Trade War Through Time: The History of Asset Performances Including Bitcoin Since the US Tariff Announcements in 2018

The 2018 US tariff announcements had a profound impact on financial markets, affecting everything from traditional stocks and bonds to emerging assets like Bitcoin. This article explores the history of asset performances including Bitcoin since the US tariff announcements in 2018, examining the initial market reactions and long-term trends to provide a comprehensive understanding of investor behavior during this period.

Key Takeaways

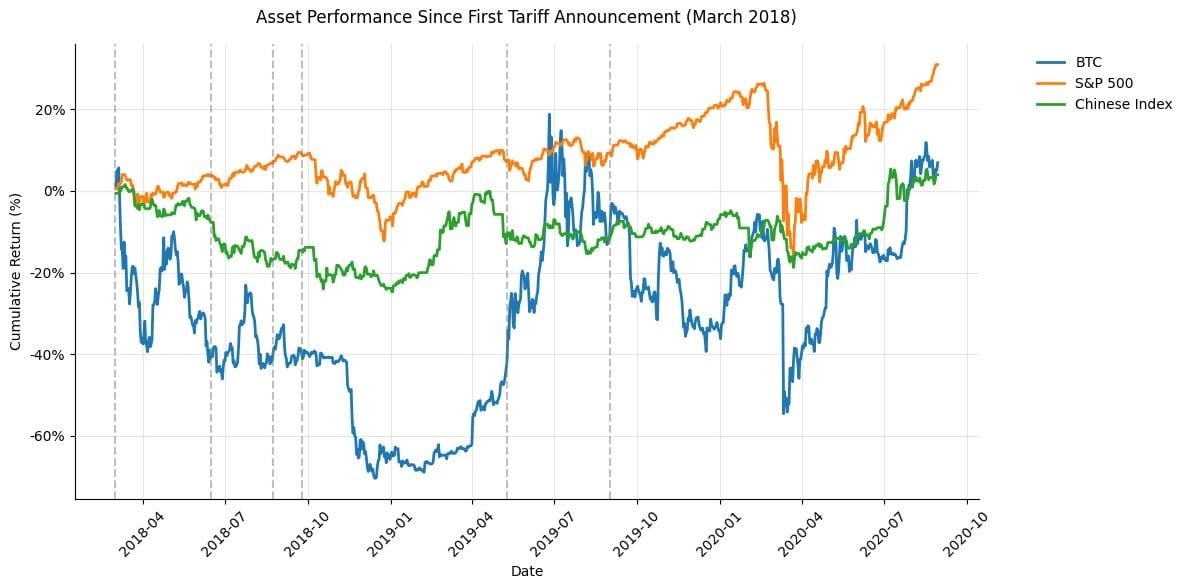

- The 2018 tariff announcements led to mixed market responses, with short-term volatility in equity markets and a notable surge in Bitcoin prices as a refuge for investors.

- Safe-haven assets like gold and U.S. Treasuries gained investment as stock markets declined, emphasizing a shift towards defensive strategies amid rising trade tensions.

- Cryptocurrencies, particularly Bitcoin, outperformed traditional assets over time, highlighting their volatility and potential as alternative investments during periods of economic uncertainty.

Initial Impact of 2018 Tariff Announcements

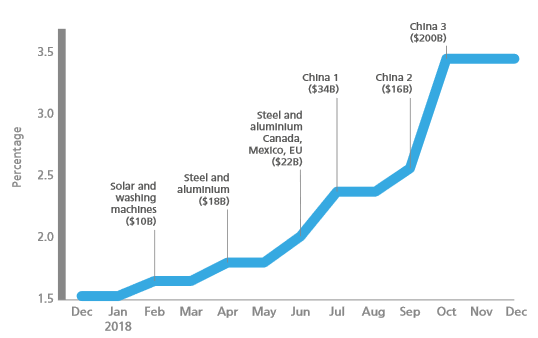

The Trump administration’s 2018 tariff announcements led to a mixed market response, marked by equity market weakness and increased volatility. The announcement of tariffs on washing machines and solar cells in January, followed by a 25% tariff on steel and a 10% tariff on aluminum in March, set the stage for broader tariffs on imports from China.

While the overall market response was generally mild, certain sectors experienced significant fluctuations. The stock market witnessed shorter-term volatility, but the impact on capital market performance was short-lived.

Bitcoin prices surged during this period, underscoring its role as a refuge for investors amidst economic turmoil.

Equity Markets Reaction

U.S. stocks fell on tariff announcement days, reflecting the immediate impact on market participants. Small-cap stocks, however, showed a less significant reaction, suggesting that the broader market was not uniformly affected. International markets also exhibited notable responses, with the MSCI China Index falling by 1.2% in May 2019.

Despite initial spikes, the VIX index quickly reverted, indicating the short-lived impact of the tariff announcements. This pattern was observed multiple times, underscoring the resilience of the stock market despite the ongoing trade tensions.

Bond Market Movements

U.S. Treasuries emerged as a safe haven during the tariff announcements, attracting investors seeking stability. The 10-year Treasury, in particular, successfully protected capital, reflecting the preference of market participants for lower-risk assets during periods of uncertainty.

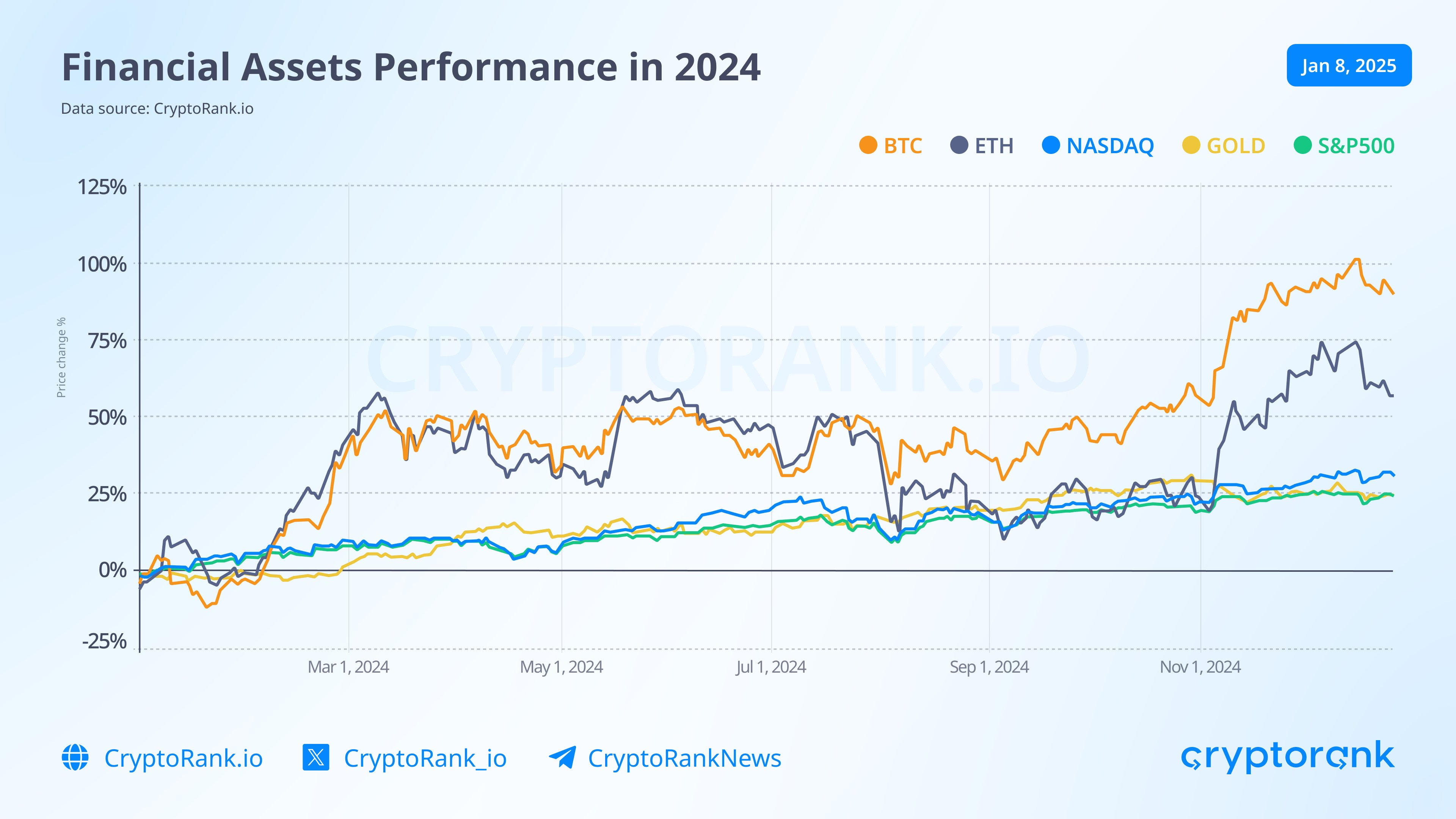

Bitcoin Prices Surge

Bitcoin’s price surged amid the economic turmoil triggered by tariff announcements, driven by factors like a weakened U.S. dollar and rising inflation. Historically, Bitcoin has performed well during periods of currency devaluation, positioning it as an attractive refuge for investors seeking alternatives to traditional assets.

Market volatility spurred by the tariffs led to significant rises in Bitcoin’s price, cementing its status as a hedge against economic instability. The surge in Bitcoin prices highlighted the growing acceptance of cryptocurrencies as viable investment options during financial uncertainty.

Asset Performance During Heightened Trade Tensions

As trade tensions escalated, the performance of various assets diverged significantly. The stock markets experienced notable declines, while safe-haven assets like gold and Treasury bonds saw increased investments.

The cryptocurrency markets, particularly Bitcoin, exhibited higher returns but with significantly greater volatility.

Stock Market Fluctuations

In 2018, major indices like the S&P 500 and Dow Jones dropped around 10%, while the Nasdaq declined by 8%. Developed markets were more adversely affected by the tariff announcements compared to emerging markets, prompting investors to adopt more defensive strategies.

Investors increasingly focused on sectors less sensitive to trade policies, adjusting strategies to mitigate risks from ongoing trade tensions. This shift in focus underscores the broader impact of trade policy uncertainties on global markets.

Safe-Haven Assets’ Response

Gold and Treasury bonds saw increased investments during heightened trade tensions, reflecting a flight to safety. Gold prices, in particular, often rise at the onset of geopolitical crises as investors seek security amidst market instability.

Cryptocurrency Markets Volatility

The escalation of trade tensions led to increased volatility in cryptocurrency markets, with Bitcoin experiencing pronounced price swings. Speculative trading intensified during these periods, contributing to the heightened volatility observed in the crypto markets.

Bitcoin consistently outperformed many altcoins, while the broader cryptocurrency market experienced rapid growth, especially during trends like decentralized finance (DeFi). This dynamic performance highlights the unique risk profiles and opportunities within the cryptocurrency space.

Long-Term Effects of Tariffs on Global Markets

The long-term effects of tariffs on global markets are complex and multifaceted. Tariffs have led to temporary increases in inflation rates due to higher import prices and have influenced economic growth and GDP.

The reduction in international trade volumes, particularly with China, has also left a lasting impact on various sectors within the global economy.

Economic Growth and GDP

Tariffs have reduced economic output and income, with estimates suggesting a long-term GDP decrease in the U.S. For instance, the proposed 10% tariffs on China were estimated to reduce economic output by 0.1%, while higher tariffs on Canada and Mexico could lead to a more significant reduction.

If tariffs were removed, it would likely boost GDP and employment, highlighting the economic burden impose tariffs by these trade policies.

International Trade Volumes

Trade with China decreased significantly after the tariffs, though the overall trade balance remained relatively stable. Imports of affected goods, including chinese imports, have also declined, reflecting the broader impact of tariffs on international trade volumes and the ongoing discussions around a potential trade war and trade deal.

Sector-Specific Impacts

Export-reliant sectors like agriculture and manufacturing faced considerable challenges due to tariffs, highlighting the sector-specific impacts of trade policies.

These challenges highlight the broader economic implications of additional tariffs imposed on specific industries.

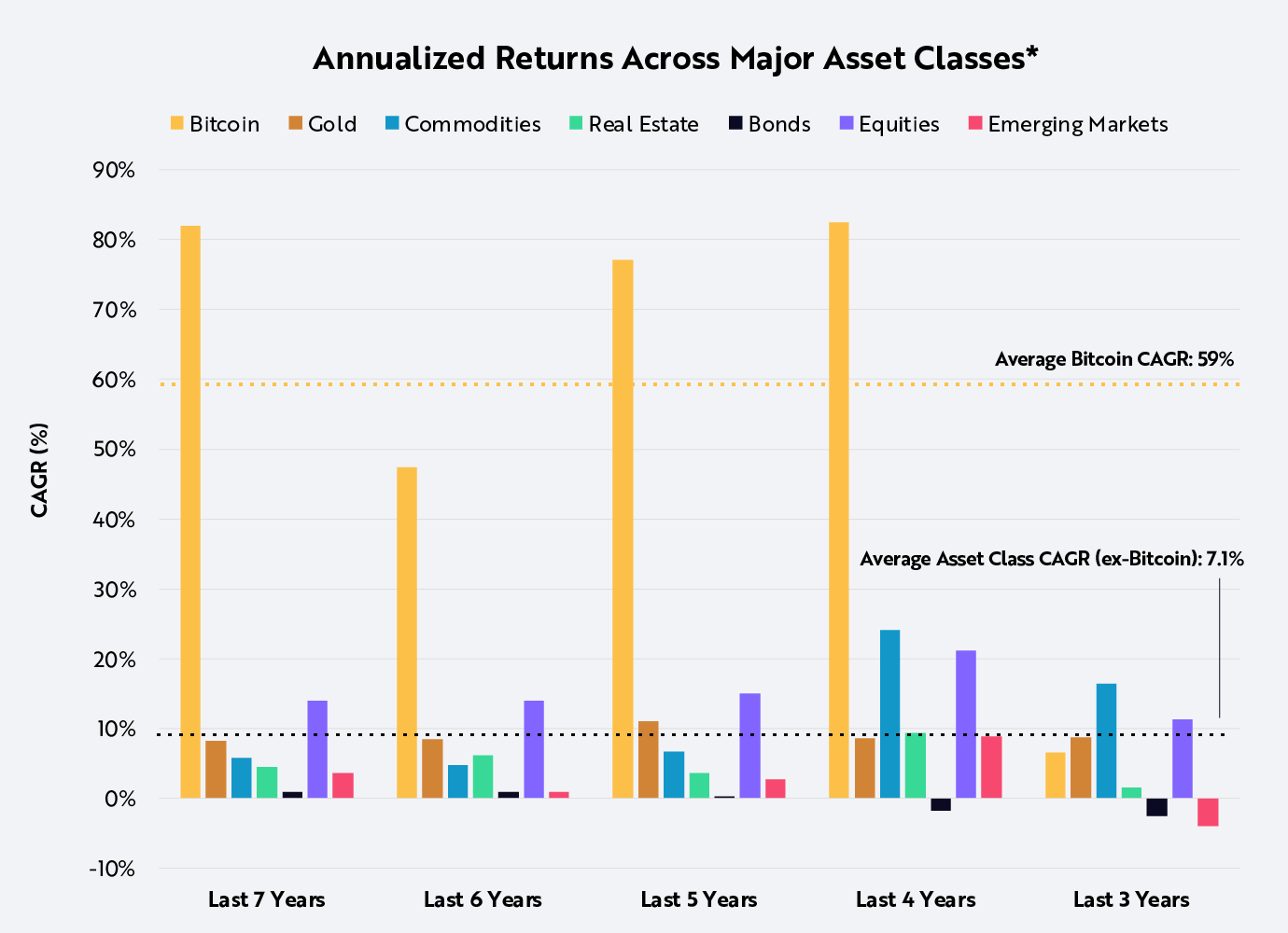

Comparative Performance of Cryptocurrencies vs Traditional Assets

The performance of cryptocurrencies and traditional assets since 2018 reveals distinct differences. Bitcoin, for instance, showed a staggering return of over 26,000%, significantly surpassing traditional assets like stocks and bonds.

This remarkable performance underscores the volatility and potential of cryptocurrencies in the context of trade tensions.

Bitcoin’s Price Trends

From 2018 to late 2020, Bitcoin’s price fluctuated dramatically between $3,000 and $40,000, reflecting its high sensitivity to market conditions. These fluctuations provide insights into Bitcoin’s behavior amidst significant economic events, such as the tariff announcements and trade tensions.

Bitcoin’s performance during this period highlights its role as an alternative asset, its volatility contrasting sharply with the steadier returns of traditional assets.

Altcoins and Broader Crypto Market

Many altcoins have seen substantial price increases since 2018, with some even outperforming Bitcoin during specific market phases. The broader cryptocurrency market has exhibited significant volatility and growth, reflecting the diverse opportunities and risks within the crypto space.

Traditional Asset Stability

Traditional assets like stocks and bonds have generally shown steadier returns compared to the unpredictable price swings seen in cryptocurrencies. This stability appeals to risk-averse investors who prefer consistent performance over the volatility common in the cryptocurrency markets.

Investor Sentiment and Market Participants’ Strategies

Investor sentiment and market participants’ strategies have evolved significantly in response to trade tensions. The increased market volatility has led to shifts in investment strategies, with many investors focusing on sectors likely to benefit from domestic manufacturing support.

Shifts in Investment Strategy

Major stock indices like the S&P 500 and Dow Jones typically decline during trade conflicts, prompting retail investors to shift towards safer assets. This defensive approach reflects the uncertainty and risk aversion among investors during periods of economic turmoil.

Hedge Funds and Institutional Investors

Hedge funds increasingly focused on emerging markets and diversification strategies to navigate the volatility from tariff impacts.

Institutional investors, on the other hand, maintain significant cash reserves to remain flexible and respond promptly to market changes driven by tariff announcements.

Retail Investor Behavior

Retail investors showed heightened sensitivity to tariff announcements, rapidly shifting their trading activities. Many reacted by reallocating their portfolios away from equities towards alternative assets like bonds and cryptocurrencies during market fluctuations.

Summary of Key Findings

The initial 2018 tariff announcements led to immediate fluctuations in U.S. and global stock markets, indicating high sensitivity to trade policy changes. Bitcoin experienced significant price movements in response to the increased market volatility, reflecting broader investor sentiment during periods of uncertainty.

Various asset classes, including stocks and bonds, showed differing levels of stability and responsiveness, highlighting the complexity of market reactions. Cryptocurrencies like Bitcoin exhibited volatility compared to more stable traditional assets, emphasizing their differing roles during economic uncertainty.

Traditional assets like equities and bonds displayed comparatively greater stability during trade tensions, unlike the frequent price fluctuations in cryptocurrency markets. Investor sentiment shifted significantly as participants adjusted their strategies in response to evolving trade policies and market conditions.

Summary

In conclusion, the trade war initiated in 2018 had far-reaching impacts on various asset classes, from traditional stocks and bonds to the emerging cryptocurrency markets. While Bitcoin and other cryptocurrencies demonstrated significant volatility and returns, traditional assets offered more stability. Investor sentiment and strategies evolved in response to these economic changes, reflecting a complex interplay of risk and opportunity.

Frequently Asked Questions

How did the equity markets react to the initial 2018 tariff announcements?

The equity markets reacted negatively to the initial 2018 tariff announcements, with U.S. stocks falling sharply, although small-cap stocks experienced less impact. The resulting volatility was brief, signaling that the initial effects on capital markets were transient.

What role did U.S. Treasuries play during the tariff announcements?

U.S. Treasuries acted as a safe haven, drawing in investors looking for stability during the volatility caused by the tariff announcements. This reaction highlights their role in providing security in uncertain financial times.

Why did Bitcoin prices surge during the economic turmoil caused by tariff announcements?

Bitcoin prices surged during the economic turmoil caused by tariff announcements because investors viewed it as a refuge amid a weakened U.S. dollar and concerns over currency debasement and inflation. This shift highlighted its role as a hedge in uncertain economic times.

How did trade tensions affect the performance of different asset classes?

Trade tensions negatively impacted stock markets while boosting demand for safe-haven assets such as gold and Treasury bonds, resulting in increased volatility across cryptocurrency markets.

What long-term effects did tariffs have on global markets?

Tariffs have led to decreased economic output and GDP, as well as diminished international trade volumes, adversely impacting export-reliant sectors such as agriculture and manufacturing. Ultimately, these effects can create long-lasting challenges for global markets.