The Most Active Crypto VC’s of 2025: Top Firms Driving Blockchain Innovation

Wondering who the most active crypto VC’s of 2025 are? This article spotlights top players like Andreessen Horowitz, Pantera Capital, and Paradigm. Learn about their key investment areas, major portfolio companies, and how they’re shaping the future of blockchain technology.

Key Takeaways

- Leading crypto VC firms like Andreessen Horowitz and Pantera Capital focus on early-stage startups in areas such as DeFi, blockchain infrastructure, and NFTs, providing both financial backing and strategic mentorship.

- The investment strategies of crypto VC firms are evolving towards diversification across sectors and a long-term vision, enabling them to effectively navigate market volatility and capitalize on emerging trends.

- Increased institutional participation and a shifting regulatory landscape are expected to drive significant growth in crypto venture capital, enhancing the legitimacy of cryptocurrencies as a distinct asset class.

Leading Crypto Venture Capital Firms of 2025

The crypto ecosystem has seen a surge of interest from venture capital firms that recognize the transformative potential of blockchain technology. These firms are playing a pivotal role in funding and guiding blockchain startups, driving innovations that could redefine our financial systems. The leading crypto venture capital firms of 2025 are focusing on key areas such as DeFi, blockchain infrastructure, and NFTs, ensuring that these innovations have the support they need to succeed in the crypto industry and the crypto and blockchain space.

Not only do these firms provide financial backing, but they also offer valuable mentorship and strategic advice, helping to shape the direction of their portfolio companies. Investing in early-stage projects and supporting their growth, crypto VC firms bridge the gap between innovative ideas and successful execution.

Andreessen Horowitz (a16z)

Andreessen Horowitz, commonly known as a16z, has established itself as a powerhouse in the crypto venture capital space since its founding in 2009. The firm has a product-first mindset and performs rigorous technical due diligence, ensuring that its investments are not only innovative but also viable. With notable investments in projects like Coinbase, OpenSea, and MakerDAO, a16z has consistently backed groundbreaking blockchain innovations.

The firm’s focus on Web3 and gaming highlights its commitment to foundational projects that contribute to the broader crypto ecosystem. Prioritizing partnerships and community building, a16z ensures its portfolio companies have the resources and support needed to thrive in the competitive crypto market.

Pantera Capital

Pantera Capital is one of the most influential crypto venture capital firms, known for its early investment in Bitcoin and a strong portfolio that includes over 100 blockchain startups. The firm’s investment strategy is research-driven, focusing on projects that challenge traditional finance models and emphasize innovation and scalability in blockchain technologies. This approach has positioned Pantera Capital as a leader in the industry, with a portfolio that spans DeFi, blockchain infrastructure, and digital assets.

Beyond financial backing, Pantera Capital provides active mentorship, assisting its portfolio companies with compliance measures, global expansion, and technology scaling. This hands-on support is crucial for startups aiming to navigate the complex and rapidly evolving crypto landscape.

Paradigm

Paradigm is a venture capital firm that primarily focuses on early-stage projects in finance and decentralized applications. With notable investments in transformative technologies like Uniswap and Compound, Paradigm is committed to foundational projects for Web3 and DeFi protocols. Their investment strategy includes check sizes ranging from $1 million to over $100 million, tailored to support high-potential startups.

Paradigm’s approach is research-driven and emphasizes thesis-driven investments, engaging deeply with the crypto community through hands-on support, mentorship, and educational programs. This level of involvement ensures that their portfolio companies are well-equipped to innovate and succeed in the competitive crypto space.

Coinbase Ventures

Founded in 2018, Coinbase Ventures focuses on investing in early-stage startups in blockchain, DeFi, and Web3. With over 400 investments to date, Coinbase Ventures not only provides funding but also offers access to its extensive user base for market validation. This dual approach of financial support and practical resources helps startups gain traction and credibility in the crypto market.

Notable investments by Coinbase Ventures include companies like Alchemy, Graph, Uniswap, OpenSea, and Dapper Labs, emphasizing its role in fostering mainstream crypto adoption. The firm also provides mentorship in business development, marketing, and community building, ensuring that its portfolio companies have the support they need to succeed.

Binance Labs

Binance Labs focuses its investments on exchanges, blockchain infrastructures, DeFi platforms, and NFTs, emphasizing its commitment to Web3, AI, and blockchain infrastructure. With over 200 investments to date, Binance Labs employs a strategy that includes incubation, funding, and empowering decentralized projects. This approach is designed to provide startups with the resources and support needed to innovate and scale.

One of Binance Labs’ unique advantages is its integration with Binance’s massive user base and technical resources, which enhances its ability to identify and support promising projects. Offering access to Binance’s exchange, wallet infrastructure, and global reach, Binance Labs ensures its portfolio companies have the tools to thrive in the competitive crypto market.

Emerging Trends Among Top Crypto VC Firms

As the crypto market continues to evolve, leading venture capital firms, including sequoia capital, are adapting their strategies to stay ahead of emerging trends in crypto ventures.

Key investment areas for 2025 include:

- Early-stage startups

- Decentralized finance (DeFi)

- NFTs

- Blockchain infrastructure

These firms excel at identifying potential early on, capturing emerging opportunities that could redefine the crypto space and crypto companies.

Investment strategies are also evolving, with a shift towards late-stage funding and consolidation among established firms. By providing strategic advice, marketing support, and introductions to industry leaders, crypto VC firms play a crucial role in guiding the direction of their portfolio companies and ensuring their long-term success.

Emphasis on Decentralized Finance (DeFi)

Top venture capital firms are increasingly prioritizing investments in DeFi projects to capitalize on the growing demand for decentralized financial solutions. Firms like a16z and Coinbase Ventures are directing their investments towards layer-1 blockchain protocols, DeFi applications, and Web3 infrastructure, highlighting a diversified approach within the DeFi sector.

Uniswap, backed by a16z, has played a pivotal role in the evolution of decentralized finance by enabling users to swap tokens without intermediaries, revolutionizing the trading experience with its automated liquidity protocol. This innovation has significantly impacted the DeFi space, offering high liquidity and greater financial inclusion.

Focus on Blockchain Infrastructure

Investments in blockchain infrastructure projects are aimed at improving scalability, security, and overall interoperability of a vast network for decentralized applications. Venture capitalists are focusing on foundational blockchain layers to identify projects with the potential for scalability and strong market impact.

This emphasis on blockchain infrastructure is not only about enhancing scalability but also about increasing security and interoperability, ensuring a more robust decentralized application ecosystem. By investing in these foundational projects, crypto VC firms are laying the groundwork for the future of the broader crypto ecosystem.

Strategic Investments in NFTs

NFTs are rapidly gaining traction as crucial digital assets, attracting the attention of various investors and developers. Leading crypto VC firms are increasingly allocating funds to NFT-related projects, recognizing their transformative potential in the market.

Successful crypto VC firms utilize insights from analysts, technologists, and thought leaders to identify promising NFT trends, ensuring that their investments are strategically positioned for success. These investments are anticipated to significantly influence the digital asset market, shaping new economic models and consumer engagement.

Investment Strategies and Approaches

The investment strategies of crypto venture capital firms are evolving to keep pace with the rapid changes in the market. Successful investments in crypto investment firms seek game-changing blockchain technologies that have the potential for long-term growth. These firms are increasingly focusing on early-stage projects that showcase innovative blockchain solutions, providing both financial backing and strategic guidance to enhance their growth prospects.

Crypto VC firms employ strategies such as balancing risk management with long-term bets to mitigate potential pitfalls. Investing early, even during industry slumps, allows vc firm to capitalize on market opportunities and nurture startups with the potential to transform the industry.

Diversification Across Sectors

Crypto VC firms are increasingly adopting diversified investment strategies to offset the impact of price fluctuations in the cryptocurrency market. This involves a combination of traditional venture capital practices and unique approaches tailored for the crypto market.

Effective diversification strategies in crypto involve investing in sectors such as DeFi, NFTs, and blockchain infrastructure. By utilizing rigorous evaluation processes, venture capitalists identify blockchain projects that demonstrate disruptive potential and scalability, ensuring that their portfolios are well-rounded and resilient.

Early-Stage Project Support

Supporting early-stage projects is a crucial strategy for venture capital firms, as it helps startups refine their offerings and achieve marketable products. Typically, venture funds and VC firms provide capital investment in multiple funding rounds as the company progresses, ensuring sustained support to attract capital and growth.

Crypto VC firms often offer mentorship and strategic guidance, enhancing the growth prospects of startups. For instance, Paradigm and a16z provide comprehensive support, including marketing, recruiting, and regulatory guidance, to ensure their portfolio companies can scale effectively and navigate the complexities of the crypto space.

Long-Term Vision and Market Adaptation

Successful crypto VCs maintain a long-term vision that emphasizes the potential of their investments and the founders’ goals. Andreessen Horowitz (a16z) focuses on the long-term potential of blockchain innovations, aligning strategies with visionary founders to drive sustained growth.

Binance Labs has adopted an agile investment approach that incorporates secondary market transactions and OTC deals to stay adaptive. Staying ahead of market trends and technologies is essential for VCs to effectively guide their investment choices and maximize returns.

Key Portfolio Companies and Their Impact

The impact of key portfolio companies backed by leading crypto VC firms cannot be understated. These companies are at the forefront of innovation, offering solutions that have the potential to transform the industry. Venture capital firms are not just financial backers but partners in innovation, helping to guide the direction of these projects.

Investing in high-potential projects, crypto VC firms enable groundbreaking technologies to flourish. This section highlights some of the most impactful portfolio companies, demonstrating the transformative power of strategic investments in the crypto space.

Uniswap (Backed by a16z)

Uniswap is recognized for revolutionizing decentralized exchanges by allowing users to swap tokens directly from their wallets through automated liquidity pools. One of Uniswap’s key features is its automated market maker (AMM) model, which eliminates the need for order books, enabling seamless trading experiences. This innovation has played a crucial role in the DeFi ecosystem, offering high liquidity and allowing users to trade a wide variety of tokens without intermediaries, thus fostering greater financial inclusion.

Solana (Backed by Multicoin Capital)

Solana is recognized for its high throughput and low transaction fees, making it a popular choice for developers building decentralized applications. The high performance of Solana allows for scalable decentralized applications, attracting various development projects.

Solana’s advancements are pivotal in improving the efficiency and scalability of decentralized applications in the blockchain ecosystem. This has made Solana a key player in the broader crypto ecosystem, supported by strategic investments from firms like Multicoin Capital.

Chainlink (Backed by Digital Currency Group)

Chainlink has pioneered the development of decentralized oracles, enabling smart contracts to access off-chain data. By bridging the gap between on-chain and off-chain data, Chainlink’s oracles aggregate data from multiple sources, ensuring accuracy and reliability for smart contracts.

These innovations have become essential for various blockchain applications, driving growth in decentralized finance and other sectors. Chainlink’s impact on the blockchain ecosystem is profound, as it allows for the execution of smart contracts based on real-world events, thus expanding the potential use cases for blockchain technology.

Challenges and Opportunities in Crypto VC Investing

Investing in crypto venture capital presents both significant challenges and opportunities. The inherent volatility of the crypto market makes these investments riskier than traditional ventures, but the potential for high returns is equally substantial. Navigating this landscape requires a keen understanding of market trends and strategic guidance to manage risks effectively.

These challenges exist, but there is hope for improvement. The expected easing of regulatory hurdles may lead to the establishment of new crypto VC funds and a revival in funding and deal activity. As technological developments continue to advance, crypto venture capital is poised for growth, attracting new investments and fostering innovation.

Navigating Regulatory Landscapes

Regulatory clarity is identified as a primary growth catalyst for expanding institutional engagement in the crypto market. The cryptocurrency market’s volatility, driven by macroeconomic influences and regulatory changes, makes risk management crucial for investors. A rise in institutional investment is being driven by the need for diversification and higher returns in a low-interest-rate environment.

As the regulatory landscape evolves, firms that can navigate these changes effectively will be better positioned to capitalize on new opportunities.

Managing Market Volatility

The emergence of clearer regulations is creating new compliance challenges for crypto VC firms that could hinder their operational flexibility. Managing a volatile market requires robust investment strategies and a deep understanding of market trends.

Leveraging market insights and employing effective risk management techniques, crypto VC firms navigate these challenges and continue to make strategic investments that yield high returns.

Identifying High-Potential Projects

Close partnerships between venture capital firms and blockchain innovators facilitate better understanding and evaluation of potential projects. Venture capital firms increasingly prioritize identifying high-growth projects through strategic analysis of market trends.

These partnerships enable VCs to leverage insights from innovators, enhancing their ability to identify disruptive capabilities within emerging projects. Fostering strong relationships with innovators, managing partner VCs improve their decision-making process and ultimately drive the success of their investments.

Future Outlook for Crypto Venture Capital

The future of crypto venture capital looks promising, with regulatory frameworks expected to attract institutional capital and validate cryptocurrencies as a legitimate asset class. The landscape is shifting towards mainstream acceptance, with significant increases in institutional investment.

Favorable market conditions and increased public and institutional demand are contributing to the renewed interest in crypto venture capital. As technological advancements continue and regulatory barriers decrease, the crypto VC landscape is projected to grow significantly.

Increasing Institutional Participation

Institutional investors are increasingly engaging in crypto VC, as evidenced by significant investments such as the $2 billion into Binance, marking a historic high. A recent survey indicates that 86% of institutional investors have either allocated funds to cryptocurrencies or plan to do so by 2025.

The U.S. government’s stance is shifting towards supporting digital assets, promoting innovation while ensuring adequate investor protections. This growing involvement of institutional investors is further legitimizing cryptocurrencies as a distinct asset class.

Evolution of Investment Models

Traditional VC investment models are adapting to accommodate diverse digital assets beyond just Bitcoin and Ethereum, enhancing portfolio diversification. This includes token-based investments and decentralized funding mechanisms to meet the unique needs of crypto vc funding projects.

These adaptations reflect a significant shift in investment strategies, aimed at maximizing returns and effectively managing risks in a rapidly evolving crypto landscape. Institutional investors are increasingly classifying cryptocurrencies as a distinct asset class, impacting their investment strategy frameworks. An institutional asset manager can play a crucial role in this evolving landscape.

Expansion into New Markets

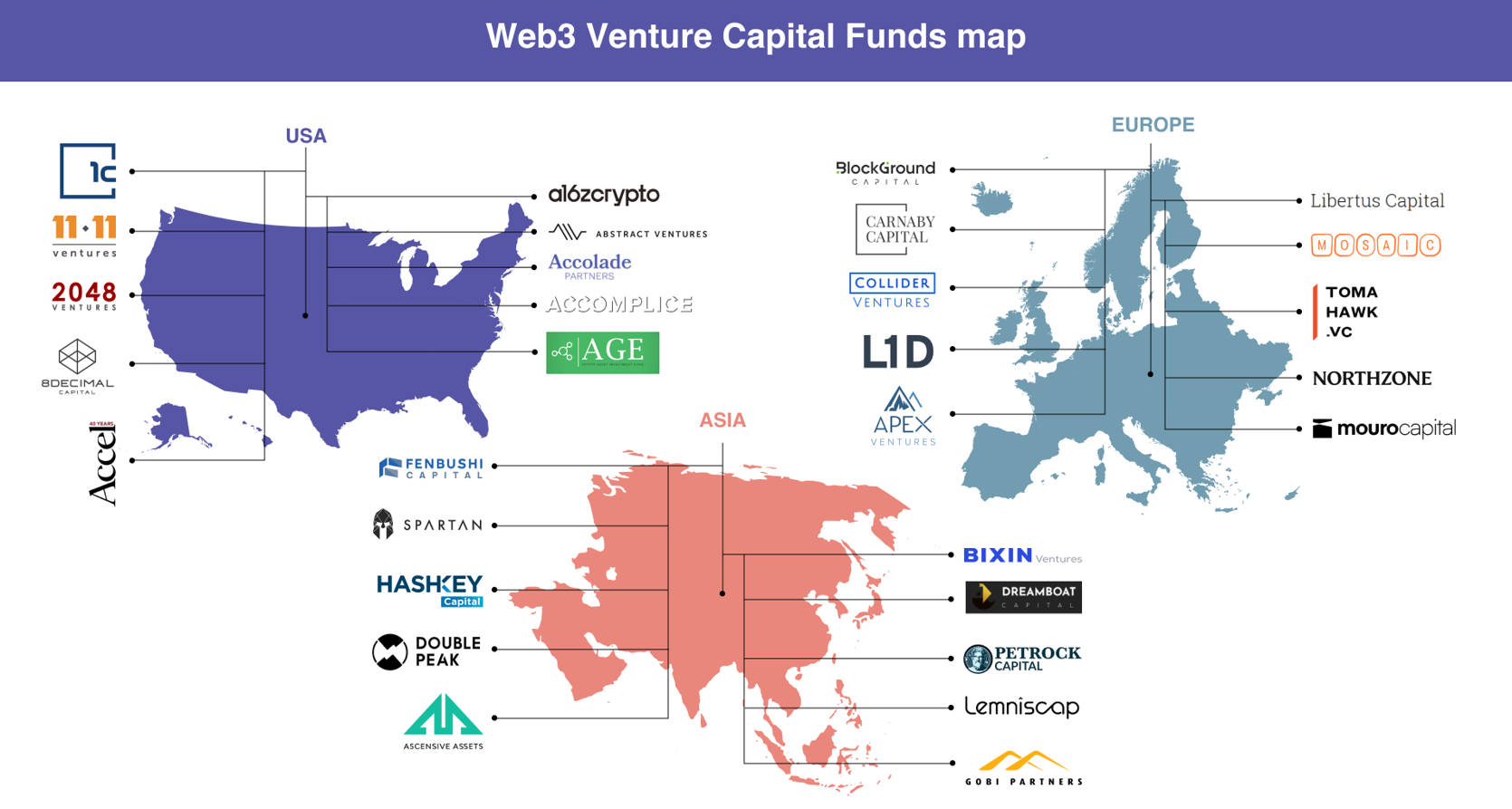

Emerging markets, particularly in Asia, are seeing increased crypto venture activity as investor interest grows, diversifying the global investment landscape. The potential for crypto venture firms to explore new geographical markets in the crypto markets is rising as awareness and adoption of blockchain technology, the crypto world, and crypto exchange expands globally.

Emerging markets are becoming a focal point for crypto VC investments due to rising digital asset adoption and unique regional opportunities. This expansion into new markets is driven by the growing need for blockchain solutions in developing economies.

Summary

As we’ve explored, the leading crypto venture capital firms of 2025 are not just financial backers; they are pivotal players driving the blockchain revolution. By focusing on key areas like DeFi, NFTs, and blockchain infrastructure, these firms are supporting innovations that have the potential to reshape our financial systems and digital interactions.

Looking ahead, the future of crypto venture capital is bright, with increasing institutional participation, evolving investment models, and expansion into new markets. The synergy between strategic investments and technological advancements will continue to propel the crypto ecosystem forward, paving the way for a more decentralized and inclusive financial future.

Frequently Asked Questions

What are the primary focus areas for leading crypto venture capital firms in 2025?

In 2025, leading crypto venture capital firms are primarily focused on decentralized finance (DeFi), blockchain infrastructure, and non-fungible tokens (NFTs) for their investment strategies. These areas are poised to drive significant innovation within the crypto space.

How do crypto VC firms support their portfolio companies beyond financial backing?

Crypto VC firms enhance their portfolio companies’ success by offering mentorship, strategic advice, market insights, and access to valuable partnerships, in addition to financial support. This holistic approach fosters growth and innovation within the companies they invest in.

Why is regulatory clarity important for the growth of crypto venture capital?

Regulatory clarity is essential for the growth of crypto venture capital because it fosters institutional engagement and mitigates compliance challenges, thereby solidifying cryptocurrencies as a legitimate asset class and attracting increased investments.

What strategies do crypto VC firms use to manage market volatility?

Crypto VC firms manage market volatility by implementing robust investment strategies, leveraging market insights, and utilizing effective risk management techniques. This enables them to navigate challenges while capitalizing on opportunities in the crypto landscape.

What is the future outlook for crypto venture capital?

The future outlook for crypto venture capital is promising, driven by increasing institutional participation and evolving investment models. This growth and innovation in the crypto ecosystem suggest a robust future for the industry.