Top Public Companies Adding Bitcoin to Their Balance Sheet: What Investors Need to Know

Public companies are increasingly adding Bitcoin to their balance sheets. This trend is driven by Bitcoin’s potential to hedge against inflation and offer financial diversification. Notable companies like MicroStrategy and Tesla lead the way, influencing the corporate world’s financial strategies. This article delves into why public companies adding bitcoin to their balance sheet is a significant move and examines its implications for corporate finance and investor perceptions.

Key Takeaways

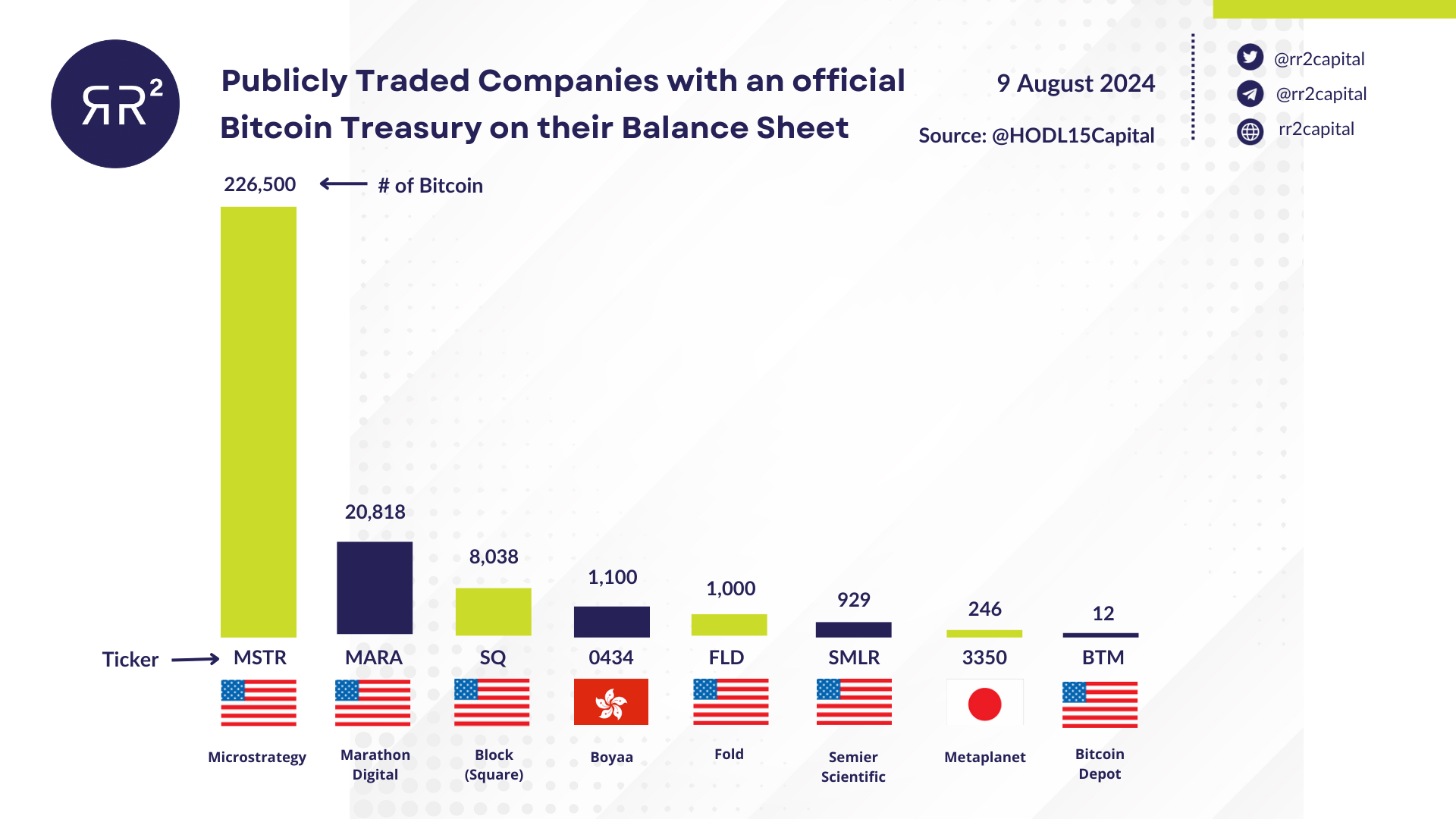

- Public companies are increasingly adopting Bitcoin as a treasury asset to hedge against inflation and diversify portfolios, collectively holding approximately 812,929 BTC.

- MicroStrategy’s pioneering strategy of incorporating Bitcoin into corporate finances has set a benchmark for other firms, significantly enhancing its market position and stock value since its adoption.

- The regulatory environment for Bitcoin is evolving, with anticipated clarity and new accounting standards expected to encourage broader corporate adoption and more accurate financial reporting.

The Rise of Bitcoin as a Corporate Treasury Asset

The adoption of Bitcoin by corporations has surged in recent years, driven by its potential to serve as a long-term store of value against inflation. Companies are increasingly seeking assets that can withstand inflation, contrasting with the declining value of the U.S. dollar. With inflation rates reaching new highs, Bitcoin’s role as a hedge against inflation is becoming more pronounced.

Bitcoin’s decentralized nature offers protection against political instability and currency fluctuations, making it a compelling choice for corporations. Companies are not just buying Bitcoin for its potential appreciation; they are also looking at it as a strategic asset that can provide a low correlation with traditional asset classes, thereby reducing overall risk in their portfolios. Currently, companies collectively hold approximately 812,929 BTC, which represents nearly 3.87% of Bitcoin’s overall supply.

Additionally, Bitcoin can enhance corporate portfolios and position companies as forward-thinking leaders in the evolving financial landscape. Managing Bitcoin’s volatility is essential, and companies may need to educate stakeholders about its price fluctuations. A diversified approach in holding Bitcoin alongside stable assets may help mitigate the risks associated with its volatility.

Using Bitcoin in corporate strategies signifies a shift in traditional finance towards embracing digital assets. This evolution is not just about adding Bitcoin to their balance sheets but also about redefining how companies view and manage their treasuries. This shift profoundly influences corporate financial health and investor perceptions alike.

Leading Public Companies Holding Bitcoin

Several public companies have made significant strides in Bitcoin adoption, symbolizing a major shift in corporate treasury management. MicroStrategy leads the pack, holding the largest amount of Bitcoin among public companies, with approximately 439,002 BTC valued at around $45.7 billion. This bold strategy has set a precedent, inspiring other companies to follow suit.

Tesla, another major player, owns about 9,720 Bitcoin, valued at approximately $1 billion. Marathon Digital Holdings, a prominent name among bitcoin mining companies, has around 40,435 Bitcoin on its balance sheet, worth about $4.2 billion. Riot Platforms, Inc. also holds a substantial amount, possessing 16,728 Bitcoin, with a current value of around $1.7 billion.

Collectively, public companies hold about 575,911 Bitcoin, translating to nearly $59.9 billion. This growing trend among publicly traded companies reflects a significant shift in how corporate treasuries are managed. Companies like Tesla and MicroStrategy have adopted Bitcoin in their treasuries to enhance growth and diversify their assets.

MicroStrategy’s approach has inspired other major corporations to adopt similar practices regarding Bitcoin. As more public companies add Bitcoin to their balance sheets, this trend is expected to gain further momentum, reshaping corporate finance.

Case Study: MicroStrategy’s Bold Bitcoin Strategy

MicroStrategy is a pioneer in Bitcoin adoption among public companies. As the first public company to integrate Bitcoin as a core asset for its treasury reserves, MicroStrategy’s strategy has been nothing short of revolutionary. CEO Michael Saylor drove this decision, seeing Bitcoin as a superior store of value compared to traditional assets.

Currently, MicroStrategy holds an impressive 423,650 BTC, having made a significant investment of $13 billion in Bitcoin. This bold move has not only fortified its balance sheet but has also significantly boosted its market standing. Since the beginning of 2024, MicroStrategy’s stock has increased by 547%, highlighting the financial benefits of its Bitcoin investment.

MicroStrategy’s strategy serves as a case study in the potential rewards of Bitcoin adoption. It has set a benchmark for other companies considering similar moves. The company’s success story underscores the transformative impact of Bitcoin on corporate finance and the potential for substantial returns. However, it also calls for a cautious approach, as the volatility of Bitcoin can pose significant risks.

Institutional Investors and Bitcoin Adoption

Institutional investors have enhanced Bitcoin’s legitimacy as a viable asset for corporate treasuries. Their involvement has increased overall market demand for Bitcoin, providing credibility and stability that attract more corporate interest. When institutional investors back Bitcoin, it sends a strong signal to the market about its potential and reliability.

Institutional investors also influence corporate reputations. While some individual investors remain skeptical about Bitcoin’s legitimacy, the backing of reputable institutional investors can sway opinions and build confidence. The approval of Bitcoin exchange-traded funds (ETFs) in early 2024 significantly boosted Bitcoin’s value, attracting both retail and institutional investors.

Institutional interest encourages other companies to consider Bitcoin as part of their financial strategy. It also fosters a more stable and mature market environment, which is essential for broader Bitcoin adoption. More institutional investors allocating resources to Bitcoin paves the way for increased corporate participation and mainstream acceptance.

Bitcoin’s Impact on Corporate Financial Statements

Classifying Bitcoin as an intangible asset under US GAAP creates accounting complexities for companies holding it. This classification can lead to impairment losses, as companies must record the asset at the lower of cost or market value. Such impairment charges can misrepresent a company’s financial health during reporting periods.

The ‘lower of cost or market’ accounting method can bias how investors perceive a company’s financial performance. Although these impairment charges do not directly impact cash flows, they can undermine investor confidence and negatively affect share prices. This creates a paradox where a company may hold a valuable asset like Bitcoin but still face negative financial reporting consequences.

Additionally, the tax complexities surrounding Bitcoin can create administrative burdens for corporate treasurers, necessitating frequent monitoring and revaluations. These challenges highlight the need for clear regulatory guidelines and accounting standards that accurately reflect the value and financial impact of Bitcoin holdings.

Risks and Rewards of Adding Bitcoin

Bitcoin’s potential for significant returns attracts institutional investors, despite concerns over its price fluctuations. The upcoming Bitcoin halving event, which reduces mining rewards, is expected to increase demand and potentially drive up prices, following historical trends. This makes Bitcoin an attractive asset for companies looking to enhance their growth potential.

However, Bitcoin’s price volatility can lead to unpredictability in corporate balance sheets, potentially causing financial instability. Companies must ensure proper security measures are in place to protect their Bitcoin holdings against theft and loss. Investments in Bitcoin can also lead to complex tax implications, necessitating precise monitoring and record-keeping.

Balancing the risks and rewards of Bitcoin investment requires a strategic approach. Companies need to manage these risks effectively to benefit from the potential rewards. This involves not only securing the digital assets but also educating stakeholders and maintaining transparency about Bitcoin’s impact on corporate financial health.

Regulatory Environment and Bitcoin Adoption

The unclear regulatory framework for Bitcoin poses challenges for corporate compliance and long-term strategic planning. As regulatory frameworks become clearer, more public companies are likely to adopt Bitcoin, leading to increased transparency and standardization in corporate Bitcoin holdings. This regulatory clarity is crucial for fostering a stable environment for Bitcoin adoption.

Some jurisdictions have started adopting fair value accounting for cryptocurrencies, allowing companies to report assets at current market value. The Financial Accounting Standards Board (FASB) is working on new guidelines to allow companies to recognize fair value changes in their crypto holdings by the end of 2024. These efforts aim to address the accounting challenges and provide a more accurate reflection of a company’s financial health.

In countries like Switzerland, Bitcoin can be classified based on its intended use, offering more flexibility than the U.S. approach. These regulatory developments are essential for encouraging broader corporate adoption of Bitcoin and ensuring that companies can manage their digital assets effectively.

Future Trends in Corporate Bitcoin Holdings

By 2025, the number of public companies holding Bitcoin is projected to increase from 68 to 100. This growth is driven by the increasing recognition of Bitcoin’s potential as a valuable treasury asset. Analysts predict that added bitcoin may reach $210,000 by 2025, influenced by increased corporate adoption spurred by entities like MicroStrategy.

The anticipated Bitcoin price trends suggest a rise to approximately $77,000 by the end of 2024, with a further increase to about $123,000 by the end of 2025. As corporate interest in Bitcoin grows, many companies are expected to allocate a portion of their reserves to Bitcoin, viewing it as a hedge against inflation.

Artificial intelligence and cryptocurrency are intersecting, with AI technologies being integrated into blockchain platforms, influencing corporate strategies regarding Bitcoin. These trends indicate a new era for corporate finance, where digital assets and crypto assets play a pivotal role. Businesses that adapt to these changes and embrace Bitcoin are likely to lead the way in the evolving financial landscape.

How to Evaluate Companies with Bitcoin Holdings

Evaluating companies with Bitcoin holdings is crucial for investors to understand their financial health and strategic positioning in the volatile cryptocurrency market. The current ratio provides insights into a company’s short-term financial health, helping investors understand its liquidity position. This ratio is particularly important for companies with significant Bitcoin holdings, indicating their ability to meet short-term obligations.

The enterprise value to net assets ratio assesses market confidence in a Bitcoin company’s future growth compared to its tangible assets. A high enterprise value relative to net assets suggests that the market expects strong future performance. A high debt to equity ratio can indicate heavy reliance on debt for financing, posing risks in a volatile Bitcoin market.

Investors need to consider these financial metrics when evaluating companies involved in Bitcoin. Understanding these factors helps investors make informed decisions and identify companies well-positioned to leverage Bitcoin’s benefits while managing associated risks.

Summary

The rise of Bitcoin as a corporate treasury asset represents a significant shift in how companies manage their financial strategies. From the pioneering efforts of MicroStrategy to the growing involvement of institutional investors, Bitcoin is reshaping corporate finance. This trend brings both opportunities and challenges, as companies navigate the complexities of accounting, regulatory compliance, and market volatility.

As we look to the future, the increasing adoption of Bitcoin by public companies is likely to continue. Investors must stay informed and understand how these changes impact corporate financial health and strategic positioning. Embracing this new era of digital assets can provide substantial rewards, but it requires careful consideration and a balanced approach to managing risks.

Frequently Asked Questions

Why are companies adding Bitcoin to their balance sheets?

Companies are adding Bitcoin to their balance sheets primarily to hedge against inflation and diversify their treasury assets, safeguarding against the declining value of traditional currencies. This strategic move enhances financial resilience amidst economic uncertainties.

Which public companies hold the most Bitcoin?

MicroStrategy holds the largest amount of Bitcoin among public companies, with Tesla, Marathon Digital Holdings, and Riot Platforms also significant holders.

What are the risks of holding Bitcoin for companies?

Holding Bitcoin can expose companies to significant price volatility, security concerns, and complex tax implications. It is crucial for businesses to implement robust risk management strategies to navigate these challenges successfully.

How does Bitcoin’s classification under US GAAP affect corporate financial statements?

Bitcoin’s classification as an intangible asset under US GAAP can lead to impairment losses and may complicate financial reporting, potentially distorting a company’s financial health. This highlights the need for careful asset management and reporting practices.

What future trends are expected in corporate Bitcoin holdings?

Corporate Bitcoin holdings are expected to rise significantly by 2025, driven by increased adoption among public companies and technological advancements such as AI, which may also contribute to higher Bitcoin prices.