Beyond Bitcoin: 7 Real World Asset Tokens Poised to Outpace the Next Bull Run

Looking to invest beyond Bitcoin? This article highlights “beyond bitcoin 7 real world asset tokens poised to outpace the next bull run.” We cover tokenized real estate, gold-backed tokens, and other innovative assets that promise growth and diversification. Learn which tokens could be the top performers in the coming market surge.

Key Takeaways

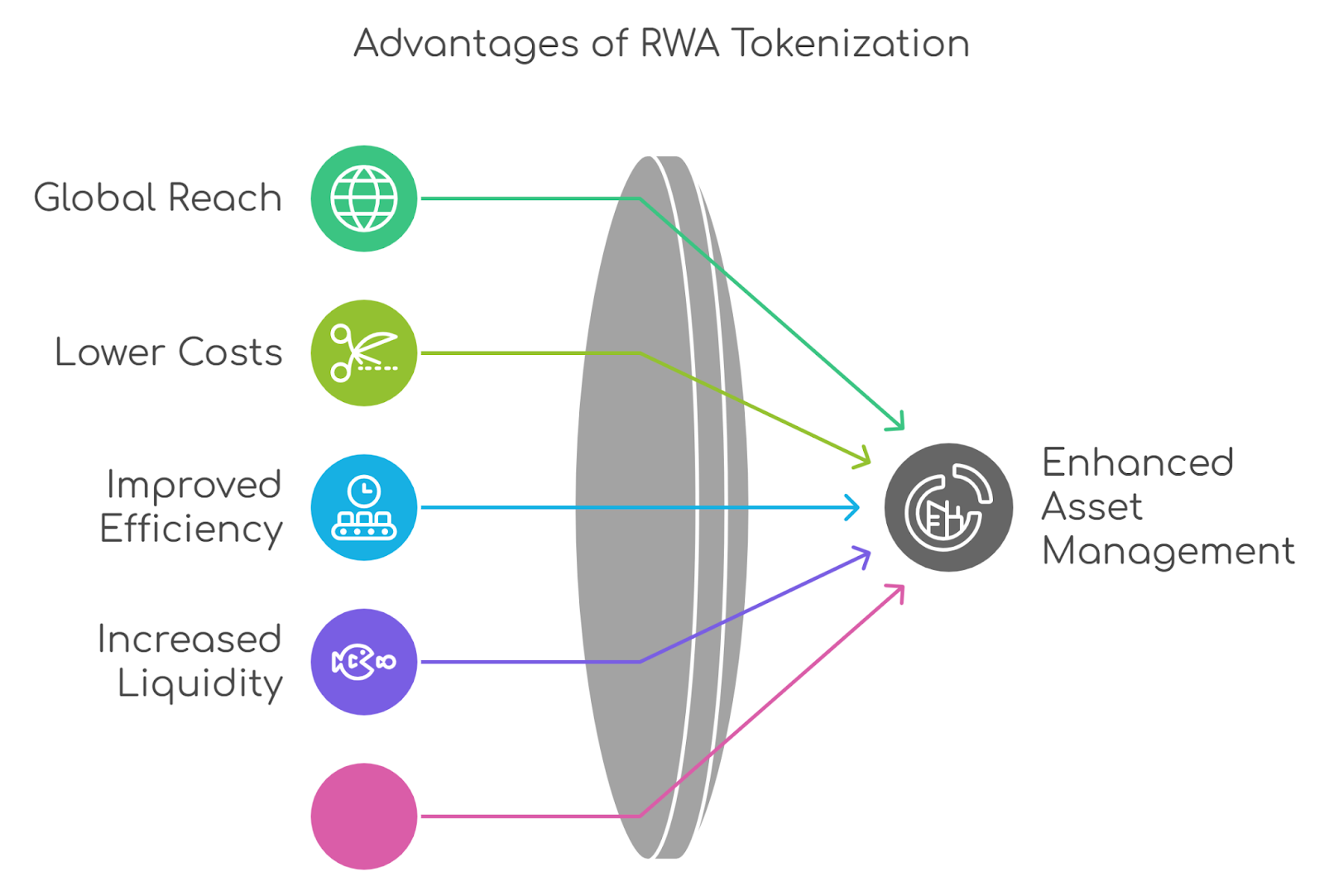

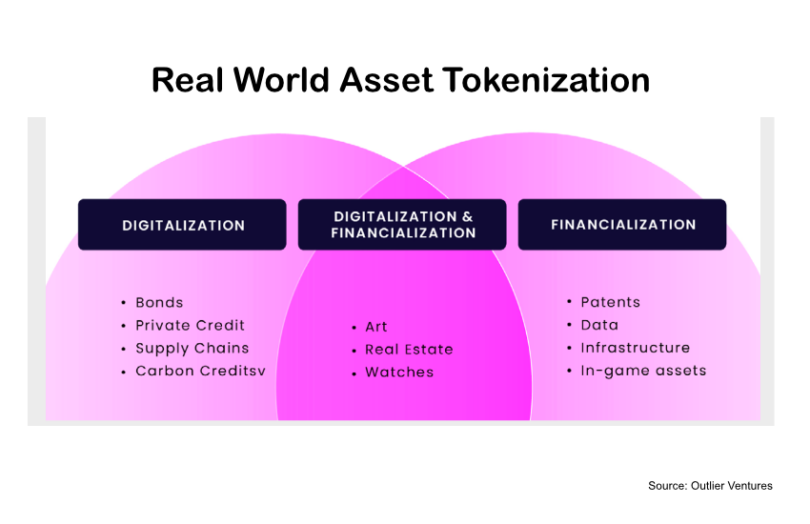

- Tokenized real estate is democratizing property investment by lowering entry barriers, enhancing liquidity, and utilizing blockchain for transparency, despite facing regulatory challenges.

- Gold-backed tokens provide a modern investment approach with fractional ownership, transparency, and liquidity, appealing to both retail and institutional investors amid economic uncertainty.

- Tokenization across various asset classes, including art, commodities, and intellectual property, offers high potential returns, enhances liquidity, and ensures security through blockchain technology, signaling significant market growth ahead.

Tokenizing Real Estate: The Future of Property Investment

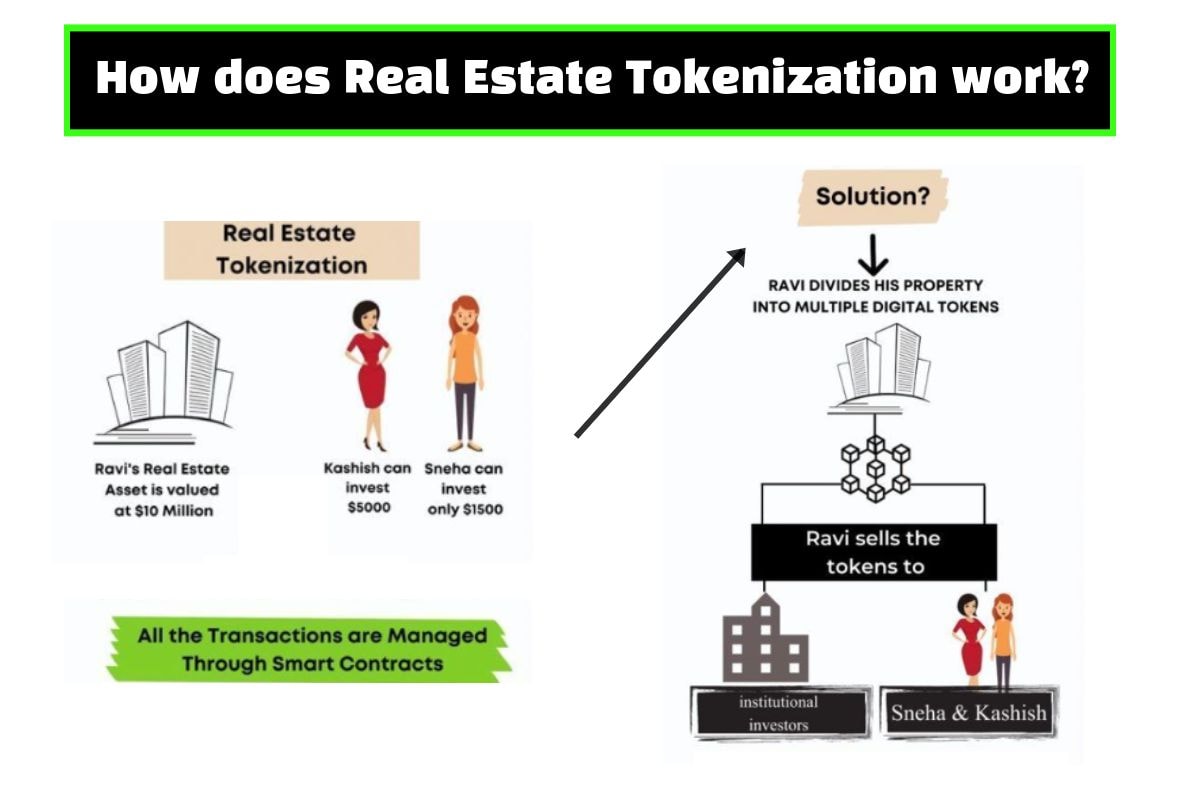

Real estate has always been one of the most coveted and stable forms of investment. However, the high entry barriers and lack of liquidity have often deterred retail investors from participating. Enter the world of tokenized real estate, where blockchain technology transforms physical properties into digital tokens, allowing multiple investors to buy shares in high-value properties, including real world asset opportunities.

Tokenized real estate lowers entry barriers, enabling individuals to invest smaller amounts compared to traditional methods. This democratization of property investment is not just a buzzword; it’s a reality that is increasing investor interest and driving the market forward. Moreover, these tokenized assets can be easily bought and sold on blockchain platforms, significantly enhancing liquidity.

Blockchain technology ensures transparent and secure transactions by maintaining an immutable record of ownership for tokenized assets. This transparency and security are attracting major players and increasing demand in the real estate market. Projects like Propbase and Blocksquare are prime examples of how tokenization is making real estate investment more accessible and efficient.

However, it’s not all smooth sailing. Investors need to navigate regulatory uncertainties as laws for blockchain-based assets differ significantly across jurisdictions. Market volatility and price volatility can also affect the value of tokenized properties, necessitating investor education to manage risks effectively. Despite these challenges, the potential benefits far outweigh the risks.

Smart contracts play a crucial role in this ecosystem by automating the distribution of rental income to token holders, enhancing operational efficiency on a smart contract platform. This automation not only simplifies the process but also ensures timely and accurate payments, making it an attractive proposition for investors seeking steady income streams and staking rewards.

Tokenized real estate also offers diversification opportunities. Instead of putting all your eggs in one basket, you can spread your investment across multiple properties, reducing the risks associated with investing in a single asset. This diversification is particularly appealing in emerging markets where real estate can be a volatile investment.

As we move into early 2025, the tokenized real estate market is poised for significant growth. With increased demand and growing investor interest, this sector is set to capture a larger market share. The future of property investment lies in the blockchain, and those who embrace this technology early stand to gain the most.

Gold-Backed Tokens: Digital Gold for Modern Investors

In times of economic uncertainty, gold has always been a go-to asset for investors seeking stability. Now, with the advent of gold-backed tokens, this age-old asset is getting a modern twist. Gold-backed tokens are digital assets linked to physical gold reserves, providing inherent value stability.

These tokens leverage the stability of gold to offer a reliable value that can counter inflation, making them particularly attractive during economic downturns. Utilizing blockchain technology, gold-backed tokens provide enhanced transparency and security through public ledgers and regular audits of gold reserves. This level of transparency boosts market confidence and attracts a broad range of investors, from retail investors to major banks.

One of the significant advantages of gold-backed tokens is fractional ownership. Tokenization allows for smaller investors who previously couldn’t participate in gold markets to now own a piece of this precious metal. This democratization is driving high demand and expanding the market share of gold-backed tokens in the broader cryptocurrency market.

These tokens can be continuously traded on digital exchanges, offering greater liquidity compared to traditional gold investments. The ease of trading and the security provided by blockchain technology make gold-backed tokens an appealing choice for investors looking to hedge against market volatility and diversify their portfolios, including those interested in hedge funds.

The crypto industry has shown renewed interest in these digital assets, with the rise of crypto ETFs and bitcoin ETFs paving the way for more gold-backed tokens to enter the market. As the regulatory news continues to evolve, the acceptance of these tokens is likely to grow, further integrating them into the mainstream financial system, including central bank digital currencies. Recently, bitcoin rose, highlighting the increasing demand for these innovative financial products, especially during a bull run. Additionally, ETF approvals are expected to play a significant role in this evolving landscape.

In a world where bitcoin’s dominance often overshadows other digital assets, gold-backed tokens stand out as a unique blend of traditional and modern investment strategies. They offer the best of both worlds: the time-tested stability of gold and the innovative technology of blockchain. As we look to the future, these tokens are set to play a significant role in the next bull market.

Art and Collectibles: Tokenizing Tangible Assets

The art world has always been a playground for the wealthy, but tokenization is changing the game. Key points include:

- Significant investments in fractionalized art NFTs, such as a $50 million backing from Andreessen Horowitz, indicate rising institutional interest in tokenized art.

- Platforms like Masterworks have already tokenized over $800 million in artwork, enabling everyday investors to own parts of iconic pieces.

- This democratization of art investment is attracting a diverse range of investors, from retail to institutional, and driving the market forward.

- The total value of tokenized assets in the art sector is expected to grow significantly, with forecasts suggesting the market will rise from USD 3.32 billion in 2024 to USD 12.83 billion by 2032.

Tokenization ensures transparency and security through blockchain technology, which permanently records ownership details. This transparency reduces the risk of market manipulation and enhances investor confidence in the digital asset market. Moreover, tokenized art is linked to digital certificates of authenticity, helping to verify the legitimacy of the asset and reducing the risk of forgery.

Major sales in the digital art space, like Beeple’s ‘Everydays—The First 5000 Days’ sold for $69.3 million, illustrate the high value potential of tokenized assets. These sales have gained traction and brought significant attention to the market, highlighting the potential for substantial returns on investment.

Smart contracts play a pivotal role in the tokenization process, automating transactions and ensuring that the terms of sale are met. This automation not only simplifies the process but also provides additional security for investors, making it an appealing proposition for those looking to diversify their portfolios.

While traditional assets like real estate and gold have long been considered safe bets, the tokenization of art and collectibles offers a unique opportunity to invest in a growing asset class with substantial upside potential. As more platforms and major players enter the market, the accessibility and attractiveness of tokenized art will only continue to grow.

The cautious approach of early adopters is giving way to a more confident embrace of this new asset class, driven by the transparency, security, and high returns that tokenized art promises. As we move deeper into 2025, the art and collectibles market is set to become a significant player in the digital asset space.

Commodities on the Blockchain: From Oil to Wheat

The world of commodities is vast and varied, encompassing everything from oil to agricultural products like wheat. Tokenizing these commodities enables the fragmentation of real-world assets into digital tokens, enhancing market liquidity and accessibility for investors.

Each token in a commodity-backed system represents a portion of an actual physical asset, allowing for easier trading of smaller quantities. This fractional ownership:

- Makes it possible for a broader range of investors to participate in commodity markets

- Drives increased demand for these tokens

- Leads to higher open interest in these tokens

Tokenized agricultural products can streamline supply chains and enhance transparency. Recording transactions on blockchain networks makes the entire process more efficient and less prone to errors or fraud. This transparency can potentially lower trading costs and increase market confidence, making it an attractive option for investors in the crypto markets.

The tokenization of energy resources, including oil, facilitates easier management and trading of these commodities. Blockchain technology introduces significant transparency in commodity trading, enabling investors to track ownership and transaction histories. This transparency is a game-changer in the commodities market, providing a level of security and trust that was previously lacking.

Standardization of token formats and transaction protocols is essential for the seamless operation of tokenized commodities across platforms. This standardization ensures that investors can easily trade and manage their assets, further enhancing the liquidity and attractiveness of these tokens.

While tokenization improves liquidity, its effectiveness relies on market depth and active participation from investors. The crypto industry is already showing interest in these digital assets, with major altcoins and blockchain networks facilitating their trading.

However, tokenization carries risks such as cybersecurity threats, which necessitate strong protective measures to safeguard investors’ assets. Additionally, regulatory issues can complicate the market for tokenized commodities, as they may be subject to securities and commodities laws.

Despite these challenges, the potential benefits of tokenizing commodities are significant, offering a new and innovative way to invest in the global demand for these essential resources. As we look to the future, the tokenization of commodities is set to play a crucial role in the cryptocurrency market, offering a unique blend of traditional and digital investment opportunities.

Tokenized Bonds: Bridging Traditional Finance and Crypto

Tokenized bonds are digital representations of traditional bonds that enhance the efficiency of fixed-income investments through blockchain technology. These digital assets offer a new way to bridge the gap between traditional finance and the burgeoning world of cryptocurrency.

The appeal of tokenized bonds lies in their ability to attract both traditional investors and those in the crypto space. By leveraging blockchain networks, these bonds can offer greater transparency, security, and efficiency in transactions, making them an attractive option for a wide range of investors.

The integration of decentralized finance (DeFi) with traditional finance through tokenized bonds is a significant development in bridging defi. Smart contract platforms automate the process of issuing and managing these bonds, reducing the need for intermediaries and lowering transaction costs. This automation also ensures timely interest payments and principal repayments, providing a level of security and reliability that is crucial for fixed-income investments.

Tokenized bonds also offer enhanced liquidity compared to traditional bonds. Traded on digital exchanges, these bonds can be bought and sold more easily, offering investors greater flexibility and access to their funds.

As the total crypto market capitalization continues to grow, the inclusion of tokenized bonds in investment portfolios is likely to increase. With the ongoing developments in regulatory clarity and the growing acceptance of the cryptocurrency market, tokenized bonds are set to become a significant player in the financial landscape, contributing to the overall market cap.

Infrastructure Tokens: Investing in the Backbone of Society

Infrastructure tokens represent a growing sector in the world of digital assets, focusing on essential services such as utilities and transportation. These tokens offer a unique opportunity to invest in the backbone of society, attracting significant institutional interest and capital.

Qubetics is revolutionizing the utilities sector by enabling cross-border tokenized freight invoices and cross border payments, streamlining logistics for companies and enhancing operational efficiency. This innovation is a prime example of how infrastructure tokens can transform traditional industries and provide new investment opportunities.

In the transportation sector, Qubetics runs cross-border tokenized freight invoices, further illustrating the potential for these tokens to improve logistics and reduce costs. The Helium network exemplifies a decentralized network that allows users to operate IoT device connections with minimal upfront investment, highlighting the diverse applications of infrastructure tokens.

The growing institutional demand for these tokens is driving significant investment in the sector. Pension funds, central banks, and other institutional investors are recognizing the potential of infrastructure tokens to provide stable returns and enhance the overall security of their portfolios, attracting institutional inflows.

Institutional adoption of these tokens is also increasing, with more traditional assets being tokenized to attract institutional capital. This trend is set to continue as the financial system evolves and more investors seek out innovative ways to diversify their portfolios.

As we move into the future, infrastructure tokens are set to play a crucial role in the financial landscape, offering a unique blend of traditional and digital investment opportunities.

Intellectual Property Tokens: Monetizing Creativity

Intellectual property (IP) is a cornerstone of the modern economy, contributing a staggering $6.6 trillion annually in the U.S. alone. Tokenizing IP assets can unlock significant value by improving accessibility and allowing for fractional ownership. This innovative approach is reshaping how creativity is monetized and how investors can participate in the lucrative IP market.

The tokenization process involves evaluating the IP asset and ensuring legal compliance, which is critical for maintaining the value and authenticity of these digital assets. Smart contracts play a crucial role in this process, embedding rights and revenue-sharing mechanisms directly into the tokens. This automation ensures that creators receive their fair share of revenue, and investors are assured of their returns.

Royalty tokens provide:

- Rights to a share of future revenue generated by the IP.

- Immediate liquidity for creators.

- Benefits for investors from the ongoing success of the IP.

- Automated royalty payments that ensure real-time distribution to token holders, enhancing efficiency and attractiveness of these investments.

Secondary trading of tokenized IP assets enables liquidity, allowing easier buying and selling of these assets in the market. This liquidity is particularly important for investors looking to diversify their portfolios and manage their risk exposure effectively.

Tokenized IP assets can also unlock new capital streams for innovation by serving as collateral for financing. This potential to attract fresh money is a game-changer for creators and innovators, providing them with the resources needed to develop new ideas and projects.

The future of IP tokenization is expected to enhance how intangible assets are monetized, leading to more structured investment opportunities. As regulatory clarity improves, the market for tokenized IP assets is set to grow, offering legal clarity and a new frontier for investors looking to tap into the creative economy.

Summary

The journey through the world of real-world asset tokens reveals a landscape rich with potential and innovation. From the democratization of property investment through tokenized real estate to the stability of gold-backed tokens, each asset class brings unique benefits and opportunities. The tokenization of art and collectibles opens new avenues for investors, while commodities on the blockchain enhance market liquidity and transparency.

Tokenized bonds bridge the gap between traditional finance and the crypto market, offering enhanced efficiency and liquidity. Infrastructure tokens represent a growing sector that attracts significant institutional investment, and intellectual property tokens unlock new ways to monetize creativity. Each of these asset classes is poised to outpace the next bull run, driven by technological advancements and increasing investor interest.

As we look to the future, the integration of blockchain technology with real-world assets promises to revolutionize the investment landscape. By embracing these innovative digital assets, investors can diversify their portfolios, reduce risks, and tap into new capital streams. The future of investment is here, and it’s beyond Bitcoin.

Frequently Asked Questions

What are the benefits of tokenizing real estate?

Tokenizing real estate lowers entry barriers while increasing liquidity and diversification opportunities. It ensures transparent and secure transactions, making real estate investments more accessible.

How do gold-backed tokens provide stability?

Gold-backed tokens provide stability by being linked to physical gold reserves, which ensures their value remains anchored to the intrinsic worth of gold, effectively countering inflation and fluctuations in the market.

What is the significance of tokenized art and collectibles?

Tokenized art and collectibles are significant because they democratize access to high-value investments while providing transparency and security through blockchain technology. This innovation opens new avenues for both artists and collectors, enhancing the overall investment landscape.

How does the tokenization of commodities enhance market liquidity?

Tokenization enhances market liquidity by breaking down commodities into smaller tradable digital tokens, facilitating easier transactions and attracting a broader range of investors. This increased accessibility leads to a more dynamic and efficient marketplace.

What role do smart contracts play in tokenized IP assets?

Smart contracts enable automated royalty payments and real-time distribution to token holders by embedding rights and revenue-sharing mechanisms directly into the tokens. This innovation streamlines the management of tokenized IP assets, ensuring efficient payments and compliance.