Bitcoin 2026 Price Forecast: Will BTC Hit New All‑Time Highs This Year?

Key Takeaways

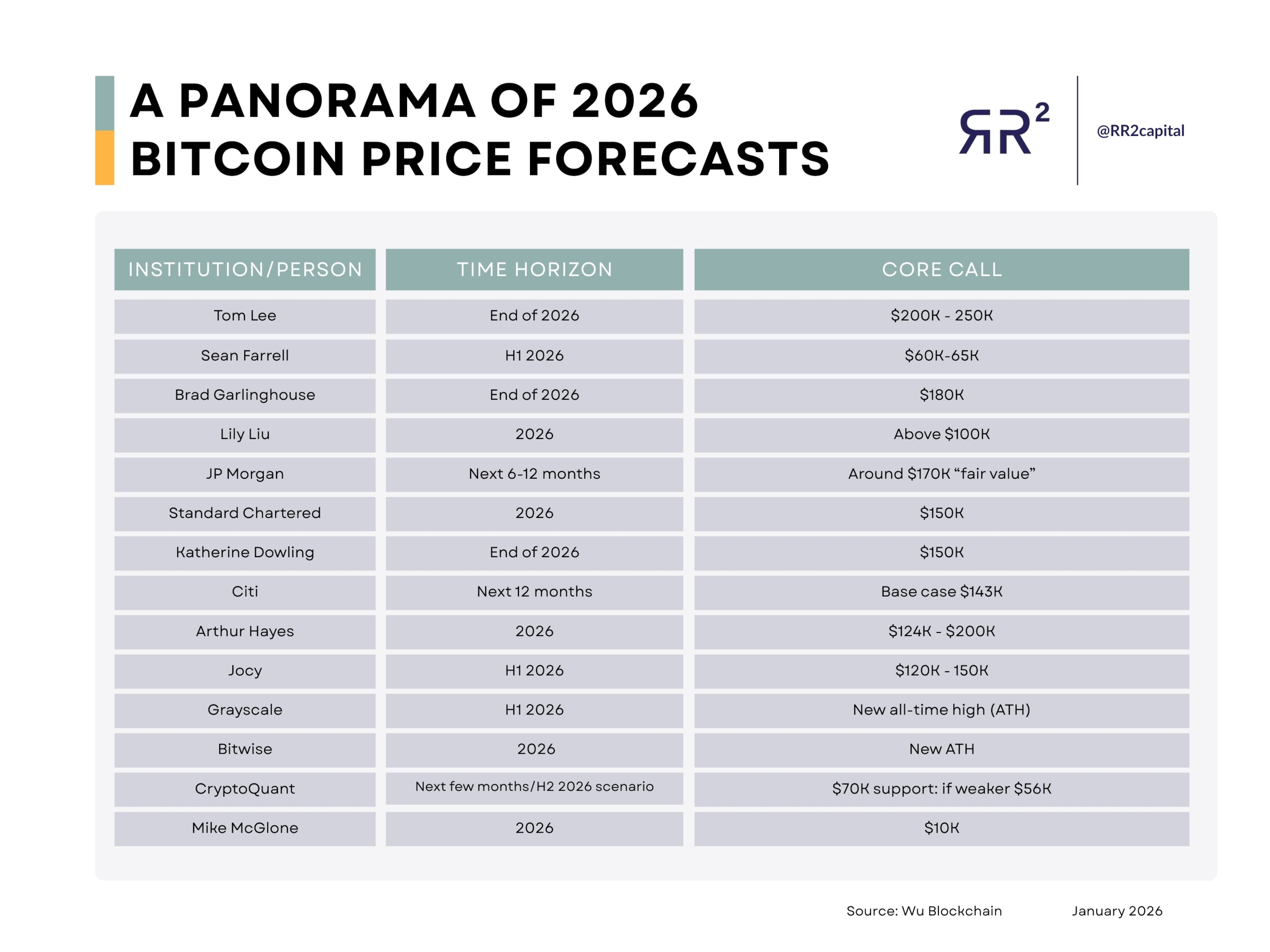

- The Bitcoin 2026 price forecast points to a base case where BTC challenges but may not sustainably hold above its prior all time high of approximately $126,000 until late 2026, with most serious projections clustering between $120,000 and $170,000 depending on ETF flows, macro conditions, and regulatory clarity.

- BTC enters 2026 trading in the $90,000–$95,000 range after a sharp 30%+ correction from its 2025 peak, setting up a potential recovery phase with early-year ROI projections around 16.5% if historical patterns hold.

- Expected 2026 trading ranges span from downside risk toward $60,000–$70,000 in a severe correction, a base case consolidation band of $80,000–$130,000, and upside targets of $150,000–$200,000 in a strong bull scenario driven by institutional demand and favorable macro conditions.

- Four key drivers will determine whether BTC prints new all time high levels in 2026: institutional and ETF flows, the Federal Reserve’s interest rate cycle and inflation trajectory, progress on regulatory clarity such as the Clarity Act, and crypto market liquidity combined with derivatives positioning.

- High volatility remains a defining characteristic of bitcoin—any 2026 price forecast is probabilistic, not guaranteed, and investors should treat specific price targets as scenarios rather than certainties.

Bitcoin’s Starting Point in 2026: Where BTC Stands Now

As we enter 2026, bitcoin trades in the $90,000–$95,000 range with a market cap hovering near $1.8–$1.9 trillion. This starting point is critical for framing the “Bitcoin 2026 price forecast” question because BTC enters the year significantly below its 2025 peak, yet well above levels that would signal a prolonged bear market.

The current price context reflects a market catching its breath after a turbulent end to 2025. Here’s where things stand:

- YTD performance: BTC has gained approximately 5–10% since January 1, 2026, with early trading days showing momentum toward $100,000

- 2025 peak reference: The last major all time high was established around $120,000–$126,000 in 2025 before the sharp correction

- Recent volatility: The 7-day change shows BTC bouncing between $85,000 and $95,000, while the 30-day picture remains choppy

- Circulating supply: Approximately 19.9–20 million BTC are now in circulation, approaching the 21 million hard cap

- Comparison to altcoins: Ether and large-cap altcoins have seen similar percentage swings, though BTC continues to dominate market cap share

Several factors have driven the early-2026 move higher. The fading of December tax-loss selling removed significant sell pressure, while renewed risk appetite in stocks—particularly tech equities—has lifted sentiment across digital assets. Geopolitical tensions in early 2026 have also triggered safe-haven flows, with some investors treating BTC similarly to hard assets like gold.

Bitcoin remains closely correlated to broader risk assets and tech indices, which means the path to new highs depends heavily on whether Wall Street continues its risk-on posture or pivots toward caution.

Will Bitcoin Hit a New All‑Time High in 2026? Base, Bull, and Bear Scenarios

The central question driving every bitcoin price prediction for 2026 is straightforward: can BTC break above its prior $126,000 peak? The base case suggests BTC will make one or more attempts at new all time high levels, potentially reaching $135,000–$150,000 at some point in 2026, but with significant risk of sharp pullbacks that could erase gains quickly.

Bear Case 2026: In a severe downturn scenario, bitcoin could retest the $50,000–$70,000 range. This would require multiple simultaneous shocks—a sharp U.S. recession forcing aggressive rate hikes rather than cuts, major regulatory crackdowns on spot ETFs, or a significant exchange failure that triggers a cascade of liquidations. Elliott Wave analysis from technical analysts points to corrective support zones at $84,000, $70,000, and $58,000 where prior cycles found floors. The bearish case isn’t the base expectation, but it represents real tail risk that investors should acknowledge. High volatility cuts both ways.

Base Case 2026: The most likely scenario involves a 2026 trading corridor of roughly $80,000–$130,000, with one or more attempts at new all time high levels toward the mid-$130,000s. This path assumes steady but not euphoric ETF inflows, gradually improving macro conditions with continued rate cuts, and partial progress on U.S. regulatory clarity including the Clarity Act. Changelly’s algorithmic forecast aligns with this view, projecting minimum prices around $130,516 and maximum around $153,147 for 2026, with monthly progressions showing steady upward momentum throughout the year.

Bull Case 2026: In an optimistic scenario, bitcoin surges to $150,000–$200,000, decisively surpassing prior all time high levels. This aligns with aggressive analyst targets like Fundstrat’s $400,000+ projection and JPMorgan’s volatility-adjusted gold model pointing to $170,000 if bitcoin sustains commodity-like capital attraction. The bull case requires strong institutional demand, potentially a major corporate treasury allocation from an S&P 500 company, and geopolitical safe-haven flows that position BTC as digital gold. Tom Lee and other prominent analysts expect bitcoin to benefit from this dynamic.

These scenarios are not promises. Position sizing and risk management matter far more than any single price target. Traders and investors should prepare for all three outcomes rather than betting everything on euphoria.

Macro Backdrop: Rates, Inflation, and Bitcoin’s Role as a Risk/Haven Asset

Any serious Bitcoin 2026 price forecast must account for the global macro environment—especially interest rates, inflation trajectories, and how BTC trades versus traditional havens like gold. The interplay between these factors will heavily influence whether bitcoin reaches new highs or consolidates.

Key macro considerations for 2026 include:

- Federal Reserve policy path: The late-2025 to 2026 trajectory appears to be moving from peak rates toward tentative rate cuts. Historically, easier monetary policy supports bitcoin by increasing liquidity and lowering the opportunity cost of holding non-yielding assets like BTC. As major central banks near the end of tightening cycles, risk assets including crypto tend to benefit.

- Disinflation effects: Cooling energy prices and easing inflation can paradoxically help bitcoin by lowering real yields and restoring growth optimism. When inflation concerns subside, investors often rotate back into growth-oriented assets including digital currencies.

- BTC’s dual identity: Bitcoin in 2026 functions as both a high-beta risk asset correlated with tech stocks and a quasi-safe-haven during geopolitical shocks. This mix complicates forecasts because BTC can rally on risk-on sentiment or on flight-to-safety flows depending on the narrative of the moment.

- U.S. fiscal concerns: Potential government shutdown risks, debt-ceiling drama, or widening deficits could increase demand for hard assets like bitcoin and gold as hedges against fiscal instability.

- Global currency dynamics: Dollar strength or weakness significantly impacts bitcoin’s trajectory. In countries facing currency depreciation, the narrative around BTC as a hedge gains traction, potentially driving global demand.

The macro picture in 2026 supports a cautiously bullish outlook, but surprises—whether from inflation rebounds, growth scares, or unexpected rate hikes—could quickly shift market sentiment from optimism to caution.

Institutional Adoption, Spot ETFs, and Derivatives Positioning

The year 2026 is likely to be dominated by institutional flows, especially through U.S. and non-U.S. spot ETFs. These financial products have transformed how institutions access bitcoin, but they also introduce new market dynamics that can amplify both rallies and crashes.

ETF flows as the baseline bid: Spot ETFs create consistent demand for bitcoin as asset managers must purchase BTC to back shares. Early 2026 has seen strong net inflows, with some estimates pointing to over $1 billion entering in the first trading days of January. However, this demand can reverse abruptly during de-risking phases—the late-2025 correction saw massive ETF outflows contribute to the $1.2 trillion crypto market wipeout. When passive funds withdraw capital simultaneously, price stability evaporates.

Positive institutional signals continue to emerge:

- Pension funds and sovereign wealth funds have begun modestly increasing BTC exposure via ETFs or custodial products

- Digital asset treasury companies are accumulating bitcoin as a balance sheet strategy, following the playbook established by Michael Saylor and Strategy (formerly MicroStrategy)

- The possibility of a marquee S&P 500 company announcing a major BTC allocation could act as a powerful sentiment catalyst, encouraging other crypto firms to follow suit

Derivatives positioning matters: Elevated open interest in BTC options and futures heading into 2026 reveals how traders are positioned. Call options concentrate near strikes like $100,000, $125,000, and $150,000—visible bets on new highs. Skew and funding rates can signal either over-leveraged euphoria or cautious positioning. When everyone crowds into similar trades, the risk of sharp reversals increases as leverage liquidations cascade.

Compared to earlier cycles like 2020–2021, the market has matured significantly. Institutions now represent a larger share of flows, reducing some retail-driven crash dynamics. However, crowding and herd behavior remain concerns. Sustained, diversified institutional demand represents one of the clearest paths for BTC to print and hold new all time high levels this year.

Liquidity, Market Structure, and the Risk of Sharp Moves

Despite a growing market cap approaching $2 trillion, bitcoin in 2026 can still be surprisingly illiquid. This makes the path to (or away from) new all time high levels jagged rather than smooth.

Evidence of thin liquidity persists at the start of 2026. Spot volumes on major exchanges remain lower than during prior peaks, and order books show significant gaps at key price levels. This fragility exists despite more regulated financial products being available—capital is now fragmented across exchanges, OTC desks, and ETFs rather than concentrated.

Key liquidity dynamics to understand:

- Magnified impact of large orders: Thin liquidity means large buy or sell orders create sharp wicks—rapid moves above $100,000 or below key support levels that don’t sustain

- Interplay between spot, ETFs, and derivatives: Options gamma squeezes can push BTC quickly toward psychological levels like $100,000, $120,000, or $150,000, while delta hedging by market makers amplifies moves

- Crowded position risk: When everyone is long through call options, sentiment can flip rapidly into long liquidations, sending price toward $70,000–$80,000 before buyers step in

On-chain liquidity proxies offer additional insight:

- The percentage of BTC supply held by long-term holders versus active traders indicates how much readily available supply exists

- Coins sitting on exchanges versus in cold storage reveals immediate selling pressure potential

- Inelastic supply from committed holders can fuel violent moves once demand surges

Even if a new all time high is fundamentally justified in 2026, market-structure fragility means the journey will likely involve extreme volatility and multiple 20–30% pullbacks. Investors should prepare for this reality rather than expecting smooth upward price action.

Technical Outlook for 2026: Trends, Moving Averages, and Key Levels

While fundamentals drive long-term value, many traders frame their 2026 bitcoin price forecast around technical indicators. Moving averages, trendlines, and support/resistance zones provide frameworks for timing entries and exits.

Short-term view (4-hour timeframe): Rising short-term moving averages signal early-January bullish momentum in 2026. Intraday traders watch levels like $90,000 as support and $100,000 as psychological resistance for quick trades. Momentum indicators suggest buyers remain in control on shorter timeframes, though conditions can shift rapidly.

Daily/medium-term view: The picture becomes mixed on daily charts. BTC may trade above a flattening 200-day moving average, suggesting consolidation rather than a straight line to new all time high levels. Divergences between price action and momentum oscillators warrant caution. This timeframe often shows the battle between bullish sentiment from post-halving dynamics and bearish concerns about the 2025 correction extending.

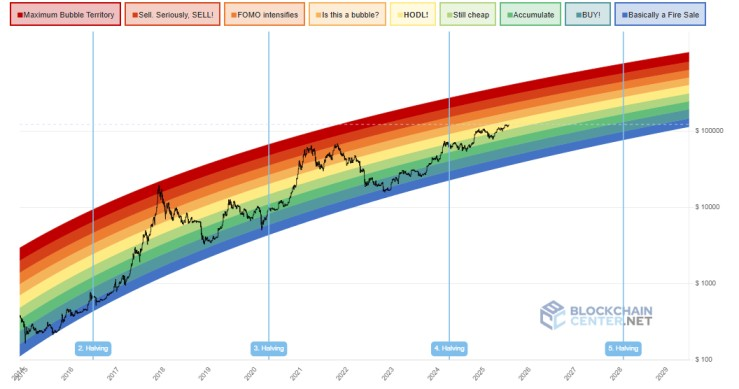

Weekly/long-term view: Weekly moving averages—particularly the 50-week and 200-week—still point to a broader uptrend since mid-2025. Key long-term support zones cluster around $60,000–$70,000, areas where prior cycles found buying interest. Resistance bands include the prior all time high zone around $120,000–$126,000, with Fibonacci extensions suggesting $150,000–$170,000 as potential targets if that resistance breaks decisively.

Technical analysis can flip quickly in crypto markets. These indicators work best when combined with macro and flow data rather than used in isolation. A bullish technical setup means nothing if ETF outflows accelerate or regulatory shocks emerge.

Regulation, Policy Shifts, and the Clarity Act’s Impact on 2026 Prices

The regulatory landscape in 2026—especially in the U.S., EU, and key Asian markets—remains one of the largest swing factors for whether bitcoin confidently makes new highs. Clarity creates confidence; uncertainty breeds caution.

U.S. regulatory developments: The potential passage of comprehensive digital-asset legislation like the Clarity Act could unlock significant institutional participation. Clearer rules around securities versus commodities treatment would reduce legal risk for institutions, encouraging larger allocations. Progress on this front represents a potential catalyst that analysts expect could drive substantial price appreciation.

Administration policy shifts: A more pro-bitcoin stance from U.S. policymakers—including easier inclusion in retirement plans, clearer tax guidance, and reduced regulatory friction—would lower barriers for mainstream adoption. Such shifts could encourage more companies to add bitcoin to treasury reserves.

Potential negative developments to monitor:

- Stricter AML/KYC requirements or aggressive stablecoin rules could inadvertently hurt BTC liquidity and sentiment

- SEC enforcement actions against crypto firms or exchange restrictions would create uncertainty

- International developments—Japan, EU, or emerging markets adjusting taxation or licensing—could influence global demand in either direction

Regulatory headlines historically move bitcoin sharply in both directions. The year 2026 could feature pivotal decisions that swing price forecasts from the $50,000s to well above $125,000 depending on outcomes.

The balanced view: regulation is both a risk and an opportunity. The same clarity that scares away speculative excess can legitimize bitcoin as a mainstream asset, improving the odds of durable all time high levels later in the decade.

Long‑Term Context: How 2026 Fits into the Bigger Bitcoin Cycle

The year 2026 exists within Bitcoin’s broader multi-year halving and adoption cycles. Understanding this context helps frame whether current price action represents opportunity or warning.

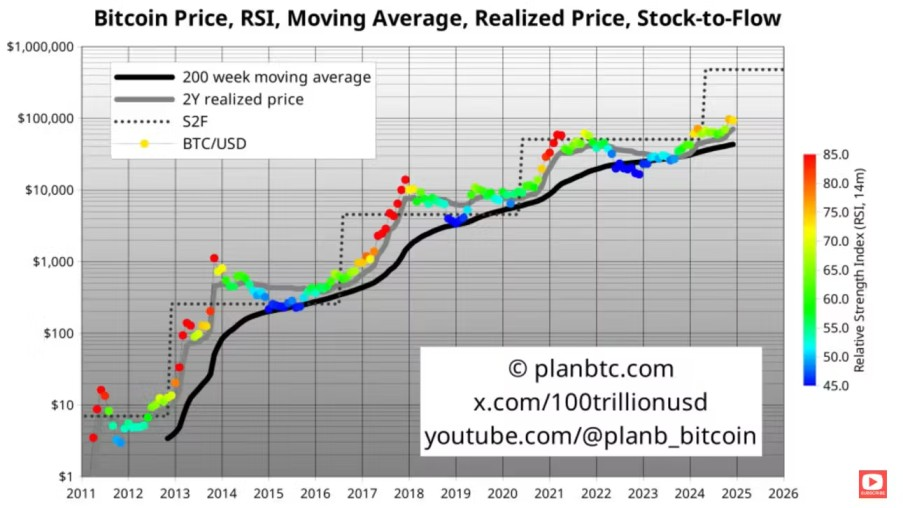

Historical price evolution: Bitcoin has progressed from near zero in 2010 through major cycle tops—2013, 2017, 2021, and 2025—with significant corrections between each peak. Crucially, each new cycle has eventually produced higher highs and higher lows. The four year cycle tied to halving events remains a dominant pattern.

Post-halving dynamics: The 2024 halving reduced miner rewards by half, constraining new supply. Historically, the 12–24 months following halving events show strong but volatile price action. The year 2026 sits in this favorable post-halving period, though the 2025 peak-then-crash pattern adds complexity to standard cycle expectations.

Notable long-term forecasts from research firms and analysts:

| Timeframe | Price Target Range | Assumptions |

|---|---|---|

| 2026 | $120,000–$170,000 | Base case with steady ETF flows |

| 2027–2028 | $150,000–$250,000 | Continued institutional adoption |

| 2030 | $500,000–$1,000,000 | Aggressive bull case, major macro shifts |

These projections carry substantial uncertainty and depend on macro, technological, and regulatory factors that remain unpredictable over such horizons.

Long-term ROI models from various analysts project substantial cumulative upside over decades, though with immense interim drawdowns that test investor conviction. Whether or not BTC makes a new all time high in 2026, the more important question for long-term investors remains their time horizon, risk tolerance, and conviction in Bitcoin’s role as digital sound money or a macro hedge.

Is Bitcoin a Good Investment in 2026? Risk, Reward, and Strategy

The price-forecast discussion ultimately connects to practical decisions—whether to buy, hold, or reduce BTC exposure in 2026. Understanding risk matters as much as identifying upside.

Volatility and drawdown reality: Bitcoin has experienced multiple 50%+ crashes in past cycles. Even a bullish 2026 forecast doesn’t eliminate the possibility of a 30–40% drawdown occurring before any new all time high. This high volatility makes BTC unsuitable for investors who cannot stomach watching their portfolio value cut in half temporarily.

Relative risk positioning: BTC is generally less risky than most altcoins but far more volatile than stocks, bonds, or gold. Treating bitcoin as a small allocation within a diversified portfolio—rather than a concentrated bet—reflects this risk reality.

Practical investment strategy considerations:

- Position sizing: Many advisors suggest limiting crypto exposure to a small percentage of net worth that you can afford to lose entirely

- Dollar-cost averaging: Regular purchases over time reduce the risk of buying at a local peak versus lump-sum investing

- Time horizon: Multi-year holding periods historically reward patience; trading around headlines often underperforms

- Stress testing: Use profit calculators to model scenarios (“What if BTC hits $125,000?” or “What if it falls to $60,000?”), treating these as illustrations rather than guarantees

Before committing capital, conduct your own research. Understand local regulations and tax implications. Consider whether your personal finances and psychology can handle large swings without panic selling at lows.

Bitcoin can be a compelling high-upside asset in 2026, but it remains unsuitable for investors who cannot tolerate extreme volatility or potential multi-year downturns. The possibility of substantial gains comes packaged with meaningful risk of substantial losses.

FAQ: Bitcoin 2026 Price Forecast and Beyond

Can Bitcoin crash back to $20,000–$30,000 in 2026?

While such an extreme drawdown isn’t the base case, it’s not impossible. A combination of simultaneous shocks—global recession, aggressive regulatory crackdowns including ETF bans, major exchange failures, or complete risk-off sentiment in equities—could theoretically push bitcoin toward those levels. Historical data shows 80%+ drawdowns have occurred in previous cycles. Tail risks exist in crypto, and prudent investors acknowledge this possibility even if they assign it low probability.

How much could $1,000 invested in Bitcoin today be worth if BTC hits $150,000 in 2026?

With bitcoin trading around $93,000–$95,000 in early 2026, reaching $150,000 would represent approximately a 58–61% gain. A $1,000 investment would grow to roughly $1,580–$1,610 in this scenario. This is purely hypothetical and assumes perfect execution without fees. Actual returns would vary based on entry point, exchange fees, and whether the rise is sustained or temporary.

Is it better to wait for a dip or buy Bitcoin now in 2026?

Timing the market consistently is extremely difficult, even for professional traders. Dollar-cost averaging—investing fixed amounts at regular intervals—reduces the emotional burden of trying to identify perfect entry points. If you have a multi-year time horizon and believe in bitcoin’s long-term value proposition, waiting for a dip that may never come carries its own opportunity cost. Match your strategy to your risk tolerance and conviction level.

What are the biggest non-price risks for Bitcoin in 2026?

Beyond price volatility, investors face several structural risks: regulatory clampdowns that restrict trading or custody options; large exchange or stablecoin failures that freeze assets or trigger contagion; major protocol or security issues (though bitcoin’s network has proven resilient); and environmental or political backlash that prompts institutional divestment. These concerns deserve attention alongside any price-focused bitcoin price prediction.

Will Bitcoin still be relevant in 10 years if it doesn’t hit a new ATH in 2026?

One year’s performance doesn’t determine long-term viability. Bitcoin’s relevance over the coming decade depends on continued network security, growing adoption as a store of value or payment method, regulatory acceptance, and its role in the broader financial system. Even if 2026 proves disappointing for price action, the fundamental thesis—scarce digital money with fixed supply—remains intact. Long-term investors focused on other things beyond short-term gains may find temporary underperformance irrelevant to their decade-long thesis.