Sui or Aptos: One of the Most Interesting Crypto Battles Unveiled

Sui versus Aptos: a crypto battle born from Facebook’s Diem collapse. Both bring unique solutions to scalability, security, and developer support, making Sui or Aptos one of the most interesting crypto battles in the industry. Which platform is better? This article breaks down their key features, ecosystem growth, tokenomics, and market performance to find out.

Key Takeaways

- Sui and Aptos emerged from the remnants of the abandoned Diem project, securing significant funding and attracting top blockchain talent to drive their innovations.

- Both platforms focus on scalability and security, with Sui processing up to 120,000 transactions per second and utilizing the Narwhal and Tusk consensus, while Aptos employs AptosBFT and features like the Move prover for smart contract verification.

- Community engagement and developer support are critical for growth, as shown by Sui’s 1,300 active developers and Aptos’s partnerships, indicating strong ecosystems poised for future adoption.

Background of the Sui and Aptos Battle

The story of Sui and Aptos begins with the collapse of Facebook’s ambitious Diem project. When Diem was abandoned, it left behind a pool of highly skilled blockchain developers who were determined to continue their work in the crypto space. From this talent pool emerged two significant players: Sui and Aptos. Both of these platforms secured substantial funding to pursue their visions, with Sui raising $300 million and Aptos securing $350 million.

The leadership behind these projects is equally impressive. Aptos was co-founded by Mo Shaikh and Avery Ching, both of whom have extensive experience in blockchain development. On the other hand, Sui is led by Evan Cheng, who previously spearheaded Meta’s crypto wallet development. These leaders bring a wealth of knowledge and experience, positioning both Sui and Aptos as strong contenders in the blockchain arena.

Key Features Comparison

Understanding the battle between Sui and Aptos requires examining their key features. These platforms offer unique approaches to scalability, security, and developer support, each aiming to solve long-standing issues in the blockchain space.

Examining these aspects reveals the strengths and challenges each network faces.

Scalability and Throughput

Scalability plays a vital role in the success of any blockchain platform. Both Sui and Aptos have engineered their systems to be highly scalable, leveraging unique technical designs to enhance performance. Sui, for instance, can handle up to 120,000 transactions per second by processing simple transactions in parallel, which significantly contributes to its high throughput. Sui’s high transaction processing speed positions it as a leader, though it may face scalability challenges with growth.

Aptos, meanwhile, has also focused on achieving high scalability and throughput. Aptos’s technical architecture offers a slight edge in scalability over Sui, making it a strong contender in the discussion of aptos vs sui. These advancements are crucial for reducing latency and supporting a growing user base and transaction volume.

Security and Consensus Mechanisms

Security in blockchain technology is paramount, and both Sui and Aptos employ advanced consensus mechanisms to safeguard their secure blockchain networks. Sui employs a consensus technique known as Narwhal and Tusk, which allows for efficient parallel processing and is resistant to DoS attacks. This protocol allows Sui to maintain security while enhancing transaction speed.

Aptos, on the other hand, uses the AptosBFT consensus mechanism, which is robust against network attacks and aims to improve both security and transaction efficiency. Additionally, Aptos includes a formal verification tool called the Move prover, which ensures the correctness of smart contracts. These features underscore Aptos’s dedication to a secure and reliable blockchain.

Developer Ecosystem and Support

A thriving developer ecosystem fuels growth and innovation in blockchain platforms. Sui blockchain has seen a significant increase in its developer community, with over 1,300 developers engaged as of summer 2024. This growth reflects strong community involvement and robust support for Sui developers.

Aptos has also made impressive strides in attracting developers. In 2023 alone, Aptos attracted around 1,000 new developers, compared to 700 for Sui. This influx of talent highlights the significance of developer ecosystems in advancing blockchain technology.

With their expanding developer communities, both platforms are poised for significant roles in the future of decentralized applications.

Tokenomics and Utility

Tokenomics critically influence the sustainability and investor appeal of any blockchain network. Sui tokens have a fixed total supply of 10 billion, with around 860 million currently in circulation. The Sui network’s staking mechanism allows token holders to earn rewards by contributing to network security, and these tokens are also used for governance and transaction fees. This approach helps maintain scarcity and value, attracting potential long-term investors.

Aptos, in contrast, has a more dynamic token model with high inflation rates and substantial token unlocks every month. To manage this inflation, Aptos incorporates a token burn mechanism, which could counteract the effects of inflation and support the token’s value. These tokenomics models reflect the distinct strategies of each platform in the crypto space.

Both Sui and Aptos offer unique utilities that cater to different aspects of the blockchain ecosystem. Sui’s design supports dynamic gaming applications and metaverse projects, while Aptos is more focused on decentralized finance (DeFi) applications. These utilities enhance their ecosystems and influence investor perceptions and market dynamics.

Ecosystem Growth and Adoption

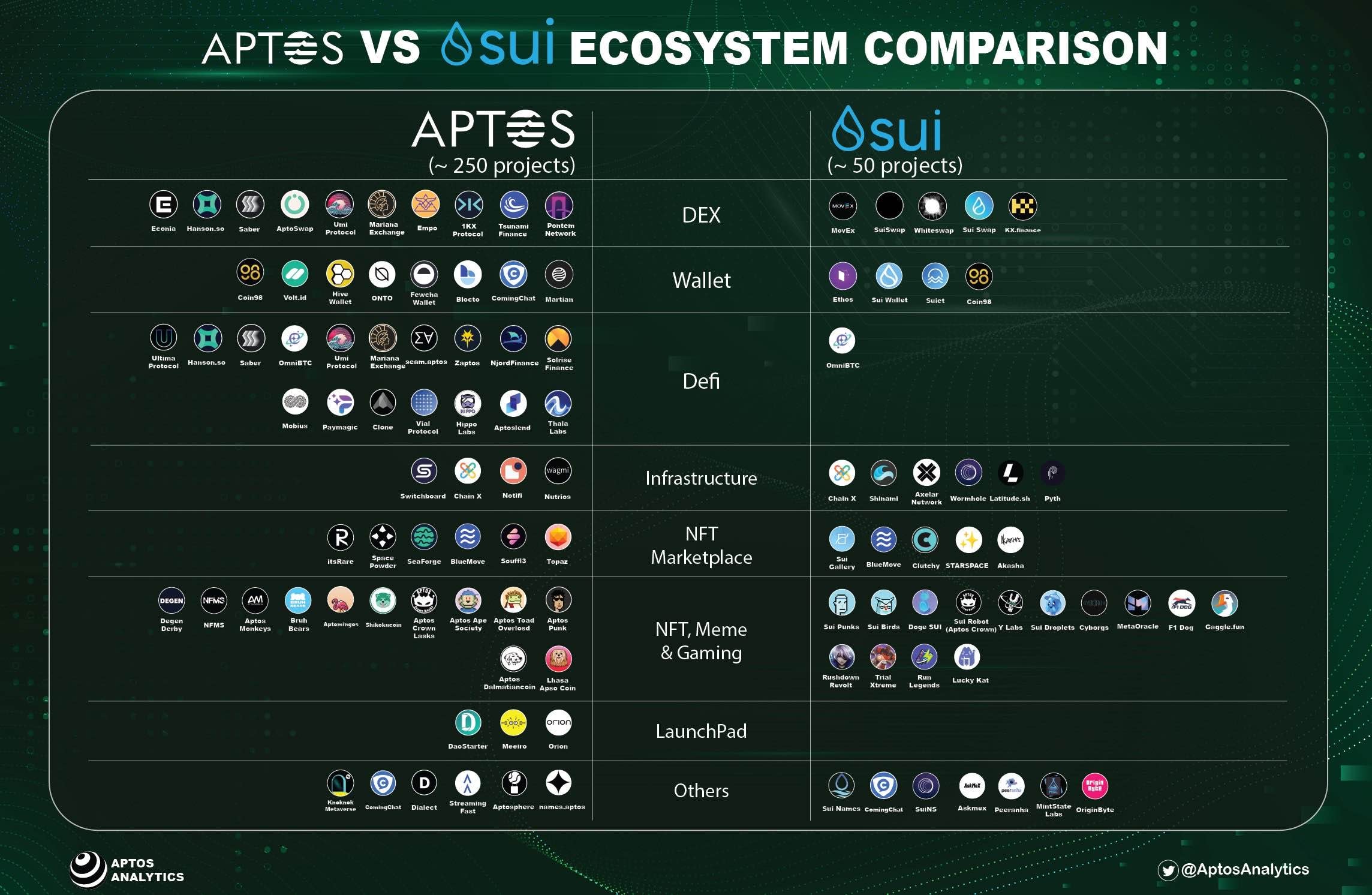

Ecosystem growth testifies to the adoption and utility of a blockchain platform. Aptos has established notable partnerships, including collaborations with Franklin Templeton, enhancing its presence in the blockchain space. This strategic focus enabled Aptos to process over 115 million transactions in a single day in October 2024.

Sui, on the other hand, is making waves with its focus on gaming and metaverse projects. Sui’s targeted approach shows its commitment to building a decentralized application ecosystem addressing real-world issues.

Both platforms exhibit strong ecosystem growth, driven by their unique focuses and strategic partnerships.

Programming Language and Execution Layer

Choosing the right programming language and execution layer is pivotal for blockchain development. Both Sui and Aptos utilize the Move programming language, designed to enhance security in blockchain development. Sui’s implementation of Move focuses on an object-centric approach, allowing for scalable and efficient transaction processing.

Aptos, meanwhile, employs a more traditional address-centric model for the Move programming language, emphasizing flexibility and security in application development. The key distinction in their Move implementations lies in Sui’s object-centric design versus Aptos’s address-centric model, influencing their smart contract capabilities and performance.

These differences underscore the unique approaches each platform takes to support developers and enhance their ecosystems.

Market Performance and Predictions

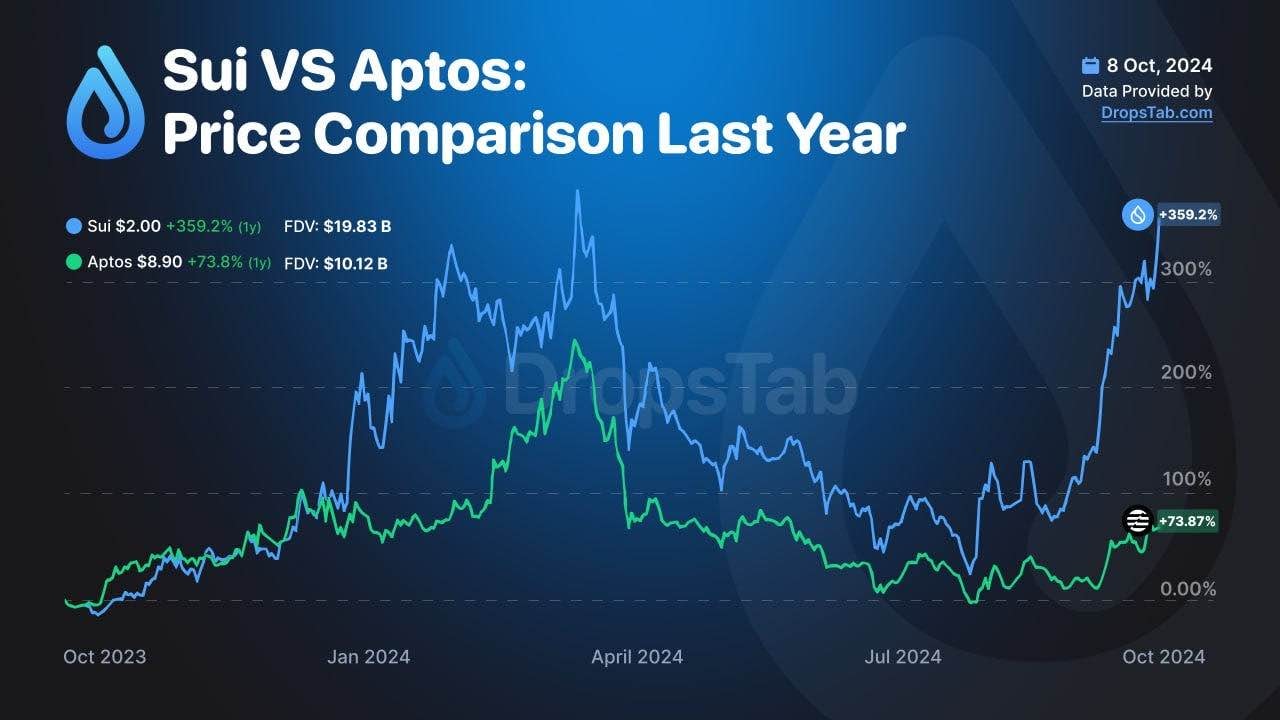

Market performance critically indicates a blockchain platform’s success and investor confidence. As of October 4, 2024, Aptos’s market capitalization reached $4.4 billion, with its price increasing by 33% to $8.31. This growth reflects strong investor sentiment and robust platform performance.

In comparison, Sui’s recent price movements have also been noteworthy. The price of Sui tokens reached $1.85, with a recent all-time high of $2.36, retested at $2.08. Despite a 22% decrease in volume over the last 24 hours, Sui’s market activity indicates a strong bullish trend.

Future price predictions for both platforms indicate continued growth. Aptos is projected to potentially hit between $11.80 and $17.80 by the end of 2024, with a minimum projection of $6.90 and a maximum of $10.30 by the end of 2025. These predictions reflect optimism about Aptos’s future, driven by strong performance and investor confidence.

Community Engagement and Partnerships

Community engagement drives adoption and fosters trust, making it a cornerstone of blockchain success. Both Sui and Aptos recognize the importance of community involvement and strategic alliances. Aptos has developed a vibrant community and formed various partnerships across sectors, broadening trust in its technology.

Sui is also focusing on community engagement, leveraging its growing developer base to build a robust sui ecosystem. Forming strategic partnerships and fostering community involvement, both platforms enhance their ecosystems and drive adoption.

This commitment to community engagement is crucial for long-term success and growth.

Potential Challenges and Future Outlook

Despite their promising futures, Sui and Aptos face potential challenges. Both platforms must continuously innovate to maintain their competitive edge. For instance, Sui faced allegations of insider trading, which the team denied, but such issues can impact investor confidence.

Looking ahead, both platforms have significant potential to shape the future of blockchain technology. Investors are always on the lookout for undervalued gems that can yield significant returns. Sui and Aptos’s future outlook will depend on their ability to innovate, address challenges, and capitalize on their strengths.

Expert Opinions and Investor Sentiments

Expert opinions and investor sentiments offer valuable insights into the potential of blockchain platforms. Sui and Aptos differ in transaction processes: Sui allows certain transactions to bypass consensus for quicker completion, while Aptos processes them sequentially. This difference can influence their performance and appeal to users.

In 2023, Aptos attracted more new developers compared to Sui, with 1,000 developers joining Aptos versus 700 for Sui. This influx of talent highlights growing interest and confidence in Aptos’s ecosystem.

Early investors see significant potential in both platforms, but thorough own research is crucial before making investment decisions.

Summary

In summary, the battle between Sui and Aptos is shaping up to be one of the most exciting in the crypto space. Both platforms have unique strengths and approaches, from their origins and leadership to their technical architectures and community engagement. Sui’s focus on gaming and metaverse projects contrasts with Aptos’s emphasis on DeFi applications, offering diverse opportunities for growth and adoption.

As these platforms continue to evolve, their success will depend on their ability to innovate, address challenges, and maintain strong community and investor support. The future of blockchain technology looks promising with Sui and Aptos leading the charge, each carving out its niche in this dynamic industry.

Frequently Asked Questions

What are the origins of Sui and Aptos?

Sui and Aptos originated from the talented developers who were part of the Diem project before its discontinuation. This lineage emphasizes their strong foundation in blockchain technology.

How do Sui and Aptos handle scalability?

Sui achieves scalability by processing up to 120,000 transactions per second in parallel, whereas Aptos benefits from a superior technical architecture for improved scalability.

What consensus mechanisms do Sui and Aptos use?

Sui utilizes the Narwhal and Tusk protocol, whereas Aptos employs the AptosBFT consensus mechanism.

How are Sui and Aptos performing in the market?

Sui is currently priced at $1.85, while Aptos boasts a market capitalization of $4.4 billion, reflecting a strong position in the market. Overall, both projects are demonstrating significant progress.

What are the future outlooks for Sui and Aptos?

The future outlooks for Sui and Aptos are positive, driven by their potential for continuous innovation and strong community engagement. These factors are essential for their continued growth and success in the blockchain space.