How Will Artificial Intelligence Change Crypto Investing As We Know It?

Will artificial intelligence change crypto investing as we know it? Yes, it will. AI is revolutionizing crypto trading with better data analysis, market predictions, and automated strategies. This leads to smarter, faster, and more informed investment decisions. This article examines the impact of AI on cryptocurrency investing and reveals new tools and trends.

Key Takeaways

- AI is revolutionizing cryptocurrency trading by enhancing predictive analytics, enabling real-time market strategy adjustments, and automating trades for improved efficiency.

- AI-driven platforms provide personalized investment advice and automate portfolio management, making crypto investing more accessible and tailored to individual investor needs.

- Future trends indicate significant growth in the AI agent market, offering diverse investment opportunities and emphasizing the importance of understanding AI-crypto integration for traders.

The Role of AI in Cryptocurrency Trading

Artificial Intelligence (AI) is fundamentally reshaping the landscape of cryptocurrency trading. One of the most significant advancements is the use of machine learning algorithms to analyze large datasets, enabling AI bots to adjust strategies based on real-time market conditions. These algorithms can sift through mountains of data, from historical price charts to current market sentiment, providing traders with a more comprehensive view of the market dynamics.

Predictive analytics is another game-changer. AI platforms significantly enhance traders’ decision-making by identifying market trends and patterns. For instance, AI can analyze unstructured data like social media sentiment alongside traditional market data, offering a holistic view that was previously unattainable. This ability to backtest strategies using historical data further refines trading approaches, maximizing the likelihood of successful trades.

The efficiency gains from AI are nothing short of remarkable. Automated trading systems can execute trades in milliseconds, ensuring that traders capitalize on market volatility even when they are not actively monitoring the market. AI reduces human error and optimizes trade timing, enabling traders to manage investments more effectively and achieve higher returns.

In essence, AI has made cryptocurrency trading smarter and more responsive to market changes.

Enhancing Investment Strategies with AI Bots

AI bots have become indispensable in the world of crypto trading, accounting for over 60% of trading transactions on major exchanges. These bots are capable of analyzing vast amounts of data, including market sentiment and trading volumes, to make informed trading decisions. Executing predefined strategies without emotional interference, AI minimizes human errors common in manual trading.

One of the standout features of AI-driven tools is their ability to automate portfolio management. These tools can adjust allocations based on user-defined investment goals, ensuring that the portfolio remains aligned with the investor’s objectives. For many investors, this automation is a game-changer, as it allows for continuous optimization without the need for constant professional management.

Moreover, the speed at which AI bots operate is unparalleled. They can execute trades based on market data at speeds unattainable by humans, ensuring that investment opportunities are seized in real-time. This capability is particularly beneficial in the fast-paced world of crypto, where market conditions can change in the blink of an eye. Leveraging AI enhances investment strategies, enabling more informed and timely decisions.

AI and Blockchain: A Powerful Combination

The fusion of AI and blockchain technology is a match made in digital heaven. Addressing data security and transparency challenges, this powerful combination fosters a more trustworthy and efficient crypto market. AI enhances blockchain by streamlining data management and improving transaction efficiency, making the entire system more robust.

One of the most compelling aspects of this synergy is the way AI ensures data integrity and trust within blockchain networks. Blockchain technology, known for its immutability, provides a solid foundation for AI applications, enabling more secure and transparent operations. This integration not only enhances decision-making processes but also builds public trust, which is crucial for the widespread adoption of digital currencies.

AI tools also simplify the management of crypto assets across multiple blockchain networks. AI agents provide real-time performance insights, enabling more effective asset management and easier tracking of holdings. In essence, the collaboration between AI and blockchain is driving innovation, making the crypto world more accessible and efficient for everyone involved.

Personalized Investment Advice through AI

Personalized investment advice is no longer the exclusive domain of human advisors. AI investment platforms are now capable of providing tailored strategies by analyzing users’ financial goals, preferences, and risk tolerances. These platforms utilize real-time data analysis to offer personalized recommendations, significantly enhancing decision-making for investors.

For instance, AI can analyze data from various sources, including Exchange Traded Fund and individual stocks, to provide informed decisions that align with the investor’s investment objectives. This level of customization ensures that the investment strategy is not only effective but also aligned with the investor’s unique needs.

Moreover, many AI-driven platforms offer educational resources and support, making them accessible even to beginners unfamiliar with the complexities of cryptocurrency investment. AI demystifies the investment process and provides actionable insights, empowering a new generation of investors to make informed and confident decisions regarding digital assets.

Mitigating Risks in the Crypto Market with AI

Investing in the crypto market comes with its fair share of risks, but AI is proving to be an invaluable tool for mitigating these risks. AI agents can adapt to market volatility, enhancing their responsiveness and effectiveness in real-time. This adaptability is crucial in a market known for its rapid fluctuations.

Advanced risk management capabilities are another significant advantage of AI agents. These tools help maintain optimal asset allocation and limit potential losses, providing a safety net that traditional trading bots often lack. Analyzing market data to detect fraudulent activities, AI enhances digital asset security, allowing investors to trade with greater peace of mind.

Furthermore, the use of AI in crypto trading allows for quicker execution of trades, improving decision-making amidst market fluctuations. Automated tasks like portfolio rebalancing and trade execution help limit emotional trading decisions, which can often lead to substantial financial losses. In this way, AI not only mitigates risk but also helps investors navigate the complex and volatile crypto market more effectively.

AI-Driven Platforms for New Investors

For new investors, AI-driven platforms are proving to be a game-changer. These user-friendly apps offer features like:

- Easy-to-use interfaces

- Learning tools

- Virtual trading advisors

- Real-time market analysis

- Trading signals

Such features make it easier for novice investors to get started and engage in sophisticated trading strategies.

Platforms like Shrimpy and CoinStats, for example, provide integrations with multiple exchanges, enabling users to consolidate their holdings in one place for better management. This unified approach simplifies portfolio management across various blockchain networks, making it more accessible for new investors.

Moreover, AI-driven platforms are designed to support the high computational needs of AI tasks, ensuring that even resource-intensive applications run smoothly. Lowering execution costs and improving transaction speeds, these platforms make crypto investing more efficient and accessible, attracting a new wave of investors.

Ethical Considerations and Challenges

As AI continues to integrate with the crypto market, several ethical considerations and challenges must be addressed. One of the primary concerns is data privacy. Decentralized AI can enhance data privacy by allowing data to remain with its owners and using encryption methods. However, data ownership remains a contentious issue, with a few firms controlling vast amounts of data without compensating the original owners.

Bias in AI algorithms is another significant challenge. Biased training data can lead to discrimination in applications like credit scoring, posing ethical dilemmas. Accountability in decentralized AI setups is also complicated by the involvement of multiple anonymous participants, making it difficult to assign responsibility for decisions.

Decentralized autonomous organizations (DAOs) offer a potential solution by providing governance and accountability in decentralized AI setups. However, platforms promoting decentralized AI must address these ethical implications to ensure fair and responsible use of AI technology. The concentration of power in AI technology also creates barriers for smaller companies and independent developers, highlighting the need for a more inclusive and equitable AI ecosystem.

Future Trends in AI and Crypto Investing

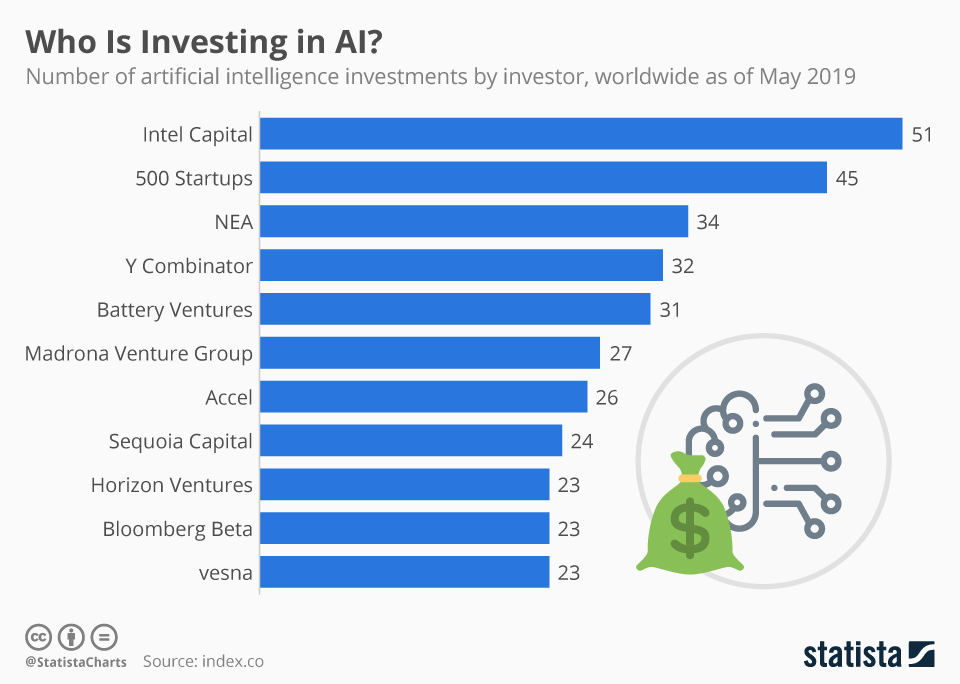

Looking ahead, the future of AI in cryptocurrency investing is incredibly promising. The AI agent market value is projected to grow from $5 billion in 2024 to $47 billion by 2030, reflecting the increasing adoption and advancements in AI technology. One exciting development is the tokenization of AI agents, which allows for fractional ownership and enables users to invest in AI-driven systems.

There are three primary investment opportunities with AI agents: investing in platforms creating AI agents, investing in AI agents directly, and investing in meme coins promoted by AI agents. AI-focused crypto assets have recently outperformed other segments of the crypto market, indicating a strong growth trajectory. Understanding the intersection of AI and crypto is crucial for seizing these opportunities and navigating the highly speculative nature of the market.

As AI continues to evolve, it will become more advanced and proficient, opening up new possibilities for investors. Staying informed about these trends and developments will be key to leveraging the full potential of AI in crypto investing.

Summary

Summarize the key points discussed in the blog post, emphasizing the transformative potential of AI in crypto investing. Reinforce the importance of understanding AI’s role in enhancing investment strategies, mitigating risks, and providing personalized advice. Conclude with an inspiring message encouraging readers to stay informed and consider the implications of AI in their investment strategies.

Frequently Asked Questions

How does AI improve cryptocurrency trading?

AI enhances cryptocurrency trading by utilizing machine learning algorithms to analyze extensive datasets, enabling real-time adjustments to trading strategies and minimizing human error. This leads to more informed decision-making and improved trading outcomes.

What are the benefits of using AI bots for investment strategies?

Using AI bots for investment strategies enhances decision-making by analyzing market sentiment, automating portfolio management, and executing trades quickly, all while minimizing the need for continuous monitoring. This leads to more efficient and effective investment management.

How does AI enhance blockchain technology?

AI enhances blockchain technology by streamlining data management and improving transaction efficiency, thereby ensuring greater data integrity and trust. This makes the overall system more robust and secure.

What ethical considerations are associated with AI in crypto investing?

AI in crypto investing raises ethical concerns such as data privacy, algorithmic bias, accountability in decentralized systems, and potential power imbalances. It’s essential to address these issues to ensure a fair and transparent investment environment.

What future trends should investors watch for in AI and crypto investing?

Investors should focus on the growth of the AI agent market, the tokenization of AI agents, and advancements in AI-focused crypto assets, as these developments are key indicators of future opportunities. Staying informed on these trends can provide a significant edge in investment strategies.