Bitcoin vs Traditional Assets: A Risk-Reward Perspective You Need to Know

How does Bitcoin compare to traditional assets in terms of risk and reward? This article dives into Bitcoin vs traditional assets: a risk-reward perspective. We will compare Bitcoin’s volatility and potential returns with those of stocks, gold, and real estate. Read on to understand which investment might be the better choice for you.

Key Takeaways

- Bitcoin is characterized by high volatility and speculative nature, presenting both significant risks and potential high returns compared to traditional assets.

- Traditional assets like stocks, gold, and real estate offer stability and intrinsic value, which contrast sharply with Bitcoin’s unpredictable behavior.

- Including Bitcoin in an investment portfolio can provide diversification benefits, as it has demonstrated unique correlation patterns and potential resilience during market shocks.

Understanding Bitcoin as an Asset Class

Bitcoin’s market behavior is a fascinating study in contrasts. Key characteristics include:

- Significant speculative nature

- Pronounced price volatility

- Changes in investor sentiment

- Supply capped at 21 million coins, unlike traditional assets

- Constraints on liquidity due to limited supply

This limited supply can amplify price volatility, particularly during market fluctuations, led to higher volatility that can be measured to some extent. It is worth noting that these dynamics in markets can significantly impact investor behavior and sell decisions, causing a rise in certain patterns.

However, the introduction of futures contracts has contributed to greater market efficiency, gradually stabilizing Bitcoin’s volatility over time. This evolution signals a maturing asset class that is slowly finding its footing in the broader financial landscape.

What makes Bitcoin particularly intriguing is its dual nature. On one hand, it exhibits speculative tendencies, drawing comparisons to high-risk investments. On the other hand, it possesses potential safe-haven traits, appealing to investors seeking refuge from traditional market turmoil.

Bitcoin’s supply dynamics further contribute to its perceived value. Unlike traditional securities, Bitcoin’s value is not tied to company performance or physical assets, making it a distinct financial asset in the investment portfolio. As the bitcoin market continues to evolve, understanding these unique characteristics of bitcoin supply is crucial for any investor considering digital assets.

Traditional Assets Overview

Traditional assets have long been the cornerstone of investment portfolios. Stocks, for instance, provide intrinsic value through ownership in a company, offering dividends and voting rights, which starkly contrasts with cryptocurrencies that often lack such backing. This intrinsic value is a key consideration for investors looking for stability and long-term growth in equities.

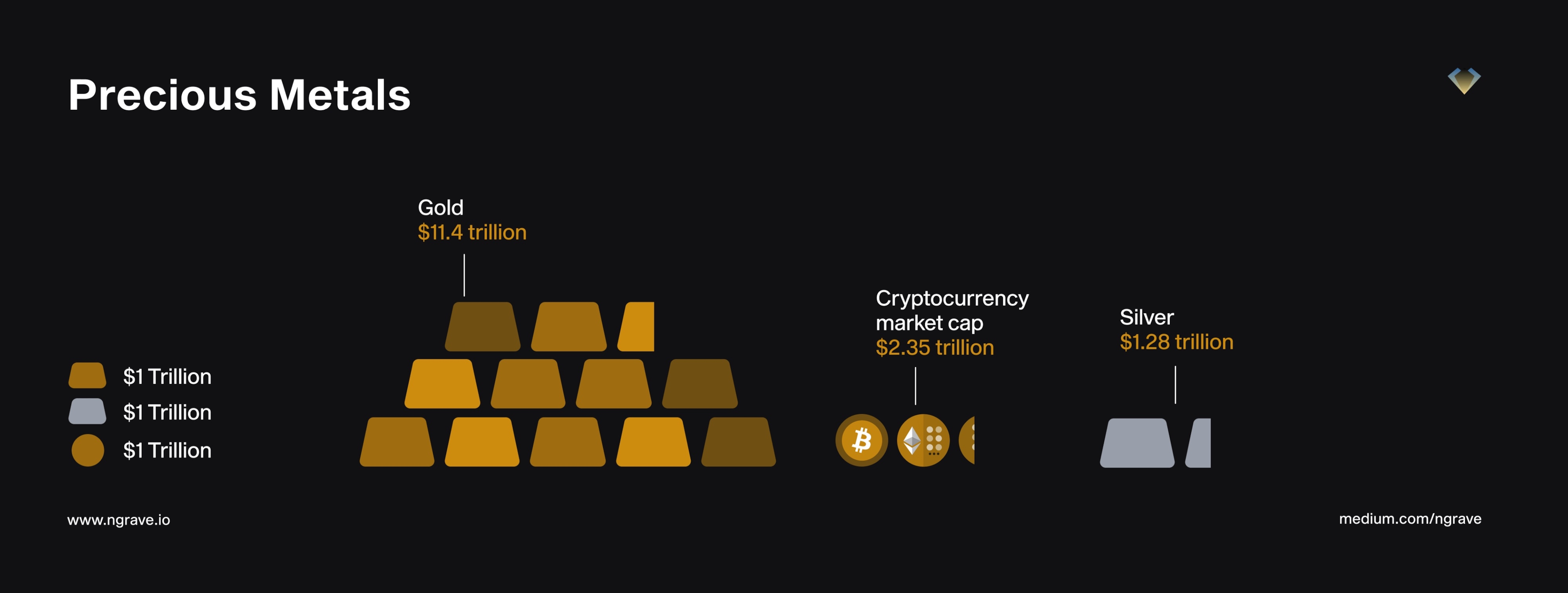

Gold, another traditional asset, has been influenced significantly by central bank purchases. Since 2022, central banks have acquired over 1,000 tonnes of gold annually, underscoring its status as a reliable store of value. The steady demand from central banks has contributed to gold’s relatively stable price performance.

Real estate also stands out as a traditional asset class, favored for its stability and tangible value. With average home prices appreciating approximately 3% each year, real estate offers a dependable, albeit lower, return compared to more volatile assets like Bitcoin. Moreover, established regulations governing real estate investments provide a level of security and predictability that appeals to many investors as the asset class matures.

These traditional asset classes have proven their worth over time, providing a foundation of stability in an investment portfolio. They are governed by well-established regulations, offering a sense of security and predictability that digital assets have yet to fully achieve.

Understanding the characteristics and roles of these traditional assets is essential for any comprehensive analysis of an investment portfolio. As we delve deeper into the risk and reward comparisons, keeping these foundational aspects in mind will help us assess the potential of Bitcoin alongside these established assets.

Risk and Reward Comparison: Bitcoin vs. Stocks

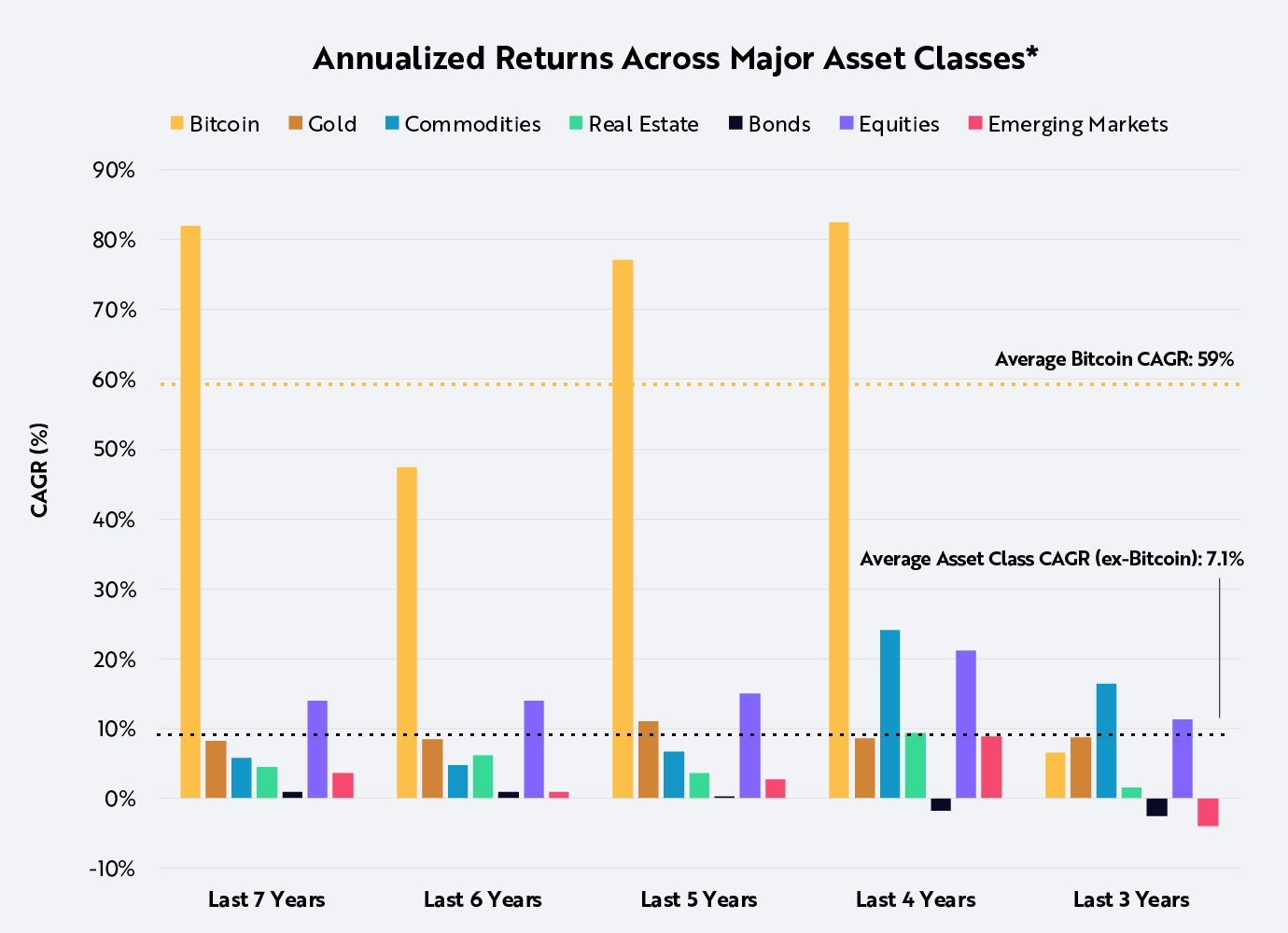

When comparing Bitcoin to stocks, the stark differences in risk and reward become evident:

- Over the last decade, Bitcoin has returned ten times more than the NASDAQ 100, highlighting its potential for higher returns.

- Bitcoin’s annualized return is 230%, far exceeding the 23% return of the NASDAQ 100.

- Bitcoin’s return also surpasses the 14% return of US large caps.

Despite these impressive returns, Bitcoin’s high volatility presents significant risks. With extreme price fluctuations occurring frequently, Bitcoin is significantly more volatile than stocks. This volatility is a double-edged sword, offering the potential for high profits but also substantial losses.

Interestingly, there is a growing interest in Bitcoin among investors, driven by its rapid appreciation. However, investing in the stock market generally carries a lower risk compared to Bitcoin, as stocks are backed by company assets and earnings. This backing provides a cushion against the high volatility that characterizes the Bitcoin market and influences stock prices.

During economic downturns, the perception of stocks often declines as investors seek safer investments like real estate and gold. Bitcoin, on the other hand, tends to react sharply to systemic macroeconomic shocks, leading to significant drawdowns followed by strong recoveries. These dynamics are crucial for investors weighing the risk-reward profiles of Bitcoin and stocks.

Risk and Reward Comparison: Bitcoin vs. Gold

Bitcoin and gold are often compared as alternative investments, each with its unique risk and reward profile. Over the period from 2011 to 2021:

- Bitcoin achieved cumulative gains of over 20,000,000%, vastly outperforming gold.

- Investing $1 in Bitcoin during this timeframe would yield approximately $6.258 million.

- The same investment in gold would only yield $1.69.

Despite Bitcoin’s impressive returns, gold maintains a lower volatility, averaging around 15.5%. This lower volatility makes gold a more stable investment compared to the high risk associated with Bitcoin. However, the volatility ratio between Bitcoin and gold has decreased, reaching 3.6 times at the end of Q1 2025.

Bitcoin also serves as a hedge against the U.S. dollar, particularly during inflationary periods. This characteristic is shared with gold, which has long been viewed as a safe-haven asset. The correlation coefficients between Bitcoin and gold can vary, but both assets offer unique advantages in an investment portfolio.

Risk and Reward Comparison: Bitcoin vs. Real Estate

Real estate has consistently been viewed as the best long-term investment by Americans for 12 consecutive years, with 37% favoring it in recent surveys. This preference is rooted in the stable and tangible value that real estate provides. However, Bitcoin’s potential for high returns presents a compelling alternative.

A typical Bitcoin investment could grow to an ending value of $1,927,664.00 after five years, showcasing its potential for high returns. In contrast, real estate offers more stable but lower returns, with home prices appreciating approximately 3% each year. This stability is attractive to investors seeking lower volatility.

Bitcoin requires significantly lower initial investment costs and has no ongoing maintenance requirements, making it a more accessible option compared to real estate. Additionally, the regulatory landscape for cryptocurrencies remains uncertain, in contrast to the established regulations governing real estate investments.

These differences highlight the unique risk-reward profiles of Bitcoin and real estate, providing investors with diverse options based on their risk tolerance and investment goals.

Diversification Benefits of Including Bitcoin in Your Portfolio

Including Bitcoin in an investment portfolio offers unique diversification benefits. Bitcoin displayed a positive correlation with the S&P 500 in 2017-2018, but a negative correlation in 2019. This varying correlation makes Bitcoin an intriguing asset for diversification strategies.

Bitcoin is only effective as a diversifier for some traditional assets, highlighting its selective correlation characteristics. During market turmoil, Bitcoin has demonstrated a strong safe haven property by being negatively correlated with the returns of other assets.

Bitcoin’s properties include risk diversification, hedging capability, and safe-haven properties, which are crucial for portfolio management. Its high short-term volatility contrasts with its stronger long-term correlation with traditional assets, making it a unique investment option.

The negative correlation of Bitcoin with certain assets allows it to be integrated into diversification strategies for managing portfolio risks. Including Bitcoin can potentially lower the overall volatility of an investment portfolio.

Market Shocks and Bitcoin’s Resilience

Bitcoin’s performance during extreme market shocks reveals its potential resilience. During these periods, Bitcoin tends to correlate positively with risk assets, indicating a sharp increase in risk tolerance among investors.

Price movements in Bitcoin show volatility clustering, indicated by positive coefficients for ARCH and GARCH terms. This clustering highlights Bitcoin’s sensitivity to market sentiment and the dynamics of investor behavior.

Market shocks can result in significant disruptions, and Bitcoin often displays unique responses compared to traditional assets. These responses underline Bitcoin’s potential resilience and its ability to recover quickly from market disruptions.

Overall, Bitcoin’s reaction during market shocks reveals its potential resilience when compared to traditional financial assets. These dynamics can help investors navigate the high volatility and market sentiment associated with Bitcoin.

Future Outlook for Bitcoin and Traditional Assets

The future outlook for Bitcoin and traditional assets offers intriguing possibilities. The expected historical average annual return for the S&P 500 is around 10%, which contrasts sharply with Bitcoin’s potential for much higher returns.

Consumer-facing companies, including social media and telecom firms, may lead the next wave of digital asset adoption through innovative payment solutions. This trend suggests an example of a growing integration of digital assets and data into everyday transactions in the world.

Traditional financial institutions are poised to succeed in the digital asset space by leveraging their established risk management skills and client relationships to establish this integration, which could further legitimize digital assets like Bitcoin in the broader financial market.

During crises, Bitcoin’s perception as a hedge against economic uncertainty has increased, particularly in countries with unstable currencies. Recent events have shown that Bitcoin’s fundamentals are increasingly resilient to industry-specific failures, with investors able to distinguish between centralized risks and Bitcoin’s core value.

The potential role of Bitcoin as a hedge against systemic financial instability is becoming more evident, as demonstrated by the significant price surge following the collapse of Silicon Valley Bank in 2023. This resilience suggests a promising future for Bitcoin in the investment landscape.

Summary

Summarizing the key points, Bitcoin’s potential for high returns and its unique characteristics make it a compelling investment option. However, its high volatility and speculative nature contrast sharply with the stability and intrinsic value of traditional assets like stocks, gold, and real estate.

Investors must weigh these factors carefully when making investment decisions. As the investment landscape continues to evolve, staying informed and understanding the risk-reward dynamics of different asset classes is crucial. Embrace the future of investing by considering a balanced approach that includes both traditional and digital assets.

Frequently Asked Questions

How does Bitcoin’s return compare to traditional assets like stocks?

Bitcoin significantly outperforms traditional assets like stocks, providing returns that are ten times greater than those of the NASDAQ 100 over the last decade. This demonstrates Bitcoin’s potential as a lucrative investment option.

Is Bitcoin more volatile than traditional assets?

Yes, Bitcoin is significantly more volatile than traditional assets such as stocks and gold, often experiencing sharp and frequent price fluctuations.

Can Bitcoin be used as a hedge against inflation?

Yes, Bitcoin can effectively act as a hedge against inflation, especially when the value of the U.S. dollar declines. Its limited supply and decentralized nature appeal to those seeking to preserve wealth.

How does Bitcoin’s regulatory landscape compare to that of traditional assets?

Bitcoin’s regulatory landscape is far less defined than that of traditional assets, which benefit from well-established regulations. This uncertainty creates additional risks for investors in the cryptocurrency space.

What are the diversification benefits of including Bitcoin in an investment portfolio?

Including Bitcoin in your investment portfolio can enhance diversification by providing low correlation with traditional assets, which helps mitigate risk and may serve as an effective hedge against inflation and market volatility. This unique property can strengthen your overall investment strategy.