The Final Shakeout Before Bitcoin’s Next Leg Up: Why Smart Money is Buying the Fear

Bitcoin’s price has dropped recently, triggering fear among retail investors. However, smart money sees this as the final shakeout before Bitcoin’s next leg up: why smart money is buying the fear. This article explains why institutional investors are buying the fear and what factors are driving the market turmoil. Discover why experienced investors see a buying opportunity in the current climate.

Key Takeaways

- Bitcoin’s recent price decline and increased fear sentiment have led to significant retail panic selling, while institutional investors are taking advantage by accumulating Bitcoin for long-term gains.

- Historical market patterns indicate that periods of deep investor fear can precede meaningful price recoveries, suggesting the current turmoil might be a buying opportunity.

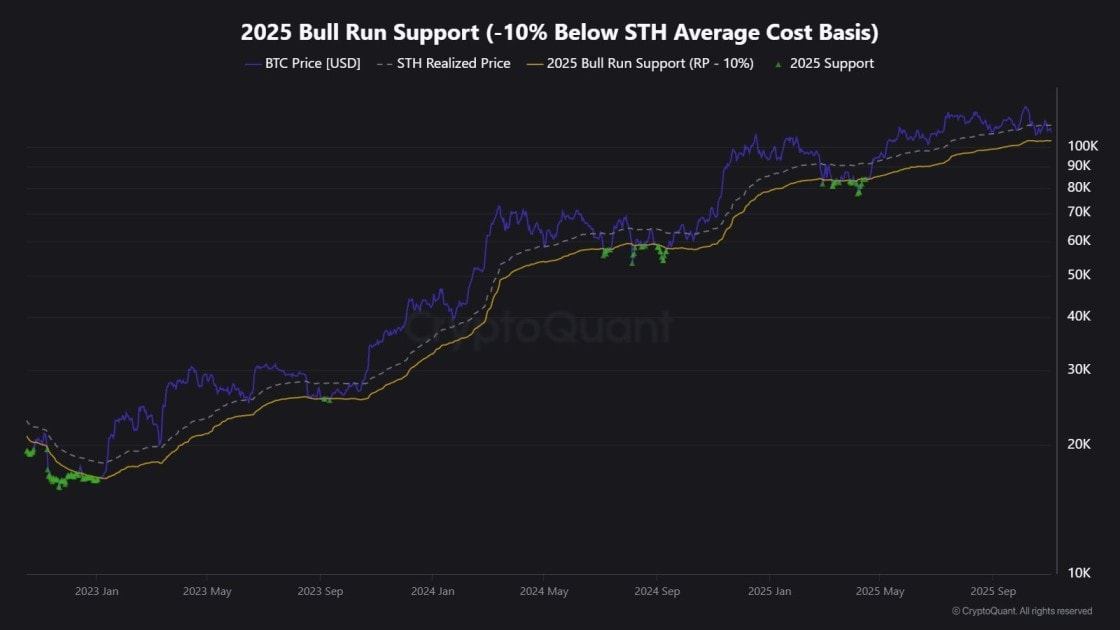

- Key support levels around $100,000 are crucial for Bitcoin’s potential market recovery, with whales and institutions likely to defend this zone for future price movements.

The Current Market Scenario

Bitcoin’s price has seen a substantial decline recently, dropping from $126,000 to around $103,000. This dramatic fall has shifted investor sentiment from confident to cautious, as evidenced by the recent plunge in the Fear and Greed Index, which fell 19 points into the Fear territory. This fear-driven environment often leads to panic selling among retail traders, exacerbating the downward pressure on prices, a metric comparing current prices.

The broader crypto market has not been spared from this turmoil. A significant liquidation wave affected not only bitcoin but also other major cryptocurrencies like Ethereum and Solana, resulting in over $300 million in combined liquidations. This wave of liquidations led to a decrease in trading volumes by 20–40% since mid-October, highlighting the market’s current state of distress. Additionally, bitcoin’s market dominance has increased, indicating a shift of funds from altcoins to bitcoin as investors seek relative stability in crypto prices. Bitcoin’s collapse has further exacerbated the situation, prompting caution among traders.

Adding to the market’s woes, a liquidity squeeze caused by the U.S. government shutdown is impacting various financial markets, including cryptocurrency. This shutdown has created an environment of uncertainty, leading to tighter liquidity conditions across the board. As a result, both bitcoin slipped and altcoins have seen significant drops in value, with long traders comprising nearly 90% of the total liquidations and bullish positions being eliminated.

Despite the sentiment remains bleak, these challenging conditions often precede market recoveries. Historical analysis shows that periods of investor anxiety and market downturns can present buying opportunities. The current scenario, marked by corrections and potential buying opportunities, suggests that the final shakeout may be underway, with much happening beneath the surface, setting the stage for Bitcoin’s next leg up.

Institutional Accumulation Amidst Retail Panic

Amidst the chaos in the crypto market, institutional players are seizing the opportunity to increase their Bitcoin holdings. Data from Glassnode showing steady inflows highlights a consistent flow of investments into Bitcoin by larger investors, signaling ongoing institutional inflows that have steadily increased. This behavior contrasts sharply with the fear-driven selling exhibited by retail traders, who often react impulsively to market downturns.

One notable example of institutional confidence is MicroStrategy’s recent acquisition of 397 BTC for $45.6 million. This purchase brings MicroStrategy’s total Bitcoin holdings to an impressive 641,205 BTC, demonstrating their long-term bullish outlook on the asset. Despite a temporary drop in MicroStrategy’s stock price following the acquisition, the move reflects strong market expectations for both the stock and Bitcoin prices.

The actions of institutional wallets indicate a structurally tighter shift towards a more sustained hold on Bitcoin, with these large investors exhibiting a quiet conviction amidst market turbulence. As smart money accumulates, it becomes clear that these players are positioning themselves for long-term recoveries, capitalizing on the fear and uncertainty that dominate the market through aggressive accumulation.

Historical Patterns: Echoes from Past Market Bottoms

History often repeats itself, especially in the volatile world of cryptocurrency. The current market scenario bears striking similarities to the setups seen in 2018 and 2020, where periods of despair preceded significant accumulation phases. In those previous cycles, panic gave way to explosive rallies, demonstrating how fear in the market often leads to substantial gains for those who remain patient and strategic. This reflects the same dynamic observed in earlier trends, as many investors follow the same playbook. An analyst draws parallels between these situations and the current trends.

Investor psychology plays a crucial role in these market dynamics. During economic downturns, macro events can trigger panic selling among retail investors, while large holders, known as whales, often increase their Bitcoin holdings. This pattern of behavior has been observed time and again, where large investors capitalize on low market sentiment to accumulate more Bitcoin, signaling a potential market reversal.

The cyclical nature of the market is further illustrated by the fact that pain and confusion have been key patterns preceding every bull cycle, reflecting the cycle’s defining emotion. These historical echoes suggest that the current market turmoil may be the final shakeout before the next leg up, providing savvy investors with a unique opportunity to buy Bitcoin at a discount.

Key Levels and Support Zones

Bitcoin is currently facing a critical support level around the $100,000-$101,000 range. This zone is crucial for Bitcoin’s price movement, as it represents a key level that could potentially ignite the next breakout phase. Technical analysts are closely watching this range, as a sustained hold above this level could signal the end of the current bear market and the beginning of a new bullish trend.

The importance of this support zone cannot be overstated. It serves as the strongest support zone in the current market scenario because:

- It acts as a potential ignition point for the next major price movement.

- Large addresses, or whales, are likely to defend this level.

- This defense further reinforces its significance.

- It increases the likelihood of a market reversal, especially when entering the pain zone.

The Role of Macro Events in Market Movements

Macro events play a significant role in shaping market movements, and the current U.S. government shutdown is a prime example of this influence. This shutdown, coupled with rising inflation expectations and government uncertainty, has contributed to a cautious investor sentiment in the crypto market. Traders are now waiting for clearer signals before making new investments, reflecting the broader market’s hesitance to dive into riskier assets.

Economic factors like asset liquidity also impact investor confidence. Concerns about liquidity have led many investors to seek safer alternatives, further exacerbating the selling pressure in the crypto market. These macroeconomic conditions often precede market bottoms, as they create an environment ripe for accumulation by those who can see beyond the immediate turmoil in crypto assets.

Despite the current challenges, these macro events can act as a catalyst for future recovery. Historically, periods of economic uncertainty have been followed by significant market rebounds, as investor sentiment shifts from fear to optimism. Understanding the role of these macro events can help investors navigate the market more effectively and position themselves for the next leg up.

ETF Driven Demand and Future Projections

The introduction of Bitcoin ETFs is expected to play a pivotal role in stabilizing the market by:

- Attracting institutional investors

- Adding a layer of legitimacy and accessibility to Bitcoin, making it more appealing to a broader range of investors

- Increasing demand, which analysts project could help mitigate market volatility; ETF driven demand adds support for a more stable price trajectory for Bitcoin

- Supporting a more stable price trajectory for Bitcoin

Future projections for Bitcoin’s price are optimistic:

- Analysts forecast an average price of approximately $125,210.79 by the end of 2025.

- Over the longer term, Bitcoin is expected to experience significant price growth, with potential returns exceeding 200% by 2028.

- Perera’s upper range projection places Bitcoin’s value at up to $493,553 by the end of 2028, highlighting the immense growth potential of the asset.

In the short term, Bitcoin is expected to maintain a minimum price of $111,291.77 in November 2025, according to market forecasts. These projections offer a glimpse into the potential future of Bitcoin, as bitcoin hovered, underscoring the importance of strategic accumulation during periods of market turbulence. The btc price will be a crucial factor to watch.

Trading Advice During Market Turbulence

During periods of market turbulence, it is crucial for retail traders to remain calm and avoid making hasty decisions driven by fear and speculation. Understanding market’s sentiment is key, as emotions like fear and greed can lead to irrational trading behavior that often results in significant losses.

Diversifying a portfolio is one of the strongest signals of a sound investment strategy, as it reduces risk and provides a buffer against market downturns. Setting predetermined buy and sell limits can help traders stick to their strategies and avoid making emotional decisions during volatile market conditions.

Additionally, engaging in thorough research, including conducting your own research before making any investment decisions, can help identify potential opportunities and risks, ensuring a more informed approach to trading. By following these guidelines, retail traders can better navigate the crypto market’s ups and downs, positioning themselves for long-term success even amidst short-term turbulence.

The Calm Before the Rally: Whales Accumulate

While retail investors panic sell, significant players, or whales, are actively accumulating more Bitcoin. Recent data shows significant Bitcoin purchases by whales, suggesting they anticipate a rebound in prices and are positioning themselves for the next market rally. This behavior often signals the end of the prevailing selling pressure in the market and marks the beginning of a new accumulation phase.

The quiet conviction of these whales creates a fear of missing out (FOMO) among retail investors, potentially driving further market upswings as more participants rush to buy Bitcoin before prices rise. This cycle’s defining emotion is one of cautious optimism, as smart money accumulates in anticipation of future gains.

The final shakeout before the rally is an opportunity for informed investors to capitalize on today’s setup in the current market conditions, following the lead of whales who have historically signals been ahead of the curve in predicting market movements and historical fair value during the final leg.

Summary

The recent market turmoil has created a landscape of fear and uncertainty, but it is precisely in these moments that the greatest opportunities arise. Institutional investors are increasing their Bitcoin holdings, historical patterns suggest a potential market bottom, and key support levels are being tested. Macro events like the U.S. government shutdown and the introduction of Bitcoin ETFs add further complexity to the market dynamics.

As we look ahead, the actions of whales and the cautious optimism among smart money investors indicate that a market rally may be on the horizon. By staying informed and making strategic decisions, investors can navigate the current turbulence and position themselves for the next leg up in Bitcoin’s price.

Frequently Asked Questions

What is the reason for the bitcoin surge?

The surge in Bitcoin’s price is primarily due to increasing demand outpacing the limited supply, as the available new bitcoins are steadily decreasing. This imbalance is contributing to the upward momentum in its value.

What event caused bitcoin’s price to surge above $100,000?

Bitcoin’s price surged above $100,000 primarily due to surging retail investor demand and optimism surrounding the policies of the new Trump administration. This combination of factors contributed to a substantial rally in the cryptocurrency market.

Why has Bitcoin’s price dropped recently?

Bitcoin’s price has recently dropped due to significant liquidation events, broader market volatility, and a liquidity squeeze linked to the U.S. government shutdown. This confluence of factors has contributed to the decline in its value.

What is the significance of institutional accumulation during market downturns?

Institutional accumulation during market downturns is significant because it reflects a long-term bullish outlook and indicates that large investors are confident in the future value of assets like Bitcoin. This behavior often suggests potential market recovery and strength ahead.

How do historical patterns inform current market conditions?

Understanding historical patterns reveals that moments of market despair often foreshadow significant rallies, as seen in 2018 and 2020. Staying patient and strategic during such periods can lead to substantial gains.