The Future of Privacy Coins in 2026 and Beyond:

Where are privacy coins are heading next

Privacy coins like Monero, Zcash, and Dash are likely to remain central to the crypto ecosystem in 2026, even as regulators tighten the screws on anonymity features. The market continues to reward privacy focused assets, but the landscape is becoming increasingly fragmented.

- Markets rewarded privacy focused assets through late 2025 and into the first half of 2026, with ZEC, XMR, and DASH posting gains that outpaced broader crypto benchmarks

- Exchange delistings and regional bans are creating a patchwork environment where liquidity depends heavily on jurisdiction and platform type

- The next phase of privacy coin evolution will shift from absolute anonymity toward selective disclosure and compliance compatible designs

- Success in the coming year will favor projects that balance strong on chain privacy, deep liquidity, and regulatory resilience rather than coins that simply generate the most buzz

- Key milestones include the IRS Form 1099 DA rollout affecting 2025 tax year reporting, EU DAC8 implementation timelines extending into 2026, and privacy coin market caps crossing roughly $24 billion in early 2026

Why privacy coins matter in a surveillance driven crypto world

The era of blockchain surveillance expands every quarter. Exchange KYC rules, analytics firms tracking wallet clusters, and reporting regimes like IRS Form 1099 DA and EU DAC8 have made transparent digital assets like Bitcoin effectively pseudonymous rather than private. For users seeking genuine financial privacy, the public nature of most blockchains creates a fundamental problem.

- Privacy coins obscure sender, receiver, and transaction amounts using cryptographic techniques, transforming blockchains into cash like rails for digital payments

- The privacy coin market cap crossed roughly $24 billion in early 2026, reflecting sustained demand from users and investors alike

- ZEC, XMR, and DASH outperformed broader crypto benchmarks in Q4 2025, signaling that privacy tokens are gaining traction as a distinct asset class

- Investors increasingly view privacy as a structural requirement for capital markets using blockchains, not merely an ideological stance held by cypherpunks

- Industry experts note that as blockchain surveillance tools become more sophisticated, the demand for privacy preserving solutions rises in parallel

- Financial institutions like Goldman Sachs and Morgan Stanley have begun exploring how privacy layers might support institutional use cases without violating compliance obligations

Core anonymity technologies powering privacy coins

Privacy coins rely on layered cryptography embedded at the protocol level rather than mixing services bolted on after the fact. These technologies make private transactions possible on public ledgers without relying on trusted third parties.

- Ring signatures and Ring Confidential Transactions (RingCT): Monero uses this approach to mix a real input with decoy inputs, obscuring the true spender while simultaneously hiding transaction amounts. Think of it like signing a document as “one of this group” without revealing which specific member you are.

- Stealth addresses: These are one time destination addresses generated for each transaction, preventing anyone from linking payments to a public receiving address. The benefit is fungibility, meaning every coin remains equal regardless of its history.

- zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge): Zcash pioneered this approach, allowing shielded transfers where network nodes verify that a transaction is valid without ever seeing the sender, receiver, or amount. The Electric Coin Company continues to develop these proofs for enhanced privacy.

- Emerging selective disclosure features: View keys and similar mechanisms let users or businesses reveal transaction details to auditors, tax authorities, or regulators without exposing everything publicly on chain. This middle ground is expected to define the next generation of privacy infrastructure.

- Anonymity sets: The strength of privacy often depends on how many potential participants could have made a given transaction. Larger anonymity sets make individual identification exponentially harder.

Monero, Zcash and Dash: Current leaders and their 2026 trajectories

Monero and Zcash remain the reference privacy coins in 2026, each representing distinct philosophies about how privacy should work. Dash occupies a hybrid role, offering optional privacy features that make it more palatable to some regulated venues but less robust for users prioritizing anonymity.

Monero (XMR)

- Privacy is mandatory by default on Monero, with every transaction using ring signatures, stealth addresses, and RingCT

- Market cap surpassed roughly $14 billion in early 2026, with prices reaching an all time high near $790 despite ongoing exchange delistings

- The project’s uncompromising stance on privacy has made it a target for regulators but a favorite among users who refuse to sacrifice anonymity

- Liquidity increasingly flows through decentralized venues and peer to peer markets rather than major centralized exchanges

Zcash (ZEC)

- Zcash offers a dual model with transparent and shielded pools, letting users choose their privacy level

- zk-SNARKs power shielded transactions, and wallet support for shielded use improved substantially through 2025

- Prices peaked above $600 in late 2025, and the coin attracted renewed interest from analysts evaluating its regulatory positioning

- Selective disclosure via view keys makes Zcash more compatible with institutional compliance needs

Dash (DASH)

- PrivateSend uses CoinJoin style mixing, which is optional rather than mandatory

- This approach makes Dash more acceptable to some regulated venues but offers weaker privacy guarantees compared to Monero or shielded Zcash

- Dash remains a bridge for users who want some privacy without fully exiting mainstream exchange infrastructure

- Across all three, liquidity is shifting from centralized exchanges to decentralized venues and self custody wallets as compliance pressures mount

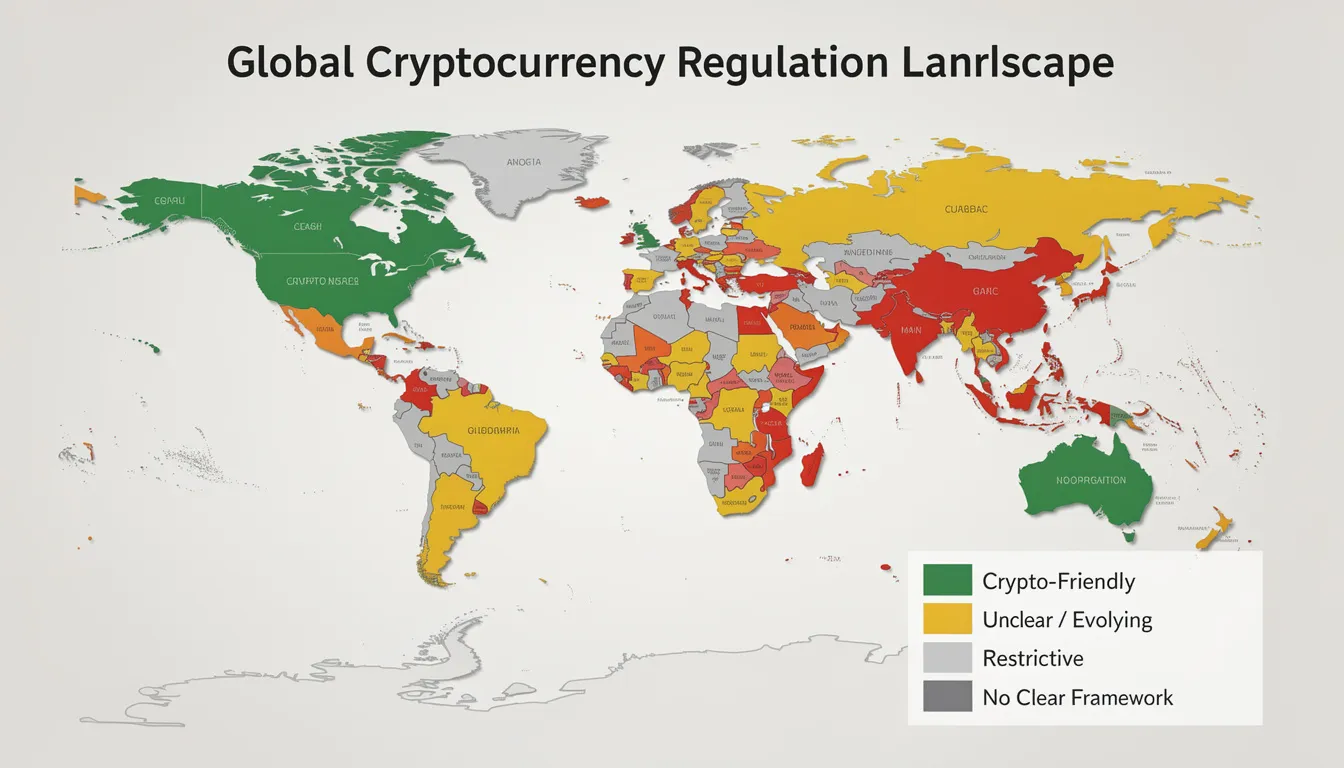

Regulatory headwinds: DAC8, MiCA, IRS reporting and regional bans

The regulatory environment in 2026 is defined by heavier reporting requirements in the US and EU rather than a blanket global ban on privacy coins. Regulators are applying pressure at the infrastructure layer, compelling exchanges and custodians to make difficult choices about which digital assets to support.

- IRS Form 1099 DA: The rollout for 2025 tax year reporting creates new compliance burdens for custodial platforms holding privacy coins. Reporting gains from assets like Monero and Zcash becomes complicated when transaction details are obscured by design.

- EU DAC8 Directive: This framework obliges crypto asset service providers to report user transactions to tax authorities. Exchanges listing privacy coins face raised concerns about their ability to comply with detailed reporting obligations.

- MiCA and AMLA: The Markets in Crypto Assets regulation and the incoming Anti Money Laundering Authority framework do not automatically outlaw privacy coins. However, bank and custodian incentives strongly favor limiting exposure to assets that might attract regulatory warning letters.

- Regional bans and delistings: Jurisdictions including the UAE have implemented localized bans on privacy coins. Major EU exchanges delisted XMR and ZEC between 2024 and 2026 in response to tighter policies and pressure from banking partners.

- The economic impact of these rules falls disproportionately on retail users who rely on centralized fiat off ramps. Sophisticated users with self custody capabilities and access to decentralized exchanges face fewer constraints.

- Industry leaders in compliance technology are developing tools that might allow selective disclosure to regulators without breaking on chain privacy, though these solutions remain nascent.

Markets are rewarding privacy, but with rising scrutiny

Despite negative headlines and exchange delistings, privacy focused tokens outperformed most other crypto sectors in late 2025 and early 2026. The market is sending a clear signal that demand for privacy is not fading, even as the infrastructure for accessing these coins becomes more constrained.

- ZEC posted a roughly 861 percent rally over the prior year, making it one of the standout performers in the crypto space

- XMR delivered more than 100 percent gains during the same period, defying predictions that delistings would crush prices

- DASH recorded double digit increases, benefiting from its hybrid positioning even as privacy purists criticized its optional model

- Institutional and venture capital interest is growing around privacy preserving infrastructure for payments, DeFi, and Web3 identity rather than just standalone privacy coins

- AML and KYC constraints at fiat off ramps remain the primary vulnerabilities, with banks pressuring exchanges to limit high risk coins to preserve banking relationships

- Wall Street observers note that the greater the interest in privacy coins, the greater the scrutiny from regulators, creating a feedback loop that shapes liquidity dynamics

- Investors seeking exposure must weigh the risk of sudden exchange delistings against the potential for continued price appreciation driven by scarcity and demand

From full anonymity to selective disclosure

The simple binary of “anonymous versus transparent” is giving way to a spectrum where users can selectively share data with specific parties. This evolution reflects both regulatory realities and practical needs in a world where some verification is unavoidable for many economic activities.

- Selective disclosure allows users to reveal transaction proofs, balances, or identity attributes to auditors, tax authorities, or counterparties while remaining opaque to the general public

- Zcash view keys represent an early example, enabling read only access to transaction details without compromising the broader anonymity of the shielded pool

- Similar capabilities are emerging across other privacy protocols, including newer Layer 1 projects and privacy layers built atop general purpose chains

- Enterprises and institutional investors in 2026 demand privacy features that integrate with compliance obligations rather than position themselves in direct opposition to regulations

- The next generation of privacy coins and privacy layers will likely embed policy controls, allowing organizations to set internal rules for what must be disclosed under which conditions

- This approach represents a consolidation of privacy design philosophy, moving away from the all or nothing stance that characterized early privacy coin development

- The trade off is clear: users gain access to more infrastructure and potential mainstream adoption, but accept that total anonymity is no longer the primary design goal

Decentralized exchanges, Layer 2 solutions and self custody as privacy refuges

Centralized exchanges and custodians bear the brunt of regulatory pressure, which is pushing serious privacy users toward non custodial tools. The infrastructure supporting private transactions in 2026 looks fundamentally different from even two years prior.

- Decentralized exchanges that do not custody funds can list and route Monero, Zcash, and Dash trading pairs even when large centralized platforms delist them

- Cross chain bridges and atomic swap protocols allow users to move between transparent assets and privacy coins without relying on centralized intermediaries

- These tools eliminate the need for off ramps controlled by regulated entities, though they introduce their own complexity and risk considerations

- Layer 2 solutions and privacy preserving smart contract platforms are adding features like confidential transfers, which may complement or compete with classic privacy coins

- Self custody wallets with strong privacy defaults and improved UX launched or upgraded in 2025 and 2026 have lowered the barrier for average users to hold and transact privately

- The rise of artificial intelligence powered wallet interfaces is making complex privacy operations more accessible to non technical users

- This shift toward decentralized infrastructure represents both an opportunity and a risk: liquidity may be thinner, prices may be less efficient, but censorship resistance improves dramatically

What will define the “winners” among privacy coins

Future winners in the privacy coin market are unlikely to be the loudest or most aggressively marketed projects. Success will favor coins that survive regulatory cycles, maintain real world utility, and avoid becoming isolated from the broader crypto ecosystem.

Core success factors for privacy coins in 2026 and beyond:

| Factor | Why It Matters |

|---|---|

| Strong default privacy | Users need confidence that privacy works out of the box without complex configuration |

| Robust liquidity | Both centralized and decentralized market depth ensure users can enter and exit positions |

| Sustainable development funding | Long term protocol maintenance requires resources beyond volunteer contributions |

| Compliance compatible features | Selective disclosure and audit trails expand the potential user base |

| Integration with broader crypto stack | DeFi protocols, merchant tools, and identity systems create utility beyond speculation |

- Privacy coins that integrate with DeFi, payment systems, and on chain identity infrastructure will avoid becoming isolated niches

- Regulatory resilience means building ecosystems that function even if large Western exchanges remove trading pairs

- By 2027, investors will judge privacy coins not just on anonymity strength but also on uptime, tooling, community governance, and adaptability to new rules

- The trade war dynamics and fiscal stimulus patterns under the Trump administration may influence which jurisdictions become friendliest to privacy focused innovation

- Higher rates environments in bond markets could reduce speculative capital flowing into crypto generally, making fundamental utility even more important for privacy coins

- Insurance products and custody solutions for privacy coins remain underdeveloped, presenting both risk and opportunity for the sector ahead

Investor takeaways: positioning for the future of privacy coins

Privacy coins sit at the intersection of two powerful forces: growing demand for financial privacy and expanding regulatory surveillance. Navigating this space requires awareness of both the opportunity and the substantial risks involved.

Monitoring priorities for investors:

- Track DAC8 implementation timelines in the EU and how exchanges respond to reporting obligations

- Watch IRS enforcement actions around Form 1099 DA compliance and any guidance specifically addressing privacy coins

- Follow new AML directives that may shape exchange listing decisions in major jurisdictions

- Pay attention to country level bans or restrictions that could affect price discovery and liquidity

Portfolio considerations:

- Diversification across privacy approaches reduces concentration risk, including both base layer privacy coins and privacy layers on general purpose chains

- Consider the scale of liquidity available for any privacy coin position, as thin markets amplify volatility

- Evaluate self custody options and familiarity with decentralized exchanges before taking significant positions

Key risks to acknowledge:

- Liquidity fragmentation can make exiting positions difficult during market stress

- Sudden exchange delistings create immediate price and access disruptions

- Custody limitations mean fewer institutional grade solutions compared to mainstream crypto assets

- Regional restrictions may affect access depending on your country of residence

Forward looking perspective:

- 2026 to 2028 is likely to be a consolidation phase where a smaller set of privacy protocols emerge as infrastructure like tools rather than speculative side bets

- The gain from positioning early in protocols that successfully navigate regulation could be substantial, but so could the money lost on projects that fail to adapt

- Last year taught investors that privacy coin performance can defy bearish expectations, but the launch of new regulatory frameworks creates ongoing uncertainty

- Matter of fact assessment: not every privacy coin will survive, and selecting the right exposure requires ongoing research rather than a single buy and hold decision

The future of privacy coins depends on whether these projects can evolve beyond their cypherpunk origins to serve a broader market while preserving their core value proposition. For investors willing to accept the risks, the opportunity to participate in this transition remains open, but only for those who approach it with clear eyes and realistic expectations.