DYOR Is Not Just a Meme: Here’s How to Actually Research a Crypto Project

In the world of crypto, “DYOR is not just a meme; here’s how to actually research a crypto project”—it’s essential. This guide will teach you how to properly conduct your research. We’ll cover key steps like evaluating the team, technology, and tokenomics, helping you make informed investment decisions and dodge scams.

Key Takeaways

- DYOR (Do Your Own Research) is essential for informed investment decisions in the volatile crypto market, helping investors avoid scams and make better choices.

- Key steps in researching a crypto project include assessing the development team, understanding tokenomics and technology, and reviewing the project’s whitepaper and roadmap.

- Engaging with the crypto community and staying updated on news outlets are crucial for understanding market sentiment and making timely, informed decisions.

Understanding DYOR in the Crypto World

In the fast-paced and often volatile crypto world, DYOR—Do Your Own Research—is more than just a catchy phrase; it’s a survival tool. This practice helps crypto investors make informed decisions and steer clear of scams. Thorough research enables investors to grasp the fundamental aspects of a crypto project, leading to better investment outcomes and a comprehensive understanding of market influences. Remember to research dyor in crypto to enhance your investment strategy.

The crypto space is rife with volatility and fraud, making thorough research indispensable. Investors should scrutinize various aspects to ensure they are investing in a legitimate project, such as:

- The development team

- Tokenomics

- Technology

- Strategic partnerships

Exploring multiple most crypto projects allows investors to understand their options and make well-informed decisions about a good crypto project and crypto assets.

Why DYOR is Essential for Crypto Investors

DYOR empowers investors by enhancing critical thinking and risk management capabilities, leading to more informed decision-making. In unpredictable crypto markets, evaluating projects independently instead of relying on external opinions is invaluable. This process not only helps investors avoid common pitfalls and scams but also increases their chances of investment success by ensuring their choices are grounded in solid research and understanding.

Common Misconceptions About DYOR

Despite its importance, DYOR is often misunderstood. Some perceive it as merely a meme or an empty phrase, but in reality, it is a vital practice for crypto investors. Thorough research distinguishes legitimate projects from scams, protecting investors from potential losses.

DYOR is not just for novice investors; it is an ongoing process that benefits all levels of traders by providing a deeper understanding of the market and its dynamics.

Initial Steps in Researching a Crypto Project

Starting your crypto journey involves understanding how to research crypto a project initially. Here are the key steps:

- Gather data from trustworthy platforms to ensure accuracy.

- Recognize the importance of a project’s scalability.

- Evaluate the innovative technology used to solve existing problems.

Effective DYOR includes evaluating a project’s whitepaper and community engagement, which are key to making informed decisions.

Reviewing the Project’s Whitepaper

The whitepaper outlines a project’s objectives, technology, and the problems it aims to solve. Despite their technical nature, reading and understanding whitepapers is crucial as they provide key information about the project’s technical details and token distribution.

Evaluating the whitepapers of well-established projects like Bitcoin and Ethereum can provide good benchmarks.

Analyzing the Development Team

The development team forms the backbone of any crypto project. Assessing the credibility and background of the team member reduces the risk of fraud. Look for development teams with a strong track record in crypto, blockchain, or related fields; reputable teams often have histories of successful projects.

Checking the project’s GitHub repository for developer activity provides insights into ongoing innovation and potential.

Evaluating a Project’s Technology and Roadmap

Grasping a project’s technology and roadmap is key to assessing its long-term potential for a more comprehensive understanding of its technical aspects. Assess the clarity and specificity of the project’s roadmap to understand its goals and objectives.

Ensure the roadmap’s feasibility aligns with the project’s vision and market demands, allowing it to achieve its milestones and growth targets.

Understanding the Underlying Technology

Understanding the underlying technology is essential for informed investment decisions. The technology must demonstrate innovation and problem-solving capabilities. A project’s infrastructure determines its speed, security, and efficiency, all critical for success.

Conducting security audits and evaluating a project’s use case are crucial for ensuring viability and market need, as part of due diligence.

Assessing the Project’s Roadmap

Evaluating a project’s potential roadmap requires assessing its feasibility, uniqueness, and market alignment. Promising solid projects usually have clear propositions, ongoing improvements, and fewer potential challenges.

Regularly assessing the project’s official development progress ensures it stays on track with its roadmap, enhancing the project’s credibility and potential.

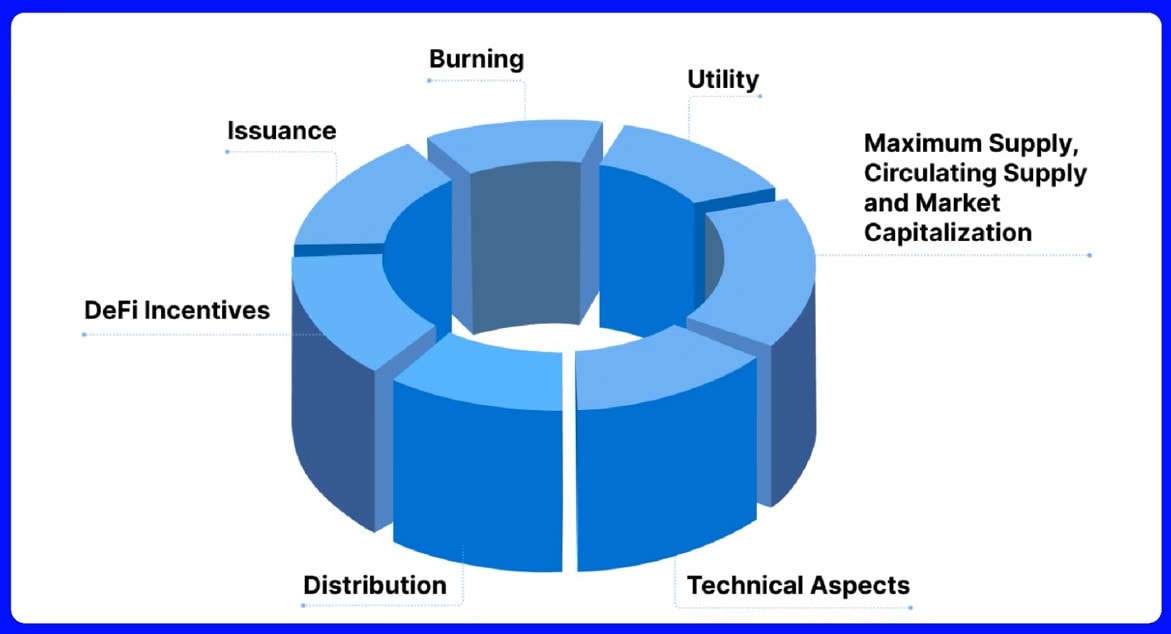

Analyzing Tokenomics and Market Dynamics

Understanding tokenomics and market dynamics is key to making informed investment decisions in the crypto market. Project’s tokenomics involves studying economic models behind cryptocurrency tokens, including supply, distribution, and token utility.

Tracking community sentiment and exchange flows can offer valuable insights into market movements and trader intentions.

Token Supply and Distribution

Clear tokenomics help avoid inflation and ensure fair distribution among stakeholders. Knowing a token’s:

- total supply

- distribution

- economic model is crucial for informed investment decisions. Poorly planned token distribution can cause inflation and hinder growth.

A balanced distribution strategy addresses stakeholder needs and avoids supply concentration that could lead to market manipulation.

Market Sentiment and Trading Volume

High trading volumes and market capitalization indicate stability and popularity. Key points include:

- Established projects like Bitcoin and Ethereum are less susceptible to manipulation, representing more accurate market sentiment.

- High trading volumes often signal popularity and stability.

- These factors make such projects a good sign for potential investors.

Conversely, be cautious of projects with manipulated trading activities or wash trading.

Engaging with the Project’s Community

Community involvement significantly indicates a crypto project’s viability. A vibrant, engaged community often signifies potential success. Regularly checking official websites, social media, and forums provides valuable insights into the project’s progress and market sentiment. Active participation in forums can lead to better understanding and more informed decisions.

Social Media Presence and Community Forums

Evaluating a project’s social media presence helps understand its visibility and community engagement on social media platforms. Platforms like Medium, Discord, and Reddit host detailed articles, real-time communication, and extensive cryptocurrency discussions. Active participation in these forums offers valuable insights into market trends and project updates, making it crucial for research.

Monitoring Community Sentiment

Community sentiment can significantly influence cryptocurrency prices, often driven by emotions rather than fundamental analysis. Be cautious about following influencers in crypto communities, as some may promote coins without solid technology.

Monitoring community sentiment helps gauge overall mood and reactions, aiding more informed decisions. Negative news, like exchange failures or hacks, can trigger significant market crashes, highlighting the delicate balance of sentiment.

Using On-Chain Data for Comprehensive Analysis

On-chain data offers deeper insights into a project’s performance and potential. Incorporating community feedback into on-chain analysis leads to a more accurate understanding of a project’s strengths and weaknesses. Using on-chain data with community insights helps investors make more informed decisions about crypto projects.

Analyzing Historical Data

Analyzing historical data identifies trends that inform future market predictions. Reviewing historical price movements highlights significant trends and turning points in a cryptocurrency’s value. This analysis is crucial for understanding past performance and can serve as a foundation for predicting future trends, improving investment decisions.

Evaluating On-Chain Metrics

Metrics like transaction volume and active addresses indicate engagement and market activity. Transaction volume quantifies the total value of assets transferred on a blockchain technology, indicating economic activity. Active addresses measure user engagement within a blockchain, reflecting participation levels over time.

These metrics are vital indicators of a project’s usage and community interest.

Staying Informed with Crypto News Outlets

Staying informed through reliable crypto news outlets is crucial for reacting quickly to market changes and making timely decisions. Following crypto news outlets and project announcements helps investors by:

- Keeping them updated with new trends and technologies

- Enabling timely and informed decisions

- Enhancing the ability to navigate the crypto market effectively

Reliable Crypto News Outlets

Trusted news outlets provide critical insights into market trends and project updates, essential for informed decision-making. CoinDesk and Decrypt are recognized as premier sources for comprehensive cryptocurrency news and analysis through official channels. X (formerly Twitter) often breaks crypto-related news first, making it a useful tool for staying updated.

Avoiding Misinformation

Assessing the credibility of news outlets avoids misleading information and ensures accurate insights. Many crypto news sites may have conflicts of interest; verifying their background is essential for accurate information.

Relying solely on social media for crypto news can lead to unverified information; stay informed by crosschecking information across several websites.

Key Takeaways for Effective DYOR

DYOR is not just a slogan; it’s a critical practice for successful investing in cryptocurrency. Thorough research gives investors the confidence to make smart choices and avoid potential scams. Staying updated with cryptocurrency news and performing both fundamental and technical analysis enhances decision-making and risk management.

Importance of Thorough Research

In-depth knowledge about crypto projects enables better-informed decisions. Using reputable sources ensures timely updates and verified information, crucial for informed decisions. Thorough research leads to better investment choices and enhances the ability to navigate the complexities of the crypto market.

Continuous Learning and Adaptation

Successful crypto trading requires:

- Continuous learning and staying informed

- Adaptability to respond effectively to the ever-evolving crypto market

- Objectivity, skepticism, and curiosity during DYOR (Do Your Own Research) to ensure vigilance and openness to new information

These qualities enhance decision-making capabilities.

Summary

In conclusion, DYOR is an indispensable practice for anyone involved in the crypto space. It empowers investors to make informed decisions, manage risks, and avoid scams. From understanding the importance of DYOR, analyzing whitepapers and development teams, to engaging with communities and staying informed with reliable news outlets, each step is vital for navigating the crypto markets effectively. Remember, thorough research and continuous learning are your best allies in the ever-changing world of cryptocurrency.

Frequently Asked Questions

What is DYOR in crypto?

DYOR, or “Do Your Own Research,” is essential for making informed investment choices in the crypto market. Engaging in thorough research helps mitigate risks associated with cryptocurrency investments.

Why is DYOR important for crypto investors?

DYOR is crucial for crypto investors as it enables them to avoid scams, manage risks, and make well-informed investment choices through comprehensive research and understanding. This approach ultimately leads to better investment outcomes.

What should I look for in a crypto project’s whitepaper?

When reviewing a crypto project’s whitepaper, focus on its objectives, the technology it employs, the specific problems it addresses, and the token distribution strategy. These elements are vital for assessing the project’s viability and potential impact.

How can I assess a crypto project’s development team?

To effectively assess a crypto project’s development team, examine their background in crypto or blockchain, their track record, and their GitHub activity. A history of successful projects can also provide valuable insight into their capabilities.

Why is community engagement important for a crypto project?

Community engagement is crucial for a crypto project as it indicates potential success and fosters invaluable insights through regular updates and active participation. Engaging with the community can enhance trust and adaptability in response to market sentiment.