How Bitcoin Can Restore Its Sense of Adventure and Innovation with DeFi: Key Insights

Bitcoin has always been at the forefront of financial innovation, but it faces stiff challenges from emerging blockchains. One of the key questions is how Bitcoin can restore its sense of adventure and innovation with DeFi. This article delves into the transformative potential of Bitcoin smart contracts, liquidity solutions, and the growing interest from institutional investors. Discover how integrating DeFi can rejuvenate Bitcoin and re-establish its pioneering status in the crypto world.

Key Takeaways

- Bitcoin smart contracts enhance security and efficiency, driving financial innovation and making Bitcoin a formidable player in the DeFi space.

- Liquidity and scalability improvements through Layer 2 solutions, like the Lightning Network, are crucial for Bitcoin DeFi’s growth and adoption.

- Building user trust and ensuring robust security measures are essential for the success and wider acceptance of Bitcoin DeFi platforms.

The Role of Bitcoin Smart Contracts in Financial Innovation

Bitcoin has always been synonymous with financial innovation. Its ability to enhance security, efficiency, and scalability makes it a transformative force in the financial sector. As the backbone of the crypto industry, Bitcoin’s unique capabilities drive financial innovation, ensuring safer transactions and building user confidence.

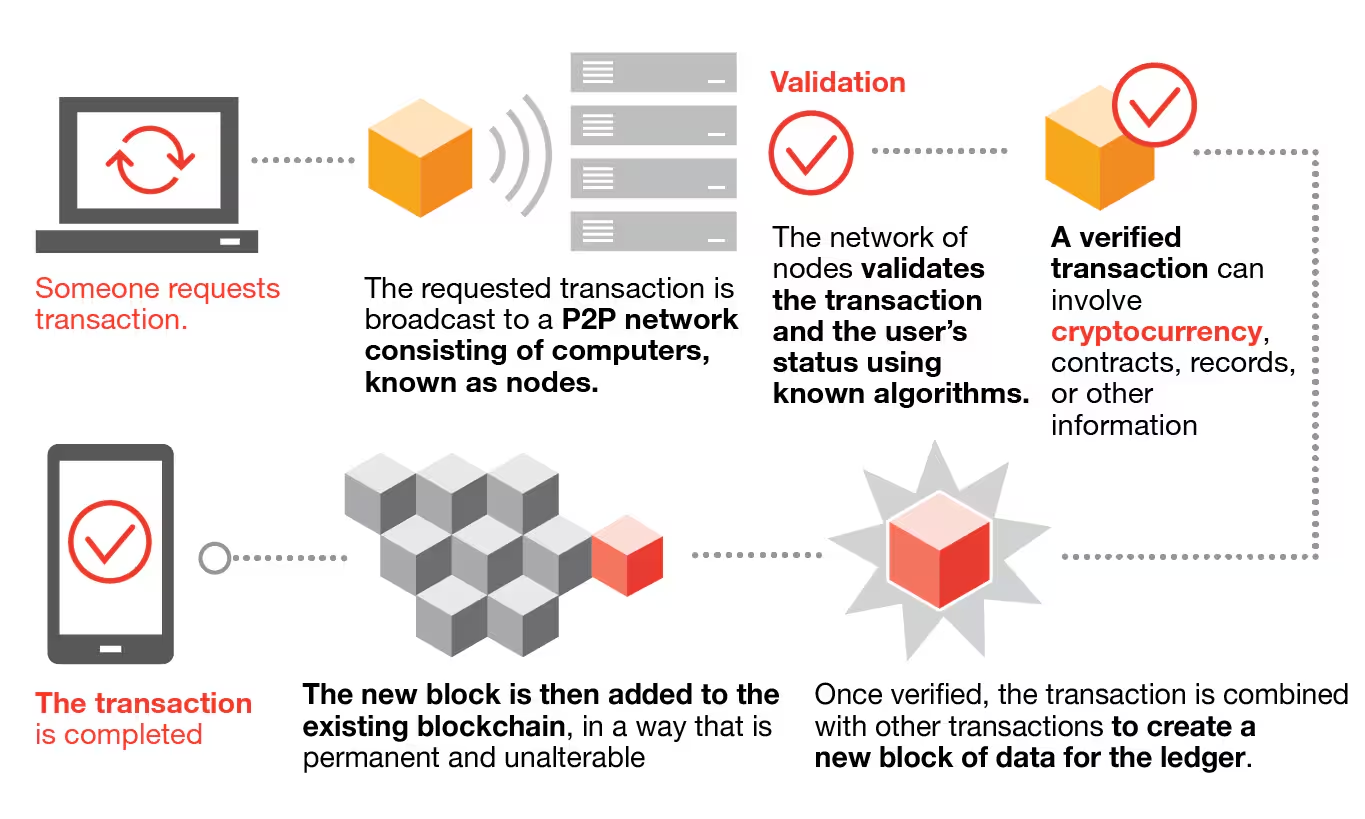

The potential of Bitcoin smart contracts is vast. Automated transactions reduce the need for intermediaries, cutting down transaction times and costs. This efficiency is crucial for Bitcoin’s adoption as a global financial tool. Exploring the intricacies of Bitcoin smart contracts reveals their comparability to rival chains and their role in establishing a fully programmable global ledger.

Bitcoin’s capabilities extend beyond enhancing current financial processes, paving the way for innovative applications that can redefine the financial landscape, embodying bitcoin’s spirit.

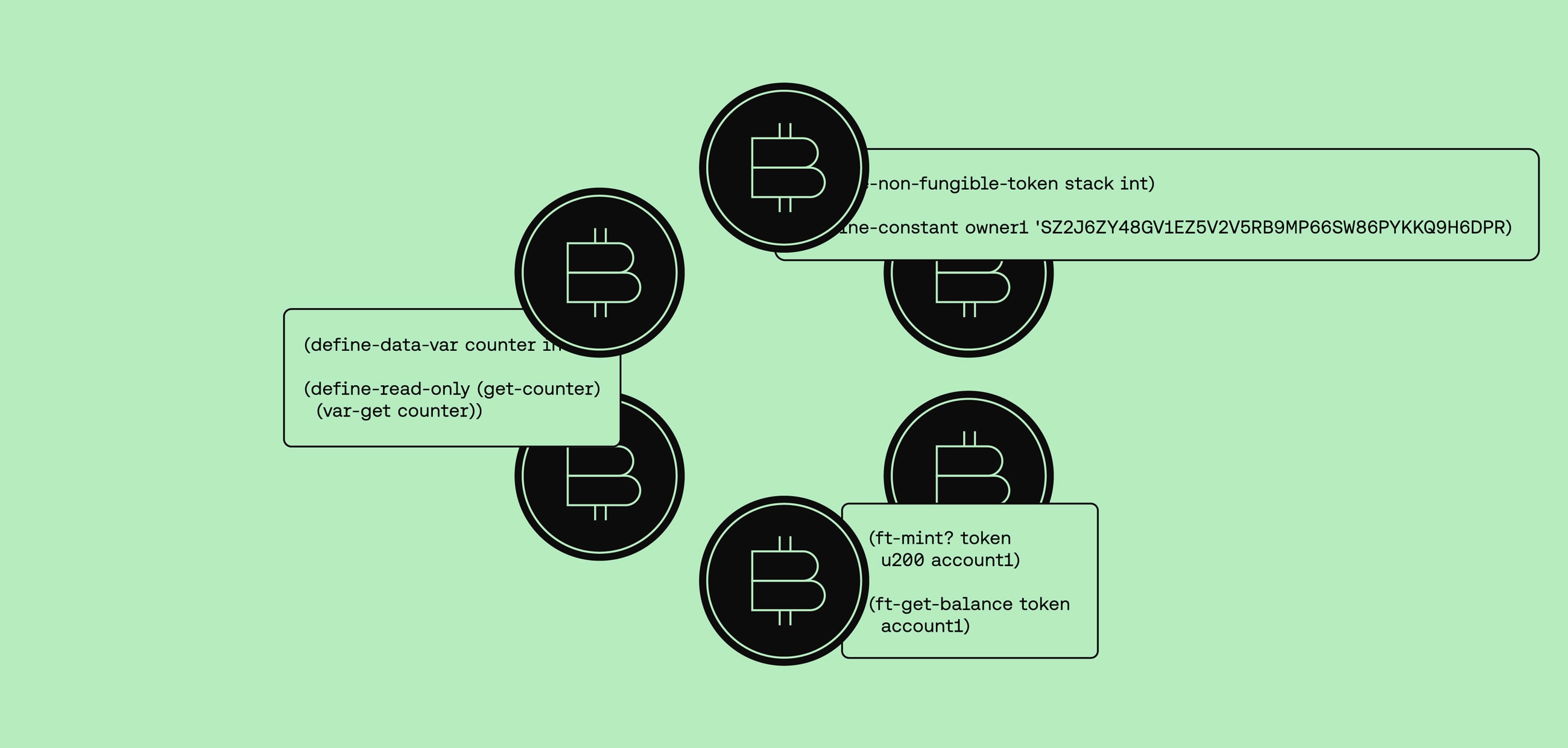

Bitcoin Smart Contracts vs Rival Chains

Bitcoin smart contracts, though simpler compared to those on rival blockchains like Ethereum, offer unique advantages. The simplicity stems from Bitcoin’s basic scripting language, which, while limiting complexity, enhances reliability and security. The unique UTXO (Unspent Transaction Output) model used by Bitcoin ensures that each transaction is self-contained and easier to verify, providing a level of security and transaction privacy that stands out in the crypto space.

This model contrasts sharply with Ethereum’s account-based model, which, while more flexible, introduces additional complexities and potential vulnerabilities. Bitcoin’s UTXO model offers reliability and security, making it a formidable player against rival chains.

Fully Programmable Global Ledger

Transitioning Bitcoin into a fully programmable global ledger holds immense potential. It could significantly strengthen digital property rights across various ownership models, enhancing accountability through automated contract execution. Imagine a world where every transaction is not only secure but also transparent and accountable, thanks to smart contracts.

RSK facilitates the creation of Bitcoin-backed assets, allowing for decentralized applications that maintain Bitcoin’s security and stability, ensuring a robust and reliable fully programmable global ledger.

Enhancing Bitcoin DeFi’s Value

Bitcoin smart contracts are unlocking new levels of productivity, potentially increasing the use of Bitcoin in various financial applications. Automated transactions without intermediaries make financial processes more efficient and cost-effective.

Bitcoin DeFi’s potential to enhance liquidity and scalability attracts new participants and capital to the bitcoin ecosystem. This influx of new participants and capital is essential for driving the growth and maturity of the Bitcoin DeFi space, making it a vibrant part of the crypto industry.

Exploring ways to enhance Bitcoin DeFi’s value includes examining improvements in liquidity and scalability, as well as growing interest from institutional investors.

Liquidity and Scalability Improvements

Layer 2 solutions, such as state channels, sidechains, and rollups, play a critical role in enhancing Bitcoin’s scalability. These solutions allow Bitcoin to process transactions offchain, significantly increasing transaction speed and reducing fees. Integrating scalable blockchains addresses fragmented liquidity, leading to lower transaction costs and better user experiences.

Recent upgrades like Taproot have further improved Bitcoin’s smart contract capabilities, enabling more complex financial interactions while maintaining security. These advancements have led to the creation of various financial tools, such as decentralized exchanges and yield farming platforms, enhancing user interaction and engagement.

Institutional Investors and Wealth Management

Institutional investors are exploring Bitcoin DeFi for wealth management, attracted by its cost reduction potential and improved liquidity. This growing interest in digital assets reflects a significant shift towards utilizing cryptocurrency for diversified asset management.

Bitcoin DeFi’s potential to offer superior real returns compared to traditional finance is attracting institutional investors, indicating broader acceptance in the financial industry. This shift is crucial for the continued growth and adoption of Bitcoin DeFi, making it an integral part of the global economy.

Embracing Boundless Innovation

Decentralized finance has transformed the financial landscape, offering a range of innovative products and services. Bitcoin DeFi aims to attract more participants by improving liquidity and scalability, which are critical for the growth of decentralized finance.

The strategies employed in Bitcoin DeFi, such as innovative financial tools and mobile-first applications, are designed to enhance user engagement and accessibility. Embracing boundless innovation with defi helps Bitcoin regain its sense of adventure. This will enable it to remain a pioneering force in the crypto industry.

Examining the specifics of Lightning Network integration and innovative financial tools provides deeper insights.

Lightning Network Integration

The Lightning Network, a Layer 2 solution, significantly enhances Bitcoin’s transaction speed and reduces costs, making it more scalable for mass adoption. This second-layer protocol enables near-instant payments while maintaining the security of the main Bitcoin blockchain, thus facilitating higher liquidity.

The Lightning Network enhances Bitcoin’s efficiency for DeFi applications, enabling billions of payments per second with minimal fees through microtransactions and off-chain transactions. This integration is crucial for the broader adoption of Bitcoin in the DeFi space.

Innovative Financial Tools

Emerging financial tools like Zest Protocol facilitate Bitcoin lending and borrowing via smart contracts, enhancing transaction transparency and efficiency. Tokenization allows institutional and retail investors to access fractional ownership of traditionally exclusive investment-grade assets, broadening the scope of investments.

Mobile-first DeFi applications, aimed at improving accessibility and user engagement, are becoming increasingly popular, particularly among younger investors. These innovations are expanding Bitcoin’s utility beyond simple transactions, making it a more versatile and attractive financial tool, often referred to as digital gold.

Security and Trust in Bitcoin DeFi

Security and trust are paramount in the world of DeFi. Despite its potential, decentralized finance faces significant challenges, including reliance on centralized entities and security vulnerabilities. Addressing these issues is crucial for the growth and adoption of Bitcoin DeFi.

Robust security measures and building user trust are essential steps in this journey. Implementing comprehensive security protocols and fostering transparency can help Bitcoin DeFi overcome challenges and thrive in the crypto industry.

Ensuring Robust Security Measures

Robust security measures protect user assets in Bitcoin DeFi. Regular audits and code reviews are crucial to identifying vulnerabilities and enhancing platform security. Engaging third-party firms for comprehensive audits before deploying smart contracts ensures potential risks are mitigated.

Adopting multi-signature wallets, which require multiple approvals for transactions, adds an extra layer of security. Additionally, implementing bug bounty programs encourages ethical hackers to find vulnerabilities, further enhancing overall platform security.

Building User Trust

User trust in Bitcoin DeFi platforms is vital for broader adoption. Transparency in operations and clear communication of security measures significantly contribute to building trust. Open-source code allows users to verify the security and functionality of DeFi protocols, fostering greater confidence.

Compliance with regulatory frameworks is also essential for maintaining user trust and avoiding legal complications. Using reliable oracles to ensure accurate data feeds minimizes risks associated with price manipulation, further enhancing platform reliability.

Case Studies and Success Stories

Bitcoin DeFi platforms like RSK and Sovryn showcase the potential of decentralized services that leverage Bitcoin’s security. These platforms offer enhanced user engagement and demonstrate how Bitcoin can drive innovation in the DeFi space.

By examining these success stories, we can gain valuable insights into the strategies that have worked and the lessons learned from early adopters. This knowledge is crucial for understanding the future trajectory of Bitcoin DeFi.

Notable Bitcoin DeFi Projects

Sovryn, a decentralized platform for trading and lending Bitcoin, operates as a non-custodial platform, allowing users to engage in margin trading and yield farming without needing additional tokens. This project exemplifies how Bitcoin DeFi can drive innovation and enhance the cryptocurrency ecosystem.

By leveraging smart contract capabilities, Sovryn and similar projects contribute to the growth and maturity of the Bitcoin DeFi space, making it an integral part of the global economy.

Lessons from Early Adopters

Early adopters of Bitcoin DeFi have been critical in shaping the current landscape. Their experiences highlight the importance of usability, efficiency, and security in promoting broader adoption. Insights from early adopters emphasize the need for user-friendly interfaces and robust security measures, crucial for the growth and adoption of Bitcoin DeFi.

Challenges and Future Prospects

The decentralized finance landscape necessitates strong security measures to protect user assets and maintain trust. As of December 2024, the Total Value Locked (TVL) in Bitcoin DeFi was around $7.48 billion. This figure indicates a considerable interest from investors.

Focusing on governance, education, and regulatory clarity is necessary to overcome current challenges. Addressing these issues is crucial for Bitcoin’s growth. This way, it can continue to evolve and thrive in the DeFi space.

Overcoming Current Challenges

Adopting best practices for developers and implementing robust decision-making frameworks can address governance issues in Bitcoin DeFi. Enhanced community participation models can improve governance by involving more users in decision-making. These strategies are essential for a decentralized and transparent ecosystem.

Educational resources support new users, helping them navigate the complexities of Bitcoin DeFi. Solving governance challenges and enhancing user education can help Bitcoin restore its sense of adventure and innovation in finance.

Future Trends and Opportunities

Advancing regulatory clarity is expected to attract institutional investors by reducing perceived risks associated with DeFi investments. Regulatory clarity will enhance trust and attract institutional investors to Bitcoin DeFi, potentially leading to increased investment and market growth.

The integration of traditional finance with decentralized finance is likely to create new opportunities for asset tokenization in Bitcoin DeFi. This fusion of traditional and decentralized finance could drive significant innovation and expansion in the global economy.

Summary

Bitcoin DeFi holds immense potential to restore its sense of adventure and innovation. By leveraging smart contracts, Bitcoin can enhance security, efficiency, and scalability, driving financial innovation and attracting new participants and capital. The integration of Layer 2 solutions and innovative financial tools further boosts Bitcoin’s capabilities in the DeFi space.

Institutional interest in Bitcoin DeFi is growing, indicating a broader acceptance of cryptocurrency in wealth management and asset management. Ensuring robust security measures and building user trust are essential steps to overcome current challenges and drive broader adoption.

As we look to the future, regulatory clarity and the integration of traditional finance with DeFi present exciting opportunities for Bitcoin. By embracing boundless innovation, Bitcoin can continue to be a pioneering force in the crypto industry, reshaping the global economy and financial landscape.

Frequently Asked Questions

What are Bitcoin smart contracts, and how do they differ from those on rival chains?

Bitcoin smart contracts are simpler and more secure due to Bitcoin’s UTXO model and basic scripting language, ensuring each transaction is self-contained and easier to verify. This contrasts with Ethereum’s more complex account-based model, which allows for greater flexibility but potentially increased risks.

How can Bitcoin DeFi enhance liquidity and scalability?

Bitcoin DeFi can enhance liquidity and scalability through Layer 2 solutions and upgrades like Taproot, which improve transaction speed, reduce fees, and enable more complex financial interactions. This ultimately allows for greater participation and efficiency in the DeFi ecosystem.

Why are institutional investors interested in Bitcoin DeFi?

Institutional investors find Bitcoin DeFi appealing due to its potential to lower costs and enhance liquidity, while also offering the possibility of superior returns and diversified asset management. This combination makes it an attractive alternative to traditional finance.

What role does the Lightning Network play in Bitcoin DeFi?

The Lightning Network significantly enhances Bitcoin’s scalability and transaction efficiency by enabling near-instant payments and reducing costs. This makes it a vital component for facilitating DeFi applications on the Bitcoin network.

How can Bitcoin DeFi address security and trust issues?

To effectively address security and trust issues in Bitcoin DeFi, it’s crucial to implement regular audits, utilize multi-signature wallets, and establish bug bounty programs. Transparency through open-source code and adherence to regulatory frameworks further enhances user trust.