How Blockchain is Helping to Stop Fraud and Scams: A Powerful Tool for Prevention

Blockchain is helping to stop fraud and scams by making transactions transparent and immutable. These features allow for early detection of suspicious activities and enhance security through decentralized monitoring. This article will explore how blockchain is helping to stop fraud and scams through its unique characteristics, from real-time alerts to secure identity verification.

Key Takeaways

- Blockchain’s immutability and transparency enhance fraud prevention by making records tamper-proof and enabling early detection of suspicious activities.

- Real-time monitoring and automated alerts through smart contracts improve fraud management by quickly identifying unusual transactions and facilitating swift responses.

- Blockchain significantly strengthens identity verification and supply chain management, protecting against identity theft and ensuring product authenticity through transparent transaction histories.

Blockchain’s Role in Fraud Prevention

Blockchain technology stands out as a formidable force in the fight against fraud. Its main characteristics—immutability, transparency, and decentralization—make it exceedingly difficult to manipulate records, thus providing a solid foundation for fraud detection and prevention. Ensuring all transactions are visible and tamper-proof allows blockchain to identify suspicious activities early, a key factor in thwarting fraudulent schemes.

The decentralized nature of blockchain further enhances fraud prevention by involving multiple stakeholders in the monitoring process. This collaborative approach not only strengthens the security framework but also fosters trust among participants.

Blockchain solutions mitigate fake bills, false payments, and scams by providing a secure and traceable transaction environment, making it a powerful tool against fraud.

Enhancing Trust with Immutable Transaction Records

One of blockchain’s most significant advantages is its immutability. Once recorded on the blockchain, data cannot be altered or deleted, maintaining integrity and reliability. This irreversible nature ensures that transaction records remain authentic and unmanipulated, thereby fostering trust among all participants involved in the transaction.

Transparency is another key feature of blockchain that aids in preventing fraud. Making transaction histories visible to all users reduces the chances of fraudulent activities. This transparency enables quick audits and swift investigations of suspicious activities, minimizing human error and enhancing transaction efficiency.

The combination of immutability and transparency makes blockchain a trustworthy solution for secure transactions.

Real-Time Monitoring and Automated Alerts

Blockchain technology allows for immediate access to transaction records throughout the network. This capability is essential for effective real-time monitoring. Continuous monitoring quickly identifies irregular activities, enhancing proactive fraud management. Tracking credit card transactions in real-time aids in early detection of fraudulent activities, providing robust security.

Automated alerts are another critical feature of blockchain-based fraud detection systems. Smart contracts can automatically flag transactions that don’t comply with predefined rules, triggering alerts for unusual activity. This automation speeds up response time to potential fraud, enabling rapid crime prevention measures. Public access to blockchain transaction data facilitates external audits, making it easier to detect and investigate illicit activities.

In addition to enhancing internal fraud detection capabilities, advanced blockchain monitoring tools can analyze transaction patterns and detect anomalies, particularly in cryptocurrency transactions. This capability extends to monitoring the deep and dark web, helping security teams anticipate and counteract various forms of crypto fraud. Real-time monitoring and automated alerts are crucial in identifying and mitigating fraudulent activities as they occur.

Smart Contracts: Automating Fraud Detection

Smart contracts represent a significant leap forward in automating fraud detection. These self-executing contracts perform predefined actions when specific conditions are met, reducing human error and enhancing efficiency. Automating the flagging of suspicious transactions ensures that any deviations from the norm are promptly addressed.

The integration of smart contracts with machine learning further augments their capabilities. This combination enables advanced predictive analysis, identifying fraud patterns that might otherwise go unnoticed.

In blockchain identity management, smart contracts automate the verification process, ensuring that only authenticated users can access sensitive information. This automation extends to secure transactions, where funds are released only when all criteria are satisfied, adding another layer of fraud prevention.

Securing Identity Verification and Authentication

Identity theft is a significant concern in the digital age, but blockchain technology offers a robust solution. By securely authenticating users and devices, blockchain significantly lowers the risk of identity theft. This technology prevents unauthorized access to personal data, keeping sensitive information protected.

Blockchain identity systems also provide users with control over their personal information, enhancing transparency and trust. Individuals can create a single digital identity usable across multiple platforms, streamlining the verification process and reducing the chances of fraud.

In essence, blockchain verifies user identities securely and efficiently, making it a powerful tool in the fight against identity theft.

Transparent Supply Chain Management

Supply chain management benefits immensely from blockchain’s transparency. Transparent tracking through blockchain reduces the chances of data tampering regarding products. This transparency extends to product traceability, enabling stakeholders to track the history and conditions of production, thus preventing supply chain fraud. Additionally, effective supply chains can leverage this technology for improved efficiency.

The use of digital IDs and Verifiable Credentials helps prevent the sale of counterfeit goods by providing a transparent and verifiable history for each product. Blockchain’s immutability ensures that transaction data cannot be altered, making it exceedingly difficult for fraudsters to falsify information. This unbreakable data chain fosters trust among participants, ensuring secure supply chain transactions.

Fighting Financial Fraud

Financial fraud is a pervasive issue, but blockchain technology offers a robust solution. Its decentralized nature complicates the execution of schemes like Ponzi schemes, making it harder for fraudsters to manipulate financial transactions. Transactions requiring consensus from multiple computers add another layer of security.

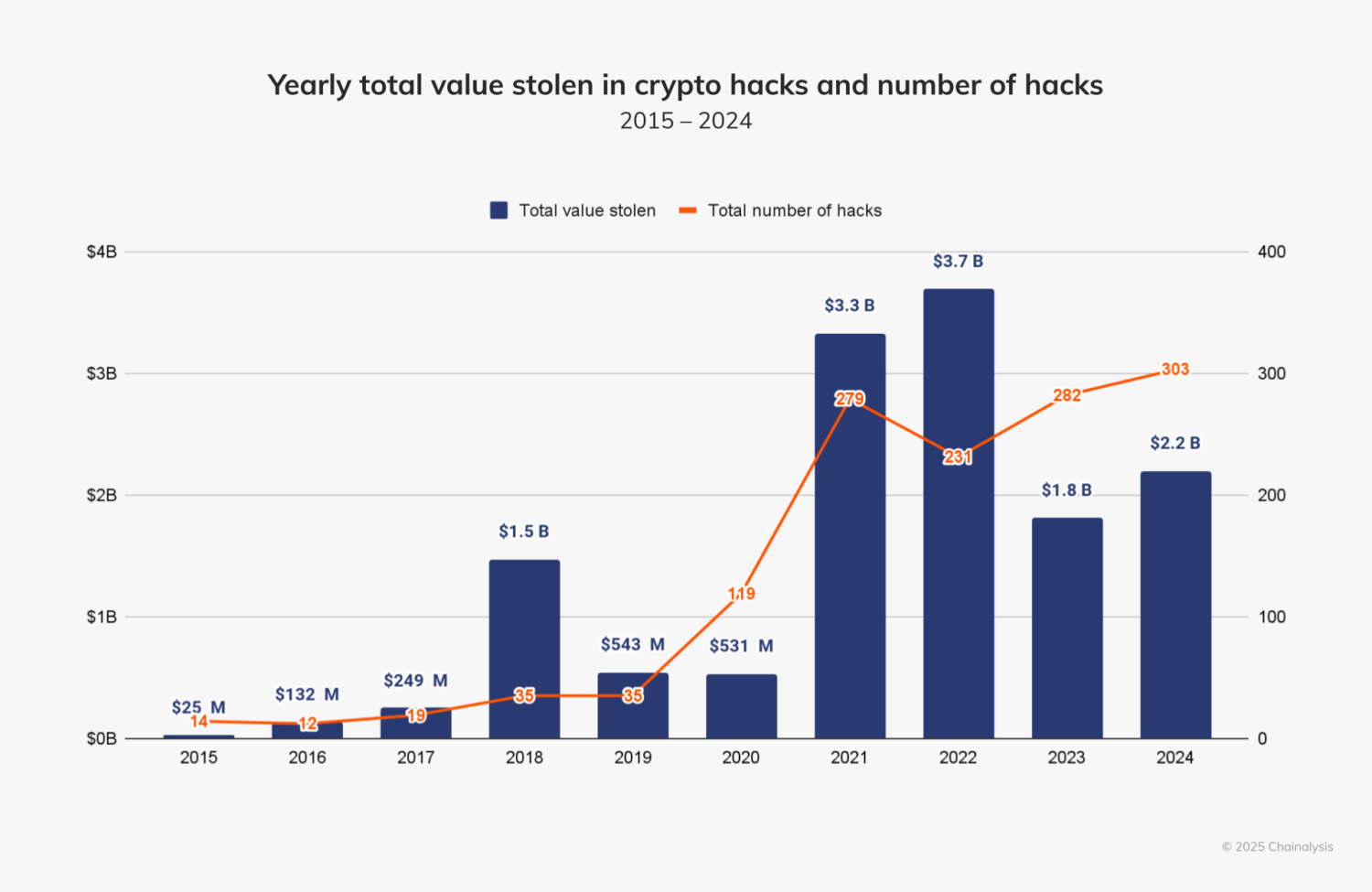

Blockchain enables real-time data sharing and updates with approval from all parties, improving the detection of financial fraud. Companies like Chainalysis provide tracking services for cryptocurrencies, showcasing the effectiveness of blockchain in real-time monitoring.

By addressing various types of fraud, including financial fraud, identity theft, supply chain fraud, and fraudulent activity, blockchain proves to be an invaluable tool in fraud detection and prevention.

Distributed Ledger Technology for Enhanced Security

Blockchain’s decentralized structure significantly improves security by eliminating single points of failure. Altering data on a blockchain requires consensus from multiple participants, making it exceedingly difficult for criminals to compromise the system. This decentralized nature also enhances the overall security framework, ensuring that transactions are validated before being added to the blockchain.

Private blockchains further enhance security by limiting participant access and ensuring controlled membership. The reliance on cryptography and the intricate design of blockchain’s distributed ledger technology make unauthorized data manipulation almost impossible.

These security features make blockchain a robust tool for preventing fraud and securing transactions.

Anti-Money Laundering (AML) Compliance

Blockchain technology significantly enhances Anti-Money Laundering (AML) compliance by providing immutable records and real-time monitoring. This capability allows for permanent and unchangeable tracing of fund origins, simplifying the detection of suspicious transactions. The real-time monitoring and analysis of transaction patterns further aid in AML compliance, ensuring that financial systems meet regulatory standards.

Offering a transparent and traceable transaction history, blockchain simplifies compliance with stringent AML regulations. This helps in detecting and preventing money laundering and builds trust among regulatory bodies and financial institutions. Blockchain’s role in AML compliance is thus indispensable in the modern financial landscape.

Case Studies: Successful Implementation of Blockchain Solutions

Case studies highlight the effectiveness of blockchain technology in fraud prevention. Walmart, for instance, utilizes blockchain to track and trace food products, ensuring authenticity and preventing supply chain fraud. This initiative not only enhances transparency but also builds consumer trust in the brand.

Everledger’s platform verifies the authenticity of art and luxury goods by recording unique characteristics on the blockchain, reducing the risk of fraud. Similarly, IBM TrustChain tracks and verifies the origin, ownership, and transaction history of diamonds, ensuring their authenticity.

These implementations demonstrate how blockchain can combat fraud across various industries.

Overcoming Challenges and Limitations

Despite its many advantages, blockchain technology faces several challenges. Scalability remains a crucial issue as blockchain networks grow, impacting speed and efficiency. Regulatory uncertainty and legal complexities also pose significant barriers to blockchain adoption. These challenges create unpredictability for enterprises looking to implement blockchain solutions.

Privacy concerns related to storing sensitive data on blockchain networks need careful consideration for successful implementation. Additionally, the integration of blockchain technology can be resource-intensive, requiring significant investments in infrastructure and training. Maintaining a blockchain network is an ongoing responsibility, demanding resources for updates and checks from participants.

Addressing these challenges is key to the widespread adoption of blockchain in fraud prevention.

Future Trends in Blockchain Fraud Prevention

The future of blockchain in fraud prevention looks promising, with continuous innovations driving the field forward. Emerging blockchain technologies, such as improved consensus mechanisms and AI integrations, are being developed to boost fraud detection and prevention capabilities. These advancements will enhance real-time transaction monitoring, essential for detecting fraudulent activities as they occur.

Smart contracts will continue to play a pivotal role in automating processes, enabling immediate actions against potential fraud scenarios without human intervention. Automation facilitated by blockchain technology reduces operational overhead and increases transaction speed, further deterring fraud.

As organizations overcome challenges related to blockchain adoption, the technology’s role in fraud prevention will only grow stronger.

Summary

Blockchain technology offers a revolutionary approach to fraud prevention, leveraging its unique features to enhance security across various domains. From immutable transaction records to real-time monitoring and automated alerts, blockchain provides a robust framework for detecting and preventing fraud. Successful case studies highlight its effectiveness, while future trends promise even greater advancements.

As we move forward, overcoming challenges related to scalability, regulatory issues, and privacy concerns will be crucial. However, the potential benefits of blockchain in fraud prevention far outweigh these hurdles. With continuous innovations and widespread adoption, blockchain technology is set to become an indispensable tool in the fight against fraud.

Frequently Asked Questions

How does blockchain technology prevent fraud?

Blockchain technology effectively prevents fraud through its immutability, transparency, and decentralization, which make record manipulation extremely difficult. This robust framework enhances both fraud detection and prevention.

What role do smart contracts play in fraud prevention?

Smart contracts play a crucial role in fraud prevention by automating processes and executing predefined actions when specific conditions are met, which minimizes human error and increases efficiency. This automation significantly enhances the reliability of transactions.

How does blockchain secure identity verification?

Blockchain secures identity verification by authentically linking users and devices, which reduces the risk of identity theft and unauthorized access to personal data. This technology ensures a more secure and trustworthy identity management system.

Can blockchain help in supply chain management?

Absolutely, blockchain enhances supply chain management by offering transparent tracking and verifiable histories, which significantly reduce the risks of fraud and counterfeiting. This level of transparency helps build trust among stakeholders.

What are the challenges of implementing blockchain technology?

Implementing blockchain technology poses challenges such as scalability, regulatory uncertainty, privacy concerns, and the significant resources required for integration and maintenance. Addressing these issues is crucial for successful adoption and operation.