Why Bitcoin Needs Donald Trump as Next President: An Economic Analysis

Bitcoin could thrive under Donald Trump’s presidency; this is why Bitcoin needs Donald Trump as next president. His pro-crypto stance, commitment to reducing regulations, and vision for U.S. leadership in digital assets might be exactly what Bitcoin needs to grow and innovate.

Key Takeaways

- Donald Trump supports pro-crypto policies, emphasizing Bitcoin’s potential to strengthen the U.S. economy and pledging to create a favorable regulatory environment to foster innovation in the crypto sector.

- Trump’s pro-crypto stance contrasts sharply with the Biden administration’s regulatory approach, which he criticizes for stifling innovation through excessive regulation and enforcement actions, particularly against crypto firms.

- Trump’s commitment to strengthening U.S. Bitcoin mining infrastructure includes ensuring future Bitcoins are minted domestically, promoting American-made ASICs, and exploring partnerships to support energy demands, particularly focusing on nuclear energy as a sustainable option.

The assassination attempt of Donald Trump

The recent assassination attempt on former President Donald Trump has sent shockwaves through the nation. The FBI and the Secret Service are actively investigating how the attacker managed to access the rooftop of a building adjacent to the Butler Farm Show in Pennsylvania, from where he fired a shot that grazed Trump’s ear. The attacker, a 20-year-old dietary aide with no clear ideological motives, was noticed behaving oddly outside the rally by spectators. Despite being a registered Republican, he had donated to a progressive political action committee on the day President Biden was sworn into office, adding to the mystery of his motives.

The investigation has revealed that:

- The attacker used an AR-style rifle, which authorities believe was purchased by his father

- A video posted on social media showed the attacker lying motionless on the rooftop, wearing a gray t-shirt with a black American flag on the right arm

- Despite the rooftop being previously flagged as a potential security vulnerability by the Secret Service, the attacker was still able to exploit it.

As the investigation continues, the nation watches closely, understanding that this incident could have far-reaching implications for the Trump campaign and the political climate in the U.S.

Trump’s Pro-Crypto Stance

Former President Donald Trump, also known as President Trump, has become a vocal advocate for cryptocurrencies, recognizing their potential to play a significant role in the future U.S. economy. His pro-crypto stance is rooted in the belief that the U.S. can become a global hub for cryptocurrency innovation. This vision aligns with his broader economic policies, aiming to foster a favorable environment for digital assets and attract leading crypto innovators to American shores.

Trump’s Embrace of Bitcoin

Trump has specifically highlighted Bitcoin as a valuable asset with significant potential benefits for the American economy. His commitment to the Bitcoin community is evident in his planned appearance as a speaker at the Bitcoin 2024 Conference. This move underscores his dedication to ensuring the future of Bitcoin is secured within the U.S. borders. Trump has also promised to protect the rights of the nation’s 50 million crypto holders, emphasizing the importance of self-custody and individual financial sovereignty.

In May, Trump made a bold statement that he would ensure Bitcoin and other cryptocurrencies are made in the USA. This declaration aligns with his broader economic policies of bringing manufacturing and technological innovation back to American soil. By supporting Bitcoin and other digital assets, Trump aims to position the U.S. at the forefront of the global financial revolution, ensuring that the country remains competitive in the rapidly evolving digital economy.

Criticism of Biden Administration

Trump has been vocal in his criticism of the Biden administration’s approach to cryptocurrency regulation. He argues that the excessive regulations imposed by President Joe Biden’s administration stifle innovation and hinder growth in the crypto sector. One of the key points of contention is the significant enforcement actions taken by SEC Chair Gary Gensler against crypto firms, which many in the industry view as overly aggressive. Additionally, the proposed 30% excise tax on Bitcoin miners, aimed at addressing environmental concerns, has been seen as a major deterrent to the growth of the mining sector.

Trump’s pro-Bitcoin stance contrasts sharply with President Joe Biden, who has been less favorable towards the cryptocurrency industry. This divergence in policy approaches highlights a fundamental difference in how each administration views the role of digital assets in the economy. Trump’s criticisms resonate with many in the crypto community who believe that the current administration’s policies are holding back the potential of this innovative sector.

Encouraging American Leadership in Crypto

Trump envisions the U.S. leading the world in cryptocurrency technologies by fostering a more favorable regulatory environment. In recent discussions with major U.S. Bitcoin miners, he emphasized the importance of American leadership in the crypto industry. This vision includes:

- Creating a supportive ecosystem for crypto innovators

- Encouraging investment

- Ensuring that the U.S. remains at the cutting edge of digital financial technologies.

By advocating for policies that encourage American leadership in the crypto sector, Trump aims to:

- Position the U.S. as a global hub for digital assets

- Support the growth of the crypto industry

- Boost innovation

- Create jobs

- Enhance the country’s global competitiveness

In doing so, Trump hopes to ensure that the U.S. leads the way in the next wave of financial technology advancements.

Strengthening U.S. Bitcoin Mining Infrastructure

A key component of Trump’s pro-crypto policy is strengthening the U.S. Bitcoin mining infrastructure. He has declared that all future Bitcoins will be minted in the U.S. if he returns to the White House, emphasizing the importance of keeping mining operations within the country. This initiative not only supports the domestic crypto industry but also aligns with his broader economic policies of promoting American manufacturing and technological innovation.

Made in America: Bitcoin Mining

Trump’s commitment to ensuring that future Bitcoin mining operations remain within the United States is a cornerstone of his crypto policy. By advocating for Bitcoin to be ‘Made in America,’ he aims to:

- Protect domestic manufacturing

- Reduce reliance on foreign entities, particularly China

- Safeguard the U.S. economy

- Promote job creation within the crypto sector.

Furthermore, Trump views Bitcoin mining as a defense against the implementation of Central Bank Digital Currencies (CBDCs). By maintaining control over Bitcoin mining within the U.S., he believes the country can better protect the financial sovereignty of its citizens and prevent undue government control over digital assets. This approach aligns with his broader economic policies of promoting individual financial freedom and reducing government intervention in the economy.

Energy Partnerships and Innovations

To support the growing energy demands of Bitcoin mining, Trump has discussed innovative partnerships and strategies to build out energy production and transmission infrastructure. One of the key elements of this strategy is the use of nuclear energy, which is seen as a cleaner and more sustainable alternative to meet the ballooning power demands of both Bitcoin mining and artificial intelligence. By tapping into nuclear energy, Trump aims to provide a stable and efficient power supply for the crypto industry while addressing environmental concerns.

In addition to nuclear energy, Trump’s discussions with Bitcoin mining executives have focused on the role of these miners in stabilizing the power grid. By partnering with utility companies, Bitcoin miners can help balance power demands and provide a stabilizing effect on the grid. This collaborative approach not only supports the growth of the crypto industry but also contributes to the overall resilience and efficiency of the U.S. energy infrastructure.

Supporting U.S.-Made ASICs

Trump’s emphasis on U.S.-made ASICs aligns with his “America First” economic agenda. By supporting domestic manufacturing of ASICs, Trump aims to reduce reliance on foreign-made equipment and promote job creation within the U.S. One notable example is Auradine, a U.S.-based startup that is manufacturing ASICs to support domestic Bitcoin mining equipment production.

The significance of U.S.-made ASICs extends beyond job creation. By bringing chip manufacturing back to the U.S., Trump aims to:

- Strengthen the country’s technological capabilities

- Ensure that the U.S. remains at the forefront of innovation in the crypto sector

- Support the growth of the domestic crypto industry

- Align with Trump’s broader economic policies of promoting American manufacturing and technological advancement.

Regulatory Environment Under Trump

A Trump presidency could lead to significant changes in the regulatory environment for cryptocurrencies. Trump has pledged that regulators will “get out of the way of innovation” if he is elected, appealing to the crypto industry frustrated with the current regulatory landscape.

Potential nominees for key regulatory positions, such as former chairs of the Commodity Futures Trading Commission J. Christopher Giancarlo and Heath Tarbert, indicate a shift towards a more favorable regulatory framework for crypto.

Pro Crypto Regulation

Trump’s pro-crypto stance is expected to reduce regulatory uncertainties and encourage investment in the sector. By pivoting from a crypto skeptic to a supporter, Trump aims to gain favor within the crypto community and foster a more innovation-friendly regulatory environment. His platform includes a commitment to permit Americans to transact digital assets free from government surveillance and control, ensuring the right to self-custody of digital assets.

However, Trump’s pro-crypto agenda might face opposition from lawmakers concerned about regulatory oversight and financial stability. The potential for making digital asset regulation more partisan could complicate efforts to find a balanced regulatory approach. Despite these challenges, Trump’s alignment with the crypto industry could lead to significant shifts in policy that promote innovation and growth.

Opposition to Central Bank Digital Currency (CBDC)

Trump has expressed strong opposition to the creation of a Central Bank Digital Currency (CBDC), citing concerns about government control and centralization. He argues that CBDCs could grant the government greater control over personal spending data, posing a threat to individual financial freedom. Instead, Trump prefers decentralized digital assets, which he believes better align with the principles of financial sovereignty and privacy.

This opposition to CBDCs is reflected in the official Republican Party platform, which includes a commitment to prevent the creation of a U.S. central bank digital currency. By taking a stand against CBDCs, Trump aims to protect the financial autonomy of American citizens and promote the use of decentralized digital assets like Bitcoin. This stance resonates with a significant portion of the Republican base, with 68% of those familiar with CBDCs opposing their adoption in the U.S..

Impact on Bitcoin ETFs

Trump’s pro-crypto stance could lead to a more favorable regulatory environment for Bitcoin ETFs. By appointing pro-crypto figures to key regulatory positions, such as Paul Atkins, a former SEC commissioner, Trump could influence the SEC’s approval process for Bitcoin ETFs. This shift could encourage greater institutional investment in Bitcoin and other cryptocurrencies, further integrating digital assets into the mainstream financial system.

The potential approval of more Bitcoin ETFs under a Trump administration could have significant implications for the crypto market. It could:

- Increase the accessibility of Bitcoin to a wider range of investors

- Boost market liquidity and stability

- Align with Trump’s broader economic policies of promoting innovation and ensuring that the U.S. remains at the forefront of the global financial revolution.

Economic Implications of Bitcoin Adoption

Trump’s embrace of supportive policies towards cryptocurrency could lead to its wider acceptance and integration into the mainstream financial system. This integration has the potential to bring about significant economic benefits, including increased investment, job creation, and enhanced global competitiveness for the U.S.

As we explore these economic implications, it’s essential to understand how Trump’s vision aligns with the broader goals of fostering innovation and solidifying American leadership in emerging technologies.

Boosting Investment and Innovation

Supportive policies under a Trump administration could:

- Reduce regulatory uncertainties, thereby encouraging institutional investors to allocate more funds to the crypto market

- Stimulate research and development in blockchain technologies, leading to significant technological advances

- Attract international talent to the U.S., bolstering its position as a hub for innovation

For instance, the approval of spot Bitcoin ETFs in the U.S. has already brought in roughly $60 billion in assets under management, highlighting the potential economic impact.

Furthermore, Trump’s policies could foster a more conducive environment for crypto innovators and startups, driving growth in the technology sector. By encouraging investment in emerging technologies, Trump’s administration aims to position the U.S. at the forefront of the global blockchain revolution. This approach not only supports the growth of the crypto industry but also aligns with broader economic goals of boosting innovation and maintaining global competitiveness.

Job Creation in the Crypto Sector

Trump’s pro-crypto policies could lead to significant job creation within the crypto sector. By fostering the growth of Bitcoin mining and supporting domestic manufacturing of ASICs, Trump’s administration aims to create employment opportunities in areas such as software development, cybersecurity, and financial services. The supportive stance on Bitcoin mining could also lead to the establishment of new mining facilities, further increasing job opportunities.

Industry leaders believe that more favorable regulatory policies under Trump’s administration could attract investment and promote job creation. By supporting the growth of the crypto sector, Trump’s policies could help address the increasing demand for skilled professionals in the technology sector, providing a boost to the overall economy. This focus on job creation aligns with Trump’s broader economic goals of promoting domestic manufacturing and technological advancement.

Enhancing U.S. Global Competitiveness

Leading in cryptocurrency adoption could give the U.S. a competitive edge in the global blockchain technology market. By positioning the U.S. as a leader in Bitcoin adoption, Trump’s policies could enhance America’s global economic competitiveness, especially against regulatory stances by other countries. This approach aims to ensure that the U.S. remains at the forefront of technological advancements and continues to attract top talent and investment in the crypto sector.

Trump has emphasized the need to keep all remaining Bitcoin mining in the U.S. and out of China, highlighting the importance of maintaining a competitive edge. Some key industry figures believe that enabling the private sector to compete with China’s digital yuan is essential for maintaining U.S. leadership in the global financial landscape. By fostering a favorable regulatory environment and supporting the growth of the crypto industry, Trump’s policies could help ensure that the U.S. remains a dominant player in the global economy.

Voter Perspectives on Trump’s Crypto Policies

Trump’s shift to supporting cryptocurrency has garnered attention across various voter demographics. As we explore voter perspectives on his crypto policies, it becomes clear that his pro-crypto stance has potential implications for the upcoming election. From Republican voters to independents and young voters, Trump’s crypto policies resonate with different segments of the electorate, influencing their voting decisions and shaping the political landscape.

Republican Party Support

Trump’s pro-crypto stance has resonated with a significant portion of Republican voters, particularly younger demographics. More than a quarter of Republicans polled (28%) have engaged in crypto ownership, with a skew towards younger, male, and non-white demographics.

The Republican National Committee’s new policy platform includes:

- A pledge to halt what they describe as the “unlawful and unAmerican crypto crackdown” by Democrats

- Emphasizing defending the right to mine Bitcoin

- Ensuring every American can self-custody their digital assets.

Polling data compiled by Echelon Insights showed that 60% of surveyed Republicans believe Congress should establish clear and predictable rules for crypto businesses. Trump’s campaign and affiliated political action committee accepting cryptocurrency donations further demonstrate the growing support for his crypto stance within the Republican Party. Additionally, a poll sponsored by crypto investment firm Paradigm indicated that 13% of Republicans who weren’t planning on voting for Trump viewed him more positively due to his crypto stance.

Independent and Young Voters

Trump’s recent positive remarks on aiding the U.S. crypto sector have caught the attention of some independent and young voters. A third of likely U.S. voters indicated they would consider candidates’ crypto positions when deciding whom to support. Industry polls suggest that younger demographics among Republicans are likelier to have engaged in cryptocurrency.

Despite this, fewer than one in three voters in key swing states had a positive view of crypto according to a Harris Poll.

Industry and Investor Reactions

Wealthy cryptocurrency executives have promised to support Trump’s campaign financially and with fundraisers, incentivizing him to adopt pro-crypto policies. The anticipation of Trump’s policies could influence investor confidence and market sentiment, potentially leading to increased volatility in the cryptocurrency markets.

A Trump administration’s approach to Bitcoin could affect the global competitiveness of the U.S. in the cryptocurrency market, possibly leading to a more cautious approach globally.

Challenges and Criticisms

Trump’s pro-crypto stance faces several challenges and criticisms. From environmental concerns to political and legal hurdles, these issues must be addressed to ensure a balanced and sustainable approach to cryptocurrency regulation.

As we explore these challenges, it’s essential to understand how Trump’s policies can navigate these obstacles while promoting innovation and protecting consumers.

Environmental Concerns

Bitcoin mining under Trump’s policies may face scrutiny for potentially exacerbating carbon emissions. Trump has discussed the potential comeback of fossil fuels to meet the increased energy demands of AI and data centers. However, his crypto policies might not fully address the environmental criticisms tied to Bitcoin mining, which remain a significant concern for many.

Political and Legal Hurdles

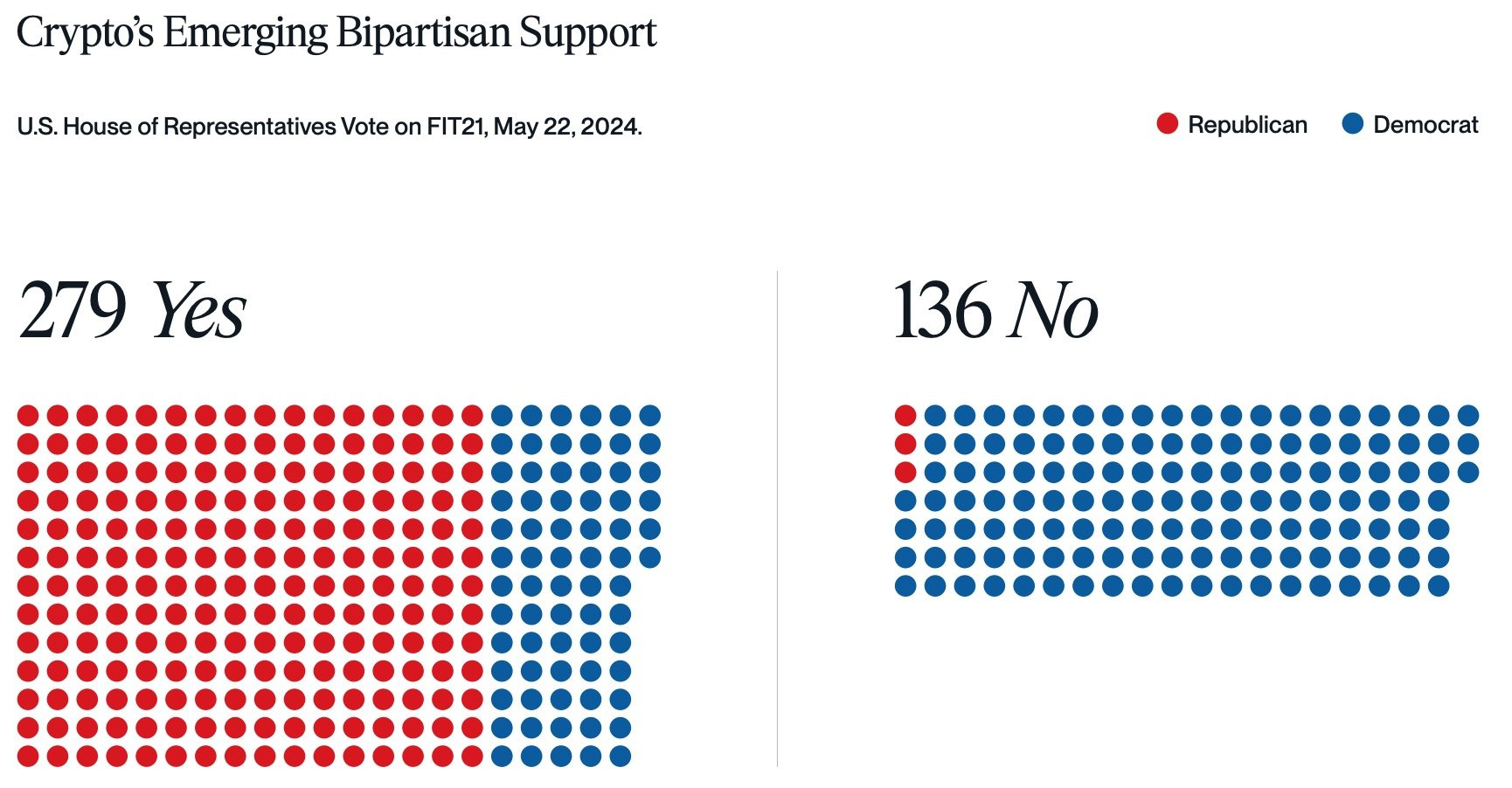

Trump’s direct support for crypto faces opposition from key Democrats like Elizabeth Warren, who warn of financial system risks. Bipartisan House legislation aimed at reversing SEC guidelines has faced potential veto threats from the Biden administration.

Increased regulatory scrutiny could impact job creation within the crypto industry by potentially slowing down the pace of innovation and market entry for new companies.

Balancing Innovation and Regulation

Maintaining a balance between innovation and regulation is challenging due to the rapidly evolving nature of the crypto sector. Ensuring that regulations do not stifle technological advancements while protecting consumers remains a key challenge in the crypto sector.

Trump’s policies could lead to stricter regulations on cryptocurrencies due to concerns about volatility, security, and illicit use.

The assassination attempt of Donald Trump

Authorities continue to probe into the recent assassination attempt on former President Donald Trump, focusing specifically on the attacker’s motives and the method he used to gain rooftop access where he fired the shot. The FBI and Secret Service are working jointly to unearth the details surrounding this disturbing event.

Key details about the attacker:

- 20-year-old dietary aide

- No clear ideological motives

- Exhibited peculiar behavior outside the campaign rally

- Registered as a Republican

- Donated $15 to a progressive political action committee on the day President Biden took office

These details complicate the understanding of his intentions.

The suspect, armed with an AR-style rifle thought to be bought by his father, was discovered motionless on the rooftop, donned in a gray t-shirt featuring a black American flag on the right arm. Despite the rooftop being previously flagged as a potential security vulnerability by the Secret Service, the attacker was still able to exploit it. As the investigation unfolds, the nation anxiously awaits, cognizant that this incident may have far-reaching consequences for Trump’s campaign and the wider political climate in the U.S.

Summary

In conclusion, Donald Trump’s pro-crypto stance represents a significant shift in U.S. economic policy that could have far-reaching implications for the cryptocurrency industry. From fostering innovation and job creation to enhancing global competitiveness, Trump’s policies aim to position the U.S. as a leader in the digital financial revolution. However, these ambitions are not without their challenges, including environmental concerns, political and legal hurdles, and the need to balance innovation with regulation.

As we move closer to the next presidential election, it is clear that Trump’s vision for cryptocurrency will play a crucial role in shaping the future of the U.S. economy. His commitment to supporting Bitcoin and other digital assets, coupled with a favorable regulatory environment, could unlock new opportunities for growth and innovation. As we look to the future, it is essential to consider how these policies will impact not only the crypto industry but also the broader economic landscape.

Frequently Asked Questions

What is Donald Trump’s stance on Bitcoin and other cryptocurrencies?

Donald Trump supports cryptocurrencies and believes in their potential for the US economy. He aims to protect the rights of crypto holders and promote American innovation in the crypto space.

How does Trump plan to support Bitcoin mining in the U.S.?

Trump plans to support Bitcoin mining in the U.S. by aiming to have all future Bitcoin minted in the country and encouraging domestic mining operations, in order to reduce reliance on foreign entities. This initiative is also seen as a defense strategy against Central Bank Digital Currencies (CBDCs).

What are the criticisms of Biden’s administration regarding cryptocurrency regulation?

Critics, including Trump, argue that Biden’s administration’s excessive regulations on crypto companies hinder sector growth. Specific concerns include SEC enforcement actions and the proposed 30% excise tax on Bitcoin miners.

How could Trump’s policies impact Bitcoin ETFs?

Trump’s pro-crypto stance could lead to a more favorable regulatory environment for Bitcoin ETFs, possibly encouraging greater institutional investment in cryptocurrencies.

What are the potential challenges and criticisms of Trump’s pro-crypto stance?

Trump’s pro-crypto stance faces challenges such as environmental concerns, political and legal hurdles, and the need to balance innovation with regulation. Critics argue that his policies might exacerbate carbon emissions, face opposition from lawmakers, and add a partisan aspect to the crypto regulation debate.