance helps crypto businesses mitigate the impact of market fluctuations and safeguard their assets against potential losses.

Cryptocurrency companies face unique risks that traditional businesses do not. These include exposure to theft, fraud, and market volatility. The decentralized and digital nature of crypto assets makes them particularly vulnerable to cyberattacks and hacks. For instance, exchanges like Binance have established emergency insurance funds to protect user assets in case of security breaches.

Crime insurance is another layer of insurance protection that some companies, such as Coinbase, have implemented to secure their assets against theft. However, it’s important to note that such insurance policies may not cover individual user accounts from unauthorized access, which underscores the need for comprehensive coverage solutions tailored to the crypto sector.

Past incidents underscore the need to adapt insurance policies to the unique challenges of the cryptocurrency market. The booming crypto market has increased the need for businesses to secure cryptocurrency insurance, ensuring that their digital assets are protected from unforeseen calamities.

Current State of Cryptocurrency Insurance

The current state of cryptocurrency insurance is akin to an untapped goldmine, with less than 1% of the $1 trillion in crypto assets having insurance coverage. This significant gap indicates a tremendous opportunity for growth within the insurance industry. Despite the growing interest, the lack of historical loss data from the crypto sector makes it challenging for insurers to set appropriate premiums, thus complicating the underwriting process.

Individual private crypto insurance offerings vary greatly in levels and scope. Lloyds of London, for instance, offers products specifically designed to protect cryptocurrency held in online wallets from certain types of loss. Additionally, commercial crime insurance can provide coverage for losses arising from cryptocurrency theft. However, some experts recommend holding multiple insurance policies to maximize coverage, despite the potential for higher costs.

Given their central role in the industry, cryptocurrency exchanges dominate the cryptocurrency insurance market. These exchanges, along with startups, form the backbone of the crypto sector, driving demand for specialized insurance products. Major players in blockchain insurance include incumbent insurers, tech entrepreneurs, and digital giants, all vying to establish a foothold in this burgeoning market.

As the industry matures, crafting more tailored insurance products becomes crucial to provide comprehensive coverage and boost confidence among crypto businesses and investors.

Challenges Faced by Crypto Insurers

The insurance industry faces a myriad of challenges when dealing with the cryptocurrency market. One of the primary issues is the ambiguity surrounding the regulation of digital assets. This lack of regulatory clarity contributes significantly to the hesitation of insurers to engage with crypto businesses. The high perceived risk of fraud also makes insurers wary, as the digital nature of cryptocurrencies makes them susceptible to various forms of financial crimes.

Assessing the security of digital assets presents another significant challenge. The lack of historical data on cryptocurrencies complicates risk assessment, making it difficult for insurers to accurately determine which risks can be prudently underwritten. Tailoring insurance policies to address the specific operational risks of crypto firms is essential, yet challenging.

Ineffective risk assessment is a critical challenge for insurers entering the cryptocurrency market. Many are still in the process of determining which risks can be prudently underwritten. The digital nature of cryptocurrencies makes companies highly vulnerable to cyberattacks, underscoring the importance of cyber insurance in any comprehensive coverage plan.

Although these challenges exist, the potential rewards for insurers navigating the crypto landscape effectively are immense. Insurers’ reluctance to engage with cryptocurrency businesses, due to unique risk exposure and regulatory inconsistencies, remains a major barrier to widespread adoption.

Regulatory Landscape and Its Impact

The regulatory landscape for cryptocurrencies is still evolving, with only 19 out of 60 analyzed countries having established comprehensive regulations covering taxation, anti-money laundering (AML), consumer protection, and licensing. This lack of regulatory clarity poses a challenge for insurers looking to enter the crypto market. However, significant strides are being made, with major countries like Australia, the UK, Brazil, and South Korea expected to announce new cryptocurrency regulations in 2024.

Among the 60 countries analyzed, 33 have legalized cryptocurrency, while 17 impose partial bans and 10 enforce general bans. Interestingly, there is a weak correlation between cryptocurrency adoption rates and the restrictiveness of regulations. Over 90% of countries surveyed are exploring central bank digital currency (CBDC) projects, prompting simultaneous updates to cryptocurrency regulations.

Key regulatory authorities involved in digital asset regulations in the US include FinCEN, the Securities and Exchange Commission, and CFTC, each playing crucial roles in the landscape. Stablecoin regulation is emerging as a focal point, particularly with the implementation of the EU’s Markets in Crypto-Assets Regulation (MiCA), which aims to create a regulatory framework for licensing crypto-asset providers and could significantly shape the future of crypto insurance.

Innovative Insurance Solutions Leveraging Blockchain Technology

Blockchain technology is revolutionizing the insurance sector by offering innovative solutions to protect digital assets. The Blockchain Deposit Insurance Corporation (BDIC) is at the forefront, with a platform designed to safeguard digital asset holders from risks related to exchange failures and cyberattacks. This initiative addresses the $2.2 billion in annual losses from crypto-related failures.

Web3 technology presents a unique opportunity for insurance companies to innovate their business models. Decentralized finance (DeFi) allows insurers to explore new forms of mutual insurance, engaging the community in collective risk management. This approach not only supports innovation but also enhances customer-centric propositions.

The BDIC plans to roll out its insurance services initially in key Asian markets with high cryptocurrency adoption. This new insurance framework is expected to increase user confidence in cryptocurrency, facilitating both daily transactions and long-term investments.

Smart Contracts and Their Role in Crypto Insurance

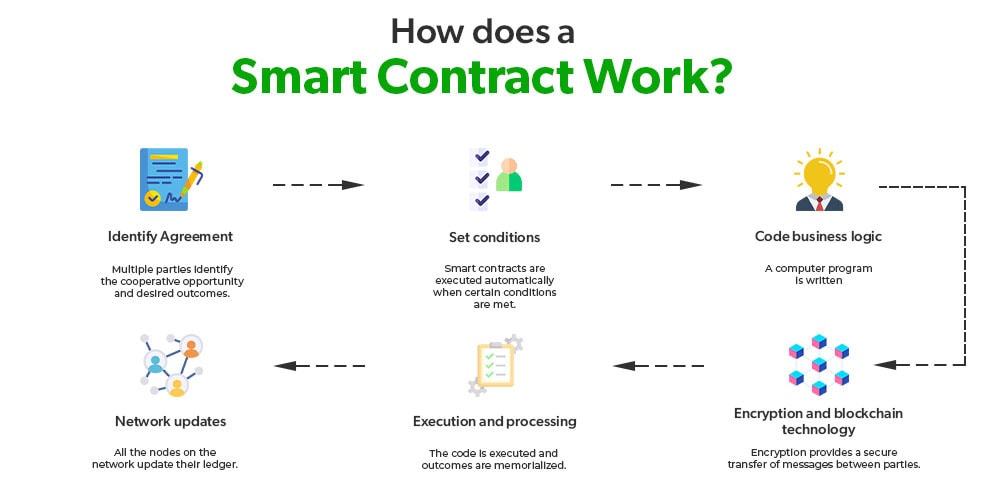

Smart contracts are transforming the insurance industry by automating and streamlining various processes, such as risk assessment and claims handling. These self-executing agreements have terms directly written into code, ensuring automatic compliance and reducing the need for manual intervention. The Blockchain Deposit Insurance Corporation (BDIC) utilizes smart contracts to automate claims processing and risk assessments for cryptocurrency wallets.

Growing demand for efficiency and transparency in insurance transactions is fueling the rise of smart contract technology. By eliminating manual processes, smart contracts can significantly reduce operational costs in the insurance sector. This leads to faster claim resolution, enhancing customer satisfaction and trust. Additionally, smart contracts maintain immutable records of transactions, thereby enhancing data security and integrity.

As the integration of blockchain technology in insurance continues to evolve, the role of smart contracts will become increasingly pivotal in providing responsive insurance solutions that are both efficient and secure.

Case Studies: Successful Implementations

Successful implementations of blockchain in insurance are emerging, showcasing innovative uses of technology in the cryptocurrency industry. One notable example is the Lemonade Crypto Climate Coalition, which uses blockchain to provide affordable crop insurance for farmers in Kenya. Automating claims based on weather data ensures timely and accurate payouts, demonstrating blockchain’s potential in insurance.

Other successful implementations in the crypto insurance space highlight the adaptability of blockchain technology. These examples illustrate best practices and lessons learned, which can help shape the future of insurance in the crypto sector. For instance, the use of smart contracts for automating claims processing and risk assessment has proven effective in enhancing efficiency and reducing operational costs.

These case studies provide valuable insights into how existing business practices can be improved through innovative solutions. The widespread adoption of such technologies could lead to more efficient and customer-centric insurance models, ultimately benefiting all network participants.

Future Prospects for Crypto Insurance

As the cryptocurrency sector continues to grow, the demand for specialized insurance coverage is also on the rise. Cryptocurrency companies often need to transfer some of their risks to insurers to ensure financial stability and protect their digital assets. More integration of blockchain technology in insurance could yield innovative business models that enhance financial inclusion and risk management.

Studying successful cryptocurrency insurance implementations offers a framework for best practices that can improve future offerings in the sector. The growing demand for insurance products tailored to the unique risks of the crypto industry presents an opportunity for insurers to develop responsive and innovative solutions.

Crypto insurance holds a promising future, with potential for significant growth and innovation. As insurers continue to adapt to the evolving landscape, they will play a crucial role in ensuring the financial future of the cryptocurrency industry.

Summary

In summary, the necessity of insurance in the crypto industry cannot be overstated. The volatile nature of the crypto market, combined with unique risks such as cyberattacks and theft, underscores the importance of robust insurance coverage to safeguard digital assets. As we’ve explored, the current state of cryptocurrency insurance presents both challenges and opportunities, with less than 1% of crypto assets currently insured.

The challenges faced by crypto insurers, including regulatory ambiguity and difficulties in risk assessment, highlight the need for tailored and innovative insurance solutions. However, the evolving regulatory landscape and the integration of blockchain technology offer promising avenues for the development of more efficient and secure insurance products. The use of smart contracts, in particular, has the potential to revolutionize the insurance sector by automating processes and enhancing transparency.

Looking ahead, the future prospects for crypto insurance are bright. As the cryptocurrency sector continues to expand, the demand for specialized insurance coverage will only grow. By leveraging blockchain technology and smart contracts, insurers can develop innovative solutions that meet the unique needs of the crypto industry, ensuring its financial stability and fostering greater confidence among investors and businesses alike.

Frequently Asked Questions

Why is insurance necessary in the crypto industry?

Insurance is necessary in the crypto industry to protect against the unpredictable market volatility and risks of theft, offering a layer of security for digital assets and promoting financial stability.

What is the current state of cryptocurrency insurance?

The current state of cryptocurrency insurance is characterized by a significant lack of coverage, with less than 1% of crypto assets insured. Nevertheless, interest is on the rise, prompting major players to develop specialized insurance products.

What are the main challenges faced by crypto insurers?

Crypto insurers primarily face regulatory ambiguity, high fraud risk perceptions, challenges in security evaluation, insufficient historical data for risk assessment, and substantial risks from cyberattacks. Addressing these challenges is crucial for the growth and stability of the crypto insurance market.

How can blockchain technology and smart contracts improve crypto insurance?

Blockchain technology and smart contracts enhance crypto insurance by automating processes, thus reducing operational costs while improving efficiency and transparency. This results in a more secure and reliable insurance experience for all parties involved.

What are the future prospects for crypto insurance?

The future prospects for crypto insurance are promising, with rising demand for specialized coverage driven by the expanding cryptocurrency sector. Additionally, the integration of blockchain technology may foster innovative business models and enhance financial inclusion.