Is the Solana ETF Next in Line? Unpacking the Future of Crypto Investments

Are we on the brink of a Solana ETF? That’s the current topic of interest for those eyeing the crypto investment space. This article aims to provide you with a clear perspective on the potential for a Solana ETF, what its introduction could mean for the market, and the essential steps it needs to clear with regulators. Stay informed on the future of Solana in the ETF market here, without overly committing to predictions. Is the “Solana ETF next” on the horizon? Keep reading to find out.

Key Takeaways

- Interest in a Solana-based ETF is growing, with Franklin Templeton’s positive outlook on the ecosystem potentially influencing investor confidence and the likelihood of regulatory approval for a Solana ETF.

- The approval of Bitcoin ETFs has set a precedent for other cryptocurrencies like Solana; however, regulatory hurdles remain, and the unique attributes of Solana’s blockchain might affect its ETF journey differently.

- Investment firms have begun filing for Solana ETFs, reflecting growing interest in the asset; however, the potential for Solana ETFs, like any cryptocurrency investment, comes with market volatility and requires careful investment strategy.

The Buzz Around Solana ETF

There is a current surge of interest in the crypto industry about the potential of a Solana-based ETF. Solana, a high-performance blockchain known for its speed and scalability, has become a hot topic in crypto circles. An ETF based on Solana’s native token (SOL) could offer a myriad of benefits for investors, including access to the broad Solana ecosystem and exposure to the price movements of SOL without the need to buy Solana directly.

The anticipation grows as investment giant Franklin Templeton expresses a positive attitude towards the Solana ecosystem, indicating an upswing in institutional interest. This fuels speculation that a Solana ETF might be on the horizon. But the question remains, will the Solana ETF follow a similar journey to Bitcoin ETFs, or will it carve a unique path?

Franklin Templeton’s Hint

Franklin Templeton, a significant player in the crypto industry, has offered optimistic perspectives on the Solana ETF. His insights are expected to boost investor confidence in the Solana ETF. The firm’s interest in the Solana ecosystem has raised speculations about the potential impact on Solana ETF approval prospects. If a leading investment firm like Franklin Templeton is showing interest in Solana, it could signify a significant shift in institutional sentiment towards the crypto asset.

Franklin Templeton’s positive attitude could potentially sway other firms and investors, resulting in higher investment in the Solana token. However, it is crucial to remember that while Franklin Templeton’s interest is a positive signal, the actual approval of a Solana ETF will still depend on regulatory agencies’ decisions.

Comparing Bitcoin’s Journey to an ETF

The new precedent in the cryptocurrency investment world is set by the recent approval of the Spot Bitcoin ETF. This approval has boosted confidence in other firms that are now potentially more poised to file ETFs for other crypto assets like Solana. Bitcoin’s price rally in the past was significantly influenced by the enthusiasm generated from the expectation of a spot Bitcoin ETF.

The journey of Bitcoin towards an ETF may inform the trajectory and expectations around the establishment of an ETF for Solana. If Solana follows a similar path to Bitcoin, we could witness a similar price rally and increased investor interest. However, the unique characteristics of the Solana blockchain, such as its exceptional speed and scalability, could also influence its journey towards an ETF.

The Mechanics of a Solana ETF

Solana ETFs are designed to track the performance of the Solana blockchain and associated assets, allowing investors to gain exposure without needing to purchase Sol tokens directly. This means that investors can benefit from the price movements of SOL without the complexities of managing a crypto wallet or dealing with crypto exchanges. A spot Solana ETF would hold SOL tokens, providing a product that closely reflects the price movements of the native cryptocurrency.

A Solana ETF would encompass a diversified assortment of assets from the Solana ecosystem, mitigating the risk in comparison to investing in individual cryptocurrencies. These ETFs are expected to trade on major stock exchanges, offering high liquidity and enabling investors to buy or sell shares at market prices anytime during trading hours. The benefits of investing in a Solana ETF include:

- Diversification: Investing in a Solana ETF provides exposure to a range of assets within the Solana ecosystem, reducing the risk associated with investing in individual cryptocurrencies.

- Liquidity: Solana ETFs are expected to trade on major stock exchanges, offering high liquidity and allowing investors to easily buy or sell shares at market prices.

- Cost-efficiency: The fees associated with Solana ETFs are generally lower than those of actively managed funds, making them a more cost-efficient investment option for Solana.

Spot vs. Futures-Based ETFs

The SEC, influenced by a court decision involving Grayscale Investments, approved Bitcoin ETFs. This decision set a legal precedent applicable to possible Solana ETFs, as it established that spot Bitcoin and Bitcoin futures ETFs rely on closely related underlying assets. This means that if a spot Bitcoin ETF can get approval, there’s a good chance a spot Solana ETF could as well. However, the road to approval may not be straightforward.

Complexities such as ‘contango’ and ‘backwardation’ in Bitcoin futures markets could hinder futures ETFs from accurately reflecting the spot price of Bitcoin, unlike spot ETFs. The successful launch of spot Bitcoin ETFs has contributed to increased speculation and anticipation surrounding the launch of other crypto ETFs, including those for Solana. As such, the approval of a spot Solana ETF is a development that many investors are eagerly watching.

Regulatory Hurdles and Progress

Spot Bitcoin ETFs in the U.S. has been approved. This could have potential implications for the cryptocurrency market. Securities and Exchange Commission signals an evolving regulatory landscape for crypto ETFs. This development has laid the groundwork for other cryptocurrencies, like Solana, to potentially follow suit. Solana ETFs might follow a similar regulatory trajectory to Bitcoin, potentially starting with Solana futures ETFs before spot ETFs.

While the SEC approved Bitcoin ETFs, it has yet to extend this approval to ETFs based on other cryptocurrencies, leaving a path forward for Solana ETFs under the established regulatory framework. However, it’s worth noting that achieving regulatory approval is not a guarantee but rather a possibility that’s contingent on a variety of factors, including market conditions and regulatory concerns.

Solana’s Market Positioning

Solana’s blockchain platform distinguishes itself with exceptional speed and scalability, factors that are significant contributors to its growing popularity and the anticipation of a potential Solana ETF. These features make Solana especially suited for launching ETFs due to its ability to:

- Handle high transaction throughput

- Maintain low transaction costs

- Offer programmable smart contracts, which are key for scalability and efficiency in trading.

With its market capitalization exceeding $35 billion, Solana ranks fifth in the list of the world’s most valuable cryptocurrencies, highlighting its significant footprint in the crypto market. Targeting a massive $1 trillion market cap, Solana is positioned as a potential rival to Ethereum, with its strategy centered around catering to retail investors through user-friendly features.

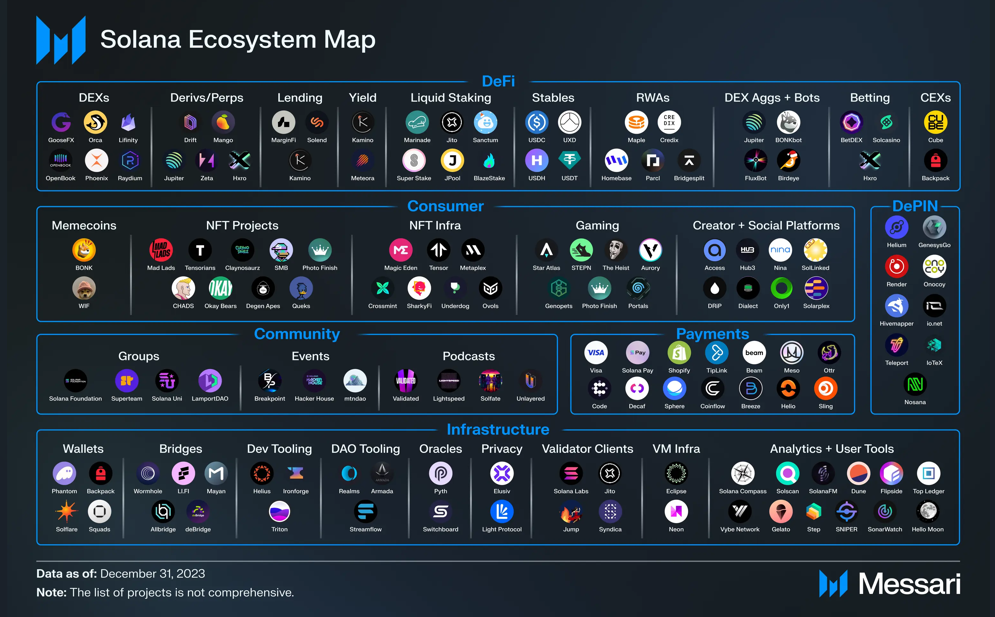

Solana vs. Ethereum Ecosystem

Ethereum’s ecosystem is more developed with a larger user base and more decentralized apps due to its first-mover advantage, while Solana is criticized for its relative centralization. Ethereum’s strong position in the market is largely due to its extensive network of developers and users, as well as its robust ecosystem of decentralized applications (dApps). While Ethereum boasts a more established ecosystem, Solana’s superior speed and scalability present a strong alternative.

Ethereum dApps are predominantly built on JavaScript which offers accessibility to a broader developer community, in contrast to Solana’s use of Rust which is not as widely adopted among blockchain developers. This means that while Ethereum might have a head start in terms of developer adoption, Solana’s superior performance could potentially attract a new wave of developers and users in the future.

Growth Trajectory and Investor Interest

VanEck and other financial firms have recently filed applications for Solana ETFs, indicating a rise in the industry’s interest in the cryptocurrency. This signifies a noteworthy trend within the financial sector, indicating that the financial industry recognizes Solana’s potential and is ready to invest in its future.

The Solana NFT market, featuring popular projects like Degenerate Ape Academy, has grown rapidly due to its scalability, higher transaction speeds, and lower fees, making it attractive to investors and users of Solana’s native token.

While there is significant investor interest, the value of Solana ETFs remains subject to market volatility and the underlying performance of the Solana blockchain. As such, potential investors should be aware of these risks and carefully consider their investment strategies.

Trading Solana: ETFs vs. Direct Investment

Solana ETFs are designed to offer easy access to retail investors, allowing them to invest in the Solana blockchain’s performance without the need to handle the complexities of crypto management. This offers a significant advantage to investors who are unfamiliar with the intricacies of blockchain technology or who prefer the convenience and simplicity of trading ETFs on traditional stock exchanges.

However, potential investors should be aware of the following factors when considering Solana ETFs:

- Liquidity concerns, as these affect the bid-ask spreads and subsequently impact the trading costs.

- Expense ratio, which should be considered to align with investment goals. Look for funds with lower expense ratios.

- Tracking accuracy, as funds with lower tracking errors are preferable.

These factors should be taken into account to make informed investment decisions.

The Appeal of ETFs to Traditional Investors

ETFs provide a streamlined investment option in Solana, expanding access to crypto investments for those who might find direct investment challenging. Traditional investors often prefer the regulated format of ETFs, aligning with their comfort in dealing with familiar investment markets. ETFs offer a route for traditional investors to partake in cryptocurrency value fluctuations, minus the technicalities of handling or storing the cryptocurrencies themselves.

ETF investments offer several advantages for investors:

- They bypass the hurdles of managing digital wallets and keys, which can be a deterrent for those unfamiliar with crypto technology.

- The regulatory oversight of ETFs adds layers of protection for investors, such as transparent pricing and mechanisms against common risks like hacking.

- The ETF structure is a well-understood financial model amongst traditional investors, making crypto ETFs an attractive proposition.

Crypto Enthusiasts’ Perspective

On the other hand, crypto enthusiasts often prefer direct investment in cryptocurrencies like Solana for the following reasons, which are unique to the crypto world:

- Full control over their assets

- Active participation in the blockchain’s ecosystem

- Autonomy and flexibility that come with owning the actual tokens

- Engaging in activities such as staking, lending, or participating in decentralized finance (DeFi) platforms.

Solana’s effortless onboarding and user-focused development environment attract traders who prioritize user-friendliness and a positive developer experience in their cryptocurrency transactions. While ETFs offer a way to invest in Solana’s growth, direct investment allows for a deeper level of engagement with the Solana ecosystem.

Navigating the Investment Landscape

The goal of crypto ETFs is to monitor the performance of cryptocurrencies without the need for a direct investment in the digital asset. This allows investors to gain exposure to the price movements of cryptocurrencies without the need to buy and store the actual tokens. By using a crypto exchange, investors can access other financial instruments related to crypto, like exchange traded notes, which can offer alternatives with varying levels of exposure and risk.

The inherent volatility of cryptocurrency markets, however, presents a significant risk to the performance and stability of crypto ETFs. Investor sentiment in the crypto market can rapidly change, influencing market trends and impacting the success of crypto-related investment products like ETFs.

As such, investing in a diversified portfolio including crypto ETFs can mitigate risk while offering exposure to the potential growth of the cryptocurrency sector.

Risk Assessment and Strategy

The core-satellite investment strategy includes a mix of stable and diversified core investments, with crypto ETFs serving as the satellite part for potential higher growth, acknowledging their higher risk. This strategy allows investors to take advantage of the potential high returns of crypto investments while mitigating risk with more stable core investments.

The barbell approach to investing involves pairing crypto ETFs with very low-risk investments, requiring disciplined rebalancing to ensure the investor’s risk profile remains consistent. Investors can potentially achieve a balance of high growth and managed volatility by allocating a portion of their portfolio to crypto ETFs while maintaining stable core investments in equity and fixed income ETFs. Integrating crypto ETFs, such as a potential Solana ETF, into investment portfolios necessitates careful risk assessment to cater to the investor’s risk tolerance and financial goals.

Alternatives to a Solana ETF

Alternatives to a Solana ETF include:

- Cryptocurrency ETFs, which encompass a diversified portfolio of cryptocurrencies and blockchain technology companies

- Over-the-counter crypto index funds

- Bitcoin futures contracts

These alternatives provide exposure to the broader crypto market and can help diversify an investment portfolio.

Investors seeking focused exposure to the cryptocurrency industry might consider Bitcoin mining ETFs and blockchain ETFs which specifically target companies involved in the cryptocurrency mining sector and blockchain industry respectively. While these alternatives offer different levels of exposure and risk, they all provide an opportunity to gain exposure to the rapidly evolving world of cryptocurrencies and blockchain technology.

Summary

From the buzz around a potential Solana ETF to the mechanics of how such an ETF would operate, it’s clear the crypto world is eyeing this development with keen interest. Despite regulatory hurdles, the optimism fueled by the approval of Bitcoin ETFs and the growing interest from traditional investors suggest a promising future for Solana ETFs. However, as with all investments, careful risk assessment and a clear understanding of the market landscape are crucial. As we keep our eyes on the evolving crypto market, one thing is certain – the potential of Solana ETFs adds yet another exciting chapter to the thrilling saga of cryptocurrency investments.

Frequently Asked Questions

What is similar to Solana coin?

Solana has several competitors including Taiko, Fuel Labs, and Monad Labs, which offer similar blockchain solutions. Other potential alternatives to Solana include Retik Finance, Fusionist, Bonk, Injective, Fantom, and Avalanche. Keep an eye on these options for potential similarities to Solana.

What is an ETF in stocks?

ETFs, or exchange-traded funds, are investment funds that allow investors to pool their money and invest in a preselected basket of securities, such as stocks, bonds, currencies, futures contracts, or commodities. They trade on exchanges, typically tracking specific indices, offering a way to diversify and lower risk in a portfolio.

What is a Solana ETF?

A Solana ETF is an Exchange Traded Fund that allows investors to track the performance of the Solana blockchain and associated assets without needing to directly purchase Solana tokens. This provides an alternative way to gain exposure to Solana.

Why is there a buzz around Solana ETF?

The buzz around Solana ETF is due to increasing interest from institutional investors and the positive outlook from investment heavyweight Franklin Templeton, indicating a potential for significant investment opportunities.

How would a Solana ETF work?

A Solana ETF would work by holding Solana’s native tokens (SOL) to reflect the cryptocurrency’s price movements and offering a diversified collection of assets from the Solana ecosystem, tradable on major stock exchanges.