From Bitcoin to DePIN: Why Real-World Crypto Projects Could 10X This Cycle

From Bitcoin to DePIN, why real-world crypto projects could 10X this cycle is due to technological advancements, substantial institutional investments, and expanding real-world use cases. This article explores what makes these projects particularly promising right now.

Key Takeaways

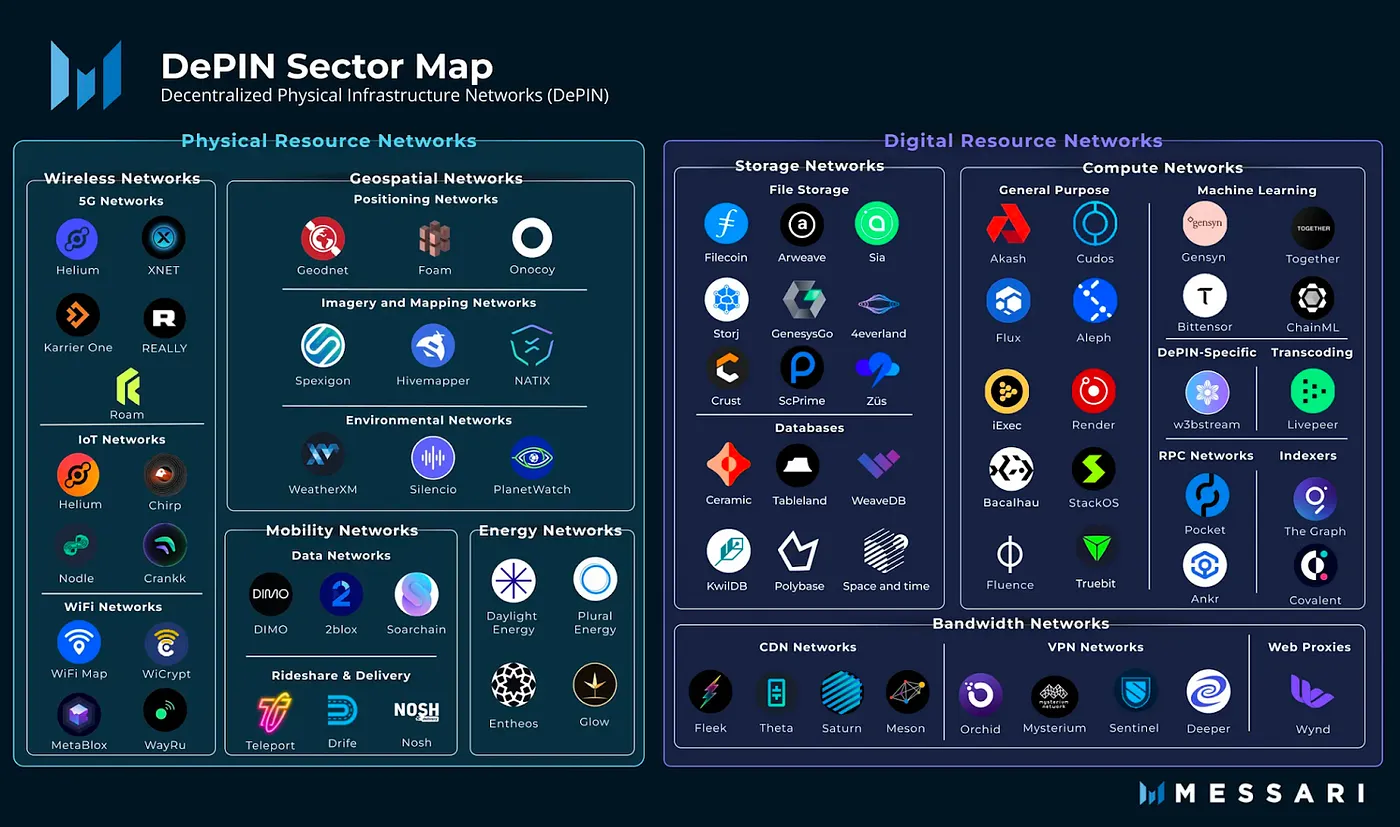

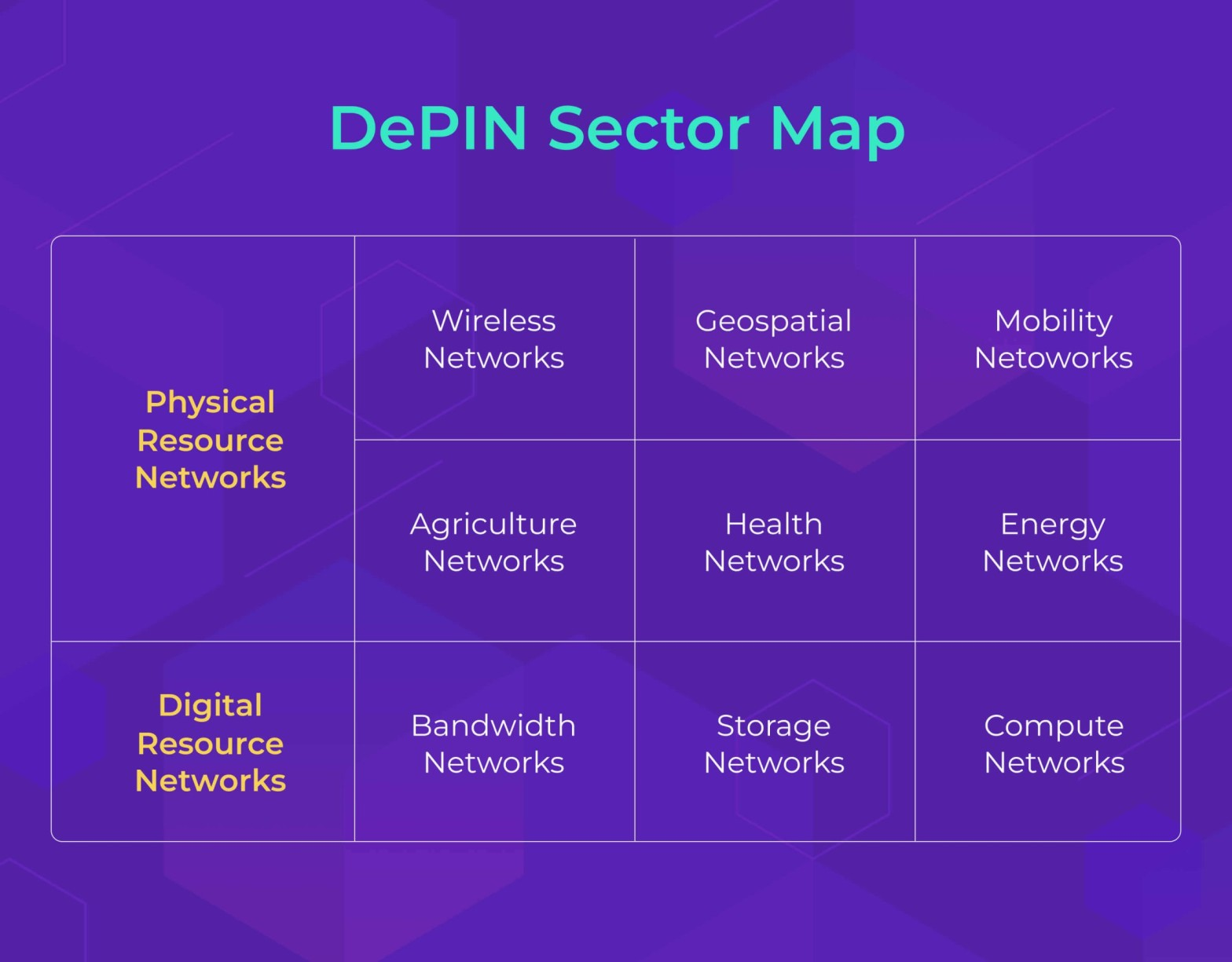

- DePIN technologies represent the next evolution in blockchain, integrating real-world infrastructure to enhance efficiency and address physical challenges.

- The DePIN sector is experiencing significant growth, driven by institutional investment, real-world utility, and integration with AI and IoT technologies.

- Key DePIN projects like Helium, Render Network, and Filecoin showcase the potential of decentralized infrastructures in various sectors, indicating strong investment opportunities.

The Evolution from Bitcoin to DePIN

Bitcoin’s introduction in 2009 was a watershed moment, marking the birth of decentralized digital currencies and a new asset class. It disrupted traditional financial systems by providing a decentralized alternative for transactions and savings.

Ethereum, launched in 2015, expanded the possibilities of blockchain technology with smart contracts, enabling developers to build decentralized applications (dApps) that operate autonomously. This paved the way for a new era of blockchain use cases beyond mere financial transactions.

Now, the rise of DePIN technologies signifies the next evolutionary step, integrating blockchain with real-world infrastructure to enhance efficiency and address physical infrastructure challenges.

Bitcoin: The Pioneer of Digital Assets

Bitcoin, the first decentralized digital currency, revolutionized the concept of digital assets. Bitcoin allowed peer-to-peer transactions without intermediaries, offering a decentralized alternative to traditional savings and transactions, disrupting conventional financial systems. Its introduction sparked discussions about the future of finance and digital property, shaping the evolving dynamics of digital finance and investment strategies.

Bitcoin’s influence continues to be felt across the total crypto market, setting the stage for subsequent crypto projects.

Ethereum and Smart Contracts: Expanding Use Cases

Ethereum’s introduction of smart contracts in 2015 marked a significant leap in blockchain technology. These self-executing contracts, with terms written directly into code, allowed developers to build dApps that operate on a blockchain. This innovation expanded blockchain’s use cases beyond cryptocurrencies, enabling:

- Decentralized finance (DeFi)

- Supply chain management

- Gaming

- Identity verification

Smart contracts reduce costs and increase efficiency by enabling peer-to-peer transactions without intermediaries.

The Rise of DePIN Technologies

DePIN technologies represent a significant advancement in how blockchain can be utilized to modernize decentralized physical infrastructure networks through hardware deployment in a distributed network. DePIN networks integrate physical assets with digital nodes to capture sensor data, operating autonomously and in real-time to enhance responsiveness and adaptability.

Projects like Helium’s decentralized internet access and Wicrypt’s tokenized wireless infrastructure are early examples of DePIN’s potential. Participants in DePIN projects receive token-based rewards for their contributions, further driving engagement and innovation.

Why Real-World Crypto Projects Are Poised to 10X This Cycle

The DePIN sector is on the brink of explosive growth, with its total market capitalization surpassing $32 billion as of November 2024. This remarkable financial growth indicates significant potential for real-world utility and adoption. Investment firms are increasingly focusing on DePIN projects, with substantial funds being allocated to fuel their growth.

Technological innovations and integration with emerging technologies like AI and IoT are also crucial factors driving DePIN’s success. These elements combined make DePIN projects poised to 10X this cycle.

Real-World Utility and Adoption

DePIN projects are transforming various sectors by providing decentralized solutions for real-world infrastructure. In agriculture, DePIN technologies offer decentralized crop monitoring and facilitate direct farmer-to-consumer transactions, enhancing efficiency. In healthcare, they secure medical data management, enable decentralized telemedicine, and improve clinical trial tracking, improving patient outcomes.

DePIN also optimizes energy management through decentralized energy sharing and renewable sources. The DePIN ecosystem’s combined market capitalization of approximately $80 billion highlights its significant value and mainstream adoption.

Institutional Capital and Investment

Institutional capital is playing a crucial role in the growth of DePIN projects. In 2024, the market capitalization of the DePIN sector saw a significant increase, reflecting growing investor confidence. Major investment firms have launched substantial funds to support the growth of DePIN projects, demonstrating their belief in the sector’s potential.

This influx of institutional investment is a strong indicator of the sector’s viability and future success.

Technological Innovations and Integration

The integration of emerging technologies like AI and IoT is driving the demand for DePIN technologies. Efforts to enhance the interoperability of AI and IoT within the DePIN ecosystem are improving functionality and expanding applications.

Developing collaboration frameworks and standards is essential for ensuring seamless integration and driving innovation across DePIN platforms. These technological innovations and collaborative initiatives are crucial for facilitating the growth of DePIN and their applications.

Key DePIN Projects Leading the Way

As the DePIN sector continues to grow, several key projects are leading the way:

- Helium

- Render Network

- Filecoin These projects are among the top DePIN projects that have surpassed significant market valuations and demonstrated substantial growth potential.

These projects showcase the diverse applications and advantages of DePIN technologies, including enhanced efficiency, improved security, scalability, and increased resilience. Depin’s success is a testament to the lucrative investment potential in the DePIN space.

Helium (HNT): Decentralized Wireless Network

Helium (HNT) stands out in the DePIN landscape for its decentralized wireless network catering to mobile and IoT connectivity through wireless networks and sensor networks. With over 379,000 active Hotspots worldwide and a market cap of $496 million as of September 2025, Helium has rapidly scaled its network coverage.

The rollout of 5G capabilities this year is set to further accelerate Helium’s service offerings and device support. Individuals can earn HNT tokens by providing coverage, creating a strong incentive for participation.

Render Network (RENDER): Decentralized GPU Rendering

Render Network democratizes access to GPU rendering resources, providing decentralized rendering services used in 3D content, generative AI, and the metaverse. By transitioning to Solana, Render Network has enhanced transaction speed and scalability, ensuring 99.99% uptime and reduced costs for users.

The ATH token rewards GPU providers and enables compute credit purchases, incorporating 518 million RENDER tokens in circulation. Collaborations on notable VR and cinematic projects further highlight its market presence.

Filecoin (FIL): Decentralized Storage Solutions

Filecoin continues to dominate the decentralized storage sector, establishing itself as a primary player. The diversification of base chains in DePIN signals that it is becoming a cross-chain movement.

Decentralized applications (dApps) use the DePIN layer to deliver real-world services, showcasing the utility of decentralized storage solutions.

How DePIN Projects Deliver Real-World Services

DePIN projects deliver real-world services by transforming traditional infrastructure through the integration of blockchain technology and decentralized infrastructure. They effectively allocate resources to vital physical infrastructure, creating more inclusive networks and driving significant economic progress in various sectors, including depin crypto projects.

By enabling decentralized operations, DePIN technologies enhance efficiency and scalability while reducing costs. This transformation is crucial for the success of DePIN projects in providing real-world services.

Infrastructure Ownership and Token Incentives

DePIN projects enable individuals and communities to contribute resources to a decentralized network and receive rewards through token incentives. Unlike traditional centralized infrastructure, DePIN allows anyone to participate and get rewarded for their inputs.

Node providers and node operators earn rewards based on the quality and consistency of their contributions, verified by on-chain validation mechanisms like Proof of Coverage and Proof of Compute. This collaborative approach enhances the functionality of decentralized applications across various sectors.

Enhancing Efficiency and Reducing Costs

DePIN projects enhance operational efficiency and reduce costs by:

- Eliminating the need for centralized data centers

- Crowdsourcing underutilized resources like bandwidth and GPU cycles

- Reducing manual intervention and errors

- Providing cost-effective, efficient, and secure data analysis storage solutions

Democratizing Access to Essential Infrastructure

DePIN projects democratize access to essential infrastructure by:

- Tapping into community participation and integrating distributed resources

- Facilitating demand response and peer-to-peer trading of renewable energy, promoting decentralized energy sharing

- Allowing participants to earn cryptocurrency tokens for sharing excess energy, enhancing energy management in smart cities

DePIN also impacts supply chains management and environmental monitoring, showcasing its broad applicability in environmental data.

Investing in DePIN Projects: Opportunities and Risks

Investing in DePIN projects presents both opportunities and risks. To navigate this, consider the following steps:

- Research each project thoroughly.

- Evaluate the potential of the projects.

- Understand the associated risks.

- Stay informed about market trends.

- Invest through reputable platforms like BingX to ensure secure and trustworthy transactions.

The rapidly evolving DePIN space offers significant potential but also comes with inherent risks that need careful consideration.

Evaluating Market Volatility and Emerging Trends

Market volatility is a significant risk factor for investors in the DePIN sector due to fluctuations in asset values and the immature nature of the technology. Despite these risks, the potential for extraordinary profitability, with projections suggesting growth of up to 243 times in the near-to-medium term, makes it an attractive investment.

Prioritizing factors like infrastructure utility, token economics, technological moat, corporate partnerships, and regulatory alignment is crucial when investing in DePIN projects.

Assessing Project Viability and Long-Term Potential

To assess the viability and long-term potential of DePIN projects, it’s essential to consider their market capitalization and fundraising success. The sector saw a 270% year-over-year increase in market capitalization, reflecting strong growth. From January 2024 to July 2025, $744 million was raised for DePIN projects, indicating robust investor interest.

Robust partnerships with established companies are also vital indicators of legitimacy and potential for long-term success.

Navigating Regulatory Clarity and Compliance

The regulatory landscape for DePIN projects is evolving, with authorities recognizing the need to adapt to blockchain technologies. Ensuring regulatory clarity and compliance is crucial for the success and sustainability of DePIN investments.

Staying informed about regulatory changes and ensuring compliance can help mitigate risks and enhance the legitimacy of DePIN projects.

The Future of DePIN and Real-World Crypto Projects

The future of DePIN and real-world crypto projects is promising, with significant potential for growth and innovation. Projects that balance technological innovation with sustainable economics will form the backbone of Web3’s physical layer, including real world assets.

The integration of digital assets with the physical world is expected to further drive the expansion and success of DePIN technologies. Continued advancements and collaboration within the DePIN space will be crucial for its future success.

Integration with AI and IoT Systems

Advancements in blockchain are facilitating decentralized systems and centralized systems that combine AI, IoT, and other emerging technologies. DePINs enable shared platforms for IoT devices, enhancing the scalability and functionality of these technologies.

Integrating ai systems and IoT is key for the scalability and wide application of artificial intelligence digital interactions DePIN projects, promising a more interconnected and efficient digital ecosystem.

Expansion into Emerging Markets

DePIN projects have significant potential in emerging markets, providing decentralized solutions that can enhance accessibility and economic development. These markets present a unique landscape for DePIN projects to address local challenges and foster economic growth.

By connecting underutilized resources, DePIN projects can help reduce costs and stimulate business development in developing regions through economic incentives.

Collaboration and Interoperability Initiatives

Collaboration within the DePIN ecosystem is crucial for driving innovation and ensuring seamless interactions among various platforms. Innovative interoperability solutions, such as cross-chain communication, are emerging to enhance the efficiency of decentralized networks. Real-world applications of these collaborative efforts include streamlined operations that benefit users and stakeholders alike.

The future holds potential for increased synergy and performance, promising a more interconnected and efficient ecosystem.

Summary

The evolution of crypto projects from Bitcoin to DePIN marks a significant advancement in the integration of blockchain technology with real-world infrastructure. DePIN projects like Helium, Render Network, and Filecoin are leading the way, demonstrating the potential for explosive growth and real-world impact. With substantial institutional investment, technological innovations, and a focus on delivering practical services, DePIN projects are poised to 10X this cycle. As the DePIN sector continues to evolve, its success will be driven by the balance of technological innovation, sustainable economics, and collaboration. The future of DePIN and real-world crypto projects is bright, promising a more decentralized and efficient digital ecosystem.

Frequently Asked Questions

What is DePIN?

DePIN, or Decentralized Physical Infrastructure Networks, combines blockchain technology with real-world infrastructure to improve efficiency and scalability. This innovative approach enables more effective management of physical assets.

Why are DePIN projects poised to 10X this cycle?

DePIN projects are primed for substantial growth this cycle because of their real-world utility, increasing institutional investment, and advancing technological innovations. These factors create a solid foundation for a potential 10X increase in value.

What are some key DePIN projects to watch?

Key DePIN projects to watch are Helium (HNT) for decentralized wireless networks, Render Network (RENDER) for decentralized GPU rendering, and Filecoin (FIL) for decentralized storage solutions. These projects are paving the way for innovative decentralized infrastructure.

How do DePIN projects deliver real-world services?

DePIN projects deliver real-world services by decentralizing operations to improve efficiency, lower costs, and increase access to essential infrastructure. This innovative approach transforms traditional systems, making them more accessible and effective for users.

What are the risks associated with investing in DePIN projects?

Investing in DePIN projects carries risks such as market volatility, technological uncertainties, and fluctuating regulatory frameworks. It’s crucial to conduct thorough research and analysis to make informed decisions.