Bitcoin and War: How Global Conflicts Influence Crypto Markets

How does Bitcoin respond to global conflicts? When war breaks out, Bitcoin’s price can experience significant volatility. This article explores the impact of bitcoin and war, examining historical events and providing strategies for investors to navigate these turbulent times.

Drawing on data from multiple countries, we analyze how Bitcoin trading volume and returns are affected during periods of geopolitical conflict.

Key Takeaways

- Bitcoin shows significant volatility during geopolitical conflicts, often experiencing initial price surges followed by declines, as evidenced by the Russia-Ukraine War and Israel-Gaza conflict.

- Despite short-term volatility, Bitcoin has demonstrated long-term resilience, frequently recovering to pre-crisis levels and gaining institutional acceptance as a legitimate asset.

- Investors should adopt strategies such as diversification and dollar-cost averaging to manage risks associated with Bitcoin investments during periods of geopolitical instability.

Bitcoin’s Historical Performance During Conflicts

Bitcoin’s history is a testament to its volatile nature, especially during times of geopolitical conflict. The Russia-Ukraine War and the Israel-Gaza War serve as prime examples of how Bitcoin’s price can be both reactive and resilient. Initially, Bitcoin surged before experiencing a decline during the early days of the Russia-Ukraine conflict in 2022. Notably, after the initial surge, Bitcoin entered a bear market, mirroring similar downturns seen during previous periods of geopolitical uncertainty. This pattern of initial spikes followed by volatility is a recurring theme in Bitcoin’s performance during global conflicts.

The Russia-Ukraine War saw Bitcoin prices soar over 18% in the week following Russia’s invasion of Ukraine, only to drop significantly later. Similarly, during the Israel-Gaza wars, Bitcoin’s price remained largely unaffected in the long term, rising above pre-crisis levels within 50 days. The impact of the Ukraine invasion on global markets continues to be analyzed.

These historical performances underscore the importance of understanding Bitcoin’s behavior during conflicts to make informed investment evidence decisions. Historically, Bitcoin was viewed as a speculative asset, which influenced its market reactions and volatility during conflicts.

The Russia-Ukraine War

When Russia invaded Ukraine in early 2022, Bitcoin’s initial response was a surge of over 18% within a week, as investors sought refuge in the decentralized asset amid geopolitical instability. However, this optimism was short-lived. By March 31st, Bitcoin’s price began to decline, a trend that continued throughout the year. From its high in March to December 22nd, Bitcoin experienced a decline of over 65%, reflecting broader market uncertainties and the complex interplay of global events. Country-specific factors, such as Russia’s significant role in global energy markets, also influenced Bitcoin’s behavior during the conflict.

Despite this initial volatility, Bitcoin’s long-term performance told a different story. By mid-2023, Bitcoin had fully recovered to pre-war levels, and gained larger acceptance among institutional investors. The war also affected the distribution and activity of Bitcoin miners, as regulatory changes and instability in the region led to shifts in mining operations, impacting network security and supply. This recovery highlighted Bitcoin’s resilience and growing legitimacy as a financial asset, even amid ongoing geopolitical conflicts.

The Russia-Ukraine War thus serves as a crucial case study in understanding how Bitcoin can both fluctuate wildly and recover robustly in the face of world turmoil.

The Israel-Gaza War

In stark contrast to the Russia-Ukraine War, Bitcoin’s price during the Israel-Gaza conflict in October 2023 remained largely unaffected in the long term. While the initial reactions were marked by anxiety and minor fluctuations, Bitcoin’s price rebounded quickly, rising above pre-crisis levels within 50 days.

This performance illustrated Bitcoin’s potential for stability amid regional conflicts, particularly in the Middle East. Tensions involving Tehran, given its strategic location and influence, also play a significant role in shaping market sentiment and regional stability. Investors who remained patient and did not succumb to panic selling were rewarded as Bitcoin demonstrated its capability to weather storms and emerge stronger.

Immediate Impact of Geopolitical Instability on Bitcoin Prices

Geopolitical instability often leads to significant volatility in Bitcoin prices. The immediate impact of such events is usually a sharp decline, as evidenced by various historical occurrences. Geopolitical events can lead to notable declines in Bitcoin values, creating volatile trading environments that are both risky and opportunistic for investors. For instance, the escalation of conflicts often results in increased volatility in Bitcoin prices, reflecting its sensitivity to global events.

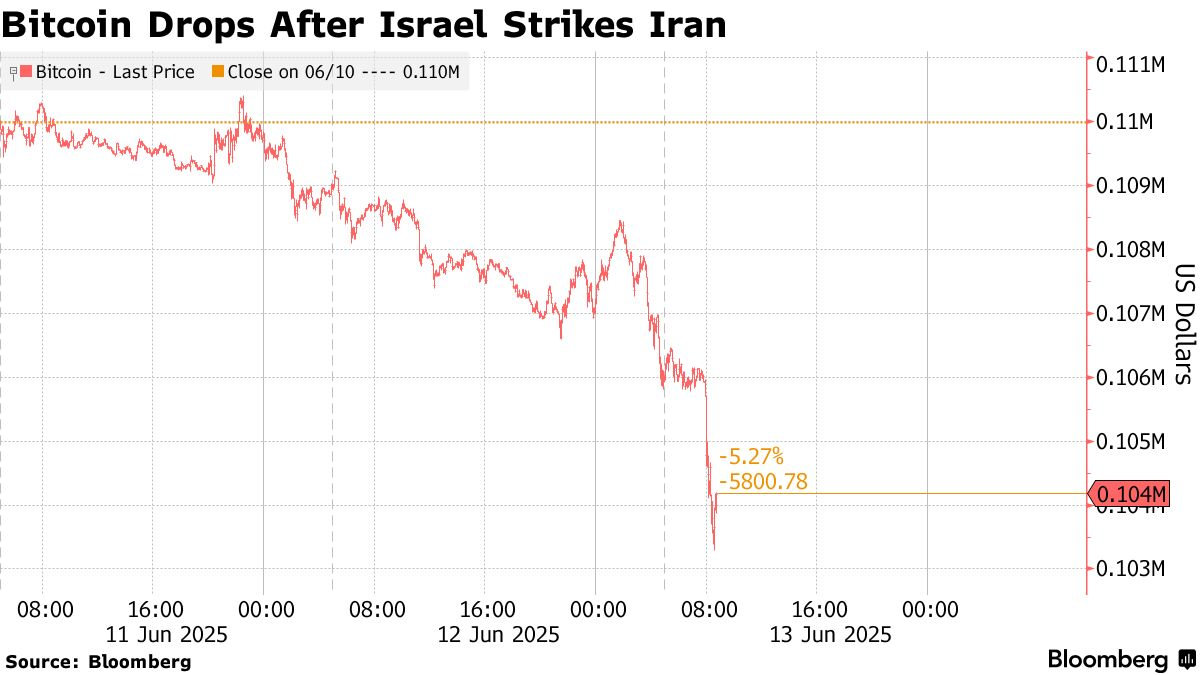

The June 2025 Israel-Iran tensions serve as a recent example of this phenomenon. During this period, bitcoin price plummeted by 4% in a single day, dropping to $103,556. This significant decline was a direct result of broader market panic and speculation about potential U.S. involvement in the conflict. At the same time, there was a rise in oil prices and safe-haven assets, as investors sought stability amid uncertainty, which further influenced Bitcoin’s price movements.

Such immediate impacts underscore the importance of understanding the crypto market’s reaction to geopolitical events and preparing for potential volatility.

Case Study: June 2025 Israel-Iran Tensions

In June 2025, tensions between Israel and Iran escalated dramatically, causing a ripple effect across global financial markets, including cryptocurrencies. Bitcoin’s price fell by 4% in a single day, plummeting to $103,556. This drop reflected a broader market panic, as investors grappled with the uncertainty and potential ramifications of the conflict. The crypto market lost billions in liquidation, and trading sentiment declined significantly due to the ongoing Israeli-Iranian conflict.

The speculation about potential U.S. involvement in the Israel-Iran war further fueled concerns, with fears of a larger conflict impacting market stability in America. The rapid decline in Bitcoin’s price during this period illustrated the cryptocurrency’s vulnerability to geopolitical shocks and the importance of staying informed about global events that could lead to a collapse in market conditions.

However, it would be wrong to assume that all geopolitical conflicts have the same impact on Bitcoin, as each event brings unique market dynamics.

Investor Reactions to Conflict

During times of geopolitical conflict, investors often seek refuge in traditional safe-haven assets, such as gold and the U.S. dollar, perceiving Bitcoin as a risky asset. This reaction is driven by concerns over the cryptocurrency’s volatility and the broader market instability, influenced by the us federal reserve. As a result, funds are diverted away from crypto assets, leading to sharp selloffs and increased market volatility.

Understanding these investor behaviors is crucial for navigating the crypto market during periods of geopolitical instability.

Long-Term Resilience of Bitcoin Amid Global Conflicts

Despite its short-term volatility during geopolitical conflicts, Bitcoin has demonstrated remarkable resilience over the long term. Historical patterns indicate that Bitcoin often shows a pattern of quick recoveries following geopolitical crises, often bouncing back to pre-crisis levels within a month. This resilience underscores Bitcoin’s potential for long-term growth despite geopolitical tensions.

Bitcoin’s ability to recover from downturns is supported by ongoing institutional investments, which act as a stabilizing force during global conflicts. Increased activity and holdings on exchanges also contribute to Bitcoin’s resilience and recovery, as exchanges provide liquidity and facilitate transfers during periods of market stress. This resilience suggests that dips in Bitcoin’s price during geopolitical crises may present buying opportunities for investors who can weather the short-term volatility.

Technical indicators and comparative analysis with gold further highlight Bitcoin’s potential as a unique asset class.

Technical Indicators of Recovery

Technical indicators, such as the Relative Strength Index (RSI), are crucial for identifying potential recovery points in Bitcoin’s price after major declines. Key points include:

- During significant selloffs, Bitcoin’s RSI can fall to oversold levels, indicating potential rebounds.

- For instance, during the June 2025 selloff, Bitcoin’s RSI hit 25.51.

- This value suggested a deeply oversold level and a potential recovery as it approached critical support.

These technical indicators provide valuable insights for investors looking to capitalize on Bitcoin’s resilience during periods of geopolitical instability.

Comparative Analysis with Gold

Comparing Bitcoin’s performance with gold during crises reveals that Bitcoin has consistently shown greater price appreciation. Since 2020, Bitcoin has outperformed gold, particularly during economic uncertainties. For example, post-pandemic lows in 2020 saw Bitcoin surge by 131%, while gold gained only 6%. Similarly, the NASDAQ experienced a rapid rebound and reached record highs during the same period, highlighting the strong recovery of certain asset classes after the COVID-19 pandemic.

This trend suggests that Bitcoin may serve as a superior hedge against market instability, offering greater potential for price appreciation compared to traditional safe-haven assets.

Risk Factors for Bitcoin Investors in Times of War

Investing in Bitcoin during times of war comes with several risks that investors must consider. Geopolitical escalation, correlation with traditional financial markets, and regulatory risks are among the primary concerns. During economic crises, Bitcoin has displayed a tendency to drop in value, similar to other risk assets, contrasting with gold’s historical stability. Central banks’ monetary policies, such as quantitative easing and low interest rates, can significantly impact Bitcoin and other risk assets during periods of instability by increasing liquidity and influencing market recovery. Understanding these risks is crucial for making informed investment decisions.

Bitcoin often behaves like a tech stock during initial geopolitical tensions, experiencing a drop alongside traditional risk assets. Analysts predicted that Bitcoin could drop by 10-20% if the U.S. entered the Israel-Iran conflict. These potential drops highlight the importance of diversification and risk management strategies for Bitcoin investors during times of geopolitical instability.

Geopolitical Escalation

Geopolitical escalation can significantly impact Bitcoin prices and market conditions. For instance, during the Russia-Ukraine War, concerns about escalation and potential U.S. intervention exacerbated market conditions. The fear of further conflict and instability can lead to reduced liquidity and increased volatility in the crypto market. Investors must remain vigilant and consider the potential impact of geopolitical events on their Bitcoin investments.

The Middle East is another region where geopolitical tensions can influence Bitcoin prices. Conflicts in this region often lead to heightened market volatility, as investors react to changing geopolitical landscapes. Understanding the potential for geopolitical escalation and its impact on Bitcoin prices is essential for navigating the crypto market during times of conflict.

Correlation with Traditional Financial Markets

Bitcoin’s correlation with traditional financial markets can drive its price volatility during geopolitical instability. During periods of geopolitical crisis, Bitcoin tends to exhibit increased volatility, paralleling the fluctuations seen in stock markets. This correlation underscores Bitcoin’s role as a risk asset rather than a stable store of value in uncertain times.

Investors must consider this correlation when strategizing their Bitcoin investments during geopolitical conflicts.

Regulatory Risks

Regulatory risks are another significant concern for Bitcoin investors during times of geopolitical tension. The potential for increased regulatory scrutiny and intervention in the cryptocurrency market can impact investor confidence and market stability. Regulatory bodies may take measures to oversee or intervene in Bitcoin transactions and usage, especially during crises.

Understanding these regulatory risks is crucial for Bitcoin investors to remain vigilant and navigate the market effectively during periods of geopolitical conflict.

Investment Strategies for Navigating Bitcoin Amid Global Conflicts

Investors must adopt effective strategies to navigate Bitcoin investments during global conflicts:

- Build a diversified crypto portfolio to manage investment risk.

- Employ dollar-cost averaging to capitalize on potential recovery.

- Be aware of increased government scrutiny over cryptocurrencies during geopolitical tensions, which may lead to regulatory changes impacting market sentiment.

Understanding these strategies and external factors is crucial for making informed investment decisions.

Monitoring oil price movements and global inflation is also essential when strategizing around Bitcoin. These external factors can influence market conditions and Bitcoin prices, making it important for investors to stay informed and adjust their strategies accordingly.

Conducting thorough research and relying on credible sites for up-to-date information and analysis is essential for making sound investment decisions during global conflicts.

Diversification and Dollar-Cost Averaging

Diversification and dollar-cost averaging are essential strategies for managing investment risk during geopolitical instability. Diversification helps investors spread money risk across multiple assets, reducing potential losses during market volatility.

Dollar-cost averaging involves investing a fixed amount regularly, regardless of price fluctuations, allowing investors to accumulate more assets over time. Combining these strategies can help investors manage risk and capitalize on potential recovery during periods of geopolitical conflict.

Summary

Throughout history, Bitcoin has demonstrated both vulnerability and resilience in the face of geopolitical conflicts. While short-term volatility is inevitable, Bitcoin’s ability to recover and grow over the long term makes it a unique asset class. By understanding historical patterns, immediate impacts, and long-term resilience, investors can better navigate the crypto market during times of global instability. Employing strategies such as accumulation at support levels, diversification, and dollar-cost averaging can help manage investment risk and capitalize on potential recovery. Ultimately, Bitcoin’s resilience through geopolitical crises underscores its role as a unique and valuable asset class, suggesting that dips are buying opportunities.

Frequently Asked Questions

How did Bitcoin perform during the Russia-Ukraine War in 2022?

Bitcoin initially surged over 18% following Russia’s invasion of Ukraine in 2022 but subsequently declined. However, by mid-2023, it had recovered to pre-war levels and gained wider acceptance among institutional investors.

What was the impact of geopolitical tensions between Israel and Iran on Bitcoin’s price in June 2025?

The geopolitical tensions between Israel and Iran in June 2025 caused a significant impact on Bitcoin’s price, resulting in a 4% decline to $103,556 within one day. This illustrates how external conflicts can influence cryptocurrency market dynamics.

How does Bitcoin’s performance compare to gold during crises?

Bitcoin tends to outperform gold during crises, as evidenced by its 131% surge following the 2020 pandemic lows compared to gold’s mere 6% increase. This trend suggests Bitcoin may serve as a more effective store of value in turbulent times.

What are some risks associated with investing in Bitcoin during times of geopolitical conflict?

Investing in Bitcoin during geopolitical conflict carries risks such as heightened volatility due to escalated tensions, potential correlations with traditional financial markets, and regulatory uncertainties. It’s crucial to stay informed and assess these factors before making investment decisions.