Discover how Bitcoin Can Restore Its Sense of Adventure and Innovation with DeFi

Bitcoin’s label as ‘digital gold’ hides its potential for innovation. This article explores how bitcoin can restore its sense of adventure and innovation with DeFi. We’ll look at how smart contracts, new financial tools, and scalable solutions can make Bitcoin a central figure in decentralized finance.

Key Takeaways

- Bitcoin smart contracts leverage the network’s security and adoption to drive financial innovation, positioning Bitcoin beyond just a store of value.

- The rise of Bitcoin DeFi is enhancing liquidity and scalability, attracting institutional interest and promising significant growth in the ecosystem.

- Innovations like a fully programmable global ledger and the integration of DeFi applications can revitalize Bitcoin’s utility and restore its pioneering spirit in the financial landscape.

The Role of Bitcoin Smart Contracts in Financial Innovation

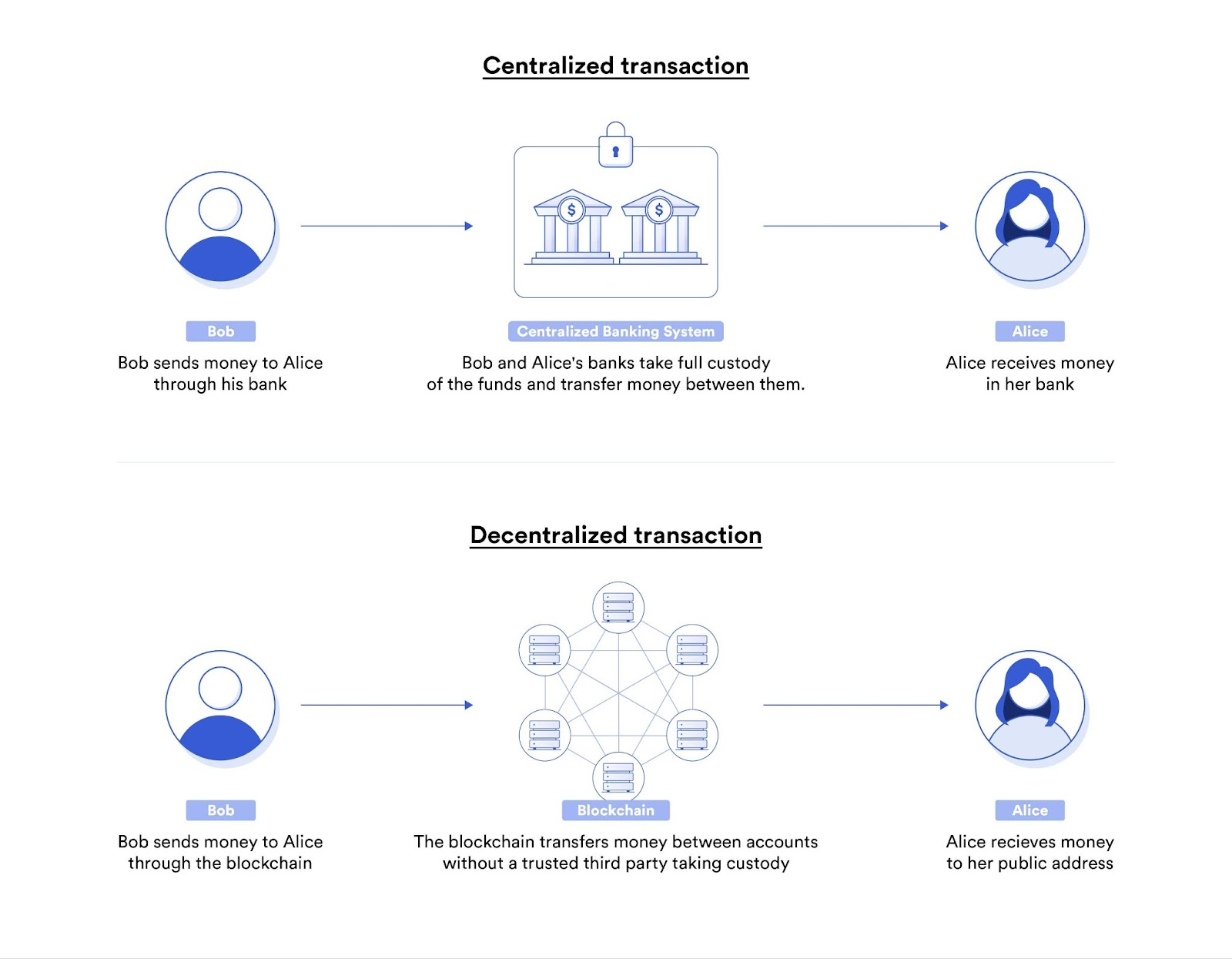

Bitcoin smart contracts are the unsung heroes in the realm of financial innovation. They enable decentralized, secure, and tamper-proof transactions without the need for intermediaries, thereby reducing costs and improving efficiency. Unlike rival chains, Bitcoin smart contracts leverage the security and widespread adoption of the Bitcoin network, providing unique advantages in scalability and decentralization. This positions Bitcoin not just as a store of value but as a catalyst for financial innovation that can reshape various sectors within the crypto industry.

The potential of Bitcoin smart contracts extends further with the introduction of a fully programmable global ledger, a concept that promises to revolutionize digital property rights and ownership transparency. This innovation is not just a dream but a practical evolution, thanks to the robust foundation of Bitcoin’s security protocols and its continuous upgrades like Taproot, which enhance its smart contract capabilities.

We will examine how Bitcoin smart contracts compare to their rivals and the transformative potential of a fully programmable global ledger.

Bitcoin Smart Contracts vs Rival Chains

Bitcoin smart contracts are emerging as a formidable competitor to Ethereum’s dominance in the smart contract space. One of the key advantages is their integration with existing Bitcoin security protocols, providing a robust foundation that rival chains may lack. Projects like RSK and the Liquid Network are creating smart contracts and confidential transactions, thus expanding Bitcoin’s application in the DeFi space. The unique UTXO model of Bitcoin offers distinct advantages for smart contracts, allowing for innovative financial products that differ from those on rival chains.

The Taproot upgrade has introduced features that enhance Bitcoin’s smart contract capabilities, drawing more attention to its potential for innovation in finance. Storage-based consensus paradigms in Bitcoin smart contracts provide near-unlimited transaction performance while ensuring data traceability. This positions Bitcoin as a strong contender in the smart contracts arena, offering unique features that could enhance financial innovation.

Fully Programmable Global Ledger

A fully programmable global ledger could revolutionize digital property rights by enabling seamless ownership transfers on the blockchain. This concept enhances accountability in digital transactions, ensuring that ownership and conditions of contracts are clearly recorded and verifiable. The integration of a global ledger with Bitcoin smart contracts can redefine ownership and transfer of digital assets, facilitating more efficient and transparent property rights.

The Taproot upgrade has significantly improved Bitcoin’s scripting capabilities, facilitating the development of decentralized applications directly on the blockchain. This enhancement supports the creation of a fully programmable global ledger, which promises to bring about a new era of digital property rights.

By embracing this innovation, Bitcoin can further solidify its position as a leading force in the crypto industry.

Bitcoin DeFi’s Value Add

Bitcoin DeFi introduces innovative financial tools that can potentially enhance liquidity and scalability within the Bitcoin ecosystem. By centralizing liquidity on a single scalable blockchain, Bitcoin DeFi can enhance efficiency and reduce costs associated with fragmented DeFi liquidity. This integration not only enhances Bitcoin’s functionality but also attracts new participants and capital, reigniting Bitcoin’s innovative potential.

The Bitcoin DeFi landscape is anticipated to grow significantly by 2025, driven by technological innovations and increased adoption. Emerging strategies include the development of yield-bearing assets and innovative staking mechanisms catering to diverse investor needs.

We will investigate how Bitcoin DeFi boosts liquidity and scalability while appealing to institutional investors and wealth management.

Enhancing Liquidity and Scalability

Layer 2 solutions like the Lightning Network are essential for scaling Bitcoin’s capabilities, allowing decentralized finance applications to flourish. These solutions address scalability issues by enhancing transaction efficiency and reducing costs. Interoperability between Bitcoin and other blockchain systems is also improving through developments in cross-chain solutions, including atomic swaps.

Integrating real-world assets on blockchain is expected to boost liquidity and attract traditional investors to the Bitcoin DeFi market. By consolidating liquidity onto one blockchain, a seamless user experience is created, encouraging broader adoption of DeFi services. These advancements make Bitcoin more versatile and efficient in the DeFi landscape.

Institutional Investors and Wealth Management

Institutional interest in Bitcoin DeFi is rising, with institutions increasingly utilizing these platforms for management and yield generation. DeFi’s potential to lower transaction fees and improve liquidity makes it financially viable for institutional investors to engage with the market. As DeFi matures, its ability to provide transparent and efficient financial services may reshape wealth management strategies for institutional investors.

The evolving regulatory landscape is making Bitcoin DeFi more appealing to institutions, fostering a secure environment for investment. This trend indicates that the next trillion in assets could potentially flow into Bitcoin DeFi, revolutionizing the financial ecosystem.

Restoring Bitcoin’s Spirit of Adventure

The introduction of Bitcoin DeFi is transforming Bitcoin from a mere store of value into a crucial component of the financial ecosystem. This transformation promises to rejuvenate Bitcoin by fostering boundless innovation and creating a more adventurous financial ecosystem. By integrating DeFi, Bitcoin can restore its sense of adventure and reclaim its pioneering spirit.

We will explore how fostering boundless innovation and revitalizing Bitcoin’s ecosystem can reignite its spirit of adventure and establish it as a dynamic financial force, as highlighted by the bitcoinos co founder.

Embracing Boundless Innovation

Unlike Ethereum, Bitcoin’s smart contracts utilize a less comprehensive scripting language, yet they encourage creativity among developers due to their unique limitations. Creating a supportive environment for innovation in Bitcoin’s DeFi sector involves cultivating a community that encourages experimentation and collaboration. This environment can lead to groundbreaking applications in the Bitcoin DeFi landscape.

The integration of the Lightning Network into Bitcoin DeFi applications is likely to enhance the appeal of low-cost, instant transactions for users. By fostering boundless innovation, Bitcoin can reclaim its spirit of innovation and adventure.

Revitalizing Bitcoin’s Ecosystem

Adopting new DeFi applications can enhance Bitcoin’s utility, making it a more versatile asset within various financial ecosystems. Introducing applications that leverage DeFi can significantly enhance user engagement and diversify Bitcoin’s utility. The experience of early Bitcoin DeFi projects highlights the significance of community engagement in building a robust user base.

By revitalizing Bitcoin’s ecosystem, these new applications can breathe new life into Bitcoin, ensuring it remains a dynamic and innovative force in the crypto industry.

Security and Trust in Bitcoin DeFi

Security in Bitcoin DeFi is critical due to the decentralized nature of blockchain, which relies on user trust without a central authority. While Bitcoin DeFi is poised to disrupt traditional banking, it faces security risks and governance challenges due to its decentralized nature. Ensuring robust security measures and building trust with users are essential for the success of Bitcoin DeFi.

We will outline strategies for ensuring robust security measures and building trust with users in the Bitcoin DeFi space.

Ensuring Robust Security Measures

Users should opt for well-known open-source DeFi projects to reduce the risks associated with faulty code. Conducting professional audits on smart contracts is essential to identify and rectify vulnerabilities before deployment. Utilizing layered solutions like the Lightning Network and Stacks enhances security by allowing transactions to occur off-chain, reducing strain on the Bitcoin blockchain.

Early adopters of Bitcoin DeFi solutions are discovering the importance of ensuring trust and security to encourage wider user adoption. These measures are crucial for building a secure and reliable Bitcoin DeFi ecosystem.

Building Trust with Users

Transparency in code and operations is critical in gaining user trust in DeFi applications. Open-source code enables users to audit and verify the security of the platforms they interact with, fostering transparency in DeFi applications. Transparent communication about risks and security measures helps to establish and maintain user trust in Bitcoin DeFi platforms.

User trust can be strengthened by employing services that audit dApps for security and reliability, such as DefiSafety. Successful exchanges emphasize the importance of regulatory compliance, user education, and strong community engagement as vital lessons for newcomers in Bitcoin DeFi.

Case Studies and Success Stories

Bitcoin DeFi is revolutionizing the financial landscape by providing decentralized alternatives for traditional banking services. Notable projects like RSK and Sovryn have successfully enabled decentralized applications, showcasing the functionality of DeFi on a Bitcoin network. These projects have demonstrated increased user engagement and liquidity within the ecosystem, highlighting their effectiveness in meeting users’ needs.

Overall, Bitcoin DeFi projects illustrate how innovation with defi financial solutions can enhance the user experience, promote accessibility, and contribute to the market’s growth.

We will review notable Bitcoin DeFi projects and the lessons learned from early adopters.

Notable Bitcoin DeFi Projects

The Total Value Locked (TVL) in Bitcoin DeFi reached an unprecedented $7.48 billion as of December 2024, indicating growing investor interest. ALEX has quickly established itself in Bitcoin DeFi, accumulating over $20 million in total value locked and over 26,000 active wallets. Zest Protocol allows users to engage in Bitcoin lending and borrowing through smart contracts, promoting transparency and efficiency in transactions.

Practical implementations of DeFi in Bitcoin could include decentralized lending platforms and new asset management tools. New applications such as liquid staking tokens are shaping the Bitcoin DeFi landscape, fostering complex financial use cases and enhancing market dynamics.

Lessons Learned from Early Adopters

Early adopters of Bitcoin DeFi have played a crucial role in shaping its evolution, providing valuable insights into its functionality and usability. One significant insight from early adopters is the need for user-friendly interfaces, as many solutions initially lacked accessibility. The integration of DeFi with Bitcoin has demonstrated increased transaction efficiency, appealing to early adopters seeking faster and cheaper alternatives.

Early adopter experiences have shown that Bitcoin’s resilience and security contribute positively to the confidence of users in DeFi applications. Many early adopters reported enhanced liquidity options provided by Bitcoin DeFi solutions, leading to increased participation and investment.

However, challenges such as a steep learning curve for new users indicate that educational resources are needed to onboard more participants.

Challenges and Future Prospects

High-risk environments like DeFi demand users exercise caution, yet the potential rewards are immense. The current challenges facing Bitcoin DeFi include security vulnerabilities, scalability issues, and regulatory uncertainties. However, these hurdles also present opportunities for innovation and growth in the Bitcoin DeFi space.

The future of Bitcoin DeFi looks promising, with emerging trends and opportunities poised to drive its growth. The rise of regulatory clarity is expected to encourage more institutional investors to engage with Bitcoin DeFi, expanding its market reach. Mobile-first DeFi applications are anticipated to reshape user experience, making crypto trading more accessible and appealing.

We will delve into the current challenges and future prospects in more detail.

Overcoming Current Challenges

DeFi insurance is emerging as a protection mechanism against threats like hacking and contract failures. To mitigate smart contract vulnerabilities, developers must enhance security protocols and conduct thorough audits before deployment. Early participants in Bitcoin DeFi encountered challenges like market volatility and limited resources, shaping their investment strategies.

Many early DeFi users learned the importance of patience, as holding onto Bitcoin rather than selling quickly would have yielded substantial returns. The increasing complexity of governance in DeFi platforms requires innovative solutions to prevent power concentration among a few stakeholders.

By addressing these challenges, Bitcoin DeFi can continue to evolve and thrive.

Future Trends and Opportunities

The rise of regulatory clarity will likely encourage more institutional investors to engage with Bitcoin DeFi, expanding its market reach. Mobile-first DeFi applications are anticipated to reshape user experience, making crypto trading more accessible and appealing. The emergence of new DeFi protocols on Bitcoin is expected to facilitate innovative lending and borrowing solutions, boosting user adoption.

The future of Bitcoin DeFi is bright, with boundless opportunities for financial innovation and adventure. By embracing these trends, Bitcoin can continue to restore its sense of adventure and innovation, solidifying its position as a pioneering force in the crypto industry.

Summary

In summary, Bitcoin DeFi holds the potential to transform Bitcoin from a mere store of value into a dynamic force driving financial innovation. Bitcoin smart contracts offer unique advantages over rival chains, and the concept of a fully programmable global ledger promises to revolutionize digital property rights. Bitcoin DeFi enhances liquidity and scalability, attracts institutional investors, and fosters boundless innovation.

As we navigate the challenges and embrace future trends, Bitcoin can restore its spirit of adventure and innovation, revitalizing its ecosystem and solidifying its position in the crypto industry. The journey of Bitcoin DeFi is just beginning, and the possibilities are limitless. Embrace the adventure and explore the exciting world of Bitcoin DeFi.

Frequently Asked Questions

What are Bitcoin smart contracts?

Bitcoin smart contracts facilitate decentralized and secure transactions on the Bitcoin network, eliminating the need for intermediaries and ensuring tamper-proof agreements.

How does Bitcoin DeFi enhance liquidity and scalability?

Bitcoin DeFi enhances liquidity and scalability by utilizing innovative financial tools and Layer 2 solutions, such as the Lightning Network, which improve transaction efficiency and reduce costs. This allows for quicker and more cost-effective transactions within the Bitcoin ecosystem.

Why are institutional investors interested in Bitcoin DeFi?

Institutional investors are interested in Bitcoin DeFi because it offers lower transaction fees, enhanced liquidity, and greater transparency, which can lead to more efficient financial services. This potential makes Bitcoin DeFi a compelling avenue for investment.

What are the main security challenges in Bitcoin DeFi?

The primary security challenges in Bitcoin DeFi are vulnerabilities in smart contracts, inadequate security measures, and governance issues stemming from its decentralized structure. Addressing these challenges is crucial for ensuring the integrity and safety of DeFi platforms.

What are some notable Bitcoin DeFi projects?

Notable Bitcoin DeFi projects include RSK, Sovryn, and ALEX, all of which have successfully facilitated decentralized applications and improved liquidity in the ecosystem. These projects are leading the way in enhancing user engagement within Bitcoin’s DeFi landscape.