Web3 and Blockchain Adoption in 2026 Real World Use Cases Driving Massive Growth

The conversation around web3 and blockchain adoption in 2026 real world use cases driving massive growth has shifted from speculation to measurable business outcomes. What started as experimental pilots and proof of concepts has evolved into production deployments across finance, supply chains, digital identity, and consumer applications. The data tells a compelling story: the global Web 3.0 market reached USD 6.61 billion in 2024 and is projected to hit USD 257.13 billion by 2033, with compound annual growth rates hovering near 50% across multiple analyst projections.

This growth is not theoretical. Institutional on chain volumes already measure in the trillions of dollars. Stablecoins process well over USD 6 trillion annually. Tokenized real world assets have crossed the USD 60 billion threshold. Web3 gaming revenues are projected to surpass USD 45 billion. These numbers represent actual transactions, actual users, and actual value creation happening right now.

The year 2026 marks a tipping point because blockchain technology has finally matured to the point where enterprises can deploy it without betting their business on unproven infrastructure. Regulatory clarity in the EU through MiCA and evolving US stablecoin frameworks has reduced the legal uncertainty that previously kept institutional capital on the sidelines. Meanwhile, infrastructure improvements have brought transaction fees down to fractions of a cent and finality times under one second for many applications.

This article focuses on live deployments and concrete pilots scheduled through 2026. You will learn which use cases have achieved product market fit, how enterprises are measuring ROI, and what infrastructure makes it all possible. If you are evaluating blockchain for your organization, developing applications in the blockchain space, or investing in digital asset ecosystems, this guide provides the practical context you need.

What Is Actually Working In Web3 And Blockchain In 2026

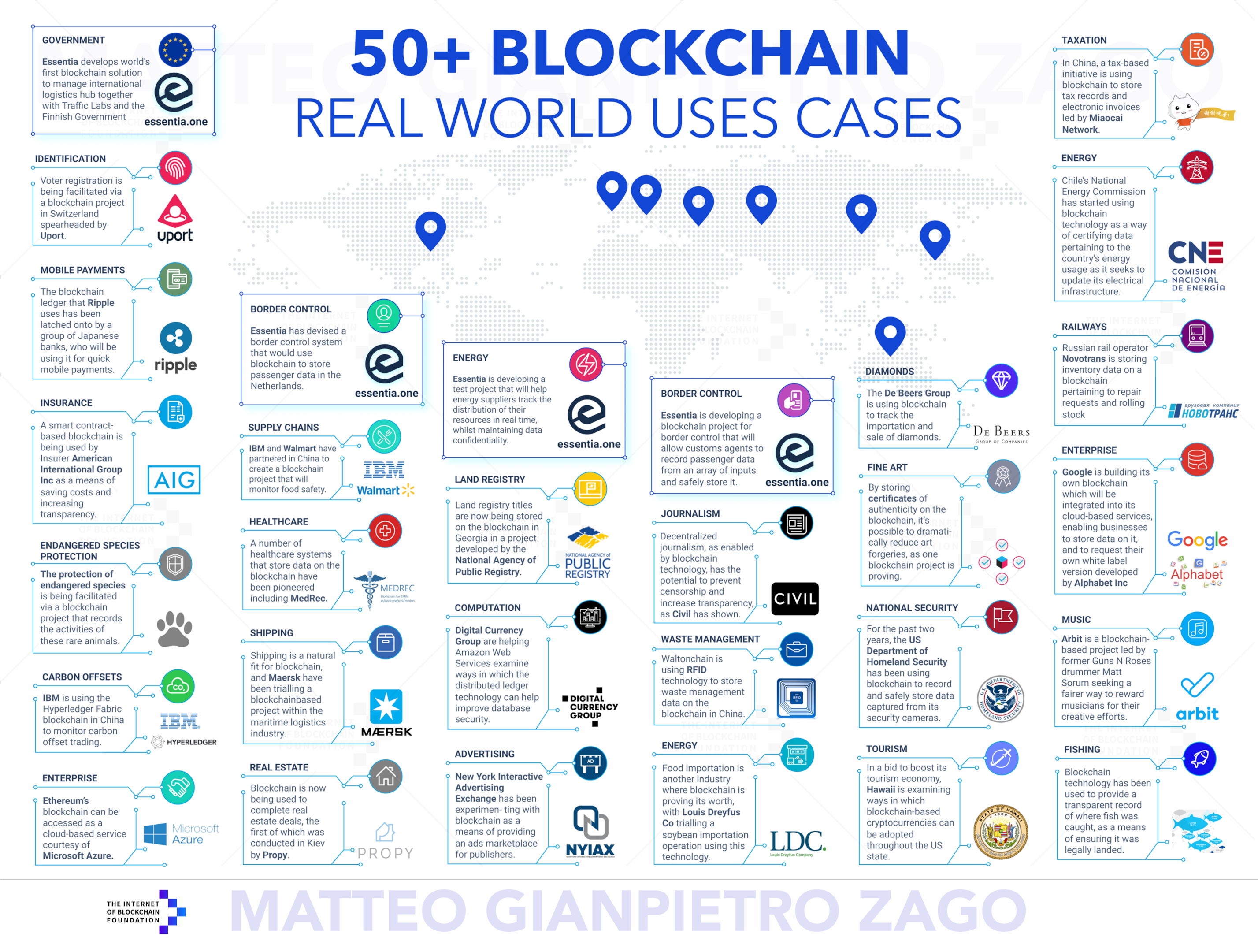

By 2026, several Web3 use cases have moved beyond experimentation into clear product market fit. The winners share a common trait: they solve concrete problems faster, cheaper, or more transparently than conventional systems. Stablecoins have become the backbone of digital payments and cross border settlement. Real world asset tokenization is unlocking liquidity in previously illiquid markets. Supply chain traceability is delivering measurable fraud reduction and recall efficiency. Decentralized identity is streamlining compliance while enhancing data ownership. Blockchain games are generating sustainable revenue through player owned economies.

The numbers tell the story of enterprise adoption reaching critical mass:

Stablecoins are processing well over USD 6 trillion annually across major networks, with total supply surpassing USD 400 billion by mid 2026. This volume rivals traditional payment networks and represents genuine utility rather than speculative trading.

Tokenized real world assets have crossed USD 60 to 70 billion in on chain value, led by treasuries and money market funds. Major asset managers including BlackRock and Franklin Templeton have launched regulated tokenized products with billions under management.

Supply chain blockchain deployments at companies like Walmart have cut food recall resolution times from weeks to minutes. Luxury brands, pharmaceutical companies, and industrial manufacturers are running production systems that trace millions of items annually.

Decentralized identity initiatives are scaling through government backed programs like the EU Digital Identity Wallet, with enterprise adoption accelerating in financial services for KYC and AML automation.

Web3 gaming represents a quarter or more of daily blockchain transactions, with tens of millions of daily active wallets interacting with games and market projections exceeding USD 100 billion by early 2030s.

The shift from experiments to production deployments is most visible in how large institutions talk about blockchain. Banks, logistics giants, and consumer brands no longer discuss whether to adopt blockchain solutions but rather which use cases to prioritize and how to scale existing pilots. This transition coincides with regulatory clarity across jurisdictions globally, particularly the EU Markets in Crypto Assets regulation fully in force since 2024 and ongoing US stablecoin legislation shaping 2026 deployments.

Finance In 2026: From Crypto Speculation To Institutional Infrastructure

By 2026, Web3 is embedded into core financial market plumbing rather than sitting at the speculative edge. The crypto winter of 2022 and 2023 cleared out projects without sustainable business models and left behind infrastructure that institutional capital now uses daily. Banks, asset managers, and fintechs are deploying blockchain rails for payments, tokenized treasuries, and collateral management with production volumes that would have seemed impossible just three years ago.

The transformation is most visible in how global financial systems are adopting blockchain infrastructure. JPMorgan processes billions in intraday repo transactions through its blockchain platform. BlackRock manages over USD 1 billion in tokenized assets. Central bank digital currencies are operating at scale in multiple countries. These are not pilots or experiments but core business operations.

What makes 2026 different is the convergence of three factors. First, infrastructure has matured to handle institutional grade throughput with sub second finality and enterprise level security. Second, regulatory frameworks in major economies provide legal clarity for digital assets, stablecoins, and tokenized securities. Third, the talent and tooling ecosystem has developed to the point where traditional financial institutions can leverage blockchain technology without building everything from scratch.

The impact on legacy systems is significant. Settlement times are compressing from days to seconds. Reconciliation overhead is dropping as shared ledgers eliminate discrepancies. New financial assets like tokenized real estate and private credit are becoming accessible to retail investors through fractional ownership. The following subsections explore the three most mature financial use cases in detail.

Stablecoins And Digital Money Rails

In 2026, dollar and euro stablecoins operate as core settlement assets for cross border B2B payments and crypto exchanges, accounting for around one third of all on chain transaction volume. Total stablecoin supply has surpassed USD 400 billion by mid 2026, with yearly transfer volumes exceeding USD 7 trillion across major networks like Ethereum, Solana, and Layer 2 rollups.

The regulatory landscape has matured considerably. MiCA requirements for euro stablecoins in the EU mandate specific reserve and disclosure standards. Proposed US laws require one to one reserve backing and regular audits. This regulatory compliance has accelerated enterprise adoption by removing legal uncertainty that previously kept corporate treasurers on the sidelines.

Enterprise use cases demonstrate the practical value proposition:

Cross border B2B payments see multinational firms settling supplier invoices in tokenized dollars on permissioned or public chains. A payment that previously took three to five days through correspondent banking now settles in minutes with lower transaction costs.

Merchant payments are expanding as major payment processors integrate stablecoins into merchant flows. Circle, Tether, and PayPal USD have become mainstream options alongside traditional card networks.

Treasury operations at crypto native companies and increasingly at traditional enterprises use stablecoins for working capital management, taking advantage of 24/7 settlement and programmable controls through smart contracts.

Remittances have been transformed by fintechs offering instant cross border transfers via stablecoins. A worker sending money home no longer waits days or pays 5 to 10 percent in fees when stablecoin rails can deliver settlement in minutes for fractions of a percent.

The stablecoin market structure has consolidated around a few dominant issuers with strong compliance programs, reserve transparency, and banking relationships. This consolidation, while reducing decentralization, has enabled the institutional adoption that drives 2026 volumes.

Interbank Networks CBDCs And Wholesale Settlement

By 2026, over 80 percent of central banks are researching central bank digital currencies, and several have live or extended pilots running. China’s e CNY operates at city and provincial scale with millions of wallets and recurring government subsidy payments as daily use cases. The technology enabling these deployments often runs on permissioned blockchain variants that leverage distributed ledger technology for resilience and auditability.

The BIS mBridge initiative represents the most ambitious cross border wholesale CBDC project. Multiple central banks including those from China, Thailand, Hong Kong, and the UAE are participating in a shared platform that enables cross border wholesale transfers with settlement finality in seconds rather than days. This project demonstrates how blockchain infrastructure can transform correspondent banking relationships.

Major commercial banks have deployed their own interbank networks:

JPMorgan’s Onyx platform handles billions in intraday repo transactions and cross border payments through JPM Coin, a tokenized dollar used for instant settlement between institutional clients.

Partior, a joint venture involving DBS, JPMorgan, and Temasek, provides a blockchain based clearing and settlement network for banks in Asia and beyond.

HSBC and BNP Paribas have launched tokenized bond settlement platforms that reduce settlement risk and free up collateral previously locked in multi day settlement cycles.

The distinction between CBDCs and private stablecoins matters for different use cases. CBDCs carry the full faith and credit of sovereign issuers and are designed for policy objectives like financial inclusion and monetary transmission. Private stablecoins offer programmability and composability with decentralized finance ecosystems. Many 2026 financial systems use both, with CBDCs handling wholesale settlement and stablecoins serving retail and commercial applications.

Tokenized Treasuries Bonds And Real World Assets

Tokenization of real world assets is one of the fastest growing financial Web3 segments in 2026. Tokenized treasuries and money market funds lead adoption because they combine the safety of government securities with the efficiency of blockchain settlement. The on chain RWA market has exceeded USD 60 to 70 billion, with growth accelerating as institutional grade infrastructure matures.

BlackRock’s BUIDL fund crossed USD 1 billion in tokenized assets by 2026, offering institutional investors exposure to short term US treasuries with blockchain based subscription and redemption. The fund demonstrates that the world’s largest asset manager views tokenized assets as a core distribution channel rather than an experiment.

Franklin Templeton’s OnChain US Government Money Fund was among the first regulated funds to issue shares on a public blockchain, proving that existing securities law can accommodate tokenized financial assets.

Ondo Finance and similar protocols have accumulated billions in tokenized treasury products targeted at crypto native treasuries and DeFi protocols seeking yield on stablecoin holdings.

The benefits driving adoption include:

Near real time settlement that reduces counterparty risk and frees capital previously locked in multi day settlement cycles.

Automated coupon and dividend payments through smart contracts that execute without manual intervention.

Reduced reconciliation overhead as all participants share a single source of truth rather than maintaining separate books.

Fractional access that allows smaller investors entry with tickets in the USD 1000 range or lower, democratizing access to institutional grade products.

Banks including Goldman Sachs, UBS, and Societe Generale operate regulated issuance platforms supporting tokenized bonds and structured products. The competitive advantage goes to institutions that master both traditional securities operations and blockchain development, creating new business models that blend the best of both worlds.

Supply Chain Logistics And Provenance: From Pilot To Production

In 2026, supply chain blockchain projects have moved beyond proofs of concept into ongoing programs with clear ROI. The early pioneers like IBM Food Trust and the Maersk and IBM TradeLens initiative (before its shutdown) proved the concept. Newer consortia formed between 2024 and 2026 focus on automotive parts, electronics components, and pharmaceutical supply chains where the value of traceability and fraud prevention justifies blockchain overhead.

The measurable outcomes driving continued investment include:

Recall resolution has compressed from weeks to seconds for companies with mature blockchain traceability. When a contaminated ingredient or defective part is identified, the blockchain provides instant visibility into exactly which batches and locations are affected.

Paperwork costs have dropped by double digit percentages in cross border shipping corridors where blockchain based bills of lading replace paper documentation that previously required manual verification at every handoff.

Fraud reduction in high value goods like luxury items, pharmaceuticals, and electronics components saves millions annually by providing immutable records that counterfeiters cannot replicate.

The technology stack has matured to integrate blockchain with existing enterprise systems. Modern deployments connect to ERP platforms, warehouse management systems, and IoT sensor networks through standard APIs. Data integrity is maintained through cryptographic proofs while sensitive data remains off chain to comply with privacy requirements.

Quantifiable Business Value In Logistics

Walmart’s deployment of IBM Food Trust remains the benchmark for supply chain blockchain ROI. The retailer cut food recall resolution times from days or weeks to minutes by tracing product batches on shared ledgers. When a food safety issue emerges, Walmart can identify the source farm, processing facility, and affected shipments within seconds rather than the industry average of days.

Container shipping networks are adopting smart contracts that automate processes previously requiring manual intervention. When cargo is scanned at destination ports, payment is automatically triggered to carriers, reducing disputes and accelerating cash flow. Early pilots show 20 to 30 percent reductions in claims processing time for cargo insurance.

Air freight corridors between major hubs use blockchain to coordinate between airlines, freight forwarders, and customs authorities. The shared ledger eliminates discrepancies that previously caused delays and additional costs for express shipments.

Automotive supply chains have formed consortia to track components through multi tier supplier networks. When a defect is discovered in a part, manufacturers can trace exactly which vehicles are affected rather than recalling entire production runs.

The move toward consortium operated permissioned blockchains reflects practical requirements. Participants need control over governance, privacy, and performance while still benefiting from blockchain enhances data security and auditability. These permissioned networks increasingly interoperate with public Web3 networks for verification and financing, enabling hybrid architectures that balance enterprise needs with the transparency of decentralized networks.

Provenance Traceability And Sustainability Claims

Brands in 2026 use blockchain to prove origin and sustainability of products with verifiable evidence rather than marketing claims. Consumer trust benefits are clear: shoppers can scan a product and trace its journey from source to shelf with confidence that the data has not been tampered with.

Seafood traceability programs track catches from fishing vessels to supermarket shelves. Companies like Bumble Bee and Thai Union register millions of kilograms of seafood on chain annually, providing immutable records that support sustainable fishing certifications and help combat illegal fishing.

Luxury authentication has become standard practice for major brands. Louis Vuitton, Prada, and Cartier through the Aura blockchain consortium issue digital passports for handbags, watches, and jewelry. These NFT style certificates travel with products through resale markets, protecting brand value and giving buyers confidence in authenticity.

Recycled materials tracking helps manufacturers prove recycled content claims for ESG reporting. Plastic recyclers, aluminum producers, and textile companies issue tokens representing verified recycled materials that flow through supply chains with cryptographic proof of origin.

Fair trade and ethical sourcing programs use blockchain to connect consumers directly with producer communities. Coffee companies trace beans from specific cooperatives, cocoa suppliers document fair labor practices, and apparel brands verify factory conditions.

Governments and ESG auditors increasingly accept blockchain based data streams for regulatory compliance when combined with verified IoT sensors or trusted oracle feeds. The combination of tamper evident records and automated data collection creates audit trails that satisfy regulatory requirements while reducing manual verification overhead.

Digital Identity Governance And Compliance In 2026

Decentralized identity and verifiable credentials represent one of the most policy driven Web3 use cases maturing by 2026. Unlike financial applications where market forces drive adoption, identity systems require coordination between governments, enterprises, and standards bodies. The payoff is significant: streamlined processes, reduced fraud, and user control over patient data, financial records, and personal credentials.

Government led initiatives are creating the foundation for citizen centric digital identity. The European Digital Identity Wallet under the revised eIDAS regulation is rolling out across EU member states. US states are launching mobile driver license programs that store credentials on devices rather than central databases. These systems leverage decentralized identity principles even when the underlying infrastructure is not a public blockchain.

Enterprises adopt self sovereign identity models to streamline KYC onboarding, reduce fraud, and comply with data privacy regulations like GDPR and CCPA. The value proposition is clear: rather than collecting and storing sensitive data (with all the liability that entails), businesses can verify credentials issued by trusted authorities without taking custody of personal information.

The technology bridges citizen government applications and enterprise compliance use cases. Digital signatures and on chain attestations provide cryptographic proof that credentials are valid without revealing unnecessary personal details. Zero knowledge proofs enable verification that someone meets a requirement (over 18, licensed professional, accredited investor) without exposing the underlying data.

Citizen Digital Wallets And Government Services

The EU wide digital identity wallet is rolling out through 2025 and 2026, giving citizens control over how they share identity information. Instead of providing copies of IDs, diplomas, and licenses to every service that requests them, users store verifiable credentials on their devices and share only what is needed for each interaction.

Blockchain or distributed ledgers serve as neutral verification layers. When a university issues a diploma credential, the hash of that credential is anchored to a shared registry. When the graduate needs to prove their degree, the verifier checks the registry rather than contacting the university directly. This architecture enables selective disclosure where citizens prove attributes (has engineering degree, is licensed medical professional) without revealing full identity data or irrelevant information.

Concrete use cases include:

Public benefits applications where citizens prove eligibility through verifiable credentials rather than submitting documents that must be manually verified by case workers.

Car rental and hospitality services that verify driver license and age credentials instantly through wallet based authentication, reducing friction and fraud.

Border crossing within the Schengen area using digital credentials validated against trust registries, potentially reducing queues and enhancing secure communication between border agencies.

Early pilots in Estonia and Spain demonstrate integration of government e services with wallet based logins. Citizens access tax records, healthcare providers, and municipal services through unified digital identity rather than maintaining separate accounts with each agency.

Privacy advocates raise important concerns about surveillance potential and interoperability between systems. The technical architecture supports privacy through selective disclosure, but policy choices about data retention and government access remain contested. These debates will shape how digital identity evolves beyond 2026.

Compliance Automation For Financial And Enterprise Use

Banks, fintechs, and large enterprises are adopting verifiable credentials in 2026 to transform compliance workflows. The current model of repeated document submissions and manual checks for KYC, KYB, and AML is expensive, slow, and frustrating for all parties. Web3 based identity verification networks offer a better approach.

The model works through trusted issuers and reusable credentials:

- A bank completes KYC verification on a client, confirming identity, address, and source of funds

- The bank issues a verifiable credential to the client’s wallet attesting to the completed verification

- When the client opens an account at another institution, they share the credential rather than repeating the entire verification process

- The receiving institution verifies the credential against a shared registry and the issuing bank’s cryptographic signature

The benefits are substantial:

Onboarding times compress from weeks to hours for complex corporate clients when credentials can be verified rather than recreated.

Manual review costs drop by double digit percentages as automated verification replaces document review.

Customer experience improves dramatically when business owners and executives do not have to submit the same documents repeatedly.

On chain attestations and audit trails support regulatory reporting and internal risk management. When regulators ask how a client was verified, the institution can provide cryptographic proof of the verification chain rather than digging through document archives. This improved security and auditability aligns blockchain with compliance requirements rather than positioning it as a regulatory challenge.

Gaming NFTs And Consumer Web3 Experiences

By 2026, Web3 gaming and NFT based digital ownership have matured beyond speculative mania into sustainable models integrated with mainstream games and platforms. The play to earn hype of 2021 and 2022 crashed hard, but it left behind infrastructure and lessons that inform current designs. Successful blockchain games in 2026 prioritize gameplay first and use Web3 for specific features rather than as a marketing gimmick.

The numbers reflect genuine engagement rather than speculation:

Transaction volume from Web3 gaming represents a quarter or more of daily blockchain transactions, driven by millions of daily active wallets.

Market projections exceed USD 100 billion by early 2030s, with 2026 revenues already surpassing USD 45 billion across the sector.

Major studio involvement has increased as publishers like Ubisoft, Square Enix, and EA run pilots or launch titles with on chain assets.

The shift is from tokenomics driven design (where token price appreciation was the value proposition) toward player driven economies where blockchain enables true ownership and portability of in game assets. Independent studios and decentralized applications built by player communities lead innovation, while major publishers take more conservative approaches with controlled pilots.

The key insight from the 2022 crash was that enabling users to earn money is not a substitute for fun gameplay. Successful 2026 titles use blockchain for specific valuable features like asset ownership, secondary markets, and cross game interoperability while delivering entertainment value comparable to traditional games.

In Game Asset Ownership And Player Economies

Players in 2026 truly own in game items such as skins, land, characters, and collectibles as NFTs that exist independently of any single game marketplace. This digital ownership model fundamentally changes the relationship between players and publishers.

Secondary markets for in game assets now operate with transparent pricing and royalty flows. When a player sells a rare item, the original game studio can receive a percentage of every resale automatically through smart contract logic. This aligns studio and player incentives around long term asset value rather than extraction.

Cross game portability remains limited but is growing. Some ecosystems allow cosmetic items or character attributes to carry between games from the same publisher or consortium. A sword skin earned in one game might appear in another title from the same studio.

Trading volume on chains like Ethereum Layer 2s, Solana, Immutable X, and specialized gaming chains is publicly visible, creating transparency about actual player engagement rather than self reported metrics.

The contrast with traditional closed economies is stark. In conventional systems, players invest hundreds or thousands of hours building inventories that have zero value outside the game and can disappear if the publisher shuts down servers. In Web3 enabled games, those assets exist on decentralized systems that persist regardless of any single company’s decisions.

Traditional gaming companies run controlled pilots to manage risk. Rather than tokenizing entire franchises, studios might allow select collections like limited edition cosmetics or championship rewards to be tokenized. This cautious approach lets companies learn from early adopters before scaling across their full portfolios.

NFTs As Loyalty Identity And Fan Engagement

The shift from speculative NFT drops toward NFTs as utility tokens for access, loyalty, and identity represents the maturation of the market. Rather than buying JPEGs hoping for price appreciation, consumers in 2026 acquire NFTs that provide ongoing value through exclusive access and membership benefits.

Music artists issue NFT fan passes that grant early ticket access, backstage experiences, exclusive content drops, and voting rights on setlists or merchandise designs. These passes create direct relationships between artists and fans without intermediary platforms taking large cuts.

Consumer brands run loyalty programs where tokens unlock discounts, early access to products, and exclusive collaborations. The tokens are portable across the brand ecosystem and can be earned through purchases, engagement, or referrals.

Sports leagues and entertainment brands experiment with on chain tickets and collectibles. NBA Top Shot demonstrated the market for digital collectibles. Ticketing on blockchain reduces fraud and enables instant resale with royalties flowing back to teams and venues.

The key to mainstream adoption is abstracting away crypto complexity. Successful 2026 programs integrate with normal email or social logins rather than requiring users to manage seed phrases. Custodial wallets handle key management. Users experience the benefits of digital ownership without the technical expertise traditionally required for blockchain interaction.

The marketing outcomes justify investment: higher retention, increased engagement, and direct customer relationships that bypass centralized platforms. Brands own their customer data rather than renting access from social media platforms, fundamentally changing power dynamics in digital marketing.

Infrastructure For Mass Adoption: L1s L2s And Modular Stacks

The real world use cases described above are only possible because blockchain infrastructure has matured dramatically. The tech stack supporting 2026 deployments delivers transaction finality under one second and fees measured in fractions of a cent for many applications. This performance enables use cases like gaming microtransactions and high frequency trading that were impossible when Ethereum transactions cost dollars and took minutes.

The infrastructure evolution mirrors cloud computing maturation in the 2010s. Early cloud adopters built everything themselves. Today, enterprises consume managed services for compute, storage, databases, and AI. Similarly, 2026 blockchain infrastructure provides managed node services, compliance tooling, key management, and monitoring that let enterprises focus on their use cases rather than protocol operations.

EVM compatible environments dominate enterprise adoption because they offer the largest developer ecosystem and tooling library. Solidity smart contracts can deploy across Ethereum, Layer 2 rollups, and EVM compatible Layer 1s with minimal modification.

High performance chains like Solana, Sui, and Aptos serve use cases requiring maximum throughput, particularly gaming, trading, and high frequency applications.

Modular architectures separate execution, settlement, and data availability layers, allowing applications to optimize for their specific requirements rather than accepting one size fits all tradeoffs.

High Performance Networks And Enterprise Grade Web3 Stacks

Networks like optimized Ethereum rollups, Solana, and new high throughput L1s achieve thousands of transactions per second with sub second finality. This performance enables trading platforms, blockchain games, and microtransaction applications that require speed and low operational costs.

Key performance metrics for production deployments include:

| Metric | 2026 Performance | Legacy Comparison |

|---|---|---|

| Block time | Under 500 milliseconds | Minutes for traditional settlement |

| Transaction cost | Fractions of a cent | Dollars on congested networks |

| Uptime SLA | Above 99.9 percent | Variable in early blockchain |

| Throughput | Thousands of TPS | Tens of TPS on early chains |

Compatibility with Ethereum tools and languages accelerates enterprise adoption. Developers trained on Solidity can deploy to any EVM chain without retraining. Popular development frameworks, testing tools, and security auditing practices work across the ecosystem. This reduces switching costs and allows enterprises to leverage blockchain technology without building specialized teams from scratch.

Specialized infrastructure providers have emerged offering APIs, node services, key management, and compliance tooling as managed services. Companies like Alchemy, Infura, and QuickNode provide institutional grade infrastructure that meets enterprise requirements for reliability, security, and support. This mirrors how AWS, Azure, and GCP enabled cloud adoption by removing infrastructure management burden from application developers.

The most mature ecosystems show coexistence of diverse applications. Ethereum Layer 2s like Arbitrum and Optimism host tokenized assets, stablecoins, DeFi protocols, and consumer applications sharing liquidity and developer tooling. This ecosystem density creates network effects that make adoption easier as each new application benefits from existing infrastructure and user bases.

Challenges And Risk Factors Slowing 2026 Adoption

Despite massive growth, Web3 and blockchain adoption in 2026 still face structural obstacles that require honest acknowledgment. The challenges are not existential but they do slow adoption and increase costs for enterprises evaluating blockchain solutions.

Regulatory fragmentation across jurisdictions globally creates compliance complexity for global deployments. While the EU has MiCA and US stablecoin legislation is progressing, other regions have inconsistent or unclear frameworks. Enterprises operating across borders must navigate multiple regulatory regimes with different requirements for the same underlying technology.

Security breaches and protocol hacks continue to plague the industry. High profile bridge exploits and DeFi vulnerabilities from 2023 to 2025 resulted in billions in losses. While security practices have improved, the risk profile remains higher than traditional systems. Enterprises must invest in audits, insurance, and security monitoring that add to deployment costs.

User experience friction persists despite improvements. Managing private keys, understanding gas fees, bridging between networks, and navigating different wallet interfaces still requires technical expertise that average users lack. The goal of making blockchain invisible to end users is progressing but not yet achieved for most applications.

Developer and auditor shortage creates bottlenecks for enterprise adoption. Blockchain development requires specialized skills, and demand exceeds supply. Security auditing is particularly constrained, with wait times of months for reputable auditing firms.

Mitigation strategies are maturing:

Insurance products from traditional and crypto native insurers provide coverage for smart contract failures and custody risks.

Formal verification and improved testing frameworks reduce the probability of exploits reaching production.

Account abstraction and improved wallet experiences reduce user friction for new applications.

Training programs and developer tooling improvements are expanding the talent pool.

The pragmatic approach is not to wait for perfect solutions but to factor these risks into deployment decisions, implement appropriate controls, and choose use cases where the benefits clearly outweigh the additional overhead.

How To Participate In Web3 And Blockchain Growth In 2026

The path to participating in Web3 growth differs based on your role. Business leaders, developers, and investors each have distinct opportunities and requirements. The common thread is focusing on real world value creation rather than speculative positioning.

For enterprises evaluating blockchain adoption:

Start with targeted pilots tied to measurable KPIs rather than broad transformation initiatives. The most successful enterprise deployments focus on specific pain points where blockchain provides clear advantages. Cross border payments with stablecoins, supply chain traceability for high value goods, and compliance automation for KYC are proven starting points with demonstrated ROI.

Build internal capability gradually. Partner with established infrastructure providers rather than building from scratch. Hire or train a small team to evaluate opportunities and manage vendor relationships. Avoid betting on unproven protocols or chains without production track records.

Engage with regulatory developments proactively. Understand how MiCA, evolving US frameworks, and local regulations affect your use cases. Early engagement with regulators can shape favorable interpretations and reduce compliance risk.

For developers building in the blockchain space:

Focus on mastering core ecosystems. Ethereum and major Layer 2s offer the largest job market, tooling ecosystem, and enterprise adoption. Solidity proficiency opens doors across thousands of projects and companies.

Specialize in high demand areas. Security auditing, smart contract development for financial applications, and enterprise integration skills command premium compensation. Automated workflows and AI assisted development tools are changing the profession, so stay current with tooling.

Build projects that demonstrate real world value. Portfolios showing sustainable applications with actual users carry more weight than speculative token projects. Contribute to open source projects that enterprises rely on.

For investors and capital allocators:

Prioritize projects with clear value propositions, regulatory strategies, and sustainable tokenomics. The crypto winter eliminated projects without business models. Survivors and new entrants in 2026 must demonstrate institutional capital worthiness through traditional metrics like revenue, user growth, and unit economics.

Understand that global adoption timelines extend beyond 2026. The trillion dollar on chain asset market projections target 2030 and beyond. Position for sustained growth rather than quick speculation.

Evaluate infrastructure plays alongside application layer investments. The picks and shovels thesis applies: node providers, security auditors, and compliance tooling providers may offer more predictable returns than consumer applications with uncertain adoption curves.

Conclusion: Web3 And Blockchain Adoption In 2026 And Beyond

Web3 and blockchain adoption in 2026 real world use cases driving massive growth is not a prediction but an ongoing reality. The use cases explored in this article are live in production: stablecoins processing trillions, tokenized treasuries attracting institutional billions, supply chains tracking millions of items, digital identity credentials verifying millions of users, and blockchain games engaging tens of millions of players.

The key takeaway is that only projects solving concrete problems faster, cheaper, or more transparently than legacy systems will survive the next cycle. The speculative excess of 2021 and subsequent crash clarified what matters: real value creation for real users. Enterprises adopting blockchain in 2026 are doing so because the technology delivers measurable improvements in settlement speed, cost reduction, fraud prevention, or customer experience.

Infrastructure scalability, regulatory clarity, and improved user experience are converging to support mainstream usage by the late 2020s. The building blocks are in place: sub second finality, fraction of a cent fees, institutional grade custody, and legal frameworks in major economies. What remains is execution, iteration, and the gradual expansion of the user base beyond early adopters.

Looking toward 2030, the trajectory points toward multi trillion dollar on chain asset markets and Web3 powered consumer platforms where users own their data and digital assets by default. The transition will not happen overnight, and setbacks are inevitable. But the direction is clear, and organizations that begin building capability in 2026 will be positioned to capture the opportunities ahead. The time to investigate, evaluate, and experiment is now.