Why Chainlink LINK Might Be the Most Undervalued Coin in Crypto and Ready to Explode

Why might Chainlink (LINK) be the most undervalued coin in crypto? Its unique role in linking traditional finance to blockchain, deflationary tokenomics, strong technical indicators, and real-world utility suggest significant growth potential. This article will break down these factors to explain why Chainlink LINK might be the most undervalued coin in crypto and how it stands out.

Key Takeaways

- Chainlink is crucial for institutional adoption of blockchain, bridging traditional finance and decentralized finance through secure data delivery and cross-chain interoperability.

- The tokenomics of Chainlink, featuring a deflationary mechanism, enhances its value by reducing circulating supply while increasing demand through enterprise usage.

- Recent technical indicators suggest a bullish trend for LINK, with key price support levels indicating potential for significant future price appreciation.

Chainlink’s Unique Role in Institutional Adoption

Chainlink is increasingly being recognized as a linchpin in bridging the gap between traditional finance and blockchain technology. Its integration with major financial institutions underscores its pivotal role in this transition. For instance, Chainlink’s secure and reliable delivery of off-chain data is essential for the functionality of many decentralized finance (DeFi) protocols, making it a cornerstone of the blockchain ecosystem. This capability is not just theoretical; recent pilots in Europe and Asia have shown that institutions are leveraging Chainlink for secure cross-chain fund settlements, highlighting its practical utility.

The Cross-Chain Interoperability Protocol (CCIP) is a significant leap forward for Chainlink, positioning it as a standard for linking various blockchain ecosystems. This protocol facilitates seamless cross-chain communication, allowing for more efficient and secure transactions across different blockchain networks. Enhancements in Chainlink’s architecture have also led to reduced transaction costs, potentially boosting its profitability and scalability, making it an even more attractive choice for institutional adoption. Additionally, cross chain messaging plays a crucial role in enhancing these capabilities.

Strategic partnerships with financial giants like S&P Global and Mastercard further bolster Chainlink’s credibility and integration within traditional financial systems. Aiming to enhance blockchain technology integration within existing financial infrastructures, these partnerships are more institutions than just for show, marking the next phase of development.

With a projected compound annual growth rate (CAGR) of 67% in revenue, Chainlink is poised for significant market growth, driven by the increasing demand for decentralized oracle solutions.

Tokenomics: The Deflationary Mechanism Driving LINK’s Value

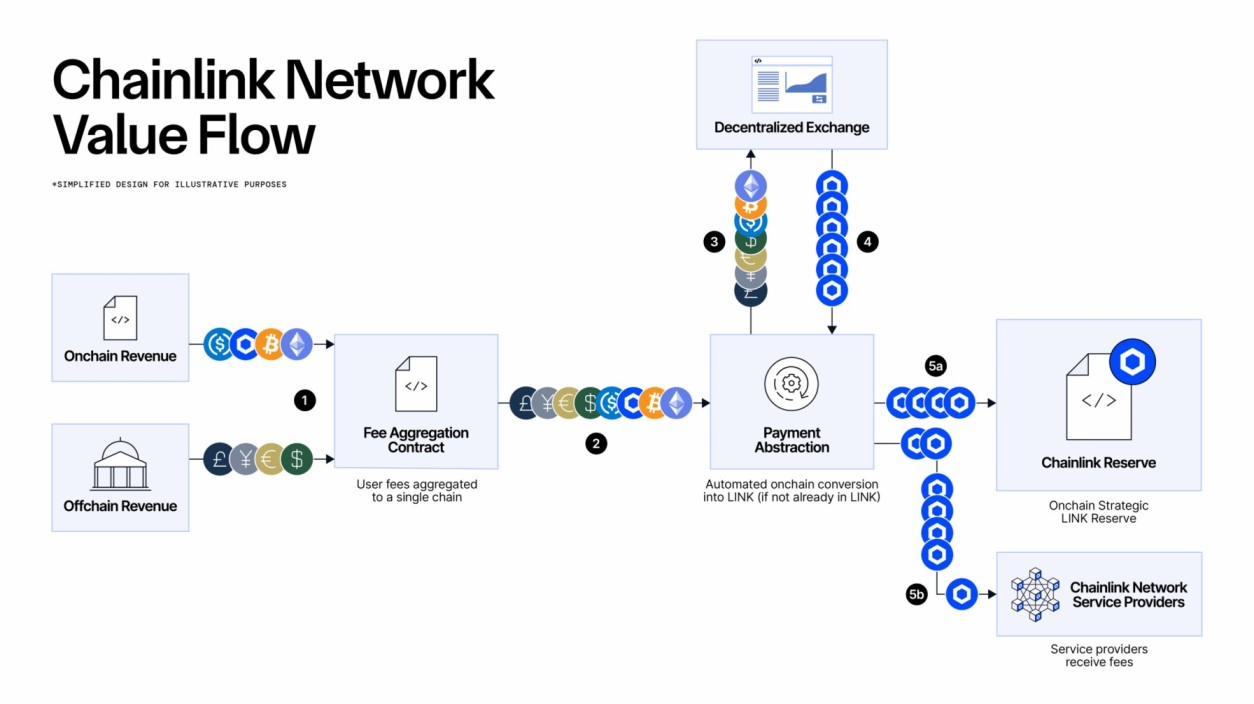

Chainlink’s tokenomics are designed to align the token’s value with its real-world demand, creating a self-sustaining ecosystem that benefits both retail and institutional investors. One of the key components of this model is the Payment Abstraction system, which creates a deflationary flywheel effect. This system enhances the overall tokenomics model by reducing the circulating supply of LINK, thereby putting upward pressure on its price.

Staking is another critical element that contributes to the deflationary mechanism. Locking up LINK tokens for staking reduces the circulating supply, helping to stabilize and potentially increase the token price. This mechanism is particularly appealing for long-term investors, as it provides a form of passive income while also contributing to the token’s overall value appreciation.

Beyond reducing supply, Chainlink’s tokenomics also concentrate on increasing demand. Enterprises convert their revenue into LINK tokens via decentralized exchanges, creating a direct link between the token’s market value and its utility. This alignment of token value with real-world demand indicates a growing need for Chainlink’s services, making it a compelling investment opportunity.

Technical Momentum Signaling Bullish Trends

In the world of cryptocurrencies, technical indicators can often provide valuable insights into future price movements. For Chainlink, the current technical momentum suggests a bullish trend despite a recent price drop. Over the past month, Chainlink’s price has decreased by over 10%, which some analysts interpret as a potential buying opportunity. This dip could be a strategic entry point for investors looking to accumulate LINK at a discounted rate.

The market cap of Chainlink remains robust, and the token is considered significantly undervalued given its solid fundamentals and accelerating momentum. The recent price action indicates that LINK is establishing a solid base above $14.5, suggesting continued bullish momentum if it can maintain this support level. Furthermore, a breakout above $16.90 could signal a stronger upward trend, with $20 as the next significant resistance level.

Recent fundamental catalysts, such as increased institutional adoption and strategic partnerships, add to the positive outlook for LINK. These factors, combined with rising trading volumes, indicate growing investor confidence in Chainlink’s short-term link price performance. As the cryptocurrency market evolves, accumulating link appears well-positioned to capitalize on the next wave of growth, and the link remains supported by crypto headlines that bolster this trend.

Real World Utility: Beyond Speculative Asset

Chainlink has evolved far beyond being just a speculative asset to become a fundamental infrastructure layer for on-chain finance. One of its most significant contributions is facilitating asset tokenization of over $322 billion in real-world assets, including tokenized assets. This capability allows traditional financial assets to be represented on the blockchain, unlocking new levels of efficiency and transparency. Supporting the automation of complex financial agreements through smart contracts, Chainlink is revolutionizing how tokenizing real world assets are conducted.

The company’s early entry into the decentralized oracle space has established a broad user base, making it a leading choice for DeFi applications. Its partnership with Swift to improve tokenized fund workflows further emphasizes its role in the evolution of digital asset management. These partnerships and real-world applications demonstrate Chainlink’s real utility, distinguishing it from many other cryptocurrencies that remain purely speculative assets.

Chainlink’s real-world usage and partnerships with financial giants present a compelling case for its long-term value to savvy investors. As more traditional financial institutions adopt blockchain technology, the demand for reliable oracle solutions like Chainlink reserve will only increase, solidifying its position as a critical infrastructure player in the digital finance landscape, leveraging real world data to address real world problems.

Chainlink’s First Mover Advantage

Chainlink’s pioneering role in the decentralized oracle network space has given it a significant first-mover advantage. By being the first to market, Chainlink has been able to establish itself as the standard solution for Web3, setting the benchmark for other oracle networks. This early dominance has created network effects that make it costly and challenging for new competitors to attract users away from Chainlink’s well-established platform.

The network value generated by Chainlink’s initial dominance is evident in its market capitalization, which significantly outpaces its competitors. This first-mover advantage extends beyond just market share; it also includes a vast array of partnerships and integrations across the blockchain ecosystem. Such collaborations reinforce Chainlink’s status as the go-to solution for decentralized oracle services.

Maintaining and expanding its lead defines Chainlink’s first-mover advantage, beyond just being first. The company’s continuous innovations and strategic partnerships ensure that it remains at the forefront of the oracle network market, providing unparalleled value to its users and investors alike.

Cross Chain Interoperability and Messaging

Cross-chain interoperability is a crucial aspect of the blockchain ecosystem, and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is at the forefront of this innovation. CCIP supports the secure transfer of data and assets across more than 60 different blockchains, enabling seamless integration between traditional finance and decentralized finance. This capability allows for more efficient and secure cross-chain transactions, which are essential for the growth of the crypto ecosystem.

Chainlink’s infrastructure is designed to secure these cross-chain transactions, employing decentralized oracle networks to ensure transaction integrity and mitigate risks. The collaboration with the Intercontinental Exchange (ICE) allows Chainlink to utilize its Consolidated Feed data and price feeds to provide reliable market rates, which is crucial for the emerging tokenized asset market. This integration is a significant move towards creating a globally accessible on-chain financial system, potentially impacting hundreds of trillions in assets.

Enabling developers to create cross-chain tokens that maintain ownership and control, Chainlink facilitates seamless asset utilization across different blockchain networks. This cross-chain interoperability and messaging capability make Chainlink a foundational piece of the blockchain infrastructure, driving the adoption of decentralized finance solutions.

Chainlink Labs and Partnerships

Chainlink Labs has been instrumental in forging strategic alliances that bolster Chainlink’s credibility and enhance its long-term value. Partnerships with major financial institutions like the New York Stock Exchange (NYSE) and the Intercontinental Exchange (ICE) significantly bolster Chainlink’s market presence. These collaborations, including the ice partnership, are not just for show; they are designed to enhance the integration of blockchain technology within traditional financial infrastructures.

The partnership with SWIFT, for instance, could significantly enhance Chainlink’s operational capabilities and market reach. Such collaborations highlight Chainlink’s first-mover advantage, as it secures vital partnerships with various high-profile blockchain projects and platforms. These alliances strengthen Chainlink’s position as a critical infrastructure player in the blockchain ecosystem.

Supporting early-stage projects and fostering innovation, Chainlink Labs continues to drive network growth. This proactive approach ensures that Chainlink remains at the cutting edge of blockchain technology, continually expanding its ecosystem and enhancing its value proposition for investors through their own research.

Investment Thesis: A Strategic Bet on Blockchain Infrastructure

Investing in Chainlink is essentially a strategic bet on the future of blockchain infrastructure. Chainlink provides reliable oracle services and cross-chain interoperability, establishing itself as a critical player in the blockchain ecosystem. The tokenomics model of Chainlink creates a self-reinforcing cycle where the demand for LINK increases as more enterprises adopt its services. This alignment of the token’s value with the actual utility of the network enhances its appeal for investors.

Analysts often look for robust developer activity, growing ecosystems, and rising transaction volumes as indicators of undervalued coins. The MVRV ratio for Chainlink—a metric used to assess whether an asset is undervalued or overvalued—indicates that LINK may be positioned as an undervalued asset. Real-world use cases and healthy networks characterize undervalued altcoins, making Chainlink a compelling candidate for investment.

Investors seeking to diversify their portfolios with digital assets will find Chainlink offers a unique combination of real-world utility, robust infrastructure, and strong market positioning in the crypto market. Its potential for significant price appreciation makes it an attractive option in the cryptocurrency market and digital currency.

Automated Compliance Engine: Enhancing Trust and Security

One of Chainlink’s standout features is its Automated Compliance Engine (ACE), which enhances trust and security by ensuring regulatory compliance across various jurisdictions. Key functionalities of the ACE include:

- Allowing institutions to implement compliance policies directly into smart contracts, facilitating seamless regulatory adherence.

- Alerting institutions of any compliance breaches or anomalies in real-time.

- Aiding in proactive risk management.

Chainlink collaborates with the Apex Group to support institutional-grade stablecoin infrastructure, showcasing its commitment to regulatory compliance. The ACE also supports reusable digital identities for improved Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. These features make Chainlink a reliable and secure choice for institutions looking to navigate the complex regulatory landscape of the digital finance world, including the depository trust framework.

Integrating with existing identity standards, Chainlink’s ACE facilitates efficient identity management across multiple blockchains. This capability is crucial for compliance-focused tokenized funds, enabling secure delivery versus payment transactions. Overall, Chainlink’s ACE significantly enhances the trust and security of its network, making it a preferred choice for institutional investors.

Recent Analysis and Price Prediction

Recent analysis of Chainlink’s price action suggests the following key points:

- LINK is on the verge of breaking a critical price point, with a target near $20 if it can maintain support around $16.

- LINK is establishing a solid base above $14.5, indicating continued bullish momentum.

- A breakout above $16.90 could signal a stronger upward trend.

- $20 is the next significant resistance level.

Current trading volumes are rising, indicating increased investor confidence in LINK’s short-term price performance. By 2028, analysts forecast Chainlink’s current prices could range from a low of $70.68 to a high of $86.67. In 2031, the average expected price for Chainlink is projected to be approximately $212.51. A maximum price of $763.68 for Chainlink is anticipated in the year 2034.

Experts predict that Chainlink price prediction could experience a minimum price of around $10.63 in 2026. These projections highlight the long-term growth potential of Chainlink, reinforcing its status as a compelling investment opportunity in the cryptocurrency market.

Summary

In summary, Chainlink’s unique role in institutional adoption, robust deflationary tokenomics, technical momentum, and real-world utility make it a standout in the cryptocurrency market. Its pioneering status and first-mover advantage in the decentralized oracle network space further enhance its appeal. Strategic partnerships and innovative solutions like the Cross-Chain Interoperability Protocol and Automated Compliance Engine solidify its position as a critical infrastructure player.

With bullish price predictions and a growing ecosystem, Chainlink is poised for significant growth. Investors looking for undervalued assets with strong fundamentals and real-world applications should consider accumulating LINK. As blockchain technology continues to disrupt traditional finance, Chainlink is well-positioned to lead the charge.

Frequently Asked Questions

What’s better, XRP or Chainlink?

Ultimately, the choice between XRP and Chainlink depends on your investment goals; XRP boasts a higher market ranking, while Chainlink has shown greater price growth recently. Consider these factors when making your decision.

What is the most undervalued Cryptocurrency?

Chainlink (LINK) is often considered one of the most undervalued cryptocurrencies, trading around $17.68 and significantly below its all-time high. Its leadership in the oracle network infrastructure positions it for potential future growth.

What role does Chainlink play in institutional adoption of blockchain technology?** **?

Chainlink plays a pivotal role in the institutional adoption of blockchain technology by providing the necessary infrastructure to connect traditional finance with decentralized platforms through secure off-chain data. Its collaborations with prominent financial institutions highlight its significance in facilitating the integration of blockchain within mainstream finance.

How does Chainlink’s deflationary mechanism impact the token’s value?** **?

Chainlink’s deflationary mechanism, through the reduction of circulating supply, exerts upward pressure on the LINK token’s price, enhancing its potential value. By tying the token’s worth to real-world demand, it fortifies stability in its market dynamics.

What are the recent technical indicators suggesting about Chainlink’s price movement?** **?

Recent technical indicators for Chainlink suggest a bullish trend, with a solid base above $14.5 and potential for a breakout above $16.90 leading toward the next resistance level at $20. Increased trading volumes further reflect growing investor confidence.