Bitcoin vs Traditional Markets: Where Institutions See Value

Key Takeaways

- Since 2020, institutional investors have steadily increased bitcoin exposure alongside equities, bonds, and real assets, especially after U.S. spot BTC ETF approvals in January 2024

- Bitcoin is now treated as a high-volatility risk asset with diversification benefits, not a pure safe haven, with correlations to global equities rising during shocks like COVID-19 and then fading again by 2024–2025

- Institutions see structural value in bitcoin’s fixed supply, censorship-resistant settlement, and 24/7 liquidity, while still relying on traditional markets for income, regulation, and deep credit/real-economy exposure

- BTC’s role in portfolios is typically small (1–5% for most institutions, higher for hedge funds) but can materially change risk/return profiles when combined with stocks and bonds

- Different access routes (spot ETFs, CME futures, ETPs, tokenized products) allow institutions to integrate bitcoin within existing governance, risk, and compliance frameworks

Bitcoin vs Traditional Markets: Why This Comparison Matters Now

After the 2020–2021 bull market, 2022 drawdown, and 2024 all-time highs, institutional investors must now systematically compare bitcoin’s role to that of equities, bonds, commodities, and currencies in their portfolios. This comparison has moved from theoretical to practical necessity.

Several concrete milestones mark this evolution. MicroStrategy’s first treasury allocation in August 2020 demonstrated corporate adoption. Tesla’s purchase in early 2021 brought mainstream attention. The SEC’s approval of multiple spot bitcoin ETFs in January 2024 provided regulated access that traditional finance could embrace.

The contrast between bitcoin’s programmatic monetary policy and central bank-driven traditional markets became stark during recent cycles. While the Federal Reserve implemented aggressive rate hikes in 2022–2023, bitcoin operated on its predictable, algorithmic schedule independent of policy decisions.

Key developments driving institutional comparison:

- 24/7 global trading vs traditional market hours

- Fixed supply cap vs central bank flexibility

- Decentralized settlement vs intermediated systems

- Regulatory clarity improving across major jurisdictions

This analysis focuses on where institutions see incremental value in bitcoin compared with traditional markets, not wholesale replacement of existing allocations.

How Institutions Currently Allocate: Bitcoin vs Traditional Assets

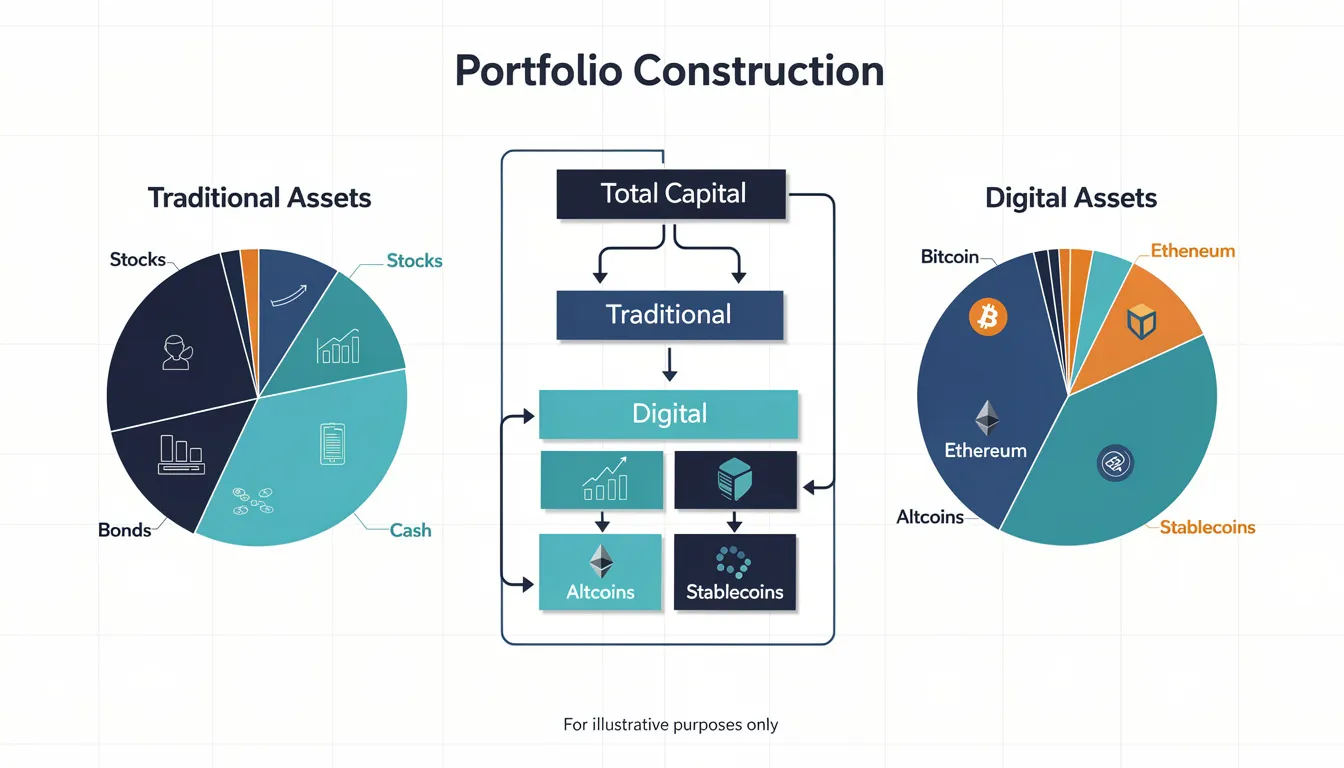

Most institutional portfolios maintain traditional foundations: majority allocations to public and private equities, sovereign and corporate bonds, real estate, and alternatives. Bitcoin and other digital assets remain a small but growing allocation sleeve within this framework.

Current allocation patterns show institutional caution balanced with growing interest. Most pension funds, insurers, and asset managers who participate keep bitcoin and digital assets around 1-5% of total assets under management. Hedge funds and family offices sometimes exceed 5-10% in risk-on mandates, reflecting their greater flexibility and higher risk tolerance.

Typical institutional allocation ranges:

| Asset Class | Conservative Institutions | Aggressive Institutions |

|---|---|---|

| Global Equities | 50-70% | 40-60% |

| Bonds/Fixed Income | 25-40% | 15-30% |

| Real Estate/REITs | 5-15% | 5-15% |

| Private Credit | 0-10% | 5-15% |

| Commodities | 0-5% | 0-10% |

| Bitcoin/Crypto | 0-2% | 1-10% |

These allocations compete for risk budget within portfolio construction frameworks. The growth in private credit and infrastructure since 2010 demonstrates how institutions gradually embrace new asset classes when they demonstrate consistent risk-adjusted returns and regulatory acceptance.

Survey data indicates high percentages of institutions planning to increase digital asset exposure by 2025, with majority preference for BTC and ETH spot exposure over more speculative tokens. This measured approach reflects institutional governance requirements and fiduciary responsibilities.

Worth noting that bitcoin allocations must be considered within existing risk management frameworks where traditional assets provide the stability and income required for liability matching and regulatory capital requirements.

Bitcoin’s Market Profile vs Traditional Markets

Institutions assess bitcoin using the same analytical framework they apply to equities or commodities: market size, liquidity, volatility, and trading behavior across cycles. This systematic approach helps position bitcoin within established portfolio construction methodologies.

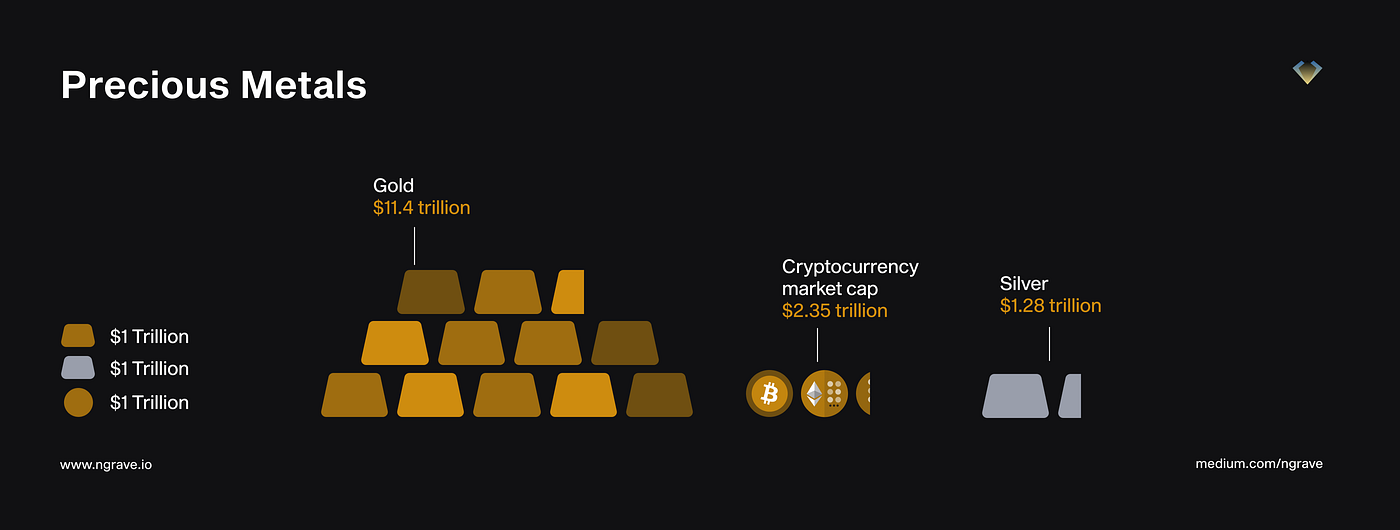

Bitcoin’s market capitalization of approximately $1-1.5 trillion in 2024-2025 places it among major large-cap equity sectors but remains dwarfed by global financial assets. Traditional markets like the S&P 500, U.S. Treasuries, and global investment-grade credit maintain superior depth and liquidity, though BTC trades continuously with increasingly robust derivative markets on CME and major exchanges.

Market infrastructure comparison:

| Metric | Bitcoin | S&P 500 Futures | 10-Year Treasury |

|---|---|---|---|

| Trading Hours | 24/7 | Business Hours | Business Hours |

| Daily Volume | $15-30B | $200-400B | $100-200B |

| Bid-Ask Spread | 0.01-0.05% | 0.001% | 0.01-0.02% |

| Market Cap | ~$1.5T | ~$45T | ~$26T |

The evolution from 2017 through the March 2020 COVID crash to the 2024 ETF launch era shows meaningful maturation in market structure. Bid-ask spreads have tightened, daily trading volumes increased, and open interest in futures and options expanded substantially.

This infrastructure development enables institutions to implement sophisticated trading strategies, risk management, and position sizing similar to their approaches in traditional markets.

Volatility, Drawdowns, and Correlations

Bitcoin’s volatility historically exceeds stocks, bonds, and gold, but has trended downward compared with its early years (2013-2017). The asset maintains a “fat-tailed” return distribution with more extreme upside and downside movements than traditional assets.

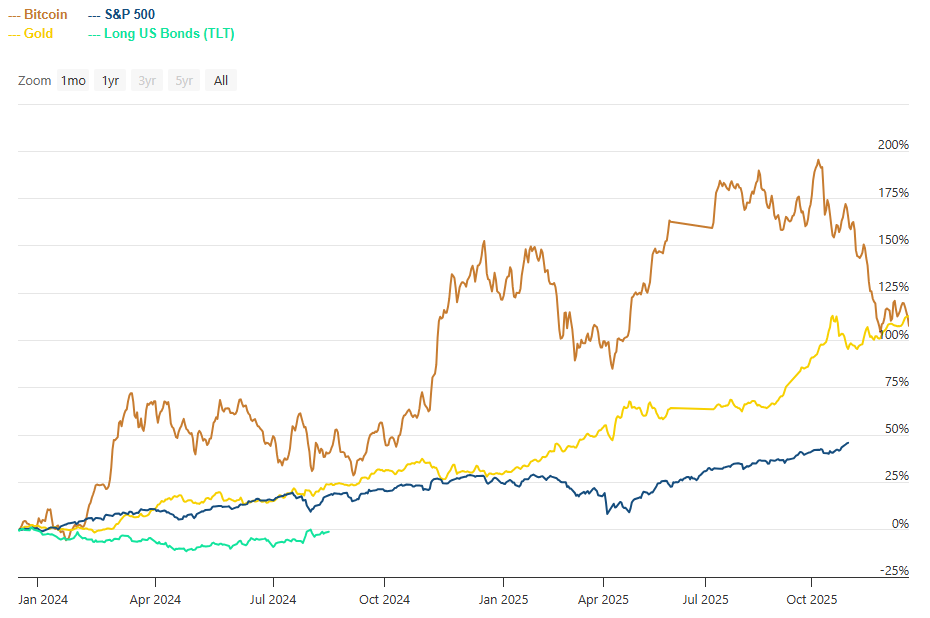

Research findings reveal bitcoin’s time-varying correlation with traditional assets. Correlations remained low pre-2019, spiked with risk assets during COVID-19 and the 2022 tightening cycle, then partially decoupled again in 2024-2025. This pattern suggests bitcoin functions primarily as a risk asset that can provide portfolio diversification during normal market conditions.

Correlation patterns during market stress:

- Normal conditions: Low correlation (0.1-0.3) with equities and bonds

- Crisis periods: High correlation (0.6-0.8) with risk assets

- Recovery phases: Correlations often revert to lower levels

Bitcoin’s drawdown profile differs markedly from traditional assets. Sharp, V-shaped declines followed by rapid recoveries (2018-2020, 2022-2024) contrast with drawn-out equity bear markets like the 2000-2013 technology recovery or 2008-2013 financial crisis recovery.

Many investors view bitcoin as a risk asset providing diversification benefits rather than a consistent safe haven. During acute global stress, correlations tend to converge with equities as liquidity needs drive selling across asset classes.

Risk/Return and Sharpe Ratios

Historical analysis over 5-10 year horizons shows bitcoin delivering superior annualized returns and Sharpe ratios compared with global equities, U.S. Treasuries, and gold through mid-2024. However, this performance came with significantly higher interim volatility and deeper intra-year drawdowns.

Even small bitcoin allocations (1-2%) would have increased portfolio returns and Sharpe ratios historically, though at the cost of substantially higher volatility during risk-off periods. This improvement stems from bitcoin’s high historical returns combined with its partially decorrelated behavior.

The more stable risk/return patterns of bond-heavy portfolios remain essential for institutions with funding obligations and regulatory capital requirements. Asset managers typically frame bitcoin as a satellite or opportunistic allocation added to traditional core holdings rather than a replacement for established equity or bond exposures.

Key performance insights:

- Small allocations (1-2%) can meaningfully improve portfolio efficiency

- Risk contributions scale non-linearly with position size

- Forward-looking expectations more conservative than historical data

- Integration requires sophisticated risk budgeting approaches

Where Institutions See Structural Value in Bitcoin vs Traditional Markets

Beyond price performance, institutions evaluate bitcoin’s structural features that fundamentally differ from traditional markets: monetary policy, settlement infrastructure, programmability, and censorship resistance. These characteristics create unique value propositions independent of short-term price movements.

The 2020-2024 period highlighted these differences. COVID stimulus, inflation spikes, and rapid rate adjustments led some institutions to examine bitcoin as a hedge against currency debasement and monetary experimentation. Even skeptical institutions recognize bitcoin’s role as a gateway to broader digital asset infrastructure and blockchain-based settlement systems.

Bitcoin’s value drivers contrast sharply with traditional markets that depend on cash flows, dividends, interest payments, and legal claims on real assets. This fundamental difference creates both opportunity and challenge for institutional integration.

Monetary Properties: Fixed Supply vs Central Bank Flexibility

Bitcoin’s 21 million supply cap, predictable halving schedule (approximately every four years, most recently April 2024), and decentralized issuance contrast fundamentally with central bank-managed fiat currencies and bond markets. This scarcity model appeals to institutions concerned about long-term inflation risk and debt monetization.

The Federal Reserve’s balance sheet expansion during 2020-2021, combined with inflation peaks in 2022, demonstrated the potential for rapid monetary policy changes. Bitcoin’s algorithmic monetary policy provides a hedge against such discretionary decisions, though this protection remains unproven across full economic cycles.

Monetary comparison framework:

- Bitcoin: Fixed supply, predictable issuance, no central authority

- Fiat currencies: Flexible supply, policy-driven rates, central bank control

- Gold: Physical scarcity, mining supply changes, no yield

- Bonds: Credit risk, interest rate sensitivity, government backing

Some asset managers incorporate bitcoin into “store of value” or “monetary debasement hedge” allocations alongside gold, Treasury Inflation-Protected Securities, and real assets. However, bitcoin’s volatility typically limits position sizes compared with traditional inflation hedges.

The purchasing power preservation thesis requires long-term perspective and tolerance for significant interim volatility, making it suitable primarily for patient capital and strategic allocations.

Settlement, Market Access, and 24/7 Liquidity

Bitcoin settles natively on-chain in approximately 10 minutes on average with near-final settlement, compared with T+2 (now T+1 in U.S. equity markets as of 2024) and multi-day settlement cycles in cross-border securities and foreign exchange markets. This efficiency appeals to trading desks and market makers requiring continuous liquidity and collateral management.

The 24/7 settlement capability provides operational advantages over traditional markets that close on weekends and holidays. Global accessibility enables around-the-clock risk management and position adjustments, particularly valuable for institutions managing portfolios across multiple time zones.

Settlement comparison:

- Bitcoin: 10-minute finality, 24/7 availability, peer-to-peer networks

- Equities: T+1 settlement, business hours, multiple intermediaries

- FX/Wire: Same-day to multi-day, cut-off times, correspondent banking

- Government bonds: T+1 to T+3, market hours, clearing systems

Lightning Network and custodial payment rails enable near-instant, low-cost BTC transfers, creating parallel infrastructure to traditional card networks and correspondent banking systems. This programmable settlement infrastructure supports atomic swaps and smart contracts unavailable in legacy systems.

Institutions still rely on trusted custodians and prime brokers for both BTC and traditional assets, but appreciate the efficiency potential of on-chain settlement for operational improvements.

Macro Role: Risk Asset, Diversifier, or Hedge?

Empirical research positions bitcoin primarily as a high-beta risk asset with positive correlation to stocks and commodities, and negative correlation to the U.S. dollar over longer horizons. This classification helps institutions properly size and risk-manage their exposures.

Bitcoin’s hedging properties appear selective rather than consistent. The asset sold alongside equities during March 2020 and 2022 stress periods, but sometimes outperformed during monetary easing cycles and liquidity expansion phases. This mixed performance suggests tactical rather than strategic hedging applications.

Bitcoin’s macro behavior patterns:

- Bull markets: Often outperforms with high positive correlation to risk assets

- Bear markets: Mixed performance, sometimes correlates with equity selling

- Monetary easing: Tends to benefit from liquidity expansion

- Rate hiking: Pressure from reduced risk appetite and dollar strength

For regulatory and risk modeling reasons, most institutions continue relying on bonds and cash for defensive allocations. Bitcoin functions as a supplementary macro hedge in growth-oriented or speculative mandates rather than core defensive positioning.

The nuanced macro role requires sophisticated analysis and scenario planning rather than simple safe haven assumptions.

Network Effects vs Incumbent Financial Infrastructure

Bitcoin’s value benefits from network effects similar to how global equity and foreign exchange markets achieved dominance through decades of infrastructure development. More users, exchanges, custodians, and regulatory clarity increase liquidity and perceived institutional safety.

These digital network effects operate alongside traditional financial infrastructure rather than immediately replacing established systems. Stock exchanges, clearing houses, SWIFT networks, and card systems maintain advantages through regulatory recognition, deep liquidity, and operational maturity.

Infrastructure comparison:

- Traditional: Centralized control, regulatory oversight, jurisdiction-specific

- Bitcoin: Decentralized consensus, global accessibility, permissionless access

- Hybrid solutions: Regulated custodians, compliant exchanges, institutional wrappers

Institutions favor bitcoin over smaller cryptocurrencies due to its longest track record, largest market cap, and most developed ecosystem of service providers and compliance tools. This preference reflects conservative risk management and proven network stability.

Metcalfe’s Law suggests network value grows with user adoption, complementing rather than replacing traditional cash flow-based valuation methods used for equities and bonds.

Comparing Bitcoin to Major Traditional Asset Classes

Institutions evaluate bitcoin not in isolation but against specific traditional asset alternatives. Each comparison reveals unique trade-offs in return potential, income generation, risk characteristics, regulatory treatment, and portfolio construction implications.

Asset class comparison matrix:

| Feature | Bitcoin | Equities | Bonds | Gold | USD Cash |

|---|---|---|---|---|---|

| Yield/Income | None | Dividends | Coupons | None | Interest |

| Inflation Sensitivity | Mixed | Variable | Negative | Positive | Negative |

| Regulation | Evolving | Mature | Mature | Mature | Mature |

| Market Hours | 24/7 | Limited | Limited | Limited | 24/7 |

| Volatility | High | Medium | Low | Low-Medium | Minimal |

Bitcoin vs Equities

Both bitcoin and equities function as risk assets with high expected returns and significant volatility, but their fundamental value drivers differ substantially. Equities represent ownership claims on corporate cash flows and real economic activity, while bitcoin derives value from monetary scarcity and network adoption without underlying cash generation.

Institutions leverage equities for growth exposure, dividend income, and participation in real economy performance. Bitcoin serves as an asymmetric upside bet and potential hedge against monetary debasement, though this hedging function remains inconsistent across cycles.

During 2020-2021, bitcoin often tracked technology-heavy indices like NASDAQ closely, particularly as both benefited from liquidity expansion and low interest rates. This correlation diverged during 2022-2024 as macro and regulatory factors affected each differently.

Key institutional considerations:

- Regulatory capital treatment favors equities for core allocations

- Accounting standards better developed for equity holdings

- Risk models incorporate equity factors more systematically

- Dividend yield provides tangible income missing from bitcoin

Despite bitcoin’s superior historical returns, regulatory capital rules and fiduciary frameworks typically limit its weight relative to established equity allocations.

Bitcoin vs Bonds (Sovereign and Corporate)

The contrast between bitcoin and bonds highlights fundamental differences in institutional portfolio construction. Bonds provide predictable income streams, legal claims against issuers, and regulatory benefits for matching liabilities and maintaining solvency ratios.

During periods of low or negative real interest rates (2020-2021), some institutions explored bitcoin as an alternative store of value relative to long-duration sovereign bonds exposed to inflation and interest rate risk. However, bitcoin’s lack of income and extreme volatility limited these substitutions.

Functional differences:

- Bonds: Predictable cash flows, credit protection, regulatory capital benefits

- Bitcoin: No income, extreme price volatility, regulatory uncertainty

- Risk-off behavior: Bonds often rally during stress; bitcoin typically declines

Despite bitcoin’s appeal during negative real rate environments, liability-driven investors like pension funds and insurance companies continue relying on bonds for matching obligations and regulatory compliance. Bitcoin typically appears only in surplus or growth-oriented allocations.

Some managers combine BTC with Treasury Inflation-Protected Securities, commodities, and real estate in “inflation-sensitive” allocations, though with explicit risk limits due to volatility differences.

Bitcoin vs Gold and Commodities

The “digital gold” comparison stems from shared characteristics: finite supply, government independence, and long-term store-of-value narratives. However, gold maintains advantages through its centuries-long track record, regulatory recognition, and lower volatility that appeal to conservative institutions.

Gold remains the primary alternative store of value in central bank reserves and institutional portfolios due to established regulatory frameworks and physical settlement markets. Energy and industrial commodities provide real-economy demand drivers fundamentally different from bitcoin’s purely financial demand profile.

Comparative advantages:

- Gold: Lower volatility, regulatory acceptance, physical settlement

- Bitcoin: Higher potential returns, digital portability, programmable features

- Commodities: Real economy exposure, inflation sensitivity, production cycles

Some institutions reallocate small portions of gold or commodity exposure to bitcoin seeking higher convexity and upside potential, particularly in macro-oriented or thematic strategies.

The liquidity comparison favors bitcoin’s electronic, 24/7 trading versus gold’s established but more limited physical and futures markets. However, gold’s market depth and regulatory acceptance maintain institutional preference for core precious metals allocations.

Bitcoin vs Fiat Currencies (Especially USD)

Bitcoin functions as a non-sovereign, borderless digital asset contrasting with fiat currencies backed by governments, central banks, and taxation systems. This independence creates both opportunities and limitations for institutional adoption.

Research demonstrates negative correlation between bitcoin and the U.S. dollar index over longer horizons, suggesting potential hedging properties against dollar weakness or global liquidity expansions. However, unlike USD, bitcoin lacks legal tender status in most jurisdictions and the deep credit infrastructure supporting major fiat currencies.

Currency comparison factors:

- Legal status: USD legal tender vs bitcoin commodity/property classification

- Infrastructure: Established payment systems vs emerging digital networks

- Stability: Central bank intervention vs algorithmic monetary policy

- Global adoption: Universal acceptance vs growing but limited adoption

Institutions continue pricing most assets in USD, EUR, or JPY while potentially holding small bitcoin allocations as hedges against currency debasement or long-duration options on alternative monetary systems.

The growing acceptance of bitcoin in El Salvador since 2021 and exploration by other nations provides institutional precedent, though most institutions await broader regulatory clarity before significant fiat substitution.

How Institutions Express Bitcoin Views vs Traditional Markets

Institutional bitcoin access has evolved to mirror traditional asset implementation: multiple channels chosen for regulatory compliance, operational efficiency, and risk management alignment. This evolution bridges digital asset innovation with established institutional infrastructure.

Increasing regulatory clarity across major jurisdictions since 2020 expanded compliant options for professional investors. The menu of access methods affects tracking error, liquidity, costs, custodial risk, and integration with existing risk management systems.

Access method comparison:

| Method | Regulatory Clarity | Operational Complexity | Cost Structure | Custodial Risk |

|---|---|---|---|---|

| Direct Ownership | Moderate | High | Low fees, high setup | Institution bears |

| Spot ETFs | High | Low | Management fees | Third-party |

| Futures | High | Medium | Roll costs, margin | Clearing house |

| Structured Products | Variable | Medium | Embedded costs | Counterparty |

Direct Bitcoin Ownership and Custody

Institutions can purchase spot BTC through regulated dealers and custody via institutional-grade providers, analogous to equity and bond custody relationships. This approach provides full on-chain ownership, participation in specialized strategies, and elimination of some intermediary risks present in wrapped products.

Benefits include authentic exposure to bitcoin’s monetary properties, ability to participate in on-chain activities, and potential cost advantages over fund structures. Well known firms have established comprehensive custody solutions including cold storage, multi-signature controls, and insurance coverage.

Implementation challenges:

- Private key management and cybersecurity requirements

- Anti-money laundering and know-your-customer procedures

- Accounting treatment under existing institutional standards

- Operational complexity relative to securities-based alternatives

Large corporates and family offices pioneered this approach around 2020-2021, while regulated funds often prefer securities-like wrappers for compliance and governance reasons.

The emergence of qualified custodians and prime brokerage services has reduced operational barriers, though many institutions maintain preference for familiar fund structures.

Spot ETFs, ETPs, and Trust Structures

Spot bitcoin ETFs approved in the U.S. in January 2024, alongside earlier European and Canadian ETPs, provide familiar regulated wrappers comparable to commodity or equity index funds. These vehicles offer simple brokerage access, standardized reporting, and easier integration within existing investment mandates.

Institutional advantages:

- Familiar prospectus and regulatory structure

- Standard brokerage platform access

- Clear management fee structure

- Professional custody and market making

Trade-offs include management fees, potential tracking error versus spot bitcoin, and reliance on third-party custodians and authorized participants. These factors mirror considerations in gold ETFs and commodity tracking products.

The ETF structure enables institutions to gain bitcoin exposure within mandates restricting them to listed securities, while benefiting from economies of scale in custody and administration.

Market makers and authorized participants provide liquidity mechanisms similar to traditional ETF markets, though bitcoin’s 24/7 trading creates unique arbitrage dynamics absent in traditional markets.

Futures, Options, and Derivatives

Cash-settled bitcoin futures on regulated exchanges like CME (operating since late 2017) enable institutions to gain exposure without handling physical BTC. This mirrors common approaches for equity index and commodity exposure through derivative instruments.

Typical institutional use cases:

- Tactical positioning and market timing

- Hedging spot holdings or ETF exposures

- Basis trading between spot and futures markets

- Risk management around portfolio rebalancing

Considerations include margin requirements, basis risk between futures and spot prices, roll costs for maintaining positions, and liquidity concentration in near-term maturities. These factors require active management similar to commodity futures strategies.

Options markets provide institutional hedging and structured exposure capabilities, enabling protective puts, covered calls, and other strategies familiar from equity and foreign exchange markets.

The regulated derivative infrastructure facilitates institutional participation while maintaining compliance with existing risk management frameworks and regulatory requirements.

Tokenized and Structured Products Bridging TradFi and Crypto

Structured notes, total return swaps, and tokenized products embed bitcoin exposure within traditional legal wrappers, enabling institutions to access digital asset returns through familiar documentation and risk frameworks.

This approach mirrors how banks and asset managers have historically offered exposure to commodities, foreign exchange, or alternative strategies through structured products and swap agreements.

Key advantages:

- Integration with existing custody and reporting systems

- Customizable payoff profiles and risk parameters

- Established legal documentation and counterparty relationships

- Regulatory compliance within traditional investment frameworks

Tokenization platforms increasingly package bitcoin-linked strategies into compliant securities that can coexist with bonds and traditional funds on institutional platforms. This bridges the gap between digital asset innovation and legacy operational infrastructure.

Regulatory treatment, counterparty risk assessment, and documentation complexity require careful evaluation, particularly for cross-border offerings and novel token structures.

Portfolio Construction: Integrating Bitcoin with Traditional Markets

The central question for institutional investors extends beyond whether to own bitcoin to determining optimal allocation sizes relative to equities, bonds, and alternatives given risk constraints, correlation patterns, and mandate limitations.

Historical backtesting suggests small BTC allocations can improve risk-adjusted returns, but risk contributions scale rapidly without disciplined sizing and rebalancing protocols. Regulatory, operational, and reputational factors often cap allocations below theoretical optimums, particularly for fiduciary-bound institutions.

Forward-looking analysis requires more conservative assumptions than historical data suggests, as past performance reflects a maturing market transitioning from frontier to established alternative asset status.

Impact on Portfolio Performance and Diversification

Backtesting analysis of adding 1-5% bitcoin to balanced portfolios (such as 60/40 global equity/bond allocations) historically increased returns and Sharpe ratios while raising maximum drawdowns and intra-year volatility. These improvements stem from BTC’s high historical returns combined with partial correlation during non-crisis periods.

Performance impact summary:

- 1% allocation: Minimal risk increase, modest return enhancement

- 2-3% allocation: Noticeable Sharpe ratio improvement, manageable volatility

- 4-5% allocation: Significant performance impact, substantial risk contribution

- Higher allocations: Diminishing marginal benefits, exponentially increasing risk

The diversification benefits depend critically on correlation stability, which varies across market cycles and appears to increase during stress periods when diversification is most needed.

Many chief investment officers treat bitcoin as one component within broader “alternatives” or “innovation” allocations competing with venture capital, private equity, and growth technology investments rather than replacing traditional core holdings.

Scenario analysis and stress testing complement mean-variance optimization by examining performance across various macro environments and correlation regimes.

Risk Budgeting and Sizing Decisions

A fundamental consideration in bitcoin allocation involves its disproportionate contribution to total portfolio risk due to high volatility and fat-tailed return distributions. Small capital allocations can account for large shares of portfolio Value-at-Risk and tracking error.

Risk contribution guidelines:

- 2% allocation: Approximately 10-15% of total portfolio risk

- 4% allocation: Approximately 20-25% of total portfolio risk

- Higher allocations: Risk contribution exceeds capital weight significantly

Investment committees often impose explicit risk contribution limits, such as bitcoin not exceeding specified shares of portfolio volatility or drawdown risk. Positions may require rebalancing when bitcoin’s volatility spikes during market stress.

This approach parallels institutional sizing of other high-volatility allocations like emerging market equities, small-cap stocks, or leveraged credit strategies.

Governance frameworks specify clear investment theses, time horizons, review frequencies, and exit criteria for bitcoin positions, similar to protocols for alternative asset classes.

Mandates, Regulation, and Stakeholder Communication

Legal investment mandates, fiduciary duties, and regulatory capital requirements significantly influence whether and how institutions can implement bitcoin exposure compared with traditional markets.

Some funds face securities-only restrictions, making ETFs, ETPs, and structured notes the exclusive feasible routes. Others may hold spot BTC directly if policy documents and local regulators permit, though this often requires explicit mandate amendments and board approvals.

Governance considerations:

- Investment policy statement modifications

- Board and beneficiary communication strategies

- Regulatory capital impact assessment

- Environmental, social, and governance policy alignment

Chief investment officers must address bitcoin’s role and risks differently than traditional assets due to limited track record and evolving legal frameworks. This communication challenge requires clear risk disclosure and conservative positioning.

Environmental, social, and governance considerations around bitcoin mining energy consumption feature in some institutions’ approval processes, similar to debates around fossil fuel investments or high-emission industries.

The approval process typically involves comprehensive risk assessment, stakeholder communication, and ongoing monitoring protocols exceeding those required for established asset classes.

Future Outlook: Convergence of Bitcoin and Traditional Markets

The distinction between digital assets and traditional markets continues blurring as infrastructure, regulation, and tokenization mature through 2025 and beyond. Institutions increasingly envision unified portfolio management where bitcoin, tokenized bonds, and real-world assets operate on integrated platforms with shared risk and reporting systems.

Several trends support this convergence. Growth of spot ETFs and derivatives markets provides familiar access methods. Institutional-grade custody solutions reduce operational barriers. Integration of bitcoin price feeds and risk factors into mainstream portfolio management systems enables systematic analysis alongside traditional assets.

Convergence indicators:

- Unified risk management across digital and traditional assets

- Cross-margining between bitcoin and traditional derivatives

- Tokenized treasury bills and credit instruments providing yield

- Regulatory harmonization across major jurisdictions

The emergence of tokenized treasuries and corporate credit as yield-bearing complements to bitcoin creates more complete digital asset portfolios that can compete functionally with traditional fixed income allocations.

Upside scenarios for institutional adoption:

- Broader regulatory acceptance and clear frameworks

- Continued volatility decline and correlation stability

- Deep, liquid derivative markets supporting sophisticated strategies

- Integration with central bank digital currencies and payment systems

Risk scenarios limiting adoption:

- Adverse regulatory developments or outright restrictions

- Technological setbacks or security breaches affecting confidence

- Prolonged bear markets reducing institutional risk appetite

- Persistent high volatility preventing integration with liability-driven strategies

The ultimate trajectory depends on bitcoin’s evolution toward either a mature macro asset comparable to gold or continued classification as a speculative, high-beta technology play.

Macro cycles, regulatory clarity, and technological infrastructure will determine whether bitcoin achieves broader institutional integration or remains a niche allocation within alternative investment frameworks.

FAQ: Bitcoin vs Traditional Markets for Institutional Investors

Can bitcoin realistically replace any part of our core equity or bond allocation?

For most institutions, bitcoin functions better as a small satellite position complementing rather than replacing core stock and bond holdings. Bitcoin’s high volatility, lack of income generation, and evolving regulatory treatment make it unsuitable for liability-matching or defensive portfolio functions that bonds provide. Even aggressive institutions typically limit bitcoin to 1-5% of total assets while maintaining traditional core allocations for stability and income requirements.

How should we think about bitcoin in our risk models compared with traditional assets?

Treat bitcoin as a separate, high-volatility risk factor with time-varying correlations rather than a substitute for existing asset classes. Use stress testing and scenario analysis alongside traditional mean-variance optimization, employing conservative forward-looking parameters rather than relying solely on historical data. Bitcoin’s fat-tailed return distribution and correlation spikes during market stress require sophisticated modeling that accounts for regime changes and extreme events.

Is bitcoin a better inflation hedge than commodities or real estate?

Bitcoin has shown mixed performance as an inflation hedge, sometimes responding positively to monetary expansion but behaving inconsistently across different inflationary episodes. Traditional real assets like commodities and real estate maintain more direct ties to production costs and replacement values. Most institutions combine bitcoin with established inflation hedges rather than substituting entirely, treating BTC as a potential monetary debasement hedge while relying on proven real assets for core inflation protection.

How do regulatory and accounting issues differ for bitcoin versus traditional market instruments?

Jurisdictions treat bitcoin variously as a commodity, intangible asset, or financial instrument, affecting regulatory capital charges and accounting treatment. Unlike equities and bonds with established standards, bitcoin may require impairment testing and mark-to-market accounting that increases earnings volatility. Institutions must consult local regulations and audit guidance before allocating, as tax treatment and reporting requirements continue evolving across jurisdictions.

What governance practices are essential before adding bitcoin to an institutional portfolio?

Establish clear investment thesis, allocation limits, and approved access vehicles (ETF, futures, or spot holdings) before implementation. Define risk contribution limits, rebalancing protocols, and review frequency similar to other alternative assets. Develop stakeholder communication strategies addressing bitcoin’s unique risks and regulatory status. Create exit criteria and stress-testing procedures while ensuring board-level understanding of digital asset exposure and its impact on overall portfolio risk profile.