Building Wealth with Crypto: 3 Strategies That Still Work in This Market

Wondering how to build wealth with crypto in this volatile market? Despite the ups and downs, “building wealth with crypto: 3 strategies that still work in this market” can be effectively utilized today. This article will guide you through practical methods to grow and secure your investments with crypto.

Key Takeaways

- HODLing focuses on long-term growth by holding established cryptocurrencies like Bitcoin and Ethereum despite market volatility, promoting stability and potential high returns.

- Dollar-Cost Averaging (DCA) allows investors to minimize market impact by investing a fixed amount regularly, leading to consistent gains and reduced emotional trading decisions.

- Diversifying a crypto portfolio across established assets, altcoins, stablecoins, and infrastructure projects mitigates risks and enhances potential for overall growth.

HODLing for Long-Term Wealth

HODLing, which originated from a misspelled ‘hold,’ represents a patient investment strategy focused on long haul growth. This approach emphasizes commitment to crypto assets instead of pursuing quick gains. New investors can navigate the inherent volatility of the cryptocurrency markets by focusing on the long-term potential of their holdings instead of short-term fluctuations.

HODLing is particularly effective for established cryptocurrencies like Bitcoin and Ethereum, especially when market fundamentals are favorable. These cryptocurrencies have shown resilience and have a track record of long-term growth. Holding bitcoin onto these investments during volatile periods allows investors to benefit from long-term growth prospects. This strategy also contributes to market stability during downturns, as dedicated holders usually refrain from selling.

However, investors should be aware of the risks associated with HODLing, such as regulatory changes, market crashes, and technological threats. It is crucial to choose cryptocurrencies for HODLing carefully, considering their unique opportunities and asset trust. Projects that have clear goals tend to be more favorable. Active progress enhances a long-term HODLing strategy.

Adopting a HODL mindset helps investors align their hopes with the intrinsic value of their assets, anticipating high returns in the future.

Dollar-Cost Averaging (DCA) for Consistent Gains

Dollar-Cost Averaging (DCA) involves consistently investing a fixed amount at regular intervals, regardless of the asset’s price. This strategy minimizes the impact of market volatility and helps investors avoid emotional decisions by smoothing out the cost basis over time. Committing to invest CHF 625 weekly into Bitcoin for six months exemplifies a practical way to implement DCA.

Consistently investing the same amount helps investors acquire more units of an asset when prices are low, reducing the average cost per asset over time. This approach is particularly beneficial in a volatile market, as it allows investors to benefit from market dips without the stress of trying to time the market perfectly. Over time, this can lead to significant gains and a lower average cost for the investments.

To enhance returns, investors can reinvest any profits to compound their returns. This compounding effect can significantly boost the overall portfolio value over the long term. Dollar-Cost Averaging is a disciplined approach that encourages consistent investing and helps build a well-balanced portfolio, making it a valuable strategy for both new and seasoned investors.

Diversifying Your Crypto Portfolio

Diversification is a critical component of any long-term investment strategy in the crypto market. Spreading investments across multiple assets allows investors to hedge against market risks and capitalize on positive price movements. A well-diversified crypto portfolio should include a mix of:

- Established cryptocurrencies

- Emerging altcoins

- Stablecoins

- Infrastructure projects.

A balanced long-term crypto investment should include a variety of digital assets:

- Established cryptocurrencies, which provide stability and a proven track record

- Meticulously chosen altcoins, offering the potential for higher returns

- Stablecoins, adding a layer of security and used to hedge against volatility

- Infrastructure projects, such as those focusing on blockchain technology, providing exposure to the foundational elements of the crypto space

The principle of diversification lies in balancing investments across different assets to effectively mitigate risks. Holding a diverse portfolio in crypto investments helps to minimize potential losses during times of high volatility and enhances the potential for overall portfolio growth. Diversifying portfolios helps investors create a more resilient investment strategy, capable of withstanding the ups and downs of the cryptocurrency markets.

Conducting Thorough Research and Due Diligence

Thorough research is essential for successful long-term crypto investment. Additionally, due diligence plays a key role in this process. Understanding the technology and fundamentals behind a cryptocurrency is vital for making informed decisions. Key principles to consider include:

- The project’s white paper should clearly outline its objectives.

- The technology behind the cryptocurrency.

- How the project plans to address specific problems.

Key factors to consider when evaluating a cryptocurrency include:

- Tokenomics, including supply and distribution methods, which are crucial for understanding the cryptocurrency’s value dynamics.

- Investigating the development team’s background to assess the project’s credibility and potential for success.

- Examining the community around the cryptocurrency to gain insights into its legitimacy and development progress.

Conducting thorough research is essential for successful navigation in the cryptocurrency market. Staying informed and engaged with the community engagement enables investors to make more informed decisions and better manage risk. This disciplined approach ensures a stronger foundation for long-term investments and helps avoid pitfalls in the dynamic crypto space.

Managing Risk in Crypto Investments

Managing risk is a crucial aspect of any long-term investment strategy in the cryptocurrency market. Investors should define their risk appetite and what they hope to achieve through their investments to set realistic goals, considering their risk tolerance. Understanding market trends is crucial to making educated decisions about entering or exiting positions.

A disciplined approach to investing can prevent emotional decision-making in a volatile market. Developing a structured trading plan is essential for maintaining discipline and reducing emotional influences. Start trading by maintaining a trading journal that helps track emotional responses, aiding in better decision-making for future trades.

Utilizing strategies like DCA can help manage risk but does not ensure profits or prevent losses. Using stop-loss and take-profit orders can help limit losses and secure gains during market fluctuations. Seeking professional investment advice can provide guidance tailored to individual investment needs in crypto.

These strategies collectively contribute to a well-balanced portfolio and help manage the risks involved in crypto investments on a crypto exchange, forming a solid crypto strategy.

Staying Informed About Market Trends

Staying updated with market trends and news is crucial due to the dynamic nature of the crypto market. Awareness of news events related to cryptocurrencies can significantly impact investment decisions. Keeping abreast of regulatory developments is essential for understanding the evolving landscape of the crypto market.

Key considerations for cryptocurrency investment strategies include:

- Continuous monitoring of technological advancements in blockchain and cryptocurrencies to adapt investment strategies.

- Understanding macroeconomic factors to predict trends in the cryptocurrency market.

- Identifying influential thought leaders in cryptocurrency to gain valuable insights into market trends.

By staying informed about market conditions, regulatory changes, and technological developments, investors can make more informed decisions and better manage their crypto investments. This proactive approach helps in navigating the impact of market volatility and capitalizing on potential growth opportunities.

Using Secure Storage Solutions

Secure storage is vital as it protects assets from theft and loss in cryptocurrency investments. Cold storage methods, like a hardware wallet, are recommended for securely storing crypto assets over the long term. Hardware wallets provide an offline method to safeguard private keys, ensuring users maintain full control over their cryptocurrency assets.

Implementing best practices in crypto storage helps reduce risks and ensures the long-term safety of crypto assets. Using secure storage solutions protects investments from potential security breaches, ensuring assets remain safe from unauthorized access.

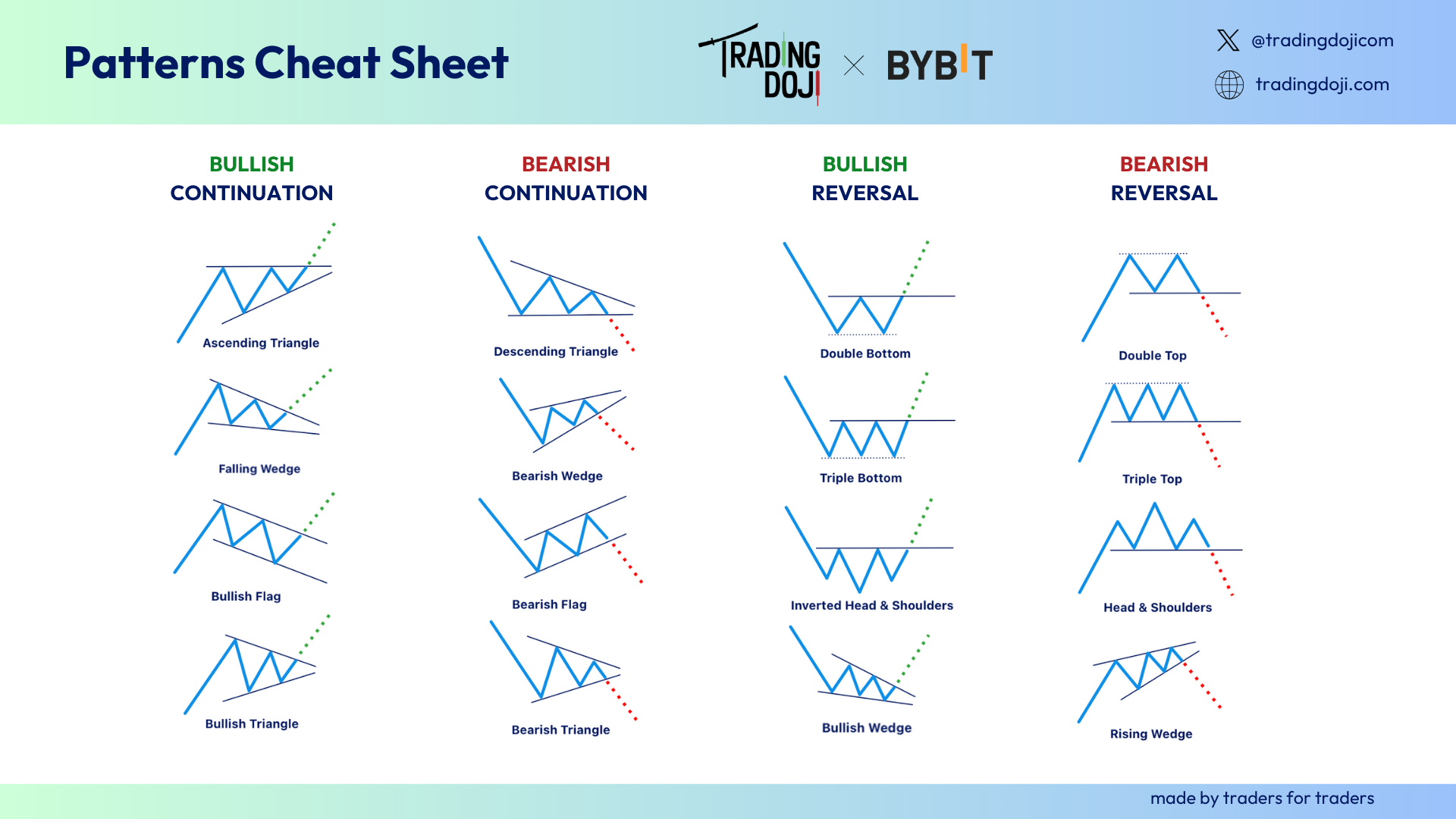

Leveraging Technical Analysis for Better Decisions

Technical analysis is crucial for recognizing potential future performance in crypto markets by examining historical price movements and patterns. Key technical analysis tools include indicators that help traders identify trends, measure volatility, and signal trades based on mathematical calculations of price and volume in crypto trading.

Moving averages, such as simple, exponential, and weighted, are essential for determining trend direction and future price movements. The Relative Strength Index (RSI) assesses price momentum to identify overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) helps traders identify potential buy and sell opportunities by analyzing the convergence of two moving averages.

These technical indicators help traders make informed trades by effectively analyzing market trends and trade dynamics. This approach helps in making more precise and strategic trading decisions, ultimately contributing to better investment outcomes.

Emotional Discipline in Crypto Investing

Emotions like fear and greed can lead to hasty decisions, negatively impacting trading performance. Experienced traders who manage their emotions tend to make more rational decisions and achieve better outcomes. A person acting during heightened emotional states should avoid making trades to prevent impulsive decisions.

HODLing requires emotional control, especially during market downturns, to avoid panic selling. This strategy removes the emotional aspect of investing, encouraging a disciplined approach to asset accumulation. Loss aversion can cause traders to avoid taking necessary risks, impeding their potential for growth.

Engaging in self-reflection can help traders identify and overcome negative personality traits that affect their trading. Emotional discipline is crucial in crypto investing to avoid impulsive decisions based on market fluctuations. Maintaining a disciplined approach helps investors better navigate the emotional rollercoaster of the cryptocurrency markets and achieve long-term success.

Summary

Summarize the key points discussed in the blog post. Reinforce the importance of long-term strategies, thorough research, risk management, and emotional discipline. End with an inspiring note encouraging readers to apply these strategies for successful crypto investing.