How the Bitcoin Halving Really Affects Price: An In-Depth Analysis for Investors

Bitcoin halving halves the rewards miners earn every four years, controlling the supply. How the bitcoin halving really affects price is crucial for investors. Historically, these events have led to significant price changes. This article explores past impacts and future expectations.

Key Takeaways

- Bitcoin halving occurs every four years, reducing mining rewards and contributing to Bitcoin’s scarcity, ultimately aiming to enhance its value as a deflationary asset.

- Historically, Bitcoin prices tend to surge significantly post-halving, with notable price increases typically observed 6 to 18 months after the event due to supply shocks and sustained demand.

- Halving events impact not just Bitcoin but the broader cryptocurrency market, often leading to increased trading volumes and speculative behaviors across altcoins as investors react to perceived market trends.

Understanding Bitcoin Halving

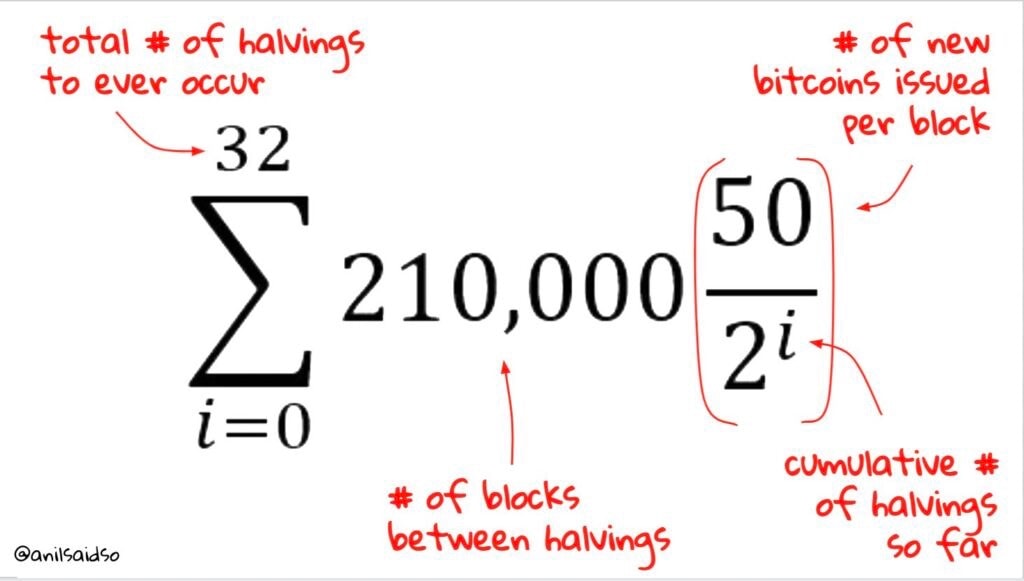

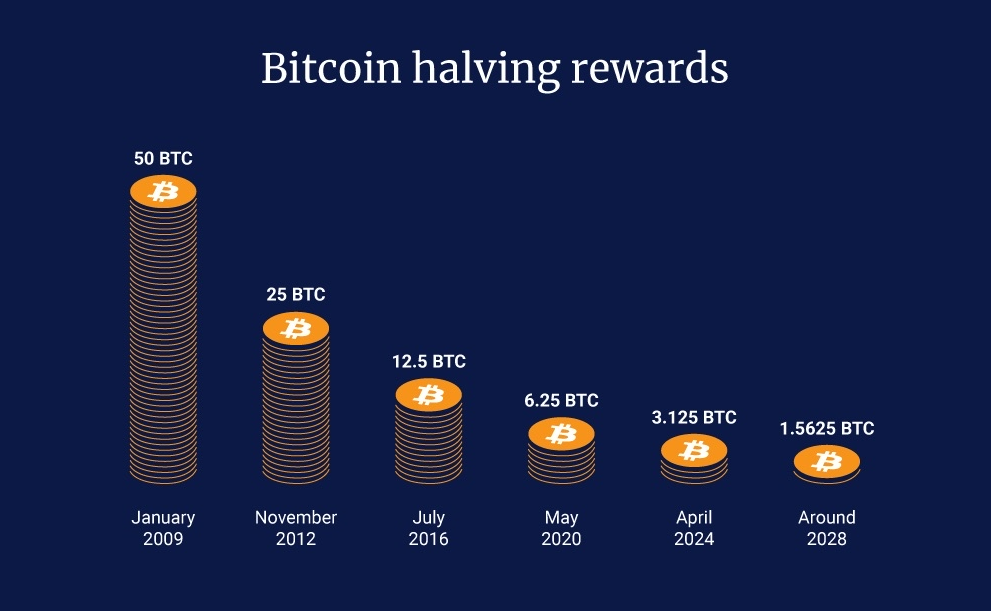

Bitcoin halving is a crucial event in the Bitcoin network, aimed at controlling the supply of new bitcoins and combating inflation. Every 210,000 blocks, or roughly every four years, the rewards for mining new blocks are cut in half. This reduction enhances scarcity and can potentially increase the value of the existing supply. The goal is to ensure Bitcoin remains a deflationary asset, in contrast to traditional fiat currencies that can be printed at will. Bitcoin’s halving is a key mechanism in this process, particularly as it relates to each new block.

Bitcoin’s maximum supply is capped at 21 million BTC, with each halving bringing us closer to that limit. The final halving is projected to occur in 2140, by which time all 21 million bitcoins will have been mined.

This mechanism of reducing block rewards ensures Bitcoin remains scarce and valuable over time. It’s a fundamental aspect of Bitcoin’s code, marking each halving event as a significant milestone for the cryptocurrency market and the bitcoin block reward.

Historical Price Trends Post-Halving

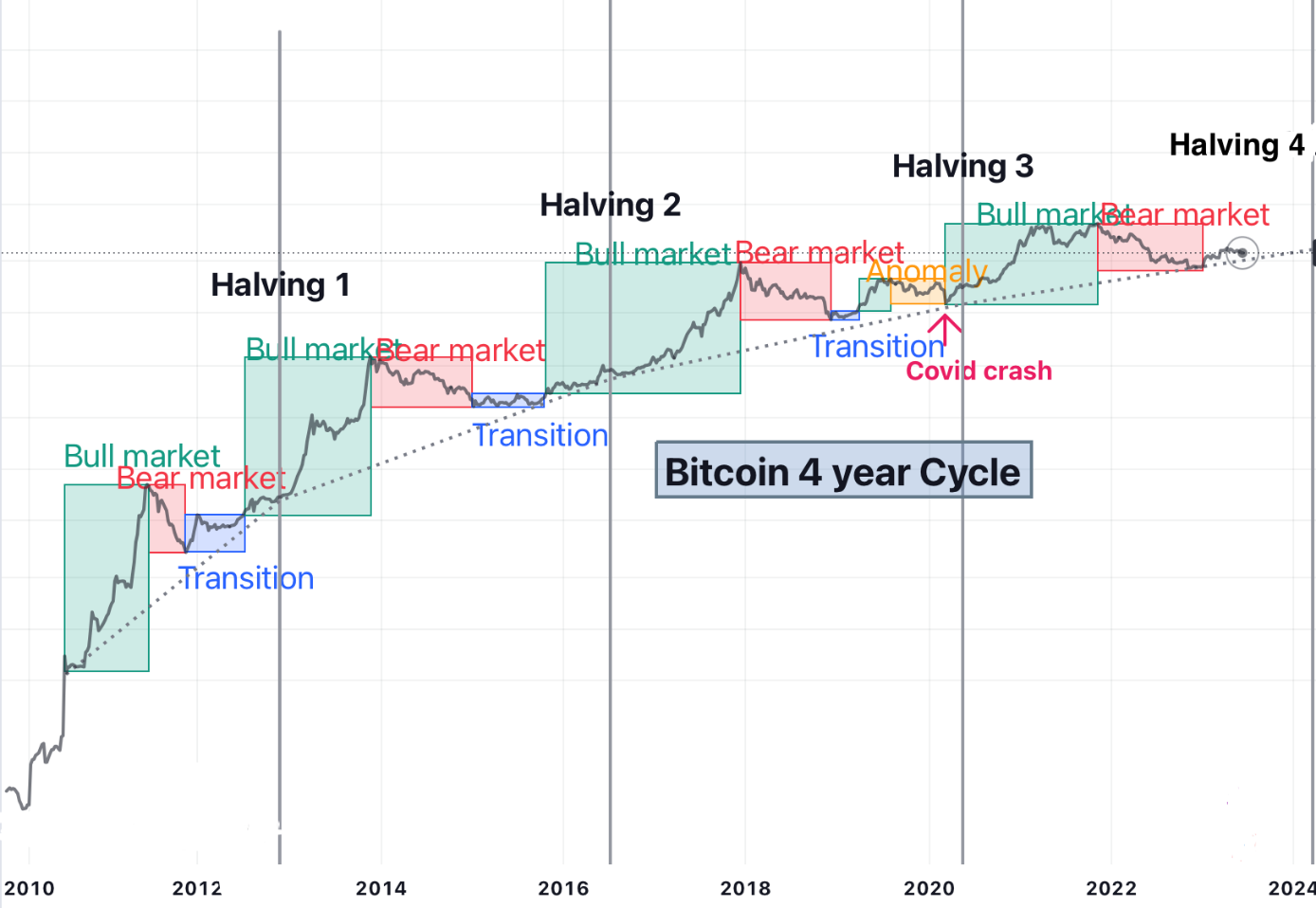

Historically, Bitcoin prices have shown significant increases following halving events. Each halving reduces the rate of new bitcoins created, leading to a supply shock that, combined with steady or increasing demand, often results in price rises.

Analysts note that price increases generally begin six to twelve months after a halving event, with notable surges often seen between 12 to 18 months post-halving.

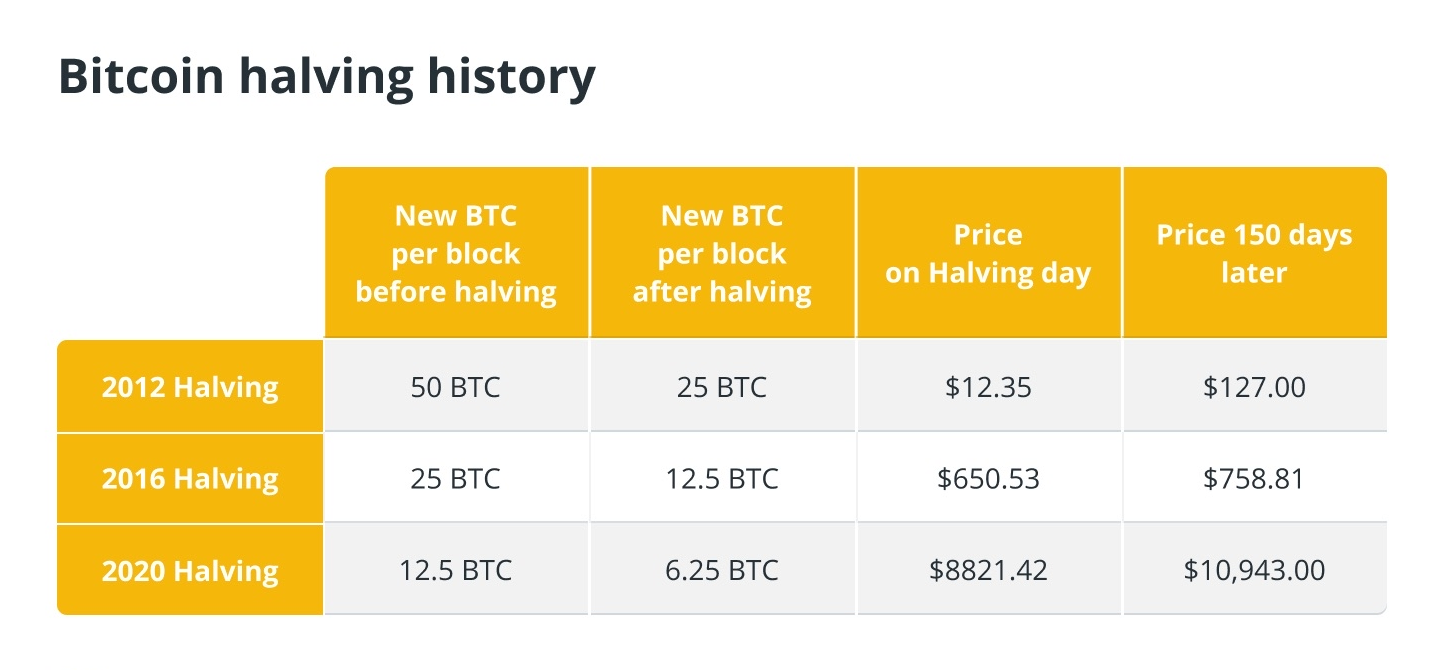

First Halving (2012)

The first Bitcoin halving in 2012 was a game-changer. Before the halving, Bitcoin’s price was relatively modest, but the event marked the beginning of a remarkable price surge. Post-halving, Bitcoin’s price skyrocketed from $12 to a staggering peak of $1,032. This dramatic price increase was driven by several factors, including heightened demand, growing acceptance of Bitcoin as a viable digital currency, and the perception of increased scarcity.

This initial halving set a precedent for future events, demonstrating the profound impact that reduced supply can have on Bitcoin’s price. Early investors who held onto their investments reaped substantial rewards, highlighting the importance of understanding and anticipating halvings reduce halving’s impact.

Second Halving (2016)

The second halving in 2016 continued the trend of significant price appreciation:

- Leading up to the event, Bitcoin’s price was around $651.

- Post-halving, Bitcoin experienced a meteoric rise.

- Bitcoin eventually reached an all-time high of $20,089.

- This peak occurred 526 days after the halving, illustrating the delayed but substantial impact of reduced supply.

This period also saw increased investor interest from many investors and media coverage, further fueling the price rally. The sustained price increase highlighted the importance of patience and long-term investment strategies in the entire crypto market, especially for crypto investors.

Third Halving (2020)

The third halving in May 2020 was another milestone in Bitcoin’s journey. At the time of the halving, bitcoin’s price was approximately $8,787. Within a year, the bitcoin price surged to over $60,000, reflecting a dramatic increase in market sentiment and investor confidence. In the following months, Bitcoin’s price continued to climb, eventually peaking at around $66,000 18 months after the event.

This rapid increase highlighted the positive shift in market sentiment and growing acceptance of Bitcoin as a store of value and investment asset. The significant price movements post-halving demonstrated that bitcoin reached a powerful influence of these events on Bitcoin’s market dynamics.

Fourth Halving (2024)

The 4th Bitcoin halving, which occurred in April 2024, reduced the block reward from 6.25 BTC to 3.125 BTC, further tightening the supply of new Bitcoin. This halving happened in a unique year with the introduction of the spot Bitcoin ETFs which brought in millions of new institutional money. The event sparked significant market attention, as Bitcoin halvings are historically followed by price increases due to reduced inflation and increased scarcity. On the day of the halving, Bitcoin’s price was around $63,821, reflecting a steady increase from previous years. The 2024 halving took place as Bitcoin was gaining more institutional recognition, and its role as a store of value was becoming more entrenched. This event brought Bitcoin closer to its maximum supply cap of 21 million coins, further solidifying its deflationary nature.

Supply and Demand Dynamics

The primary driver behind Bitcoin’s price increases post-halving is the interplay of supply and demand. Each halving reduces the daily supply of newly mined Bitcoin, creating a market supply shock. When the supply of an asset decreases while demand remains constant or increases, the natural economic response is a rise in price. This principle is at the core of Bitcoin’s price behavior following halving events.

Bitcoin’s scarcity is further enhanced by these halving events, making it more attractive as a long-term investment and store of value. Investors often consider bitcoin’s limited supply and predictable reduction in new supply as critical factors in their decision-making processes.

Historical data shows that significant price increases typically follow halving events, with a price rise upward trend stabilizing before substantial gains are observed. Historical trends indicate that halving is expected to contribute to these patterns.

Impact on Bitcoin Miners

Bitcoin halving events have profound implications for miners. The reduction in mining rewards means that miners receive fewer bitcoins for the same amount of computational effort. For many miners, especially those with higher operational costs, this reduction can make mining unprofitable, leading some to exit the market. This potential exodus could reduce the number of active miners, increasing the risk of network vulnerabilities like a 51% attack. Bitcoin halving cuts can exacerbate these challenges for miners.

To maintain profitability, miners may need to adopt more energy-efficient methods and technologies. This drive for efficiency could spur innovations in bitcoin mining hardware, including application specific integrated circuits and practices, ultimately benefiting the entire Bitcoin network and encouraging others to follow bitcoin’s lead.

Consolidation among miners may also occur, with larger, more efficient operations absorbing smaller, less profitable ones. This reshapes the mining landscape, influencing the overall security and stability of the Bitcoin blockchain.

Market Sentiment and Investor Behavior

Market sentiment plays a crucial role in Bitcoin’s price fluctuations, particularly around halving events. The first halving in 2012 significantly boosted Bitcoin’s market presence, driven by heightened interest and extensive media coverage. Similarly, the 2020 halving saw a notable shift in market sentiment, contributing to rapid price escalations and increased institutional investment. Psychological factors and market trends heavily influence investor behavior, making sentiment a critical component of price dynamics.

Media coverage can greatly impact Bitcoin’s reputation, swaying investor behavior and, consequently, its price. Investors often prepare for halving events by increasing their Bitcoin holdings during price dips, aiming to capitalize on anticipated post-halving price rallies. This behavior, coupled with increased media attention, can lead to heightened trading volumes and significant price volatility.

Future Projections: Next Bitcoin Halving

The next Bitcoin halving event is anticipated to occur in mid-2028. The last bitcoin halving on April 20, 2024, reduced the mining reward to 3.125 BTC, continuing the trend of decreased supply. As with three bitcoin halvings, the anticipation of this next halving event is likely to create a self-fulfilling cycle where rising prices attract more investors, further driving up Bitcoin’s value. Additionally, tracking bitcoin halving dates can help investors prepare for these significant events.

With only 2.5 million Bitcoins left to be mined, the upcoming halving will further reduce Bitcoin’s inflation rate, reinforcing its status as a deflationary asset. Investors and analysts will closely monitor market trends and behaviors leading up to the halving, preparing for potential price movements and opportunities.

Broader Crypto Market Effects

Bitcoin’s halving events have a ripple effect on the entire cryptocurrency market. When Bitcoin’s supply is reduced, it often triggers price movements across other digital assets. Positive market sentiment linked to halving events can drive up prices in altcoins, as investors look to capitalize on broader crypto market trends.

Historical data shows that Bitcoin halvings typically coincide with increased trading volumes and speculative trading behavior. Investors often reposition their portfolios ahead of halving events, anticipating resulting price volatility and potential gains across the crypto market.

Key Factors Influencing Price Post-Halving

Several key factors influence Bitcoin’s price post-halving:

- Technological advancements within the cryptocurrency space that can lead to improved efficiencies and potentially affect Bitcoin’s value.

- Broader acceptance of cryptocurrencies.

- Institutional investment in cryptocurrencies, which influenced the price increase post-third halving.

These factors, combined with the fundamental supply and demand mechanics of halving events, create a complex landscape for Bitcoin’s price dynamics. Investors must consider these variables when planning their strategies around halving cycles.

Investment Strategies for Halving Cycles

Developing effective investment strategies around Bitcoin halving cycles requires careful consideration of market conditions, outlook, and risk tolerance. Speculative trading often increases as the halving date approaches, with traders buying Bitcoin to profit from anticipated price rises. Both Bitcoin and altcoins can offer gains during the halving cycle, though Bitcoin tends to be more stable, while altcoins may provide higher returns following Bitcoin’s rally.

Risk management is essential due to unpredictable market conditions around halving events. Investors should implement strategies to mitigate potential losses while maximizing gains, ensuring a balanced and informed approach to their crypto investments, which can significantly impact future performance. Additionally, seeking investment advice can further enhance decision-making in this volatile environment.

Summary

The phenomenon of Bitcoin halving is a crucial aspect of the cryptocurrency’s economic model, designed to enhance scarcity and combat inflation. Historical data shows significant price increases following halving events, driven by supply and demand dynamics. The impact on miners, market sentiment, and the broader crypto market underscores the multifaceted nature of these events.

As we look to the future, the next Bitcoin halving in 2028 will likely continue to influence Bitcoin’s price and market behavior. Investors who understand the mechanics and historical trends of halving events will be better positioned to navigate the volatile landscape of cryptocurrency investments, capitalizing on opportunities and managing risks effectively.

Frequently Asked Questions

What is Bitcoin halving?

Bitcoin halving is a significant event that occurs approximately every four years, reducing mining rewards by 50% every 210,000 blocks. This process helps control Bitcoin’s supply and can impact its price and market dynamics.

How does Bitcoin halving affect the price?

Bitcoin halving generally creates a supply shock by reducing new bitcoins entering circulation, which can drive prices up if demand stays stable or increases.

When is the next Bitcoin halving expected?

The next Bitcoin halving is expected to take place in mid-2028. This event will reduce the block reward for miners, impacting the Bitcoin supply.

How do Bitcoin halvings impact miners?

Bitcoin halvings decrease mining rewards, impacting miner profitability and potentially driving some miners to exit the market or seek more energy-efficient practices.

How does Bitcoin halving influence the broader crypto market?

Bitcoin halving significantly influences the broader crypto market by typically driving up prices for altcoins and increasing overall trading volumes. This event often creates a bullish sentiment that can lead to greater market activity.