Ethereum in 2026: Upgrade Roadmap, Staking Yields and DeFi Expansion

Key Takeaways

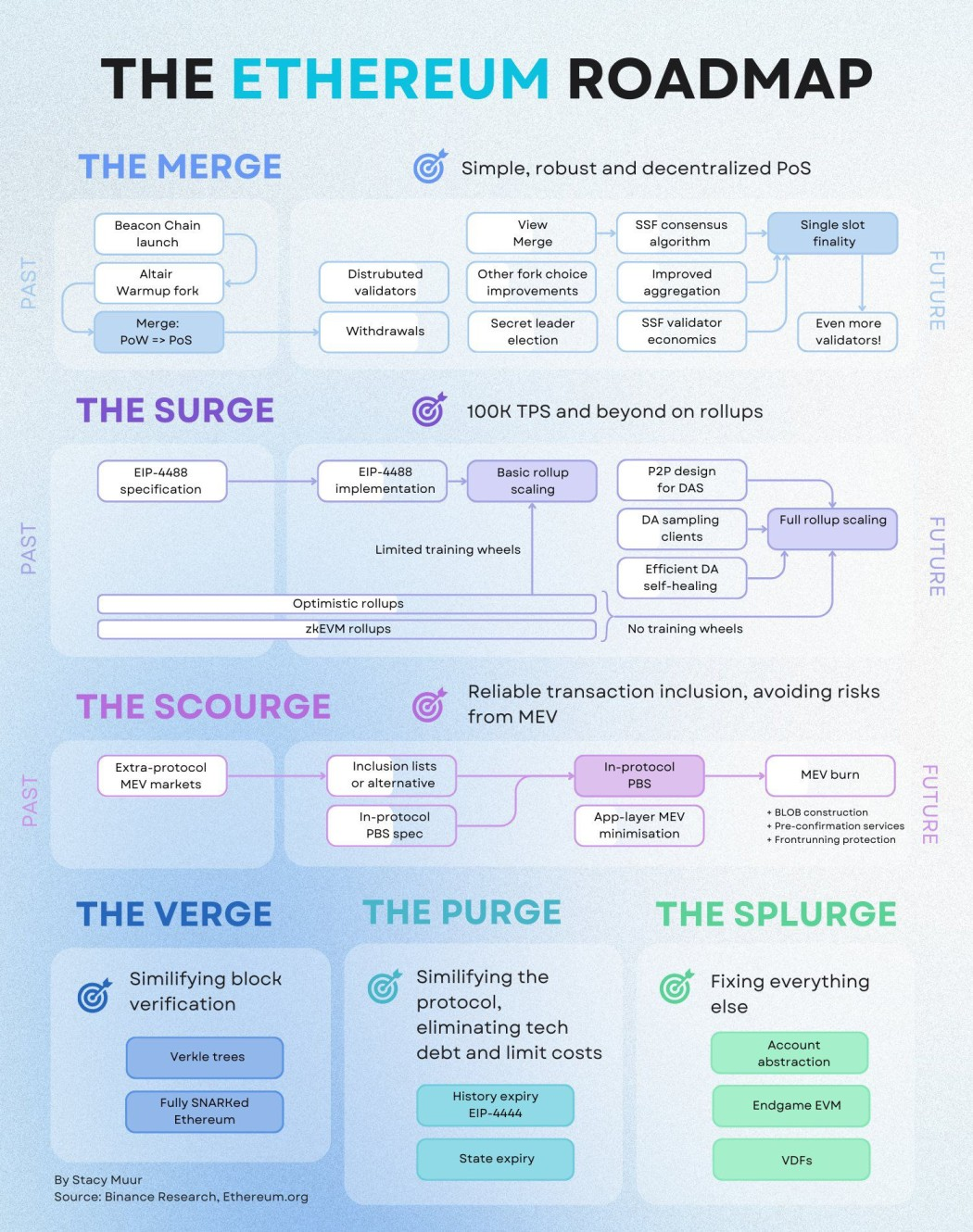

- Ethereum’s 2026 roadmap centers on two major upgrades—Glamsterdam in the first half of the year and Heze-Bogota in the latter half—targeting enhanced throughput, lower transaction fees, and stronger censorship resistance through innovations like enshrined proposer builder separation and verkle trees.

- ETH staking participation is projected to reach 30-35% of circulating supply by 2026, with real yields (after inflation and costs) stabilizing in the 2.5-4% range depending on network activity and fee revenue.

- DeFi total value locked on Ethereum and its Layer 2 ecosystems could push toward the $500B-$1T range by late 2026, fueled by real world assets tokenization, spot ETFs, and growing institutional capital inflows.

- The technical improvements directly impact investment strategy: validators benefit from more predictable economics, while DeFi participants gain access to cheaper execution and more sophisticated yield strategies.

- Regulatory clarity developments and institutional adoption are converging with the technical roadmap, positioning Ethereum as a credible global settlement layer for both digital assets and tokenized traditional finance instruments.

Introduction: Why Ethereum’s 2026 Roadmap, Staking Yields and DeFi Expansion Matter

When examining ethereum in 2026 upgrade roadmap staking yields and defi expansion, the picture that emerges is one of strategic convergence. This is the year when multiple prior upgrades—including pectra and fusaka—culminate into a more mature, institution-ready Ethereum stack. The network is transitioning from a period of foundational changes to one focused on scaling, efficiency, and real-world utility.

Entering 2026, Ethereum holds a market capitalization in the approximate $300B-$450B range, with ETH price performance still below its 2021 all time highs but stabilizing as the network matures. Ethereum continues to dominate decentralized finance with the lion’s share of total value locked and maintains roughly two-thirds market share in real world assets tokenization. The network supports over 30 million ETH staked—more than 28% of total supply—securing its proof-of-stake consensus.

This article walks through the 2026 upgrade roadmap (Glamsterdam and Heze-Bogota), dives into staking yield dynamics, and shows how these changes fuel a new phase of DeFi expansion. You’ll understand what this means for investors and builders navigating the coming years.

The approach here is data-driven and non-hype. We’ll use concrete dates, upgrade names, and ballpark projections rather than vague “next bull run” language. The goal is to give you actionable context for understanding where Ethereum is headed and how to position accordingly.

Ethereum’s 2026 Upgrade Roadmap: Glamsterdam and Heze-Bogota

Glamsterdam (expected mid-2026) and Heze-Bogota (expected late-2026) form the two-phase backbone of Ethereum’s 2026 technical roadmap. These represent a deliberate shift to a biannual upgrade cadence that prioritizes steady, incremental improvements over large-scale, high-risk deployments.

These upgrades continue the shift toward a rollup-centric roadmap, focusing on data availability, validator decentralization, censorship resistance, and cost reduction rather than radical consensus changes. The network is aiming for support of hundreds of thousands of TPS across its Layer 2 ecosystem, with the base layer handling security and finality while rollups manage execution at scale.

Broadly speaking, Ethereum developers are optimizing for long-term sustainability over short-term throughput gains. The process involves embedding critical functionality—like MEV handling and state management—directly into the protocol rather than relying on external solutions.

Glamsterdam (Mid-2026): Parallel Processing and ZK-Native Scaling

Glamsterdam is a mid-2026 hard fork focused on parallel transaction processing, more efficient ZK proof verification, and stronger proposer-builder separation on mainnet. This upgrade builds directly on the recent Fusaka hard fork, focusing on execution-layer efficiencies.

The centerpiece is enshrined proposer builder separation (ePBS), a protocol-level mechanism that formally separates block proposers from block builders. This addresses Maximal Extractable Value (MEV) concentration, reduces censorship risks, and decentralizes block production by embedding this logic natively rather than relying on off-protocol measures like MEV-Boost.

Key technical improvements include:

| Feature | Impact |

|---|---|

| Parallel execution | Potential 10,000-12,000 TPS on base layer |

| ePBS implementation | Transparent MEV handling, reduced validator centralization |

| Block level access lists | More efficient state access, lower gas fees |

| ZK verification optimization | Support for rollups reaching hundreds of thousands of TPS |

From a staking economics perspective, faster blocks and more efficient inclusion can increase fee revenue per block over time. This supports healthier validator rewards even as raw issuance remains intentionally low. DeFi protocols—especially those with frequent, low-cost transactions—experience more predictable fees and smoother operations.

Heze-Bogota (Late-2026): Verkle Trees, Storage Efficiency and Censorship Resistance

Heze-Bogota arrives in late 2026 as a follow-up upgrade bringing verkle trees, fork-choice inclusion lists (FOCIL), and further data-availability enhancements to mainnet. This upgrade confronts Ethereum’s most existential long-term challenge: unchecked state and data growth.

Verkle trees replace the current Merkle Patricia Tries with an advanced cryptographic data structure that can slash node storage requirements by up to 90%. This enables stateless or near-stateless clients, where validators verify blocks without downloading the full chain history. The practical result is like a “massive warehouse cleanup” that prunes historical bloat while supporting decades of scaled activity.

FOCIL and related inclusion-list mechanisms counteract transaction censorship and guarantee that certain transactions can be included within a bounded number of slots. This preserves Ethereum’s role as censorship resistant infrastructure.

The upgrade also targets the blob limit—potentially moving toward 72 blobs per block—to further scale rollups and reduce average L2 transaction fees. Protocol changes in Heze-Bogota could enable 10x rollup throughput increases, lowering L2 fees to pennies and unlocking use cases like high-frequency trading or real-time lending that demand sub-second finality.

For decentralized exchanges, lending markets, and options vaults, this cheaper, censorship-resistant blockspace reduces operational costs and makes high-frequency strategies viable on L2s.

From Pectra and Fusaka to 2026: Setting the Stage for a Global Settlement Layer

The 2023-2025 period laid essential groundwork for 2026. The pectra upgrade in 2025 increased the validator staking cap to 2,048 ETH per validator, making institutional-scale staking more operationally efficient. Previously, large stakers needed to manage hundreds of thousands of individual validators—a significant operational burden.

The pectra and fusaka upgrades together raised data availability capacity and cut average L2 fees by an estimated 40-90%, depending on network congestion and rollup design. Post-Fusaka, blob usage surged 5x, cutting L2 costs 90% and setting the stage for the TVL growth expected in 2026.

By early 2026, Ethereum effectively operates as a settlement and data layer for a multi-rollup ecosystem:

- Optimism Superchain: Standardized rollup stack with shared sequencing

- Arbitrum Orbit: Customizable L3 chains for specific applications

- zkSync: ZK-proof based scaling with growing DeFi ecosystem

- Base: Coinbase-backed rollup bridging retail and institutional users

Over 90% of retail transactions migrate to L2s while L1 focuses on security, finality, and high-value settlement. This positions Ethereum as the emerging global settlement layer for both crypto-native and tokenized traditional finance assets.

Staking in 2026: Yields, Queue Dynamics and Validator Economics

Ethereum’s move to proof-of-stake and the 2026 roadmap directly influence staking yields. Validator rewards depend on both base issuance and fee plus MEV revenues, which change as DeFi and rollups grow. Historical data shows yields have fluctuated between sub-3% and over 5% depending on network activity.

By early 2026, staked ETH is expected to hover around 30-35% of circulating supply. On chain data from late 2025 already shows over 35 million ETH staked, representing more than 28% of supply, with over 1 million validators securing the network.

Real yield for validators and liquid stakers—staking APR minus inflation and operational costs—could stabilize in the 2.5-4% range under normal network usage. The Glamsterdam and Heze-Bogota upgrades influence this by:

- Lowering operational costs through optimized gas and ePBS

- Democratizing validation by cutting hardware barriers

- Increasing fee revenue through higher network throughput

Queue Reversal and Long-Term Supply Lockup

After withdrawals were enabled, the staking queue initially saw net exits but reversed into net inflows by mid-2025. The exit queue shrank from millions of ETH to tens of thousands, indicating sustained demand for staking yields.

Heading into 2026, the entry queue can build up significantly—potentially near or above 1 million ETH waiting—when yields plus institutional appetite make staking attractive. This extends validator activation delay to 1-3 weeks during busy periods.

The queue dynamics create important market effects:

| Queue Status | Market Impact |

|---|---|

| High entry queue | Reduced selling pressure, ETH locked for yield |

| Low exit queue | Less ETH returning to liquid circulation |

| Rising stake share >30% | Structural float reduction |

| Extended activation delays | Signals strong staking demand |

Lower exit queues and higher entry queues reduce net selling pressure on ETH, since more coins are being locked for yield rather than exiting to be sold on exchanges. A rising share of staked ETH above 30% acts as a structural float reduction, which can amplify price moves in either direction but generally supports higher long-term value floors if demand remains strong.

Yield Composition: Issuance, Fees and MEV in a High-Throughput Era

Staking rewards break down into three sources:

- Base issuance: Intentionally low at approximately 0.5-1% annually

- Priority fees: Gas paid by users for transaction inclusion

- MEV: Value extracted from transaction ordering

Glamsterdam’s higher throughput and Heze-Bogota’s efficiency gains can keep L2 fees low for users while still producing healthy aggregate fee revenue on L1. Greater total transaction volume and blob usage drive this dynamic.

ePBS and related MEV-burn or MEV-auction mechanisms may, by 2026, make MEV more equitably distributed across validators and more transparent for liquid staking protocols. This addresses concerns about MEV concentration—still approximately $1 billion extracted yearly—that could otherwise centralize block production.

Illustrative 2026 APR expectations (not guarantees):

- Quiet markets: 2-3% APR

- Moderate activity: 3-4% APR

- Booming rollup and DeFi activity: 4-5% APR

These projections assume successful upgrade deployment and continued network growth, with risk appetite among stakers remaining healthy.

DeFi Expansion in 2026: From Retail Yield Farming to Institutional-Grade Finance

Decentralized finance on Ethereum has evolved from simple yield farming in 2020 to complex lending, derivatives, and RWA platforms by 2023-2025. The year 2026 is expected to mark full institutional integration.

Current DeFi TVL on Ethereum and its L2s sits below $100 billion in late 2025, but projections point toward $500B-$1T by late 2026 under optimistic scenarios. This growth relies on multiple catalysts:

- Lower execution costs from Glamsterdam and Heze-Bogota

- More predictable transaction inclusion via ePBS

- Stronger censorship resistance through FOCIL

- Scalable data availability for complex on-chain products

The expansion spans multiple verticals: decentralized exchanges, lending and borrowing protocols, perpetuals and options markets, structured products, and on-chain asset management. Each benefits differently from the technical improvements.

Real-World Assets (RWAs) and On-Chain Credit

Ethereum holds the leading role in tokenized real world assets, with existing 2025 TVL in the low tens of billions and approximately two-thirds market share in RWA tokenization. Smart contract platforms compete for this market, but Ethereum’s security and liquidity maintain its position.

Projections indicate tokenized RWAs could reach $150B-$200B by 2026, with a large share issued or settled on Ethereum and its major L2s. This represents new capital flowing into blockchain tech from traditional finance.

Concrete RWA use cases gaining traction:

| Asset Type | Status | 2026 Projection |

|---|---|---|

| Tokenized U.S. Treasuries | Live, billions in circulation | $50B+ market |

| Corporate bonds | Pilot programs with major issuers | Expanding institutional adoption |

| Private credit | Early-stage platforms | Integration with defi protocols |

| Money-market funds | Major asset manager participation | Mainstream institutional capital allocation |

Cheaper transactions and higher scalability in 2026 support high-volume, low-margin financial products—intraday repo, supply-chain finance—that are impractical on a congested, expensive base layer. This opens markets previously inaccessible to decentralized applications.

Structured DeFi Yields: From Simple Staking to Multi-Layer Strategies

DeFi users in 2026 may stack multiple yield layers within a single vault or structured product:

- ETH staking yield (base layer)

- L2 incentive rewards (protocol tokens, points)

- Protocol revenue-sharing (fee distributions)

- RWA yields (tokenized treasury rates, credit spreads)

Scalable rollups and cheaper execution allow more advanced strategies—automated options vaults, on-chain risk-parity funds, basis-trade strategies—to become accessible to both institutions and sophisticated retail users. The trading environment on L2s begins to rival centralized exchanges in terms of cost efficiency.

The emergence of on-chain “yield curves” allows users to choose between:

- Short-term stablecoin yields (2-5% range)

- Longer-duration RWA-backed yields (4-7% range)

- Variable ETH staking yields (2.5-5% range)

All settled on Ethereum with transparent, auditable smart contract logic.

Key risks remain, even as yields become more attractive:

- Smart contract risk from complex vault interactions

- Oracle risk from price feed manipulation or failures

- Regulatory uncertainty around securities classification

- Bridge and sequencer risks in cross-L2 strategies

Due diligence on protocol security, team track records, and audit history becomes increasingly critical as capital concentrates in successful protocols.

Institutional Adoption and Regulatory Context in 2026

Ethereum’s 2026 upgrade roadmap aligns with growing regulatory clarity in major jurisdictions. U.S. legislation such as the clarity act and stablecoin frameworks provide guardrails for institutional participation. Exchange traded products have already demonstrated demand, with spot ETFs attracting tens of billions in institutional capital.

By 2025, spot Ethereum ETFs had attracted significant inflows, with major issuers treating ETH as yield-bearing infrastructure rather than pure speculation. This shift in framing—from speculative digital assets to productive network equity—opens new capital pools.

The 2026 landscape likely sees institutions move from passive ETF exposure to more active participation:

- Direct staking through regulated custodians

- Providing liquidity to defi protocols via whitelisted vaults

- Issuing tokenized securities on Ethereum infrastructure

- Using prediction markets for risk management and hedging

Practical examples include corporate treasuries allocating small percentages to tokenized T-bill funds, banks piloting on-chain repo on Ethereum-based platforms, and asset managers launching regulated DeFi yield products.

Designing Ethereum to Meet Institutional Requirements

The 2026 roadmap addresses core institutional concerns that have historically limited adoption:

| Requirement | Technical Solution |

|---|---|

| Transaction finality | Single-slot finality research, fast L2 confirmations |

| Censorship resistance | FOCIL, ePBS, inclusion lists |

| Operational resilience | Verkle trees reducing node requirements |

| Transparent MEV handling | ePBS, MEV-burn mechanisms |

Features like ePBS and FOCIL are critical for institutions that must demonstrate fair order handling, auditability, and non-discriminatory transaction inclusion to regulators. Privacy features continue evolving while maintaining compliance capabilities.

Lower, more predictable gas fees and scalable rollups allow regulated entities to operate compliant KYC/AML layers at the edge while relying on Ethereum for settlement and security. This architecture satisfies regulatory requirements while preserving the benefits of decentralized infrastructure.

The institutional era for Ethereum involves real capital deploying into the ecosystem—not just speculation on future value, but actual utilization of the network for financial operations.

Investment and Strategy Implications for 2026

The technical roadmap connects directly to practical decisions for long-term ETH holders, stakers, and DeFi participants. Understanding how increased throughput and lower fees influence ETH demand for gas and collateral, staking yields, and the competitive position of defi protocols versus centralized exchanges and traditional finance shapes portfolio construction.

Investment angles break into three lenses:

- Owning ETH as a productive asset via staking

- Using DeFi for yield generation across protocols and L2s

- Allocating to RWA and institutional-grade products built on Ethereum

Network growth, staking share, and fee revenue trends support stronger long-term valuations if the roadmap executes successfully. However, execution risk remains—major upgrades can face delays or unexpected issues.

Positioning Around Staking Yields

Solo staking, pooled staking, and liquid staking tokens (LSTs) each present different trade-offs in 2026:

| Approach | Yield | Complexity | Decentralization | Smart Contract Risk |

|---|---|---|---|---|

| Solo staking | Highest (full rewards) | High (technical requirements) | Maximum | None |

| Pooled staking | Medium-high | Low | Varies by provider | Medium |

| Liquid staking (LSTs) | Medium (fees taken) | Low | Varies | Higher |

Real yields in the low-single-digits can still be attractive if ETH is viewed as long-term infrastructure equity, especially when combined with potential price appreciation from growing network usage. The expected growth in throughput and DeFi activity supports this thesis.

Institutional-grade staking services—regulated custodians and specialized validators—are expected to manage an increasing share of total staked ETH. This influences governance and MEV policy debates, as concentrated stake can affect protocol decisions.

Diversification makes sense: splitting exposure between direct ETH holdings, LSTs, and carefully selected DeFi yield strategies balances liquidity, yield, and risk.

DeFi Portfolio Construction in a High-Throughput Environment

A 2026 DeFi portfolio might blend:

- Core positions in blue-chip protocols (major DEXs, established lending markets)

- RWA exposure through tokenized treasury products and credit protocols

- Derivatives positions via options vaults and perpetual protocols

- Yield aggregators operating on major L2s optimizing across opportunities

Chain and rollup selection matters significantly. Evaluating security assumptions, decentralization levels, bridging risk, and fee profiles helps determine where to deploy capital across the Ethereum rollup ecosystem.

Lower transaction fees in 2026 make active strategies—rebalancing, hedging, options overlays—far more viable for smaller portfolios than in earlier cycles. A strategy costing $50 in gas per adjustment on L1 might cost pennies on an L2, fundamentally changing risk appetite for active management.

Robust risk management remains essential:

- Position sizing relative to total portfolio

- Diversification across protocols and rollups

- On-chain analytics monitoring protocol health

- Awareness of systemic risks and contagion potential

Conclusion: Ethereum’s 2026 Inflection Point

Ethereum’s 2026 upgrade roadmap—Glamsterdam and Heze-Bogota—converges with evolving staking yields and accelerating DeFi expansion to push the network closer to a true global settlement layer. The combination of higher throughput, lower fees, stronger censorship resistance, and maturing regulatory frameworks sets the stage for sustained institutional participation.

The support for scalable rollups, cheaper execution, and transparent MEV handling creates infrastructure capable of handling hundreds of thousands of transactions per second across the ecosystem. Real world assets tokenization and institutional capital inflows provide the demand side of the equation.

While projections for TVL, RWAs, and yields are inherently uncertain, the direction of travel—toward more scalable, decentralized, and yield-bearing Ethereum infrastructure—appears structurally intact. The future of the network depends on successful execution of the roadmap and continued adoption by both retail users and institutions.

Track on-chain data, upgrade milestones, and regulatory developments as leading indicators for 2026 and beyond. The range of outcomes remains wide, but the foundation being built supports Ethereum’s ambition to serve as settlement infrastructure for the digital economy.

FAQ

What makes Ethereum’s 2026 roadmap different from earlier upgrades?

Unlike the Merge in 2022, which overhauled consensus from proof-of-work to proof-of-stake, the 2026 roadmap focuses on scaling, censorship resistance, and validator decentralization without changing the fundamental consensus mechanism. Glamsterdam and Heze-Bogota deliver incremental but high-impact changes to throughput, storage efficiency, and MEV handling. This approach reduces deployment risk while still achieving significant improvements in network capacity and user experience.

How could Ethereum’s staking yields change if DeFi activity underperforms in 2026?

If fee and MEV revenues fall below expectations due to lower DeFi activity, staking APRs could compress toward the low end of the projected range—around 2% or slightly below. In this scenario, ETH becomes more akin to a low-yield but low-inflation asset. Validators would still earn base issuance, but the variable components that drive yields above 3-4% would diminish until network activity picks up.

Will small investors still be able to participate meaningfully in DeFi once institutions dominate?

Thanks to lower L2 fees and permissionless smart contract design, smaller users retain access to the same core protocols institutions use. Decentralized exchanges, lending markets, and yield aggregators remain open to anyone with an Ethereum wallet. However, some bespoke RWA and credit products may be restricted to accredited or KYC’d participants due to regulatory requirements, creating a two-tier market for certain asset classes.

How do Ethereum L2s in 2026 compare to competing L1 chains for DeFi?

Leading Ethereum rollups are likely to match or exceed competing L1 chains on fees and throughput while inheriting Ethereum’s security guarantees and deep liquidity. This security inheritance is the key differentiator—rollups settle to Ethereum’s validator set rather than maintaining independent consensus. Competing L1s may still differentiate via alternative virtual machine designs, specific ecosystem niches, or regulatory positioning, but struggle to match Ethereum’s network effects and institutional credibility.

What are the main risks that could derail the 2026 upgrade roadmap?

Key risks include: technical delays in implementing Glamsterdam or Heze-Bogota due to unforeseen complexity; consensus or MEV-related issues that emerge during rollout; major smart contract exploits that damage trust in DeFi broadly; and adverse regulatory developments that slow institutional adoption or restrict access to key markets. The transition to ZK-proof verification also introduces fragility if proof generation cannot keep pace with network demand under stress conditions.