Smart Strategies for Investing in Blockchain: Navigating the Digital Ledger Terrain

Venturing into investing in blockchain? Uncover how to navigate the digital ledger’s investment landscape with our concise guide. Learn to evaluate blockchain-based cryptocurrencies, stocks, and ETFs, and grasp the essentials of building a resilient, diversified portfolio. Ready to embark on a strategic investment journey? Let’s cut through the complexity together.

Key Takeaways

- Blockchain technology provides decentralized, secure, and transparent ledger systems, with a growing influence across various industries and essential for underpinning digital assets.

- Investment opportunities in the blockchain space include cryptocurrencies like Bitcoin and Ethereum, blockchain company stocks such as Coinbase and Canaan, and blockchain ETFs that offer diversified exposure to the technology.

- Investing in blockchain requires careful analysis of company fundamentals, technological capacity, market share, and competitive advantage, along with a diverse investment strategy and awareness of emerging trends like DeFi and NFTs.

Understanding Blockchain Technology

Blockchain technology, at its core, is a decentralized digital ledger used in various blockchain networks, including the bitcoin blockchain. Blockchain protocols play a crucial role in this technology, operating 24/7, allowing for quicker international blockchain transactions without the need for manual confirmation, hence increasing transaction efficiency. As a result, blockchain solutions are becoming increasingly popular in various industries.

Blockchain’s value proposition includes being:

- Secure

- Transparent

- Immutable

- Decentralized

Grasping this technology fully can lay a solid groundwork for those looking to invest in blockchain effectively.

Decentralized Ledger System

The concept of a decentralized ledger system lies at the center of blockchain technology. Unlike traditional centralized systems, Distributed Ledger Technology (DLT) allows for simultaneous access, validation, and record updating across a network. Each device in a DLT network, known as a node, stores a copy of the ledger, and consensus on the ledger’s validity is needed to finalize transactions.

Such decentralization brings improved security, transparency, and potential for broadening financial inclusion.

Security and Transparency

The innate security and transparency of blockchain technology form the crux of its allure. The immutability of blockchain ensures that once a transaction is recorded, it cannot be altered, fostering trust in the accuracy and authenticity of the information.

Furthermore, the technology enhances transparency by offering a clear view of the entire transaction history, thereby bolstering trust among participants.

Supporting Digital Assets

Apart from its decentralized character and security attributes, blockchain technology is instrumental in underpinning digital assets. A blockchain stores digital assets securely on a duplicated public database across a network, with each entry being immutable due to its shared and permanent nature.

It enables the minting of new digital assets and the recording of transactions such as trades or the spending of tokens on the blockchain, thereby establishing and transferring asset ownership.

Top Blockchain Investment Opportunities

The vibrant blockchain sector unveils a plethora of investment opportunities. These opportunities range from cryptocurrencies to company stocks and ETFs, providing diverse options for investors.

We will dig into each of these investment areas to arm you with the knowledge needed to make well-informed investment decisions.

Cryptocurrencies

Cryptocurrencies represent a primary opportunity within the blockchain sector. Some of the top cryptocurrencies to consider for investment based on their market capitalization are:

- Bitcoin

- Ethereum

- Tether

- Solana

- Binance Coin

Bitcoin, for instance, remains the original and most prominent cryptocurrency, notable for its substantial price growth and market cap.

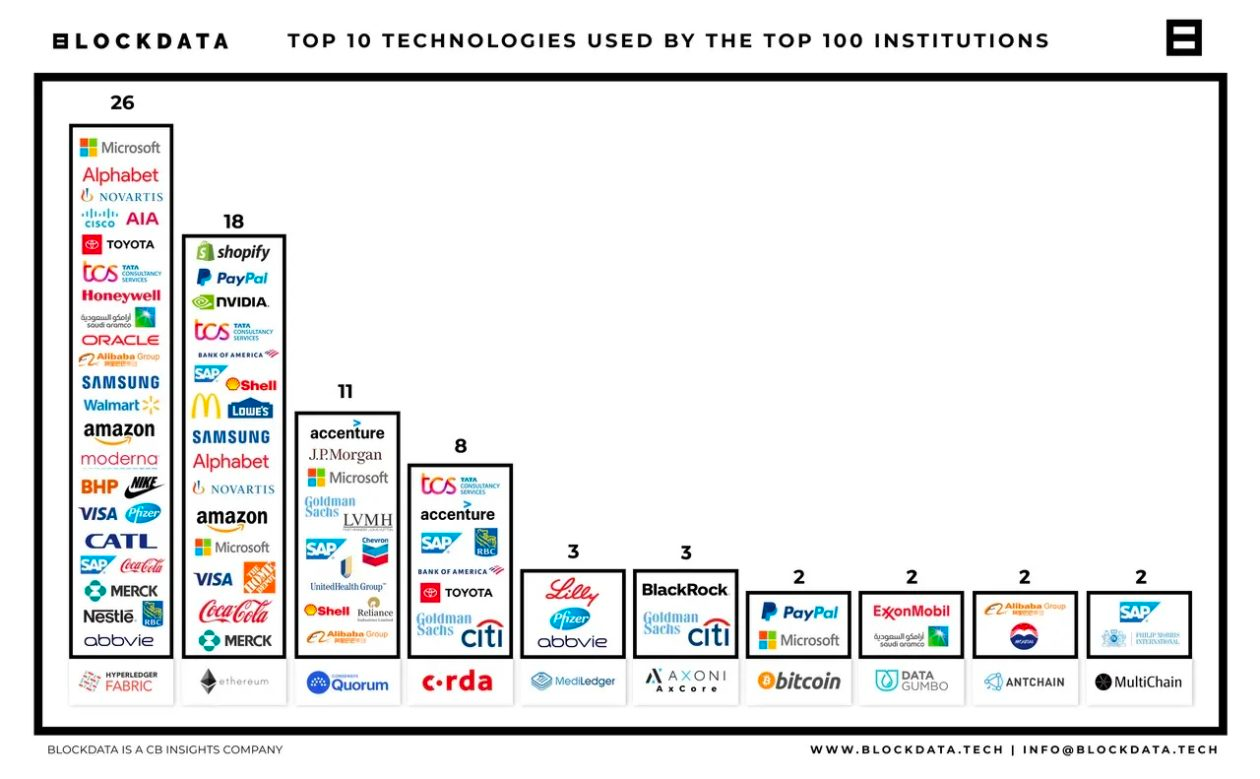

Blockchain Company Stocks

Company stocks also represent a significant investment route in the blockchain realm. Some key blockchain technology companies for investment in the blockchain space include blockchain stock options such as:

- Coinbase

- Canaan

- Chainalysis

- Hive Blockchain Technologies

Each of these companies demonstrates unique value propositions and growth trajectories, highlighting the diversity of opportunities available in blockchain stocks.

Blockchain ETFs

Blockchain ETFs are a feasible solution for investors seeking to gain exposure to a multitude of blockchain assets via a single investment. One example of a blockchain etf is the Amplify Transformational Data Sharing ETF (BLOK). Other options, such as Reality Shares Nasdaq NexGen Economy ETF (BLCN), also provide exposure to diverse companies involved in blockchain technology development and implementation.

Analyzing Blockchain Companies for Investment

Blockchain investing demands more than merely comprehending the technology and spotting opportunities. It necessitates the analysis of potential investment targets as well. In this process, you should examine:

- A company’s white papers

- Roadmaps

- Team experience

- Market position

Business Model and Revenue Streams

Grasping a company’s business model and revenue streams is an integral component of the analysis. A company’s choice of blockchain network—public, private, or consortium—can influence its business model due to differing levels of control, data access, and operational complexities.

Growth Potential and Market Share

Scrutinizing a company’s growth potential and market share constitutes another vital phase in the analysis process. For instance, the blockchain’s technical capacity, including its ability to facilitate collaboration, secure transaction value, and deliver services efficiently, directly impacts a company’s growth potential.

Competitive Advantage

Finally, pinpointing a blockchain company’s competitive edge is of paramount importance. This may derive from various unique resources and capabilities within the industry, such as proprietary technology or the ability to build and maintain strategic partnerships and networks. Companies developing blockchain solutions should focus on these aspects to ensure their success in the market.

The capacity to innovate and pivot swiftly in response to changing market conditions is a vital aspect of a blockchain company’s competitive edge.

Diversifying Your Blockchain Portfolio

In the realm of successful blockchain investing, diversification takes center stage. This involves mixing asset types, diversifying geographically, and managing risk effectively.

We will examine each of these aspects in detail.

Mixing Asset Types

Blending various asset types stands as an essential strategy for diversifying a blockchain portfolio. This could involve investing in a variety of digital assets, including a single digital asset such as:

- Payment tokens

- Security tokens

- Utility tokens

- Governance tokens

- Gaming tokens

- Non-fungible tokens (NFTs)

Geographic Diversification

Geographic diversification also plays a significant role in maintaining a balanced blockchain portfolio. Spreading investments across different regions can reduce risk by avoiding excessive concentration in any one market and enables investors to capture growth in emerging markets.

Risk Management

Finally, efficient risk management holds a pivotal position in prosperous blockchain investing. This involves diversification, regular rebalancing, and continuous portfolio evaluation.

Emerging Trends in Blockchain

As the blockchain landscape undergoes evolution, it becomes indispensable for investors to remain up-to-date with emerging trends. Key trends that have been making waves in the blockchain space include decentralized finance (DeFi), non-fungible tokens (NFTs), and supply chain management applications.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) platforms are redefining traditional financial transactions by enabling services without central authorities. Platforms like Solana, designed for DeFi uses, are significant players in the space.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are revolutionizing the way we perceive ownership in the digital space. They have transformed the monetization of blockchain gaming through in-game purchases and enabled the transfer of digital assets between games.

Supply Chain Management Applications

Blockchain technology is also enhancing supply chain management. By improving traceability and verifiability in supply chains, blockchain technology is crucial for high-stakes industries like pharmaceuticals and food.

Risks and Challenges of Blockchain Investing

Despite the enticing opportunities offered by blockchain investing, it doesn’t come without its share of risks and challenges. These include regulatory uncertainty, market volatility, and technological limitations.

We will probe into each of these challenges in detail.

Regulatory Uncertainty

Regulatory uncertainty is a significant challenge for blockchain investors. The lack of clear legal parameters regarding jurisdiction and applicable law for blockchains is a significant challenge for investors.

Market Volatility

Market volatility is another risk that blockchain investors have to navigate. For instance, Bitcoin’s price volatility is heavily influenced by supply and demand dynamics, particularly as the circulating supply approaches its 21 million coin limit, driving the prices up.

Technological Limitations

Finally, blockchain technology also has its share of technological limitations. For instance, it may face scalability challenges as more users engage with the system, resulting in network congestion and slower transaction times.

Tips for Long-term Success in Blockchain Investing

Lastly, we will uncover some tips for attaining long-term success in blockchain investing. These include conducting thorough research, maintaining patience and a long-term vision, and continuous learning and adaptation.

Conducting Thorough Research

Embarking on thorough research constitutes a vital initial step in blockchain investing. Before investing, it is crucial to understand the foundational technology, including how it differs from traditional databases and the potential for it to change industries.

Patience and Long-term Vision

Upholding patience and a long-term vision forms another success key in blockchain investing. Patience in crypto investing is crucial as chasing short-term gains can lead to impulsive decisions and potentially financial loss.

Continuous Learning and Adaptation

Finally, unceasing learning and adaptation are imperative for successful blockchain investing. Continuous learning enables investors to analyze data critically, understand the innovative aspects of blockchain, and make strategic investment choices.

Summary

In summary, blockchain technology promises to revolutionize numerous sectors and offers a wealth of investment opportunities. However, like all investments, it comes with risks and challenges. By understanding the technology, identifying opportunities, analyzing potential investments, diversifying your portfolio, staying updated on trends, and managing risks, you can navigate the digital ledger terrain and potentially achieve long-term success in blockchain investing.

Frequently Asked Questions

What is the best blockchain stock to invest in?

The most promising blockchain stocks to invest in according to analysts are CleanSpark, Inc. (NASDAQ:CLSK), Bitfarms Ltd. (NASDAQ:BITF), Riot Platforms, Inc. (NASDAQ:RIOT), NVIDIA Corporation (NASDAQ:NVDA), HIVE Digital Technologies Ltd. (NASDAQ:HIVE), and Bit Digital, Inc. (NASDAQ:BTBT). Consider looking into these for potential investment opportunities.

Can I make money on blockchain?

Yes, you can make money on blockchain through buying, selling, or trading asset-backed tokens that are represented on the blockchain.

How much should I invest in blockchain?

It is commonly recommended to allocate 1% to 5% of your investment portfolio to blockchain or cryptocurrency due to its high volatility and risk. It’s important to limit your crypto investments to less than 5% of your overall portfolio.

How to safely invest in blockchain?

To safely invest in blockchain, consider purchasing cryptocurrencies like Bitcoin or Ethereum, or buying shares in a cryptocurrency trust or ETF that invests in blockchain-related companies. It’s important to research exchanges and cryptocurrencies before investing, store crypto in a secure wallet, and follow best practices for security and risk management.

What is blockchain technology?

Blockchain technology is a decentralized digital ledger that stores data of any kind and allows for quicker international transfers without manual confirmation, increasing transaction efficiency. It operates 24/7.