Unlocking Synergy: Why DePIN and Crypto Are the Perfect Fit for the Future of Finance

Why DePIN and crypto are the perfect fit? It’s simple: DePIN leverages the decentralized advantages of cryptocurrencies to revolutionize both infrastructure management and financial transactions. Expect this article to unpack the opportunities and challenges of this harmonious relationship, providing valuable insights into the future of decentralized networks.

Key Takeaways

- DePIN models leverage blockchain technology to decentralize control over physical infrastructure, fostering a new distributed model of infrastructure management and efficient resource use.

- Crypto incentives are integral to the success of DePIN projects, using token rewards to drive user participation, build trust, and promote long-term network growth through dynamic rewards systems.

- Real-world applications of DePIN are emerging, such as Hivemapper and Render Network, showcasing practical solutions to infrastructure challenges and potential for mass adoption and sustainable growth.

The Power of Decentralization

The winds of disruption are blowing across the landscape of infrastructure management, and they carry the scent of decentralization. The DePIN model is challenging the traditional centralized control over physical infrastructure by harnessing the power of blockchain technology. This is not just a technological shift; it’s a fundamental reimagining of the technology underpinning modern civilization.

Cryptocurrencies are causing a seismic shift in the financial landscape by decentralizing finance, thereby diminishing the influence of central banks and traditional financial institutions. This marks a significant change in the perception of value and the execution of transactions.

Decentralized Physical Infrastructure

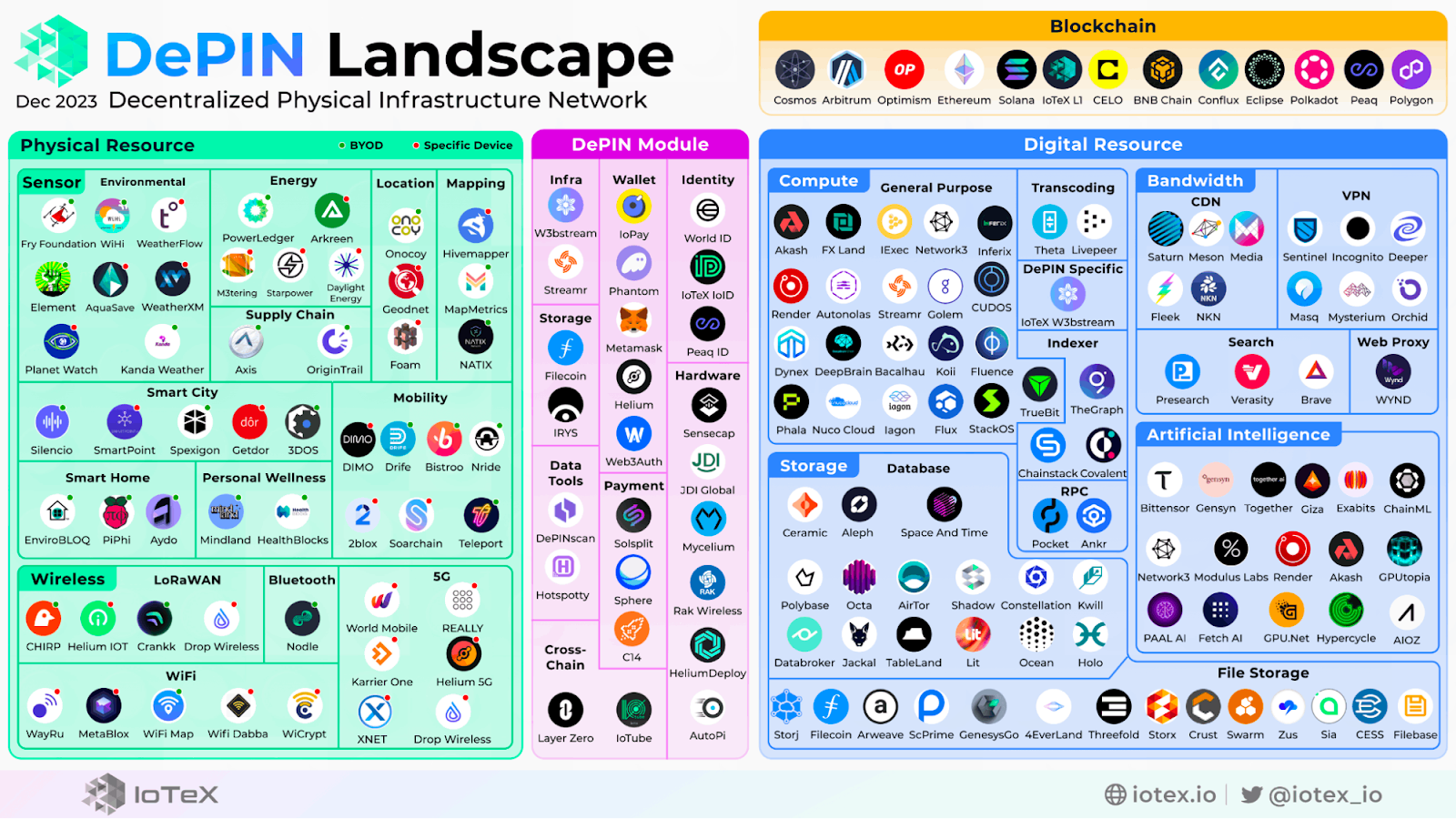

The real beauty of DePINs lies in their potential to transform infrastructure provision. They replace the centralized enterprises with a form of crowdsourcing that involves users worldwide. This is not just theoretical; real-world examples of such DePIN projects are already emerging, such as Filecoin, Render Network, and Theta Network. These projects are leading the charge in providing decentralized infrastructure solutions, addressing the limitations of current Information and Communications Technology (ICT) infrastructure.

These networks, known as decentralized physical infrastructure network, are fostering a new, distributed model of infrastructure management by incentivizing user participation, a move that could soon reshape our world. The power of these decentralized physical infrastructure networks lies in their ability to utilize resources efficiently and securely, providing solutions to real-world infrastructure challenges in a way that was previously impossible.

Blockchain Technology

The engine driving these decentralized physical infrastructure networks is none other than blockchain technology. Blockchain’s unique features include:

- Chaining of hashes, which substantially reinforces infrastructure audit processes and device configuration management

- Security and adherence to compliance standards

- A robust foundation for DePINs (Decentralized Physical Infrastructure Networks)

- An unalterable record that provides an impeccable audit trail for IT asset management, covering the entire history of device configurations and changes.

The potential for blockchain doesn’t stop there. Its decentralized architecture supports a globally accessible Web3, facilitating user engagement with decentralized applications and enhancing collective management of network infrastructure. The incorporation of blockchain technology into decentralized physical infrastructure networks signifies more than technological innovation; it heralds a paradigm shift, laying the groundwork for the next generation of global infrastructure management.

Crypto Incentives for DePIN Projects

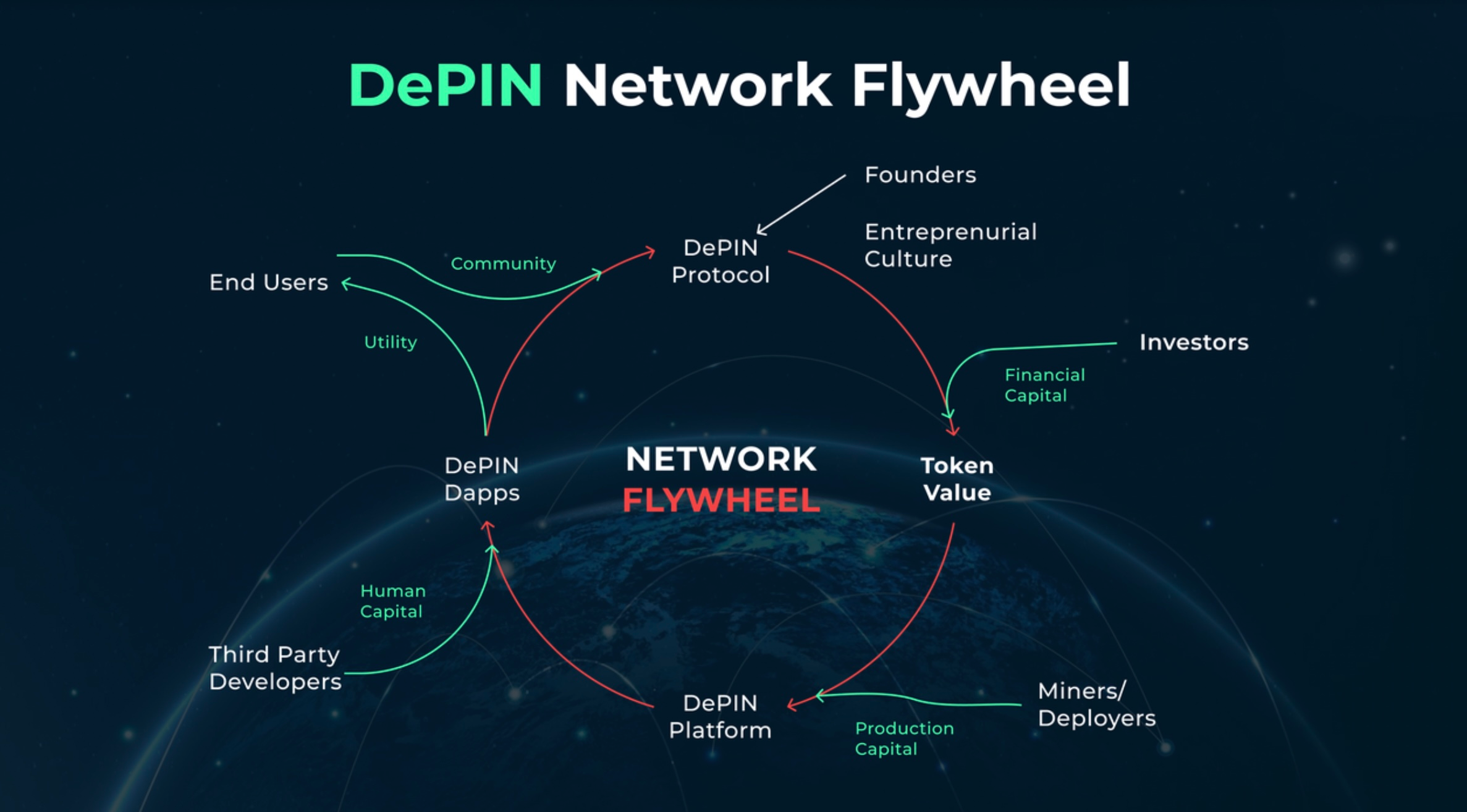

A central aspect of DePIN projects is the use of crypto incentives to drive network participation. DePIN projects facilitate a flywheel effect through token rewards, guaranteeing that early adopters receive substantial rewards for their initial contributions. This strategy not only promotes network growth but also creates a sense of trust and security among users.

The inherent transparency and security of on-chain incentives assure users that their contributions are recognized and the network is safeguarded. It’s this unique integration of blockchain technology that amplifies the power of loyalty and incentive programs, historically prominent in tech company growth, to encourage the adoption and integration of new blockchain applications.

Token-Based Rewards

In the world of DePINs, tokens are more than just digital assets. They are the lifeblood of the network, serving as a mechanism for reinforcing desirable actions by users within the network. DePIN projects are fostering a distributed model of infrastructure management that encourages individual contribution by providing token rewards for resources such as GPU power, hotspots, and storage space. This token economy model has the potential to revolutionize not just how we manage infrastructure, but also how we view and value individual contributions to collective projects.

However, the use of token rewards is not without its challenges. For these tokens to truly align the long-term incentives of DePIN projects, they must be carefully balanced. It’s a delicate dance of prioritizing long-term viability over immediate, unsustainable growth. But when done right, the potential impact of these token-based rewards can be immense, fostering a sense of community and shared purpose among network participants that could drive the future growth and success of DePIN projects.

Dynamic vs Static Rewards

While token rewards offer a powerful incentive for network participation, not all rewards are created equal. DePIN projects must navigate the ‘Static Rewards Trap,’ where contributors earn the same static rewards without adding significant value. This can damage long-term incentive structures by treating all contributions equally, leading to a lack of focus on product-market fit.

That’s where dynamic rewards come into play. Dynamic rewards, which prioritize quality and uniqueness over quantity, motivate contributors to enhance the product in the long term. They offer more than just short-lived growth; they ensure that rewards reflect the value added to the network. A well-designed dynamic reward system can create a positive feedback loop for DePIN projects, attracting supply-side participants through tokens and offering services at lower prices to consumers, thereby increasing the number of users.

Real-World Applications

While the concepts of DePIN and crypto might seem abstract, their real-world applications are already making waves. From Hivemapper’s blockchain-based mapping network that rewards contributors with cryptocurrency to enhance the quality of map data, to Render Network’s decentralized platform for internet connectivity that provides GPU computing power through a peer-to-peer blockchain network, these projects are proving that DePIN and crypto are not just theoretical concepts but practical solutions to real-world problems.

Hivemapper: A Blockchain-Based Mapping Network

Hivemapper is a prime example of a DePIN project bringing blockchain technology to the world of mapping. Hivemapper implements reputation scoring for contributors and dynamically adjusts rewards based on network progress, thereby aligning participant incentives with the success of the mapping network. This approach not only ensures high-quality data but also fosters a sense of community and shared purpose among contributors.

The Hivemapper dashcam extracts vital information for map data from captured images, including road signs and exits, enhancing the richness of mapping data. By passively collecting map data, as the Hivemapper ecosystem grows and the demand for current map data increases, contributors have the opportunity to increase their earnings proportionally. This win-win approach not only benefits the users but also ensures the continued growth and success of the Hivemapper network.

Render Network: Decentralized Platform for Internet Connectivity

The Render Network is another DePIN project making waves in the world of decentralized physical infrastructure. Its platform enables users to:

- Monetize idle GPU resources in exchange for RNDR tokens, essentially turning personal computers into mini data centers

- Incorporate Ethereum blockchain to manage complex transactions via smart contracts

- Use ORBX packages for digital rights management

To optimize transaction efficiency and costs, Render Network has adopted a Polygon proof-of-stake cross-chain bridge and set up an RNDR and escrow contract on the Layer 2 system. This approach showcases the power of blockchain technology in facilitating secure, efficient transactions in a decentralized network. Moreover, the platform is governed in a decentralized manner by the Render Network Foundation, which rewards active participants and supports VR, MR, and AR applications, setting the stage for the next generation of internet connectivity.

Challenges and Opportunities

Of course, the journey towards a decentralized future is not without its challenges. From ensuring high-quality data to generating genuine demand and navigating the complex regulatory landscape, DePIN and crypto projects must overcome numerous obstacles. Yet, these challenges also present opportunities.

The changing economy and automated world are disrupting traditional industries and potentially altering the landscape for DePIN and crypto innovations. Yet, with challenges come opportunities to innovate and redefine the norms.

Ensuring High-Quality Data

One of the most critical challenges for DePIN projects is ensuring the quality of data. It’s not enough to simply collect data; the data must be accurate, reliable, and useful. This requires aligning incentives to motivate contributors to provide high-quality data, the foundation of DePIN projects. DePIN projects can guarantee that the data they collect is valuable and useful for the network by rewarding contributions based on criteria like geography, productivity, and quality.

Reputation scoring systems for contributors can help ensure data quality by incentivizing proper equipment setup and accurate data collection. For example, the Hivemapper Network offers AI Trainer Games, allowing contributors to play and earn by helping to fine-tune the AI, thus building their reputation score. These systems not only ensure high-quality data but also foster a sense of community and shared purpose among network participants. Higher productivity contributors deserve recognition, and reputation scoring systems can provide that. In fact, higher quality contributions deserve even more recognition, further motivating participants to strive for excellence.

Generating Genuine Demand

Another significant challenge for DePIN projects is generating genuine demand. It’s not enough to simply offer a unique, decentralized solution; there must be a real-world problem that the solution can address. For DePIN projects to generate genuine demand, it is critical to quickly identify a product-market fit and utilize incentive mechanisms to direct resources and contributions to areas of higher demand.

Overcoming the ‘cold start’ problem is another critical challenge for DePIN projects. They must achieve critical mass, reaching a scale at which the network becomes valuable and capable of attracting demand. Yet, with the right strategies and incentives, these challenges can be overcome. By focusing on real-world issues that can be uniquely solved using a decentralized approach, DePIN projects can generate genuine customer demand for their infrastructure solutions and pave the way for the mass adoption of DePIN and crypto.

Future Outlook: Mass Adoption and Sustainable Growth

As we look to the future, the prospects for mass adoption and sustainable growth of DePIN and crypto are bright. These innovative technologies have the potential to revolutionize global finance, allowing for more transparent, secure, and efficient transactions across international borders.

By integrating blockchain technology with physical infrastructure, DePIN can provide better management through immutable record-keeping and decentralized control, setting the stage for a future where infrastructure is managed not by centralized entities but by the people who use it.

Decentralized Approach to Humanity’s Critical Infrastructure

The future of global infrastructure management lies in a decentralized approach. However, for DePIN projects to revolutionize critical infrastructure management, the establishment of stable and profitable business models is vital to ensure long-term success. As depin builders remain focused, DePIN projects can generate real demand and achieve mass adoption by concentrating on real-world applications that offer tangible benefits.

The incorporation of blockchain technology into decentralized physical infrastructure networks signifies more than technological innovation; it heralds a paradigm shift, laying the groundwork for the next generation of global infrastructure management. Blockchain technology, by enhancing trust and verifiability, can significantly bolster the resilience of infrastructure systems against various challenges, including natural disasters and cyberattacks. Moreover, a decentralized approach to infrastructure maintenance can lead to significant cost reductions and optimized resource allocation, contributing to a more sustainable future.

The Path to Mass Adoption

The path to mass adoption of DePIN and crypto is paved with challenges and opportunities. It requires a focus on tangible benefits and dynamic rewards that reflect the value added to the network. Market sentiment and narratives significantly influence the stability and growth of DePIN projects, posing a challenge to their adoption. Market volatility is recognized as one of the major challenges for DePIN projects and can have an adverse effect on their trajectory towards mass adoption.

Yet, with the right strategies, these challenges can be overcome. One way to do this is to establish baseline reward systems, which can then be enhanced with dynamic rewards as a strategy to mitigate the impact of market challenges, encouraging sustained participation in DePIN projects.

Furthermore, DePIN projects can pave the way for the mass adoption of decentralized physical infrastructure networks and crypto by envisioning a Universal Basic Data Income for individuals. In this scenario, every individual, regardless of their profession, hosts devices that contribute to a decentralized network and earn passive income.

Summary

In summary, the combination of DePIN and crypto holds the potential to upend traditional infrastructure management, ushering in a new era of decentralized control and participation. From token rewards to blockchain-based mapping networks, the applications of these technologies are diverse and impactful. While the journey towards mass adoption is fraught with challenges, the opportunities for innovation and transformation are immense. As we navigate this exciting new landscape, the future of finance and infrastructure management rests in our hands.

Frequently Asked Questions

What is Depin in crypto?

Depin in crypto refers to Decentralized Physical Infrastructure Networks (DePIN), which leverage blockchain technology and token incentives to develop and maintain physical infrastructure like wireless networks and power grids in a decentralized manner.

What is the biggest drawback of Bitcoin and why?

The biggest drawback of Bitcoin is its limited acceptance, which restricts where you can spend your money compared to using credit or debit cards. Oct 27, 2023.

Is it a good idea to invest in crypto?

Investing in cryptocurrency can bring high returns, but it also comes with significant risks. Before investing, consider your time horizon, risk tolerance, and liquidity needs to see if it aligns with your investment profile.

Is crypto actually used for anything?

Yes, cryptocurrency is actually used for various purposes, including buying goods and services, digital payments, remittances, and participating in software programs. It has a range of real-world applications beyond just being an investment asset.

How do crypto incentives work in DePIN projects?

In DePIN projects, crypto incentives work by using tokens to reward early adopters and encourage network growth through a flywheel effect. This helps drive participation and expansion within the network.