From Reddit to Real Estate: 5 Unexpected Ways Crypto Is Going Mainstream

Curious how cryptocurrencies are becoming a part of daily life? This article explains from Reddit to real estate 5 unexpected ways crypto is going mainstream. You’ll learn how social media, property tokenization and other surprising methods are pushing crypto into the mainstream.

Key Takeaways

- Reddit plays a significant role in cryptocurrency adoption by fostering discussions, sharing investment strategies, and driving viral market movements.

- Tokenization is revolutionizing real estate by enabling fractional ownership and increasing liquidity, making property investments more accessible to a broader range of investors.

- Institutional investors and corporations are increasingly embracing digital assets, highlighting the growing legitimacy of cryptocurrencies in mainstream finance.

Social Media Influence: Reddit’s Role in Crypto Adoption

Reddit has emerged as a crucial platform for cryptocurrency discussions, gathering a diverse community of investors and enthusiasts. With over 70 million active daily users, the scale of Reddit amplifies the conversations around crypto adoption. Crypto-related subreddits are among the most engaged communities, allowing users to exchange ideas, strategies, and news. This vibrant interaction plays a significant role in shaping public perception and driving mass adoption of cryptocurrencies.

The power of Reddit lies in its ability to democratize information. Users from all walks of life can contribute to discussions, share their experiences, and offer advice. This collective knowledge pool is invaluable, especially for novice investors who can learn from the experiences of more seasoned participants. The platform’s influence extends beyond just discussions; it can also lead to real-world market movements and trends, making it a key player in the crypto ecosystem.

The role of Reddit in crypto adoption is multifaceted, ranging from the promotion of meme coins to the sharing of investment strategies and the initiation of viral campaigns that can move markets. Each of these elements contributes to the broader narrative of how social media is driving the mainstream acceptance of cryptocurrencies.

Meme Coins & Community Power

Meme coins, such as Dogecoin and Shiba Inu, exemplify the unique power of online communities in the crypto world. Key aspects of meme coins include:

- They were initially created as jokes or parodies, often drawing their appeal from humor and Internet culture.

- Their popularity and value rely heavily on their online communities, which actively promote and support these digital tokens.

- Successful meme coins often achieve visibility through social media platforms.

- This visibility directly influences their price and trading volume.

The creation of meme coins has a low barrier to entry, allowing anyone to launch a new coin without extensive technical knowledge. However, this ease of creation also means that many meme coins lack intrinsic value and real-world applications, making them highly speculative investments. Despite this, the community-driven nature of meme coins has led to their extreme volatility in price and trading activity, attracting speculative traders hoping for quick profits.

While some meme coins achieve lasting popularity, most people tend to fade quickly after their initial hype subsides. Nevertheless, the phenomenon of meme coins underscores the significant influence that online communities, particularly on platforms like Reddit, can have on the crypto market.

The stories of bitcoin miners and early adopters who have turned these coins into substantial investments are a testament to the power of community-driven finance.

Crowdsourced Investment Strategies

Reddit is not just a platform for memes and jokes; it’s also a hub for serious investment strategies. Communities on Reddit often share investment strategies that provide collective knowledge and insights for novice investors. This crowdsourced approach to investing allows users to benefit from the collective wisdom of the crowd, much like how institutional investors leverage vast amounts of data and expert analysis.

The power of crowdsourced investment strategies lies in their ability to democratize investing. In traditional markets, institutional investors often have an edge due to their access to extensive resources and information. However, on Reddit, anyone can contribute and benefit from the shared knowledge, leveling the playing field for individual investors.

This has led to a more inclusive investment landscape, where not everyone with limited experience can make informed decisions and potentially achieve significant returns.

Viral Campaigns & Market Movements

One of the most compelling aspects of Reddit’s influence on crypto is its ability to drive viral campaigns that result in significant market movements. Viral posts on Reddit can trigger market fluctuations, demonstrating the platform’s power in influencing cryptocurrency visibility. These posts can include:

- Investment tips

- News

- Memes

- Jokes All of which can contribute to the hype and momentum around a particular coin or project.

The rapid spread of information on Reddit means that market trends can evolve quickly, often catching even seasoned investors off guard. This dynamic environment creates both opportunities and risks, as speculation in the market can be highly reactive to the latest viral post or trending topic, gaining traction.

For investors, staying informed and engaged with these online communities can provide valuable insights and early warnings about potential stock market shifts through research.

Real Estate Revolution: Tokenization of Property

The real estate market is undergoing a significant transformation with the advent of tokenization. Tokenization involves converting property ownership into digital tokens, which can be bought and sold on blockchain platforms. Key points include:

- The market value for tokenized real estate is projected to reach $3 trillion by 2030.

- The growth rate of tokenization platforms worldwide was 75% in 2023 alone.

- This indicates a rapidly growing interest in this innovative approach to property investment.

Tokenization offers a range of benefits, including increased accessibility and liquidity. Traditional real estate investments often require substantial capital and involve lengthy, complex processes. Tokenization simplifies this by allowing fractional ownership and enabling smaller investments, thus broadening the market to include more participants. This shift is not only making real estate investment more accessible but also more dynamic and efficient.

As the technology behind tokenization matures, it is expected to overcome many of the operational inefficiencies and high costs associated with traditional property investment. However, the adoption of tokenization is not without its challenges. Regulatory hurdles and the need for clear use cases, particularly in the residential sector, could slow down its widespread implementation.

Fractional Ownership

Tokenization allows for fractional ownership, enabling investors to buy smaller shares of high-value properties. This approach transforms how investments are structured and enables broader participation in the market. For instance, platforms like RealT offer tokenized properties with minimum investments as low as $50, making real estate accessible to small investors. This democratization of property ownership is a game-changer, allowing more people to invest in real estate without needing significant capital.

Fractional ownership also provides investors with the flexibility to diversify their portfolios by investing in multiple properties, rather than being tied to a single, large investment. This can potentially reduce risks and increase returns, as investors can spread their investments across various properties and markets.

Increased Liquidity

One of the most significant benefits of tokenization is the increased liquidity it brings to the real estate market. Traditional real estate investments are often illiquid, meaning it can take a long time to buy or sell properties. Tokenization changes this by making properties more accessible and tradable, offering a significant shift from traditional investment methods. Tokens can be traded on various digital exchanges, providing frictionless secondary trading and attracting more investors.

The ability to trade property tokens on multiple marketplaces enhances liquidity for investors, allowing for quicker and more efficient buying and selling of stock. This increased liquidity can also lead to more dynamic and efficient secondary markets, benefiting both investors and the overall market.

However, the greater accessibility of real estate assets could lead to higher volatility, as more frequent trading may result in rapid price fluctuations. Overall, the only reason the benefits of increased liquidity are substantial is that it makes real estate investment more flexible and appealing to a broader range of investors.

As tokenization continues to evolve, it is likely to further transform the real estate market, potentially reducing the barriers to entry and increasing participation.

Global Investment Opportunities

Tokenization opens up global investment opportunities, allowing investors from around the world to participate in real estate markets previously restricted to local players. This global reach is facilitated by the digital representation of property ownership, making investments more accessible to a broader range of investors. Regulatory support and dedicated legal frameworks are also advancing the growth of the real estate tokenization market.

For institutional investors and individual investors alike, the potential to invest in properties across different countries and markets is a significant advantage. This diversification can lead to better risk management and higher potential returns, as investors are not limited to their local real estate markets. The ability to tap into global investment opportunities is a major selling point for tokenized real estate.

As the market for tokenized real estate continues to grow, it is likely to attract more interest from both institutional and individual investors. The promise of increased accessibility, liquidity, and global reach makes tokenization an attractive option for those looking to diversify their investment portfolios and capitalize on the growing real estate market.

Institutional Investors & Corporate Adoption

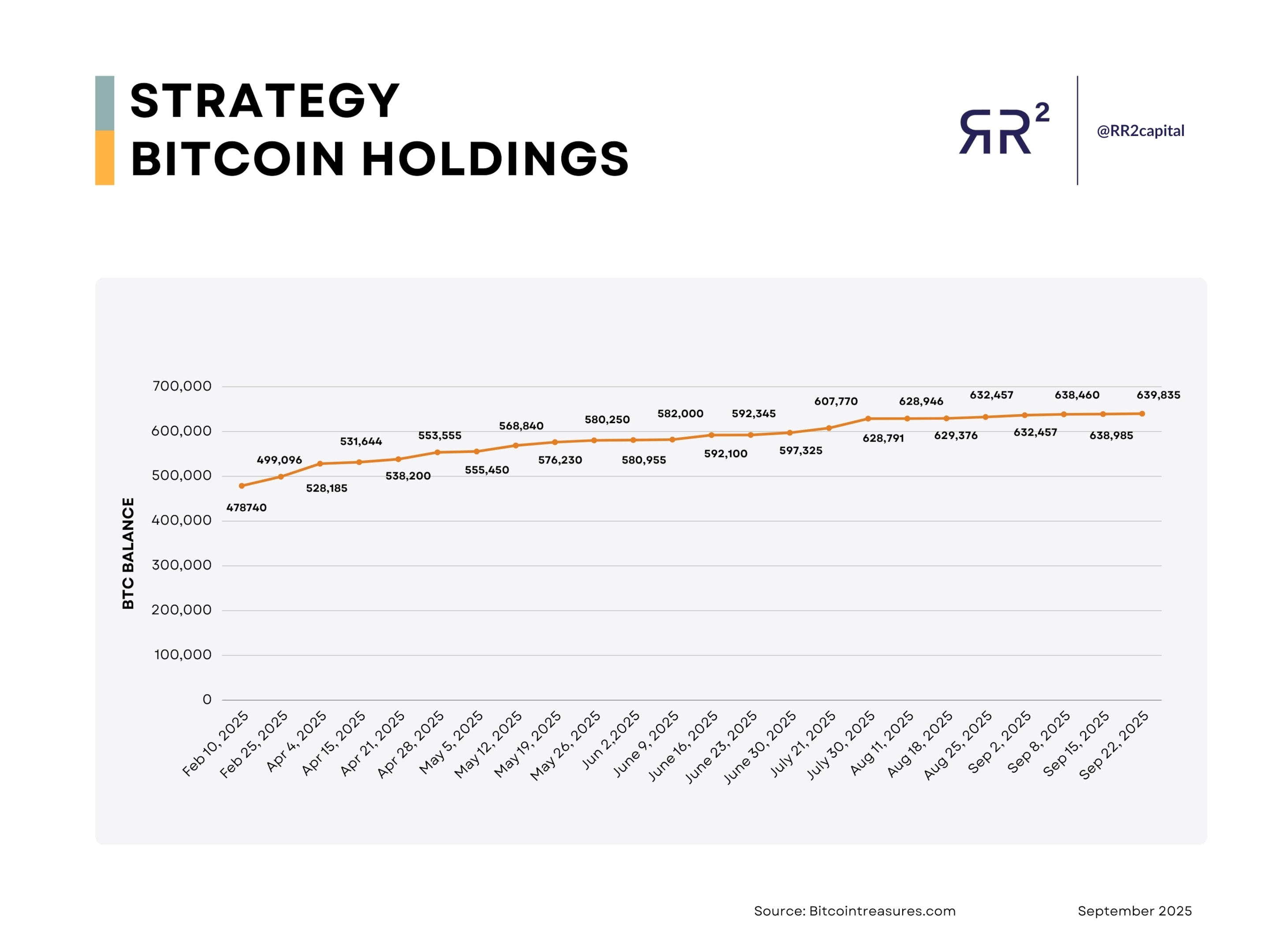

Institutional investors and corporations are increasingly embracing digital assets, signaling a significant shift in the financial landscape. In 2024, over 70% of institutional asset managers reported having exposure to digital assets, a dramatic increase from less than 10% in 2020. This growing interest is further evidenced by the nearly $98 billion raised by corporations in the first half of 2025 to invest in digital assets. These figures highlight the increasing legitimacy and acceptance of cryptocurrencies among major financial players.

The adoption of cryptocurrency payments by businesses also grew by 55% in 2023, indicating a broader acceptance of digital currencies among merchants. As stablecoins continue to gain traction, they are expected to represent a growing share of cross-border payments, potentially reaching up to 20% in the next five years. This trend underscores the potential of cryptocurrencies to revolutionize traditional payment systems and financial transactions.

The involvement of institutional investors and corporations in the crypto market is a strong indicator of its maturation and potential for future growth. As these entities continue to integrate digital assets into their financial strategies, the mainstream adoption of cryptocurrencies is likely to accelerate, further solidifying their place in the global financial ecosystem.

Bitcoin as Digital Gold

Bitcoin is increasingly being viewed as digital gold, a hedge against inflation, and a viable store of value. Institutional investors are particularly interested in Bitcoin due to its low correlation with typical portfolio assets, making it an attractive addition to diversified investment portfolios. The perception of Bitcoin as a hedge against inflation has led to increased interest from institutional investors.

This growing acceptance of Bitcoin as digital gold is a testament to its resilience and potential as a long-term investment. As more institutional investors and companies accept Bitcoin, its role as a stable, reliable store of value is likely to be further cemented.

Corporate Treasury Management

Companies are increasingly integrating cryptocurrencies into their treasury management to diversify and strengthen their financial strategies. For example, Tesla’s investment of $1.5 billion in Bitcoin showcases the corporate interest in cryptocurrencies as a potential asset class. This trend is leading to the rise of crypto treasury firms, where companies structure their business models around cryptocurrency investments.

Corporate treasury management is becoming more sophisticated as companies seek to leverage the benefits of digital assets. By incorporating cryptocurrencies into their financial strategies, companies can diversify their holdings and potentially achieve higher returns, thus enhancing their overall financial stability.

Strategic Partnerships & Investments

Strategic partnerships between traditional financial institutions and cryptocurrency firms are increasingly becoming central to the evolution of the financial landscape. Notable financial entities have established partnerships with cryptocurrency firms to explore innovative financial products. These collaborations focus on developing new investment solutions that leverage the unique capabilities of blockchain technology.

These partnerships are not only fostering innovation but also bridging the gap between traditional finance and the burgeoning world of cryptocurrency. The implications of these partnerships suggest a growing convergence between the two sectors, leading to the creation of hybrid financial products that combine the best solution of both worlds.

For investors, these strategic partnerships and investments represent new opportunities to diversify their portfolios and tap into the potential of emerging technologies. As more businesses and financial institutions collaborate, the financial landscape is likely to become more integrated and innovative, offering a wider range of options for investors.

Payment Solutions: Crypto in Everyday Transactions

Cryptocurrencies are increasingly being used for everyday purchases, marking a significant shift from their early days as niche assets. From groceries and bills to travel expenses, digital currencies are becoming viable options for a growing number of merchants. This transition is supported by the development of payment solutions that make crypto transactions fast, user-friendly, and accessible, allowing users to spend their digital currencies with ease.

The growing acceptance of cryptocurrency payments by merchants engaged in international sales highlights the practical benefits of digital currencies. By minimizing foreign exchange issues, cryptocurrencies offer a more efficient and cost-effective way to conduct international transactions. This trend is indicative of the broader acceptance and integration of cryptocurrencies into mainstream financial systems.

As more people begin to use cryptocurrencies for daily transactions, the perception of digital currencies as viable alternatives to traditional money continues to strengthen. This shift is fostering mainstream adoption and trust in these digital assets, paving the way for a future where cryptocurrencies are an integral part of everyday financial activities.

Mobile Wallets & Payment Apps

Mobile wallets and payment apps are revolutionizing how consumers interact with cryptocurrencies. These digital wallets allow users to store, send, and receive cryptocurrencies effortlessly, enabling daily transactions from shopping to bill payments. The convenience and accessibility offered by these apps are driving the mainstream adoption of cryptocurrencies.

An increasing number of merchants are beginning to accept cryptocurrencies as a payment method, fostering trust and confidence in these digital currencies. Payment applications also simplify cross-border transactions, providing low fees and faster processing times compared to traditional banking channels.

The integration of mobile wallets and payment apps into everyday financial activities is a testament to the growing acceptance and utility of cryptocurrencies. As these platforms continue to evolve, they are likely to play a crucial role in making digital currencies a standard part of the global financial system.

Merchant Adoption

A growing number of businesses are now directly accepting cryptocurrencies as payment, simplifying transactions for customers. Bitcoin, in particular, is accepted by numerous merchants globally, making it a versatile option for various industries. This widespread acceptance of Bitcoin highlights its potential as a mainstream currency, especially in the context of a bitcoin transaction.

Litecoin is also gaining popularity among merchants due to its faster transaction times and lower fees compared to Bitcoin. The increasing adoption of cryptocurrencies by merchants is fostering a more inclusive and efficient financial ecosystem, where digital currencies are used alongside traditional money.

As more businesses recognize the benefits of accepting cryptocurrencies, the trend of merchant adoption is likely to continue growing. This will further integrate digital currencies into everyday transactions, enhancing their utility and acceptance.

Cross-Border Payments

Using cryptocurrencies for international transactions can significantly reduce fees and speed up processing times compared to traditional methods. Cryptocurrencies allow for seamless transfers across borders without the need for currency conversions or high fees. This makes them an attractive option for businesses and individuals engaged in cross-border transactions.

Stablecoins, in particular, facilitate near-instantaneous settlements for cross-border transactions, reducing the time typically required by traditional payment methods. This efficiency can be particularly beneficial for businesses operating in multiple countries, as it streamlines their financial operations and reduces costs.

The use of cryptocurrencies for cross-border payments reduces the costs associated with traditional banking methods, making international transactions more accessible and efficient. As more people and businesses adopt digital currencies for cross-border payments, the global financial system is likely to become more interconnected and efficient.

Financial Inclusion and Empowerment

Cryptocurrencies are playing a crucial role in providing financial services to populations that lack access to traditional banking. By offering alternative financial solutions, digital currencies are expanding access to financial services for millions of people around the world. This is particularly important for individuals in developing regions, where traditional banking infrastructure may be limited.

Cryptocurrencies are changing the landscape for those who are traditionally excluded from the financial system, offering them new avenues for financial participation. By providing access to banking-like services, such as digital wallets and low-cost transactions, cryptocurrencies are empowering individuals and communities to manage their finances more effectively.

The role of cryptocurrencies in promoting financial inclusion and empowerment is significant, as it helps bridge the gap between the unbanked and the global financial system. This transformative potential underscores the broader impact of digital currencies on society and the economy.

Access to Banking Services

Crypto platforms provide an alternative to traditional banking, allowing users to store, send, and receive funds without needing a bank account. These platforms offer essential banking-like services, including digital wallets and low-cost transactions, to those without access to conventional banks. This is particularly beneficial for individuals who distrust conventional banks and are looking for more accessible alternatives.

By enabling users to manage funds directly through digital wallets, crypto platforms are providing a crucial service to the unbanked. This accessibility is helping to democratize financial services and ensure that more people can participate in the global economy.

Microfinance & Remittances

Cryptocurrencies can significantly reduce the costs associated with remittances, making it easier for individuals to send money across borders. Using cryptocurrencies for remittances can lower transaction fees significantly, often dropping below 1%, making it more affordable for senders. This cost-efficiency is particularly beneficial for individuals in developing regions, where remittance fees can be prohibitively high.

Cryptocurrencies also facilitate microfinance solutions by offering lower transaction fees and faster remittance options. This can be an attractive alternative for users in developing regions who need access to efficient and affordable financial services.

Empowering Entrepreneurs

Access to cryptocurrency funding can help entrepreneurs in underserved areas overcome barriers to capital and grow their businesses. In regions with insufficient access to traditional funding, cryptocurrencies allow entrepreneurs to tap into global markets and secure necessary capital. This can be vital for business growth and innovation.

In developing areas, cryptocurrencies are helping entrepreneurs to secure funding and launch businesses by eliminating barriers typically associated with traditional financing. This access to capital is empowering entrepreneurs to pursue their business ideas and contribute to economic development.

The ability to secure funding through cryptocurrencies is a game-changer for entrepreneurs in underserved regions. It provides them with the resources needed to grow their businesses, create jobs, and drive economic growth, reducing the risk of failure.

Risks and Challenges

While the mainstream adoption of cryptocurrencies offers numerous benefits, it also comes with its share of risks and challenges. Factors that impact the crypto market’s sensitivity include macro trends, regulatory shifts, and technological vulnerabilities. Institutional interest in cryptocurrency is surging, but investment returns can be extremely volatile. Bitcoin’s volatility means that returns change frequently, posing a challenge for consistent investment returns.

The rapidly changing landscape of the crypto market demands that investors expect to stay informed and adaptable. Well-established projects must continuously innovate to maintain their position. Investors should stay informed about value shifts to navigate the future of digital assets and mitigate risks.

Investing in Bitcoin poses a serious risk for loss, demanding cautious strategies from investors. Many investors consider Bitcoin as a speculative instrument, often leading to unpredictable financial outcomes.

Regulatory Uncertainty

Regulatory uncertainty is one of the major challenges facing the crypto market. Current discussions around cryptocurrency policy often lack representation from the general public, despite the potential impact on millions. Investing in Bitcoin can worsen investor behavior and increase volatility stress, which may stem from regulatory uncertainties.

The disparity in tax treatment between Bitcoin and other assets, such as gold, also affects investment behavior. Bitcoin is taxed at long-term capital gains rates, while gold is taxed at a higher collectibles rate. This disparity can influence how investors view their holdings amidst changing regulations.

Security Concerns

Security concerns are a significant risk in the cryptocurrency market:

- In 2022, cryptocurrency thefts resulted in losses of $3.1 billion.

- This significant amount underscores the vulnerabilities in the crypto market.

- The decentralized nature of cryptocurrencies means there is no central authority to safeguard users against theft or loss.

- Approximately 40% of Bitcoins that have been extracted are lost due to lost private keys.

These security concerns highlight the need for robust security measures and user education to protect against theft and loss. As the market continues to grow, maintaining security will be crucial to ensuring the long-term viability of cryptocurrencies.

Market Volatility

Market volatility is a defining characteristic of cryptocurrencies, often resulting in sudden and significant changes in value. For example, Bitcoin experienced a 16% drop over a 21-day period, and it can also see dramatic percentage declines of up to 80% that are difficult for investors to manage. This extreme volatility can pose a challenge for investors, particularly retail investors who may have less information and resources than institutional players.

It is generally recommended that investors allocate around 5% of their portfolio to Bitcoin, with a range of 0%-10% being considered reasonable. This cautious approach can help mitigate the risks associated with market volatility while still allowing investors to benefit from the potential returns of cryptocurrencies.

Summary

The journey through the mainstream adoption of cryptocurrencies reveals a dynamic and transformative landscape. From the influence of social media platforms like Reddit to the revolutionary tokenization of real estate, crypto is making significant strides across various sectors. Institutional investors and corporations are embracing digital assets, signaling a broader acceptance and integration of cryptocurrencies into the financial ecosystem.

Payment solutions are evolving, making it easier for everyday transactions to be conducted using cryptocurrencies. This shift is fostering greater trust and acceptance of digital currencies among consumers and merchants alike. Additionally, cryptocurrencies are playing a crucial role in promoting financial inclusion and empowerment, providing essential financial services to populations that lack access to traditional banking.

However, the path to mainstream adoption is not without its challenges. Regulatory uncertainty, security concerns, and market volatility are significant risks that need to be addressed. Investors and stakeholders must stay informed and adaptable to navigate this rapidly changing landscape effectively.

In conclusion, the mainstream adoption of cryptocurrencies is a multifaceted and evolving phenomenon. As digital currencies continue to gain traction, they have the potential to reshape various aspects of our lives, from finance and investments to everyday transactions and financial inclusion. The future of cryptocurrency is bright, but it requires careful navigation and thoughtful strategies to realize its full potential.

Frequently Asked Questions

How has Reddit influenced the adoption of cryptocurrencies?

Reddit significantly influences cryptocurrency adoption by fostering discussions, sharing investment strategies, and enabling viral campaigns that sway market movements. Its extensive user base amplifies these conversations, shaping public perception and facilitating broader acceptance.

What are the benefits of tokenizing real estate properties?

Tokenizing real estate properties offers fractional ownership and enhanced liquidity, enabling global investment opportunities. This makes real estate investment more accessible and attractive to a wider array of investors.

Why are institutional investors interested in Bitcoin?

Institutional investors are interested in Bitcoin primarily as a hedge against inflation and a store of value, often considering it akin to digital gold. Its low correlation with traditional assets enhances its appeal for diversifying investment portfolios.

How are cryptocurrencies promoting financial inclusion?

Cryptocurrencies promote financial inclusion by offering accessible financial services, such as digital wallets and low-cost transactions, to those without access to traditional banking. This empowers individuals in developing regions to manage their finances and engage in the global economy.

What are the main risks associated with investing in cryptocurrencies?

The main risks associated with investing in cryptocurrencies are regulatory uncertainty, security concerns, and market volatility. These factors can significantly impact investor confidence, lead to potential losses, and result in drastic fluctuations in asset values.