Top Crypto Venture Capital Companies in 2024: Leading Firms to Watch

In 2024, understanding which venture capital firms are driving the crypto industry forward is essential. This guide covers the top crypto venture capital companies in 2024, focusing on their key strategies and standout investments. Learn about the leaders shaping the blockchain landscape.

Key Takeaways

- In 2024, leading crypto venture capital firms include Pantera Capital, Andreessen Horowitz, and Coinbase Ventures, which not only provide financial support but also strategic guidance to early-stage blockchain startups.

- Key trends in crypto venture capital include a growing focus on decentralized finance (DeFi) and Web3 projects, increased participation of institutional investors, and evolving regulatory challenges that firms must navigate.

- Successful crypto VCs offer mentorship, access to valuable networks, and operational assistance, which are crucial for the growth and sustainability of their portfolio companies.

Top Crypto Venture Capital Companies in 2024: Leading Firms to Watch

Venture capital firms are the lifeblood of the crypto industry, fueling the growth of early-stage companies and blockchain startups. In 2024, firms like Pantera Capital and Andreessen Horowitz continue to dominate the space, while new players emerge with innovative approaches to crypto investments. These firms are not just financiers; they are strategic partners who help shape the future of blockchain technology.

This guide highlights the top crypto venture capital firms of 2024, detailing their investment strategies, notable investments, and the unique value they add to the crypto ecosystem.

Startups seeking funding and investors aiming to grasp the market better will find valuable insights into the dynamic world of crypto venture capital here.

Introduction

Venture capital firms are essential to the crypto space, providing the necessary funding and mentorship that startups need to thrive. These firms accelerate innovation and growth within the blockchain ecosystem, making them indispensable to the industry’s advancement.

Several venture capital firms in 2024 distinguish themselves through innovative approaches and strategic investments in the crypto market. Both investors and startups should monitor these leading firms closely, as their decisions will significantly shape the development of the crypto landscape.

Overview of Crypto Venture Capital Firms

Crypto venture capital firms, consisting of groups of investors funding early-stage projects, drive innovation and development in the cryptocurrency market. They assess projects for viability, potential risk, and expected returns, targeting the most promising investments. A crypto venture capital fund plays a crucial role in this ecosystem.

As the cryptocurrency market matures, the importance of these firms is expected to grow despite various challenges. Many crypto VC firms invest in multiple projects to spread and manage risk, mitigating potential losses and increasing the chances of discovering groundbreaking projects.

Pantera Capital and Andreessen Horowitz have established themselves as leaders in the crypto investment space by actively engaging in high-potential projects. Their success stories, along with those of other top venture capital firms, highlight the critical role these entities play in the ongoing evolution of the crypto market.

Top Crypto Venture Capital Firms in 2024

As the crypto venture capital market continues to evolve, certain firms stand out due to their strategic investments and innovative approaches. Leading the charge in 2024 are:

- Coinbase Ventures

- Pantera Capital

- Andreessen Horowitz (a16z)

- Digital Currency Group (DCG)

- Paradigm

- Binance Labs

- Blockchain Capital

- Framework Ventures

- Multicoin Capital

- Sequoia Capital

- RR2 Capital

These firms provide financial backing as well as strategic guidance, mentorship, and access to vast networks, all crucial for the success of early-stage companies and blockchain startups.

Here’s a closer look at what makes each of these firms a key player in the crypto venture capital landscape.

Coinbase Ventures

Coinbase Ventures, established in 2018, has rapidly become a leading venture capital firm in the crypto space. Specializing in early-stage investments, Coinbase Ventures focuses on decentralized finance (DeFi) platforms, blockchain-based gaming, and Web3 infrastructure. Notable investments include Compound, dYdX, and OpenSea, showcasing its impact on significant blockchain projects.

Beyond financial support, Coinbase Ventures provides its portfolio companies with access to a vast network, valuable resources, and potential partnership opportunities. This holistic support system has helped Coinbase Ventures generate over $1 billion in assets, solidifying its reputation as a key player in the crypto venture capital market.

Pantera Capital

Pantera Capital, established in 2013, holds the distinction of being the first U.S. institutional asset manager focused solely on blockchain technology. With a diverse portfolio that includes notable investments in Bitstamp, BitPesa, Circle, Polkadot, Augur, and Zcash, Pantera Capital has made significant strides in the crypto industry.

Managing approximately $4.5 billion, Pantera Capital offers a well-diversified investment fund, targeting Web3 startups and blockchain projects. This leading venture capital firm continues to play a pivotal role in funding and supporting innovative crypto ventures.

Andreessen Horowitz (a16z)

Andreessen Horowitz, commonly known as a16z, is a powerhouse in the venture capital world, focusing on blockchain-based companies.

With over five years of active involvement in the crypto investment space, a16z has made notable investments in:

- Coinbase

- OpenSea

- Uniswap

- Other blockchain-based companies

This venture capital firm’s long-term investment strategy often involves holding stakes for more than a decade, primarily in Web 3.0 startups. Andreessen Horowitz’s commitment to the crypto sector positions it as a leading venture capital firm to watch in 2024.

Digital Currency Group (DCG)

Digital Currency Group (DCG) is a significant player in the cryptocurrency market, known for its strategic investments and influence. Headquartered in New York, DCG operates notable subsidiaries including Grayscale Investments and CoinDesk, further extending its reach and impact.

Grayscale Investments, a subsidiary of DCG, holds over $45 billion in assets, making it a leader in cryptocurrency asset management. With investments in more than 30 countries, DCG’s global footprint and strategic approach position it as a top contender in the crypto venture capital market.

Paradigm

Paradigm is a venture capital firm dedicated to investing in cryptocurrency and Web3 projects, including decentralized finance (DeFi) and layer-2 solutions. Paradigm’s strategy involves supporting projects from early seed stages to mature businesses, helping them scale and succeed in the competitive crypto market.

The firm offers mentoring and advising from experts in the cryptocurrency space, ensuring its portfolio companies receive the guidance needed to thrive. Notable investments by Paradigm include Uniswap, Chainlink, and Polkadot, highlighting its influence in the blockchain sector.

Binance Labs

Binance Labs, a subsidiary of Binance founded in 2017, invests in promising crypto projects. Based in George Town, Midland, Cayman Islands, Binance Labs primarily targets investments in Asia, Europe, and North America.

The firm’s mission is to empower and support blockchain startups through funding and resources, playing a crucial role in the growth and development of the crypto ecosystem.

Blockchain Capital

Blockchain Capital, established in 2013 and based in San Francisco, California, focuses on advancing blockchain innovation and digital currencies. With over 90 investments, including notable projects like Circle, Coinbase, Ripple, and Kraken, Blockchain Capital has a significant presence in the crypto space.

The firm has also supported projects like Drift Protocol and Gameplay Galaxy, showcasing its commitment to fostering innovation in the blockchain sector.

Framework Ventures

Founded by Michael Anderson and Vance Spencer, Framework Ventures is dedicated to identifying and supporting disruptive projects within the DeFi and blockchain sectors. The firm’s team comprises investors, technical specialists, and researchers, ensuring a comprehensive approach to investment.

Notable investments by Framework Ventures include Chainlink, Synthetix, and Aave, highlighting its focus on high-potential DeFi projects.

Multicoin Capital

Multicoin Capital, founded in 2017, specializes in investing in early and growth-stage crypto projects through a crypto investment fund. The firm targets a variety of sectors within the crypto and blockchain technology landscape, including DeFi and NFTs.

By focusing on early- and growth-stage projects, Multicoin Capital aims to support innovative blockchain startups and drive the transition towards permissionless financial systems.

Sequoia Capital

Sequoia Capital, located in Menlo Park, California, is a renowned venture capital firm with a strong focus on blockchain and cryptocurrency projects. The firm provides comprehensive support to startups, from idea to IPO and beyond, ensuring their growth and success.

Recently, Sequoia Capital has concentrated on Web 3.0 projects, further reinforcing its commitment to the evolving crypto ecosystem.

RR2 Capital

RR2 Capital uses its extensive experience to research and invest in early-stage crypto startups, teams, companies, projects, and protocols. The firm’s investment thesis centers on the ‘new internet,’ driven by blockchain technology, AI, and machine learning.

In addition to financial backing, RR2 Capital serves as advisors and market makers in the cryptocurrency space, providing comprehensive support to its portfolio companies.

Investment Strategies of Leading Crypto VCs

Leading crypto venture capital firms often focus on emerging technologies and disruptive market opportunities to drive innovation. These firms target sectors with significant growth potential, such as decentralized finance (DeFi). Investments can take the form of equity stakes or participation in token sales, potentially leading to substantial returns if the projects succeed.

Many crypto VC firms invest in multiple projects simultaneously to manage risk and maximize returns, ensuring a diversified portfolio. This strategy helps them navigate the inherent volatility of the crypto market while capitalizing on high-growth opportunities.

Early-Stage Investments

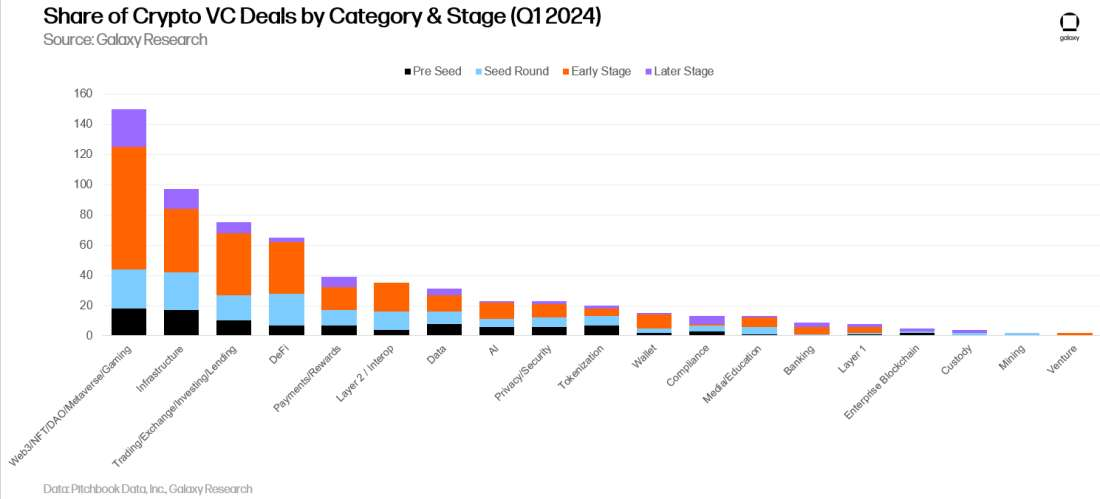

Early-stage investments are crucial for the success of many crypto projects, currently making up around 80% of activity within the crypto venture capital landscape. Venture capital firms prioritize opportunities with strong business ideas and market impact based on projected growth and potential returns.

The due diligence process involves evaluating market viability, potential returns, and scalability. During the seed round, projects must present a minimum viable product and a comprehensive business analysis to attract investors.

Knowing the VC firm’s preferred investment stages can help align expectations and foster successful partnerships.

Growth-Stage Investments

Growth-stage investments are crucial for companies aiming to enhance operational capabilities and expand market presence. Series B funding, for example, typically focuses on improving business development, sales, and human resources. Reaching a Series C round indicates commercial success and readiness for further expansion.

Such investments help companies scale operations and solidify market positions, making them attractive to later-stage investors and public offerings.

Strategic Partnerships and Mentorship

Strategic partnerships and mentorship are vital components of leading venture capital firms’ investment strategies. These partnerships provide portfolio companies with access to valuable networks, resources, and industry expertise, significantly enhancing their market potential. Co-investment opportunities often arise from these partnerships, driving growth and fostering innovation within the crypto ecosystem, including insights from Lightspeed Venture Partners.

Mentorship is crucial in guiding startups through their growth journey. Experienced leaders offer insights that accelerate decision-making and refine business models. Venture capital firms provide support mechanisms like operational guidance, marketing strategies, and access to potential customers, ensuring startups have the necessary tools to succeed.

Key Trends in Crypto Venture Capital for 2024

The crypto venture capital landscape is continuously evolving, with several key trends shaping the market in 2024. A significant trend is the increased focus on decentralized finance (DeFi) and Web3 projects, viewed as the future of the blockchain ecosystem. Investments are increasingly directed towards innovative blockchain solutions that address real-world problems, enhancing blockchain efficiency and usability.

Another crucial trend is the rise of institutional investors, significantly enhancing liquidity in the crypto market. This influx of institutional capital has made the market less volatile and more appealing to a broader range of investors. Additionally, the evolving regulatory environment presents both challenges and opportunities for crypto VCs, influencing their investment strategies and compliance efforts.

Focus on DeFi and Web3

Framework Ventures and other leading VCs are increasingly investing in DeFi projects and blockchain infrastructure, recognizing their potential to revolutionize the financial system. Multicoin Capital, for instance, aims to promote the transition from permissioned to permissionless financial systems, highlighting the growing importance of decentralized solutions.

Investments in decentralized finance (DeFi) are becoming a significant part of the crypto venture capital landscape. By diversifying investments, crypto VCs ensure support for a wide range of innovative projects, maximizing their potential for success and market impact.

Rise of Institutional Investors

The rise of institutional investors in the crypto space is a game-changer for the industry. These investors bring substantial capital and credibility, enhancing overall market stability and valuation. Despite market setbacks, investment in innovative blockchain projects continues to thrive, driven by the promise of high returns and the transformative potential of blockchain technology.

Institutional investors aim to achieve high returns by investing in promising blockchain and cryptocurrency startups. Their involvement has made the crypto market more appealing and less volatile, attracting even more interest from traditional venture capital firms.

Regulatory Challenges and Opportunities

Crypto venture capital firms face challenges such as market volatility and regulatory issues. The collapse of FTX in 2022, which severely impacted Pantera Capital, showcased the risks tied to regulatory issues in the crypto market. However, the evolving regulatory environment also presents opportunities for firms that can navigate these complexities effectively.

Many crypto VC firms focus on long-term investments, often holding their stakes for a decade or more, which helps mitigate the impact of short-term regulatory fluctuations. As the regulatory landscape becomes clearer, it will likely encourage more institutional investments and contribute to the overall growth and stability of the crypto market.

How Crypto VCs Support Their Portfolio Companies

Crypto venture capital firms provide more than just financial backing to their portfolio companies. Mentorship from experienced investors is critical in guiding startups through challenges and facilitating their growth. This support enhances innovation by offering industry-specific expertise that helps startups navigate the complex crypto ecosystem.

Access to valuable networks is another key benefit provided by crypto VCs. These networks connect startups with potential partners, customers, and other essential resources for their growth. Strategic partnerships formed by crypto VCs can provide the necessary resources and networks that facilitate the growth of portfolio companies, ensuring they have the tools and connections needed to succeed.

Operational assistance from crypto VCs often includes help with scaling business operations and enhancing market reach. This comprehensive support system is crucial for startups aiming to establish a strong market presence and achieve long-term success in the highly competitive crypto industry.

Factors to Consider When Choosing a Crypto VC Firm

Choosing the right crypto venture capital firm is crucial for a startup’s success. Reputable crypto venture funding can validate a startup’s technology, attracting further investment and industry interest. Assessing the reputation and reliability of the VC firm’s previous investments in crypto is essential to gauge their credibility.

Despite their benefits, some crypto venture funds may prioritize immediate financial gains, potentially leading to unsustainable practices for startups. Evaluating the long-term commitment and strategic alignment of the VC firm with the startup’s vision is vital. Additionally, considering the relevance of Web3 solutions and the general investment reliability can enhance the startup’s potential for success.

Evaluating the expertise of the VC firm in blockchain technology and crypto markets is another critical factor. This expertise can provide the startup with valuable insights and strategic guidance, increasing its chances of success in the competitive crypto market.

Summary

In summary, venture capital firms play a pivotal role in the crypto industry, providing the necessary funding, mentorship, and strategic guidance that startups need to succeed. The leading crypto venture capital firms in 2024, including Coinbase Ventures, Pantera Capital, Andreessen Horowitz, and others, are shaping the future of the crypto ecosystem through their innovative investment strategies and support for blockchain projects.

As the crypto market continues to evolve, the importance of these firms will only grow. By understanding their investment strategies, notable projects, and key trends, startups and investors can better navigate the dynamic world of crypto venture capital. The potential for innovation and growth in this space is immense, and with the right support, the next wave of groundbreaking blockchain technologies is just around the corner.

Frequently Asked Questions

What is a crypto venture capital firm?

A crypto venture capital firm focuses on investing in early-stage blockchain projects and startups, providing both funding and strategic support to enhance their growth in the competitive crypto landscape. This assistance is crucial for the success of innovative ideas in the blockchain space.

Why are early-stage investments important for crypto VCs?

Early-stage investments are essential for crypto VCs as they offer the opportunity to invest in innovative projects with high growth potential, ensuring a strong position in a rapidly evolving market. This strategic focus can lead to significant returns as these projects mature.

How do crypto VCs support their portfolio companies beyond financial investment?

Crypto VCs support their portfolio companies by offering mentorship, operational assistance, and access to valuable networks, helping them overcome challenges and scale effectively in the market. This multifaceted support enhances their growth potential beyond just financial investment.

What are the key trends in crypto venture capital for 2024?

In 2024, key trends in crypto venture capital will emphasize decentralized finance (DeFi) and Web3 projects, alongside the increasing involvement of institutional investors. Navigating regulatory challenges will also play a crucial role in shaping investment strategies.

What factors should startups consider when choosing a crypto VC firm?

Startups must prioritize the reputation, reliability, and expertise of the VC firm in blockchain and crypto, while also assessing their long-term commitment and alignment with the startup’s vision for sustainable growth. Evaluating these factors will help ensure a fruitful partnership.