The Rise of Autonomous Crypto Agents: Will You Be Trading Against Machines?

The rise of autonomous crypto agents will you be trading against machines is transforming cryptocurrency trading. How do these AI programs work, and what does their emergence mean for human traders? In this article, we’ll explore the technology behind these agents, their advantages, and potential impact on the market. Will you be trading against machines soon? Let’s find out.

Key Takeaways

- Autonomous crypto agents utilize AI and machine learning to make real-time financial decisions, reducing the need for human intervention and improving market efficiency.

- These agents excel in decentralized systems by executing trades, optimizing yield farming strategies, and enhancing risk management through real-time data analysis.

- Despite their advantages, challenges such as data security, algorithmic bias, and transparency must be addressed to ensure the responsible deployment of autonomous crypto agents.

The Emergence of Autonomous Crypto Agents

The rise of AI agents in the crypto space is nothing short of a revolution. These machine-learning-driven programs are designed to operate autonomously, making financial decisions based on real-time data and predefined rules. The emergence of these agents is a response to the increasing complexity and dynamism of the cryptocurrency markets, which demand more intelligent and adaptive solutions, including artificial intelligence.

Technological advancements and market demands have aligned perfectly to pave the way for Crypto AI Agents. Projects launched between 2023 and 2024 have demonstrated that AI agents can operate on-chain, interact with smart contracts, and evolve based on real-world data. This level of sophistication enables them to manage workflows and make financial decisions autonomously, reducing the need for human intervention.

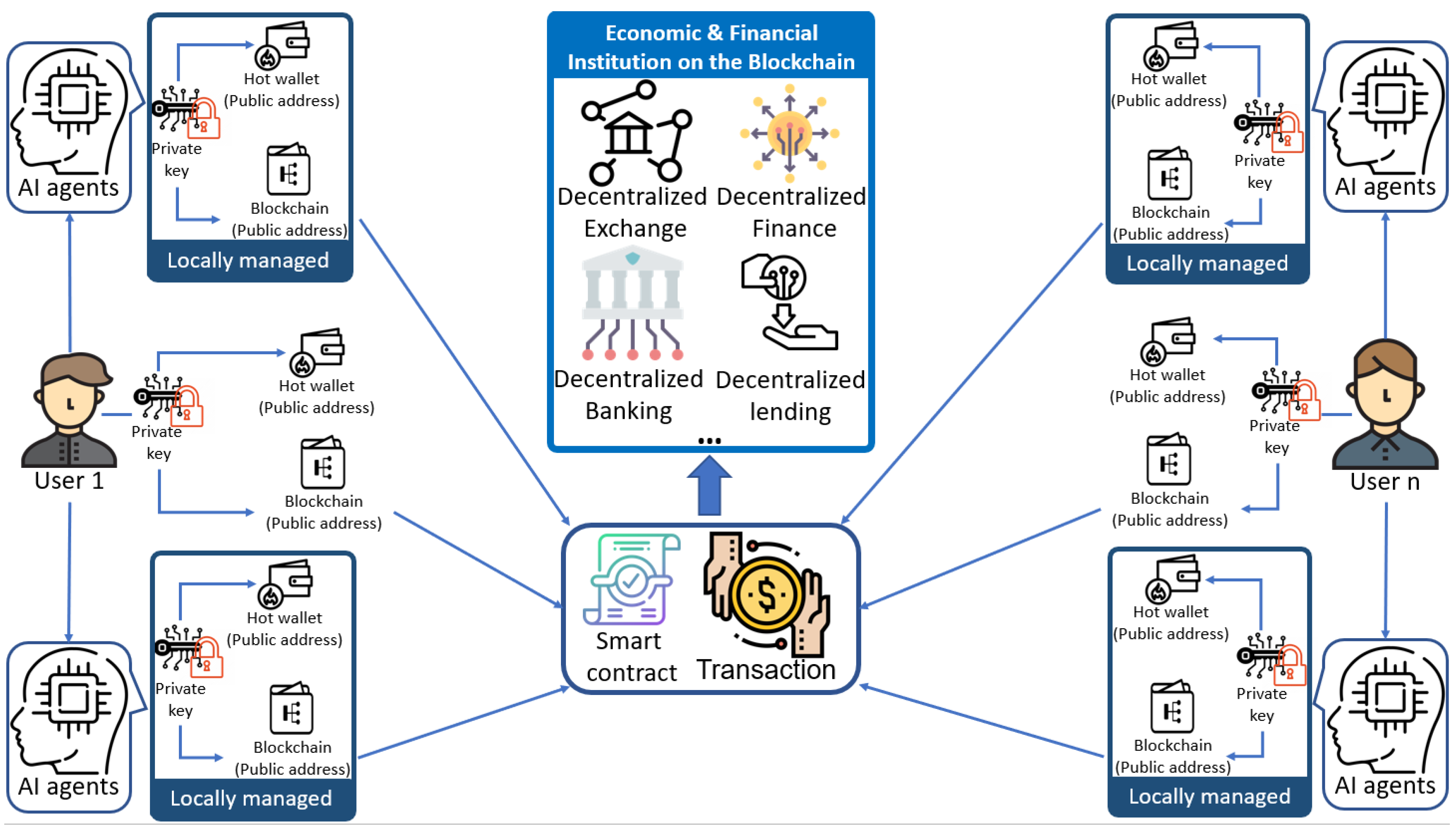

At the core of these agents is a robust architecture designed for autonomous, goal-oriented behavior. These autonomous economic agents gather and analyze data from both on-chain and off chain data sources, allowing them to perceive the world in a comprehensive manner within an agent layer. This ability to adapt and negotiate independently sets them apart from traditional finance interfaces.

The impact of autonomous crypto agents on the economic landscape is expected to be profound. As these agents gain more capabilities, they will enable AI-to-AI markets where autonomous agents trade services, data, and computational resources without human intervention. This shift towards decentralized intelligence will redefine how financial markets operate, making them more efficient, transparent, and inclusive.

How Autonomous Agents Operate in Decentralized Systems

AI agents thrive in decentralized systems, where they can execute trades and manage investments based on real-time market analysis. These agents gather data from various sources, including:

- Market data

- Social media platforms sentiment

- Price history Leveraging data from oracles allows them to incorporate off-chain signals into their decision-making processes.

One of the key strengths of autonomous agents is their ability to operate independently, executing trading strategies with minimal human intervention. They continuously monitor market conditions and adjust their strategies in real-time, responding to fluctuations as they happen. Real-time monitoring is essential for optimizing trading performance and maximizing returns.

The seamless interoperability of AI agents across various decentralized finance protocols is another critical factor in their effectiveness. The Smart Contract Interaction Layer enables these agents to interact with decentralized applications (DApps) and execute actions based on their decisions. This level of integration enables them to automate complex tasks such as portfolio rebalancing, yield farming, and risk management.

Specialized agents within the decentralized infrastructure can focus on specific tasks, enhancing the overall efficiency and performance of the system. Whether it’s optimizing yield farming strategies by evaluating gas fees and rewards or managing liquidity pools, these AI agents bring a new level of intelligence and automation to decentralized finance.

Advantages Over Traditional Trading Bots

The transition from traditional trading bots to AI crypto agents marks a significant leap in the evolution of financial technology. Unlike traditional bots, AI agents continuously learn from market movements and conditions, allowing them to adapt quickly to changes. This real-time learning capability makes them far more effective in responding to the dynamic nature of cryptocurrency markets.

AI agents are self-improving decision-makers that assess multiple variables in real-time and adjust their trading strategies dynamically. This ability to adapt and learn sets them apart from traditional trading bots, which rely on rigid algorithms and require constant human guidance. By automating complex tasks and making informed decisions independently, AI agents bring a new level of efficiency to crypto trading.

One of the key advantages of AI crypto agents is their ability to operate autonomously, executing trades and managing portfolios without human intervention. This reduces the potential for human error and biases, resulting in more accurate and consistent trading outcomes. Furthermore, the use of machine learning technology enables these agents to improve their strategies over time, aligning them more closely with user intent.

The increasing complexity of cryptocurrency markets has driven the need for increasingly complex automation solutions. AI crypto agents meet this demand by bringing advanced intelligence and automation to the trading process. As a result, they can handle higher trading volumes and execute trades more efficiently than their traditional counterparts.

Key Applications in Crypto Trading

The applications of AI agents in crypto trading are vast and varied, offering numerous benefits to crypto traders and investors alike. These intelligent systems are transforming how trading strategies are executed, portfolios are managed, and risks are mitigated. By integrating with decentralized applications (DApps), AI agents can operate continuously, optimizing trading strategies without human intervention.

One of the most significant applications is real-time trade execution, where AI agents analyze market data and real time market data in real-time to execute trades with minimal delays and errors. This capability ensures that trades are executed at the optimal moment, maximizing returns and minimizing risks.

In decentralized finance (DeFi), AI agents play a crucial role in yield optimization by reallocating funds to the most profitable yield farming options based on real-time data. They continuously monitor APYs, gas costs, and liquidity shifts to maximize returns and minimize losses.

Risk management is another critical application, where AI agents enhance security by detecting fraudulent transactions and monitoring unusual activities. By flagging suspicious transactions and preventing exploits, these agents help mitigate fraud risks and protect investors.

Real-Time Trade Execution

AI agents excel in real-time trade execution by:

- Analyzing market data instantaneously and acting on insights without delay.

- Executing trades at the optimal moment, minimizing delays and errors.

- Avoiding latency issues that traditional trading bots may suffer from.

- Ensuring trades are executed precisely when needed, maximizing returns.

The use of real-time data analysis enables these agents to continuously monitor market conditions and adjust their trading strategies accordingly. By automating portfolio management tasks such as rebalancing portfolios and mitigating risks, AI agents bring a new level of efficiency and accuracy to the trading process.

This automation reduces the potential for potential market manipulation, human involvement, error and biases, resulting in more consistent and profitable trading outcomes.

Yield Optimization in DeFi

Within decentralized finance, AI agents play a pivotal role in optimizing yield farming strategies. These agents continuously monitor APYs, gas fees, and liquidity shifts to determine the most profitable yield farming options. Dynamically reallocating funds based on real-time data allows them to maximize returns and minimize losses.

AI agents analyze market conditions to identify the best yield farming strategies, factoring in interest rates, staking rewards, and other variables to analyze market trends and predict market movements. This continuous analysis ensures that capital is always allocated to the most profitable opportunities, enhancing overall returns. As a result, ai thrives in optimizing investment strategies.

The ability to reassess gas fees, smart contract risk, and liquidity constraints in real-time allows AI agents to optimize yield farming operations effectively, optimizing liquidity pools. By doing so, they help investors navigate the complexities of decentralized finance and achieve better financial outcomes.

Risk Management and Fraud Detection

AI-powered agents significantly enhance risk management and fraud detection in the crypto space. Leveraging advanced data analysis techniques, these agents detect fraudulent transactions through pattern recognition and monitor unusual activities in real-time.

The ability to flag suspicious transactions and prevent exploits is a crucial feature of AI agents. By continuously monitoring for unusual activities and flagging potentially fraudulent transactions, these agents help mitigate fraud risks and enhance overall security.

AI agents play a vital role in managing financial risks by agent performance and ai models, including personal agents:

- Detecting the movement of large investors and assessing the liquidity impact in stock market movements

- Automatically hedging exposure to protect portfolios from significant losses

- Flagging abnormal withdrawal activity to help prevent insolvency risks

These functions ensure the stability of financial operations.

Challenges and Ethical Considerations

Despite their numerous advantages, the deployment of autonomous crypto agents comes with its own set of challenges and ethical considerations. One of the primary technical challenges is scalability, as these agents need to handle large volumes of data and transactions efficiently. Interoperability with various decentralized finance protocols is also crucial for their effective operation.

Data security is a significant concern, given the sensitive information these agents handle. Robust security measures are essential to protect against data breaches and ensure the integrity of financial operations. Algorithmic bias is another issue that needs to be addressed, as biased algorithms can lead to unfair decision-making and exacerbate existing inequalities.

Fairness and transparency in the deployment of autonomous agents are critical. Regular audits and the use of diverse training data can help mitigate algorithmic bias and enhance the fairness of these systems. Accountability is another major concern, as it can be challenging to determine responsibility for financial losses resulting from ai autonomy trades.

Transparency and robust monitoring are essential to maintain trust in systems involving autonomous crypto agents. Automation and transparency in decentralized systems present significant challenges but are necessary for the effective deployment of these intelligent systems, including ocean protocol.

Future Market Trends

Looking ahead, the future outlook for AI agents in the crypto and financial markets appears promising. The cryptocurrency market is projected to reach approximately $45 billion by 2025, reflecting significant growth and mainstream adoption. Investment in AI technologies within the FinTech sector is also expected to increase substantially, from $12 billion in 2023 to around $62 billion by 2032.

By 2025, digital assets managed by robo-advisors are projected to exceed $2 trillion, highlighting the growing shift towards digital wealth management solutions. The AI agent market itself is expected to grow at an average rate of 538% from 2023 to 2030, underscoring the increasing reliance on AI-driven solutions.

AI agents are expected to play a larger role in blockchain networks and financial ecosystems by 2025, reflecting a long-term shift in how these applications operate. The integration of agentic AI in FinTech will enable systems capable of autonomous decision-making, improving operational efficiency and customer experience.

By 2027, a substantial portion of companies are anticipated to initiate pilot projects for agentic AI, with expectations of reaching 50 percent adoption. This trend indicates that AI agents are not just a passing trend, but a transformative force that will shape the future of financial markets and influence market sentiment.

Summary

The rise of autonomous crypto agents marks a significant transformation in the financial markets. These intelligent systems bring unparalleled efficiency, transparency, and autonomy to cryptocurrency trading and decentralized finance. From real-time trade execution to yield optimization and risk management, AI agents are redefining how digital assets are managed and traded. Their ability to learn and adapt in real-time makes them superior to traditional trading bots, offering a glimpse into a more automated and intelligent future.

As we look ahead, the potential of AI agents in the crypto space is immense. The projected growth in the cryptocurrency market and investment in AI technologies underscores the long-term impact these agents will have. However, it is crucial to address the challenges and ethical considerations to ensure fair and transparent deployment. With the right measures in place, AI crypto agents are poised to revolutionize the financial landscape, paving the way for a new era of decentralized intelligence.

Frequently Asked Questions

What are autonomous crypto agents?

Autonomous crypto agents are AI-based programs that independently execute trades and manage portfolios in the cryptocurrency markets. They enhance efficiency by optimizing financial strategies without requiring human oversight.

How do AI agents operate in decentralized systems?

AI agents operate in decentralized systems by collecting real-time and off-chain data through oracles, allowing them to make informed decisions. They autonomously execute actions within decentralized protocols using smart contracts based on predefined rules.

What are the advantages of AI agents over traditional trading bots?

AI agents offer significant advantages over traditional trading bots by learning and adapting in real-time, leading to improved responsiveness to market changes. This autonomy enhances trading efficiency and reduces the need for constant human oversight.

What are some key applications of AI agents in crypto trading?

AI agents in crypto trading are essential for real-time trade execution, yield optimization in decentralized finance, and risk management. Their ability to analyze market data and detect fraud enhances investment protection and strategy effectiveness.

What challenges and ethical considerations are associated with autonomous crypto agents?

The challenges of autonomous crypto agents encompass scalability, interoperability, and data security, while ethical considerations focus on algorithmic bias, fairness, transparency, and accountability. Effectively addressing these issues is essential for their successful implementation.