The Top 6 Biggest Crypto Crashes in History and What They Mean for Investors

Friday 10 October saw the biggest crypto crash in history, but its not the only time the crypto market has dumped. Want to know the pivotal moments when the crypto market crashed? This article covers the top 6 biggest crypto crashes in history and their impact on investors. Learn what caused these crashes and how they shaped the crypto landscape.

Key Takeaways

- Historical crypto crashes, such as the Mt. Gox hacks and the Crypto Winter, highlight the inherent volatility and risks associated with cryptocurrency investments.

- External factors, including geopolitical events and corporate decisions, can significantly impact the cryptocurrency market, demonstrating its susceptibility to broader economic influences.

- Investors are advised to implement strategies such as diversification, dollar-cost averaging, and staying informed to mitigate risks during market downturns.

June 2011: The Mt. Gox Hack

In June 2011, the cryptocurrency market experienced one of its earliest and most devastating setbacks with the Mt. Gox hacker incident. Mt. Gox, a major exchange responsible for a significant portion of Bitcoin trading, suffered a severe security breach that shook the entire market. The hackers exploited vulnerabilities in the system, leading to a massive sell-off of Bitcoin.

The impact was immediate and catastrophic. Bitcoin’s value plummeted from $32 to a mere $0.01, marking a 99% drop that left investors reeling. This unprecedented decline triggered a mass sell-off, causing widespread panic and a significant loss of investor confidence. The Gox crash of 2011 is often cited as one of the biggest Bitcoin crashes in history, a grim reminder of the risks associated with cryptocurrency trading, especially in light of the ftx collapse. Bitcoin fell dramatically during this period, highlighting the volatility of the market and the potential for crashing values. The biggest crashes in cryptocurrency have left lasting scars on the industry.

The incident underscored the necessity for strong security measures in exchanges, revealing the vulnerabilities of digital currencies. It served as a wake-up call for the crypto world, stressing the need for better safeguards and more resilient infrastructure to protect investors’ assets.

April 2013: Another Mt. Gox Catastrophe

Just two years after the first major hack, Mt. Gox was at the center of another catastrophic event in April 2013. This time, the exchange was overwhelmed and hacked once again, leading to another significant crash in Bitcoin’s value. The repeated security failures at Mt. Gox highlighted the persistent risks within the cryptocurrency market.

During this crash, Bitcoin’s value plummeted from nearly $260 to about $50, representing an 83% drop. The magnitude of this decline was staggering, and it resulted in the loss of 850,000 BTC, with 740,000 BTC directly attributed to the hack. Investors were left grappling with massive losses, and confidence in the security of exchanges took another severe hit. Additionally, bitcoin plunged during this period, further exacerbating the situation.

The April 2013 Mt. Gox crash highlighted the need for stringent security protocols and regulatory oversight in the crypto world. It also emphasized choosing reliable and secure platforms for trading and storing digital assets, a lesson still relevant today.

December 2017 – December 2018: The Crypto Winter

The period from December 2017 to December 2018, often referred to as the ‘Crypto Winter,’ is characterized by:

- A prolonged bear market with a significant decline in cryptocurrency prices.

- Bitcoin reaching a peak price of over $19,000 in December 2017, driven by widespread enthusiasm and speculation.

- A sharp decline in Bitcoin’s price to approximately $6,000 by early 2018, marking the end of the initial exuberance.

Several factors contributed to this dramatic drop, including:

- Rumors of bans on cryptocurrency trading in Japan and South Korea, which led to an additional 12% decline.

- Profit-taking by investors.

- A negative shift in market sentiment, which further exacerbated the downward trend.

By December 2018, bitcoin’s price had dropped to around $3,200, marking an 80% decline from its peak.

The Crypto Winter was a sobering period for investors, highlighting the volatility and unpredictability of digital currencies. It served as a reminder that the cryptocurrency market is still in its nascent stages and subject to extreme fluctuations. Despite the challenges, the market eventually recovered, demonstrating the resilience and long-term potential of cryptocurrencies.

March 2020: The COVID-19 Pandemic Crash

The global COVID-19 pandemic in March 2020 triggered one of the most significant market crashes in recent history, affecting not just traditional markets but also cryptocurrencies. As the pandemic spread and economic uncertainty grew, Bitcoin lost 50% of its value, dropping from $10,000 to $5,000. This major crash was a direct result of the widespread fear and uncertainty that gripped the world during the early stages of the pandemic.

The COVID-19 crash revealed the interconnectedness of global markets and the susceptibility of crypto markets to broader economic events during the covid pandemic. It also highlighted the necessity of a diversified investment strategy to mitigate risks during crises.

Despite the initial shock, Bitcoin reached and the broader cryptocurrency market eventually recovered, reaching a record high in the following years.

May 2021: Tesla and Environmental Concerns

In May 2021, the cryptocurrency market faced another significant setback when Tesla announced its decision to halt Bitcoin payments due to environmental concerns. Elon Musk, the CEO of Tesla, raised issues about the fossil fuel usage in Bitcoin mining, which led to the company’s reversal on accepting Bitcoin as payment. This announcement had an immediate and profound impact on the market.

Following Tesla’s decision, Bitcoin’s value fell nearly 13% in a short period. The broader cryptocurrency market also suffered, losing more than one-third of its value in May 2021. Tesla’s initial support for Bitcoin, which included a substantial $1.5 billion investment, had initially boosted the cryptocurrency’s price, but the reversal highlighted the market’s sensitivity to news and external factors.

The Tesla episode emphasized considering environmental factors and the potential impact of corporate decisions on the cryptocurrency market. It also stressed staying informed and being prepared for sudden changes in market sentiment.

October 2025: Trumps New China Tariff Announcement

On Friday 10 October 2025, the cryptocurrency market was once again thrown into turmoil following an announcement by U.S. President Donald Trump. Trump revealed plans to implement an additional 100% tariff on Chinese imports, escalating trade tensions between the two economic giants. This announcement was prompted by China’s decision to increase export controls on rare earth materials essential for electronics manufacturing.

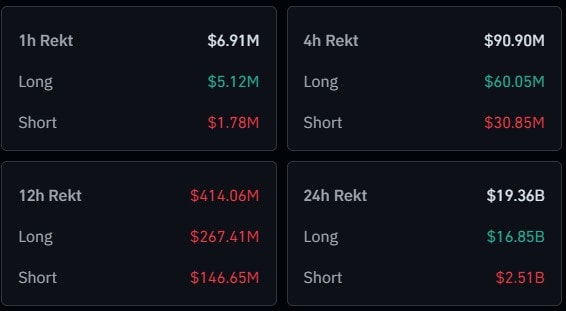

The immediate reaction in the crypto market was swift and severe. Bitcoin’s price dropped to $102,000, marking a three-month low, and the global cryptocurrency market cap fell to $3.64 trillion, reflecting an 11.80% decline within 24 hours of the news. The decentralized perpetuals trading platform Hyperliquid saw a significant portion of the day’s action: $10.3 billion in liquidations, with $9.3 billion on the long side. The market was rattled by the uncertainty and potential economic implications of the new tariffs.

This event highlighted the crypto market’s susceptibility to geopolitical events and trade policies, serving as a reminder that external factors can significantly impact prices and investor sentiment.

How to Protect Your Investments During a Crypto Crash

Given the cryptocurrency market’s volatility, investors should adopt strategies to protect their investments during a crash. Diversifying your portfolio, practicing dollar-cost averaging, and staying informed are key approaches to mitigate risks and navigate market downturns effectively.

The following subsections will delve deeper into these strategies, offering practical tips and insights to help safeguard your investments and make informed decisions during turbulent times.

Diversify Your Portfolio

Diversification is essential for managing risk in any investment portfolio. Spreading investments across different assets can reduce the impact of a crash in any single asset, particularly in the cryptocurrency market where volatility is common.

Investing in less volatile cryptocurrencies and other assets can help manage risks more effectively. A well-structured diversified portfolio provides stability and assurance during market turmoil, helping investors avoid potential losses from a crash in one particular cryptocurrency.

Understanding the factors that influence different assets and making informed investment decisions based on this knowledge can further enhance diversification. Diversifying helps build a more resilient investment strategy that can weather the ups and downs of the crypto market.

Practise Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount in cryptocurrency at regular intervals, regardless of the market price. This method allows you to take advantage of market drops without committing too many funds to one trade, potentially lowering your average cost per investment over time.

Dollar-cost averaging aims to reduce the impact of volatility and avoid the pitfalls of trying to time the market. Consistently investing the same amount of dollars can smooth out fluctuations and build your investment over time.

This strategy is particularly beneficial during market cycles, helping investors stay committed to their investment plan and avoid emotional decisions driven by short-term market movements. Over the long term, it can lead to more stable and predictable returns.

Stay Informed and Avoid Panic Selling

Staying informed and avoiding panic selling are crucial for any cryptocurrency investor. During a crypto crash, remain calm, check your portfolio, and analyze market trends before making decisions. Educating yourself about cryptocurrency and blockchain concepts helps filter out misinformation and make informed investment decisions.

Maintaining composure and analyzing market trends post-crash can lead to better investment strategies and prevent emotional decisions, such as panic sell, which can result in significant losses. Staying updated on news and understanding the broader market context helps discern hype from genuine market signals and recognize that low prices are often a periodic lull.

By staying informed and avoiding panic selling, you can navigate the volatile crypto market more effectively and make rational investment decisions that align with your long-term goals.

Summary

Throughout history, the cryptocurrency market has experienced several significant crashes, each providing valuable lessons for investors. From the Mt. Gox hacks to the recent geopolitical tensions, these events have highlighted the importance of robust security measures, diversification, and staying informed.

Despite the challenges, the cryptocurrency market has shown remarkable resilience, often recovering and reaching new heights. By understanding the causes and impacts of these crashes, investors can build more resilient investment strategies and navigate the volatile crypto market with greater confidence.

Frequently Asked Questions

What caused the Mt. Gox hack in June 2011?

The Mt. Gox hack in June 2011 resulted from a significant security breach at the exchange, which triggered a massive sell-off and caused Bitcoin’s value to plummet by 99%.

How did the April 2013 Mt. Gox crash affect Bitcoin’s value?

The April 2013 Mt. Gox crash severely impacted Bitcoin’s value, causing it to drop from nearly $260 to around $50, which is an 83% decline. This event significantly affected market perception and stability for Bitcoin at that time.

What was the ‘Crypto Winter’ of 2017-2018?

The ‘Crypto Winter’ was a significant bear market from December 2017 to December 2018, characterized by an 80% decline in Bitcoin’s price from its peak. This period marked a challenging time for the cryptocurrency market.

How did the COVID-19 pandemic impact the cryptocurrency market in March 2020?

The COVID-19 pandemic led to a significant downturn in the cryptocurrency market in March 2020, with Bitcoin losing 50% of its value amid widespread economic uncertainty. This dramatic decline reflected investors’ fear and the overall volatility of the market during that time.

What strategies can investors use to protect their investments during a crypto crash?

To safeguard your investments during a crypto crash, consider diversifying your portfolio, engaging in dollar-cost averaging, and staying informed to prevent rash decisions. These strategies can help mitigate losses and maintain stability in volatile markets.