Grayscale New Crypto Artificial Intelligence AI Fund Set to Transform Investments

Grayscale’s new Decentralized AI Fund integrates AI with blockchain to transform crypto investments, including the Grayscale New Crypto Artificial Intelligence AI Fund. By simplifying access to digital currencies, this fund offers a transparent and innovative way for investors, both new and experienced, to benefit from the growing AI and crypto sectors.

Key Takeaways

- Grayscale launched the Decentralized AI Fund on July 2, 2024, combining AI and blockchain to simplify digital asset investments for both novice and experienced investors.

- The fund focuses on tokens from decentralized AI protocols, offering a transparent investment structure through periodic rebalancing and public quotations to enhance liquidity.

- Accredited investors will have early access to the fund, providing opportunities to invest in transformative AI technologies while benefiting from Grayscale’s commitment to regulatory compliance and transparency.

Introduction to Grayscale’s New AI Fund

The inception of the Grayscale Decentralized AI Fund on July 2, 2024, marks a significant milestone in the financial landscape. This innovative fund integrates artificial intelligence with blockchain technology, creating a unique investment vehicle that aims to simplify access to digital currencies for investors.

Grayscale’s commitment to merging AI advancements with blockchain technology is evident in this new fund. The traditional security format of the fund removes the complexities of direct cryptocurrency management, simplifying investor engagement with digital assets. The fund’s components are carefully selected and periodically rebalanced to reflect the underlying digital asset values, ensuring that investors are aligned with the evolving market dynamics.

In essence, the Grayscale Decentralized AI Fund aims to democratize access to AI-driven investments, providing a seamless and transparent entry point for both seasoned and novice investors. This approach not only highlights Grayscale’s innovative spirit but also sets a new standard in the investment industry.

Understanding Decentralized AI

Decentralized AI represents a paradigm shift in how artificial intelligence operates. Utilizing blockchain technology, it converts opaque AI systems into open networks, enabling collaborative machine intelligence. This shift helps mitigate the risks associated with control concentrated in a few organizations, promoting a more democratic technology landscape through decentralized ai services.

One of the key benefits of decentralized AI is its ability to enable diverse applications that align better with individual needs. Unlike centralized models that impose uniform results, decentralized AI fosters innovation and responsiveness by distributing control among various stakeholders. This approach not only reduces the threats of mass surveillance and manipulation but also enhances the overall capabilities of AI systems.

Furthermore, decentralized AI networks can expand dynamically to meet demand while maintaining their performance and security. Addressing and reducing bias in AI models, these systems promote accuracy and fairness, building trust and encouraging innovation.

The Role of Blockchain Based AI Protocols

Blockchain technology provides a robust foundation for AI systems by ensuring data integrity and enhancing the management of identities and transactions. Its tamper-proof records make AI-driven security measures more reliable and trustworthy. Platforms like Fetch.ai utilize AI to create autonomous agents for complex tasks, enhancing operational efficiency across various industries.

Integrating AI with blockchain allows for automated security protocols that can adapt to evolving cyber threats. Projects like Cortex enable users to execute AI models within smart contracts, bridging the gap between AI functionalities and decentralized applications. This integration facilitates automated transaction processes, reducing the need for human intervention and thereby increasing efficiency.

Specific protocols such as Bittensor and Filecoin exemplify the principles of decentralization, accessibility, and transparency. Bittensor’s decentralized marketplace for machine intelligence allows AI models to share and monetize their predictive capabilities, while Filecoin offers decentralized storage solutions that are secure and cost-effective.

Key Features of the Grayscale Decentralized AI Fund

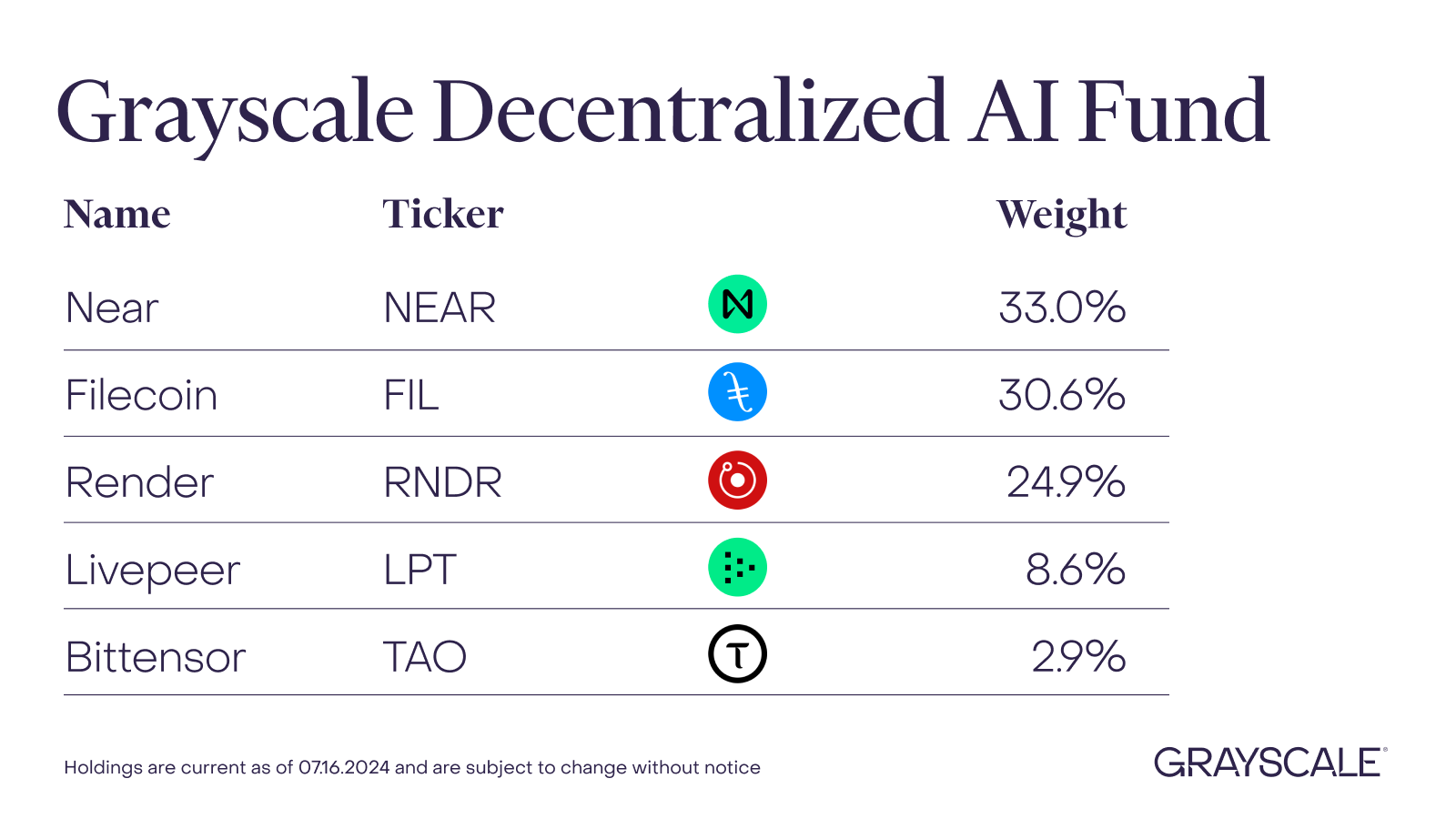

The Grayscale Decentralized AI Fund stands out as one of the initial investment vehicles focused solely on the value of tokens from decentralized AI protocols. This focus ensures that investors are directly exposed to the growth and potential of decentralized AI technologies.

Grayscale’s investment products follow a structured four-stage lifecycle to boost transparency and accessibility for investors. This lifecycle includes the careful selection and periodic rebalancing of the fund’s components to reflect the underlying digital asset values. Public quotations allow unrestricted shares from private placements to be traded, increasing liquidity for investors.

Additionally, Grayscale aims to utilize the ETF structure to better align its products’ market shares with the actual value of underlying digital assets. This alignment not only enhances market efficiency but also provides a more accurate representation of the fund’s value, benefiting investors.

Accredited Investors and Their Role

At first, Grayscale funds are available as private placements, permitting only accredited investors to participate. This approach enables these investors to gain early exposure to crypto and AI technologies that are poised for significant growth. Accredited investors play a crucial role in providing the necessary capital and support to realize the vision for AI integration in investments.

Accredited investors must meet specific criteria set by the SEC, including income or net worth thresholds. Through funds like the Howard Marks A.I. Fund, they can access venture-backed AI and tech firms that were previously available only to high-net-worth individuals. This diversification allows investors to spread their exposure across multiple AI companies, enhancing their investment portfolios, including options like ai fund llc.

Grayscale Investments’ Vision and Strategy

Grayscale Investments is dedicated to regulatory compliance and transparency, being the first in the crypto industry to report to the SEC. This ensures increased oversight and builds investor confidence. The firm aims to move its products toward ETF status, enabling ongoing creation and redemption of shares, which aligns their market price closer to their net asset value.

The Grayscale team strongly believes in the transformative potential of disruptive technologies, particularly decentralized AI. They see significant investment opportunities in this sector and are dedicated to enhancing algorithmic transparency to help stakeholders understand AI decision-making processes and identify biases.

Exploring AI Infrastructure and Services

Grayscale’s new AI fund marks a significant move into artificial intelligence and cryptocurrency, intending to reshape investment landscapes. Decentralized artificial intelligence is crucial as it empowers users and developers to innovate without central control, fostering greater cooperation in technological advancements.

Notable projects like Bittensor and Filecoin are examples of decentralized AI protocols that the fund supports. These projects showcase innovative applications in AI and provide the necessary infrastructure for data management, ensuring efficiency and scalability.

Blockchain-based AI protocols enable transparency, data integrity, and distributed computing capabilities, which are critical for decentralized AI systems.

Mitigating Fundamental Risks Emerging Alongside AI

Data diversification in AI training datasets ensures representation of various demographics, thereby minimizing bias. Regular bias audits are crucial for systematically identifying and mitigating potential biases in AI systems. The complexity of AI bias sources makes it challenging to pinpoint the exact cause, necessitating thorough evaluations.

Involving diverse communities during AI development provides valuable insights that help identify and mitigate potential biases. Grayscale’s team asserts that decentralized AI can play a vital role in alleviating fundamental risks that accompany the rapid development of AI technologies. This approach ensures that AI systems are more equitable and trustworthy.

AI’s capability to analyze data from IoT devices enhances the detection of security breaches within blockchain systems. This integration not only improves security but also demonstrates the potential of AI to address emerging risks in decentralized environments.

Prominent Projects: Bittensor TAO Filecoin FIL Livepeer LPT

Bittensor TAO operates as a decentralized neural network, allowing users to collaboratively train AI models and share the resulting benefits. This collaborative approach enhances the accuracy and efficiency of AI models by leveraging diverse inputs.

Filecoin FIL provides a decentralized storage solution that enables users to rent out their hard drive space in exchange for FIL tokens. This enhances data access for AI applications while ensuring secure and cost-effective storage.

Livepeer LPT facilitates decentralized video streaming, rewarding contributors who provide computing resources to the network. These projects exemplify the use of decentralized protocols to create collaborative opportunities and improve data accessibility for AI technologies.

Data Storage Solutions in Decentralized AI

Utilizing diverse data sources in decentralized AI helps minimize bias, leading to more equitable AI outcomes. These networks can also enhance privacy by processing data locally, thus minimizing the risk of data breaches. AI can facilitate the implementation of privacy-preserving technologies within blockchain frameworks, ensuring that sensitive information remains secure.

Bittensor addresses the compute bottleneck in AI by allowing a diverse community to share their computing resources for training models. This approach not only enhances computational efficiency but also democratizes access to AI technology, enabling broader participation in AI development.

How the Grayscale Team Feels Strongly About AI

The Grayscale team feels strongly about the transformative potential of AI in the investment landscape. They are committed to strategically integrating AI technologies to enhance investment processes and investor engagement. This commitment is evident in their new AI Fund, which exemplifies their dedication to being at the forefront of AI innovations.

Decentralized AI is viewed by the Grayscale team as a key driver of innovation, allowing for enhanced responsiveness and trust in AI applications. The integration of blockchain with AI is seen as critical for creating transparent, equitable, and efficient systems. Accredited investors are essential to the success of the AI fund, providing the necessary capital and support to realize this vision.

With the new fund, accredited investors gain access to advanced AI technologies that are expected to reshape investment strategies. The Grayscale team also recognizes the fundamental risks emerging from the rapid evolution of AI and is proactive in creating strategies to mitigate them.

Accredited Investors Exposure to AI Technology

Accredited investors are individuals or entities qualified to invest in unregistered securities, which typically include riskier investment opportunities. In the U.S., to be classified as an accredited investor, one must meet specific income or net worth criteria set by the SEC. This classification opens the door to unique investment opportunities not available to the general public, such as private placements, venture capital, and hedge funds.

Grayscale’s products are the first in the digital asset space to be SEC-reporting companies, reflecting a commitment to regulatory compliance and investor transparency. This status not only ensures higher levels of transparency and oversight but also strengthens Grayscale’s case for future ETF uplisting when allowed by regulatory frameworks. Accredited investors benefit from this regulatory compliance as it provides them with a more secure and transparent investment environment.

Investing in the Grayscale Decentralized AI Fund allows accredited investors to gain exposure to advanced AI technologies and blockchain-based AI protocols. This exposure allows them to participate in the growth and innovation of decentralized AI, potentially leading to significant returns on investment.

The Grayscale team feels strongly that their SEC-reporting status and commitment to transparency make their fund an attractive option for accredited investors looking to diversify their portfolios.

Summary

The Grayscale Decentralized AI Fund represents a significant advancement in the intersection of artificial intelligence and blockchain technology. By integrating decentralized AI protocols with blockchain’s inherent transparency and security, Grayscale offers a unique investment vehicle that simplifies access to digital currencies and AI technologies. This fund not only democratizes AI-driven investments but also sets a new standard in the investment industry.

As we have explored, the benefits of decentralized AI, the role of blockchain-based AI protocols, and the key features of the Grayscale fund highlight the transformative potential of this innovative approach. Accredited investors, through their crucial role, can gain early exposure to these advancements, ensuring they are at the forefront of technological progress. Grayscale’s commitment to transparency, regulatory compliance, and investor engagement positions them as a leader in this emerging field. The future of investments is here, and it is decentralized, intelligent, and transparent.

Frequently Asked Questions

What is the Grayscale Decentralized AI Fund?

The Grayscale Decentralized AI Fund is an investment vehicle that combines artificial intelligence with blockchain, providing streamlined access to digital currencies and AI technologies. It enables investors to participate in the evolving landscape of decentralized AI applications.

How does decentralized AI differ from centralized AI?

Decentralized AI differs from centralized AI by employing blockchain technology to foster open networks, allowing for distributed control among multiple stakeholders and minimizing the risks inherent in centralized systems. This approach enhances collaboration and security in AI development and deployment.

What role do accredited investors play in the Grayscale AI Fund?

Accredited investors play a crucial role in the Grayscale AI Fund by supplying essential capital, which not only supports the fund’s objectives but also grants them early access to emerging AI technologies and blockchain-based protocols.

What are some notable projects supported by the Grayscale AI Fund?

The Grayscale AI Fund supports notable projects such as Bittensor TAO, Filecoin FIL, and Livepeer LPT, which enhance the decentralized AI ecosystem through collaborative neural networks, decentralized storage, and decentralized video streaming. These projects are pivotal for advancing technology in their respective areas.

How does Grayscale ensure transparency and regulatory compliance?

Grayscale ensures transparency and regulatory compliance by being SEC-reporting companies, which provides higher levels of oversight and strengthens their position for future ETF uplisting. This commitment reflects their dedication to maintaining rigorous standards in the digital asset space.