2024’s Premier Blockchain Venture Capital Companies: The Ultimate Guide

Looking for the leaders in blockchain venture capital companies investment? This guide introduces you to top VC firms specializing in blockchain, highlighting their unique strategies, extensive portfolios, and the integral role they play in advancing the industry. Explore our curated list of pivotal blockchain venture capital companies that are not just betting on companies but on the transformative potential of blockchain technology itself.

Key Takeaways

- Blockchain venture capital firms specialize in supporting blockchain startups, offering financial backing, strategic partnership, and a robust network to help navigate industry-specific challenges like complex regulations and market fluctuations.

- Crypto venture capital is experiencing a surge in interest, with increased global early-stage investments, a growing focus on generative AI technologies in the face of declining metaverse investments, and a strong inclination towards early-stage and growth stage funding strategies in various sectors.

- Blockchain VCs play an essential role in the advancement of blockchain technology, offering startups critical financial support, resources for innovation, and long-term growth and business expansion while facilitating networking, talent acquisition, and strategic industry partnerships.

Navigating the Landscape of Blockchain Venture Capital Firms

Venture capital firms play a pivotal role in the blockchain ecosystem, acting not just as financial backers but as strategic partners to startups navigating the unique challenges of this rapidly evolving industry. Blockchain venture capital firms specialize in meeting the specific needs of blockchain startups, setting them apart from their traditional counterparts that have broader technology interests.

These firms bring a rich array of specialized knowledge and a robust network to the table, instrumental for blockchain startups facing industry-specific challenges like navigating complex regulations, evolving technology, and market fluctuations. They often prioritize swift investment decisions and focus on potential technological breakthroughs over conservative risk assessment, differentiating themselves from traditional venture capital models.

Given the volatile and nascent nature of the cryptocurrency and blockchain industries, these firms demonstrate a higher risk tolerance than typical venture capital firms. They are not just investing in companies; they’re betting on a technological revolution, placing their stakes in the future of crypto and blockchain.

Understanding Blockchain VC Investment Strategies

When it comes to investment strategies, blockchain venture capital firms exhibit a strong inclination towards early-stage investments. Their portfolios span a diverse range of sectors, including:

- tech startups

- European tech companies

- consumer and enterprise-focused ventures

- blockchain and digital asset sectors.

These early-stage investments typically include pre-seed, seed, and at times, series A stages, targeting early stage companies and early stage startups that demonstrate strong potential in marketplaces, applied AI, Web3, and transformative digital and physical commerce. In addition, several VC firms also focus on geographical specificity, showcasing European startups and marketplaces in their portfolios of early-stage investments.

As startups evolve, some venture capital firms begin shifting their focus towards growth stage funding, which can include later seed rounds and series A investments, fostering continued development and scaling of promising companies. Strategically, certain venture capital firm focused on supporting tokenized projects in the crypto and blockchain space, reflecting a targeted approach towards sectors anticipated to have significant growth, as opposed to traditional venture capital investments.

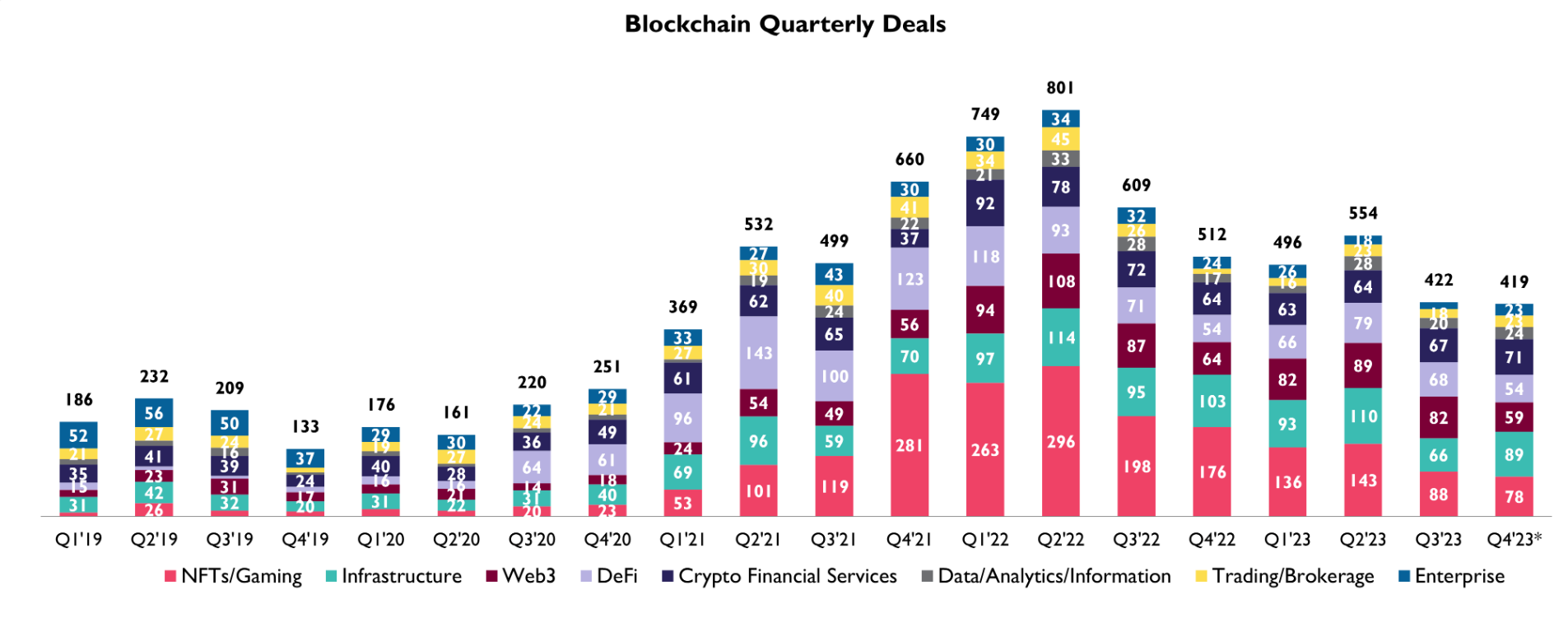

The Surge in Crypto Venture Capital Market

Venture capital firms are increasingly drawn to the crypto industry, likening it to a contemporary gold rush with numerous companies poised to capitalize. In 2022, European venture capital investment in crypto startups soared to an unprecedented $5.7 billion, representing a significant portion of the global early-stage funding for crypto startups.

Asia’s most active blockchain and crypto investors are based in China and Hong Kong, channeling significant funds into markets like the United States, Singapore, and India. Despite experiencing a decrease with metaverse company investments dropping notably in 2023, the ongoing strategic deals signal a persistent belief in the sector’s long-term potential.

The previous hype surrounding metaverse investments has declined as venture capital interest is now veering towards the burgeoning field of generative AI technologies. This indicates a shift in focus, yet the surge in the crypto venture capital market remains a testament to the sector’s vibrancy and potential.

Spotlight on Top Blockchain Venture Capital Firms

Venture capital firms are the linchpins of the blockchain ecosystem, guiding startups from inception to success. A notable crypto venture capital firm, Digital Currency Group (DCG), boasts a broad portfolio that includes initiatives across different sectors in the crypto ecosystem. Another key player, Andreessen Horowitz (a16z), supports a diverse array of technology companies and is committed to respecting the entrepreneurial process.

Coinbase Ventures, on the other hand, focuses on early-stage blockchain companies, offering funds and strategic guidance to pioneer the advancement of blockchain technologies. Meanwhile, KuCoin Ventures is known for its dedication to innovative crypto and blockchain projects, emphasizing a community-friendly and research-driven approach.

From Protocol Ventures, recognized for its successful investments in high-profile startups such as Coinbase and Circle, to Polychain Capital, known for delivering excellent investor returns through strategic blockchain project funding, these firms are pivotal in shaping the future of the crypto industry.

Pantera Capital: Pioneering Crypto VC Firm

Pantera Capital stands out as a pioneering venture capital firm in the blockchain arena, with a dedication to the decentralized ethos reflected in a robust investment portfolio that spans decentralized finance (DeFi), blockchain infrastructure, and digital assets.

An early advocate for Bitcoin, Pantera Capital’s recognition of the cryptocurrency’s potential set them apart from their peers, defining their role as industry leaders with a comprehensive understanding and expertise in the crypto landscape. Their portfolio highlights a strong emphasis on innovative and burgeoning sectors, including:

- DeFi projects like 1inch

- The NFT marketplace of OpenSea

- Infrastructure endeavors including Ripple and Circle

- Multi-chain networks such as Polkadot

With an impressive track record of over 210 investments, Pantera Capital firmly positions itself as a leading and pioneering venture capital firm within the blockchain arena. Their diverse investment portfolio and strategic approach earmark them as key players in shaping the future of the crypto industry.

Union Square Ventures: Investing in Decentralized Finance

Union Square Ventures, based in greater New York, leverages the internet’s power by investing in technology companies with a focus on decentralized finance. They have raised $2.5 million across 13 funds and their DeFi investment portfolio includes:

- Algorand, a platform enhancing scalability and security

- Numerai, a hedge fund driven by a data science competition

- Protocol Labs, known for Filecoin and its decentralized storage network

- WalletConnect, which facilitates connections between decentralized apps and mobile wallets.

Beyond DeFi, Union Square Ventures also invests in ventures like Blackbird, Primitives, and Slutty Vegan, demonstrating a broad investment strategy that complements its focus on decentralized technologies. Their diverse portfolio and strategic investment approach play a significant role in advancing the DeFi sector and shaping the future of the blockchain industry.

The Role of VC Firms in Advancing Blockchain Technology

Venture capital firms play a critical role in the advancement of blockchain technology. They provide crucial financial support and resources that allow blockchain startups to focus on innovation, research, and product development without the immediate worry of funding. VC investments cover significant costs associated with:

- Research

- Development

- Marketing

- Infrastructure

These costs are essential for turning blockchain project ideas into reality. By conducting thorough project evaluations to determine the growth potential of blockchain projects, these firms explore new concepts and technological advancements within the ecosystem.

The involvement of venture capital firms can lend credibility to blockchain startups, attracting additional attention and investments from other parties and retail investors. VC firms offer:

- Capital

- Industry connections

- Business acumen

- Technical expertise

These resources can greatly accelerate a blockchain project’s growth and success.

From Seed Funding to Growth Stage Support

Seed funding is a pivotal moment for blockchain startups, allowing them to test their products in the market and refine their business models. Crypto venture capital firms play a crucial role in early funding rounds, providing startups with capital to hire key personnel, develop marketing strategies, and enhance their products.

Blockchain startups progress through various funding stages tailored to their growth and capital needs. These stages include:

- Pre-seed

- Seed

- Series A

- Series B

- Series C

During the Series B round, companies concentrate on scalability by building robust teams and investing in business development. The Series C funding stage is often aimed at preparing for IPOs and international expansion.

The interplay between venture capitalists’ financial support and strategic guidance with the founding team’s independence is key to the enduring success of blockchain startups. This synergy propels startups from their early stages to becoming established players in the blockchain industry.

Partnering for Business Development and Network Expansion

In the blockchain ecosystem, VC firms are more than just financial backers. They are actively involved in the governance and community engagement of decentralized projects, providing not only funds but also:

- technical and strategic support

- mentorship and advisory services to navigate challenges and opportunities

- establishing a global network of investors and stakeholders through events and conferences, aiming to forge connections with promising startups

VC firms contribute to guiding blockchain companies through their growth stages.

Through their networks, VC firms help blockchain startups in the following ways:

- Forming key industry partnerships, leading to potential collaborations for mutual business development

- Enhancing a startup’s capabilities by facilitating introductions to broader networks of tech talent, potential clients, and other investors

- Providing marketing support and insights through advisory boards

By facilitating these connections and offering comprehensive support, VC firms play a pivotal role in the expansion and success of blockchain startups.

Specialized Investment Firms in the Crypto Sphere

In the diverse landscape of the crypto industry, certain investment firms stand out with their specialized focus and targeted investment strategies. Crypto and blockchain VC firms are overcoming challenges like accredited investor requirements and accessing elite deals by using services such as Token Metrics Ventures for curated deal flow and networking.

These specialized VC firms conduct thorough research and utilize analytical platforms like Token Metrics to identify high-potential investments in the dynamic crypto market. Some firms, such as Protocol Ventures, specialize by investing exclusively in crypto assets and blockchain-based projects, signaling a focused investment strategy within the broader crypto VC landscape.

Other firms in the crypto VC space include:

- Multicoin Capital, which offers distinct venture fund and hedge fund services

- Blockrocket, which targets investments specifically in blockchain companies

- Chaac Ventures, which invests solely in tech founders who are alumni of Princeton University

These firms demonstrate the range of specialized approaches within the crypto VC sphere.

Electric Capital: Developer-Centric Crypto VC Fund

Electric Capital stands out with its unique emphasis on developer-driven projects. It is hyper-focused on various aspects of the digital cryptocurrency industry, marking a clear distinction in the landscape of crypto VC firms.

Portfolio companies like Lasso Labs, Sweatcoin, and Immunefi exemplify Electric Capital’s commitment to supporting developer-centric companies in the crypto space. With investments in over a hundred different companies, Electric Capital has expanded its influence in the tech startup arena.

Their unique focus on developer-driven projects not only sets them apart but also underscores the critical role of developers in the evolution of the crypto industry. By supporting projects that are led by developers, Electric Capital is fostering innovation and helping shape the future of the crypto industry.

Multicoin Capital: Betting on the Future of Crypto

Multicoin Capital, operating out of Austin, Texas, offers a broad investment approach that spans various blockchain companies and types of digital currency. The firm provides both venture and hedge fund options, focusing on seed funding for decentralized institutions, and is recognized for its long-term, high-conviction investment philosophy through their investment fund.

Multicoin Capital’s notable investments include:

- Pyth Network

- Squads Labs

- CoinList

- Greenwood

- Bolt

These investments showcase their diverse and influential portfolio within the crypto space. Their investment approach reflects a confident bet on the future of crypto, demonstrating their commitment to fostering the growth and evolution of the crypto industry.

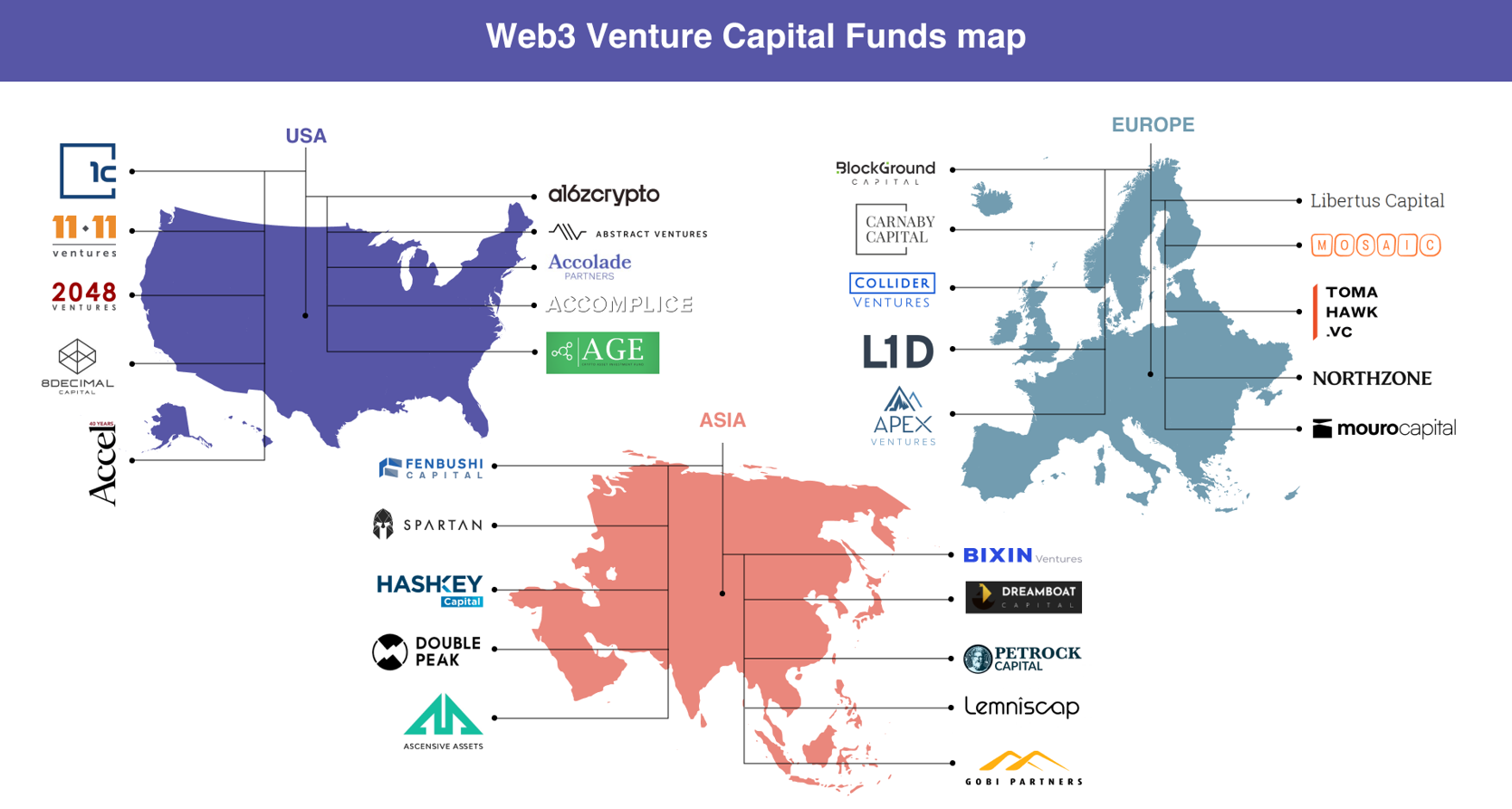

Spotlight on Regional Blockchain VC Hotspots

Blockchain venture capital has a significant global presence, with major firms like:

- Digital Currency Group investing in over 100 projects across more than 30 countries

- Coinbase Ventures

- Binance Labs

- KuCoin Ventures

These firms have been pivotal in the development of renowned cryptocurrency platforms worldwide.

The San Francisco Bay Area, represented by VC firms such as AU21 Capital, is a prominent hotspot for blockchain venture capital in the US, with San Francisco California being a key location. Meanwhile, Singapore has emerged as a key player in the blockchain venture capital ecosystem, with firms like SGInnovate based in the region.

In Australia, Carthona Capital specializes in early-stage blockchain startups, investing from the pre-seed phase to series A rounds. This global presence of blockchain VC firms highlights the international scope and influence of the blockchain venture capital ecosystem.

Asia’s Growing Influence in Blockchain VC

Asia is emerging as a significant player in the blockchain venture capital landscape, with key cities like Hong Kong, China, Singapore, and India becoming significant blockchain venture capital hubs. Prominent investment firms in these regions include:

- Animoca Brands located in Hong Kong

- Fenbushi Capital headquartered in China

- 100X VC in India

- X21 Digital in Singapore

- Axia8 Ventures known for its blockchain sector investments.

Between January 2021 and June 2022, the top 20 venture capital firms in Asia participated in a total of 495 blockchain and crypto-related investments globally, signifying their financial influence in this technology sector. Some notable venture capital firms in Asia include:

- Fenbushi Capital, the first blockchain-centric VC fund in Asia, which supports blockchain projects across four different continents

- Sequoia Capital China, which has invested in numerous blockchain and crypto startups in Asia

- IDG Capital, which has a strong focus on blockchain and has invested in leading projects in the industry

These venture capital firms play a crucial role in funding and supporting the growth of blockchain and crypto projects in Asia and beyond, as a venture capital firm based in this region.

Asia’s growing influence in the blockchain venture capital landscape reflects the region’s commitment to advancing blockchain technology and the burgeoning crypto industry.

Diverse Portfolios: How VCs Invest Across Sectors

Blockchain VCs diversify their portfolios by investing across various sectors within the technology space, including but not limited to cleantech markets and the metaverse. Examples of such diversified investments include Union Square Ventures’ seed investment in Revel, a blockchain-based urban transportation platform, and the active funding of DeFi projects and NFT markets.

Europe has seen substantial investment in blockchain infrastructure, with a particular focus on Layer1s and developer tools, totaling $1.8 billion. This highlights VC firms’ commitment to building a robust blockchain ecosystem. In comparison to traditional VCs, blockchain venture capitalists engage with token economics and may incorporate project tokens or cryptocurrencies into their investment strategies.

VC Firms Supporting Cleantech Markets

VC firms that are focused on cleantech markets include:

- Energy Foundry

- Clean Energy Trust

- 1955 Capital

- Breakthrough Energy Ventures (invests exclusively in clean energy technology)

- ArcTern Ventures (invests in sustainability)

- Blue Bear Capital

- Congruent Ventures

These firms are deeply invested in various cleantech initiatives and energy sectors.

Firms such as Chrysalix Energy Venture Capital and Lightspeed Venture Partners support a broader range of investments, including:

- Industrial innovation

- Intelligent systems

- Energy technology

- Cleantech markets

These segments are core areas of their portfolios.

The encompassing involvement of these VC firms signifies a robust venture capital-driven ecosystem that not only empowers blockchain technologies but also propels advancements in the cleantech sector.

Venture Capital’s Bet on the Metaverse

Major technology players at the forefront of metaverse development and attracting significant venture capital interest include:

- Epic Games

- Apple

- Meta

- Nvidia

Gaming is the most active and invested in sector within the metaverse, showcasing where lots of VC focus currently lies.

Venture capital investments in the metaverse sector are playing a key role in enhancing VR and AR technology, as well as the evolution of online social spaces in virtual environments. While the funding for metaverse companies diminished by 87% to roughly $530 million in 2023, the US and Canada maintained over 50% share of the total funding value in the sector.

The McKinsey 2022 report projects that investments in the metaverse could grow to $5 trillion by 2030, despite recent decreases in deal-making activities. Outlier Ventures aims to accelerate an ‘open Metaverse’ with a focus on investments that support a decentralized and interoperable virtual world.

The Impact of Blockchain VC on the Startup Ecosystem

Blockchain venture capital firms are key in promoting innovation, fueling a wide range of industries such as blockchain platforms and decentralized finance products. These firms support the growth and development of startups by providing financial resources, strategic guidance, and access to critical industry connections.

Blockchain venture capital involvement increases the chances of success for startups, aiding them in scaling challenges and establishing leadership within the industry. By providing such comprehensive support, blockchain VC firms play a crucial role in shaping the startup ecosystem and advancing blockchain technology.

Fueling Innovation in Early Stages

Crypto venture capital firms nurture early-stage blockchain projects by supplying them with essential capital, guidance, and resources that pave the way for their success. Some examples of venture capital firms that support blockchain projects at their early stages include:

- Caffeinated Capital

- Andreessen Horowitz

- Pantera Capital

- Blockchain Capital

These firms provide funding and expertise to help these projects grow and thrive in the competitive blockchain industry.

Programs and capital provided by R/GA Ventures illustrate the blend of financial and programmatic support that nurtures early-stage startup growth and innovation. Blockchain VC investments often begin at the pre-seed stage, recognizing the transformative potential that early-stage projects can have within the crypto realm.

Long-Term Growth and Scalability

In later stages of funding, blockchain VC firms play a critical role in the long-term growth of startups by assisting them in expanding their teams, enhancing their products, and increasing customer acquisition efforts. Series C funding, typically infused by blockchain VCs, is essential for startups to cement their market presence, scale operations, and open up new growth pathways.

Blockchain VC firms’ strategic investments are designed to equip startups for major scaling, tapping into new markets, or preparing for potential exits like IPOs or being acquired, showcasing their commitment to the startups’ long-term viability. By offering such extensive support, these firms play a critical role in promoting the long-term growth and scalability of blockchain startups.

Summary

The transformative power of blockchain technology is being harnessed and propelled by venture capital firms. These firms are not just financial backers but strategic partners, providing essential capital, guidance, and resources to blockchain startups. They are instrumental in shaping the crypto industry, promoting innovation, fueling diverse sectors, and nurturing startups from their early stages to long-term growth and scalability.

Frequently Asked Questions

What sets blockchain venture capital firms apart from traditional VC firms?

Blockchain venture capital firms set themselves apart from traditional VC firms by specializing in meeting the specific needs of blockchain startups and having a higher risk tolerance due to the volatile nature of the crypto industry.

How do blockchain VC firms support startups in the early stages?

Blockchain VC firms support early-stage startups by providing them with crucial capital, guidance, and resources, recognizing the transformative potential of these projects within the crypto realm. This support often begins at the pre-seed stage.

How are blockchain VC firms contributing to the long-term growth and scalability of startups?

Blockchain VC firms contribute to the long-term growth and scalability of startups by providing strategic investments that help startups expand their teams, enhance products, and increase customer acquisition efforts, ultimately preparing them for potential exits or major scaling.

What is the role of VC firms in the development of the metaverse?

VC firms play a crucial role in enhancing VR and AR technology and the development of online social spaces in virtual environments, contributing significantly to the advancement of the metaverse.

How do blockchain VC firms diversify their portfolios?

Blockchain VC firms diversify their portfolios by investing across various sectors within the technology space, including cleantech markets and the metaverse. They also incorporate project tokens or cryptocurrencies into their investment strategies to achieve diversification.