Is Solana the New Wall Street Darling? Why Funds Are Eyeing SOL in 2025

Is Solana the new Wall Street darling? Why are funds eyeing SOL in 2025? Institutional investors are attracted to Solana for its high-speed transactions, low fees, and robust ecosystem. This article explores the reasons behind Wall Street’s growing interest in SOL and its potential impact, specifically addressing the question: is Solana the new Wall Street darling, why funds are eyeing SOL in 2025?

Key Takeaways

- Solana has gained significant institutional adoption in 2025, attracting major investments and positioning itself as a key asset for corporate treasuries.

- The introduction of Solana ETFs is expected to drive $3-6 billion in new institutional investments, increasing demand and validating Solana’s position in the cryptocurrency market.

- Despite its growth, Solana faces challenges such as regulatory uncertainties, market volatility, and competition from established platforms like Ethereum, which could impact its long-term prospects.

Solana’s Meteoric Rise: Institutional Adoption in 2025

The story of Solana’s rise in 2025 is nothing short of phenomenal. Solana has recently surpassed BNB to secure the fifth position in market capitalization, driven by its increasing practical use cases and robust technological infrastructure. This leap in market cap is not just a reflection of retail interest but a significant nod from institutional investors who see immense potential in Solana’s ecosystem.

Solana’s appeal to institutional investors stems from its unmatched performance and growing ecosystem, which has made it a strategic asset for many corporate treasuries. From the creation of dedicated SOL treasuries to the launch of Solana ETFs, the blockchain is attracting both mainstream investors and institutional interest, utilizing sol strategies.

We’ll explore how Wall Street giants are supporting Solana, the impact of Solana ETFs on institutional demand, and the integration of Solana by corporate treasuries.

Wall Street Giants Backing SOL

Forward Industries has made a staggering $1.58 billion investment in Solana, marking one of the most significant endorsements from a Wall Street giant. This investment was part of a PIPE round that saw participation from major firms like Galaxy Digital and Jump Crypto, signaling a strong institutional support for Solana. Such investments underline the confidence that big players have in Solana’s potential as a viable blockchain for the future.

Galaxy Digital and Jump Crypto’s involvement further cements Solana’s status as a promising asset. Pantera Capital’s CEO has even described Solana as the fastest, cheapest, and most performant blockchain, highlighting the strong endorsements from industry leaders. These investments are not just about riding the crypto wave; they are strategic moves to capitalize on Solana’s technological edge and its growing market presence.

Moreover, Wall Street giants are developing a Solana treasury with the aim of creating the largest dedicated SOL treasury utilizing a public companies structure. This move is a testament to the trust and long-term commitment that institutional investors have in Solana, positioning it as a cornerstone asset in their strategies.

The Role of Solana ETFs in Institutional Demand

Exchange-traded funds (ETFs) have emerged as a familiar and accessible investment channel for institutional investors looking to gain exposure to digital assets like Solana. Franklin Templeton and Grayscale have initiated filings for Solana ETFs, which, if approved, could potentially release $3-6 billion in new investments into the market. This influx of capital would significantly boost institutional demand for Solana, as highlighted in recent etf news, and may also lead to the establishment of a new fund. Additionally, seeking investment advice can help investors navigate these opportunities effectively.

The launch of the first U.S. altcoin ETF based on Solana marks a pivotal shift in the crypto investment landscape. This development has not only influenced institutional interest but also validated Solana’s position as a major player in the blockchain space. Many decentralized finance projects on Solana are attracting mainstream users due to the platform’s efficiency and low transaction costs.

ETFs offer investors diversified exposure to multiple cryptocurrencies in one product, making them an attractive option for institutional investors venturing into Solana. This diversified exposure reduces risk and makes it easier for traditional investors to participate in the burgeoning broader crypto market.

Strategic Asset for Corporate Treasuries

Corporate treasuries are evolving. They are no longer content with simply holding cryptocurrencies; they are integrating them into their core business operations. Solana’s unmatched performance, strong developer tools, and growing ecosystem are the three major driving forces behind this trend. The average transaction cost on the Solana network is approximately $0.013, making it financially accessible for users.

The network offers several advantages:

- It can process thousands of transactions per second.

- Transaction fees are typically less than $0.0025.

- This efficiency makes Solana an attractive option for companies looking to streamline their operations and reduce costs.

- Companies running validator nodes on Solana can earn block rewards and commissions, generating revenue as active participants in the network.

Corporate treasuries that operate on Solana shift from passive investors to active blockchain operators, enhancing their engagement in the ecosystem. This active involvement not only generates revenue but also positions companies at the forefront of blockchain innovation.

Technological Edge: Why Solana Appeals to Smart Money

Solana’s technological prowess is one of the key reasons why it appeals to institutional investors, often referred to as “smart money.” As of 2025, institutional entities have accumulated around 8% of Solana’s circulating supply, with notable investments from firms like DeFi Dev Corp. and Artelo Biosciences. This accumulation underscores the confidence that institutional investors have in Solana’s technological capabilities.

Corporate treasuries are not just holding cryptocurrencies; they are integrating them into their core business models, becoming operators within the crypto space rather than mere investors. Solana’s ability to handle large-scale applications and its potential to revolutionize capital markets make it an attractive choice for institutional investors.

We’ll examine Solana’s high throughput and low fees, its infrastructure and ecosystem development, and the benefits of running validator nodes.

High Throughput and Low Fees

Solana boasts an impressive transaction volume capacity, making it one of the fastest blockchain networks available. This high throughput is particularly beneficial for decentralized finance (DeFi) applications, where speed and efficiency are paramount. DeFi on Solana benefits from high transaction speeds and minimal fees, which are attractive for trading and complex financial applications.

The low transaction costs on Solana further enhance its appeal, enabling more users to engage without financial barriers. The combination of high throughput and low fees makes Solana a highly attractive option for both developers and users in the blockchain space.

Infrastructure and Ecosystem Development

Solana’s platform can process thousands of transactions per second, making it highly efficient for users. This efficiency is supported by Solana’s architecture, which includes advanced tools like token extensions and permissioned environments for specialized business needs. These tools make Solana an attractive platform for developers looking to build complex applications.

Solana’s ecosystem includes various DeFi projects, enhancing its appeal to developers and investors. Recent collaborations involving Solana are focused on expanding its ecosystem and enhancing its interoperability with other blockchain networks. These developments are crucial for Solana’s long-term success and adoption.

Validator Operations and Rewards

Validator operations on Solana allow participants to earn income through both block rewards and transaction fees. This income generation model transforms passive investment in Solana into an active involvement for participants. Companies that manage validator nodes can earn income through block rewards and transaction fees, making it a lucrative option for corporate treasuries.

Validators on Solana earn rewards not only from transaction fees but also from inflation-based block rewards. This dual income stream is a significant incentive for companies to run validator nodes, further integrating themselves into the Solana ecosystem.

Market Sentiment and Price Predictions for SOL

Market sentiment plays a crucial role in Solana’s price dynamics. The growing optimism surrounding Solana is driven by increased institutional interest and its technological advancements. Despite broader economic changes, Forward Industries’ plan to create a substantial SOL treasury as part of their corporate strategy reflects the confidence in Solana’s long-term potential.

The current market sentiment is influenced by broader economic conditions, which play a significant role in Solana’s price dynamics. We’ll delve into the bullish sentiment and momentum, price predictions for SOL, and key resistance levels that could trigger potential breakouts.

Bullish Sentiment and Momentum

Despite recent price fluctuations, the overall bullish sentiment persists due to optimism surrounding Solana’s technological capabilities. The current bullish sentiment around Solana is reinforced by recent price movements and positive trading volume trends. This lasting bullish sentiment underlines the market’s belief in Solana’s growth trajectory despite external market fluctuations.

Recent positive trading volumes trends indicate robust investor interest and confidence in Solana’s potential. The momentum generated by this positive sentiment is likely to drive further price increases, making Solana an attractive option for traders looking to capitalize on its trade growth.

Solana Price Prediction: Can SOL Hit $1,000?

Solana is unlikely to hit $1,000 this year. This outcome seems improbable. However, the realistic price target for Solana in 2025 is projected to be between $500 and $600. This target is based on the current market sentiment and the technological advancements that Solana continues to make.

The current heavy resistance range for Solana’s price is between $270 and $300. If Solana’s price gets rejected at these levels, the predicted support level is between $200 and $185. This range provides a better understanding of the potential price movements and helps investors make informed decisions.

Key Resistance Levels and Potential Breakouts

Current market sentiment regarding Solana indicates a bullish outlook, suggesting significant interest from institutional investors. Predictions suggest that if Solana can break through the $100 resistance level, it may soar towards $1,000 due to growing institutional adoption.

Solana’s high transaction throughput and low fees make it an attractive option for trading, enhancing its potential to establish new price resistance levels. The interplay between bullish market sentiment, critical resistance levels, and transaction efficiency may drive Solana’s price movements in the upcoming months.

Risks and Challenges Facing Solana

While Solana has seen significant growth, it is not without risks and challenges. The current market sentiment for Solana is predominantly bearish, with approximately 58% of sentiment categorized as negative. Experts predict that Solana may experience significant price volatility, with expected highs around $224.05 for October 2025.

Analysts predict that while Solana might not reach $1,000 this year, an analyst could see significant price movements within the $500 to $600 range. However, Solana faces significant regulatory risks, as evolving legislation can create uncertainty for its operations and investment potential.

We’ll explore regulatory clarity and compliance, market volatility and security concerns, and competition from other blockchain platforms.

Regulatory Clarity and Compliance

Clear regulations are crucial for attracting institutional investors to Solana, as they often require defined legal frameworks to mitigate investment risks. The introduction of laws like the CLARITY Act aims to define regulatory roles more clearly, which may foster higher institutional investment in Solana.

The evolving regulatory landscape can significantly impact institutional confidence in investing in Solana. Institutional adoption of Solana may be stalled due to ambiguous regulatory frameworks that leave investors uncertain about the legal landscape and institutions.

Market Volatility and Security Concerns

Market fluctuations can heavily influence Solana’s price stability and investor confidence, complicating its path to broader adoption. Significant price fluctuations can deter potential users and investors from engaging with Solana, impacting its overall market stability.

Solana’s reliance on a limited number of validators raises concerns regarding decentralization and network security, which can be seen as red flags that could potentially hinder its growth and affect user trust.

Competition from Other Blockchain Platforms

Solana competes with established platforms such as Ethereum, which continues to innovate and attract developers and investors alike. Ethereum’s mature ecosystem and greater adoption for decentralized applications present significant challenges for Solana.

Solana also faces increasing competition from emerging blockchain platforms that offer innovative features, impacting its market share. Navigating this competitive landscape is crucial for Solana’s long-term success.

Real-World Applications and Future Prospects

Solana’s real-world applications and future prospects are promising. Key features include:

- Enables rapid, real-time transactions with an average settlement time of just 400 milliseconds

- Essential for onboarding traditional finance

- Supports rapid transaction processing

Despite some network outages and security vulnerabilities, Solana is experiencing rapid growth in its ecosystem, with a significant percentage of decentralized exchange transactions occurring on its platform. We’ll look into Solana’s role in decentralized finance (DeFi), the tokenization of real-world assets, and its partnerships and collaborations.

Decentralized Finance (DeFi) and On-Chain Finance

Co-founder Anatoly Yakovenko envisions solana sol as a decentralized Nasdaq, aiming to streamline financial systems. Notable projects like Worldcoin, Helium, and Jupiter have chosen Solana for their launches, reflecting its growing appeal in the DeFi space.

Platforms like Raydium allow direct token trading on Solana, eliminating the need for intermediaries, which enhances user experience in DeFi transactions.

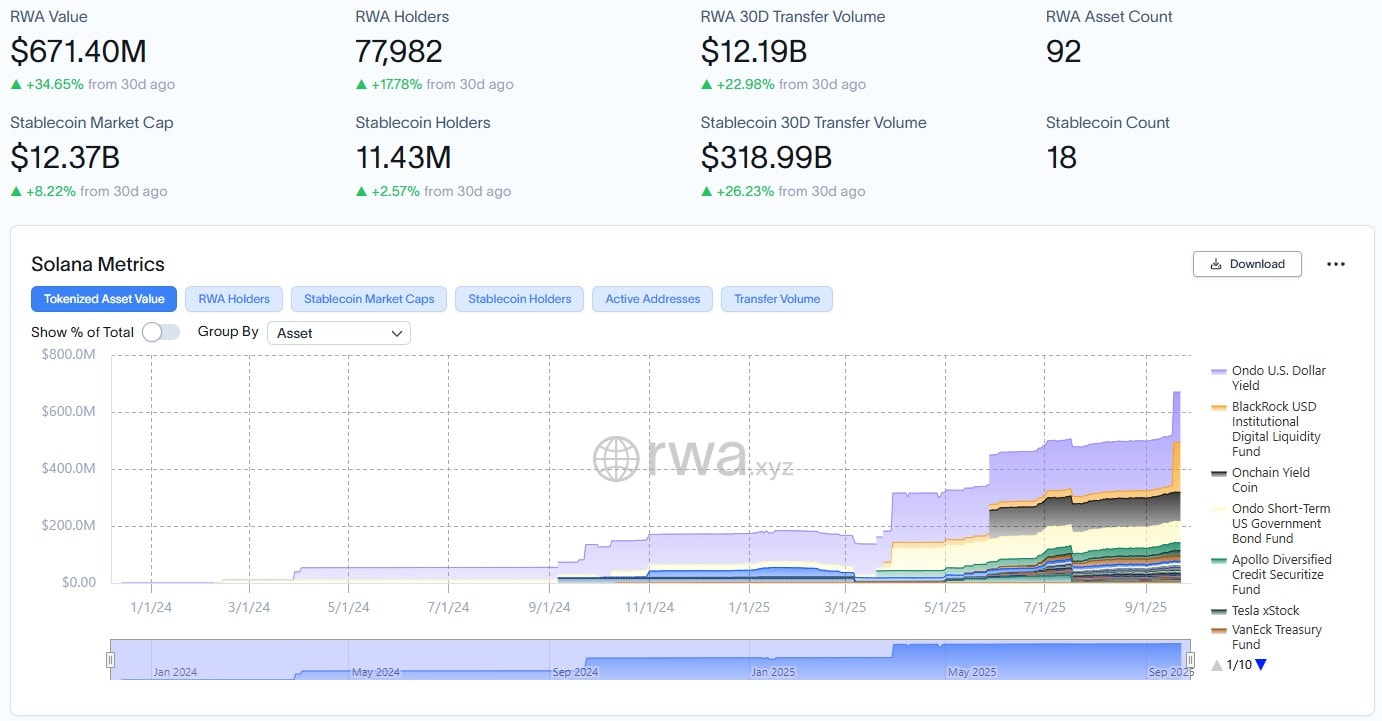

Tokenization of Real World Assets

The trend of tokenizing real-world assets on Solana aims to enhance liquidity and accessibility in global markets. Galaxy Digital became the pioneering Nasdaq-listed company to tokenize its equity on Solana, collaborating with Superstate.

Regulated RWA issuers, such as Superstate, are considering Solana. They are focusing on tokenized funds that are centered around Real World Asset.

Partnerships and Collaborations

Solana has formed several strategic partnerships with high-profile organizations to foster its ecosystem growth. Key collaborations include integrations with major DeFi platforms, enhancing accessibility and functionality on Solana.

These partnerships have led to an increase in new projects being developed on Solana, contributing to a more vibrant ecosystem. The enhanced ecosystem from these collaborations is positively influencing Solana’s market cap, attracting further investments.

Summary

Solana’s meteoric rise in 2025 is a testament to its technological innovations, strategic institutional adoption, and robust market sentiment. Wall Street giants and corporate treasuries are recognizing its potential, while Solana ETFs are paving the way for broader institutional interest. However, it is not without its challenges, from regulatory uncertainties to fierce competition.

As we look to the future, Solana’s real-world applications and partnerships paint a promising picture. Whether it’s in DeFi, tokenization of assets, or strategic collaborations, Solana is positioning itself as a leader in the blockchain space. The journey ahead is filled with opportunities and challenges, but one thing is clear: Solana is here to stay.

Frequently Asked Questions

Why are institutional investors interested in Solana?

Institutional investors are increasingly interested in Solana because of its exceptional performance, robust developer resources, and expanding ecosystem, as seen with substantial investments from firms such as Forward Industries and Galaxy Digital.

What role do Solana ETFs play in institutional demand?

Solana ETFs serve as a familiar investment vehicle, making it easier for institutional investors to enter the market. With potential approvals from firms like Franklin Templeton and Grayscale, they could unlock significant new capital inflows.

What is the realistic Solana price prediction for 2025?

A realistic price prediction for Solana in 2025 is between $500 and $600, with significant resistance around $270 to $300. This expectation reflects market trends and challenges.

What are the main risks facing Solana?

Solana’s main risks include regulatory uncertainties, substantial price fluctuations, and fierce competition from both established and new blockchain platforms. Addressing these issues is vital for its long-term growth and stability.

What are some real-world applications of Solana?

Solana is effectively utilized in traditional finance for rapid transaction processing and is gaining traction in decentralized finance (DeFi) and the tokenization of real-world assets through various partnerships. Its robust ecosystem underlines its real-world applicability.