Crypto Regulations Are Coming: How to Position Yourself Before It’s Too Late | Expert Insights & Strategies

Crypto regulations are coming; how to position yourself before it’s too late is crucial. With global regulatory bodies implementing new rules, your crypto investments could be at risk if you’re not prepared. This article will help you understand the evolving regulatory landscape, assess your portfolio for compliance, and adopt strategies to secure your assets and investments.

Key Takeaways

- The evolving regulatory landscape, exemplified by the EU’s MiCA regulation, necessitates that investors stay informed to adapt their strategies and enhance market stability.

- Compliance is critical for crypto portfolio management; understanding asset classification, keeping detailed records, and engaging legal advisors are essential to mitigate risks.

- Diversifying investments across various cryptocurrencies and assets is crucial to manage risks and ensure stability, especially in a volatile regulatory environment.

Understanding the Current Regulatory Landscape

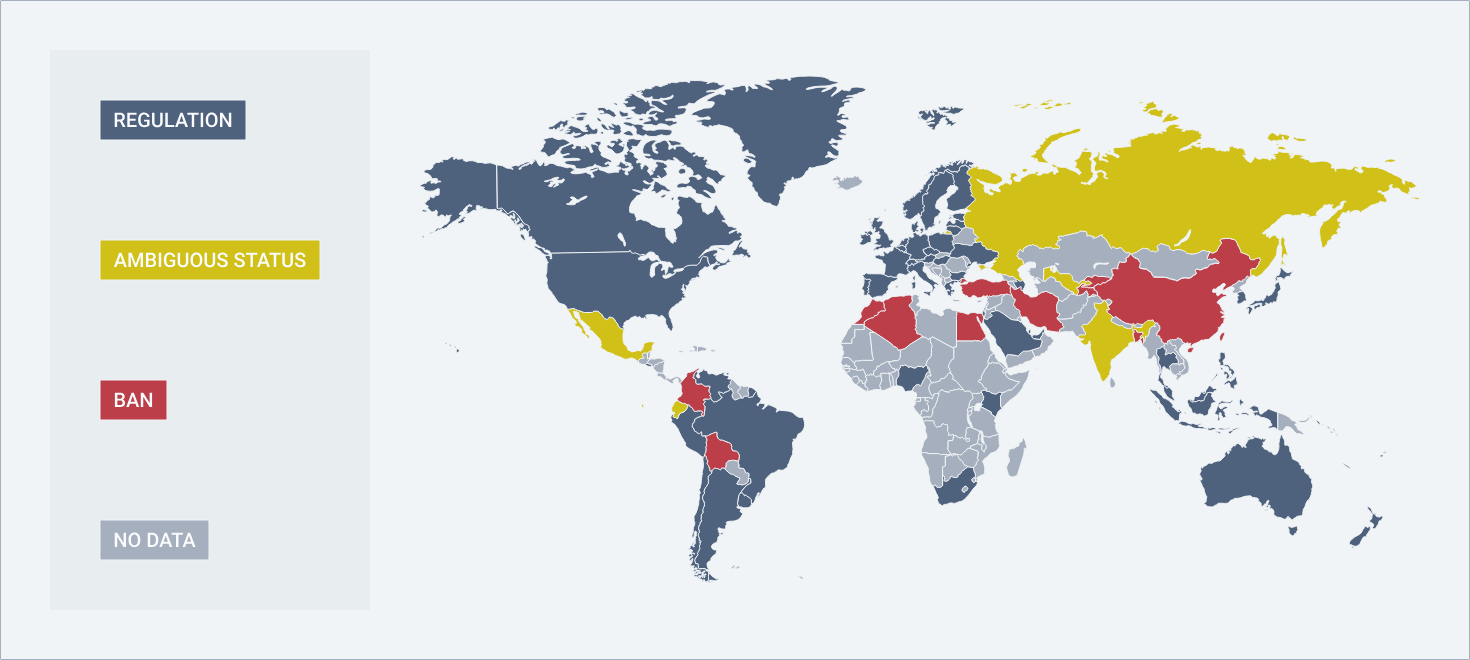

The regulatory landscape for virtual currencies is evolving rapidly, driven by international regulatory bodies like the IMF, which are actively contributing to the development of a regulatory framework worldwide. These frameworks aim to oversee the creation, trading, and taxation of cryptocurrencies, bringing them under similar scrutiny as traditional financial system assets. This shift is crucial for ensuring market stability and protecting investors.

A prime example of this regulatory evolution is the European Union MiCA regulation, enacted in June 2023. MiCA aims to create a comprehensive regulatory structure for cryptocurrencies within EU member states, providing a unified approach to regulation. Such regulations are essential for fostering a secure and transparent market environment.

However, the global approach to cryptocurrency regulation varies significantly. For instance, countries like El Salvador and the Central African Republic have embraced cryptocurrencies as legal tender, showcasing a stark contrast to more conservative regulatory approaches. In the United States, the regulatory landscape is even more fragmented, with different states implementing their own cryptocurrency regulations, leading to a patchwork of laws across the country.

Understanding these diverse regulatory structures is crucial for navigating the crypto market. Staying informed about regulatory news and developments helps you adapt to changes and make better investment decisions.

Assessing Your Crypto Portfolio for Compliance

In the rapidly evolving crypto space, regulatory challenges abound. Differing opinions on asset classification and the integration of crypto regulations into existing frameworks present significant hurdles. One key element in this landscape is the Howey Test, used by the SEC’s jurisdiction to classify crypto assets as securities. Understanding this test and its implications is crucial for managing your crypto portfolio.

Tokens that may be considered securities pose greater legal risks, especially for platforms listing these tokens. Factors such as investment contracts and sales to U.S. investors without proper documentation can result in a token being classified as a security under securities laws. To mitigate these risks, token founders should consider registering the token, decentralizing governance, and working closely with legal teams.

For investors, assessing a project’s compliance is paramount. This involves evaluating the project’s incorporation, obtaining legal advice, and ensuring adaptability to existing laws. Detailed transaction records are vital for compliance and can protect against legal action, especially in cross-border crypto activities.

Maintaining compliance is not just about avoiding legal pitfalls; it’s about ensuring the longevity and success of your crypto investments. Proactively aligning your portfolio with regulatory requirements allows you to navigate the crypto market with greater confidence and security.

Diversifying Investments to Mitigate Risk

In the volatile world of crypto investments, implementing a robust risk management strategy is not just advisable—it’s essential. Diversification is a key component of this strategy, helping to mitigate the impacts of regulatory changes and market volatility. With the crypto market still in its infancy, diversifying your portfolio can reduce exposure to risks and enhance stability.

Relying heavily on Bitcoin, for example, can be risky, especially during periods of regulatory shocks. To lessen these risks and provide a more balanced investment approach, consider:

- Diversifying across various cryptocurrencies.

- Spreading your investments across different assets.

- Investing in crypto in different geographies.

- Allocating funds across various sectors.

These strategies provide better protection against sudden market changes.

For those using a stable coin, diversification is also crucial. Here are some advisable strategies:

- Avoid holding all your capital in one stablecoin, as it is risky.

- Spread investments across multiple stable coins.

- Set stop-loss orders to help manage risks effectively and safeguard against market volatility.

In summary, diversification is not just a strategy; it’s a necessity in the unpredictable crypto market. Spreading your investments helps average the cost and reduce market timing risks, ensuring a more stable and secure investment portfolio.

Staying Informed on Regulatory News

In the ever-changing world of cryptocurrencies, staying informed on regulatory news is crucial. Global regulatory trends can significantly influence market behaviors, making it essential to remain up-to-date with the latest developments. Following reputable crypto policy newsletters and tracking updates from official sources is a great way to stay informed.

Engaging in social media platforms related to cryptocurrency and the crypto community can provide real-time updates from experts and industry leaders. Joining newsletters from law firms and industry associations can also help you receive the latest insights on regulatory changes. Participating in online webinars and seminars focused on cryptocurrency regulations can further enhance your knowledge of emerging legal frameworks.

Ways to stay informed about cryptocurrency regulation include:

- Following influential bloggers and analysts in the crypto space to gain valuable perspectives on upcoming regulatory developments.

- Utilizing dedicated apps or platforms that aggregate news related to cryptocurrency regulation to streamline the information-gathering process.

- Engaging with local cryptocurrency meetups to provide networking opportunities and shared information on regulatory topics.

By staying informed, you can better navigate the regulatory landscape and make more informed investment decisions. Knowledge is power, and in the world of crypto, staying ahead of regulatory changes can give you a significant advantage.

Enhancing Security Measures

Security is a top priority for any crypto investor. Opting for hardware wallets, such as Ledger or Trezor, can provide better security by keeping your private keys offline. Paper wallets, while secure, require careful handling to ensure the safety of your assets.

To enhance the security of your crypto exchange accounts:

- Activate two-factor authentication to add an extra layer of protection.

- Use strong, unique passwords and consider using a password manager.

- Regularly update software for your devices and wallets to incorporate the latest security patches.

Backing up your crypto wallet frequently and storing backups in multiple secure locations can prevent loss. Utilizing multisignature wallets, which require multiple approvals for transactions, can enhance security and protect your digital assets from theft and loss.

Enhancing security measures protects your investments from technical issue and potential threats. In the volatile world of cryptocurrencies, taking proactive steps to secure your assets is essential for long-term success.

Engaging with Legal and Financial Advisors

Navigating the complex regulatory environment of cryptocurrencies can be challenging. Engaging with legal and financial advisors, including a law firm, can help you develop compliance strategies that align with both domestic and international regulations. These experts can assist crypto businesses in mitigating legal risks and navigating the intricate regulatory landscape.

Financial advisors can guide clients towards securities and exchange commission-registered crypto securities, helping to mitigate compliance risks. They can also provide valuable insights into the legal implications of cryptocurrency investments, helping clients avoid potential scams and fraud.

Establishing a relationship with knowledgeable advisors can enhance your credibility and reassure clients about your investment strategies. By keeping abreast of regulatory changes, advisors can offer informed guidance to clients looking to enter the crypto market.

Preparing for Tax Implications

Tax implications are a critical aspect of cryptocurrency investments. In the U.S., cryptocurrency is generally treated as property, which means it can be subject to either Capital Gains Tax or Income Tax depending on the nature of the transaction. Crypto transactions, such as trading one cryptocurrency for another, are treated as taxable events by the IRS.

Keeping detailed records of all cryptocurrency transactions is essential for accurately reporting taxes. Key points to consider include:

- The IRS may track cryptocurrency transactions.

- Failing to report these transactions can lead to significant penalties.

- Using crypto tax calculators can simplify the process to perform cryptocurrency transactions related to gains and losses.

Consider using tax-loss harvesting strategies to offset gains by matching capital losses with capital gains. It is important to keep enough liquidity when trading crypto to pay taxes on time and avoid penalties.

By preparing for tax implications, you can ensure compliance with tax laws and avoid potential penalties. Proper tax planning is crucial for maintaining the financial health of your crypto investments.

Leveraging Regulatory Sandboxes

Regulatory sandboxes create a controlled environment where companies can trial innovative blockchain solutions under regulatory oversight. The UK’s Financial Conduct Authority established the first regulatory sandbox in 2016 to foster innovation while maintaining regulatory standards. Since then, over 140 firms have utilized the UK’s FCA sandbox to refine their products and ensure compliance before launching in the market.

Sandboxes help speed up product launches for startups by bypassing lengthy regulatory processes and allowing real-user testing. This controlled environment allows companies to innovate while ensuring that they meet regulatory requirements.

Leveraging regulatory sandboxes helps refine your products and ensure compliance before market entry. This approach reduces the risk of regulatory non-compliance and enhances the chances of success in the competitive crypto market.

Evaluating Exchange Platforms

Choosing the right exchange platform is crucial for ensuring compliance and security of funds. Sticking with licensed, regulated platforms can provide added protection for investors. Utilizing platforms that adhere to regulations may offer better investor protection and reduce the risk of legal issues, including concerns related to exchange commission.

Diversifying your exchange exposure can reduce risks associated with reliance on a single trading platform. This approach ensures that you are not overly dependent on one platform, which can be beneficial in case of technical issues or regulatory changes.

Community feedback and online reviews can provide valuable insights into an exchange’s reputation and reliability. Carefully evaluating exchange platforms allows you to make informed decisions and safeguard your investments.

Developing an Exit Strategy

In the fast-paced and ever-changing world of cryptocurrencies, having a well-defined exit strategy is crucial. This strategy allows you to make informed decisions rather than impulsive ones influenced by market emotions. Establishing clear investment goals is essential in aligning your exit strategy with your financial objectives.

Market conditions can significantly influence the effectiveness of an exit strategy, necessitating constant evaluation of trends. Implementing a phased exit approach can help secure profits gradually and minimize regret if market conditions improve. This approach involves selling a portion of your holdings at different price points, ensuring that you lock in gains while still having exposure to potential future growth.

An event-driven exit strategy enables investors to respond proactively to external changes like regulatory announcements. Setting predefined triggers based on market or regulatory events enables timely decisions to protect your investments. Having a clear exit strategy not only provides peace of mind but also enhances your ability to navigate the volatile crypto market with confidence.

Monitoring Institutional Interest

Institutional interest in cryptocurrencies is a key indicator of market confidence and regulatory impacts. The introduction of MiCA has made Europe a more appealing destination for investors seeking euro-denominated crypto funds, thereby boosting interest in the region. For fund allocators, incorporating regulatory tracking into the core due diligence framework is essential for making informed decisions.

During periods of regulatory uncertainty, users tend to gravitate towards familiar and liquid assets, indicating a preference for safety in tumultuous times. Monitoring institutional interest can provide real value insights into market trends and potential regulatory impacts, guiding personal investment strategies.

Paying attention to the movements of institutional investors and retail investors can help you stay ahead of the curve and make a good investment decisions.

Adapting to Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are poised to revolutionize the financial sector by improving efficiency and reducing transaction costs. These digital currency aims to enhance payment security, ensuring that transactions are final and less prone to fraud. For investors, adapting to the changes introduced by CBDCs is essential for staying relevant in the evolving financial landscape.

CBDCs have several potential impacts:

- Promote financial inclusion by providing banking services to individuals without access to traditional banking.

- Open up new markets and opportunities for crypto entrepreneurs and investors.

- Allow central banks to maintain control over local digital payment systems amid the rise of cryptocurrencies.

As CBDCs become more prevalent, they could introduce new regulatory frameworks that may affect cryptocurrency investments. It’s crucial for investors to stay informed about these developments and adapt their strategies accordingly. Understanding the implications of CBDCs positions you to capitalize on opportunities while navigating potential regulatory challenges.

Navigating Cross-Border Payments

Navigating cross-border payments in the crypto space can be challenging due to varying international regulations. These regulations can affect the efficiency and legality of cross-border crypto transactions and crypto payments, making it essential for investors to understand the regulatory environment in different jurisdictions.

Adhering to these regulations is crucial for ensuring that your cross-border payments are both efficient and legal. Staying informed about regulatory requirements in different countries helps navigate cross-border crypto transactions and minimize legal risks.

Understanding these regulations will help you make more informed decisions and ensure the smooth operation of your international crypto transactions.

Smart Contracts and Compliance

Smart contracts are revolutionizing the way compliance is handled in the crypto market. These self-executing contracts can integrate legal requirements directly into their code, ensuring accurate enforcement of compliance measures. This automation reduces the need for manual oversight and enhances the reliability of compliance efforts.

Blockchain technology, with its immutable ledger, facilitates a transparent audit trail for smart contracts, enhancing their compliance verification. This transparency is crucial for organizations looking to maintain compliance with current and future regulations. Smart contracts offer automated solutions for maintaining compliance, making them an essential tool for crypto entrepreneurs and investors.

These features are particularly important for organizations looking to adapt proactively to evolving regulatory landscapes. Incorporating compliance measures into smart contract code ensures businesses remain compliant with regulations while reducing human error risks. Smart contracts represent a significant advancement in the integration of technology and regulatory compliance, providing a robust framework for managing digital assets and transactions.

Preparing for Future Regulations

As the cryptocurrency market continues to evolve, preparing for future regulations is crucial for long-term success. Upcoming legislation in the U.S. aims to enhance investor protections and liquidity, potentially attracting more institutional capital to the crypto market. These changes could significantly impact investor behavior and market volatility, making it essential to stay informed about potential regulatory developments.

Historical legislative changes have shown that policy shifts can have a profound effect on the crypto market. For example, the introduction of CBDCs could introduce new regulatory frameworks that may affect cryptocurrency investments. Passing legislation and staying informed about these developments and adapting your strategies accordingly is crucial for navigating the evolving regulatory landscape.

The integration of compliance features in smart contracts helps organizations adapt to evolving regulations effectively. Incorporating these features into your investment strategy ensures compliance with regulations while leveraging blockchain’s automation and transparency. Preparing for future regulations is not just about staying compliant; it’s about positioning yourself for success in the ever-changing crypto market.

Summary

As we venture deeper into the world of crypto regulations, it’s clear that preparation and strategic planning are essential for navigating this evolving landscape. Understanding the current regulatory framework, assessing your portfolio for compliance, and diversifying your investments are crucial steps in positioning yourself for success. Staying informed about regulatory news, enhancing security measures, and engaging with legal and financial advisors further fortify your approach.

The introduction of CBDCs and the utilization of smart contracts for compliance highlight the ongoing integration of new technologies in the financial sector. By preparing for future regulations and adapting to these changes, you can ensure that your crypto investments remain secure and compliant. Leveraging regulatory sandboxes, evaluating exchange platforms, and developing a robust exit strategy are additional steps that can help you navigate the complexities of the crypto market.

In conclusion, proactive preparation and informed decision-making are key to thriving in the ever-changing world of cryptocurrencies. By following the strategies and insights provided in this guide, you can position yourself for success and confidently navigate the regulatory landscape of the crypto market.

Frequently Asked Questions

How do regulatory frameworks impact the cryptocurrency market?

Regulatory frameworks significantly impact the cryptocurrency market by overseeing aspects such as creation, trading, and taxation, which in turn influences market behaviors and investor confidence. Strong regulations can enhance trust, while uncertainty may lead to volatility.

What steps should I take to ensure my crypto portfolio is compliant?

To ensure your crypto portfolio is compliant, assess it for legal risks, maintain thorough transaction records, and seek guidance from legal advisors on relevant regulations. This proactive approach will help you navigate compliance effectively.

Why is diversification important in crypto investments?

Diversification is crucial in crypto investments as it mitigates risk by spreading your investments across different assets and sectors, reducing the impact of volatility on your overall portfolio. By doing so, you can enhance your chances of achieving more consistent returns.

How can I stay informed about regulatory changes in the crypto space?

To stay informed about regulatory changes in the crypto space, follow reputable crypto policy newsletters, engage with social media platforms, join webinars, and utilize news aggregation apps. These strategies will help you remain updated on important developments.

What are regulatory sandboxes, and how can they benefit crypto businesses?

Regulatory sandboxes offer a structured setting for crypto businesses to test innovative blockchain solutions while ensuring compliance with regulations. This approach allows companies to refine their products and reduce the risks associated with market entry, ultimately fostering innovation in the crypto space.